< lang="EN-US" style="color: #0069a6">SIGNS OF REVIVAL IN COAL DEMAND

Coal News Commentary: October - November 2019

India

Regulatory Environment

After more than five-year wait, the government may finally throw open the doors of the regulated coal sector for commercial mining by the private sector Indian and overseas miners. Government said that draft rules, bid documents and agreements for commercial mining has been prepared and it would be finalised by the first week of November with auctions starting soon thereafter in the first week of December. The decision would permit domestic mining firms like Essel Mining, Sesa Goa and global giants like Rio Tinto, BHP Billiton, PesBody, Glencore and Vale to mine and sell and help ramp up output from the country's huge reserves -- the world's fifth biggest. It will also offer an additional source of fuel for power producers, some of whom are facing low coal stocks at their plants. However, the success of the first bidding round for commercial mines would have to be weighted against lack of investor interest in the recent coal auctions for end user plants. Companies shied away from bidding for 27 coal mine put up for auctions in the recent eighth, ninth and tenth rounds of bids turning the exercise into into a damp squib. Only six blocks out of 27 received adequate bids to go under the hammer. The commercial mining auctions could see in all 15 large coal blocks with annual production potential of 5-10 mt being put up for bidding in phases. The reserves in five of these mines could be in excess of 500 mt. These could fetch anywhere between ₹50 and 60 bn to the state government. As of now, power, steel and cement companies can mine coal but for their own consumption after getting blocks through auction. CIL dominates commercial mining in India. The commercial mine auction will offer coal blocks without end-use restrictions to the private sector with permission to sell their output to consumers in steel, power and cement sectors on commercial terms.

Auction and Allocation

Andhra Pradesh has requested allocation of Mandakani coal block and Talcher coalfields in Odisha to APGenco thermal power plants. APGenco has submitted an application to the nominated authority for allotment of Mandakini-A coal block in Odisha’s Talcher for the upcoming projects. Prakash Industries emerged as the highest bidder for Bhaskarpara coal block in Chhattisgarh. Birla Corp Ltd had bagged the Brahmapuri mine in Madhya Pradesh. JSPL was the highest bidder for Gare Palma IV/1 coal block in Chhattisgarh with a bid price of ₹230/tonne. Birla Corp bagged the Bikram coal block in Madhya Pradesh with a bid price of ₹154/tonne. Bhaskarpara coal block was previously allocated to Bhaskarpara Coal Company Ltd -- a joint venture of Electrotherm (India) Ltd and Ultratech Cement Ltd, while Brahmapuri mine was previously allocated to Pushp Steels & Mining. As many as 16 power plants, including those owned by Adani, Tata Power, Jindal Power and others, with a combined generation capacity of 14,700 MW have sought coal linkages without any usage restriction. The move would enable the commissioned projects to sell coal in the short term and day-ahead market to atleast meet a part of their debt service liability. The projects include Adani’s Raikheda TPP with a capacity of 1370 MW, which completely requires coal linkages. Similarly, Jindal Power with a capacity of 1000 MW also requires the entire capacity to have coal linkages. Prayagraj Power Generation Company Ltd, with a capacity of 1980 MW, has coal linkages of 1740 MW and requires 240 MW (for new projects). Naveen Jindal’s Jindal Steel & Power has won Gare Palma IV/5 coal block in the lastest round of auctions. JSPL emerged as the highest bidder for the coal block with a bid price of ₹230 per tonne, a premium of 53 percent over reserve price. The coal block was owned by the company before the Supreme Court in 2014 cancelled all captive mine allocations. The Gare Palma IV/5 mine in Chhattisgarh was closed since deallocation. In the first tranche of coal block auction in 2015, the coal ministry had rejected Jindal Power’s best bids for Gare Palma IV/2&3 block and Tara block that received low bids as compared to other blocks. The two Gare Palma blocks were given to CIL for operation and the high court later upheld the decision.

Domestic Production

CIL has decided to move its target year for achieving an annual production capacity of 1 bt to 2024. The company was earlier planning to achieve the target by 2019-20. However, lack of adequate demand and a plethora of issues with respect to raising production levels had forced the company to push back the deadline to 2025-26. CIL is expected to produce 750 mt next fiscal. This year its production target is 660 mt which, may not be achieved due to a series of issues. CIL said it will switch over to mechanised transportation of coal through piped conveyor belts in its large mines by 2023-24, replacing the existing road movement of the dry fuel. Piped conveyor belt transportation is a covered system for movement of coal and thus promotes environment safety and prevents possible coal pilferage. The system is already operational in some of the mines of CIL. This will be implemented in 35 of CIL’s coal projects each having production capacity of 4 mtpa and above. For necessary infrastructure upgrade at these 35 projects, including railway lines, CIL will invest through its capital expenditure. This initiative involves setting up of Coal Handling Plants with silos having rapid loading systems, which will have benefits like crushing, sizing of coal, quicker and quality coal loading. Presently, coal is transported through road by trucks from the pithead to despatch point which tends to add up to dust and air pollution. CIL loaded 151 mt through silos/rapid loading system during 2018-19. Additionally, around 420 mt of coal is planned to be loaded through silos and surge bins, which will be set up at 35 projects identified, elevating the total mechanised loading to 571 mt by 2023-24. CIL aims to produce 880 mt of coal by 2023-24 which means 65 percent of the total coal produced would be moved through covered pipe conveyor system by then and loaded mechanically. Infrastructure for 24 silos and 11 surge bin loading systems will be set up in all subsidiaries of CIL by 2023-24 for mechanised loading. Coal production at the Balram opencast project of MCL remained affected for the 14th consecutive day in Odisha. There was no production of coal due for some weeks due to a stalemate between Danara and Solada villages at the Talcher coalfields in Angul district, MCL said. Till now, 220,000 tonne coal supply, around 180,000 tonne of coal production and more than 400,000 cubic meter of overburden removal have been affected from the Balram opencast project due to an internal rift between the two villages, MCL said.

Imports

Thermal coal imports declined by 17.69 percent to 51.10 mt at the country’s top 12 major ports during April-October this fiscal, latest IPA report has said. The Centre-owned ports had handled 62.08 mt of the thermal coal in the same period previous year. The IPA, which maintains cargo data handled by these 12 ports, in its recent report said "percentage variation from previous year" in thermal coal handling was at 17.69 percent. As far as coking and other coal is concerned, its handling recorded a rise of 6.88 percent at 33.43 mt during the seven months period. These ports had handled 31.28 mt of coking coal in the corresponding period last fiscal. Earlier, mjunction services -- a B2B e-commerce joint venture between Tata Steel and SAIL -- has reported 9.3 percent rise in India’s coal imports to 126.91 mt in the first six months of current fiscal. The country had imported 116.04 mt of coal in April-September period of 2018-19, according to mjunction - which publishes research reports on coal and steel verticals. India is the third-largest producer of coal after China and the US and has 299 bt of resources and 123 bt of proven reserves, which may last for over 100 years. However in the first half of current fiscal India’s coal imports increased by 9.3 percent to 126.91 mt. The country had imported 116.04 mt of coal in April-September period of FY2018-19, according to a provisional compilation by mjunction services, based on monitoring of vessels' positions and data received from shipping companies.

Coking Coal

India’s coal and coke imports in September 2019 through the major and non-major ports are estimated to have decreased by 2.71 percent over August 2019. Imports in September 2019 stood at 18.62 mt (provisional) as compared to 19.14 mt (revised) imported in August 2019. The provisional figure for the month of August 2019 was 19.91 mt. Earlier, coal and coke imports in September 2018 stood at 17.79 mt. Of the total imports in September 2019, non-coking coal was at 12.23 mt against 12.38 mt imported in August 2019. Coking coal imports were at 4.59 mt in September 2019, almost unchanged from 4.58 mt imported a month ago. The government plans to prioritise getting contracts for coking coal imports at competitive prices instead of trying to buy coal mines, as it was planning earlier. CIL will consider picking up stakes in coking coal companies instead of an outright purchase. Till now, CIL has been considering whether to buy coking coal mines or pick up stakes in companies in Australia, Canada, the US and Russia. It is also about to float a tender to select merchant bankers who will guide CIL through the process. The decision will protect the forex outflow, which stood at ₹2.71 tn last year. In the same year, India had imported 235 mt of coal; 50 mt of it was coking coal. Coking coal is scarce in India and is a key ingredient to make steel. With the government keen to develop infrastructure, steel availability and the cost of production — which will impact prices — is crucial. Around 10-15 percent of the 55-60 mt demand for coking coal in India is met by domestic supply, while the rest is catered to via imports, from Australia, the US, Canada and other countries. CIL plans to submit binding bids for acquiring stakes in coking coal assets in Australia and Canada by March 2020. The firm is in the process of appointing merchant bankers for the assets it has identified. The quantum of stake to be bought would be decided after a due diligence. In Australia, CIL has shortlisted some working mines, while in Canada, it is targeting ready-to-produce blocks where exploration, land acquisition and environmental approvals have been completed. CIL’s domestic reserves are inadequate to meet India’s demand. The plan is to set up coking coal and high-grade thermal coal mining business overseas with a view to acquiring coal resources, producing the fuel and importing it either by opening new mines or through acquisition of equity participation in working mines on production-sharing participation interest basis.

Environmental Externalities

IIT Bombay, will complete the second phase of its source appropriation study at Vasco in November. The report will indicate the exact quantity of coal, bauxite and other dust particles present in the air and this will point out the reason behind the air pollution in the port town. According to the GSPCB, dust settles during the monsoon and it is impossible to quantify the dust particle in the air. Recently, the GSPCB had granted fresh consent to operate to South West Port Ltd a unit of Jindal Steel Work to handle 400,000 tonne coal per month at MPT. It had also restricted coal handling by Adani Mormugao Port Terminal Pvt Ltd to 400,000 tonne per month at MPT.

Rest of the World

China

China, the world’s top coal buyer, is on track to boost imports of the fuel by more than 10 percent this year, traders and analysts said, countering earlier expectations that shipments would be capped by Beijing at the same level as 2018. China’s coal imports have already surged 9.5 percent in the first nine months of 2019 to 250.57 mt customs data shows, and at least 18.84 mt of seaborne coal are due to arrive this month, according to vessel-tracking and port data. With China typically bringing in about 7 mt more a month on trucks and trains from Mongolia and Russia, total volumes are likely to reach 276 mt well before the end of the year. Energy consultancy IHS Markit expects that China may bring in around 320 mt of coal this year. Some Singapore-based coal traders forecast Chinese coal imports could reach at least 305 mt. Coal traders in China are holding off purchasing from overseas despite the upcoming heating season, as spreads between domestic and seaborne coal prices narrow and import rules tighten at Chinese customs. Chinese seaborne coal imports fell 18 percent in October month-on-month to 20.65 mt and around 13.76 mt are scheduled to arrive in November, vessel tracking and port data compiled by Refinitiv showed. Traders and analysts expect coal imports will slow further in coming weeks, even though total coal imports for the year are set to reach a record high. China severely limited coal imports in the final two months of last year by halting shipment clearances, curtailing imports of the fuel by 54 percent in December. China approved 40 new "modernised" coal mines, with total capacity of 196 mt in the first three quarters of 2019. The approvals were part of a plan to unleash higher-grade coal production capacity, the National Energy Administration said. China has been shutting hundreds of small-scale coal mines that use outdated techniques, and replacing them with bigger mechanised collieries using advanced technology.

Rest of Asia

The number of new coal-fired power plants starting construction across Southeast Asia has fallen markedly over the past two years as Australia has increasingly looked to the region to expand its thermal coal exports. Analysis by US based climate research and advocacy group Global Energy Monitor found work on only 1.5 GW of new coal generation – equivalent to one large Australian plant – began in the region in the six months to June, all of it in Indonesia. It follows construction starting on plants with a capacity of 2.7 GW last year, a 57 percent fall below 2017 levels and 79 percent less than in 2016. The Global Energy Monitor analysis identified Vietnam as having the largest number of coal projects at pre-construction stage in Southeast Asia, with 22.9 GW proposed. It found another 26.4 GW had been cancelled over the past five years before being built and work on only 1.5 GW had begun since the end of 2016. South Korea’s six older coal-fired power plants will be retired by 2021, a year earlier than previously planned, as part of the country’s ongoing efforts to curb air pollution, the prime minister’s office said. South Korea, Asia’s fourth-largest economy, runs some 60 coal-fired power plants, generating around 40 percent of the country’s electricity, but coal has been blamed for worsening air quality in the country. The six older coal-fired power plants account for 7 percent of the total installed coal power capacity, or 2.6 GW, according to data from Korea Electric Power Corp. South Korea stops operations at some ageing coal-fired power plants from March to June every year to reduce air pollution levels and put a cap on coal power operations when an air pollution advisory is issued. Indonesia’s PT Bukit Asam produced 21.6 mt of coal in January-September period this year, up 9.6 percent from a year earlier, the company said. Coal sales rose 10.7 percent annually to 20.6 mt in January-September. Average selling price of Bukit Asam’s coal in the nine-month period fell 7.8 percent, due to a depressed Asian coal market.

Australia

Australian coal producer New Hope Corp Ltd said it welcomed a court’s decision dismissing an appeal against the granting of licenses for its New Acland Coal Stage 3 project. An activist group, Oakey Coal Action Alliance, had appealed court decision in September in favour of the stage 3 Acland Coal project. Due to the delays, the coal producer said in September it was laying off 150 workers at the project. The company said the New Acland Stage 3 Project will create about $4.8 bn in economic activity over the expected 15-year life of the project. South32 Ltd posted a 9 percent rise in coking coal production for the first quarter, as the miner ramped up output at its Illawarra project in New South Wales. Production of the steel-making ingredient, known as metallurgical or coking coal, was about 1.7 mt in the September quarter, compared with 1.5 mt a year earlier. Production at Illawarra, South32’s biggest source of coal, rose about 9 percent.

Western World

The German government will not force hard coal power plants to close over the next seven years, a draft law expected to be approved by the cabinet showed. The plan not to force hard coal plant closures before 2026 risks making Germany’s coal exit more expensive as the government would have to give operators generous financial incentives to shut down facilities voluntarily. The new plan is a reversal for the government, which had stipulated in a previous blueprint that utilities would be forced to deactivate hard coal power plants by 2026 if not enough closures happen voluntarily. The draft law, a key component of Germany’s plan to phase out coal by 2038, will be put for a vote in the Bundestag lower house should the cabinet approve it. Russian state development bank VEB said it and VTB bank would provide financing worth 34 bn roubles ($532.4 mn) for the construction of a coal loading terminal in Vanino port in Russia’s Far East. VEB said the terminal’s initial capacity was expected to be 12 mt of coal per year, while loading operations were scheduled to begin in 2020. Its total annual capacity was seen rising to 24 mt.

| CIL: Coal India Ltd, mt: million tonnes, bt: billion tonnes, mn: million, bn: billion, tn: trillion, JSPL: Jindal Steel and Power Ltd, MW: megawatt, GW: gigawatt, mtpa: million tonnes per annum, MCL: Mahanadi Coalfields Ltd, IPA: Indian Ports Association, FY: Financial Year, US: United States, IIT: Indian Institute of Technology, GSPCB: Goa State Pollution Control Board, MPT: Mormugao Port Trust |

NATIONAL: OIL

IOC to spend Rs10 bn to double base-oil production from Haldia refinery

18 November. Indian Oil Corp (IOC) plans to double its base-oil production from Haldia refinery in West Bengal by adding a new 270 thousand tonne per annum Catalytic Dewaxing Unit at a cost of Rs10.85 bn, the company said. The availability of a hydrocracker unit and the upcoming coker block has led to substantial potential in the refinery for augmenting the base oil production volume by setting up a new base oil production facility, the company said. It said that the base oil market is more stable than auto fuel market and the proposed project will provide additional flexibility to the refinery during major price swings. The company said the proposed hydroprocessing route for grade II or grade III base-oil production will lead to capability of producing 100 percent API grade III lube base oil. The project is expected to provide flexibility in crude selection.

Source: The Economic Times

Indian Oil bottling plant to enhance storage soon

15 November. The Madurai LPG (liquefied petroleum gas) bottling plant of the Indian Oil Corp (IOC) in Mattaparai village in Dindigul district, will soon enhance its storage capacity from the current 900 (3x300) metric tonnes (mt) by another 1,800 (3x600 mt). The plant is awaiting regulatory clearance. The plant has a capacity to fill and distribute 19,000 cylinders per day. While the annual capacity is the delivery of 60,000 cylinders, in 2018-19, it produced 93,000 cylinders, as the demand went up. The electronic carousel fills 24 cylinders per minute and 1,400 cylinders per hour. The filled cylinders are checked for valve leaks and o-ring leaks, through remote monitoring. The defective valves are replaced immediately. The plant fills domestic cylinders of 14.2 kilogram (kg), commercial use cylinders of 19 kg, nano cut cylinders for commercial applications, besides the smaller 5 kg cylinder. It has also started supplying jumbo LPG cylinders weighing 425 kg for commercial use.

Source: The Economic Times

In October, India’s diesel demand fell at steepest annual rate in 3 yrs

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Steep decline in power and diesel demand signal decline in economic activity!

< style="color: #ffffff">Ugly! |

14 November. India’s diesel demand in October fell at its steepest annual rate in nearly three years, provisional government data showed, reflecting subdued industrial and economic activity during the month. Local sales of diesel, which accounts for about two-fifths of overall fuel consumption, slipped 7.4 percent year-on-year to 6.51 million tonnes (mt). The annual decline was the most since January 2017, according to PPAC (Petroleum Planning and Analysis Cell). Demand for diesel in the world’s third biggest oil importer is seen as a measure of industrial vibrancy as it is used, for example, to fuel trucks transporting goods across the country. Sales of gasoline, or petrol, rose 8.9 percent in October from a year earlier, to 2.54 mt. However, demand for diesel is expected to recover in the next six months as the longer-than-usual monsoon season that affected transportation and industry has ended, Indian Oil Corp (IOC) said. Slowing economic and industrial activity has already led some global agencies to cut their Indian fuel demand forecasts. Growth in fuel demand in India is on course to fall to its lowest in at least six years as the economy slows and after heavy rains impacted gasoil consumption.

Source: Business Standard

NATIONAL: GAS

Essar, GSPC bag most of RIL-auctioned natural gas

18 November. Essar Steel and Gujarat State Petroleum Corp (GSPC) won two-thirds of the natural gas Reliance Industries Ltd (RIL) offered in an auction, where winning bids were $5.3-5.4 a unit. RIL-BP offered 5 million metric standard cubic meter per day (mmscmd) it plans to produce from April next year at its R-cluster field in KG-D6 (Krishna Godavari Dhirubhai 6) block. About half a dozen companies participated in the e-auction. Essar Steel is learnt to have won 2.25 mmscmd, while GSPC got 1.2 mmscmd. Hindustan Petroleum Corp ltd (HPCL) is believed to have won 0.35 mmscmd, while Adani, Mahanagar Gas and GAIL (India) Ltd won 0.3 mmscmd each. Gujarat State Fertilizer Corp is also said to have won 0.10 mmscmd. Essar Steel, which has been in news lately for its bankruptcy, will likely use the gas in its plant, while Adani and Mahanagar may feed it into their city gas network. RIL-BP sold all the gas offered. The duration of supply could not be ascertained. Buyers had the option to bid for a supply period of two to six years. Bidders were expected to quote a price as a percentage of dated Brent crude. The minimum they could quote was 8.4 percent. Bidders ended up quoting between 8.4 percent and 8.6 percent. This translates into a price range of $5.29 to $5.41 per million metric British thermal unit (mmBtu) at the current rate of $63 per barrel for dated Brent. After including the pipeline tariff, the delivered cost of gas would be about $6.5 for buyers, most of which are in Gujarat. RIL-BP have the marketing and pricing freedom for all the gas they produce from the Rcluster field. The prices, however, cannot exceed the government-set ceiling for the gas from difficult fields, which is currently $8.43 per unit. Prices during the RIL-BP’s gas auction were influenced by a collapse in the global liquefied natural gas (LNG) market and an expected rise in supply from domestic sources over the next few years. This meant the auction ended up with rates that were close to the floor price set by the producer. ONGC is also auctioning 0.75 mmscmd on 19 November.

Source: The Economic Times

IOC, GAIL to pay Adani 5 percent more charge than their own LNG terminal: Pradhan

18 November. Indian Oil Corp (IOC) and GAIL (India) Ltd will pay Adani Group 5 percent more in hiring charges for using the private firm’s upcoming LNG (liquefied natural gas) import facility at Dhamra in Odisha than their own similar terminal, Oil Minister Dharmendra Pradhan said. India’s largest oil firm IOC, which recently commissioned a 5 million tonnes (mt) LNG import terminal at Ennore in Tamil Nadu, as well as gas utility GAIL have "both technical and financial capability to develop their own LNG terminal," he said. IOC had in 2015 signed to use up to 60 percent of the terminal's capacity for importing gas for its refineries at Haldia in West Bengal and Paradip in Odisha. GAIL too had signed up for 1.5 mt of the terminal's regasification capacity. GAIL’s own Dhabhol LNG terminal in Maharashtra levies Rs49.28 per mmBtu (million metric British thermal units) regasification charge. In addition, there are other charges such as terminal charges, vessel-related charges and port charges for utilization of the Dabhol LNG terminal. Also, Petronet LNG - a firm in which GAIL and IOC are promoters, had shelved plans to set up a 5 mt a year LNG import facility at Gangavaram in Andhra Pradesh.

Source: Business Standard

15 CNG fuel stations to be set up by March next year by MNGL

17 November. The Maharashtra Natural Gas Ltd (MNGL) is planning to set up 15 compressed natural gas (CNG) stations in the district by March next year. Of the 15 stations, 12 will be set up in the premises of existing fuel stations of oil marketing companies like IOC (Indian Oil Corp), HPCL (Hindustan Petroleum Corp Ltd) and BPCL (Bharat Petroleum Corp Ltd). The remaining three would be established on the land to be provided by the Nashik Municipal Corp (NMC). All the stations will be operated by MNGL. Headquartered in Pune, MNGL is a joint venture of GAIL (India) Ltd and BPCL. Last year, it had won bids to create infrastructure and provide CNG for vehicles and piped natural gas (PNG) for households in Nashik. The bids were floated by the Petroleum and Natural Gas Regulatory Board. MNGL’s outlets at remaining 10 existing fuel stations will also be operational by the end of March next year.

Source: The Economic Times

GAIL’s gas trading business disappoints in second quarter, but recovery hopes alive

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Lacklustre gas trading does not hold promise for gas sector progress!

< style="color: #ffffff">Bad! |

14 November. The disappointment with the July-September quarter (second quarter) performance of India’s largest gas transmission and trading company, GAIL (India) Ltd, added to the already soft Street sentiment. Even though GAIL’s performance on the volume front remained decent in second quarter, its soft operating performance disappointed investors. GAIL’s gas transmission segment, too, saw a 10 percent decline in profit, with the company taking a one-time hit for retrospective adjustment in tariffs of some pipelines, such as Hazira-Vijaipur-Jagdishpur and Dadri-Panipat. While natural gas prices continued to decline, margin in petrochemicals business, too, is under pressure, with realisations being impacted by the supply glut. The 8 percent and 25 percent fall in market price of petrochemicals and liquid hydrocarbons, respectively, coupled with lower gas prices in the international market, adversely impacted GAIL’s profits in second quarter, compared to the first quarter of 2019-20.

Source: Business Standard

NATIONAL: COAL

Dilip Buildcon bags Rs21.2 bn order from Coal India arm

19 November. Highway developer Dilip Buildcon said it has bagged an order worth Rs21.2 bn from Northern Coalfields Ltd (NCL), a subsidiary of Coal India Ltd, for removal of overburden at a mining project in Madhya Pradesh. In mining, overburden is the overlying material (such as rock, soil) that generally has no commercial value. The company was declared L1 bidder (lowest bidder) in the reverse auction conducted by NCL. The contract period of the project is 1,552 days. Coal India accounts for over 80 percent of domestic coal output.

Source: Business Standard

India looks to relax norms to attract global coal miners, industry sceptical

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Relaxing regulatory norms will increase competition in coal mining!

< style="color: #ffffff">Good! |

18 November. India is looking to lower advance payments and offer larger mining blocks to attract global companies to invest in its coal sector for the first time, but industry sources say the measures may not be enough to draw in big international miners. India plans to float global tenders for the first time for coal mining blocks before end-2019, a move that could end Coal India Ltd (CIL)’s near-monopoly on the fuel. The auctions, to be aimed at paring back the nation’s coal imports, are intended to attract global miners such as Glencore PLC, BHP Group, Anglo American PLC and Peabody Energy Corp. The coal ministry said the government was looking to reduce the upfront payments of around 10 percent of the estimated value of blocks that have been awarded. Coal Minister Pralhad Joshi said in October the government was also looking to make investing in coal more attractive to bidders by carving out bigger blocks, and was readying a policy to attract foreign investors to its coal industry. October coal mine auctions directed at domestic miners drew a tepid response, with 21 of 27 blocks getting fewer than the required minimum of three bidders. Only six of the coal blocks were awarded contracts. A Singapore-based coal trader said tie-ups between Indian companies and international mine operators were one possible source of participating bidders.

Source: Reuters

Coal ministry to set up management unit to speed up mine operationalisation

17 November. The government is planning to set up a project management unit for expediting the operationalisation of allotted coal blocks. The coal ministry will hire a consultant to set up the project management unit, the ministry said in a notice while inviting bids from eligible entities. The last date for submission of bid is 19 December. The ministry has been exhorting allottees to step up efforts for bringing allotted blocks to production as well as enhance output. The ministry in September had said that policy decisions have been taken to ensure early operationalisation of coal mines but their allottees should also go the extra mile along with the government to start the mines. The decisions include allowing sale of 25 percent coal in open market in case of allocation for specified end use plant, relaxation in efficiency parameters, among others, the ministry had said. The ministry had said that it was also working on policy interventions to develop a single-window scheme for faster approvals of clearances from various central and state agencies.

Source: The Economic Times

Vedanta emerges as the highest bidder for Jamkhani coal block in Odisha

13 November. Vedanta Ltd said it has emerged as the highest bidder for Jamkhani coal block in Sundargarh district, Odisha, in the 10th tranche of captive coal block auction conducted by the government. The coal block is in proximity to the company’s Jharsuguda aluminium smelter. The Jamkhani coal block is one of the most attractive coal blocks for the company’s Jharsuguda plant in terms of location, annual capacity, reserves and readiness to produce. The approved per annum capacity of the mine is 2.6 million tonnes (mt), it said. This is the company’s second coal block after Chotia coal block in Chhattisgarh that has an annual capacity of 1 mt.

Source: Business Standard

GIDC’s Rs1.9 bn coal block request hits roadblock

13 November. State finance department officials have informed GIDC that they are against a Goa Industrial Development Corporation (GIDC) proposal which seeks nearly Rs2 bn from the government to pay the “performance guarantee” for a coal block that GIDC plans to operate. GIDC needs a financial approval from the state cabinet since the corporation has to pay a bank guarantee of around Rs1.96 bn to begin mining operations. The Dongri Tal II coal block at Singrauli in Madhya Pradesh has been allocated to Goa as part of the fifth tranche of allotment by the coal ministry. Industries Minister Vishwajit Rane had announced that the state would sign the agreement for this block by 30 October. Coal mines have been allotted to state governments for sale of coal under the Coal Mines (Special Provisions) Act, 2015. The Centre said it will accept upfront payments in three instalments from successful bidders, along with the performance guarantee - equivalent to a year’s royalty - prior to the formal signing of the coal mine development and production agreement (CMDPA). GIDC said that the government had yet to grant financial approval for accepting the coal block already allotted and that the CMDPA had not been signed.

Source: The Economic Times

NATIONAL: POWER

Kerala CM inaugurates Edamon-Kochi powerline

18 November. Kerala Chief Minister (CM) Pinarayi Vijayan formally inaugurated the 148 kilometre (km) long Edamon-Kochi power highway which will increase the states power import capability by 800 MW. Vijayan said his government after taking charge in 2016 completed 93 percent work of this project which had begun in 2005. Out of the total 148 km line, this government completed 138 km within just over three years, Vijayan said. The Edamon-Kochi line passes through Kollam, Pathanamthitta, Kottayam and Ernakulam. The new line reduces power import via inter-state Udumalpet-Palakkad and MysoreArikode lines. Kerala imports around 3000 MW from the Central pool to meet its daily power requirements.

Source: Business Standard

Bihar government considering 24x7 power to every home and penalty for load-shedding

16 November. Bihar government is considering a proposal to fine power distribution companies for load-shedding as part of its ambition to provide uninterrupted power supply to each household in the state as a matter of consumer rights. The proposed “No load-shedding policy” has been placed before the state cabinet committee recommending discoms (distribution companies) be penalised even for short outages, Power Minister R K Singh said. Singh said India had achieved the dual targets of generating surplus power and electricity connection to every household and was now working towards the next milestone of 24x7 power supply. Singh said the Central government was also encouraging the use of electrical vehicles to reduce export of petroleum products and pollution. Singh said the Indian government plans to scale up power generation from renewable energy sources from 1.13 lakh MW currently to 1.75 lakh MW by 2022 and 4.50 lakh MW over the next decade. Singh said the NDA government at the Centre was about to launch “Kusum Yojana”, in a month’s time to encourage farmers to install solar panels on their barren lands.

Source: Hindustan Times

UP Energy Minister begins prepaid meter campaign by installing one at own residence

16 November. To begin a campaign for installing pre-paid smart meters at the residence of government officials and ministers, Uttar Pradesh (UP) Energy Minister Shrikant Sharma installed a meter at his official residence. The government had on 30 October announced a campaign to install prepaid smart meters at the residence of officials, elected representatives and Ministers.

Source: The Economic Times

CESC drops plan to demerge power generation and distribution business

15 November. CESC (Calcutta Electric Supply Corporation) has decided not to pursue the demerger of its power generation and distribution business, which it had earlier planned. Demerger of these two lines of business into CESC and Haldia Energy had met with opposition from the West Bengal Electricity Regulatory Commission (WBERC). It had flagged concerns over asset distribution between the two firms in the case of a demerger, and had questioned if the demerged entities had received any favour from parent CESC. The power regulator refused to approve CESC’s planned power purchase agreement in case of a split. Previously, CESC chairman Sanjiv Goenka had said that owing to the complexity of the power generation business in the country, and the low yield from this business, CESC will focus on strengthening its distribution business. On the other hand, investments in power generation are expected to be frozen.

Source: Business Standard

Uttarakhand power firms set to put a cap on quantity of electricity given to its staff

15 November. After furore over a senior official of Uttarakhand Power Corp Ltd (UPCL) running an electricity bill of Rs4 lakh over two years but paying only Rs425 per month due to power being made available to corporation staff at highly subsidised rates, the state’s power firms - UPCL, Power Transmission Corp Ltd (PTCUL) and Uttarakhand Jal Vidyut Nigam Ltd (UJVNL) - have informed Uttarakhand High Court (HC) about their plan to put a cap on the quantity of electricity provided to their employees. The HC asked the firms to provide year-wise details on the quantum of electricity provided free of cost to their employees. UPCL along with PTCUL and UJVNL are tasked with generation, transmission and maintenance of electricity in the hill state. The HC had pulled up UPCL for providing electricity to its employees at highly subsidised rates.

Source: The Economic Times

Rajasthan’s discom earns Rs30 mn fine from theft cases

14 November. Ajmer Vidyut Vitaran Nigam Ltd (AVVNL), as part of its campaign against electricity theft in 11 districts across the state, has registered 1,606 cases of power theft and imposed penalty of Rs30 mn and 12 lakh. Managing director of AVVNL has appealed to the consumers to help in the campaign. AVVNL managing director VS Bhati said that the campaign was started, to check the cases of electricity theft in the 11 districts of the state that fall under AVVNL’s jurisdiction. Different teams were constituted to carry out the campaign in Ajmer, Bhilwara, Nagaur, Sikar, Jhunjhunu, Udaipur, Banswara, Chittorgarh, Rajsamand, Dungarpur and Pratapgarh districts. He said that in serious cases of electricity theft, FIRs have been registered against offenders as the burden of electricity theft is borne by the consumers. He appealed to the consumers to inform AVVNL about cases of electricity theft.

Source: The Economic Times

BHEL’s poor execution, high working capital point to stress in power sector

14 November. Bharat Heavy Electricals Ltd (BHEL)’s woes continue to mount. The deplorable state of the power sector has been hampering execution and cash flows of the power equipment maker. Land acquisition delays coupled with slower customer approvals and payment delays have dragged down its power segment sales by 18 percent year-on-year (y-o-y). Some relief has come in the form of a 24 percent y-o-y growth in its industrial segment sales.

Source: Livemint

Biggest drop in power demand adds to Indian Banks’ bad debt woes

14 November. The biggest drop in India’s electricity demand in at least 12 years is hindering efforts of Indian lenders to recover a pile of loans to power producers that have soured. Banks had about Rs1.8 tn ($25 bn) of stressed loans to India’s coal-fired power generators as of last year, according to the State Bank of India. Prospective bidders for these stressed generators are wary as demand from the country’s power distribution utilities contracted in three straight months to October. India’s electricity demand is closely linked to its industrial output, which contracted in September to its lowest level in eight years. An overwhelming majority of data is pointing to continued weakness in the economy that expanded 5 percent in the quarter ended June -- the slowest pace in six years. Drop in demand is adding to the weak financial health of the power distribution companies, also called discoms (distribution companies). These state-controlled utilities often serve the populist plans of their political masters by selling power below cost to certain groups of consumers, which leaves them financially broke. However, some power projects, including GMR Chhattisgarh Energy Ltd., and SKS Power Generation Chhattisgarh Ltd. have found new bidders, while some others including RattanIndia Power Ltd’s Amravati project in Maharashtra and GMR Kamalanga are nearing a resolution with lenders writing off part of the loans.

Source: Bloomberg

84 percent people in Madhya Pradesh paid less than Rs400 as power bill in September

13 November. Nearly 84 percent residents of Madhya Pradesh are paying less than Rs400 as their monthly power bills, thanks to a ‘smart subsidy’ scheme that encourages low power consumption. Close to 10 mn consumers are now covered by Indira Griha Jyoti Yojana — under which those who use 150 units of power or less a month pay only Rs1 for the first 100 units, and the rest is billed as per the tariff prescribed by Madhya Pradesh Electricity Regulatory Commission (MPERC). The government reimburses what’s left of the dues for the first 100 units. The maximum subsidy a consumer gets is Rs531 per month in urban areas, and Rs521 per month in villages. It has translated into big savings in a state that has one of the highest power tariffs in the country. The scheme has, however, drained the coffers of Rs3.5 bn in the first month of implementation. At this scale, it will cost the government Rs40 bn a year. The erstwhile BJP (Bharatiya Janata Party) government had rolled out two power schemes in June-July 2018 — one for waiver of dues and the other, named Saral Bijli Bill Scheme, for providing power at a flat rate of Rs200 per month to unorganized sector workers. Both came into effect six months ahead of the assembly polls. With a change of guard in the state, the Congress government announced in the first week of February that it would fulfil its poll promise by cutting power bills by 50 percent and that beneficiaries will need to pay only Rs100 for 100 units of power. If they exceed 100 units, consumers will have to bear the rest of the cost, it said.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

J&K fails to achieve solar energy generation target

19 November. Even five years after the signing a memorandum of understanding (MoU) with the Union Government on generating 7,500 MW solar power energy, the authorities have failed to achieve the target in this regard. In March 2014, the then NC-Congress government of Omar Abdullah had signed the MoU with the Ministry for New and Renewable Energy (MNRE) for the implementation of solar power projects of the capacity of 7,500 MW, but on ground, nothing has been done so far. Under the MoU, solar projects of the capacity of 5,000 MW in Ladakh and 2,500 MW in Kargil, possessing tremendous potential for new and renewable energy, was to be taken up for implementation. Similarly, it was also part of the MoU to set up solar panels in all technical institutes across J&K (Jammu and Kashmir). The erstwhile state of J&K, comprising Ladakh, had solar power potential of 111.05 GW and it was the second highest in the country after Rajasthan, which has the solar energy potential of 142 GW. The solar power capacity of the country recently crossed the milestone of 5,000 MW, with Rajasthan topping the list with the total commissioned capacity of 1264.35 MW, followed by Gujarat with 1024.15 MW. J&K does not figure in the list where the states have grid-connected solar power projects as it has failed to generate energy through solar power plants.

Source: The Tribune

Andhra Pradesh tightens renewable energy norms

19 November. Increasing its pressure further on renewable energy developers, the Andhra Pradesh government has amended its solar and wind power policies, effectively taking more control over setting tariffs from such power generation units. According to industry sources, the move would create further confusion in the investment environment in the renewable energy sector in the state. Deleting older provisions, the new order mandates that the transmission and distribution charges for wheeling power would be determined by the state power regulator. In its latest order, Andhra Pradesh energy department states that tariff from renewable energy-based electricity will not be more than the “difference between pooled variable cost and balancing cost”.

Source: The Financial Express

Government floats tender for first solar power plant in Faridabad

18 November. The tender of the first solar power plant to be set up in the city has been released. With the initial capacity of 30 MW, Haryana Power Generation Corp Ltd (HPGCL) plans to generate a total of 90 MW of solar power in near future. The first plant will come up in Sainik Colony of Sector 49 here with an installed capacity of 30 MW and the construction work is expected to start within the designated period after the opening of the bid on 28 November. Notably, the HPGCL had to close a 210-MW coal power station located at Bata Chowk several years ago as it had completed its life and had been a cause of air pollution. Haryana has now set a target of 3,200 MW of solar power to be generated by 2021-22.

Source: The Tribune

Ola partners with Microsoft Research to study street-level air quality in Delhi-NCR

18 November. Cab aggregator Ola has entered into a partnership with Microsoft Research to measure real-time, street-level air quality in Delhi-NCR through sensors mounted on its cabs. The project will begin this month and is expected to collect millions of data points over the course of one year to complete the spectrum of variation in Delhi’s air-pollution. Delhi faces severe air pollution crisis in winters with the interplay of a lot of contributing factors including vehicular pollution, farm fires and dust. Most air-quality sensors measure ambient air-quality which is not reflective of the street-level pollution people are subjected to on a daily basis, Ola Mobility Institute said.

Source: Business Standard

Chhattisgarh CM seeks Centre’s permission to make biofuel with surplus paddy

17 November. Chief Minister (CM) Bhupesh Baghel has requested the Centre to allow Chhattisgarh to make biofuel out of surplus paddy in the state. Baghel said that he met and requested Oil Minister Dharmendra Pradhan to allow the state to make the biofuel. Baghel said that Pradhan assured him to consult with Food and Agriculture ministries to move forward on the proposal.

Source: Business Standard

BSES plans solar power trading at individual level

15 November. BSES Rajdhani Power Ltd (BRPL), one of the power discoms (distribution companies) of Delhi, will launch a blockchain-based platform on a trial basis for consumer-to-consumer (or peer-to-peer) solar power trading. The method can be used by consumers with rooftop solar power infrastructure to further monetise their investment. Consumers with this infrastructure can sell their excess solar energy to their neighbours even if they do not have rooftop solar power, BSES said. BRPL has partnered with Australia’s Power Ledger, a global player in the blockchain technology, to launch the consumer-to-consumer solar power trading on a trial basis.

Source: The Economic Times

Don’t burn crop stubble, convert it into biofuel: UP CM

14 November. With air quality over north India deteriorating once again, Uttar Pradesh Chief Minister (CM) Yogi Adityanath has appealed to farmers to not burn crop residue but instead use it to increase soil productivity. The CM announced that the government was exploring the opportunity to convert crop residue into fuel and at some point in future, could even purchase it from farmers. Farm fires in rice producing states of UP, Haryana and Punjab have been identified as a major cause of air pollution. Several cities in UP where air pollution is being monitored have shown extremely high levels of harmful particulate matter. The CM said burning stubble decreases the productivity of soil and adversely impacts environment. The CM said that with the government promoting sugarcane production and opening more sugar mills in UP, sugarcane leaves would also be generated as “waste” but instead of being burnt, they could be used for maintaining moisture in the soil for the next sugarcane crop.

Source: The Economic Times

Renewable energy ministry rules out removal of tariff caps

13 November. The government will not remove the wind and solar ‘tariff caps’ or the fixed highest ask price in the wind and solar capacity auctions of the Government of India, MNRE (Ministry of New and Renewable Energy) secretary Anand Kumar said. SECI (Solar Energy Corp of India) conducts capacity auctions on behalf of the government. The tariff caps for the latest auctions of wind and solar were Rs2.93 and Rs2.85 respectively. The existence of the tariff caps has been a sore point with the industry, which it finds unfair and unviable. In India, solar capacity auctions were always held on the basis of tariffs. The solar energy company (or, ‘developer’) who offered to sell at the least tariffs would get to sign a power purchase agreement for a specified capacity. Utilities used to procure wind power at fixed tariffs determined by the respective state electricity regulatory commission.

Source: The Hindu Business L ine

SC asks government to explore feasibility of Japanese tech to fight air pollution

13 November. The Supreme Court (SC) directed the Centre to explore the feasibility of a hydrogen-based Japanese technology as a permanent solution to the air pollution in the NCR region and other parts of north India. The SC directed the Centre to expedite the deliberations on the issue and come before the court with its findings on 3 December. The development comes as Delhi’s air quality neared the "emergency" zone for the second time due to raging farm fires in neighbouring states and unfavourable weather conditions. The solicitor general introduced to the bench a researcher from a university in Japan, Vishwanath Joshi, who apprised it about the hydrogen-based technology that has the potential to eradicate air pollution.

Source: Business Standard

INTERNATIONAL: OIL

US shale oil output to rise 49k bpd to record 9.1 mn bpd in December: EIA

19 November. US (United States) crude oil output from seven major shale formations is expected to rise about 49,000 barrels per day (bpd) in December to a record 9.13 mn bpd, the US Energy Information Administration (EIA) said. Output at the largest formation, the Permian Basin of Texas and New Mexico, is expected to rise 57,000 bpd to 4.73 mn bpd, the smallest increase since July this year but offsetting projected declines elsewhere. Output in North Dakota and Montana’s Bakken region is expected to edge higher by 9,000 bpd to a record 1.51 mn bpd, the data showed. Meanwhile, production declines are forecast in the Eagle Ford and Anadarko basins. Production increases in the Permian and Bakken have been at the forefront of a shale boom that has helped make the US the biggest oil producer in the world, ahead of Saudi Arabia and Russia.

Source: Reuters

Norway’s oil industry faces thinner margins

19 November. Norway’s oil industry faces thinner margins as smaller new discoveries boost per-barrel development costs, Statistics Norway (SSB) said in a report. The giant Johan Sverdrup field, discovered a decade ago, came on stream in October. It has given a much-needed boost to investment and the cash flow of oil firms, but this is proving the be the exception rather than the rule. In the Arctic Barents Sea, which went largely unexplored while oil firms drilled in the North Sea and the Norwegian Sea, results of the last 20 years have been disappointing.

Source: Reuters

Colombia oil auction attracts 27 qualified bidders

14 November. Twenty-seven companies are qualified to bid in Colombia’s auction of 59 oil blocks, the National Hydrocarbons Agency (ANH) said, including international producers like Noble Energy and Parex Resources. Colombia hopes to sign 20 contracts as a result of the round, the ANH said. Five of the offered blocks are offshore and 24 have potential for gas production, the ANH said. The auction is the country’s second this year. Six companies won 11 contracts in the previous round, which the ANH said would generate some $500 mn in investment.

Source: Reuters

Qatar plans change in crude oil official selling prices in Q1 2020

14 November. Qatar Petroleum (QP) has informed some term crude buyers in Asia that it plans to change the way it prices its oil early next year. The producer currently prices two of its grades - Qatar Land and Qatar Marine - on a retroactive basis and this will be moved to forward pricing to align its prices with other Middle East producers such as Saudi Arabia. QP is targeting to implement the price change in first quarter (Q1).

Source: Reuters

Growth in global oil demand to slow from 2025: IEA

13 November. Growth in global oil demand is expected to slow from 2025 as fuel efficiency improves and the use of electric vehicles increases, but consumption is unlikely to peak in the next two decades, the International Energy Agency (IEA) said. The Paris-based IEA, which advises Western governments on energy policy, said in its annual World Energy Outlook for the period to 2040 that demand growth would continue to increase even though there would be a marked slowdown in the 2030s. The agency’s central scenario - which incorporates existing energy policies and announced targets - is for demand for oil to rise by around 1 mn barrels per day (bpd) on average every year to 2025, from 97 mn bpd in 2018. Demand is then seen increasing by 0.1 mn bpd a year on average during the 2030s to reach 106 mn bpd in 2040. The largest increases in oil production are seen coming from the United States (US), the world’s biggest producer, as well as Iraq and Brazil. US tight crude oil production is seen rising to 11 mn bpd in 2035 from 6 mn bpd in 2018. The share of oil production by members of the Organization of the Petroleum Exporting Countries (OPEC) plus Russia is seen falling to 47 percent for much of the next decade, a level not seen since the 1980s.

Source: Reuters

South Korea’s KNOC signs JV agreement with SK Gas, MOLCT for oil terminal project

13 November. Korea National Oil Corp (KNOC) has signed a joint venture (JV) agreement with SK Gas and Singapore’s MOL Chemical Tankers (MOLCT) to invest in the first phase of South Korea’s oil terminal project, the country’s energy ministry said. The first phase of the oil terminal project at the port of Ulsan would cost 616.0 bn won ($530.47 mn), with the joint venture Korea Energy Terminal investing 30 percent of the total cost, while the rest will be funded through project financing, the ministry said. The oil terminal has a capacity to store 1.38 mn barrels of refined oil products and 1.35 mn barrels of liquefied natural gas (LNG). The terminal is expected to be completed by March 2024 and start commercial operations from April 2024.

Source: Reuters

INTERNATIONAL: GAS

Algeria’s Sonatrach renews gas export deal with France’s Engie

19 November. Algerian state energy firm Sonatrach has renewed a gas export contract with France’s Engie. Sonatrach said the contract covers the medium and long term, but did not specify how much gas it will deliver to Engie. The firm has already renewed gas export contracts this year with Enel, Galp Energia, Eni, Botas, Naturgy, and Edison. Its total gas exports in 2018 were 51.4 billion cubic meters (bcm), with Italy and Spain accounting for two-thirds of the volume.

Source: Reuters

China’s Sinopec gets green light to develop Weirong shale gas field

19 November. China’s Sinopec has received approval from the ministry of natural resources to develop shale gas at the Weirong gas field in the southwestern province of Sichuan. The company plans to build 166 wells at the gas field with total production capacity of 3 billion cubic meters (bcm) each year. The first phase of construction is underway, with two testing wells reaching daily output of 313,000 cubic meters and 253,000 cubic meters, respectively, the company said. China’s shale gas production of about 10.9 bcm in 2018 accounted for less than 7 percent of total gas output. But a top researcher at PetroChina expects shale gas output could reach 280 bcm by 2035.

Source: Reuters

Papua New Guinea, Exxon to start talks on revising P'Nyang gas deal

16 November. Papua New Guinea is set to start talks with Exxon Mobil Corp to try to negotiate better terms from the P’Nyang Gas Project, Petroleum Minister Kerenga Kua said. The push to extract more benefits from the P’Nyang project is part of a wider effort by PNG (piped natural gas)’s new government to reap more rewards from the country’s mineral and petroleum resources to lift the country out of poverty. The P’Nyang project will help feed an expansion of Exxon’s PNG LNG plant, in which Australia’s Oil Search and Santos Ltd are also stakeholders. Talks over the project were put on hold earlier this year, when the government sought to revise a separate LNG agreement it has with French energy firm Total, in which Exxon is also involved. That deal was finally endorsed in early September, with minor concessions from Total.

Source: Reuters

Poland’s PGNiG tells Gazprom it plans to end gas supply deal in 2022

15 November. Poland’s dominant gas firm PGNiG said it had notified Russia’s Gazprom that it will not renew their long-term deal on gas supplies when the agreement expires after 2022. Poland had said before that it did not plan to buy gas from Gazprom after 2022. Poland still buys most of the gas it consumes from Gazprom, but has taken steps to reduce its reliance on the Russian firm, as it considers the conditions of the Yamal deal unfavourable.

Source: Reuters

INTERNATIONAL: COAL

Australia’s New Hope flags risk to Acland 2020 coal output

19 November. Australian coal producer New Hope Corp Ltd said 2020 output at its New Acland mine will fall to around 60 percent of the previous year’s levels in the absence of government approvals for an expansion of the mine. New Hope is waiting on the Queensland state government to approve mining lease applications for its New Acland Stage 3 project in Queensland, following a legal victory over an activist group that sought to halt the expansion. Pending approvals, the company expects to ramp New Acland output back up to about 5 million tonnes per annum (mtpa) and then assess the timing for a further increase up to 7.5 mtpa. The reserve areas of its Stage 2 operations are expected to be exhausted in the first half of calendar 2021. New Hope reported a 66 percent jump in first quarter saleable coal production to 3.3 million tonnes (mt), as output ramped up at its Bengalla mine.

Source: Reuters

China’s Shenhua Guoneng builds large coal mine in northeast China

15 November. China’s state-run utility and coal mining firm Shenhua Guoneng Group has built a large new coal mine in northeast China’s Heilongjiang province. The mine, located in Baoqing county of Shuangyashan city, cost a total of 3.656 bn yuan ($522.73 mn) to build and has proven brown coal reserve of more than 800 million tonnes (mt). The mine has an annual production capacity of 11 mt.

Source: Reuters

African Development Bank decides not to fund Kenya coal project

13 November. The African Development Bank (AfDB) will not fund a coal-fired power plant project in Kenya and has no plans to finance new coal plants in future. The project to build a 1,050 MW plant in eastern Kenya was backed by Kenyan and Chinese investors. Construction was originally planned to start in 2015. Dozens of top banks, insurers and development finance institutions are restricting coal investments, as climate activists and investors voice growing concerns about the impact of burning fossil fuels, particularly coal. The AfDB has been a major funder of coal projects in Africa. In the past decade, it has lent more than €1.5 bn ($1.65 bn) to South African utility Eskom for its Medupi coal plant and more than €50 mn for the Sendou coal plant in Senegal.

Source: Reuters

INTERNATIONAL: POWER

Utility hints at possible power outage in California

18 November. The San Francisco-based Pacific Gas and Electric Company (PG&E) has said that strong winds could lead to another power outage in Northern California. PG&E said that it was monitoring a potentially strong offshore wind event on 20 November, which suggests a possible prevention measure of Public Safety Power Shutoff (PSPS) that will cut power supply for some customers in North Valley, North Bay and the Sierra Foothills.

Source: The Economic Times

Kenyan government, Chinese firm launch construction of major power transmission project

15 November. Kenya’s ministry of energy and a Chinese firm, China Aerospace Construction Group, have launched the construction of a major power transmission project outside the capital, Nairobi. Once completed, the 40 kilometre (km), 400 Kva Konza-Isinya Transmission Line Project will ensure reliable power supply for Konza Technopolis, south of Nairobi.

Source: Xinhua

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

France plans new 1 GW offshore wind farm in Normandy

18 November. France wants to construct a wind farm off the coast of Normandy as the nuclear-dependent nation moves to expand power generation from renewable sources, the energy ministry said. The planned 1 GW wind farm could have up to 80 wind turbines of around 12 MW each, in an area where wind conditions and the seabed are very favorable for offshore wind power at a competitive price, the ministry said. France is racing to boost the share of renewable generation capacity in its energy mix and reduce its dependence on nuclear energy. It plans to shut down old nuclear plants and will phase out coal-fired generation to curb greenhouse gas emissions. The ministry said it plans to boost the share of renewables in the French energy mix to around 40 percent by 2030. Nuclear power from its 58 reactors currently covers around 75 percent of French electricity needs. Although France has one of Europe’s biggest coastlines with good wind speeds for viable wind farm projects, it is lagging its European peers in developing offshore wind projects. The government announced in June that it will double its target for developing offshore wind projects to 1 GW per year from 500 MW. It currently has no offshore wind farm in operation. The Normandy offshore project is likely to attract bids from major energy companies such as state-controlled utility EDF, energy major Total and Engie as the firms vie to expand the footprint in the renewables sector. EDF edged out rivals Total and Engie for a contract to build a 600 MW offshore wind project near Dunkirk in western France in June.

Source: Reuters

California, other US states sue to block EPA from revoking state emissions authority

16 November. California and 22 other US (United States) states filed suit to challenge the Trump administration’s decision to revoke California’s authority to set stiff vehicle tailpipe emissions rules and require a rising number of zero emission vehicles (ZEVs). The lawsuit, filed in the US Court of Appeals for the District of Columbia, seeks to overturn the Environmental Protection Agency (EPA)’s decision in September to revoke portions of a waiver it granted in 2013. The California ZEV mandate, adopted in 1990 and revised on numerous occasions, requires the sale of a rising number of electric or other zero-emission vehicles. Last year, California forecast that about 8 percent of the state’s new vehicle sales in 2025 will be zero emission and plug-in electric hybrids. Over the past 50 years, the EPA has granted more than 100 waivers for California emissions standards. California’s vehicle emissions rules are followed by about a dozen other US states.

Source: Reuters

European Investment Bank to cease funding fossil fuel projects by end-2021

15 November. The European Investment Bank (EIB) said it would stop funding fossil fuel projects at the end of 2021, a landmark decision that potentially deals a blow to billions of dollars of gas projects in the pipeline. The bank’s new energy lending policy, which it said was approved with “overwhelming” support, will bar most fossil fuel projects, including traditional use of natural gas. Under the new policy, energy projects applying for EIB funding will need to show they can produce one kilowatt hour of energy while emitting less than 250 grams of carbon dioxide, a move which bans traditional gas-burning power plants. The policy raises new risks for the gas industry, which has more than $200 bn in liquefied natural gas (LNG) projects lining up to go ahead worldwide over the next five years, aiming to provide a cleaner alternative to coal and oil. Under the new policy, gas projects would have to be based on what the bank called “new technologies,” such as carbon capture and storage, combining heat and power generation or mixing in renewable gases with the fossil natural gas. Environmental organisations celebrated the EIB decision, but expressed disappointment that its introduction will be delayed by a year after lobbying by European Union member states.

Source: Reuters

Saudi Sakaka solar project to be launched before end of year

15 November. Saudi Arabia’s Al Jouf region will launch its first renewable power project before the end of the year. The 300 MW Sakaka solar photovoltaic IPP project is estimated to generate enough clean energy to power 45,000 households in the Al Jouf region while offsetting over 500,000 tonnes of carbon dioxide a year, ACWA Power chairman Mohammad Abunayyan said. The project is said to be the first renewable energy project being built under King Salman’s renewable energy initiative.

Source: Reuters

Spain’s Iberdrola to enter Australia with wind, solar power project

15 November. Spanish power firm Iberdrola SA said it plans to make its first foray into the Asia-Pacific, building a A$500 mn ($343 mn) wind and solar farm in Australia. Iberdrola, which up to now has focused on Europe, the United States, Mexico and Brazil, has picked a site in South Australia, Australia’s most wind power-reliant state, to build a 320 MW hybrid project. The company aims to have the projects up and running by 2021.

Source: Reuters

China CO2 emissions from energy sector still on rise: Researchers

14 November. China’s emissions of the climate-warming greenhouse gas carbon dioxide (CO2 )from its energy sector are expected to increase this year and next, driven by rising oil and gas consumption instead of by coal, a team of industry experts warned. The oil and gas sectors could add more than 200 million tonnes (mt) of CO2 to China’s total emissions, meaning overall greenhouse gas from energy use would still rise 2 percent this year and 1.2 percent in 2020, researchers with the “China Coal Cap Research Project” said. Meanwhile, emissions from coal are expected to fall 75.6 mt in 2020 after a concerted effort to switch to cleaner energy sources, they said. The research team, led by the Natural Resources Defense Council, a US (United States) think tank, is urging China to cut its coal use by at least 400 mt – 8 percent of the total - over the 2021-2025 period. The council regularly submits recommendations to the Chinese government. China lowered the share of coal in its energy mix to 59 percent last year, from 68 percent in 2012, and the researchers said it was expected to fall to 55.3 percent by 2020. Although China is the world’s biggest carbon emitter, it is still designated as a developing country and has not yet been obliged to cut its absolute CO2 levels. However, it had promised to cut carbon intensity - the amount produced per unit of economic growth - by 40-45 percent over the 2005-2020 period, and met the target two years in advance. A government researcher has also suggested China could meet a 2030 target to bring its emissions to a peak as early as 2022. But environmental groups have warned recently of signs that China is letting up in its campaign to shift away from coal in an attempt to stimulate economic growth and head off future energy shortages. Premier Li Keqiang said that China should continue to develop more clean coal and coal-fired power.

Source: Reuters

China to impose new restrictions on small hydro plants

13 November. China will ban the construction of small hydropower plants in regions that already have an electricity surplus and encourage new dams in poor and remote locations with little grid access, its energy regulator said. China’s National Energy Administration said the draft rules aim to promote the orderly development of the hydropower sector after decades of rampant and poorly planned capacity growth. The regulator said small hydro plants would be banned in forest parks, scenic spots, habitats for rare fish and other “ecologically fragile” zones. China’s hydropower sector is a major source of clean energy, with a capacity of about 350 GW or around 18 percent of the country’s total.

Source: Reuters

DATA INSIGHT

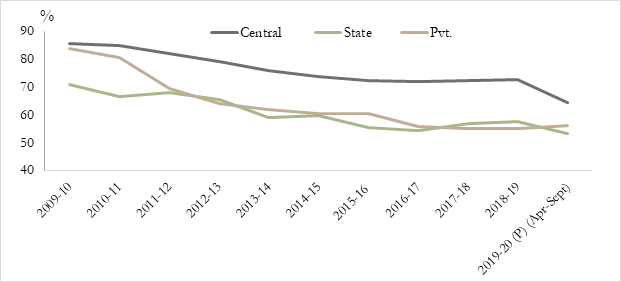

Plant Load Factor for Coal Based Power Plants

| Financial Year(s) |

All India Coal & Lignite Based

PLF (%) |

| 2009-10 |

77.5 |

| 2010-11 |

75.1 |

| 2011-12 |

73.3 |

| 2012-13 |

69.9 |

| 2013-14 |

65.6 |

| 2014-15 |

64.46 |

| 2015-16 |

62.29 |

| 2016-17 |

59.88 |

| 2017-18 |

60.67 |

| 2018-19 |

61.07 |

| 2019-20 (P) (Apr-Sept) |

57.67 |

Trends in PLF (Coal & Lignite) by Sectors

Source: Ministry of Power

Source: Ministry of Power

P: Provisional

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Ministry of Power

Source: Ministry of Power PREV

PREV