OIL PRICE VOLATILITY RAISES CONCERNS

Oil News Commentary: December 2019 - January 2020

India

Global Oil Price Volatility

A mid rising tensions between the US and Iran, India’s efforts are under way to raise domestic production and wean the economy away from oil. India aims to invest in producing O&G fields abroad to compensate for falling domestic output and to help reduce the impact of oil price volatility. India was negotiating with Russia’s Rosneft to invest in eastern Russia. Indian firms have invested in foreign O&G assets, but many of these assets are still under exploration or not hitting production goals. Acquisition by Indian investors of stakes in producing fields in the United Arab Emirates and Russia’s Vankor field had started adding to corporate revenues. Oil provides 30 percent of India’s primary energy and gas about 6 percent. Due to low prospects and domestic output, India meets 83 percent of its crude requirement through imports. As the world’s third largest buyer of oil, India’s vulnerability to West Asian flare-ups come as two-thirds of the oil and half the LNG imported by India come through the narrow shipping lane between Iran and Oman. So any tension in West Asia pinches consumers in India as global oil price spike drives up domestic pump prices. This squeezes household budgets and dampens consumption as consumers turn cautious over non-essential spending. Higher oil prices limits government’s ability to offer freebies or spend on social sector schemes. India’s energy markets would take pricing cues from crude-oil options sellers on the US based ICE Brent Oil Complex amid mounting concerns over global energy costs in the aftermath of the latest US-Iranian standoff, especially at a time of tepid economic growth. India’s net imports of crude oil and products totaled $55.99 bn until November in FY20. In FY19, the net import figure was $90 bn, according to the oil ministry’s PPAC. An increase in price of ATF has made Chennai the second most expensive city to buy jet fuel, which can force airlines to avoid refueling in the city airport. This will also lead to a hike in air fares. ATF fuel prices were increased by 2.6 percent on 1 January. This makes the one kilolitre of ATF to cost ₹65, 619 in Chennai airport while it costs ₹70,588 in Kolkata, the highest in a metro airport. Prices are lower in Mumbai and Delhi. The price was ₹63,830 per kilolitre in Chennai as of 1 December 2018. Now, airlines will have to pay ₹1,789 more. An A320 type plane uses around six tonnes of fuel for a short domestic flight. The fuel price varies from one airport to the other because state governments charge a tax. The tax is higher in Tamil Nadu. There was a call to make prices or taxes uniform across all airports.

Petrol and diesel prices were once again raised by 6 paise and 15-16 paise, respectively for the second consecutive day across all major cities. In Delhi, petrol prices rose to Rs74.74/litre as against Rs74.68/litre, while diesel price climbed to Rs67.24/litre from Rs67.09/litre, according to IOC data. In Kolkata, petrol costs Rs77.40/litre in Chennai, Rs77.70/litre and in Mumbai at Rs80.40/litre after the increase. Similarly, in Kolkata, diesel costs Rs69.66/litre in Chennai Rs71.09/litre and in Mumbai, Rs70.55/litre after an increase of 16 paise. Domestic petrol and diesel prices are reviewed by OMCs on a daily basis. Consumers may feel the pinch of higher fuel prices in coming months as the government is considering a proposal to allow OMCs charge a premium on retail prices of petrol and diesel to recover their investment in producing less polluting fuel. Public and private sector OMCs have appealed to oil ministry to support a plan to raise consumer prices of auto fuels to help them recover a portion of investments made in upgrading their refineries to produce BS Stage-VI fuel. If this proposal is accepted by the government, retail prices of petrol and diesel would come at a premium of about ₹0.80/litre and ₹1.50/litre, respectively for the next five years much to the discomfort of consumers. Refineries of public sector companies IOC, HPCL and BPCL have spent close to ₹800 bn to reach BS-VI levels after rolling out BS-IV complaint fuel for national introduction in April 2017. Even private refiners, Nayara Energy (formerly Essar Oil) and RIL have spent heavily to upgrade their facilities ahead of nationwide launch of BS-VI compliant fuel from 1 April 2020. Government support on pricing is being explored as there is very little difference in prices of petrol and diesel at pump level and uniformity needs to be given if cost recovery is allowed.

Demand

India’s petroleum products demand growth is expected to stay between 1 percent and 3 percent in the current financial year ending March 2020 and is likely to stay at the same level next fiscal 2020-2021, research and ratings agency ICRA has said. The country’s crude oil production fell 6 percent in the first six months of the current financial year and is expected to rise next fiscal due to commercialisation of some of ONGC’s fields as well as increase in production from Vedanta’s Rajasthan asset. India expects its oil consumption to expand at the slowest pace in six years as the economy sputters. The nation’s consumption of petroleum products in the financial year to March 2020 is expected to rise by 1.3 percent to 216 mt, the PPAC said in its estimates. That’s the slowest since the 0.9 percent demand growth in 2013-14, when crude oil averaged over $100 a barrel. Fitch Solutions slashed its 2020 forecast for India’s oil demand growth to 3 percent from an earlier estimate of 5 percent because of weaker economic growth prospects in the coming quarters. The IEA, which expects the country to be the fastest-growing oil consumer through 2040, expects India’s demand growth to slow to 145,000 barrels a day in 2019 and recover to 180,000 barrels in 2020. Consumption of diesel, the most-consumed petroleum fuel and the lifeblood of Indian manufacturing, transport and agriculture, is estimated to grow at the slowest pace in six years at 0.9 percent, according to the PPAC.

Refining

Fitch Ratings said it expects HPCL's refining margins to fall by one-third during the current fiscal due to volatility in crude prices leading to inventory losses. Fitch affirmed HPCL’s rating 'BBB-' with stable outlook, in line with the credit profile of its largest shareholder ONGC. HPCL is highly strategic to ONGC’s vertical integration strategy, and its refining capacity, along with its large fuel retail network, increases ONGC’s downstream integration, making the company India’s third-largest oil-refining and fuel-marketing company. HPCL has about one-fourth market share of India’s fuel marketing, and the second-largest number of retail fuel outlets. With its refining capacity of 27 mtpa including 11 mtpa of capacity in its joint venture, HPCL-Mittal Energy Ltd is set to increase it to 36 mtpa within the next 12 months, and accounts for over 10 percent of the country’s refining capacity. HPCL marketed about 19.5 mt of fuel in the six months ended 30 September 2019 and refined 8.5 mt. Fitch expected HPCL to incur around Rs600 bn in capex over FY20-FY23 to expand and upgrade its refineries, while also enhancing its retail and pipeline infrastructure. HPCL’s Mumbai refinery capacity will increase from 7.5 mtpa currently to 9.5 mtpa by end-January 2020, and that at the Visakhapatnam refinery will rise from 8.3 mtpa at present to 15 mtpa in July 2020. A new LPG bottling plant set up at a cost of Rs1.03 bn by BPCL in Odishas Balangir district was inaugurated in December. The plant with a capacity to produce 4.2 mn cylinders per year. BPCL already has a LPG bottling plant at Khurda and the new plant at Balangir will be the second for the company in Odisha. Odisha had 2.022 mn LPG consumers in 2014 which has grown up to 8.810 mn in 2019. The LPG penetration in Odisha was 20 percent in 2014 which has increased to 81.3 percent by 2019 thus an increase of 61.3 percent in penetration. Amongst the OMC’s, BPCL itself has 2.159 mn customers who consume approximately 7.8 million cylinders in a year. This consumption is expected to increase from 7.8 mn cylinders to 10.5 mn cylinders by end of 2020. With LPG demand growing, particularly in Western and South-western Odisha, need for putting up a new bottling plant was felt and the historical town of Balangir was chosen for locating the plant considering the logistics advantage of the location. The LPG plant at Balangir is spread over 23 acres and have a capacity to produce 4.2 mn cylinders per year. Balangir plant once commissioned will supply LPG cylinders to the consumers in 14 districts of Odisha - Balangir, Jharsuguda, Sundargarh, Sambalpur, Bargarh, Kalahandi, Sonepur Koraput, Malkangiri, Nowrangpur, Boudh, Kandhamal, Raygada and Nuapada.

Retailing

RIL and British energy giant BP plc signed a partnership agreement to jointly grow the Indian firm’s network of petrol pumps to 5,500 from current 1,400, the companies said. RIL currently has about 1,400 operating petrol pumps and some 30-odd aviation fuel stations at airports. These will be taken over by the RIL-BP joint venture and grown in future. RIL will hold 51 percent in the new joint venture company while BP will have the remaining 49 percent. This will assume ownership of RIL’s existing Indian fuel retail network and access its aviation fuel business. In August, RIL had said BP will pay about Rs70 bn for acquiring a 49 percent stake in its existing petrol pumps and aviation turbine fuel network. The country currently has 66,408 petrol pumps, with public sector retailers owning 59,831. PSU retailers have plans to double this network and have already starting appointing dealers. For the first time in Andhra Pradesh, an automated petrol pump or ‘e-fuel station’ is going to be installed at the Millennium Petrol station at Siripuram Junction in the city. The station is owned by HPCL. At this specific station, manual intervention will be eliminated completely and the speed of transactions will increase, according to HPCL. The consumer will be given a smart card and will be advised to use a mobile app called ‘HPCL Re-fuel’ in order to avail the service. In order to use this, the consumer will have to go to the pump, park the car in front of the bunks, swipe the card on a digital device affixed at the bunk and then refill the fuel into their vehicle on their own. HPCL has decided to adopt the advanced technology to assure “Good Fuel Promise” at all retail outlets across the country by 2022. Pepfuels, a UP-based start-up currently involved in providing doorstep delivery of diesel in the NCR to Business-to-Business (B2B) customers is eyeing cities like Bengaluru and Hyderabad to expand its operations rising on the back of the recent liberalisation of fuel marketing regulations. The company operates around seven diesel MDUs and is presently selling around 500,000 litre of diesel every month around NCR. The company is looking to add 100 MDUs in the next fiscal year if certain policy suggestions are accepted. The company will be able to clock Rs180-200 mn as revenue in the current financial year (2019-2020) and overall margins will improve in the light of the decision by the oil ministry allowing authorised start-ups to directly source fuel from oil depots as compared to an earlier requirement of sourcing from petrol pumps alone. As there was no regulation for this business model back in 2016 the company had to propose the potential of the idea to officials in the oil ministry, commerce ministry and the oil marketing companies. The Pepfuel app was launched in May 2017 and the first consignment of diesel was delivered to Uttam Toyota. It received a boost in October 2018 when the oil ministry liberalised the policy dealing with fuel marketing and allowing doorstep delivery of diesel for heavy equipment and machineries. The potential of catering to B2B customers around NCR is immense and the company is looking at increasing its diesel sale to 1 mn litre per month starting February or March next year. Assam and other North Eastern states may face fuel supply issues if the agitation against the Citizenship Amendment Bill continues for another week, as it has already led to the shutdown of refineries and oil-producing facilities in the region. IOC has been forced to shut down its Digboi refinery in Assam and is operating Guwahati unit at minimal throughput, while Oil India Ltd has been forced to shut LPG production and its crude oil production has dropped by 15-20 percent, the state-owned companies said. The companies said the agitation has blocked the movement of tankers and trucks, which are mostly used to supply petrol, diesel and LPG from the refineries to different parts of the North East.

Exploration & Production

The oil ministry has granted permission to Vedanta Ltd to explore hydrocarbon in 14 villages of Shahjahanpur and Lakhimpur Kheri districts. ONGC had done a survey in the said villages nearly 30 years ago and a recently concluded lab test in Russia has suggested that there is 95 percent chance of the presence of hydrocarbon there. If this turns out to be a commercial discovery, it will be the first time for the land-locked state. A team of experts from Vedanta recently met the villagers in Nahil village of Shahjahanpur district after which they have agreed to give their land on lease for exploration. The villagers have agreed to give their land for exploration and sign a contract. The villagers have been promised payment for their losses. Vedanta has spotted 10 villages in Kheri while four villages in Shahjahanpur district where they would be exploring the possibility of the presence of natural oil or gas. Nahil, Hardua, Bilsi and Billauri village fall in Shahjahanpur where Vedanta would dig oil wells. In 2013, Oil India Ltd had found presence of hydrocarbons in the first exploratory well drilled by it in UP under its Ganga Valley Project. The well was being dug near Bilaspur in close-by Rampur district.

Imports

Latin America’s share of Indian oil imports plunged in November to its lowest in 20-months, tanker arrival data showed, as refiners bought similar heavier grades from the Middle East to reduce shipping costs. India, the world’s third largest oil consumer, bought about 390,400 bpd of Latin American oil during November, or 9.1 percent of the country’s total imports, down from 12 percent in October, data showed. India’s overall imports from the US, Canada, and Africa also declined from October, data showed. Freight rates surged in October after nearly 300 oil tankers globally were placed off limit by oil firms and traders for fear of violating US sanctions against Iran and Venezuela. Middle Eastern oil accounted for 68 percent of India’s imports in November, up from 57 percent in October, the data showed, with Saudi Arabia regaining its status as top supplier a month after losing it to Iraq. Overall, India imported about 4.28 mn bpd in November, down 6 percent from October and 1.2 percent higher than a year earlier, data showed.

Environmental Regulations

HPCL said it has commenced delivery of fuel for ships that are compliant with IMO’s low sulphur mandate. The new global IMO rules require the maximum sulphur content in marine fuel oil to be reduced to 0.5 percent from the previous levels of 3.5 percent, effective 1 January 2020. Vessels that use higher-sulphur fuel oil must have special pollution control systems in place to reduce sulphur emissions. The first batch of very low sulphur fuel oil was produced in HPCL’s Visakh refinery in early December 2019, and was formally launched. Market leader IOC began producing IMO specified bunker fuel from October last year. Indian refiners currently supply around 15,000 barrels per day of bunker fuel. HPCL owns and operates refineries at Visakhapatnam on the east coast and Mumbai on the west coast. India plans to switch over to Euro-VI or Bharat Stage (BS) VI, emission norm compliant petrol and diesel from 1 April 2020, from current Euro-IV fuel. HPCL has the largest lube refinery in India at Mumbai and owns the second largest cross country petroleum pipeline network and vast marketing infrastructure in the country.

Upstream Regulation

With overhang of disputes choking investments in the O&G sector, the government has constituted an expert committee for time-bound resolution of exploration and production disputes without having to resort to tardy judicial process. The 'Committee of External Eminent Persons/Experts' for dispute resolution will have a tenure of three years and the resolution will be attempted to be arrived at within 3 months. India’s O&G sector has been plagued by disputes from cost recovery to production targets, and companies as well as the government have resorted to lengthy and costly arbitration followed by judicial review -- a process that takes years to resolve differences. The committee will arbitrate on a dispute between partners in a contract or with the government over commercial or production issues for O&G.

Rest of the World

Crude Prices

Oil prices gained nearly 1 percent on hopes that the US and China were close to reaching a deal on an ongoing trade dispute that has raised concerns about global demand for crude. The outlook for oil demand has been clouded by US-China trade tensions and uncertainty over whether a fresh round of US tariffs on Chinese goods would come into effect. Oil prices have firmed after OPEC and other producers including Russia agreed to rein in output by an extra 500,000 barrels per day in the first quarter of 2020. The OPEC said that it expected a small oil market deficit in the next year, suggesting the market is tighter than previously thought. Oil prices have a significant effect on Indian airlines, as ATF takes around 40 percent of the total revenues of an air carrier in India. As per the IATA forecast, the airlines fuel bill will decline in 2020 to $182 bn, which will represent 22.1 percent of average operating costs. In 2019, the fuel spend of the world airline industry was $180 bn, which was 23.5 percent of average operating costs. In 2020, the world airline industry would consume 371 bn litres of fuel, up from 359 bn litres that was used in 2019. According to the IATA forecast, the fuel efficiency - in terms of capacity use (available tonnes kilometres) - will improve by 2.1 percent in 2020 as deliveries of new aircraft grow.

OPEC

The OPEC and its allies, known as OPEC+, may consider wrapping up their oil output reduction in 2020. OPEC+ has been capping its output since 2017 in order to balance out the supply and demand on the global oil market as well as prop up oil prices. Oil demand may rise in the summer when more fuel is required by motorists. OPEC+ decided to prolong its oil output restriction deal until the end of March and to deepen the cuts in order to balance out the oil market.

Middle East

The Khafji oil field which is jointly operated by Saudi Arabia and Kuwait is expected to produce 320,000 bpd of oil by the end of 2020. The announcement was made at Khafji oil field complex in Saudi Arabia, a day after signing a deal with Kuwait that ended a dispute over the partitioned Neutral Zone that is shared by the two countries. The two OPEC members halted production more than five years ago at Khafji and Wafra field, another jointly run field. Production is also resuming at Wafra. Output from both before the shutdown was 500,000 bpd, or about 0.5 percent of the world’s oil supply. Oil output in the Neutral Zone is divided equally between Saudi Arabia and Kuwait. QP will start pricing its crude oil grades of Qatar marine and Qatar land on a prospective pricing basis in February 2020, the company said. QP currently prices the two grades on a retroactive basis but will move this to forward pricing, a more popular approach used by other Middle East crude exporters such as Saudi Arabia that better matches the trading cycle of crude. The new step will improve the overall competitiveness of Qatar Marine and Qatar Land, and allow existing and new customers to make better comparisons between the Qatari crude grades and other grades, QP said. By changing the pricing methodology, QP is following the United Arab Emirates’ ADNOC, which in November introduced a new pricing mechanism for its flagship Murban crude. ADNOC said it expected to implement its new Murban forward pricing mechanism between the second and third quarters of 2020. Middle East sour crude grades are typically traded two months forward in the Asia market, meaning that next year’s March-loading crude cargoes will be traded in January. Syria’s parliament has approved contracts for oil exploration with two Russian companies in an effort to boost production hit by more than eight years of war and Western sanctions. The deals cover exploration and production in three blocs, including an oilfield in northeast Syria and a gas field north of the capital Damascus. It said the contracts, passed in a parliament session, were signed with two Russian firms it identified as Mercury LLC and Velada LLC. Syria produced around 380,000 barrels of oil per day before the war but production collapsed after fighting hit the oil-rich east. Oil fields have largely been in the hands of Kurdish fighters who seized swathes of north and east Syria from Islamic State with US help. Israel’s Navitas Petroleum said it had purchased 50 percent of the rights in four producing oil fields in Texas from oil and gas company Denbury Resources for $45 mn. Navitas’ share in current production under the deal will be 1,363 barrels of oil a day, and it said it intends to carry out further development at the projects.

Russia

Russia’s Gazprom plans to produce more than 12 mt of oil equivalent from its Achimov formation in Western Siberia this year and increase output to at least 14 mt in 2020. Yury Masalkin, in charge of Gazprom Neft’s department on exploration and resources, also told Gazprom’s inhouse magazine that the output could double by 2025. Rosneft is seeking investment in the company’s $157 bn Vostok oil project in the Russian Arctic from Japanese trading houses and oil companies. Vostok Oil is a newly established company that was formed to unite Rosneft’s projects in northern Russia, including the Lodochnoye, Tagulskoye and Suzunskoye oilfields, and other projects, including the Ermak Neftegaz venture with BP. Crude oil is expected to be shipped to Asia via the North Sea Route. Rosneft needs backing because of the huge amounts required to develop the fields. The Vostok project will require about 10 tn roubles ($157 bn) of investment. The Russian government has broadly agreed a new tax relief package to help develop the Arctic, seen as a new oil-producing region for Russia, which is among the world’s top crude exporters. Rosneft expects to produce up to 100 mt of oil per year (2 mn barrels per day), or a fifth of what Russia currently pumps.

China

China expects to add 1.2 bt to its proved petroleum reserves in 2019, 25 percent more than was added in 2018. Crude oil production is seen reaching 191 mt. China will accelerate ocean and deep water oil and gas exploration in 2020. Crude output in China rose 1.0 percent to 174.95 mt in the first 11 months of the year, the National Bureau of Statistics said, while natural gas output also jumped robustly to 157.5 bcm in January-November period.

| FY: Financial Year, OMCs: Oil Marketing Companies, O&G: oil and gas, US: United States, mn: million, bn: billion, tn: trillion, mt: million tonnes, bt: billion tonnes, bcm: billion cubic meters, LNG: liquefied natural gas, ATF: aviation turbine fuel, IOC: Indian Oil Corp, HPCL: Hindustan Petroleum Corp Ltd, BPCL: Bharat Petroleum Corp Ltd, RIL: Reliance Industries Ltd, ONGC: Oil and Natural Gas Corp, PPAC: Petroleum Planning and Analysis Cell, IEA: International Energy Agency, mtpa: million tonnes per annum, LPG: liquefied petroleum gas, PSU: Public Sector Undertaking, UP: Uttar Pradesh, NCR: National Capital Region, MDUs: Mobile Dispensing Units, IOC: Indian Oil Corp, IMO: International Maritime Organization, OPEC: Organization of the Petroleum Exporting Countries, IATA: International Air Transport Association, QP: Qatar Petroleum, ADNOC: Abu Dhabi National Oil Company |

NATIONAL: OIL

Petrol prices fall for 3rd day, diesel rates stable

14 January. Petrol prices continued to decrease for the third consecutive day, but the diesel prices remained stable after two days of decline. In Delhi, Kolkata and Mumbai the petrol prices were cut by 11 paise a litre, while in Chennai it was down by 10 paise per litre. According to the Indian Oil Corp (IOC), the price of petrol in Delhi, Kolkata, Mumbai and Chennai has come down to Rs75.70, Rs78.29, Rs81.29 and Rs78.65 per litre respectively. At the same time, the price of diesel in the four metros continue to be Rs69.06, Rs71.43, Rs72.42 and Rs72.98 per litre respectively.

Source: The Economic Times

India’s oil imports from Iraq, Nigeria and UAE increase in November 2019

13 January. India’s oil imports from Iraq, Nigeria, and United Arab Emirates (UAE) increased in November 2019 as compared to the corresponding month a year ago as the country tries to replace Iranian and Venezuelan crude. With Iranian crude out bounds for India since the middle of last year, the country’s oil imports from Iraq, Nigeria, and the United States (US) have increased sizeably during the first eight months (April-November) of financial year 2019-20 (FY20) as compared to the corresponding period a year ago. India had imported 19 million tonnes (mt) of Iranian crude in the April-November period of FY19. India’s oil imports from Iraq increased 25 percent to 4.72 mt in November last year, as compared to the year-ago period. Overall, India’s oil imports from Iraq increased 10.25 percent to 33.44 mt in the first eight months of FY20. Iraq had replaced Saudi Arabia to become the largest oil supplier to India in FY18. India’s oil imports from Saudi Arabia in the month of November 2019 declined marginally to 4.27 mt, as compared to the year-ago period. Overall, oil imports from Saudi Arabia increased marginally to 27.97 mt in the first eight months of FY20, as compared the corresponding period a year ago. Oil imports from Nigeria increased 59 percent to 2.08 mt in November 2019, as compared to the year-ago period. Overall, oil imports from Nigeria in the first eight months of FY20 increased to 12.25 mt, as compared to the corresponding period a year ago. The country replaced Iran to become the third-largest crude oil supplier to India in FY20.

Source: The Economic Times

IOC launches special NATO class diesel for Indian Navy

13 January. Indian Oil Corp (IOC) has developed a special class diesel conforming to NATO grade for use in ships and vessels of Indian Navy. Vice Admiral G S Pabby launched the Upgraded High Flash High-Speed Diesel in presence of IOC Director (R&D) SSV Ramakumar and IOC Director (Refineries) S M Vaidya, the company said. The fuel possesses the best rheological and detergent characteristics validated against most stringent military specifications.

Source: Business Standard

No dearth of crude oil in global market: Pradhan

12 January. Oil Minister Dharmendra Pradhan said that there was no dearth of crude oil in global market and government was keeping a sharp eye on the global developments. He also appealed to oil-producing countries and their leadership for peace and stability in the global economy.

Source: Business Standard

India’s oil demand growth set to overtake China by mid-2020s: IEA

10 January. India’s oil demand growth is set to overtake China by mid-2020s, priming the country for more refinery investment but making it more vulnerable to supply disruption in the Middle East, the International Energy Agency (IEA) said. India’s oil demand is expected to reach 6 mn barrels per day (bpd) by 2024 from 4.4 mn bpd in 2017, but its domestic production is expected to rise only marginally, making it more reliant on crude imports and more vulnerable to supply disruption in the Middle East, the IEA said. China’s demand growth is likely to be slightly lower than that of India by the mid-2020s, as per IEA’s China estimates given in November, but the gap would slowly become bigger thereafter. Brent crude prices topped $70 a barrel on rising geopolitical tensions in the Middle East, putting pressure on emerging markets such as India. India is highly dependent on Middle East oil supplies, like its Asian peers, with Iraq being its largest crude supplier. India, which ranks No. 3 in terms of global oil consumption after China and the United States, ships in over 80 percent of its oil needs, of which 65 percent is from the Middle East through the Strait of Hormuz, the IEA said. The IEA, which coordinates release of strategic petroleum reserves (SPR) among developed countries in times of emergency, said it is important for India to expand its reserves. India is the world’s fourth largest oil refiner and a net exporter of refined fuel, mainly gasoline and diesel. It plans to lift its refining capacity to about 8 mn bpd by 2025 from about 5 mn bpd at present.

Source: Reuters

Ahead of 1 April deadline, Chennai begins to get BSVI fuel

9 January. With 1 April being the deadline to switch over to cleaner BSVI-compliant auto fuels, select pumps in Chennai have begun to dispense the upgraded petrol and diesel with a target of complete conversion in Tamil Nadu by February. The country will migrate to BSVI fuel standards from 1 April from the present BSIV. BSVI fuel will bring down sulphur content by five times from the current BSIV levels. Indian Oil Corp (IOC) has six fuel terminals in the state, one each in Tondiarpet, Korukkupet, Trichy, Madurai, Sankaridurg and Coimbatore. The Korukkupet terminal, which feeds pumps in Central and South Chennai, has already begun to dispense BSVI fuel. All the fuel terminals of IOC are almost ready except Coimbatore which will be fed with BPCL (Bharat Petroleum Corp Ltd) fuel from Kochi Refinery.

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Gas pricing challenge must be addressed to increase domestic production!

< style="color: #ffffff">Bad! |

Source: The Economic Times

No duty cuts to soften fuel spike: Pradhan

9 January. The government has ruled out an immediate cut in taxes on petrol and diesel to soften the impact of the geo-political tensions, which have triggered a spike in global crude oil prices. Brent prices crossed the $71-a-barrel mark morning after Iran launched a missile attack, but softened later in the day. Since last year, Brent prices have jumped nearly 15 percent and were trading around $68 a barrel. Over the past year, the increase in pump prices of diesel and petrol has been around 10 percent. Oil Minister Dharmendra Pradhan said that the government is keeping a close watch on the developing geo-political situation, while also preparing itself to face any eventuality arising out of the crisis. Pradhan has had detailed discussions with External Affairs Minister S Jaishankar, who has spoken to his counterparts in oil-producing countries stating India’s concerns. A sharp rise in oil prices has the potential to adversely impact the Indian economy with inflation facing the first round of impact.

Source: The Economic Times

BPCL Refinery employees extend support to all India strike

8 January. BPCL (Bharat Petroleum Corp Ltd) Refinery employees union extended support to the all India strike called by Central Trade Unions to be observed. The employees of the oil and gas company are protesting against the government’s decision of strategic disinvestment of BPCL. The trade unions have put forth a 12-point charter of common demands which include pay hike, minimum wage, social security and a uniform five-day week.

Source: Business Standard

NATIONAL: GAS

IEA slams India’s gas pricing, says it reduced incentives to raise supply

13 January. The International Energy Agency (IEA) has slammed India’s natural gas pricing policy, saying linking domestic production to very low global reference prices has reduced incentives for producers to raise supplies. In its first in-depth review of India’s energy policies, IEA said for the share of environment-friendly fuel to rise, the government needs to ensure gas is treated on a level playing field with other fuels for taxation and is included under the Goods and Services Tax (GST). However, one challenge to raising share of natural gas in the energy basket to 15 percent by 2030 from current 6 percent is gas pricing, it said. The Narendra Modi government, after storming to power in 2014, had approved a formula to price domestically produced gas at the average rate prevailing in gas exporting countries such as the United States, United Kingdom, Canada, and Russia. Price according to this formula currently is $3.23 per million metric British thermal units (mmBtu), half of what India’s pays for import of liquefied natural gas (LNG). IEA said there is no trading hub yet in India, although its creation has been suggested for 2019. IEA also said access to LNG facilities currently needs to be negotiated with the owner. But the government is considering establishing an open access regime for these facilities.

Source: Business Standard

60 pc of IGGL would be funded by Centre: Patowary

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">VGF for Indradhanush pipeline will accelerate gas infrastructure growth!

< style="color: #ffffff">Good! |

10 January. The CCEA (Cabinet Committee on Economic Affairs) has approved viability gap funding (VGF) at 60 percent of the estimated cost of Rs92.65 bn for setting up of the 1,656 kilometre (km) Indradhanush Gas Grid Ltd (IGGL) in the North East region, Assam Industries Minister Chandra Mohan Patowary said. The CCEA, chaired by Prime Minister Narendra Modi had approved VGF/ Capital Grant of 60 percent for the IGGL project. Patowary said it shall cover all the eight North East states of Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim and Tripura.

Source: Business Standard

L&T Infrastructure Finance to provide Rs5.1 bn loan to AG&P for city gas projects

8 January. L&T Infrastructure Finance Company Ltd will provide Rs5.18 bn term loan to Singapore-based gas major AG&P Group’s Indian arm for developing city gas networks in Rajasthan and Tamil Nadu. AG&P is the largest foreign player in the city gas distribution (CGD) business after it won licenses to retail compressed natural gas to automobiles and piped cooking gas to households in 12 cities in Andhra Pradesh, Karnataka, Kerala, Rajasthan and Tamil Nadu. These funds will be used to develop the CGD networks of AG&P CGD in Jodhpur, Barmer and Jaisalmer in Rajasthan and Ramanathapuram in Tamil Nadu. AG&P CGD India Pvt Ltd is building over 1,500 CNG (compressed natural gas) stations, supported by 1,800 kilometre (km) of steel pipelines which will run across the length and breadth of the geographies awarded.

Source: Business Standard

Oil PSUs start payments for Mozambique LNG project

8 January. Oil PSUs (Public Sector Undertakings) such as ONGC (Oil and Natural Gas Corp), BPCL (Bharat Petroleum Corp Ltd) and OIL (Oil India Ltd) have begun making their share of payment of about $2 bn towards the much-delayed Mozambique liquefied natural gas (LNG) project. Three state-run firms have a combined 30 percent participating interest in the Mozambique gas project, which made a final investment decision last year to spend about $15 bn on developing gas fields and liquefaction project. ONGC, which owns 16 percent participating interest in the project, will have to pay about $1 bn while BPCL and OIL with their 10 percent and 4 percent interest, respectively, will contribute a little less than $1 bn together.

Source: The Economic Times

NATIONAL: COAL

India is in talks with Mongolia and Russia for importing coking coal: Pradhan

13 January. India is in talks with Mongolia for either acquiring stakes in coking coal assets or sourcing the fuel used in the steel and metallurgical industry, Oil Minister Dharmendra Pradhan said. He said India needs to import high-quality coking coal.

Source: The Economic Times

CIL will remain dominant player: Joshi

11 January. Coal India Ltd (CIL) will continue to be India’s biggest coal supplier even after the government’s decision to throw open the sector to private players through an ordinance, Union Coal and Mines Minister Pralhad Joshi said. The coal ministry will also back the private sector, which along with CIL will help bring down coal imports to zero in four to five years, he said. His ministry would request the Railways to invest in infrastructure to transport coal from private mines that are not connected.

Source: The Economic Times

No financial and technical yardstick for coal auctions

10 January. India’s upcoming coal auctions will have no financial or technical qualification criteria for bidders, easing entry for interested firms, but will impose penalties strict enough to prevent companies from squatting on mines. The coal ministry will soon issue draft auction rules and they will be discussed with stakeholders before finalisation. The rules will propose relaxed norms to ensure wider participation in the auctions to increase coal availability. The centre expects coal demand of 1,250 million tonnes in 2024, which can in no way be met by Coal India Ltd alone, forcing the country to move to this market-driven approach. The Mineral Laws (Amendment) Ordinance 2020 promulgated by Union Cabinet proposed removal of the requirement to auction mines to companies ‘already engaged’ in coal mining in India.

Source: The Economic Times

Monopoly miner to deter investors from coal mining in India

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Coal monopoly is a deterrent to private investment in the sector!

< style="color: #ffffff">Ugly! |

10 January. Competition from an Indian state-run monopoly, which gets its coal mines free, may stymie Prime Minister Narendra Modi’s efforts to attract more investments into the sector. India opened up coal mining to all companies, amending laws that had restricted it mainly to power and metals firms. Unlike Coal India Ltd (CIL), new investors will have to bid for the mines. The nation is trying to increase output as new thermal power plants and steel mills boost demand at home even as the world is turning away from the polluting fuel. Last year, the government allowed 100 percent foreign direct investment in coal extraction amid surging imports and falling output at CIL.

Source: Bloomberg

Steel players hail government’s decision to open coal sector

8 January. Indian steel industry welcomed the government’s decision to promulgate an ordinance to open up coal mining in the country to non-coal companies. Indian Steel Association (ISA) said it hails the decision of the Cabinet to amend MMDR Act 1957 and Coal Mines (Special Provisions) Act 2015. The amendment, ISA said, will remove the end-user restrictions besides allowing seamless transfer of environment and forest clearance in operational mines. JSW Steel Chairman Sajjan Jindal said the move will go a long way in reducing the coal imports. India has reserves for another 300 years and the time is ripe to use it. If it is not utilised now, it wont be able to utilised in future as developed countries are against coal usage.

Source: Business Standard

NATIONAL: POWER

India’s annual electricity demand grows at slowest pace in 6 years

14 January. India’s annual electricity demand in 2019 grew at its slowest pace in six years with December marking a fifth straight month of decline, government data showed. Electricity demand is seen as an important indicator of industrial output in the country and a sustained decline could mean a further slowdown in the economy. India’s power demand grew at 1.1 percent in 2019, data from the Central Electricity Authority showed, the slowest pace of growth since a 1 percent uptick seen in 2013. The power demand growth slowdown in 2013 was preceded by three strong years of consumption growth of 8 percent or more. In December, the country’s power demand fell 0.5 percent from the year-earlier period, representing the fifth straight month of decline, compared with a 4.3 percent fall in November. But in Maharashtra and Gujarat, two of India’s most industrialised provinces, monthly demand increased. In October, power demand had fallen 13.2 percent from a year earlier, its steepest monthly decline in more than 12 years, as a slowdown in Asia’s third-largest economy deepened. Industry accounts for more than two-fifths of India’s annual electricity consumption, while homes account for nearly a fourth and agriculture more than a sixth.

Source: Reuters

Adani in early talks to acquire Reliance Power’s troubled unit

14 January. Adani Group is exploring acquisition of Vidarbha Industries Power Ltd (VIPL), a subsidiary of Reliance Power which supplies electricity to Adani Electricity Mumbai. The talks between billionaire Gautam Adani-led group and Anil Ambani-led Reliance Power are at an early stage. VIPL operates two 300 MW units at Butibori in Maharashtra, but it has not been generating any power since mid-January after Coal India Ltd (CIL) stopped supplying coal over an ongoing litigation which is in the Delhi High Court and issues relating to payment. VIPL had shut its first unit of 300 MW before that. The spat has forced Adani Electricity to buy power from the open market to meet its obligation to its 3 mn customers in the city. Adani has been procuring power from the market at Rs3.50-4/unit. In comparison, VIPL was charging it Rs4.38/unit, which could go up to Rs5.50 if it is allowed to pass on the entire cost of coal procurement. Any potential acquisition will be guided by Adani Electricity’s internal target of reducing the average cost of power to about Rs4/unit.

Source: The Economic Times

Adani seeks 1 percent cut, Tata 9 percent hike in power tariffs

11 January. The city’s two biggest power utilities, Adani Electricity Mumbai Ltd (AEML) and Tata Power Company Ltd, have submitted their tariff proposals to the state power regulator Maharashtra Electricity Regulatory Commission (MERC). While AEML has proposed tariff reduction of 1 percent for consumers using between 100 and 300 units per month, Tata Power has proposed a hike of 9 percent for the same category, for the financial year 2020-21. However, even after the reduction AEML’s tariff will continue to be higher for this category of consumers. More than 80 percent of the consumers fall in the 100-300 band. The last date for filing suggestions/objections regarding the proposals is 31 January. The public hearing for AEML will take place on 4 February and Tata Power on 7 February. The new tariff structure will come into force from 1 April. AEML has proposed a reduction of 4 percent in tariff for consumers using below 100 units per month from the existing Rs3.29 per unit to Rs3.15. In the case of consumers up to 300 units, AEML has proposed to bring down tariff from Rs6.53 to Rs6.50. For consumers using between 300 and 500 units, AEML has proposed an increase of Rs0.03 per unit. The existing tariff for these consumers is Rs7.72. In the case of consumers with consumption of 500 and above, the company has proposed a hike of 13 percent. The existing tariff for this category of consumers is Rs9.57. TPC proposed to increase tariff for consumers using up to 100 units from the existing Rs1.35 per unit to Rs2.68 – a rise of almost 99 percent. Similarly, it proposed to increase tariff for consumers using up to 300 units from the existing Rs4.05 to Rs4.41, a hike of 9 percent.

Source: The Economic Times

AAP holds protest over power tariff hike in Punjab

10 January. Police used water canons to stop the Aam Aadmi Party (AAP) workers protesting against the hike in power tariff in Punjab from moving towards the Chief Minister Amarinder Singh'’s residence. The main opposition party also sought scrapping of power purchase agreements signed during previous SAD-BJP regime with private plants. Power rates in Punjab were increased by 36 paise a unit with effect from 1 January for domestic consumers. The party leaders alleged that power consumers were being forced to pay between Rs9 and Rs12 a unit which was "much higher" as compared to electricity rates in other states. The AAP said the Congress before coming to power had promised to review the power purchase agreements but failed to do so despite being in power for more than two and a half years now.

Source: Business Standard

Jharkhand University to get help from US institute for power sector improvement

9 January. The Initiative for Sustainable Energy Policy (ISEP) at the Johns Hopkins University (JHU) announced it has signed a Memorandum of Understanding (MoU) with the Central University of Jharkhand (CUJ), India. The Initiative and CUJ will collaborate for an initial period of 3 years till November 2022 to primarily identify possible research, training, and education activities in India, specifically in Jharkhand for power sector improvement. ISEP and CUJ will collectively work to strengthen the governance process in the power sector by addressing the issues of policymaking. The Initiative and CUJ will convene distribution companies, government officials and other stakeholders to identify priorities for power sector improvements. The two parties will also together try to understand the best practices that could be implemented in the state’s power sector and work closely with decision makers, non-governmental organisations, and other stakeholders to learn from the most promising power sector experiences and apply them to achieve concrete results.

Source: The Economic Times

Uttar Pradesh power staff stop work to oppose Centre’s policies

9 January. About 15 lakh power sector employees and engineers across the country boycotted work in protest against the Centre’s move to pass the Electricity (Amendment) Bill and other privatisation policies. They also demanded the implementation of old pension scheme. The boycott call was given by National Co-ordination Committee of Electricity (NCCOEEE), an umbrella union of all federations of electricity employees and engineers in the country. In Lucknow, scores of employees gathered and raised anti-government slogans during a protest meeting at Shakti Bhawan. Chairman of coordination committee, Shailendra Dubey, said most of the amendments proposed in Electricity Act-2003 and national tariff policy were against the interests of common consumers. Under the new tariff policy, Dubey said, full cost of power will be charged by private company with guaranteed profits from consumers thus raising the bill of consumers. Under this, policy subsidy and cross-subsidy will be phased out in three years. This will raise the cost of electricity for consumers.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Pune NGO offers to produce fuel from city’s plastic waste

14 January. A Pune-based NGO Keshav Sita Memorial Foundation Trust has approached Nagpur Municipal Corp (NMC) with a solution to the ever-worsening problem of plastic waste. Under its corporate social responsibility (CSR) initiative, the NGO has offered to set up a plant to produce fuel from plastic waste at Bhandewadi dumping yard. Non-bio-degradable plastic has already become a major concern for the civic body. Despite ban on single-use plastic carry bags, city infrastructure like sanitation, water supply and rivers are being badly affected by plastic waste. If the project starts, the NMC will also get royalty from the sale of fuel produced apart from the disposal of plastic waste.

Source: The Economic Times

Ludhiana Smart City Mission to begin second phase of solar project soon

13 January. The Ludhiana Smart City mission will soon begin second phase of installation of rooftop solar panels and under this government schools and colleges will be covered. The Ludhiana Smart city limited and Punjab Energy Development Authority (PEDA) has signed an agreement wherein the latter will install the rooftop solar panels while funding will come through Smart City Mission. For this project the site survey is almost over and officials have claimed that by the last week of January or first week of February installation process will start. According to the proposal, government schools, government colleges and meritorious schools will get rooftop solar panels. As many as 25 locations have been identified for the purpose. The total capacity of these rooftop panels will be around 800 kilowatt (kW) and will cost Rs40.3 mn. The PEDA has already conducted a site survey at the locations. The purpose of the project is to reduce hefty electricity bills at government educational institutions.

Source: The Economic Times

Punjab CM reiterates demand for VGF for biomass projects

10 January. Punjab Chief Minister (CM) Amarinder Singh has written to the Centre reiterating his demand for viability gap funding (VGF) for biomass power projects and biomass solar hybrid power projects to check stubble burning in the state. In a letter to Union Minister of State for Power, New and Renewable Energy, R K Singh, the CM has sought his personal attention towards framing of scheme/guidelines for promoting biomass power projects by providing one-time viability gap funding in a phased manner, and for a pilot biomass solar hybrid power project, as suggested by the state government on several occasions. This, stressed Amarinder, would go a long way in complying with the directions of the Supreme Court of India for tackling the problem of stubble burning in Punjab. He asked the ministry to provide Punjab Rs50 mn per MW of biomass power projects and Rs35 mn per MW for biomass solar hybrid power projects to help the state address the problem of pollution arising from stubble burning.

Source: Business Standard

Power ministry seeks more time for coal plants to install emission cutting tools

10 January. India’s federal power ministry has proposed a new deadline for coal-fired power plants around New Delhi to install equipment to reduce emissions. The ministry has said that the power plants be given deadlines starting July 2020 and ending December 2021 to install the equipment. The last deadline for installing such equipment ended on 31 December 2019, with just one out of the 11 utilities in the national capital region having installed the equipment. The utilities could not meet the emissions standards of December 2017, which was then extended by another 2 years. The environment ministry will take the final call on the power ministry’s proposal. The finance ministry is considering waiving about $6 per ton of carbon tax on coal.

Source: Business Standard

Indian Railways to procure 1 GW solar power by 2021-22

9 January. Indian Railways has planned to source around 1,000 MW solar power and 200 MW of wind power by 2021-22 across zonal railways and production units, the rail ministry said. Of this, 500 MW solar plants are to be installed on the roof top of Railway buildings which will be used to meet non-traction loads at Railway Stations while 500 MW land based solar plants will be used to meet both traction and non-traction requirements. South Central Railway zone is implementing several measures aimed at energy conservation by harnessing renewable energy. This includes installation of solar panels at stations and service buildings across the zone. The Nandyal–Yerraguntla section in Guntakal Division has been declared as the first solar section in South Central Railway. Across the network of Indian Railways, 16 stations have already been declared green which are meeting energy needs completely either through solar or wind power.

Source: The Economic Times

Government, NTPC to sign MoU for solar park in Jaisalmer

8 January. The government is set to ink an agreement with NTPC Ltd for developing a 925 MW solar park in Jaisalmer that would fetch nearly Rs40 bn investment. The ultra-mega solar park at Nokh, spread over 1850 hectare, will be the first project for developing a park under the new solar policy announced. Rajasthan Renewable Energy Corp Ltd (RRECL) said that discussions and decisions with NTPC have taken a definite shape for developing the Nokh Ultra Mega Solar Park and an agreement is likely to be signed very soon. In the new solar policy that aims to achieve a target of 30,000 MW solar power projects, RRECL has laid emphasis on setting up Ultra Mega Renewable Energy Power Parks in joint venture. RRECL has already had preliminary discussions with Power Finance Corporation, Solar Energy Corp of India, and National Hydroelectric Power Corp for developing solar parks.

Source: The Economic Times

INTERNATIONAL: OIL

Indonesia to allow Pertamina 50 mn barrels of crude imports in 2020

14 January. Indonesian government will allow state oil and gas company PT Pertamina to import 50 mn barrels of crude oil in 2020, lower than requested, energy ministry’s acting oil and gas director general, Djoko Siswanto, said. The crude import quota is around 30 mn barrels short of what Pertamina requested, he said.

Source: Reuters

China’s 2019 annual crude imports set record for 17th year

14 January. China’s crude oil imports in 2019 surged 9.5 percent from a year earlier, setting a record for a 17th straight year, as demand growth from new refineries built last year propelled purchases by the world’s biggest importer, according to data from the General Administration of Customs. Last year, China imported a record 506 million tonnes (mt) of crude oil, according to data. That is equivalent to 10.12 mn barrels per day (bpd). Chinese crude imports have set records every year since 2003. The annual increase equates to 882,000 bpd in incremental purchases, largely because of demand from new plants that added 900,000 bpd to China’s oil-processing capacity, although some of the units started operating only in December. December imports were boosted by private refiners using up their annual import quotas, while state plants stocked up on oil before the holiday shutdown that accompanies China’s Lunar New Year festival, which falls in late January this year.

Source: Reuters

Equatorial Guinea to add 20k bpd of oil production this year

12 January. Equatorial Guinea will add 20,000 barrels per day (bpd) of oil production by October, Oil Minister Gabriel Obiang Lima said. Equatorial Guinea, a member of the Organization of the Petroleum Exporting Countries (OPEC), currently produces 120,000 bpd. Asked about the need to extend the OPEC+ production cuts agreement beyond March, he said the deal should be maintained if the oil price range remains between $60 and $70 a barrel. In the country’s budget for 2020, the oil prices is forecast at $51 a barrel, he said. He said agreements and Memorandums of Understanding (MoU) for two new oil refineries would be announced in April. Plans for new energy projects worth $1 bn, including the two refineries, were announced in November. Construction of the two refineries, which are expected to process up to 40,000 bpd of crude oil, is expected to start by the end of the year, he said. Equatorial Guinea will also probably announce a new bidding round for several exploration blocks in April, he said. He said an announcement would be made in June on who would invest in the Zafiro oilfield after Exxon exits.

Source: Reuters

Woodside, partners get final go-ahead for Senegal’s first oil project

10 January. Australia’s Woodside Petroleum Ltd said its $4.2 bn Sangomar project, Senegal’s first oil development block, is all set to roll into motion as it has received all necessary approvals. The offshore oil project, which is expected to strike first oil in the next three years, has entered the “execute phase,” with operator Woodside issuing notice to proceed with drilling, subsea construction and installation contracts, the oil and gas company said. The project, run as a joint venture between Woodside Energy, Cairn Energy Plc, Far Ltd and Senegal state-owned Petrosen, is estimated to target 231 mn barrels of oil resources in its initial phase of development. Senegal authorized the West African country’s first oil development, galvanizing partners in the project who are eager to push ahead even as they await the outcome of arbitration over a dispute with Far Ltd.

Source: Reuters

Global oil market well supplied, see no reason for spike in prices: IEA

10 January. The global oil market is well supplied with about 1 mn barrel per day (bpd) of excess supply which will help keep a lid on prices, IEA (International Energy Agency) Executive Director Fatih Birol said. He said oil prices had temporarily gone up due to geopolitical events but have come down. Oil prices in 2019 remained around $60 per barrel despite attack on Saudi Aramco’s oil facilities, Iran oil going out of market and collapse of major oil producer Venezuela, he said. India is 84 percent dependant on imports to meet its oil needs and any spike in global prices has a direct bearing on its economy. He said the IEA does not make a price forecast. He said IEA expects US (United States) shale production to continue to increase but the range of increase is going to slow.

Source: The New Indian Express

Belarus halts own oil exports to Germany, Russian oil transit unaffected

10 January. Belarus’ state oil company Belorusneft has suspended supplies of its own oil to Germany this month as Minsk needs to compensate for shortages of Russia-sourced oil amid a contract dispute with Moscow. Russia suspended oil supplies to Belarus on Jan. 1 in relation to a dispute over supply contract terms between Moscow and Minsk. Two Russian firms, Russneft and Neftisa, restored some supplies late on 4 January. Belorusneft’s decision to suspend oil flows to Germany shows the challenges Minsk is facing while trying to negotiate the new oil supply deal with Russia. Moscow and Minsk have had several oil and gas spats over the past decade. The Belorusneft supplies are separate from Russian oil transit to Europe via the Druzhba pipeline, part of which comes via Belarus and which so far has not been affected. Belorusneft supplies more than 100,000 tonnes per month of its crude oil to PCK Raffinerie GmbH in the north east of Germany. The refinery is majority owned by Rosneft. Royal Dutch Shell has 37.5 percent in the plant, while Italian Eni owns 8.33 percent. Rosneft has said it is the third largest oil refining company on the German market with a total crude oil refining capacity of up to 12.5 million tonnes per year, representing more than 12 percent of Germany’s capacity.

Source: Reuters

Norway sees rapid growth in oil output from 30 years lows

9 January. Norway’s oil output will grow by 43 percent from 2019 to 2024 as new fields come on stream and older production facilities are upgraded, forecasts from the Norwegian Petroleum Directorate (NPD) showed. By 2023, combined output of oil and gas is expected to reach close to the record level seen in 2004, the agency said, although gas would have a greater share than before. Production growth in Norway, alongside steep output gains in the United States (US) and Brazil, will add pressure on oil prices in a market which is already perceived as oversupplied. OPEC (Organization of the Petroleum Exporting Countries) has been curbing output since 2017 to balance the market, but oil prices have failed to go above $70 per barrel even though US sanctions on Iran and Venezuela have steeply cut exports from those nations. Crude output from Norway’s offshore fields is now predicted to hit 2.02 mn barrels per day (bpd) in 2024, up from a 30-year low of 1.41 mn last year, as major oilfields Sverdrup and Castberg gradually come on stream. The NPD now expects Norway’s oil output to total 1.76 mn bpd in 2020, up from a previous forecast of 1.74 mn made a year ago. While exploration increased in 2019, to 57 wells from 53 the previous year, it will likely decline to 50 wells in 2020, the NPD said.

Source: Reuters

INTERNATIONAL: GAS

China’s natural gas demand growth in 2020 seen slowest in 4 years

13 January. China’s natural gas demand in 2020 is expected to grow at its slowest pace in four years due to a faltering economy, according to a think-tank at the country’s largest energy producer, China National Petroleum Corp. Slower demand growth in China would drag down global LNG (liquefied natural gas) markets already grappling with oversupply and low spot prices. The think tank forecast natural gas consumption to rise 8.6 percent this year to 330 billion cubic meters (bcm). That would mark the slowest demand growth since 2016. CNPC expects 2019 gas consumption up 9.6 percent year-on-year at 304 bcm. China’s natural gas output would hit 187.5 bcm in 2020, up 8.2 percent year-on-year, boosted by Beijing’s push to increase domestic production, it said, adding that imports of the fuel is expected to reach 150 bcm, up 9.3 percent from a year ago. The imports will partly come from Russia, driven by the landmark Siberian gas pipeline which was launched in December. In 2020, LNG imports are expected to rise 9.5 percent year-on-year to around 94 bcm. The think-tank also expects China’s LNG receiving capacity to exceed 88 million tonnes per year. China overtook Japan as the world’s top importer of LNG in November and December on a monthly basis, but on an annual basis Japan is still the No. 1 LNG importer worldwide.

Source: Reuters

Nord Stream 2 gas pipeline will be finished by year-end: Russian President

11 January. Russian President Vladimir Putin said he hoped the Nord Stream 2 gas pipeline would be completed by the end of the year or in the first quarter of 2021, after sanctions imposed by the United States (US) delayed construction. The pipeline, which will carry Russian gas to Europe avoiding transit across Ukraine, requires some 160 kilometre (km) of pipes to be laid and was initially expected to be in operation in the first half of 2020.

Source: Reuters

PetroChina produces 8.03 bcm shale gas from Sichuan in 2019, up 88 percent

9 January. China’s state energy giant PetroChina pumped out 8.03 billion cubic meters (bcm) of shale gas in the southwestern province Sichuan in 2019, up 88 percent from 2018, the company said. Daily shale gas output at the Southern Sichuan field, the biggest shale gas production base in China, reached as much as 30.97 million cubic meters it said. The company started to drill 456 new shale gas wells in 2019, with 229 wells having been launched. PetroChina expected that the combined shale gas output at PetroChina and Sinopec to reach 15 bcm in 2019.

Source: Reuters

Indonesia plans new gas pricing for industrial users in March

9 January. Indonesia plans to unveil a new gas pricing policy for industrial customers in March in a bid to lower energy costs for manufacturers, Energy and Mineral Resources Minister Arifin Tasrif said. Indonesia’s President Joko Widodo asked his cabinet to come up with a strategy to lower gas prices for manufacturers to around $6 per million metric British thermal units (mmBtu). Manufacturers have been complaining about gas prices running at about $8-$9 per mmBtu, despite a 2016 rule that ordered energy companies to cut natural gas prices for some industries. The energy ministry is studying a so-called Domestic Market Obligation (DMO), Tasrif said, which would force gas producers to sell some of their output locally at capped prices to ensure cheap supplies for manufacturers. Indonesia produced 229.1 cargoes of LNG from the two plants in 2019, 111.7 cargoes from Bontang and 117.4 cargoes from Tangguh, SKK Migas data showed. Around 74 percent of the total was exported and the rest sold domestically.

Source: Reuters

INTERNATIONAL: COAL

Germany’s Siemens to support Australian coal project despite protests

13 January. German engineering group Siemens said it would fulfil its contractual obligations to a controversial coal mining project in Australia’s outback, attracting criticism from environmental groups. Siemens was awarded a contract last year to provide signaling technology for a railway line to transport coal from a remote coal mine run by India’s Adani Group in northern Queensland state. Environmental activists slammed the decision and pledged to continue their protests, concerned the continued use of coal will lead to higher emissions of carbon dioxide, a gas which is linked to global warming.

Source: Reuters

Dutch insurer Aegon to reduce coal investments

13 January. Dutch insurer Aegon said it will gradually reduce holdings in companies generating revenue from coal-fired power plants, or coal mining, to support the transition toward a low-carbon economy. Aegon said it already excludes companies that derive more than 30 percent of sales from the exploration, mining, and refining of thermal coal. It will scale back those investments over the next decade. The Dutch insurer, with more than 300 bn in managed assets at the end of 2018, said it will cease investing in companies who own more than 10 GW of coal-fired electricity generation capacity and have plans to extend their capacity. Aegon will cease to invest in companies producing more than 20 million tonnes of thermal coal annually, and are expanding coal-related business, it said.

Source: Reuters

Tri-State to close coal power plants in Colorado and New Mexico

10 January. Tri-State Generation and Transmission Association said it will close its Escalante Station in New Mexico by end of 2020, and Craig Station and Colowyo Mine in northwest Colorado by 2030. The wholesale power supplier will recognize a one-time impairment loss of about $282 mn in the first quarter of 2020 due to early retirement of 253 MW, coal-fired Escalante generating station.

Source: Reuters

INTERNATIONAL: POWER

Nepal’s TIA facing electricity shortage

12 January. Nepal’s Tribhuvan International Airport (TIA) has reported facing electricity shortage, with authorities urging all stakeholders to make sure that power being supplied to the airport was utilised in an optimum manner. A notice issued by the airport management said that excessive power consumption at TIA for trivial purposes was directly affecting the communication, navigational aids and surveillance equipment needed for flight operation. As part of its Visit Nepal 2020 campaign, the government of the Himalayan nation has invested 240 mn Nepalese rupees to upgrade TIA to a boutique airport. But lack of adequate electricity supply at TIA may affect the campaign that aims to double the annual tourist arrivals.

Source: The Economic Times

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

By 2030, 57 percent of global power demand should be met by renewables: IRENA

14 January. Renewable energy should supply 57 percent of global power demand by the end of the decade, up from 26 percent, according to the intergovernmental International Renewable Energy Agency (IRENA). Additional investments bring significant savings by minimising losses caused by climate change because of inaction. Savings could amount to between $1.6 tn and $307 tn annually by 2030, IRENA said. IRENA data shows that 60 percent of new electricity access can be met by renewables in the next decade through stand-alone and mini-grid systems.

Source: The Economic Times

China to make national carbon trading breakthrough by year-end

14 January. China expects to make a “breakthrough” on the establishment of a nationwide carbon emissions trading scheme (ETS) by the end of this year, Li Gao, head of the climate office at the Ministry of Ecology and Environment, said. The nationwide ETS was one of the pledges made by China ahead of the Paris climate change agreement in 2015, but its full implementation has been repeatedly delayed.

Source: Reuters

London launches green energy firm to fight climate change, poverty

13 January. London’s mayor launched a green energy company that will provide “fair-priced” electricity from renewable sources, seeking to reduce carbon emissions and make fuel more affordable. One in 10 Londoners cannot afford to pay their energy bills, according to figures from the mayor’s office, which said the new, company London Power, would offer a competitive tariff. Profits will be invested into community projects that help tackle fuel poverty, fight climate change and meet the British capital’s goal of becoming carbon neutral by 2050. London Power is run in partnership with British firm Octopus Energy and will generate electricity from renewable sources including solar and wind. Britain was the first G7 country to commit to reaching net-zero emissions by 2050 and in 2019 produced more electricity from zero-carbon sources such as wind, solar and nuclear than from fossil fuel plants for the first time. London is not the first British city to launch its own energy provider. In 2015 the English city of Nottingham created a not for profit green energy company to tackle local fuel poverty - calling it Robin Hood Energy, after the legendary local hero famed for robbing the rich to pay the poor.

Source: Reuters

UAE to double renewable energy portfolio in next 10 years: ADNOC

13 January. The United Arab Emirates (UAE) grew its renewable energy portfolio by more than 400 percent in the last 10 years, and is on track to double that again in the coming decade, Abu Dhabi National Oil Company (ADNOC) said. ADNOC will reduce greenhouse gas intensity by an additional 25 percent. ADNOC said it would expand the capacity of its Al Reyadah carbon capture, utilization and storage facility, aiming to reach 5 million tonnes of carbon dioxide per year by 2030. Indonesian President Joko Widodo, visiting Abu Dhabi for the sustainability event, called for more investments in clean energy in his country and said its new capital, currently under construction, would adopt a environmentally friendly and low carbon lifestyle.

Source: Reuters

France will not decide on new nuclear reactors before end of 2022

9 January. The French government, which has asked state-controlled utility EDF to look into the feasibility of building six new EPR reactors, said it would not decide whether to go ahead before the end of 2022. French Energy Minister Elizabeth Borne said that the decision on new reactors will come after the start-up of EDF’s Flamanville 3 EPR reactor, which is under construction in the north of France. Borne said France will proceed with shutting down 14 nuclear reactors as indicated in its long-term plan, if all conditions are met, and will continue to diversify its energy mix. France aims to cut the share of nuclear power in its electricity mix to 50 percent by 2035 from around 75 percent now, while increasing the share of renewable solar, wind and biomass. The two oldest reactors at Fessenheim will halt production in February and June this year. Two others will be halted in the middle of the decade, two others in 2027 and 2028, and the remaining reactors by 2035, Borne said.

Source: Reuters

Canada’s Cenovus Energy aims for 30 percent cut in emission intensity by 2030

9 January. Canada’s Cenovus Energy unveiled plans to reduce per-barrel greenhouse gas emissions by 30 percent by the end of 2030, as the country’s oil industry faces growing pressure from environmental activists. The Alberta-based integrated oil and gas company said it will spend an additional C$1.5 bn on businesses run by the country’s indigenous communities. Opposition from environmental and indigenous groups have stalled new pipeline projects in Canada and the United States that are needed to move Canadian crude to refineries. Investors in the region have also become more vocal about environmental, social and governance issues. Prime Minister Justin Trudeau promised Canada would achieve net-zero carbon emissions by 2050. Trudeau, however, lost his majority in the parliament and failed to win a single seat in Alberta, which produces 80 percent of Canada’s crude. Alberta’s oil sands, among Cenovus’s main businesses, have been a focal point of global efforts to stifle fossil fuel production by environmental groups. Cenovus said its long-term ambition is to reach net-zero emissions by 2050. The company will reclaim 1,500 decommissioned well sites and complete C$40 mn ($30.65 mn)of caribou habitat restoration work by 2030. The company said it is adopting a climate and greenhouse gas emissions strategy with several options to help it reach targets. The strategy will also advance its methane emission reduction initiatives that are already underway at its Deep Basin operations.

Source: Reuters

Germany’s RWE is possible takeover target in renewables boom: Goldman Sachs

8 January. RWE, Germany’s largest power producer, could become a takeover target as big industry players strive to expand their renewable portfolios around the world, Goldman Sachs said. Following an asset swap with E.ON, RWE last year became Europe’s third-largest renewables player after Spain’s Iberdrola and Italy’s Enel, and the world’s No.2 offshore wind player after Denmark’s Orsted. Goldman said the global renewables market was fragmented, and that consolidation to add scale was becoming increasingly important to deliver profitable growth.

Source: Reuters

Barclays pressured by shareholders to cut fossil fuel financing

8 January. A group of Barclays shareholders coordinated by responsible investment lobby group ShareAction want the bank to phase out financing fossil fuels, stepping up pressure on one of Europe’s biggest funders of the sector. Eleven institutional investors have filed a resolution to be voted on at Barclays’ annual meeting in May, requiring the bank to set out plans to stop providing all financial services to firms not aligned with the Paris climate agreement. The pressure on Barclays comes at a time when shareholders, prompted by activists and mounting public concern, are increasingly urging the companies they invest in to do more to combat the climate crisis. Up to now, investors have largely focused their collective efforts on big oil and gas companies responsible for producing fossil fuels, with resolutions at companies including Royal Dutch Shell, BP and Equinor. The Barclays resolution will mark the first time a European bank has faced such shareholder action on fossil fuel financing.

Source: Reuters

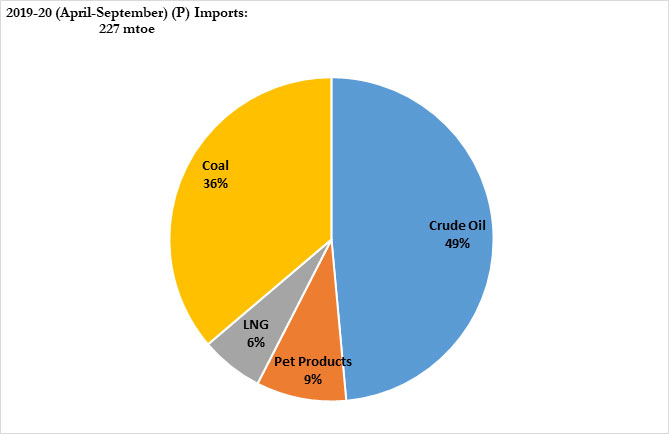

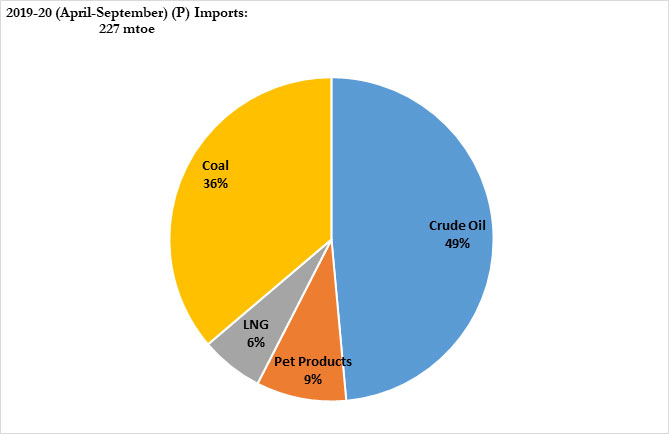

DATA INSIGHT

Energy Imports Scenario of India

Energy imports in Value ($ million)

| Energy Type |

2018-19 |

2019-20 (P)

(April-September) |

| Crude Oil |

111914.67 |

52517.85 |

| Pet Products |

16340.79 |

8524.19 |

| LNG |

10558.24 |

4860.29 |

| Coal |

26177.78 |

12215.31 |

Energy imports in Volume (mtoe)

P: Provisional

mtoe: million tonnes of oil equivalent

Source: PPAC, Ministry of Petroleum & Natural Gas & Ministry of Commerce & Industry

|

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar |

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV