GAS SECTOR INCHES TOWARDS THE LOGIC OF THE MARKET

Monthly Gas News Commentary: October - November 2019

India

Regulatory Environment

The Union Cabinet may by next month consider a proposal to hive off state-run gas utility GAIL (India) Ltd’s pipeline business into a separate entity but its sale to a strategic investor may not happen before 2022. GAIL is India’s biggest natural gas marketing and trading firm and owns more than two-thirds of the country’s 16,234 km pipeline network, giving it a stranglehold on the market. Users of natural gas have often complained about not getting access to GAIL’s 11,551 km pipeline network to transport their fuel. To resolve the conflict arising out of the same entity owning the two jobs, bifurcating GAIL is being considered. A proposal is likely to be moved before the Union Cabinet for transferring the pipeline business into a 100 percent subsidiary. The proposal may be considered and approved by the Cabinet this month or latest by November. After the Cabinet approval, a consultant will be appointed to transfer the pipeline business into a separate subsidiary. This would take 8-10 months to accomplish. However, selling off the pipeline subsidiary to a strategic investor is not likely before 2022 as the thinking in the government is that the gas market will not be mature before that and state support would be needed for GAIL to accomplish building a national gas pipeline grid. GAIL will continue to own the marketing business as also the stakes in LNG terminals. GAIL already keeps separate accounts for its gas pipeline and marketing businesses, making it easier to split them into two entities. By unbundling GAIL and opening the sector, the government hopes to increase gas use to 15 percent of the energy mix by 2030 from current 6.2 percent. India is investing over $60 bn in developing natural supply and distribution infrastructure as it chases the target of more than doubling the share of natural gas in its energy base to 15 percent by 2030. Natural gas currently constitutes 6.2 percent of all energy consumption in the country. The government is giving special impetus to develop gas infrastructure across the length and breadth of the country connecting north to south and east to west parts of India. City gas distribution network is expected to cover 70 percent of India’s population. Inclusion of natural gas in the goods and services tax regime, pipeline tariff reform and pricing freedom for all domestic gas would be necessary to make the proposed gas trading hub a success, the chief of PNGRB has said. India is aiming to build a gas trading hub to help develop the domestic gas market, and the downstream regulator, PNGRB, is working out regulations for the proposed hub. Natural gas, crude oil, jet fuel, petrol and diesel were not included in GST when it was rolled out two years ago as states, heavily dependent on petroleum taxes, resisted. The Punjab government reduced VAT on natural gas to 3 percent from 14.3 percent. With this, Punjab has become the state with the lowest VAT on natural gas in the northern region comprising Haryana, Himachal Pradesh, Rajasthan, Delhi and Chandigarh. The decision will also give a boost to industrial units in Gobindgarh and Ludhiana to replace conventional fuel. With the reduction in the rate of VAT, the sale of natural gas in Punjab is likely to increase substantially, thereby yielding increased revenue. National Fertilisers Ltd is a major consumer of gas and uses it for plants at Bathinda and Nangal.

Infrastructure and Retail Sector

GAIL has claimed that at least 550 households in the city have started getting PNG supply under the Pradhan Mantri Urja Ganga Yojana. Besides, 6,500 households are connected with the gas pipeline as on date. The construction work for combined CNG and LNG terminal at Anayara in Thiruvananthapuram Kerala is on full swing. IOC is constructing the fuel-dispensing unit adjacent to KSRTC depot at Anayara. In March 2018, the government had allotted 1.78 acres at Anayara on lease for 30 years to IOC for constructing the fuel-dispensing station. In addition to CNG and LNG, the fuel station will also have electric vehicle-charging facility and petrol and diesel-dispensing unit. The LNG-dispensing station for heavy vehicles will be a separate unit inside the KSRTC bus stand as it is dedicated for transport corporation buses. The rest of the retail facility can be used by private vehicles also. After construction, Thiruvananthapuram will be the second district in the state to have a CNG-dispensing facility (Ernakulam is the first). A well-planned circulating area is proposed in the fuel-dispensing station for each unit. One vehicle can use the facility at a time.

International Investments

American oil and gas firm, ExxonMobil, said it has signed an MoU with IOC India’s largest fuel retailer, to expand LNG initiatives in the country. The MoU was signed between IOC and ExxonMobil India LNG Ltd, an affiliate of ExxonMobil. It said that the MoU builds on the long history of productive cooperation between IOC and ExxonMobil in the LNG space. French energy giant Total SA is spending $600 mn to expand its presence in one of the world’s fastest growing natural gas markets. Total agreed to purchase a 37.4 percent stake in India’s Adani Gas Ltd, a distributor of the fuel that is developing import terminals and a national chain of vehicle-filling outlets. Total said that the acquisition will cost about $600 mn taking into account its divestment in another Indian LNG terminal earlier this year. The deal will give Total access to India’s natural gas market and support its drive to become one of the world’s top LNG players. India’s annual LNG demand will hit 28 mt by 2023, making it the world’s fourth largest importer of the fuel. Adani is developing the Mundra and Dhamra LNG import terminals in India. It plans to expand its distribution network in the next decade to about 6 mn homes and 1,500 retail outlets for natural gas vehicles. Russia’s Novatek is exploring opportunities to set up a small scale LNG plant in India for retail sales.

Domestic Production

India’s natural gas production declined 4 percent to 2,568 mmscm in September due to drop in fields operated by ONGC and JV companies. Gas production in the April-September 2019 period registered a marginal 1.5 percent drop at 16,005 mmscm. ONGC posted a 4.6 percent decline in gas production at 1,913 mmscm in September due to fall in output from fields in Andhra Pradesh, Assam, Gujarat, Tamil Nadu, Rajasthan and western offshore. OIL another oil and gas explorer, posted only a marginal increase in gas production at 232 mmscm in September due to decline in production from fields in Assam. BP said there are 100 tcf of yet-to-be-discovered natural gas reserves in India that would be enough to meet half of the nation’s gas demand till 2050. BP in partnership with RIL is investing about $5 bn to bring about 1 bcf/day of new domestic gas onstream beginning mid-2020. The government mandates a cap price based on alternate fuels for gas from difficult areas, which for the October 2019 to March 2020 period is $8.43/mmBtu more than double the $3.23/mmBtu rate for other domestic gas. ONGC has issued a tender to supply 750,000 scmd of natural gas beginning 26 December 2019 for three years from its eastern offshore gas field in Andhra Pradesh. The pricing basis for the tender is linked to Platts LNG DES West India price assessments. The reserve gas price for the tender would be calculated based on the simple average of daily Platts DES West India price for three months preceding the relevant month in which gas supplies are made plus a $1/mmBtu constant. The bids are required to be quoted as a premium over the reserve gas price, which will be published by ONGC on a monthly basis in $/mmBtu. Based on the above formula, the reserve price for November would be $5.93/mmBtu, Platts data showed. In comparison, the RIL and BP domestic gas tender’s reserve gas price at 8.4 percent of Brent -- for November would be around $5.08/mmBtu. Natural gas produced from discoveries in deep-water, ultra-deep-water and high pressure-high temperature areas can be priced independently, but has a price ceiling of $8.43/mmBtu for October 2019 to March 2020. The government sets the price ceiling bi-annually. The ceiling price would be the lowest of imported prices of LNG, fuel oil or weighted average price of coal, fuel oil and naphtha. The price of domestic natural gas was set at $3.23/mmBtu for October 2019 to March 2020 from regular gas fields. RIL has said that it is on track to start production from a new gas field in the flagging KG-D6 block in the Bay of Bengal from mid-2020 even as output from its existing fields continued to fall. RIL and its partner BP Plc had in June 2017 announced an investment of ₹400 bn in the three sets of discoveries to reverse the flagging production in KG-D6 block. These finds were expected to bring a total 30-35 mcm of gas a day onstream, phased over 2020-22. The three sets of discoveries are R-Cluster, Satellite Cluster and MJ field. R-Cluster will be first to come on stream. Drilling of three out of the five wells on Satellite Cluster has been completed and engineering and fabrication for SPS was on track. Satellite Cluster is to begin production in 2021. For MJ, first phase of drilling will commence in January-March 2021. RIL has so far made 19 gas discoveries in the KG-D6 block. Of these, D1 and D3 -- the largest among the lot -- were brought into production from April 2009 and MA, the only oilfield in the block, was put to production in September 2008. The output from D1 and D3 has fallen sharply from 54 mmscmd in March 2010 to 1.68 mmscmd in the July-September. The fields had produced an average of 1.76 mmscmd of gas in April-June 2019. MA field ceased to produce last year. RIL is the operator of the block with 66.6 percent interest while BP holds the remaining stake in the block. MJ gas find is located about 2,000 metres directly below the currently producing D1 and D3 fields in the KG-D6 block and is estimated to hold a minimum of 0.988 tcf of contingent resource. Besides MJ-1, four deepsea satellite gas discoveries -- D-2, 6, 19 and 22 -- are planned to be developed together with D29 and D30 finds on the block. The third set is the D-34 or R-Series find. The government had in 2012 approved a $1.529 bn plan to produce 10.36 mmscmd of gas from four satellite fields of block KG-D6 by 2016-17. RIL has put off bidding for the new gas it plans to produce from eastern offshore KG-D6 block to next month following a request from potential bidders. RIL and its partner BP Plc had put out NIO seeking bids from potential users for the 5 mmscmd of natural gas they plan to produce from the R-Cluster Field in KG-D6 block from the second quarter of 2020. The rate sought compares to the government-mandated $3.23/mmBtu price that its currently producing D1 and D3 fields in KG-D6 block get. The government gas pricing policy, however, provides for a higher cap price for future gas produced from difficult fields like those in deepsea. This cap currently is fixed at $8.43/mmBtu. RIL-BP is developing three sets of discoveries in KG-D6 block -- R-Cluster, Satellites and MJ -- by 2022 that can produce a peak of 30 mmscmd of gas. The quantity offered for bidding in the NIO is 5 mmscmd from R-Series fields which will start production in mid-2020. Peak output from R-Series is 12 mmscmd, while Satellites will produce another 7 mmscmd beginning mid-2021. MJ field, which will start production in the second half of 2022, also has a planned peak output of 12 mmscmd. The NIO said the gas price would be lower of the quoted rate or the government-mandated ceiling for the difficult fields. The formula RIL is using to price gas for R-Series fields is different from its last price discovery it made for CBM from its Sohagpur coal-bed methane blocks in Madhya Pradesh. RIL ended up buying the CBM gas from its block after it bid $1.836/mmBtu, lower than $3.156 bid by rival Piramal Glass and $3.495 bid by GAIL.

LNG

Indian customers are choosing spot cargoes over long-term LNG contracts as spot purchases are cheaper. In this light Petronet is considering renegotiating long term LNG contracts with Qatar’s RasGas. Delivered Price of Spot LNG is $6.30-$6.40/mmBtu vs $7.50-$8.50/mmBtu for supplies under long term deals. Petronet is also looking at buying a 26 percent stake in Bharat Petroleum Corp Ltd’s planned east coast terminal. GAIL has issued a swap tender offering two cargoes of LNG for loading in the US and seeking one for delivery to India. The offer is for two cargoes loading from the Cove Point plant on 10-12 November and 16-18 December. The sought cargo is for delivery to either the Dahej or Dabhol terminal in India on 20-23 November. More than a year since its inauguration, Gujarat government-backed LNG project at Mundra, built at an estimated cost of ₹55 bn, may finally get commissioned by December. A commercial dispute between the partners GSPC and Adani Group had stalled commissioning of the 5 mtpa LNG import facility. The terminal was completed in mid-2018. However, the commissioning has been stalled due to delay in finalisation of certain lease and sub-commission agreements between the promoters and the Gujarat government. A commissioning cargo from the US had arrived at Mundra LNG terminal last November, but it had to be diverted to Hazira after it was not allowed to discharge at Mundra. The Mundra terminal, whose capacity will be expandable to 10 mtpa in the future, is designed to have a berth for receiving LNG tankers of sizes 75,000 cubic metres to 2,60,000 cubic metres, two LNG storage tanks of capacity 1,60,000 cubic metres each, facilities for regasification and gas evacuation.

Rest of the World

Asia-Pacific

China’s CNOOC is on the hunt for LNG tankers to charter, looking to replace ships it had previously hired that are linked to a Chinese company sanctioned by the US for allegedly transporting Iranian oil. The company, COSCO Shipping Tanker (Dalian), is one of four Chinese firms on which the Trump administration imposed sanctions on 25 September, in what it described as the biggest sanctions taken by the US government since a crackdown on Iranian oil exports designed to put pressure on Tehran to abandon nuclear programmes. That move had already pushed global crude oil tanker freight rates to multi-year highs. Now, prompt demand by Chinese state giant CNOOC for LNG ships has caused freight rates for such tankers to nearly double to $130,000-$150,000 a day from about $80,000. Growth in Chinese imports of LNG is set to slow sharply this year reflecting a slowing economy and record high coal imports, according to analysts. Beijing since 2017 has pushed households to convert to gas or electric heating from coal and this year has set its highest yet target for conversions at 5.24 mn households. However, growth of LNG demand in China in 2019 is expected to slow to 14 percent-17 percent from 41 percent-42 percent in 2018, according to analysts from Wood Mackenzie and IHS Markit. China bought 9.47 mcm of LNG in October, its lowest intake since April and down 2.5 percent from a year earlier despite adding LNG terminals and storage, vessel-tracking and port data compiled by Refinitiv showed. Gas faces competition, however, with more than half of the 5.24 mn households due to ditch coal expected to switch to non-gas heating such as electricity and geothermal, according to the Ministry of Ecology and Environment, which drafts and implements China’s winter anti-pollution campaigns. Gas is five times more expensive than coal. China’s economy grew at its slowest pace in almost 30 years in the third quarter, putting Beijing under increasing pressure to lower costs for industry. Benchmark LNG prices in China rose 19 percent to 4,178 yuan a tonne in October from a month earlier, according to Sublime China Information Co, a China-based consultancy. A new Russia-China gas pipeline due to start operating next month is also expected to hit LNG demand in the longer term, also contributed to the moderating LNG demand growth. Plans for a Japanese-backed project to import LNG to Australia have hit a hurdle as the group struggles to lock in customers, including Australia’s top gas retailer, Origin Energy. Potential buyers are holding off signing contracts after a drop in local gas prices, industry observers and sources said, leaving the $171 mn project well behind its initial schedule of delivering gas in late 2020. The delay risks AIE’s aim of opening a gas terminal in Port Kembla in New South Wales state ahead of a rival project by Australia’s AGL Energy, while both projects are racing to meet a looming gas shortage. AIE, backed by Japan’s JERA, the world’s biggest LNG buyer, trading house Marubeni Corp and Australian mining billionaire Andrew Forrest’s Squadron Energy, is one of five projects aiming to bring gas to southeast Australia. It had hoped its Port Kembla Gas Terminal would start delivering imported gas to industrial users, such as chemicals and brick makers, in late 2020, making it the first off the rank. Industry observers say manufacturers don’t want to commit to AIE as a global LNG glut has spurred two gas exporters in Queensland - Royal Dutch Shell and APLNG, led by ConocoPhillips - to offer more gas into the local market, driving down prices. With manufacturers holding off, AIE is chasing Origin Energy, Australia’s biggest gas retailer, to help get the project off the ground.

Russia

Plans for the expansion of Russia’s Sakhalin-2 LNG plant have been put on hold, according to three sources involved in the project, a potential setback to Russia’s ambition to lift its global LNG market share. The main reasons for the hold-up are the lack of gas resources and international sanctions, the sources said, but plans of Russian gas giant Gazprom to boost its pipeline gas supplies to China, have also had an impact. Russia plans to raise its global LNG market share from less than 10 percent now to 20 percent by 2035, mainly thanks to cranking up of output by non-state producer Novatek and its partners in the Arctic. Gazprom, Russia’s sole exporter of natural gas via pipelines, has been slower in its LNG plans, focusing on pumping the fuel via pipes instead. Sakhalin-2, off the country’s eastern shores, is Russia’s first LNG producing plant with a capacity of over 10 mtpa. Its two production units, or trains, were launched in 2009 in strategic proximity to Japan, the world’s largest consumer of the sea-borne LNG. The consortium, Sakhalin Energy, has plans to expand and build a third train with a capacity of 5 mtpa. Gazprom had said the expansion could happen in 2021. Yet, Sakhalin-1, where the state oil company Rosneft is also a shareholder, is aiming for its own LNG plant. The talks about usage of Sakhalin-1 gas for the Sakhalin-2 LNG plant’s expansion have dragged on for years. The bulk of Russian gas sent to Europe flows via Ukraine but there are a number of obstacles to a new gas deal, such as a political row between Kiev and Moscow, a pro-Russian insurgency in eastern Ukraine, and litigation between Russian gas supplier Gazprom and Ukraine energy company Naftogaz. The current gas transit agreement between Moscow and Kiev expires after 31 December. The gas talks between Ukraine, Russia and the European Union will continue at the end of November, just a month before the current deal expires. Ukraine’s parliament passed a law to establish an independent gas transit operator, a move aimed at creating a competitive domestic gas market and helping the country’s position in trilateral gas transit talks with the EU and Russia. To comply with European energy rules, Ukraine has committed to split its Naftogaz energy firm into production and transportation companies.

Middle East and Africa

Iran has discovered a gas field near the Gulf with enough reserves to supply the capital for 16 years. The Eram field contained 19 tcf (538 bcm) of natural gas, the National Iranian Oil Company said. The oil ministry said the field was located in Fars province, about 200 km south of Shiraz. The amount of gas in the newly discovered field was enough to supply Tehran -- a city with an estimated population of around 8 mn -- for 16 years. A deal that would transfer control of a natural gas pipeline between Israel and Egypt is expected to be closed in the next few days, the companies said. Texas-based Noble Energy, Israel’s Delek Drilling and Egyptian East Gas Co have partnered in a venture called EMED, which last year agreed to buy a 39 percent stake in the subsea EMG pipeline for $518 mn that will carry Israeli gas exports to Egypt. Partners in Israel’s Leviathan and Tamar offshore gas fields had agreed to sell $15 bn worth of gas to a customer in Egypt — Dolphinus Holdings — but the deal was amended to boost supply by 34 percent to about 85 bcm or an estimated $20 bn. The supply deal with Egypt is expected to start in January. To buy into EMG, which owns the 90 km subsea pipeline between Ashkelon in Israel and El-Arish in Egypt, the three partners formed the joint company EMED. The EMG pipeline has a planned capacity of around 7 bcm per year, with a possibility of increasing that to around 9 bcm per year via the installation of additional systems. Libya’s NOC said that gas production from Faregh field would reach 250 mcfd in November after completion of a second development phase. Gas production after the first phase of development was 70 mcfd, NOC said. The field’s condensates production would expand to 15,000 barrels per day.

North and South America

Sempra Energy and Mitsui & Co, Ltd have signed an MoU for developing LNG export projects in the US and Mexico. The MoU reflects a preliminary deal by in which Mitsui would participate in the Cameron LNG Phase 2 project in Louisiana and a future expansion of the ECA LNG project in Baja California, according to Sempra. Phase 1 of ECA – under development by Sempra’s IEnova subsidiary – includes one liquefaction train with an export capacity of 2.4 mtpa, Sempra said. The proposed Cameron LNG Phase 2, which has won necessary permits from the Federal Energy Regulatory Commission, would add up to two liquefaction trains – 9.97 mtpa of extra LNG production capacity – and up to two LNG storage tanks at the Louisiana facility, which Mitsui partly owns. Norway’s Equinor ASA is scouting locations on Brazil’s coast to install new natural gas infrastructure, as the firm’s gas-heavy offshore fields come on-line in the coming years. Many of the region’s assets have significant amounts of natural gas, but consumption is low among Brazilians and the nation has few pipelines and terminals to facilitate exports. As a result, firms have largely opted to “re-inject” the gas, in a process that increases crude output. That will only work for so long. Some fields coming on-line in the pre-salt have too much gas to re-inject. Two massive government auctions in early November in a gas-rich zone are likely to add to the conundrum. Brazil’s oil company Petrobras said it has signed an MoU with Equinor ASA focussed on the joint development of natural gas business projects. The companies aim to maximize downstream value through thermoelectric generation as well as feasibility studies related to gas processing assets and pipelines owned by Petrobras in the Rio de Janeiro region where a natural gas processing plant is being built in Itaboraí. The companies intend to combine efforts in investment in the natural gas, LNG and power generation segments.

Europe

The amount of LNG sent to the UK gas system jumped to the highest level since Refinitiv Eikon data began five years ago, as the country accommodates ample cargo arrivals amid oversupplied global LNG market. With a total of nine cargoes expected at the Isle of Grain and South Hook terminals, Britain’s third terminal, Dragon, has started to send gas to the system after being idle for more than three months, the data showed. British terminals are expected to send around 110 mcm of LNG to the country’s gas system, equivalent to 40 percent of Britain’s gas demand, expected at around 275 mcm according to National Grid data. British shale gas developer Cuadrilla said initial analysis of gas fracked from the second well at its site in northwest England is high quality and shows the country is sitting on a huge natural gas resource. Cuadrilla began fracking at the second well at Preston New Road but was forced to stop in August after operations caused a 2.9 magnitude earth tremor. The government has signalled support for the shale gas industry and is keen to cut the country’s reliance on imports of natural gas, used to heat around 80 percent of Britain’s homes.

| PNGRB: Petroleum and Natural Gas Regulatory Board, km: kilometre, mn: million, bn: billion, tn: trillion, GST: Goods and Services Tax, VAT: Value Added Tax, PNG: piped natural gas, CNG: compressed natural gas, LNG: liquefied natural gas, IOC: Indian Oil Corp, KSRTC: Kerala State Road Transport Corp, MoU: Memorandum of Understanding, mt: million tonnes, mmscm: million metric standard cubic meter, ONGC: Oil and Natural Gas Corp, OIL: Oil India Ltd, RIL: Reliance Industries Ltd, bcf: billion cubic feet, mmBtu: million metric British thermal units, scmd: standard cubic meter per day, KG-D6: Krishna Godavari Dhirubhai 6, mmscmd: million metric standard cubic meter per day, NIO: Notice Inviting Offer, CBM: coal-bed methane, US: United States, GSPC: Gujarat State Petroleum Corp, mtpa: million tonnes per annum, China National Offshore Oil Corp, AIE: Australian Industrial Energy, bcm: billion cubic meters, tcf: trillion cubic feet, mcm: million cubic meters, mcfd: million cubic feet per day, EU: European Union, NOC: National Oil Corp, ECA: Energia Costa Azul, Petrobras: Petroleo Brasileiro SA |

To read article ‘Universal Access to Electricity in India: Is this an Evolutionary or Revolutionary Outcome? Part I (1947-1975)’ please refer to India Energy Analysis (https://indiaenergyanalysis.wordpress.com/2019/11/15/universal-access-to-electricity-in-india-is-this-an-evolutionary-or-revolutionary-outcome-part-i-1947-1975/)

NATIONAL: OIL

India to invite foreign firms to invest in state-owned oil companies

12 November. International energy firms will be invited to participate in India’s privatisation of state-owned oil companies, Oil Minister Dharmendra Pradhan said. Pradhan said Indian Prime Minister Narendra Modi recently met with the chief executives of energy firms in Houston, including those from Exxon Mobil Corp, BP Plc, Royal Dutch Shell, Rosneft Oil Co, Saudi Aramco and Abu Dhabi National Oil Co (ADNOC). This is the first time Pradhan has signalled the government’s intent bring foreign investment into the country’s state-owned oil companies. Pradhan said a planned oil refinery on India’s west coast in partnership with Aramco and Adnoc is on the right track. India is also open to crude oil imports from Russia, Pradhan said.

Source: Reuters

IOC sees diesel demand rising in 6 months as longer-than-usual monsoon ends

11 November. India’s diesel demand is expected to recover in the next six months as a longer-than-usual monsoon season that affected transportation and industry has ended, Indian Oil Corp (IOC) said. Diesel consumption usually tapers in monsoon season as rains hit construction and mobility. Any longer-term slowdown in fast-growing India’s fuel use could dim prospects for global oil demand. India’s fuel demand fell to its lowest in more than two years in September, with consumption of diesel at its weakest since January 2017. State-owned refiners, such as IOC, Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL), traditionally buy fuel from private companies to meet demand at the pump. But falling local demand for diesel, which accounts for about two-fifths of overall fuel consumption, is prompting state refiners to export the product. In the current fiscal year to March, IOC’s diesel exports could be more than before because of the slowdown in consumption. BPCL will export about 200,000 tonnes of diesel every month between November and March. IOC accounts for about a third of India’s refining capacity of 5 mn barrels per day.

Source: Business Standard

NGC Energy, Petredec to set up ₹4 bn LPG terminal

8 November. NGC Energy India Pvt Ltd - a joint venture between Oman-based National Gas Company and Singapore-headquartered Petredec - would jointly set up a liquefied petroleum gas (LPG) import and storage terminal at Krishnapatnam Port at an investment of ₹4 bn. NGC Energy would produce propane, butane at the refrigerated terminal which would have a storage capacity of 30,000 tonne and a throughput capacity of 1.4 million tonnes per annum (mtpa). India was world’s second largest consumer and importer of LPG. LPG demand was growing seven percent annually from 24 to 42 mtpa.

Source: Business Standard

Cairn O&G secures PSC extension for Ravva field in Andhra Pradesh

6 November. The government has approved a 10-year extension of the PSC (Production Sharing Contract) to Cairn Oil and Gas (O&G) of Vedanta Ltd for the Ravva block in Andhra Pradesh. The contract is now effective from 28 October for the next 10 years, Vedanta said. The approval was directed through the Directorate General of Hydrocarbons which is under the Ministry of Petroleum and Natural Gas. Ravva, the oldest producing asset in India for Cairn, becomes the first large field to get production sharing contract extension. The move will enable joint venture partners to recover about 13 mn barrels of oil equivalent (boe) of oil. The joint venture partners will invest ₹5.5 bn to drill seven Revised Field Development Plan (RFDP) wells targeting additional reserves of 11.7 mn boe. The company has been a pioneer in speedy adoption of cutting-edge technologies, and this was demonstrated best at Ravva where Cairn took production up from 3,000 to 50,000 boe a day and sustained this production for nine years.

Source: Business Standard

India on track to achieve 10 percent cut in crude oil import by 2022: Pradhan

6 November. The government is on track to meet the target of cutting India’s oil import dependence by 10 percent by 2020, Oil Minnister Dharmendra Pradhan said. Prime Minister Narendra Modi had said that India needs to bring down its oil import dependence from 77 percent in 2013-14, to 67 percent by 2022, when India will celebrate its 75th year of independence. But with consumption growing at a brisk pace and domestic output remaining stagnant, India’s oil import dependence has risen from 82.9 percent in 2017-18, to 83.7 percent in 2018-19, according to the oil ministry’s Petroleum Planning and Analysis Cell (PPAC). Pradhan said blending of ethanol in petrol has risen to 6 percent at present and the blending would rise further to 10 percent by 2022. The country’s oil consumption grew from 184.7 million tonnes (mt) in 2015-16 to 194.6 mt in the following year and 206.2 mt in the year thereafter. In 2018-19, demand grew by 2.6 percent to 211.6 mt. India’s crude oil output fell from 36.9 mt in 2015-16 to 36 mt in 2016-17. According to PPAC, India spent $111.9 bn on oil imports in 2018-19, up from $87.8 bn in the previous fiscal year. The import bill was $64 bn in 2015-16. For the current fiscal, it projected crude oil imports to rise to 233 mt and foreign exchange spending on it to marginally increase to $112.7 bn. Oil and Natural Gas Corp (ONGC)’s output fell to 19.6 mt in 2018-19 from 20.8 mt in the previous year.

Source: Business Standard

NATIONAL: GAS

Government to lift pricing curbs on domestically produced gas

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Lifting pricing curbs on domestically produced gas will encourage domestic production!

< style="color: #ffffff">Good! |

12 November. In one of the last reforms in the oil and gas sector, the government is set to free up pricing of all domestically produced gas that would help scale up local production from fields of ONGC (Oil and Natural Gas Corp), OIL (Oil India Ltd), Reliance Industries Ltd (RIL) and Vedanta and help create a uniform gas where the fuel is freely tradable on exchanges. Government said that discussions on lifting price restrictions on locally produced natural gas have started that would culminate into a decision about the timing of the new reform initiative. The current timing is considered ideal to free up gas prices as oil market and prices have remained stable. A panel led by the Niti Aayog vice chairman has also suggested free-market pricing for natural gas produced from all fields to boost domestic output. However, any move to completely lift price regulation in the gas sector will be done gradually as has been suggested by the Kelkar Panel. This would mean that the present system of regulated gas pricing for domestic production would continue for at least three more years but during the period producers would be given freedom to sell a portion of the total output under negotiated pricing deals (market determined) with their customers The NDA government’s reform initiatives has already allowed free gas pricing for production coming from small and marginal blocks, difficult high pressure/deep water blocks and all production coming under the newly bid blocks under the Hydrocarbon Exploration Licensing Policy (HELP). But the pricing and marketing of gas from Pre-NELP (New Exploration Licensing Policy) exploration blocks and those under NELP is still regulated. The current gas pricing method for pre-NELP and NELP blocks is based on a 2014 government-set formula that takes average rates from global trading hubs to determine domestic prices twice a year - in April and then in October. Under the formula, the current gas price is at $3.23 per million metric British thermal unit (mmBtu). Gas producers have been critical of this low pricing that adversely impacts investments in the upstream sector. At present, producers can charge market rates for gas from deep sea and other difficult fields but rates must stay below a government-prescribed ceiling that's linked to the prices of alternative fuels. The price ceiling is currently at $8.43 per mmBtu. The new policy will look into this ceiling price as well.

Source: The Economic Times

Gujarat government gives nod for CNG port terminal at Bhavnagar

10 November. The Gujarat government gave its approval for a compressed natural gas (CNG) terminal in Bhavnagar with a proposed investment of ₹19 bn. The facility, approval for which was given by the Gujarat Infrastructure Development Board headed by Chief Minister Vijay Rupani, would be the world’s first CNG port terminal. The proposed CNG port terminal will have a capacity to handle 1.5 million metric tonnes per annum (mmtpa).

Source: Business Standard

RIL cuts base price for new gas by 7 percent from KG-D6 block

10 November. Reliance Industries Ltd (RIL) has cut by about 7 percent the minimum price it is seeking for the natural gas it plans to produce from newer fields in the Bay of Bengal KG-D6 (Krishna Godavari Dhirubhai 6) block, after key customers such as fertiliser plants protested over the high base price. RIL and partner BP are seeking bids from potential users for the 5 million standard cubic metres per day of gas they plan to produce from the R-Cluster Field in KG-D6 from mid-2020. RIL initially set a floor or minimum quote of 9 percent of the dated Brent price — which meant that bidders had to quote the higher percentage.

Source: Business Standard

NATIONAL: COAL

Coal imports at major ports slip 18 percent to 51 mt in April-October

11 November. Thermal coal imports declined by 17.69 percent to 51.10 million tonnes (mt) at the country’s top 12 major ports during April-October this fiscal, latest Indian Ports Association (IPA) report has said. The Centre-owned ports had handled 62.08 mt of the thermal coal in the same period previous year. The IPA, which maintains cargo data handled by these 12 ports, in its recent report said "percentage variation from previous year" in thermal coal handling was at 17.69 percent. As far as coking and other coal is concerned, its handling recorded a rise of 6.88 percent at 33.43 mt during the seven months period. These ports had handled 31.28 mt of coking coal in the corresponding period last fiscal. Earlier, mjunction services -- a B2B e-commerce joint venture between Tata Steel and SAIL -- has reported 9.3 percent rise in India’s coal imports to 126.91 mt in the first six months of current fiscal. The country had imported 116.04 mt of coal in April-September period of 2018-19, according to mjunction - which publishes research reports on coal and steel verticals. India is the third-largest producer of coal after China and the US (United States) and has 299 billion tonnes (bt) of resources and 123 bt of proven reserves, which may last for over 100 years.

Source: Business Standard

Indian coal mines still burning after a century

10 November. The fires started in 1916. More than a century later, coal pits in Jharia, in a remote corner of India’s eastern Jharkhand state, continue to spew flames and clouds of poisonous fumes into the air. Coal is an important contributor to India’s growth, supporting its iron and steel industries and generating more than half the country’s power. In Jharia, the heart of India's coal industry, the livelihoods of half a million people depend on it. For the past century, inhabitants have braved sizzling temperatures, deadly sinkholes and toxic gases. The coal fires pose an even greater threat to the lives of those who work in the mines, which cover more than 260 square kilometre. Decades of underground coal mining have hollowed Jharia’s land. In 2008, Bharat Coking Coal Ltd, a subsidiary of Coal India Ltd (CIL), began a program to relocate almost 53,400 families living in fire-affected areas by 2021. But by 2016, only 4,000 families were relocated. With few jobs available, many young people work as coal loaders for less than $4 a day or risk their lives scavenging coal.

Source: The Economic Times

Centre changes track to focus on coal contracts, instead of buying mines

6 November. The government will now prioritise getting contracts for coking coal imports at competitive prices instead of trying to buy coal mines, as it was planning earlier. Coal India Ltd (CIL) chairman Anil Kumar Jha said while getting the contracts is a priority, the company will consider picking up stakes in coking coal companies instead of an outright purchase. Till now, CIL has been considering whether to buy coking coal mines or pick up stakes in companies in Australia, Canada, the US (United States) and Russia. It is also about to float a tender to select merchant bankers who will guide CIL through the process. Union Coal Minister Pralhad Joshi said the decision was been taken to protect the forex outflow, which stood at ₹2.71 tn last year. In the same year, India had imported 235 million tonnes (mt) of coal; 50 mt of it was coking coal. Coking coal is scarce in India and is a key ingredient to make steel. With the government keen to develop infrastructure, steel availability and the cost of production — which will impact prices — is crucial. Around 10-15 percent of the 55-60 mt demand for coking coal in India is met by domestic supply, while the rest is catered to via imports, from Australia, the US, Canada and other countries.

Source: Business Standard

Prakash Industries emerges as highest bidder for Bhaskarpara coal block

6 November. Prakash Industries emerged as the highest bidder for Bhaskarpara coal block in Chhattisgarh. Birla Corp Ltd had bagged the Brahmapuri mine in Madhya Pradesh. Jindal Steel and Power Ltd (JSPL) was the highest bidder for Gare Palma IV/1 coal block in Chhattisgarh with a bid price of ₹230 per tonne. Birla Corp bagged the Bikram coal block in Madhya Pradesh with a bid price of ₹154 per tonne. Bhaskarpara coal block was previously allocated to Bhaskarpara Coal Company Ltd (BCCL) -- a joint venture of Electrotherm (India) Ltd and Ultratech Cement Ltd, while Brahmapuri mine was previously allocated to Pushp Steels & Mining. The Supreme Court had in 2014 cancelled 204 coal mines allocated to various government and private companies since 1993 under the provisions of the Coal Mines (Nationalisation) Act, 1973.

Source: Business Standard

Coal ministry not in favour of overseas acquisitions by CIL: Coal Minister

6 November. Coal Minister Pralhad Joshi said his ministry was not in favour of overseas coal asset "acquisition" by Coal India Ltd (CIL). Joshi said last year India imported 235 million tonnes (mt) of coal and the forex outflow was ₹2.7k bn. Joshi had already advanced the 1 bn coal production target of CIL by 2 years to FY24. CIL chairman A K Jha said CIL was scouting for stakes in coking coal assets only.

Source: Business Standard

CM writes to PM for allocation of coal block to Andhra Pradesh

6 November. Andhra Pradesh Chief Minister (CM) Y S Jaganmohan Reddy wrote to Prime Minister (PM) Narendra Modi, requesting allocation of Mandakani coal block and Talcher coalfields in Odisha to APGenco thermal power plants. APGenco has submitted an application to the nominated authority for allotment of Mandakini-A coal block in Odisha’s Talcher for the upcoming projects, the CM said in the letter.

Source: The Economic Times

NATIONAL: POWER

Four new power grids to address power shortage of 13 western UP districts

12 November. The Uttar Pradesh (UP) government took a slew of decisions in its Cabinet meeting to address the problem of power roasting and overloading. Now, UP Power Corp Ltd (UPPCL) will be setting up power grids in four UP districts-- Rampur, Sambhal, Meerut and Sindhauli. With a budget of ₹1.15 bn, 765 kV (kilovolt) transmission will be setup in Meerut and Rampur and 400 kV in Sambhal and Sindhauli, on public private partnership (PPP) mode. Soon after the Cabinet meeting, the government said that three bids were received for 765 kV transmission in Meerut and 400 kV transmission at Sindhauli. The power grid was awarded on the basis of a proposal of ₹1.15 bn. Its work will be completed by 2021. Approval has also been given to power grids for 765 and 400 kV transmission lines at Rampur and Sambhal. It will also be completed by 2021. A total of 13 districts of Western UP will benefit from this.

Source: The Economic Times

India’s electricity demand falls at fastest pace in at least 12 yrs

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Fall in electricity demand is a warning bell on economic activity and investment in energy production capacity!

< style="color: #ffffff">Bad! |

11 November. India’s power demand fell 13.2 percent in October from a year ago, posting its steepest monthly decline in over 12 years, government data showed, reflecting a deepening growth slowdown in Asia’s third-largest economy. India’s June quarter GDP (Gross Domestic Product) grew at its weakest pace in six years as consumer demand and government spending slowed, and economists see the falling electricity demand as a reflection of a further slowdown. Consumption in heavily industrialized states such as Maharashtra and Gujarat led the decline. Last month, power demand in Maharashtra declined by 22.4 percent and in Gujarat by 18.8 percent, the data from the Central Electricity Authority (CEA) showed. Barring four small states in the country’s north and the east, demand fell across regions, the data showed. Populous states such as Uttar Pradesh (UP) and Madhya Pradesh (MP) saw demand fall - with MP’s electricity requirement falling by over a fourth and UP seeing a decline of 8.3 percent.

Source: Reuters

UPPCL launches instalment scheme for consumers

7 November. The Uttar Pradesh Power Corp Ltd (UPPCL) has decided to start a new scheme under which consumers can pay dues in instalments. Now consumers living in urban areas, having electricity connections up to a load of 5 KW can pay their dues in 12 easy instalments. For rural consumers the dues can be paid in 24 instalments. UP Energy Minister Shrikant Sharma said that registration for the new scheme will be launched on 11 November and will continue till 31 December. The scheme will be only for LMV-1 or domestic consumers of urban areas up to 4 KW load and all consumers of rural areas. However, only those consumers would be eligible for the scheme who continue to pay power bills regularly on time, the Minister said. Appealing to the consumers, the Minister said that payment would only be accepted online and all queries of consumers would be answered through the toll-free number 1912 and power department offices.

Source: The Economic Times

Power ministry issues order for reconstitution of NCT

7 November. The power ministry recently said that it will reconstitute the National Committee on Transmission (NCT) with amended composition and terms of reference (TOR). It said that the committee will be headed by the chairperson of the Central Electricity Authority. Under the revised TOR, the NCT will evaluate the functioning of the national grid on a quarterly basis and consider the review of the Regional Power Committee for Transmission Planning (RPCTP) for system expansion and strengthening of the transmission system. The central transmission utility (CTU) is required to carry out periodic assessment of transmission requirements under inter-state transmission system (ISTS). It said that after considering the recommendations of the CTU and the regional committees, the NCT would be required to assess the trend of growth in demand, generation in various regions, and identify constraints in the inter-state, inter-region transfer system. Other functions of the committee will include proposing construction of transmission lines, grid stations, and will draw up perspective plans keeping 10 to 15 years time in mind.

Source: The Economic Times

Power sector needs good dose of private investments: Niti Aayog CEO

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Investments in supply, be it green or brown, may become liabilities if demand does not keep pace!

< style="color: #ffffff">Ugly! |

6 November. India needs a good dose of private investment to make power distribution viable, and a strong regulatory framework to attract foreign investment, Niti Aayog CEO (chief executive officer) Amitabh Kant said. Foreign direct investment (FDI) in India has grown by 66 percent at a time when investment across the globe has fallen by 30 percent, but FDI in the power sector can come in only if the regulatory regime is predictable and consistent, Kant said. In order to give relief to power generation companies, the Centre has enforced a payment security mechanism where discoms (distribution companies) are required to open letters of credit for getting power supply. UPERC (Uttar Pradesh Electricity Regulatory Commission) chairman R P Singh said without smart metering, India’s power sector will remain in financial stress.

Source: The Economic Times

Not all state power discoms see financial benefit in smart meters

6 November. The Union power ministry has an ambitious plan for 100 percent smart metering over the next two years. However, not all state distribution companies (discoms) see a financial benefit from smart meters. Also, vendors are reluctant to supply to some states, on payment concerns. A smart meter has a modem (communication device) and a remote switch by which demand, supply and billing can be monitored and controlled remotely. Data from these is collected in a cloud server. This reduces energy theft, improves billing and bill collection. It also helps discoms collect data on consumer demand patterns, useful for improved planning of supply. At present, smart metering is being pushed through two ways. One is where states can go ahead and make a capital expenditure by changing to smart metering. This involves huge upfront outgo. The second way is to allows discoms to move to smart meters through the operating expenditure (opex) model, where nodal agencies like Energy Efficiency Services (EESL) step in to fund it. EESL has installed 400,000 smart meters till date, in Uttar Pradesh, Delhi, Haryana, Bihar and Andhra Pradesh. In addition to some unwilling discoms, there are supply-side concerns.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

India to cross 200 GW renewable energy capacity mark by 2022: Singh

12 November. Power and New & Renewable Energy Minister R K Singh exuded confidence that India will have over 200 GW of renewable energy capacity by 2022. India has set an ambitious target of having 175 GW of renewable energy capacity by 2022. Singh said that more than 55 percent of installed power generation in India will be from renewable sources by 2030.

Source: The Economic Times

Solar power addition falls 35 percent in the first half of 2019

12 November. New solar installations in the country are coming down, as India added only 3.2 GW of solar power across the country in the first half of this year, down 35 percent year-on-year. As against this, about 5 GW of solar capacity was installed across the country including both large-scale and rooftop solar in the first half of 2018. Cumulative solar installations at the end of September 2019 reached 33.8 GW, representing 9.2 percent of the total power generation capacity in India, which comes around 366 GW. India's target is to reach 100 GW capacity of solar installations by 2022. Of late, investor concerns on policies, falling tariffs, land issues and funding have resulted in no takers for new biddings for solar projects. Rooftop solar installations accounted for 17 percent of total solar installations in the first half, a decline of 45 percent compared to first half of the 2018. Cumulative rooftop installations totalled nearly 3,816 MW as of June. Although new solar installations were down, India was still third largest solar market in the world behind China and the United States, data from Mercom India Research, part of global clean energy communications and consulting firm Mercom Capital Group, said. The Mercom report said Adani is the largest project developer in terms of cumulative solar installations as of June 2019. Five companies, led by ACME Solar, had a cumulative project development pipeline of over 1.5 GW apiece at the end of June 2019.

Source: Business Today

In G20, only India is close to 1.5 degree Celsius temperature rise ‘pathway’

12 November. Extreme weather events led to around 16,000 deaths and economic losses of $142 bn in G20 nations on average every year during 1998-2017 with India reporting the highest number of deaths among them and figuring in the list of top five countries in terms of economic losses during the period, a global report said. The ‘Brown to Green Report 2019’, released by the Climate Transparency, however, noted that India is the only country among G20 nations that is close to 1.5 degree Celsius temperature rise ‘pathway’ - a scenario which the scientific community has pitched for at this juncture to save the world from the disastrous consequences of average temperature rise. The G20 countries are together responsible for approximately 80 percent of global GHG (greenhouse gas) emissions. Covering 80 indicators, the report is the world’s most comprehensive review of G20 climate action, mapping achievements and drawbacks in efforts to reduce emissions and adapt to climate impact as part of their respective climate actions goals - called Nationally Determined Contribution (NDC) — which countries had submitted to the UN climate body as part of the Paris Agreement targets. It also noted that India is currently investing most in renewable energy while Brazil and Germany are the only G20 countries with long-term renewable strategies. The report found that the G20 nations’ CO2 (carbon dioxide) emissions went up in all sectors in 2018, with the highest rise (4.1 percent) in the buildings sector compared to 2017. While power sector recorded increase of 1.6 percent, the transport sector emissions increased by 1.2 percent in 2018.

Source: The Economic Times

Bhakra Beas Management Board signs MoU for 40 MW hydropower project

11 November. Bhakra Beas Management Board (BBMB) signs MoU for 40 MW hydropower project Shimla: After 40 years of completion of Beas Satluj Link (BSL) project, 40 MW hydel project would come up at Pandoh-Baggi tunnel. BBMB has entered into an MoU (Memorandum of Understanding) with the Himachal Pradesh government for setting up of 40 MW Baggi power house in Mandi district during the ‘Global Investors Meet’ at Dharamshala. This power project includes two units of 20 MW each and is located at the tail of Pandoh-Baggi tunnel. BBMB chairman D K Sharma said the project has been assigned to them by the Union power ministry on 22 October, after concurrence of all the partner states. Sharma said that the project would cost of ₹3.5 bn.

Source: The Economic Times

Researcher develops bio-drying technology in Kochi

11 November. A research scholar at Cusat has developed a technology to reduce the moisture content in municipal solid waste (MSW) and make it suitable for manufacturing fuel that can be used in waste-to-energy plants. The researcher, Asha P Tom, who was working under the guidance of Renu Pawels, professor, civil engineering department, Cusat, was recently awarded a doctorate based on her work titled ‘Biodrying: A Sustainable Technology for Municipal Solid Waste Management’. Pawels said the pilot scale bio-drying reactor for treating mixed MSW with high moisture content was developed in collaboration with NIIST, CSIR, Thiruvananthapuram, under the supervision of Ajit Haridas. This technology reduces the moisture content and increases the energy value of MSW by convective evaporation process, by utilizing the controlled aerobic reactions and the resulting biological heat. A major hindrance towards the use of energy producing applications of MSW are high moisture content and low calorific value. Mixed MSW in raw state has only one-third heating value of coal. The highlights of bio-drying process are easy storage, sorting and transportation of MSW due to the reduced volume and moisture content. Considerable reduction in odour and zero leachate are positive features of this process. The project was financially supported by Kerala State Council for Science Technology & Environment.

Source: The Economic Times

MNRE issues norms for 10 lakh solar power pumps under PM-KUSUM scheme

11 November. The Ministry of New and Renewable Energy (MNRE) has issued guidelines for setting up of 10 lakh grid-connected solar power pumps under the ambitious Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) scheme. Under “Component C” of the scheme 10 lakh agriculture pumps of 7.5 horsepower (HP) capacity each are planned to be solarised by 2022. As per provisions of the scheme, initially one lakh grid-connected pumps are targeted to be solarised on pilot basis and further scale-up will be carried out after the evaluation of the pilot phase. The scheme aims at ensuring reliable day time power supply for irrigation, reducing subsidy burden on power distribution companies (discoms) and providing additional sources of income to the farmers. The scheme provides for support for individual farmers with grid-connected agriculture pumps. It will support setting up solar photovoltaic capacity up to two times the pump capacity in kW so that farmers can use the power to meet their irrigation needs and generate additional income by selling surplus solar power to discoms. The guidelines for the implementation of PM KUSUM Scheme were issued in July this year stating that central public sector undertakings and state implementation agencies will carry out the tendering process. The centre has already said it will provide Central Financial Assistance (CFA) up to 30 percent of the cost of solarisation of the pump for solar PV (photovoltaic) components including solar modules, controllers or inverters, balance of system, installation & commissioning on the basis of benchmark cost or cost discovered through tender. The CFA will be provided for solarisation of pumps up to 7.5 HP and depending upon the tariff model adopted, discoms will purchase solar power from farmers at a rate decided by the respective state entities.

Source: The Economic Times

Paddy stubble to drive bio fuel production in Punjab, Haryana

10 November. Crop stubble in Punjab and Haryana, blamed for making the already foul air of northern India more toxic on being burnt, will feed four large ethanol and bio-CNG (compressed natural gas) plants being set up in the two states. Farming in the two states produces 30 million tonnes (mt) of paddy stubble every kharif season. Most farmers burn this crop residue as there is no cheaper way of clearing the fields. But this practice, and the criticism that it is leading to health emergencies, could soon ebb as work on the planned ethanol and bio-CNG plants has picked up pace. Praj Industries is the main technology provider for second-generation ethanol to Indian companies including IOC (Indian Oil Corp), BPCL (Bharat Petroleum Corp Ltd), HPCL (Hindustan Petroleum Corp Ltd) and MRPL (Mangalore Refinery and Petrochemicals Ltd). It is working on the four-integrated commercial-scale smart biorefineries based on in-house 2nd-generation technology to convert biomass to ethanol. IOC and HPCL are setting up bio-refineries in Haryana and Punjab, respectively.

Source: The Economic Times

CIL invites bids for 100 MW solar project

9 November. Coal India Ltd (CIL) has invited bids from developers for setting up a 100 MW solar power plant in Solar Power Developer and Operator mode in Chhattisgarh. It will cater to the green energy requirement of CIL subsidiary of South Eastern Coalfields which consumes around 850 million units of power annually. CIL’s total annual Power requirement for coal production is around 4.5 billion units which would require setting up 3000 MW of solar power projects. In order to achieve its goal, the company has formed a joint venture with NLC India, formerly Neyveli Lignite Corp, to jointly set up 5000 MW of power generation capacity of which 3000 MW would be solar powered while the rest 2000 MW would be coal-fuelled.

Source: The Economic Times

Come January, over 40k buildings in Kerala will have solar-powered rooftop

8 November. As many as 42,500 buildings will sport solar panels on its rooftops, as Kerala State Electricity Board (KSEB) is set to tap solar energy from January onwards. It has selected the buildings among 2,78,257 registered for the Soura programme. The buildings include houses, shops, institutions. Thrissur tops the list with 7549 buildings ready for solar makeover. Power Minister M M Mani said the first phase of project would be completed by June. The project aims at generating 200 MW of power. Nearly 150 MW of projects would be developed under the tariff-based renewable energy service company (RESCO) mode and 50 MW will be developed under engineering, procurement, and construction (EPC) mode. KSEB had started online registration of the program in July 2018 and closed it on 31 January 2019. The second phase of the project is aimed at generating 300 MW. It is expected to complete by May, 2021.

Source: The New Indian Express

SJVNL signs pact for 430 MW hydro project in Himachal

7 November. Satluj Jal Vidyut Nigam Ltd (SJVNL) signed a pact with Himachal Pradesh for commissioning the 430 MW Reoli Dugli Hydro Electric Project on the Chenab river basin. Earlier, the SJVNL had signed seven pacts with the state. SJVNL chairman and managing director (CMD) Nand Lal Sharma said the eight projects required an investment of ₹240 bn and they are expected to generate employment for 11,950 people. The eight projects will generate 2,388 MW of electricity. The company is currently generating 2015.2 MW of power.

Source: The Economic Times

Solar tiles may replace clay tiles in Goa homes: Cabral

6 November. Clay roof tiles, colloquially referred to as Mangalorean tiles, that typically adorn roofs of traditional Goan homes, may soon make way for more modern and solar energy-generating tiles, if Goa Power Minister Nilesh Cabral has his way. Cabral said his ministry would soon implement the Renewable Energy Service Company (RESCO) model of solar power generation, in which roof space is utilised for outfitting of solar panels that help generate cheaper power. Cabral said private empanelled vendors will be roped in for installation of solar tiles, which would reduce consumption of conventional energy up to 30-40 percent inside the dwellings. Twenty percent of the cost of the electricity saved will be paid to the vendors for installation of the solar panels. Cabral said the Goa government plans to generate at least 13 MW of power through solar installations in the state by March next year, and the solar power would be connected to the state power grid. The state consumes 650 MW of power on a daily basis.

Source: The Economic Times

Cabinet approves pact with Guinea on renewable energy

6 November. The Union Cabinet gave ex-post facto approval to a pact signed between India and Guinea in the field of renewable energy. The objective of the MoU (Memorandum of Understanding) is to establish the basis for a cooperative institutional relationship and to encourage and promote bilateral technical cooperation in renewable energy on the basis of mutual benefit, equality and reciprocity between the parties. The areas of cooperation include solar energy, wind energy, bio-energy, and waste to energy, small hydro storage and capacity build.

Source: Business Standard

80 Moradabad coal factories fined ₹17.5 mn for flouting pollution norms

6 November. Coming down heavily on erring coal factories operating without pollution-control systems in Moradabad, the Uttar Pradesh Pollution Control Board (UPPCB) in the last three days has shut down 80 coal units and slapped a fine of ₹17.5 mn on them. The pollution control board had recently conducted surveys to identify factories flouting pollution parameters in which 100 such factories were under the scanner. The UPPCB said the action was taken in view of rising air-pollution levels in the city.

Source: The Economic Times

INTERNATIONAL: OIL

TC Energy restarts Keystone oil pipeline at 20 percent pressure reduction: US regulator

12 November. TC Energy Corp has completed repairs and restarted the Keystone oil pipeline at a 20 percent pressure reduction after spilling more than 9,000 barrels in North Dakota, a US (United States) regulator said. The US Pipeline and Hazardous Materials Safety Administration (PHMSA) continues to investigate the cause of the rupture in Edinburg, North Dakota. TC Energy said the pressure restriction will remain in effect until all the elements of the integrity verification plan have been completed and approved by PHMSA. The 590,000 barrels per day (bpd) Keystone system is an important artery for Canadian heavy crude, imported by US refiners, particularly in the Midwest.

Source: Reuters

Kazakhstan, Russia partly agree contaminated oil compensation

11 November. State oil pipeline operators of Kazakhstan and Russia have signed an agreement on compensation for 14 Kazakh companies whose oil was contaminated in the Russian pipelines, the Kazakh firm, KazTransOil, said. A total of 38 Kazakh producers have been affected by the contamination this year, it said, and work on the remaining compensation is under way.

Source: Reuters

Iran finds new oilfield with 53 bn barrels: President

10 November. Iran has discovered a new oilfield in the southwest of the country that has the potential to boost its reserves by about a third, President Hassan Rouhani said. The field stretches over 2,400 square km (927 square miles) in the oil-rich Khuzestan province, Rouhani said. Iran ranks as the world’s fourth–largest reserve holder of oil, and the second-largest holder of gas reserves, according to the United States Energy Information Administration (EIA). Iran had an estimated 157 bn barrels of proved crude oil reserves in January 2018, the EIA said.

Source: Reuters

Iraq oil production and exports stable, extraction healthy: Oil Minister

9 November. Iraq’s oil production and export rates remain stable, Oil Minister Thamer Ghadhban said, as the country remained gripped by widespread anti-government protests. The country remained committed to maintaining its production share in OPEC (Organization of the Petroleum Exporting Countries).

Source: Reuters

Saudi Aramco signs China’s crude oil supply deals for 2020

7 November. Saudi Aramco said it had signed crude sales agreements for 2020 with five Chinese customers, increasing total volume by 151,000 barrels per day compared to 2019 oil supply contracts. The new deals will further “solidify the company’s position as China’s top crude supplier and reflect the company’s marketing efforts on strategic relations and market expansion,” Aramco said.

Source: Reuters

INTERNATIONAL: GAS

Norway approves Equinor’s request to cut Troll gas quota: Oil ministry

11 November. Norway has approved energy firm Equinor’s request to reduce the gas production quota at its Troll oil and gas field for the current year, the oil ministry confirmed. The ministry said the Troll gas output quota had been set at 36 billion cubic meters (bcm) for the gas year 2019, which runs from October 2019 to October 2020, 2 bcm lower than in the previous year. Studies by the Norwegian Petroleum Directorate (NPD) have shown that overly quick gas production at Troll could have an impact on oil and gas extraction in nearby areas. Equinor, Europe’s second-largest gas supplier after Russia’s Gazprom, said in May its production permit for the Troll field had been increased from 36 bcm to 38 bcm for the gas year 2018, which ended on 30 September.

Source: Reuters

Indonesia signs 20 year PSC for Corridor natural gas block

11 November. Indonesia’s government signed a PSC (Production Sharing Contract) with units of ConocoPhillips, PT Pertamina and Repsol SA for the Corridor natural gas blocks, Energy and Mineral Resources Minister Arifin Tasrif said. The contract will extend by 20 years the current contract with the same companies that will expire in late 2023 Under the new contract, the companies will have 53.5 percent of the gas produced from the block and 48.5 percent of the oil. The Corridor block in January-September this year delivered 833 mn standard cubic feet of gas per day, according to data from upstream oil and gas regulator SKK Migas.

Source: Reuters

China’s CNPC launches deepest onshore gas field

11 November. China National Petroleum Corp (CNPC) has fully launched the deepest onshore gas field in the country, Keshen 9, in the south foot of Tianshan in Tarim oilfield. CNPC said that the company has successfully drilled 32 new gas wells by far this year in the south foot of Tianshan, with each well reaching daily output over 300,000 cubic meters. The company expects to add nearly 4 billion cubic meters (bcm) natural gas capacity next year on top of the 24 bcm capacity in the south foot of Tianshan, as there are 21 key exploratory wells and 37 development wells currently under drilling.

Source: Reuters

Spain becomes Europe’s cheapest gas market on flood of low-cost LNG

7 November. The Spanish gas market has become the cheapest in Europe for the first time, distorted by an influx of low-priced liquefied natural gas (LNG) cargoes that keep arriving in the country despite subdued demand. Gas prices in Spain - Europe’s major LNG market - usually hold a premium over prices on some major European gas markets because the country imports gas from fewer supply sources. But in the past week Spanish gas prices for day-ahead, weekend and December delivery dropped to the lowest level across the continent as once expensive LNG has been trading lower than gas on some European gas hubs this year, flooding markets including Spain. Spain has imported 14.24 million tonnes (mt) of LNG this year so far, a 50 percent increase from the same period in 2018, Refinitiv data shows. Gas storage in Spain is almost 95 percent full, a situation similar to most European gas markets.

Source: Reuters

Cyprus signs deal for offshore gas concession

7 November. Cyprus signed a 25-year concession with a three-member consortium for the exploitation of a gas reservoir southeast of the island first discovered in 2011. The contract with Noble Energy, Shell and Delek is the first commercial exploitation license signed by the Mediterranean island. The Aphrodite field is thought to hold an estimated 4.1 trillion cubic feet (tcf) of gas. Cypriot authorities have said natural gas will start being extracted in 2025, with estimated earnings of €9.3 bn ($10.29 bn) over an 18-year period.

Source: Reuters

Japan marks 50 yrs of LNG imports with eye on Asia growth

6 November. Japanese gas buyers marked the 50th anniversary since the first cargo of liquefied natural gas (LNG) arrived in Japan, now the world’s biggest importer of the fuel. The arrival of the cargo on 4 November 1969 helped transform Japan’s energy system, which had relied on oil, coal and gas from coal in an era of high growth, before nuclear power was developed. But Japan’s energy situation is undergoing huge changes in the wake of the Fukushima nuclear disaster in 2011, which pushed LNG imports to record highs as reactors were closed and the government liberalised the gas and power markets. Japan’s gas industry should contribute its knowhow to help develop LNG markets in Southeast Asia where energy demand is expected to grow, Japan Gas Association chairman Michiaki Hirose said.

Source: Reuters

INTERNATIONAL: COAL

No forced hard coal power plant closures before 2026: German draft law

12 November. The German government will not force hard coal power plants to close over the next seven years, a draft law expected to be approved by the cabinet showed. The plan not to force hard coal plant closures before 2026 risks making Germany’s coal exit more expensive as the government would have to give operators generous financial incentives to shut down facilities voluntarily. The new plan is a reversal for the government, which had stipulated in a previous blueprint that utilities would be forced to deactivate hard coal power plants by 2026 if not enough closures happen voluntarily. The draft law, a key component of Germany’s plan to phase out coal by 2038, will be put for a vote in the Bundestag lower house should the cabinet approve it.

Source: Reuters

Chinese coal traders slow buying over import rules, narrowing spread

7 November. Coal traders in China are holding off purchasing from overseas despite the upcoming heating season, as spreads between domestic and seaborne coal prices narrow and import rules tighten at Chinese customs. Chinese seaborne coal imports fell 18 percent in October month-on-month to 20.65 million tonnes (mt), and around 13.76 mt are scheduled to arrive in November, vessel tracking and port data compiled by Refinitiv showed. Traders and analysts expect coal imports will slow further in coming weeks, even though total coal imports for the year are set to reach a record high. China severely limited coal imports in the final two months of last year by halting shipment clearances, curtailing imports of the fuel by 54 percent in December.

Source: The Economic Times

Russian state banks VEB and VTB lend $532 mn for coal terminal project

7 November. Russian state development bank VEB said it and VTB bank would provide financing worth 34 bn roubles ($532.4 mn) for the construction of a coal loading terminal in Vanino port in Russia’s Far East. VEB said the terminal’s initial capacity was expected to be 12 million tonnes (mt) of coal per year, while loading operations were scheduled to begin in 2020. Its total annual capacity was seen rising to 24 mt.

Source: Reuters

INTERNATIONAL: POWER

British power capacity market a boon for Germany’s Uniper

12 November. Germany’s Uniper lifted its full-year earnings outlook, seeing itself a beneficiary of the revival of the British power capacity market programme. The British government gave the go-ahead to reinstate the power capacity market scheme after the European Commission approved it, compensating providers for making output capacity available regardless of whether electricity is delivered. Uniper, which opposes a takeover bid by Finnish state-owned company Fortum, said it was now targeting €750 mn ($827 mn) to €950 mn in 2019 adjusted earnings before interest and tax (EBIT), up from the 550-850 mn it previously predicted.

Source: Reuters

European power prices set to jump 30 percent by 2025: S&P Global

8 November. European wholesale electricity prices could soar by around 30 percent by 2025 due to a recovery in gas and carbon emissions prices and the planned phase out of some coal and nuclear power generation units, S&P Global rating said in a report. S&P said the supply gap would likely be filled by the rise in renewable solar capacity in Europe which could increase to 43 percent of the electricity mix from 23 percent in 2018. S&P said wholesale power prices are set fall in 2020 compared with 2019 but will rise across all markets until 2023 due to a combination of increased fuel and carbon emissions permit prices, and the “large-scale” power plant closures.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

French’s EDF halts Cruas nuclear reactors for tests after earthquake

12 November. French utility EDF said had temporarily stopped operating reactors 2, 3 and 4 of its Cruas nuclear plant in the Ardeche region, to carry out additional checks after the area was hit by an earthquake earlier in the day. Reactor 1 of the Cruas plant had already been shut down for scheduled maintenance. EDF said that reactors would be restarted after the checks have been completed and approved by French nuclear safety authority ASN. Halting the reactors removed around 2,700 MW of French power generation capacity. The Cruas reactors have a capacity of around 900 MW each. Reactor number 1 has been offline since 7 September for planned maintenance and it is expected to restart on 1 December.

Source: Reuters

Italian aerospace group Leonardo invests in solar-powered drones

12 November. Italian defense and aerospace group Leonardo has invested in a company developing solar-powered drones potentially capable of unlimited flight with no refueling, it said. The drone, which is expected to begin autonomous flights next year and go into production in 2021, can operate from existing airbases around the world and remain airborne for much longer than current aircraft.

Source: Reuters

Iran starts key step in building second nuclear power plant

10 November. Iran started pouring concrete at its second nuclear power plant, a key step in building the facility with Russian help in the southern port of Bushehr. The United States plans to allow Russian, Chinese and European companies to continue work at Iranian nuclear facilities to make it harder for Iran to develop a nuclear weapon.

Source: Reuters

Singapore pushes shipping industry to use cleaner fuels to reduce carbon emissions

8 November. Singapore is pushing the shipping industry to use cleaner fuels such as liquefied natural gas (LNG) in a bid to reduce the city state’s carbon emissions, the Maritime and Port Authority (MPA) chief executive officer (CEO) Quah Ley Hoon said. The country is introducing incentives for ships to install engines that use alternative fuels with lower carbon content such as LNG, and to use LNG bunker during port stay, CEO said.

Source: Reuters

Some leading Polish companies back climate neutrality goal

6 November. Over 20 Polish companies, private and state-run, have backed the European Union (EU) proposal for the bloc to achieve net-zero emissions by 2050 at a time when the country’s pro-coal government is reluctant to support the ambitious plan. Poland, which generates 80 percent of its electricity from polluting coal, in June led a handful of eastern EU states in blocking a push by France and most others to commit the bloc to net zero emissions by mid-century.

Source: Reuters

In boost to climate policy, EU makes first move to end fossil fuel funding

6 November. A preliminary text agreed by EU (European Union) member states calls on the European Investment Bank to stop funding fossil fuel projects, in what would be a breakthrough in the bloc’s climate policy and a blow to the coal, gas and oil industries. The text for the first time calls on the European Investment Bank (EIB), a multilateral development bank (MDB) and the bloc’s top lender, to bring to an end its multi-billion-euro funding of fossil fuel projects in a bid to reduce carbon emissions.

Source: Reuters

DATA INSIGHT

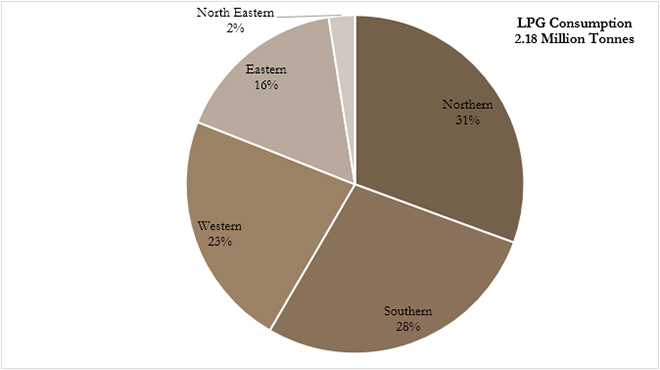

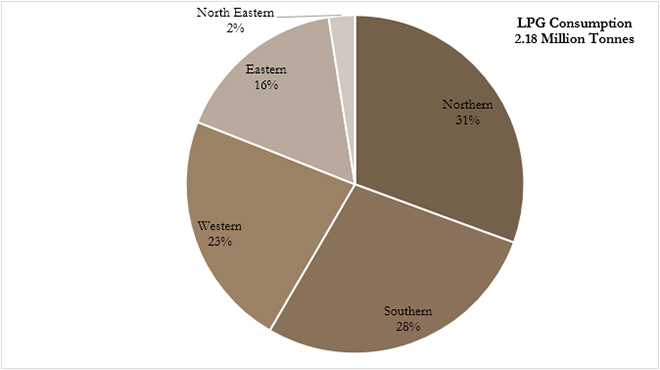

Consumption Scenario of Liquefied Petroleum Gas

| |

Cumulative consumption growth (%) for periods |

| April-September 2018 |

April-September 2019 |

| LPG Packed Domestic |

7.4 |

4 |

| LPG Packed Non Domestic |

14.5 |

10.5 |

| Bulk LPG |

-9.5 |

-16.5 |

| Auto LPG |

-0.9 |

-5.8 |

| Total LPG |

7.2 |

4.1 |

Region-wise Share of LPG Consumption for September 2019

Source: Petroleum Planning & Analysis Cell

Source: Petroleum Planning & Analysis Cell

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Petroleum Planning & Analysis Cell

Source: Petroleum Planning & Analysis Cell PREV

PREV