According to the Ministry of Power’s “Vision 2024” document, the power demand in India is expected to grow in the foreseeable future, and the supply will struggle to keep pace with it. This piece traces the recent developments in the energy sector in the form of a detailed commentary.

PEAK SHORTAGE IS CONSIGNED TO HISTORY

Monthly Power News Commentary: July - August 2019

India

During the Q1 of the FY 2019-20, India’s power supply increased slightly with the power deficit declining to 0.4 percent from the 0.6 percent recorded during the Q1 of FY 2018-19, according to the data provided by the CEA. During the period between April -June 2019, around 347,771 mn kWh of electricity were supplied against a demand of 346,208 mn kWh. This was a decrease of 1,563 mn kWh over the targeted energy requirement. During the same period, against a peak demand of 183,673 MW of electricity, 182,533 MW was supplied. This was 1,140 MW fewer than the required supply to meet the peak demand, resulting in a peak power supply deficit of 0.6 percent. According to the CEA report, power generation in India grew by 6.23 percent in Q1 of FY 2018-19. Power generation in the northeastern region grew by 14.5 percent, in the western region by 8.74 percent, in the northern region by 8.22 percent, and in the eastern region by 4.13 percent. The southern region witnessed a negative growth of 0.7 percent, compared to Q1 of FY 2018-19. Meanwhile, the power imported from Bhutan has been increased by 9.83 percent. During the first quarter of FY 2019-20, the northeastern region faced the highest power supply deficit of 5.4 percent, followed by the northern region at 1.1 percent and the eastern region at 0.2 percent. The southern and western regions recorded zero power supply deficit in the country. In terms of peak power supply deficit, the northeastern region led with 2.1 percent followed by the northern region at 1.7 percent, and the southern region at 0.2 percent. The western and eastern region witnessed zero power deficit during the same period. According to the Ministry of Power’s “Vision 2024” document, the power demand in India is expected to grow in the foreseeable future, and the supply will struggle to keep pace with it.

Average spot power price dipped 2 percent to ₹3.38/kWh in July at the IEX as compared with ₹3.46/kWh a year ago. Low price coupled with greater certainty and predictability in procurement continue to make compelling proposition for the power discoms as well as open access consumers to step up their procurement through the IEX, the company said. The company said that the day-ahead market alone saw an increase of 19 percent y-o-y in volumes, while the term-ahead market, which is leveraged by the discoms to manage demand-supply variability close especially in the scenario of high renewable energy concentration in the grid, increased 290 percent on the yearly basis. On an all-India basis, peak demand met touched 175 GW registering a four percent increase on a y-o-y basis, while all-India energy supply stood at 117 bn kWh increased 6 percent y-o-y, according to data from the National Load Dispatch Centre. The overall electricity market at the IEX recorded a 27 percent increase on a y-o-y basis and a 15 percent increase on a month-on-month basis in July 2019. The increase in volume corroborated well with increase in demand for electricity in the select eastern, western and southern states. The discoms across these states preferred the day-ahead and the term-ahead electricity market on exchange to leverage the competitive price discovery, coupled with the benefit of flexible and predictable procurement since 'One Nation and One Price' prevailed on all 31 days during the month of July, the company said.

Power prices at IEX rose ₹1.16/kWh or almost 50 percent, during the last five days on the back of a near 60 percent rise in demand propelled by increased buy bids from South India. Some states have been asked to supply power 24x7 leading to increased buying from the exchange. Power prices during the 9 pm – 10 pm slot was highest at ₹7.45/kWh as demand outstripped supply by almost 25 percent for the slot. Average market price was ₹2.41/kWh which inched up to ₹3.57/kWh. Demand for power was 119.57 mn kWh which shot up to 190.23 mn units. According to IEX, demand from states like Andhra Pradesh, Kerala, Telengana and Tamil Nadu has resulted in the surge in prices. Tamil Nadu registered the highest demand among southern states.

IEX witnessed a 30 percent rise in power demand as compared to 15 July. Average price for deliveries was settled at ₹3.81/kWh, 6.73 percent more than previous average price. According to IEX data, demand for power was 214 mn kWh while total sell offer stood at 230.35 mn kWh, 6.18 percent less than on previous. Maximum price settled for the day was ₹7.17/kWh, 14 percent less than 15 July. Demand for power continued to rise and remained more than supplies between 7 pm and 12 midnight during the day.

The power ministry is considering a proposal to allow all gencos flexibility to supply electricity from any plant in their stable, a move that will reduce cost of power for discoms and ease pressure to raise consumer tariffs. The ministry’s line of thinking has been encouraged by fuel cost reduction of over ₹3 bn since April due to such flexibility allowed to 49 coal-fired power stations of NTPC Ltd, aggregating 56 GW capacity and about 1 bn kWh per day of generation. Called Security Constraint Economic Despatch in government parlance, the norm allows gencos to raise capacity utilisation of more efficient plants in their stable or units that are closer to coal mines and have lower freight cost — both of which have a bearing on cost of power. Higher capacity utilisation improves ratings of power plants, while discoms save on cost of power purchase.

The power ministry introduced mechanism 'Trust Retention Account' for certain stressed power plants to utilise their surplus after meeting operating expense, for servicing debt in the first place. In case the developers using coal linkage of amended SHAKTI policy, a TRA must be put in place, if it is not there already, a power ministry order said. According to the order, all the revenues generated shall be deposited to the TRA. The high-level committee on stressed power projects in its report had suggested in November last year that the net surplus after meeting operating expenses generated shall be used for servicing debt in the first place. The recommendations were implemented in earlier in March this year.

The dues to be paid discoms in India to generators stand at a monthly average of ₹210 bn and large firms including GMR Energy and CLP India top the list of developers facing the highest level of financial stress as a result of these mammoth receivables, according to the latest analysis by CRISIL. The analysis is based on data on 18 generators -- 6 central and 12 private -- with a total conventional capacity of 115 GW tied up with state discoms across the country. NTPC, which has 54 GW of operational power-generation capacity, has the largest share in overdue from discoms. Among private gencos, Adani Power, which operates 10 GW of generation assets and supplies power to different states, has ₹32 bn overdue. The monthly average discom overdue as a share of the annual revenue of gencos stands at 212 percent for GMR Energy, 87 percent for CLP India and 75 percent for JPVL. A parallel analysis of the discom-wise share in overall overdue reveals UP tops the chart accounting for 22 percent of the total dues to generating companies, followed by Tamil Nadu (15 percent), Karnataka (15 percent) and Telangana (9 percent). In order to address the issue of dues, the power ministry has directed all the discoms to open and maintain sufficient LC as a payment-security mechanism under PPAs signed with generation companies. The order, dated 28 June 2019, is to be implemented from August.

The implementation of the order will benefit generators, as the power supplied to discoms is conditional upon the opening of an LC for an amount adequate to cover the entire quantum of power to be supplied. Once an LC is opened, it will be communicated to the load despatch centre, enabling generators to recover any overdue amount by invoking the LC when a discom does not pay on time. Delaying payments to generators has helped discoms manage their working-capital cycles, meet short-term obligations and avoid costly working-capital loans. This extra working-capital cushion, leveraged extensively by discoms, will not be available now, compelling discoms to raise additional funds either through internal accrual or state-government support in the form of grants or bank borrowings to finance operations. Alternatively, discoms will be forced to undertake load-shedding when requisite generation is not available. That move, however, is going to be penalised as the government is likely to announce stringent norms to that effect.

The aim of the Centre is to have "One Nation One Grid" and pay damages to consumers in case of load sheddings. The ministry would seek the Union Cabinet’s nod for the power tariff policy in next few days, which would provide for penalty for unscheduled power cuts except in the case of technical faults or act of God (natural calamities). There would be a provision in the tariff to cap transmission and distribution losses. Once the tariff policy is approved, the distribution companies would not be allowed to pass on these losses beyond 15 percent. The move is part of the government’s efforts to ensure the states fulfil their commitment of 24x7 power supply they gave by signing the ‘Power for All’ document. The penalty will be the second tough measure taken by the ministry in recent times to discipline discoms, after tough norms for timely payments by discoms to power stations. However, industry players have expressed scepticism, saying it will be hard to determine wilful blackouts, most of which will be passed off as technical faults. In addition there is the issue of political interventions that keep household and agricultural tariff low leaving power outages as the only means to manage their finances. This will deflect cause of discom revenue challenge from the politician to the discom. In other words what is essentially a political problem will be recast as a technical or administrative problem.

The government is planning a national-level selection committee for appointing chairpersons and members in all state electricity regulatory commissions to set the bodies free from political intervention, helping them take correct decisions. The selection committee will not have representation from the state for which electricity regulators or members are being appointed. Industry experts have over the years questioned the said independence of power regulatory commissions for not allowing tariff hikes and not taking action against discoms for not filing timely petitions. Regulators have also been creating regulatory assets (deferred tariff hikes) in favour of distribution companies, which are piling up. The ministry of power has recently written to the Appellate Tribunal for Electricity to exercise powers to address the situation at state regulators level. At the same time, the commissions impose unfair charges on industrial consumers to refrain them from purchasing power from sources other than distribution companies.

India’s power sector regulator CERC has proposed new rules aimed at a complete overhaul of the power trading market in the country including changed net-worth criteria and trading margin that can be charged by companies. The existing regulations defining the criteria for grant of trading license were notified in February 2009 while the trading margin norms were notified in 2010. CERC said in the draft regulations that since then, many developments have taken place in the power sector. CERC has proposed raising the minimum net-worth requirement for category-I trading licensees, which account for 81 percent of the total trade, from the existing ₹500 mn to ₹750 mn for a volume of trade between 5,000 mn kWh and 10,000 mn kWh. For trade exceeding 10,000 mn kWh in a year, additional ₹200 mn net-worth would be required for every 3,000 mn kWh. India generates 1,300 bn kWh of electricity annually. Around a 10th of this is traded in the short-term market, through bilateral deals between discoms, trading entities and the two power exchanges – IEX and Power Exchange India -- and DSM. Excluding direct bilateral deals between discoms and DSM, the size of the short-term market was about ₹304.27 bn in 2017-18, the latest year for which data is available.

J&K, Rajasthan and Telangana face blackouts as their distribution companies have either not opened the bank guarantees backing power purchases or put conditions on generators for invoking them. Experts said if implemented in letter and spirit, the Centre's directive to stop power supply without payment guarantee from 1 August will transform the ailing power sector. Interpreting the order differently, Uttar Pradesh has opened bank guarantees in favour of power plants outside the state. Four major plants – Reliance Power’s Rosa, Lalitpur Generation Company, Lanco’s Anpara-C and Prayagraj Power that has been bought over by Resurgent Power – have been left out by the state. Rajasthan and Telangana have opened conditional letters of credit in favour of power plants. In case of non-payment by discoms of these states, the generators can invoke the letters of credit only if they are authorised by the state government. Tamil Nadu discoms have also been selective, while Kerala discoms have some technical issues with certain new plants, which are likely to be resolved in a day or two.

TPDDL has become the first power utility in the country to deploy micro drones for the maintenance of its network. Small-sized drones, weighing less than 2 kg, with a flying capacity of below 200 feet are being used by the discom to patrol 66 and 33 kV transmission lines in north and north west Delhi areas. The drones are equipped with integrated thermal vision camera to render infrared radiations, Light Detection and Ranging capability to measure distances with the use of laser lights, and high resolution camera for electrical asset inspection. The monitoring and mapping of the drones is manoeuvred through their GPS-enabled autopilot system by a ground control station. Drone usage will have wide application in the years to come and reinforce TPDDL’s credentials as a "future ready utility". The drones are being used for maintenance of the discom's power lines, poles and towers. Permission to use such drones has been taken from the Ministry of Home Affairs and police authorities. Besides, they are being used to determine if anyone is encroaching on the power lines along with thermal inspection at grids, TPDDL said. Delhi government announced that consumers consuming up to 200 kWh of electricity won't need to pay their power bills. The Delhi government will give full subsidy to those consuming up to 200 kWh of electricity. Those consuming 201 to 401 kWh of electricity will continue to get 50 percent power subsidy from the government.

The UP government plans to invest ₹200 bn in five years for improving power transmission, seeking to provide uninterrupted electricity to industries as it aims to become a $1 tn economy. It's estimated that the peak hour energy demand in the state will increase by more than 35 percent from 22,000 MW at present to nearly 30,000 MW by 2024. In 2016, the peak hour power demand was only 16,500 MW. The policy of electrifying all households in the urban and rural areas, coupled with incremental demand is pushing up the power consumption in the state. The government has increased power transmission capacity 60 percent from 15,000 MVA in 2017 to the current level of 24,000 MVA. The plant load factor of state run power generation units have jumped 13.8 percent to 78.83 percent over the last 2 years. By 2021, prepaid and smart electricity meters are to be installed at premises of all rural and urban power consumers respectively. Over the past 2 years, nearly 11 mn households in UP were provided with power supply under the central Saubhagya scheme, while more than 178,000 hamlets were electrified. The UP government said it will implement a mechanism whereby electricity bills of ₹20,000 or more will be sent to consumers having a power connection of 2 kW or less only after verification. This will give relief to consumers, who wrongly get a heavy pending electricity bill. Consumers can dial 1912 helpline number and register their grievances pertaining to their electricity bills.

Assam is heavily dependent on power procured from external agencies to meet its demand as it has very limited power generation capacity of its own. The power demand during the peak hour (1700 hours to 2200 hours) is about 1,850 MW, against which the Assam Power Generation Corp Ltd produces 260 MW on its own. Assam Power Distribution Company Ltd, in a bid to meet the electricity demand, procures about 1,200 MW power from the Central quota, 4 MW from private sectors and nearly 650 MW from Energy Exchange. In 2018-19, the government earned ₹1.69 bn as monthly bill from domestic electricity consumers, ₹810.6 mn from commercial consumers and ₹1.71 bn from other consumers.

The ADB would provide ₹15.4 bn for upgradation of power generation, transmission and distribution projects in Tripura. ADB would provide 80 percent of the ₹19.25 bn ($275 mn) Tripura power generation upgradation and distribution reliability improvement projects. The rest (₹3.85 bn) would be contributed by the state government. Under the ADB-funded projects, electricity generation at the Rokhia gas-based power plant in western Tripura would be increased from 63 MW to 120 MW at an estimated cost of ₹7 bn. In June, the ADB had agreed to provide financial assistance for the ₹16.5 bn ($235 mn) infrastructure development projects in seven of the eight district headquarters of Tripura. Meanwhile, the government-owned PGCIL is implementing the ₹13.72 bn World Bank-funded projects for development of power infrastructure in the state. Tripura, a power surplus state, is supplying 190 MW to Bangladesh and 40 MW to Nepal.

A high-level meeting of KSEB decided against imposing power cuts or load shedding till 31 August at least. There has been substantial dip in the anticipated inflow of water to reservoirs in the months of June and July. The extraordinarily weak monsoon in early monsoon months and its spiteful impact on the hydel power generation in the state, the KSEB is unlikely to declare power cut or load shedding till 31 August. The board currently generates only 10 to 12 mn kWh of power on a daily basis from hydel power stations within the state. Under the present circumstances, the board would be able to maintain this power generating ratio till 31 August, provided a set of other conditions too remain favourable.

The Madhya Pradesh government has objected to a decision of the NCA to halt production of electricity at the SSP-RBPH. NCA consented to Gujarat’s request in April this year to halt power generation at the SSP-RBPH so that the reservoir could be filled to capacity this monsoon. Operating the river bed power house at the dam site requires release of water in downstream areas of the reservoir. The Madhya Pradesh Power Management Company Ltd will incur a loss of ₹2.29 bn because of the proposal to halt power generation at the dam site.

The Maharashtra government has decided to set up two new 660 MW units in Koradi even though the district already has five power plants having total installed capacity of 7,230 MW of which 6,450 MW is operational. The need for new thermal units is itself questionable given the massive solar capacity addition being done. According to MSEDCL the new units are coming up as old units would be decommissioned in the coming years. MAHAGENCO has stated that the two 660 MW units are replacement of four old decommissioned 120 MW units and a 210 MW unit. MAHAGENCO had earlier planned to set up two 800 MW in Umred but could not acquire land. The decision is also questionable as several private power plants are lying idle in the state. Instead of going in for new units, MAHAGENCO can simply restarted these plants. A 1,350 MW power plant belonging to RattanIndia is lying idle in Sinnar in Nashik district. Power Finance Corp had urged MAHAGENCO to buy it but the request was turned down. Nashik district has only one power plant belonging to MAHAGENCO and the second power plant would have distributed the pollution load. The power plants are concentrated only in Nagpur and Chandrapur districts.

Implying anomalies in certain deals, the Government of Andhra Pradesh has decided to review the PPAs entered into during the five-year tenure of past government. During the past five years, PPAs were entered in wind and solar energy sectors at very high prices for 25 years though it was not common practice across the country. Only five companies were said to be responsible for 70 percent of PPAs.

Rest of the World

Spot power prices in Texas almost tripled on forecasts demand for electricity would hit record levels as consumers crank up their air conditioners to escape a heat wave blanketing much of the state. The ERCOT, the grid operator for much of the state, forecast that heat would push peak demand to more than 73,600 MW on 8 August and over 75,300 MW on 12 August. That would top the current all-time high of 73,473 MW on 19 July 2018. ERCOT has said it expects to have about 78,154 MW of generating capacity to meet demand this summer, but warned there was an increased chance low reserves would force it to issue more alerts calling on customers to conserve energy this summer than last year. When ERCOT declares an alert, it can take advantage of additional resources that are only available during scarcity conditions, including power imports from neighbouring regions and demand response programs that pay consumers to curtail power use when needed.

Brazil’s state-controlled oil company Petrobras, is studying the creation of a subsidiary comprised of around 15 power plants, which could then be sold through an initial public offering, analysts at XP Investimentos said. Petrobras operates 20 power plants with 6,000 MW in total capacity. Brazilian energy company EMAE is seeking partners for a $1.7 bn thermoelectric power project due to be tendered in an upcoming government auction. The company, owned by the state of Sao Paulo, is in talks with potential investors for the 1.7 GW capacity natural gas project, and the so-called Piratininga Thermal Block I project has already obtained environmental permits from state licensing agencies.

Indonesia’s state power company PLN was instructed to have had plans in place to prevent a major electricity blackout that affected 21 mn customers in Jakarta and neighbouring provinces. In the wake of the biggest power outage in 14 years, the government demanded to know why the utility PLN did not have a back-up plan given its history of blackouts. Jakarta, the center of government and business in Indonesia, suffers periodic blackouts that are usually short-lived and confined to certain areas. Power failed after faulty transmission circuits triggered “cascading voltage” that disconnected power plants supplying electricity to the west part of Java island, which includes the capital, PLN said. The outage, the biggest since a transmission failure cut power in Java and Bali in 2005, halted Jakarta’s subway system and commuter train lines, stranding passengers. PLN said a number of power plants had been restarted and 23 substations were operating. PLN said that overgrown trees had made contact with a high-voltage power line and started a fire that triggered the transmission failure.

The Federal government of Nigeria has signed an implementation agreement for the Nigeria Electrification Roadmap, a partnership between governments of Nigeria and Germany and Siemens AG, to upgrade Nigeria’s power transmission and distribution infrastructure. The agreement states that Siemens, Transmission Company of Nigeria and the regulator will work hand in hand to achieve 7,000 MW and 11,000 MW of reliable power supply by 2021 and 2023 in the first and second phases of the deal, respectively. By 2025 when the contract will lapse, a total of 25,000 MW is expected to have been met. Through the agreement, Siemens is expected to help Nigeria achieve 11,000 MW of reliable power supply by 2023, in two phases. After these transmission and distribution system bottlenecks have been fixed, Nigeria will seek in the third and final phase to drive generation capacity and overall grid capacity to 25,000 MW.

Uganda’s power producer Bujagali Energy Ltd, in which Jubilee Holdings has a 25 percent stake, last year took new loans worth $500 mn (Sh51.5 bn) to extend the maturity of debt and lower its finance costs. The debt refinancing was disclosed by the IFC which provided $100 mn (Sh10.3 bn) as its share of the new debt pool. The IFC said it contributed the sum to the refinancing for its own account, out of an about $500 mn total package. The new debt investment is not expected to result in any change to the physical or operational footprint of the hydropower plant or its electricity transmission arrangements, IFC said. Bujagali has an installed capacity of 250 MW and supplies nearly half of Uganda’s effective energy capacity. Bujagali is an independent power producer, which sells electricity to Uganda Electricity Transmission Company Ltd under a 30-year power purchase agreement signed on 6 December 2007.

Greece unveiled a plan to overhaul loss-making state-controlled PPC to shore up its finances, including voluntary redundancies and selling shares in its distribution network. PPC, which is 51 percent owned by the state, has been struggling to collect part of more than €2.4 bn ($2.7 bn) of arrears from bills left unpaid during the country’s debt crisis, which began in late 2009. Under a post-bailout agreement between Greece and its lenders, PPC sells power at below-cost prices to alternative producers to help open up the market, a measure which has also weighed on the utility’s profit. The new government also plans to proceed with the partial privatisation of PPC’s low-voltage distribution network and implement a targeted voluntary redundancy scheme. In a bid to boost its liquidity, PPC will also double its efforts to collect as much as it can out of the €800 mn ($897.36 mn) in arrears from habitual defaulters.

| FY: Financial Year, CEA: Central Electricity Authority, Q1: first quarter, mn: million, bn: billion, tn: trillion, mt: million tonnes, kWh: kilowatt hour, IEX: Indian Energy Exchange, y-o-y: year-on-year, discoms: distribution companies, gencos: generating companies, TRA: Trust Retention Account, GW: gigawatt, UP: Uttar Pradesh, LC: letters of credit, PPAs: power purchase agreements, CERC: Central Electricity Regulatory Commission, DSM: deviation settlement mechanism, J&K: Jammu and Kashmir, TPDDL: Tata Power Delhi Distribution Ltd, kg: kilogram, kV: kilovolt, GPS: Global Positioning System, MW: megawatt, MVA: megavolt-ampere, kW: kilowatt, ADB: Asian Development Bank, PGCIL: Power Grid Corp of India Ltd, KSEB: Kerala State Electricity Board, NCA: Narmada Control Authority, SSP-RBPH: River Bed Power House of the Sardar Sarovar Project, MSEDCL: Maharashtra State Electricity Distribution Company Ltd, MAHAGENCO: Maharashtra State Power Generation Company, ERCOT: Electric Reliability Council of Texas, Petrobras: Petroleo Brasileiro SA, EMAE: Empresa Metropolitana de Águas e Energia, PLN: Perusahaan Listrik Negara, IFC: International Finance Corp, PPC: Public Power Corp |

NATIONAL: OIL

BPCL to set up two mega projects in Bokaro

12 August. Jharkhand Chief Minister Raghubar Das and Oil Minister Dharmendra Pradhan laid the foundation stones of Bharat Petroleum Corp Ltd (BPCL)’s two projects. BPCL will set up a LPG (liquefied petroleum gas) bottling plant and POL (petroleum, oil and lubricants) terminal. The petrol consumption in Jharkhand had increased 61 percent, signifying growing prosperity, Pradhan said. The state government has allotted 20 acres of land to BPCL in Bokaro Industrial Estate for the project. The POL project, which will come up at Radhanagar, is expected to complete in 2021-22.

Source: The Economic Times

RIL to produce only jet fuel, petrochemicals at Jamnagar after oil-to-chemical strategy

11 August. Reliance Industries Ltd (RIL) plans to produce only jet fuel and petrochemicals at its mega Jamnagar refinery complex as it implements an oil-to-chemical strategy that will eliminate most fuels it produces in favour of high value products. The company is preparing its Jamnagar complex, the world's largest refinery at a single location , to be future ready as fuel demand undergoes change with advent of electric vehicles. Its refineries currently convert crude oil, sourced from around the globe, into petrol, diesel, LPG, aviation turbine fuel (ATF), LPG (liquefied petroleum gas), naphta and other value added fuels. Some of these products are used to produce petrochemicals used for making plastics and other products. Now, it is implementing a strategy that will convert the crude oil only into petrochemicals and ATF used in aeroplanes. The fundamentals of the Jamnagar oil-to-chemical strategy are to employ advanced molecule management to upgrade the refinery intermediate streams by value. India already has an oil refining capacity that is in excess of fuel demand. RIL said the objectives of this plan was to preserve as well as upgrade existing refinery margins, while maximising asset utilisation for a sustainable competitive cost of chemicals.

Source: The Economic Times

Adani, Haldia and Accord submit bids to revive Nagarjuna Oil Corp

7 August. The bankrupt Nagarjuna Oil Corp (NOCL), which is under liquidation process after failing to find out a successful resolution plan, has received bids from three firms — Adani Ports and Special Economic Zone, Haldia Petrochemical and Accord Distillers and Brewers — to revive the company. NOCL, which is setting up a 6 million tonnes per annum (mtpa) petroleum and oil refinery project in Cuddalore in Tamil Nadu, had been ordered to undergo liquidation process after the company failed to get a successful resolution plan in the Corporate Insolvency Resolution Process. Subsequently, in December 2018, the National Company Law Tribunal, Chennai, ordered liquidation of the company, which is an associate of Nagarjuna Oil Refinery.

Source: The Financial Express

HPCL to shut some secondary units at refineries to upgrade for Euro-VI fuel

7 August. Hindustan Petroleum Corp Ltd (HPCL) plans to shut some secondary units at its Mumbai and Vizag refineries in the current fiscal year in order to be able sell Euro-VI compliant fuel from April, its chairman M K Surana said. The refiner plans to shut units that improve gasoline specs and a diesel hydro desulphuriser at its 166,000 barrels per day (bpd) Vizag refinery in southern India from early September to the end of October for upgrades, he said. HPCL plans to shut a gasoline deslphuriser at its 150,000 bpd Mumbai refinery in the western state of Maharashtra for 15-20 days in December, he said. The refiner had shut a 70,000 bpd crude unit at the Mumbai refinery in April for 23 days, he said, adding the company has no further plans to shut crude units at its two refineries in 2019/20.

Source: Business Standard

NATIONAL: GAS

Government planning for a wave of reforms in the natural gas sector

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Reforms in the natural gas sector will boost prospects for gas demand!

< style="color: #ffffff">Good! |

13 August. The government is planning to introduce a wave of reforms in the natural gas sector, aimed at local discovery of prices and development of a national gas market. The oil ministry has prepared a Cabinet note that proposes snapping the power sector’s priority access to cheap local gas, setting up a gas trading platform to encourage market-discovery of prices, and hive off GAIL (India) Ltd’s transportation unit to enhance third-party access to its pipelines. At present, India produces just half of the gas it consumes, a government set formula determines rates for most local gas, and the absence of market price deters producers from investing in the country. By allowing marketing freedom to gas from new discoveries, the government has tried to address much of the investors’ concerns in recent years but officials think developing a free market was essential to sustained investment in the sector. Which is why the government wants to build a gas trading platform that can facilitate market discovery of prices. A gas exchange will enhance trade transparency, boost consumer confidence, and increase market opportunities for suppliers. The oil ministry has, therefore, proposed to knock off the power sector, the biggest consumer of local gas, from the so-called priority list. It has proposed limiting the allocation to city gas (CNG vehicles and households) and the fertiliser sector. The power sector consumes about 31 percent of the local gas while the fertiliser and city gas sectors consume 24 percent and 22 percent, respectively.

Source: The Economic Times

RIL, BP joint venture to invest ₹350 bn in KG basin

12 August. Reliance Industries Ltd (RIL) and BP Plc will together invest ₹350 bn for bringing to production three sets of natural gas fields in the Krishna-Godavari (KG) basin block in the Bay of Bengal, Chairman and Managing Director Mukesh Ambani said. The three projects will help reverse the falling gas output from what was once the biggest gas-producing block in the country. In July, the two partners had announced investment sanction for development of their deepest natural gas discovery in the KG-D6 block. With world-class deep-water infrastructure in the east coast of India, the joint venture is uniquely positioned to monetise over 3 trillion cubic feet (tcf) of discovered resources in the KG D6 block, he said adding the projects to develop these gas-fields are among the most complex being executed anywhere in the world. He said the natural gas business will soon regain its pride of place in RIL’s value-creation strategy. With RIL de-emphasising its shale gas business in the United States, the company is currently focused only on India.

Source: The Economic Times

GSPL pipeline plan gets boost from J&K move

9 August. Gujarat State Petronet Ltd (GSPL)’s (GSPL) ambitious project of developing a natural gas pipeline project from Mehsana all the way up to Jammu and Kashmir (J&K) is expected to get a major boost with revocation of special status to J&K under Article 370. The project is divided in two phases. Work on first phase connecting Gujarat and Punjab has been on. The second phase, covering J&K, has been stuck for a long time. Also, the Central government’s plans for industrial development in J&K will create a market for the clean fuel option. The J&K Gas Pipeline Act, 2014 with provisions of Right of User (RoU) needed amendments that got stuck with the state government for a long time. The Centre’s decision to do away with the special status for J&K paves way for the project as it will now fall under the Union government’s Petroleum and Minerals Pipeline (P&MP) Act, 1962. The construction work for first phase to build a 1,670 km gas pipeline from Mehsana to Bhatinda will begin in a month’s time. The first phase will be commissioned in 2020 following which construction for the second phase will begin.

Source: The Economic Times

Lower spot LNG may push India's top gas importer to renegotiate deals

8 August. India’s top gas importer Petronet LNG will consider renogiating its long-term supply deals to secure lower liquefied natural gas (LNG) prices if spot prices remain weak for two to three years. An inexorable decline in spot market prices for LNG is driving some buyers in Japan and China to request delays in term cargoes, while others are looking to lift lower volumes under their term contracts from LNG sellers. Petronet has a deal to buy 7.5 million tonnes (mt) of LNG annually from Qatar’s Rasgas and 1.44 mt from Exxon’s Gorgon project in Australia. The Indian company is buying gas under these deals at $8.25-$9.50 per million metric British thermal units (mmBtu), while spot LNG LNG-AS prices are around $4 per mmBtu. India wants to raise the share of gas in its energy mix to 15 percent in next few years from 6.5 percent currently.

Source: Reuters

Gas firms to set up 340 CNG outlets in 2 yrs

8 August. Even as the government pushes the idea of electric vehicles (EVs) by doling out tax incentives, city gas distribution (CGD) companies are embarking on their most ambitious network expansion plan ever and reaching out to customers. Publicly traded CGD entities—including Indraprastha Gas Ltd (IGL), Mahanagar Gas Ltd (MGL), and Gujarat Gas Ltd (GGL)—will set up nearly 340 compressed natural gas (CNG) stations across their geographical areas in the next two years. Among these companies, Delhi-based IGL will add 100 CNG stations taking its tally to over 600 CNG stations. The company is spending ₹6 bn on setting up the 100 CNG stations. While Gujarat-based GGL will set up 200 CNG outlets over two years, Mumbai-based Mahanagar Gas Ltd will add 40 CNG stations over the same period to its existing network of network of 240 CNG stations.

Source: Livemint

GAIL offers US LNG cargoes for October-December

8 August. GAIL (India) Ltd has offered three cargoes of liquefied natural gas (LNG) for loading from the Cove Point terminal in the United States (US). The cargoes are offered for loading over October, November and December. The tender closes on 8 August. The Indian importer has 20-year deals to buy 5.8 million tonnes (mt) a year of US LNG, split between Dominion Energy’s Cove Point plant and Cheniere Energy’s Sabine Pass site.

Source: Reuters

ONGC displays gas potential of Khubal to prospective customers in Tripura

7 August. ONGC (Oil and Natural Gas Corp) Tripura Asset, in association with department of Industry and Commerce, Government of Tripura, organized an awareness campaign workshop on ‘Khubal’ Gas at the International Trade Fair Centre of Hapania, Agartala. The workshop received several queries from the prospective customers from small and medium scale industries. ONGC has struck gas at Khubal field (NELP Block) in Panisagar area near Dharmanagar, North Tripura district.

Source: The Economic Times

NATIONAL: COAL

Government index to show revenue of coal block operators

13 August. The government will use its own coal price index to calculate revenue earned by operators of coal black to ascertain its share of income from 27 blocks being auctioned to the non-regulated sector. The decision will rule out potential disputes over possible under-reporting of revenues by operators, which, the government feels, cannot be audited regularly. Payments by operators are likely to be made on monthly basis and the government has released that keeping a tab on the price/revenue may not be feasible on a regular basis. Winners of the current auction will be selected on the basis of the highest share of revenue offered to the government. In order to reflect market price, the index will be weighted average price for coal available from different sources including Coal India Ltd (CIL)’s notified prices, winning prices under forward, special & spot e-auction for different subsidiaries, international coal prices and prices of coal sold by private and public sector entities.

Source: The Economic Times

Centre relaxes timelines, sweetens deal in coal auctions

< style="color: #ffffff">Quick Comment

< style="color: #ffffff">Coal auctions not likely to take off with extended timelines and sweetened deals as long as MDO route provides risk free returns!

< style="color: #ffffff">Ugly! |

7 August. The coal ministry has relaxed timelines and ironed out policy issues hoping to get a better response to the latest round of coal mine auctions. The Centre will be auctioning 27 coal mines and allocating 15 mines to developers. The old mines are those that have been put up for auction in earlier rounds. It also includes mines like Tokisud North that were bid out and then relinquished by the winner.

Source: The Hindu Business L ine

NATIONAL: POWER

KSEB to ensure power to homes of the poor

13 August. In a bid to reach out to the flood-hit people who are economically weak, Kerala State Electricity Board (KSEB) would make arrangements for a temporary wiring at the houses where power can be restored because of damage in house wiring. Field-level officers of the board have been asked to ensure that at least one electrical bulb would gleam at the flood-hit homes of the economically weak consumers once they start flocking back home.

Source: The Economic Times

EESL successfully installs and operationalises over 5 lakh smart meters across India

13 August. Energy Efficiency Services Ltd (EESL) has successfully installed over 5 lakh smart meters in Uttar Pradesh, Delhi, Haryana, Bihar and Andhra Pradesh, under Smart Meter National Programme (SMNP). The meters will enhance consumer convenience and rationalise power consumption. Smart meters are part of the overall advanced metering infrastructure solution (AMI) that measures and records consumers’ electricity usage at different times of the day and sends this information to the energy supplier through GPRS technology. It offers consumers better access to information and enables them to make more informed decisions on the use of power at their homes. It can immediately control AT&C (Aggregate Technical and Commercial) losses, due to power pilferage, bypassing meters, defective meters, or errors in meter reading. Every kilowatt of power drawn from the grid is thus accounted for – and billed, thereby boosting distribution company (discom) revenues. A public sector enterprises under the power ministry, EESL’s model – Pay-as-you-save (PAYS) has been the base of implementation. EESL procures smart meters including servicing, enabling discom’s to benefit with zero upfront investment. Smart meter technology is critical to India’s ongoing power sector reforms. The Smart Meter National Programme aims to retrofit 25 crore conventional meters with smart variants leading to 80-100 percent improvement in billing efficiency.

Source: The Economic Times

Gujarat distribution company seeks to stop high Adani tariff

12 August. Gujarat Urja Vikas Nigam Ltd (GUVNL) has approached the electricity regulator to withdraw support of higher tariff to Adani Power’s imported coal-based Mundra power plant, alleging breach of terms of the relief package. The power distribution utility of Gujarat has also sought refund with interest of excess power tariff paid to Adani Power due to fuel cost pass through. In its petition to the Central Electricity Regulatory Commission (CERC), GUVNL has prayed to recall the commission’s order passed on 12 April, granting approval to Mundra Thermal Power Station passing on the burden of imported coal costs to the consumer. CERC had approved the higher tariff by making provisions through new ‘supplementary agreements’ to the original power purchase agreements between Adani Power Mundra and GUVNL. Adani Power’s Mundra plant had signed two power purchase agreements (PPAs) of 2,000 MW with the Gujarat government in February 2007.

Source: The Economic Times

Average spot power price likely to be ₹3.40 per unit in August

11 August. Average spot power price is likely to be around ₹3.40 per unit in August on account of higher supplies especially from hydro and wind energy segments. During the monsoon season, power load of air conditioners and agriculture (for irrigation) comes down and it results in lower demand for power across the country. On pan-India basis, peak demand met touched 175 GW -- registering a 4 percent increase on y-o-y (year on year) basis, while all-India energy supply stood at 117 bn units -- rising 6 percent y-o-y, as per National Load Dispatch Centre data. The average power price had dropped by 2 percent to ₹3.38 per unit in July at the Indian Energy Exchange (IEX) as compared with ₹3.46 per unit in same month a year ago. In the day ahead market on IEX, the average market clearing price on 10 August, for supply on 11 August, was ₹2.69 per unit. The maximum market clearing price (spot power price) was ₹4.87 per unit on 10 August, for supply on 11 August at IEX. Similarly the minimum spot power price was 1.8 per unit.

Source: The Economic Times

Over 80 percent of mini-grid users in India satisfied with their connections

10 August. Over 80 percent of mini-grid household users in India are satisfied with their connections, despite affordability challenges, according to a report on electricity access and consumer demand by Smart Power India (SPI). The report is based on primary data collected from over 10,000 rural households and 2,000 rural enterprises across four states – Bihar, Uttar Pradesh, Odisha and Rajasthan. The data from the report ‘Rural Electrification In India - Customer Behaviour And Demand’ by SPI -- a subsidiary of the Rockefeller Foundation in collaboration with the Initiative for Sustainable Energy Policy -- also showed that 90 percent of enterprise users in these villages claimed to be satisfied with mini-grids. According to the report, grid-electrification coverage and adoption was high among rural households. In the study area, only 65 percent of enterprises had grid-electricity connections.

Source: The Economic Times

Adani Electricity to invest ₹12 bn in Mumbai distribution business

10 August. Adani Electricity, a subsidiary of Adani Transmission, will invest ₹12 bn in its Mumbai distribution business during the current financial year (FY20). The investment is expected to help make up for the lack of capacity addition in the previous years of the distribution asset. Adani Group acquired the Mumbai distribution business from Reliance Infrastructure in August last year. The firm now wants to invest in expanding transmission network for the distribution business.

Source: Business Standard

UPPCL curtails power supply to tube wells by 8 hours

9 August. The Uttar Pradesh Power Corp Ltd (UPPCL) has decided to reduce power supply to tube wells from 18 hours to 10 hours, drawing ire of the consumers' body. The development in the midst of kharif crop season follows separation of tube well feeders from the ones providing electricity to rural habitations where the state government promised at least 18 hours of supply. UPPCL has issued an order to all control rooms directing restriction of power supply to tube wells from 7am to 5pm. When contacted, principal secretary (energy) Alok Kumar said that the 10-hour power supply to tube wells was good enough. Significantly, the development comes close on the heels of the government proposing a hike in power tariff for tube wells from ₹150 per horse power to ₹170 per horse power. Earlier, when there was no feeder separation, there was 18 hours of power supply to tube wells. The issue will now be taken up by UP Electricity Regulatory Commission (UPERC), which is taking petitions and holding public hearings in the state before announcing a fresh power tariff order, probably by the first week of September.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Soon, solar panels to be a must in new Greater Noida buildings

13 August. All new constructions in Greater Noida will soon have to mandatorily install solar panels to meet at least 10 percent of their electricity requirement. In a move aimed towards meeting the guidelines of the Smart Cities Mission, the Greater Noida Industrial Development Authority (GNIDA) is promoting the use of renewable energy to supplement electricity supply in the city. Solar panels will also be installed at the Authority office and other government buildings. NMRC metro stations have already installed solar panels. Private developers will be asked to mandatorily set up solar panels, which will be checked before approving the layout maps. The requirement will be inserted in the building bylaws and will be discussed during the board meeting by the end of the year.

Source: The Economic Times

Government planning mega renewable energy projects like UMPPs

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Mega renewable energy projects in a sector awash with unutilised capacity may not stand the test of economics!

< style="color: #ffffff">Bad! |

13 August. The government is planning large renewable energy projects like the coal-based ultra-mega power projects (UMPPs) through the public-private-partnership route. The renewable power projects may include any renewable source of generation or a combination of them. The plants are likely to be 1,800 MW in capacity, which can be spread over three areas of 600 MW each, and the power purchase agreements (PPAs) will be for 25 years. Industry insiders, however, are skeptical about the idea of such ultra-mega renewable power projects as recent auctions of solar power contracts received tepid response. A tender by the Solar Energy Corp of India (SECI) for 1,200 MW solar power purchase received bids from SoftBank-backed SB Energy and Chennai-based GRT Jewellers. Though SECI guarantees payments, the tariff ceiling is fixed at ₹2.65 per unit. An NTPC tender for 1200 MW, too, received poor response, forcing the company to extend the deadline. The power tariff renegotiation bid by Andhra Pradesh has left investors nervous about taking up the otherwise lucrative projects. India aims for 175 GW green power capacity by 2022. As on 30 June, the capacity stood at 80 GW of the total installed generation capacity of 350 GW. Solar stands at 30 GW and wind at 36 GW in this pie.

Source: The Economic Times

NHPC expects forward movement on mega Northeast hydropower projects

12 August. NHPC, India’s state-owned hydropower producer, is hoping to quickly ramp up generation capacity in the Northeast on the back of a slew of approvals for large projects received recently. This includes the 500 MW Teesta-VI project in Sikkim, the 2,880 MW Dibang multipurpose project in Arunachal Pradesh and the 2,000 MW Lower Subansiri project located at the border of Assam and Arunachal Pradesh. The National Company Law Tribunal (NCLT) has approved NHPC’s bid for Lanco Teesta Hydro Power for ₹8.97 bn under the Corporate Insolvency Resolution Process. The project will be implemented at an estimated cost of ₹57.48 bn. The Cabinet Committee on Economic Affairs had approved the 2,880 MW Dibang project in Arunachal Pradesh at a cost of ₹16 bn. On completion, the project will be the country's largest storage-based hydoelectric project. It will supply power at a tariff of ₹4.64 per unit after completion in nine years.

Source: The Economic Times

Rajasthan government releases biofuel policy 2019

10 August. The Rajasthan government released biofuel rules-2019 on the eve of the World Biofuel Day. Deputy Chief Minister Sachin Pilot said Rajasthan is the first state in the country to bring the policy for biofuel after the notification of the Centre. Promotion of biofuel will reduce the need of fossil fuel in the interest of environment, and also generate employment opportunities, he said in a function at Science Park. Transport Minister Pratap Singh said that efforts will be made to use biofuel in the buses of state road transport corporation.

Source: The Economic Times

Out of 25k target, MSEDCL installed 2,150 solar power pumps

9 August. MSEDCL (Maharashtra State Electricity Distribution Company Ltd) has miserably failed to meet the solar farm pump installation target under Mukhyamantri Saur Krishi Yojana (MSKY). The state government had set a target of installing 25,000 solar pumps in 2018-19 and another 50,000 between April and December 2019. However, so far it has installed only 2,150 pumps. MSEDCL had been asked to set a target of installing 1,00,000 solar farm pumps by March 2020.

Source: The Economic Times

India to hike import duty on solar power equipment in coming years: Power Minister

9 August. India will increase import duty on solar equipment to encourage domestic industry in the coming years, Power Minister R K Singh said. He also announced that a storage policy will be unveiled soon which would provide tax incentives, especially for solar equipment manufacturing in India. He assured that the rise in import duty will not impact solar energy bidding process in India. Recently, Andhra Pradesh distribution company had demanded lowering of tariff on some renewable energy projects. The Solar Energy Corp of India and NTPC Ltd, however, have refused to lower tariff of green energy. India had imposed safeguards duty of up to 25 percent on solar cell imports from China and Malaysia in July last year.

Source: The Economic Times

Government may ask OMCs to offtake entire biodiesel supply from used cooking oil

9 August. The government is likely to announce a scheme wherein Oil Marketing Companies (OMCs) will offtake the entire supply of biodiesel from used cooking oil from all current and future plants to commemorate World Biofuel Day. Biofuels in general are relatively environmentally-friendly fuels derived primarily from biomass such as plant, algae material or animal waste. Biodiesel, a type of biofuel, can be produced from used cooking oil as well. While this move is welcome, industry players say that it is not enough to cater to the demand for biofuels in the country as set out by the National Policy on Biofuels 2018 released by the Ministry of New and Renewable Energy (MNRE). According to the policy, currently the ethanol blending percentage in petrol is around 2 percent and biodiesel blending percentage in diesel is less than 0.1 percent. The policy has set an indicative target of 20 percent and 5 percent, respectively, by 2030.

Source: The Hindu

PM Modi to inaugurate 3rd Global Renewable Energy Investors meet on 30 October

8 August. Prime Minister (PM) Narendra Modi will inaugurate the third Global Renewable Energy Investors' Meet on 30 October. India is expecting an investment of $80 bn in 2-3 years in the renewable energy sector, MNRE (Ministry of New and Renewable Energy) Secretary Anand Kumar said. The investors' meet will be held at Greater Noida, he said. He said that India has emerged as the big renewable energy market with an installed capacity of 80 GW.

Source: The Economic Times

IIT partners with NIOT to harness electricity from ocean waves

8 August. Researchers from the Indian Institute of Technology (IIT) Madras and National Institute of Ocean Technology (NIOT) are developing turbines that can harness the power of ocean waves to generate electricity. The research is being headed at IIT Madras by Abdus Samad of Department of Ocean Engineering, who specialises on extracting energy from the ocean waves. The work of Samad and his team is aimed at meeting renewable energy and climate change objectives of the government of India.

Source: The Economic Times

INTERNATIONAL: OIL

Malaysia to develop $480 mn oil storage, ship refuelling site in south

13 August. Malaysia said the Johor Port Authority was working to develop a 2 bn ringgit ($477 mn) oil storage and ship refuelling site in the country’s south. That marks the latest step in a push to turn Malaysia’s southern peninsular state of Johor into an oil and gas hub that could one day rival Singapore, currently Asia’s main oil centre. The “Bunker Island Development” is set to have the capacity to store about 1.2 million cubic meters of various oil and gas products, the transport ministry said. The ministry said that the project would also be used to promote cleaner marine fuel in accordance with International Maritime Organization (IMO) rules that will require lower sulphur content in shipping fuel from 2020.

Source: Reuters

Russia’s top independent oil refinery restoring output after hiatus

12 August. The Antipinsky oil plant, Russia’s largest independent refinery, is on track to more than double its output this month following suspension of its operations for more than two months. The refinery, located in western Siberia, with an annual capacity of 9 million tonnes (181,000 barrels per day), temporarily halted oil processing in April through June amid financial problems that led to the arrival of new owners and bankruptcy proceedings. The refinery said Russian oil major Surgutneftegaz would be the main supplier of oil to the plant.

Source: Reuters

Congo Republic oil find could quadruple national output

12 August. An oil discovery in Republic of Congo could produce nearly 1 mn barrels of oil per day, a company involved said, possibly quadrupling the nation’s output and propelling it into the same league as Africa’s largest producers. Congo’s cash-strapped energy industry has been boosted by major recent finds from Italy’s ENI and France’s Total, lifting an economy hobbled by debt, civil unrest and corruption, and raising output to about 350,000 barrels per day. Production from the new field, developed by SARPD-OIL in la Cuvette region, could dwarf that, the company said. SARPD estimates the field holds 1 billion cubic meters of hydrocarbons, including 359 mn barrels of oil, with a potential for daily output of 983,000 barrels, Rahmani said.

Source: Reuters

Kuwait committed to implement accord to reduce oil output: Oil Minister

12 August. Kuwait is “fully committed” to implementing an agreement between oil exporting countries to cut production in order to support crude prices, Oil Minister Khaled al-Fadhel said. He said his country has cut its own output by more than required by this agreement. He said fears of a global economic downturn, which have weighed down on prices, were “exaggerated,” and global demand for crude should pick up in the second half, helping reduce the surplus in oil inventories gradually. The Organization of the Petroleum Exporting Countries (OPEC), Russia and other non-OPEC producers, known as OPEC+, agreed to reduce output by 1.2 mn barrels per day (bpd) from 1 January for six months, a deal designed to stop inventories building up and prop up prices.

Source: Reuters

US shale oil output seen rising to 8.77 mn bpd in September

12 August. US (United States) oil output from seven major shale formations is expected to rise by 85,000 barrels per day (bpd) in September, to 8.77 mn bpd, the US Energy Information Administration said in its monthly drilling productivity report. The largest change is forecast in the Permian Basin of Texas and New Mexico, where output is expected to climb by 75,000 bpd, to 4.42 mn bpd in September.

Source: Reuters

Russia’s Rosneft to seek compensation from Transneft for drop in oil output

10 August. Russia’s biggest oil producer Rosneft said for the first time that it will claim compensation from pipeline monopoly Transneft for a drop in oil output due to the contamination in the Transneft network. The contamination, first discovered in April in Belarus, led to the stoppage of Russian oil exports via the 1 mn barrels per day Druzhba pipeline and a reduction in oil production in Russia, one of the world’s top producers of crude. Rosneft said in its second-quarter results based on Russian accounting standards that the company will include losses from the fall in oil output in an estimate of damages from the contamination.

Source: Reuters

Libya restarts production at El Sharara oilfield

8 August. Libya is gradually restarting production at the El Sharara oilfield, the country’s largest, after unknown gunmen had blocked a pipeline. The field, south of Zawiya port in western Libya, and which produces around 290,000 barrels per day (bpd), was shut late in July by an armed group. The field accounts for a quarter of Libya’s oil production. Prior to the shutdown, Libya was producing 1.2-1.3 mn bpd, a six-year high for the OPEC (Organization of the Petroleum Exporting Countries) member which has struggled to return to a pre-civil war capacity of 1.6 mn bpd.

Source: Reuters

CNPC extends Oman oil production contract for 15 yrs

8 August. China National Petroleum Corp (CNPC) has extended a contract for developing an aged oilfield in Oman for another 15 years, the Chinese state oil and gas group said. In 2002, CNPC won a 50 percent stake in Oman Block 5, an oilfield that covers an area of 992 square kilometre (383 square miles) but was producing only 700 tonnes of crude oil a day after more than a decade of over-rapid drilling, CNPC said

Source: Reuters

INTERNATIONAL: GAS

Japan’s prices for spot LNG cargoes fall to lowest since May 2016

9 August. The price Japanese utilities paid for spot cargoes of liquefied natural gas (LNG) last month were at their lowest in more than three years, data from the Ministry of Economy, Trade and Industry (METI) showed. The price for spot LNG shipped to Japan in July fell to an average of $4.70 per million metric British thermal units (mmBtu), the lowest since May 2016, when the price was $4.10 per mmBtu, data showed. The July price was the third lowest for monthly spot cargoes since METI began compiling the data in March 2014 and was down from $5.50 per mmBtu in June. The drop in spot LNG prices LNG-AS is helping Japan’s utilities cut costs but their overall import price in June was much higher, at $9.14 per mmBtu, because most of their fuel purchases are done via contracts linked to oil prices. METI surveys spot LNG cargoes bought by Japanese utilities and other importers, but only publishes a price if there is a minimum of two eligible cargoes reported by buyers.

Source: Reuters

US natural gas demand is at a record, prices keep dropping

8 August. US (United States) natural gas demand is at an all-time high and expected to keep rising - and yet, prices are falling. US gas futures collapsed to a three-year low, while spot prices were on track to post their weakest summer in over 20 years. In other markets, such lackluster pricing would cause investment to retrench and supply to contract. But gas production is at a record high and expected to keep growing. Demand is rising as power generators shut coal plants and burn more gas for electricity and as rapidly expanding liquefied natural gas (LNG) terminals turn more of the fuel into super-cooled liquid for export. Analysts believe the natural gas market is not trading on demand fundamentals because supply growth continues to far outpace rising consumption. So much associated gas is coming out of the ground that gas prices in the Permian basin in Texas and New Mexico, the biggest US shale oil formation, have turned negative on multiple occasions this year. The US Energy Information Administration (EIA) projects gas production will rise 10 percent to 91 billion cubic feet per day (bcfd) in 2019 after soaring 12 percent to a record 83.4 bcfd in 2018, its biggest annual percentage increase since 1951. US LNG exports, particularly to Asia, are powering increased demand. They are expected to rise from a record 3.0 bcfd in 2018 to 6.9 bcfd in 2020, according to EIA projections, making LNG the nation’s fastest-growing source of demand. Still, LNG exports account for only about 5 percent of total US gas use.

Source: Reuters

INTERNATIONAL: COAL

Australian Pacific Coal mulls options after regulator bars mine extension

13 August. Australian Pacific Coal said it was considering its options after a state regulator refused to extend the life of a mothballed coal mine, partly due to a lack of information around the proposed mine’s carbon emissions. Australian Pacific applied last year to restart a thermal coal mine in New South Wales. The ruling is the second this year to signal Australian authorities are tightening up coal mine approvals after the state’s land court ruled against developers planning to build a mine in the same region in February. The Dartbrook mine was placed on care and maintenance in late 2006 due to operational difficulties and lower coal prices. Coal miner Whitehaven also requires planning commission approval for a proposed expansion of its Vickery coal mine.

Source: Reuters

China’s July coal imports jump 21 percent on strong summer power demand

8 August. China’s coal imports jumped 21.4 percent in July from a month earlier to 32.89 million tonnes (mt), customs data showed, boosted by strong demand for electricity as households and businesses cranked up their air conditioning in the face of hot weather. China, the world’s biggest coal user, took in a total 187.36 mt of the fuel in the first seven months of 2019, up 7 percent from the same period last year, data from the General Administration of Customs showed. Traders said that some inland ports in Inner Mongolia also tightened coal imports by reducing the number of trucks that could enter at border checkpoints. The central government has been urging domestic coal miners to ramp up production to ensure sufficient supply of the fuel.

Source: Reuters

Botswana’s private coal mine produces first saleable coal

7 August. Botswana’s privately owned coal mine has produced its first saleable coal that has been exported to South Africa and Namibia. The Masama Coal Mine has extracted roughly 39,000 tonnes of coal since July and aims to ramp up production to 100,000 tonnes per month of saleable coal by next year, Minergy Chief Executive Morné du Plessiss said. The open cast mine and associated coal wash plant is located 60 km (37 miles) northwest of Botswana’s capital Gaborone and was developed at a cost of 400 mn pula ($37 mn). The Masama mine, the first privately-owned coal mine in Botswana, is estimated to hold 390 million tonnes of coal reserves. Despite Botswana’s huge estimated coal resources of 212 billion tonnes, Minergy’s Masama mine is one of only two operating coal mines in the country. The other is state-owned Morupule Coal Mine.

Source: Reuters

INTERNATIONAL: POWER

Texas power demand to hit record again as heat wave bakes US Southeast

13 August. Demand for electricity in Texas will break a record high that was hit as consumers keep their air conditioners cranked up to escape a heat wave baking much of the US (United States) Southeast, according to the state’s power grid operator. The US National Weather Service issued heat advisories for much of the Southeast. The Electric Reliability Council of Texas (ERCOT), grid operator for much of the state, projected demand will rise over 75,100 MW, topping preliminary peak of 74,531 MW. That beat the prior all-time high of 73,473 MW on 19 July 2018. ERCOT has more than 78,000 MW of generating capacity to meet demand this summer, but warned low reserves could force it to issue alerts urging customers to conserve energy.

Source: Reuters

Kenyans to pay more for delayed power transmission lines

12 August. Kenyans may be forced to incur increased expenditure on electricity transmission running into billions of shillings as Kenya Electricity Transmission Company (KETRACO) is facing difficulties in having the projects concluded in time. The extra charge on the taxpayer is in the form of contract cost variation- increased prices of materials brought about by delays in having the projects completed as scheduled, or breach of agreement implications occasioned by termination of contracts by KETRACO. Already the electricity transmission firm has Sh4.59 bn in pending wayleave compensation bills, which is likely to go up as the cost of land can only appreciate. The project entails construction of a transmission line from Suswa to Isinya together with five sub-stations at Suswa, Kimuka, Isinya, Athi River and Komarock. Kenya procured a loan from the Exim Bank of India to fund two transmission lines and six sub stations that have dragged for years.

Source: Daily Nation

'No malicious intent' behind mass blackout: UK power operator

12 August. UK (United Kingdom) power operator said 'no malicious intent' behind mass blackout National Grid, which runs Britain’s power network, said it was confident of "no malicious intent" behind a major outage that hit nearly 1 mn people and caused travel chaos. The company has blamed the blackouts, that left more than 900,000 customers without power for several hours and transport systems reeling, on the loss of two generators in quick succession. National Grid director of operations Duncan Burt said the company would provide a technical report on the outage to industry regulator Ofgem, which demanded an immediate investigation into the incident. Industry experts believe the blackout was prompted by a gas-fired power station in Bedfordshire, north of London, and then an offshore wind farm in Yorkshire, northern England, both disconnecting from the grid. The outage lasted for several hours, affecting around 300,000 customers in London and the southeast, and 500,000 in the Midlands, southwest England and Wales, according to regional power utilities.

Source: The Economic Times

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Indonesia needs $15 bn investment to meet geothermal target by 2025

13 August. Indonesia may require an estimated $15 bn in investment to meet its target of reaching 7.2 GW of geothermal power capacity by 2025 and is studying ways to reduce project costs, the energy ministry said. The capacity would be an increase from less than 2 GW of geothermal power currently, the ministry said. Indonesian Vice President Jusuf Kalla said during a speech that progress in geothermal power development in the past decade has been “very slow” and the dependency on coal power has caused air pollution around the capital Jakarta. PT Pertamina Geothermal Energy, a unit of state energy company PT Pertamina, is aiming to invest $2.7 bn in geothermal power through 2026. The company aim to increase its geothermal capacity to 1.1 GW by 2026 from 672 MW currently.

Source: Reuters

Australia offers climate funding to Pacific islands

13 August. Australia announced a Aus$500 mn ($340 mn) climate change package for Pacific island countries, which have been increasingly vocal in demanding their powerful neighbour curb its carbon emissions. Prime Minister Scott Morrison said the funding, drawn from Australia's existing international aid budget, would help Pacific island nations invest in renewable energy and climate change resilience. The climate-sceptic leader made the announcement before traveling to the Pacific Islands Forum in Tuvalu, where island nations threatened by rising seas have vowed to put global warming at the top of the agenda. Smaller members of the 18-nation grouping have been sharply critical of Australia's climate policies ahead of this year’s summit amid a diplomatic push from Canberra to counter China's growing power in the region. Morrison has staunchly defended Australia's climate record, insisting the country will meet its 2030 emissions reduction target set under the Paris Agreement.

Source: Voice of America

German network agency awards 208 MW of onshore wind power licences

9 August. Germany’s power network agency Bundesnetzagentur said it had awarded licences to build onshore wind turbines with the capacity to produce 208 megawatts (MW), as its August auction, aiming for a possible maximum of 650 MW, was again undersubscribed. The average price was 0.62 euro per kilowatt hour (kWh), with most of the 32 permits awarded to bidders in Brandenburg and North Rhine Westphalia states, the agency said. The next tenders will be held on 1 September and 1 October.

Source: Reuters

China’s solar PV potential decreasing due to air pollution

8 August. World’s largest consumer of solar photovoltaic (PV) electricity, China’s PV potential decreased on average by 11 percent to 15 percent between 1960 and 2015 due to increased air pollution, according to a recent report published in the journal Nature Energy. Air pollution from fossil fuels -- black carbon and sulfur dioxide -- is acting as a wall between sunlight and solar panels. It said that reverting back to 1960s radiation levels in China could yield a 12 percent to 13 percent increase in electricity generation, equivalent to an additional 14 terawatt hour (TWh) produced with 2016 PV capacities, and 51 TWh to 74 TWh with the expected 2030 capacities. According to Inverse, the country had 130 GW installed capacity at the end of 2018, which is projected to reach 400 GW by 2030 and cover 10 percent of the country’s energy needs.

Source: The Economic Times

DATA INSIGHT

Scenario of Solar Electricity Generation Capacity in India

As on 31 May 2019

| < style="color: #ffffff">State/UT (with more than 100 MW Capacity) |

< style="color: #ffffff">Installed Capacity (MW) |

| Andhra Pradesh |

3290.76 |

| Bihar |

144.95 |

| Chhattisgarh |

231.35 |

| Delhi |

132.15 |

| Gujarat |

2564.14 |

| Haryana |

232.16 |

| Karnataka |

6134.9 |

| Kerala |

140.33 |

| Madhya Pradesh |

1992.25 |

| Maharashtra |

1639.15 |

| Odisha |

396.89 |

| Punjab |

905.62 |

| Rajasthan |

3551 |

| Tamil Nadu |

2812.05 |

| Telangana |

3598.8 |

| Uttar Pradesh |

1045.1 |

| Uttarakhand |

309.84 |

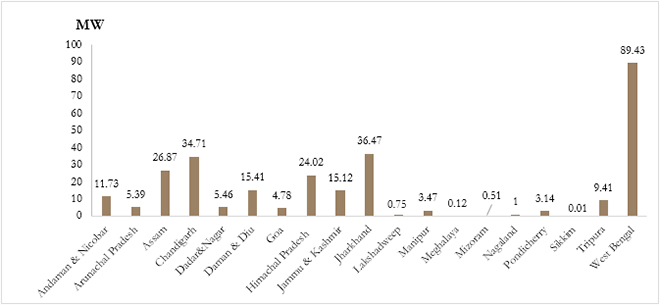

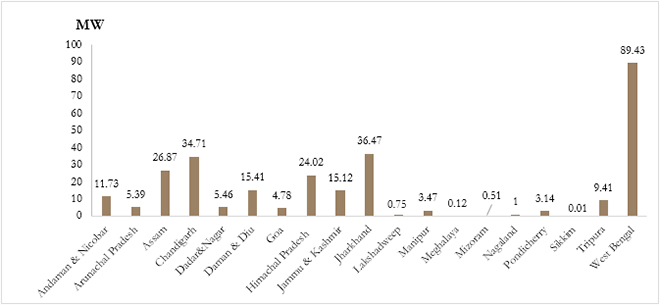

State/UT with less than 100 MW Capacity

Source: Parliament Questions (for Ministry of New & Renewable Energy)

Source: Parliament Questions (for Ministry of New & Renewable Energy)

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

Source: Parliament Questions (for Ministry of New & Renewable Energy)

Source: Parliament Questions (for Ministry of New & Renewable Energy) PREV

PREV