Quick Notes

Decarbonisation and Development in India: The Trade-off

The Case for Development

The possibility of trade-offs between

decarbonisation and development has been discussed in a number of academic papers. The dominant view is that if climate change is not addressed through decarbonisation, its consequences such as floods and drought will

slow down economic growth. A climate activist vantage point promotes the view that

decarbonisation will encourage re-industrialisation and consequently drive economic growth. The uncommon view is that decarbonisation may impose costs on growth. It is this uncommon view that the chapter on “Climate Change and Environment: Preparing to face the Future” in the

Economic Survey 2022-23 explores. The post pandemic increase in demand for electricity and the consequent increase in demand for coal along with the volatility in global energy markets on account of the crisis in Ukraine are probably among reasons influencing the views expressed in the survey. The key point made is that single minded focus on decarbonisation may come at the cost of development and energy security.

The Economic Survey cites notable experts to support its case for development. One is the economist

Jean Pisani-Ferry, cofounder of Bruegel, Europe’s leading economic think tank, who observed in 2021 before the Ukraine crisis that accelerating the targets for net carbon emission reductions too aggressively could create much larger economic disruptions than generally anticipated, what he called “

an adverse supply shock, very much like the shocks of the 1970s.” Such a transition, according to Pisani-Ferry is “unlikely to be benign and policymakers should get ready for tough choices”. He added in 2022 that “

climate action has become a major macroeconomic issue, but the macroeconomics of climate action is far from the level of rigour and precision that is now necessary to provide a sound basis for public discussions and to guide policymakers adequately”. Pisani-Ferry expressed concern that “

advocacy has too often taken precedence over analysis for understandable reasons”. He said that “at this stage of the discussion, complacent scenarios have become counterproductive. The policy conversation now needs methodical, peer-examined assessments of the potential costs and benefits of alternative plans for action.”

The Survey also quotes

Nobel Laurate Thomas Schelling who said that the most effective way to combat climate change is to let nations grow first. He pointed out that if per person income growth in the next 40 years compares with the 40 years just past, vulnerability to climate change will diminish and resources available for adaptation will be greater.

Surveying India’s Options

The Economic Survey gives three additional reasons as to why growth and development is key to addressing climate change. The first is the

difficulty in securing funding from developed countries. Given that public finances in developed countries are stretched because of the pandemic and the crisis in Ukraine, the survey argues that developed countries have little or no intention of mobilising resources to address climate change in developing countries. The report adds that rich countries do not have the appetite to

provide additional capital to multilateral institutions that could lend to poorer countries. Second is the private sectors limited ability to undertake long-gestation projects for the energy transition. Lastly, the Survey argues that it is not irresponsible for developing countries to

put their own growth and development aspirations ahead of their global climate obligations. To illustrate the Survey quotes the example set by developed countries especially countries in Western Europe. Threatened by supply disruptions and price increases of fossil fuels, European countries set aside their “obsessive” concerns over climate change and global warming to

burn more coal to generate electricity. This indicated that even a short-term disruption of their lifestyles in terms of thermal comfort, driving, flying and eating could not be tolerated.

The Survey sets the context for the discussion by

highlighting the trilemma over how much of its scarce resources it can devote to “bread-and-butter” developmental priorities and to adapting to the already changing climate, and how much to dedicate to mitigating emissions of green-house gases (GHGs). It reiterates the argument that

developed nations have prospered through the unrestricted use of fossil fuels, including coal, crude oil, and natural gas. The Survey observes that while it is theoretically elegant to argue that switching to renewable or non-fossil fuel energy would generate investments and jobs this does not work out so smoothly in practice.

It cites

China’s declaration that future energy supplies, including alternative ones, must be secured first before dispensing with existing energy sources. Countries may not want to scrap coal-fired power plants, as the alternatives may be held up either due to technology, financial resources, skilled and trained human resources, or some combination of all three. The Survey comes to terms with the reality that jobs that are likely to be created in the so-called ‘green economy’ are tilted

towards skill and technology-intensive jobs than in traditional industries. The Survey acknowledges that it may be easier to speak of retraining and relocating people than actually doing so.

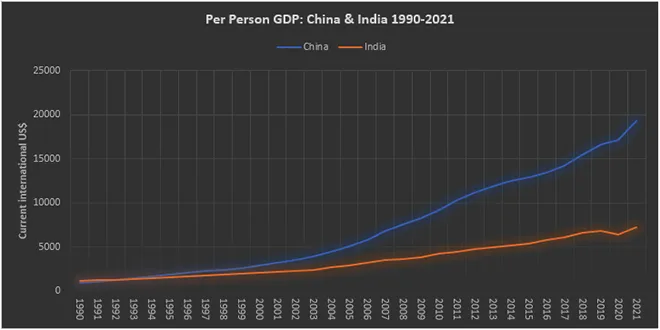

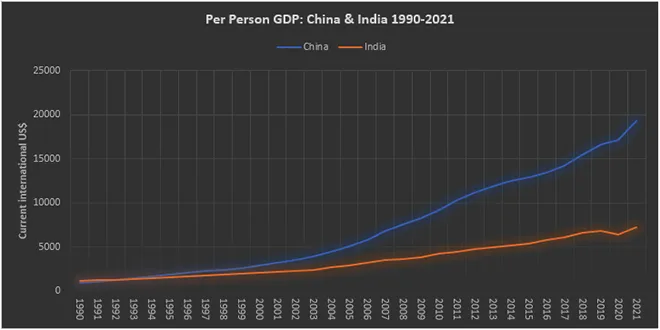

In the decade from

1990 to 2000 India’s GDP (gross domestic product) grew at an average of about 6.15 percent annually while its

population grew by 2.1 percent and consequently its per person GDP grew at an annual average of 3.8 percent. In the following decade India’s GDP grew at an annual average of 6.7 percent and its

population grew at an average of 1.6 percent and its per person GDP grew at over 5 percent. Between 2010 and 2020, India’s per person GDP grew by 4.1 percent annually while the

population grew by 1.2 percent and its per person

GDP grew at an average of 3.8 percent. In the thirty-year period (1990-2020) post partial liberalisation of the economy,

India’s per person GDP grew at 4.2 percent. In the same period,

China’s per person GDP grew at an annual average of about 8.5 percent. Growth and development have enabled China to not only become the world leader in clean energy technology but also empowered its population to cope with natural disasters. While per person GDP is a statistical artifact that does not capture deep inequalities in wealth distribution, it is an indicator of the country’s ability to cope with the impact of climate change as observed by Thomas Schilling.

If India’s per person GDP in the next thirty years is twice that in the last thirty years, it would give India sufficient resources to invest in technologies that address climate change and also empower most of its population to move away from subsistence agriculture that made them vulnerable to impacts of climate change such as floods and droughts. This does not minimise concern about climate change but underscores the flawed logic of growing economies making sacrifices in their development to minimise the emission of gases that may change the climate to their disadvantage. Continued development is the best defence against climate change.

Source: World Bank Database

Source: World Bank Database

Monthly News Commentary: Natural Gas

Natural Gas to meet Peak Power Demand

India

Policy & Governance

India has revised the gas procurement policy for fertiliser companies, allowing them to buy about a fifth of their monthly needs through the domestic spot market to help the government cut its subsidy bill. The government provides financial support for domestic fertiliser sales at rates below the market to insulate farmers from high prices and to contain inflation. The government expects to cut its fertiliser subsidy bill by up to INR240 bn (US$2.94 bn) if the fifth of companies' supplies is bought through bilateral contracts or gas exchange. The government has amended 2015 gas procurement guidelines under which fertiliser plants had to procure 80 percent of their gas through long-term contracts, and the balance through three-month tenders. Fertiliser plants can source gas through the Indian Gas Exchange and inter-company contracts. The new rule also allows fertiliser companies to withdraw tenders if they feel the bidding has led to higher-than-expected prices. Fertiliser plants bought gas at US$38 per mmBtu for supply in the October-December quarter through a tender. The maximum price quoted in the tender was US$55 while gas was available at the Indian Gas Exchange and bilateral markets for US$15 to US$20 per mmBtu.

India has asked state-run firms to increase imports of natural gas in anticipation of higher power demand next summer, three government sources said, aiming to avoid repeating a power crisis in April that was its worst in more than six years. While the share of natural gas in India’s power generation was just 1.5 percent this year, down from 3.3 percent in 2019 due to limited local availability and high global prices, the authorities see it as a crucial stop-gap power source for crunch times, especially when intense summer heat drives up air conditioning use. The Indian government has asked the country’s largest gas distributor, GAIL (India) Ltd, to increase supplies to power plants during the summer months. India’s largest power producer NTPC Ltd has also been asked to have up to 2 gigawatt (GW) of gas-fired power plants - more than half of its capacity - ready to produce at full capacity if needed next year to address peak summer demand.

Production

Oil and Natural Gas Corporation

(ONGC) proposes to drill 53 exploratory wells in Andhra Pradesh- 50 in Godavari on-Land PML (Petroleum Mining Lease) Block of KG Basin and three in CD-ONHP-2020/1 (OALP-Vi) Block Of Cuddapah basin with an investment outlay of INR21.50 billion (bn) (US$263.2 mn). Andhra Pradesh State-Level Environment Impact Assessment Authority (SEIAA) in a meeting held cleared two separate proposals put up by the ONGC for environmental clearance. According to ONGC, it proposes to carry out the onshore exploration of 50 wells during 2021-'28 in Godavari on-land PML block of KG basin in East and West Godavari Districts of AP based on the geological and geophysical studies. These wells will be converted to development wells and connected to the nearest Early Production System (EPS)/ Gas Collecting Station (GCS) if proved commercially viable, it further said. ONGC proposes to carry out the prospecting and exploration drilling in the CD-ONHP-2020/1 block of Cuddapah basin falling in Kurnool, Anantapur and YSR Kadapa districts of AP, it said in another proposal adding based on the geological and geophysical studies the three exploratory locations are planned to be drilled during the period 2021-24. ONGC currently produces 4.4 million standard cubic feet of gas and over 700 tonnes of oil from KG Basin per day.

LNG

Petronet LNG Ltd (PLL), India’s largest liquefied natural gas importer, will

set up a floating Liquefied Natural Gas (LNG) receipt facility at Gopalpur port in Odisha at INR23.06 bn (US$282.3 mn). The company has signed an agreement with Gopalpur Ports Ltd for the facility that will have a capacity of about 4 million tonnes per annum (mtpa). The company’s board had accorded investment approval for setting up the floating storage and regasification unit (FSRU)-based LNG terminal at Gopalpur. LNG is a natural gas that has been supercooled, changing it from a gas into a liquid that is 1/600

th of its original volume. This helps in easy transportation through ships. At the receipt facility, it is turned back into gas before being supplied to factories to produce fertiliser, generate electricity at power plants, or turned into CNG for running automobiles. Petronet’s project in the Ganjam district in Odisha, which is expected to be operational before the end of 2025, will be financed by a combination of debt and equity. Gopalpur will be the third LNG terminal on the east coast -- Indian Oil Corp (IOC) operates a 5 million tonnes a year facility at Ennore in Tamil Nadu while Adani Group in partnership with TotalEnergie of France is building a facility at Dhamra port. Petronet management had previously stated that the FSRU-based receiving and regasification scheme has the provision to be converted in the future to a land-based terminal - with an expected capacity of 5 mtpa. The firm is planning to charter hire an FSRU for the Gopalpur terminal with a target to meet the increasing gas demand of the eastern and central parts of the country. It, currently, operates the 17.5 mtpa terminal at Dahej in Gujarat and a 5 mtpa facility at Kochi in Kerala. The Dahej terminal is undergoing expansion to a capacity of 22.5 million tonnes. Petronet is adding 5 million tonnes of extra capacity at Dahej - already the world’s largest LNG import facility - by constructing a new jetty that will also able to handle propane and ethane shipments, plus more LNG storage tanks and bays for loading trucks. State-owned Indian Oil Corporation (IOC), ONGC, GAIL (India) Ltd and Bharat Petroleum Corporation Ltd (BPCL) each hold a 12.5 percent stake in Petronet.

Gas Trade

Reliance Industries Ltd

(RIL) and its partner bp plc of the UK have sought bids for the sale of natural gas from the eastern offshore KG-D6 block at a price linked to the rate at which LNG (liquefied natural gas) is delivered to Japan and Korea. The two partners invited bids for the sale of 6 million standard cubic meters per day (mmscmd) of gas starting February 2023, according to the tender document. Users such as city gas operators that convert gas into CNG (compressed natural gas) for sale to automobiles and pipe it to household kitchens for cooking purposes, or power plants that use it to generate electricity or fertilizer units that use it to make urea, have been asked to quote premium they are willing to pay over the JKM price. JKM is the Northeast Asian spot price index for LNG delivered ex-ship to Japan and Korea. JKM price for February is US$28.83 per million metric British thermal units (mmBtu). Bidders have been asked to quote variable 'V' in the gas price formula 'JKM + V'. The maximum valid bid for 'V' shall be US$5.01 per mmBtu beyond which the bid shall not be accepted by the e-bidding portal, it said. The gas price, it said, shall be higher of the government-set ceiling price for gas produced from deepsea fields or the lower of price arrived at the bidding and the ceiling price. The price discovered in that e-auction came at a US$0.06 discount to the JKM (Japan-Korea Marker) LNG price. Prior to that, the duo had sold 7.5 mmscmd of gas at a discount of US$0.18 per mmBtu to JKM. The government sets a cap or ceiling rate at which natural gas from difficult fields like deepsea can be sold. This cap for the period 1 October 2022, to 31 March 2023, is US$12.46 per mmBtu. RIL has so far made 19 gas discoveries in the KG-D6 block. Of these, D-1 and D-3 -- the largest among the lot -- were brought into production in April 2009, and MA, the only oilfield in the block, was put to production in September 2008. While the MA field stopped producing in 2020, output from D-1 and D-3 ceased in February 2021. Since then, RIL-BP is investing US$5 billion in bringing to production three deepwater gas projects in block KG-D6 -- R-Cluster, Satellites Cluster, and MJ which together are expected to meet about 15 percent of India's gas demand by 2023.

Rest of the World

Europe

Norway’s Vaar Energi, majority owned by

Italy’s Eni, said it had made a gas discovery near the Goliat field in the Arctic Barents Sea, supporting the group's long-term plans to expand in the area. Preliminary estimates place the size of the gas discovery between 57 million and 132 million barrels of recoverable oil equivalents, or 9 million to 21 million standard cubic metres (mcm). The find in the Lupa prospect strengthens Vaar's foothold in the north.

Hungary’s Foreign Minister Peter Szijjarto said that Budapest will not have to notify or consult with the European Commission if it wants to modify its

long-term gas contract with Russia should an EU-wide gas price cap be approved. Hungary, a European Union (EU) member that largely relies on Russian gas and oil imports, has repeatedly said that it opposes a price cap on Russian gas. EU ministers were meeting in an effort to agree the cap on prices. Szijjarto said that if the gas price cap was approved, Hungary would need to adjust its deal with Russia, which was open to a possible change. Under a 15-year deal signed last year, before Russia’s invasion of Ukraine, Hungary currently receives 4.5 billion cubic meters (bcm) of gas per year via Bulgaria and Serbia under a long-term deal with Russia. Szijjarto said that at the Brussels meeting he suggested that the European Commission work out a proposal that would ban certain oil pipeline operators from demanding transit fees that are above those of the EU average. The operator of the Adria pipeline transporting oil from Croatia towards Hungary wants to raise transit fees by 80 percent next year for Hungarian oil and gas company MOL.

Dutch energy firms have been forced to tap into the country’s gas reserves as the cold wave is boosting demand. As a result, the gas consumption of Dutch households and companies has risen significantly recently and the country has had to resort to its stored gas reserves to satisfy demand, Dutch energy network operator Gasunie said. Gasunie estimated that the Netherlands consumed 1.5 bcm of gas over the last cold week, more than doubling the average weekly usage of about 0.61 cubic meter this year until the end of November. Hence the need to tap into the reserves. Despite the cold, the Dutch have used less gas than they normally would in cold weather in order to save costs. About 20 percent less gas was used than in previous years under the same winter conditions. Energy prices have remained at high levels in the Netherlands since the beginning of this year.

Portugal and Spain should start negotiations with the EU to allow them to extend beyond May a cap on the benchmark price of gas used by power plants to generate electricity, Portuguese Prime Minister (PM) Antonio Costa said. Recognising the Iberian Peninsula has weak energy links to the rest of Europe, the European Commission in May allowed the two countries to initially cap gas prices at €40 per megawatt-hour, with the price limit projected to average out at €50 (US$53.14) over 12 months. Costa said the Iberian cap had already allowed Portuguese electricity consumers to save around €360 million. European Union energy ministers are meeting in Brussels to try

to agree an EU-wide cap on gas prices after months of deadlock over whether the measure can ease the energy crisis. The contract price would also need to be €35 higher than a reference price based on existing liquefied natural gas price assessments.

EU countries will consider a proposal for a gas price cap slightly lower than a Brussels proposal that some view as too high, with a handful of countries pushing for an even lower limit. EU countries start negotiations on a European Commission proposal for a cap to limit gas price spikes. The Commission proposed a gas price cap that would kick in if the front-month Title Transfer Facility (TTF) gas price exceeded €275 (US$289) per megawatt-hour for two weeks and was €58 higher than a liquefied natural gas reference price for 10 days. Some countries criticised that proposal, suggesting it was designed with such a high price and with criteria so strict that the cap would never be triggered, and thus fail to cushion their economies from price spikes.

Greece, Bulgaria, Romania and Hungary agreed to

upgrade the interconnection and transport capacity of their gas grids, part of their long-standing efforts to diversify gas sources and boost their role in Europe's energy supply chain. In 2016, the four countries agreed to develop the necessary infrastructure for the realisation of the so-called Vertical Gas Corridor, which will enable bidirectional gas flows from Greece to northern Europe, through Bulgaria, Romania and Hungary. After Russia cut gas supplies to Europe in the wake of the war in Ukraine, European countries have been looking for alternative gas suppliers and have been pursuing energy cooperation more actively.

The Norwegian energy ministry said it had approved operator Equinor’s plan for new investments in the North Sea Oseberg petroleum fields, which will boost gas exports to Europe from 2026. Equinor and its partners estimated that the amended development plan will increase output at Oseberg by 31.2 mcm of oil equivalent, or around 196 million barrels of oil equivalent, 87 percent of which will be gas. The reconstruction will make Oseberg the country’s third biggest gas field, after Troll and Snoehvit, measured in remaining reserves, Equinor said.

Oseberg is expected to produce 100 billion cubic metres (bcm) of gas between 2022 and 2040, the company said.

Middle East

Turkey has discovered a new natural gas reserve of 58 bcm in the Black Sea, as the country’s total reserve in the sea has reached 710 bcm, President Recep Tayyip Erdogan has announced. In addition to the new discovery at a depth of 3,023 meters in the Caycuma-1 field, the total gas reserve was raised also by a revision of the estimated volume in the Sakarya field to 652 bcm from 540 bcm, Erdogan said. The Turkish government will also focus on exploration activities in the Mediterranean, as Turkey's ultimate goal is to achieve oil and gas independence, Erdogan noted. Earlier, Turkish Energy and Natural Resources Minister Fatih Donmez said the government plans to pump gas from its reserves in the Black Sea to its national grid in the first quarter of 2023. Turkey is heavily reliant on energy imports from Russia, Azerbaijan and Iran.

North and South America

The US (United States) Energy Department

approved permits for Sempra Energy to send US natural gas to Mexico for re-export from LNG terminals, which a source said led a Republican senator to lift holds on four Biden administration nominees. The permits allow Sempra to ship natural gas via pipeline to western Mexico in coming years where it will be converted to liquefied natural gas at the company’s terminals and sent to consumers in Asia and other markets. The LNG will be exported from Sempra terminals Energy Costa Azul - which is being built in two phases, the first of which is expected to be completed in mid-2025 - and Vista Pacifico, which has not yet begun construction. The department allows Sempra to export an LNG equivalent of 475 billion cubic feet (bcf) per year of gas from the proposed Costa Azul facility, and 200 bcf a year from Vista Pacifico. Proponents of natural gas have been pressuring President Joe Biden’s administration to quickly boost export permits for the fuel after the 24 February invasion of Ukraine by Russia, the world’s biggest exporter of fossil fuels. While the permits will do nothing this year to help Europe while it faces an energy crisis, they will add alternatives to LNG from Russia for consumers, particularly in Asia.

The

US and Britain announced an energy partnership aimed at sustaining a higher level of LNG exports to Britain and collaborating on ways to increase energy efficiency. Britain and other European countries have turned to the United States as they try to reduce their reliance on Russian energy supplies following Moscow’s invasion of Ukraine begun in February 2022. The US became the world’s largest LNG exporter in the first half of 2022, US Energy Information Administration data showed as the country rapidly increased its export capacity and high prices, particularly in Europe led to higher exports. Britain said the US would aim to export 9-10 bcm of LNG over the next year under the agreement, maintaining the increase in exports seen this year. Refinitiv Eikon data showed Britain has imported around 11 bcm of gas from the United States so far in the first 11 months of 2022, up from 4 bcm in 2021.

Russia & the Far East

Moscow is ready to resume gas supplies to Europe through the Yamal-Europe Pipeline, Russian Deputy Prime Minister Alexander Novak said. The Yamal-Europe Pipeline usually flows westward, but has been mostly reversed since December of 2021 as Poland turned away from buying from Russia in favour of drawing on stored gas in Germany. In May, Warsaw terminated its agreement with Russia, after earlier rejecting Moscow’s demand that it pays in roubles. Russian supplier Gazprom responded by cutting off supply and said it would no longer be able to export gas via Poland after Moscow imposed sanctions against the firm that owns the Polish section of the Yamal-Europe pipeline. Novak reiterated that Moscow is discussing additional gas supplies through Turkey after a creation of a hub there. He said that Moscow expects it will have shipped 21 bcm of LNG to Europe in 2022. Novak said that in the long-term, Russia can send its natural gas to the markets of Afghanistan and Pakistan, either using the infrastructure of Central Asia, or in a swap from the territory of Iran.

China

China is making fast inroads in the market for new build LNG tankers as local and foreign ship-owners turn to its shipbuilders for the specialty vessels because long dominant yards in South Korea are fully booked. Three Chinese shipyards - only one of them having experience building large LNG tankers - won nearly 30 percent of this year’s record orders for 163 new gas carriers, claiming ground in a sector where South Korea usually captures most of the business. LNG tanker order books for Chinese yards tripled as China’s gas traders and fleet operators sought to secure shipping after freight rates soared to records following the upending of global energy supply flows by Russia’s invasion of Ukraine. With South Korean shipbuilders swamped by orders to service Qatar’s massive North Field expansion, Chinese yards also attracted more foreign bookings, including first overseas orders for some ship makers only recently certified to build membrane-type LNG carriers. Chinese shipyards this year won 45 LNG tanker orders worth an estimated US$9.8 billion, about five times their 2021 order values, according to shipping data provider Clarksons Research. By late November, Chinese yards had grown their LNG order books to 66 from 21, giving them 21 percent of global orders worth around US$60 bn.

Rest of Asia-Pacific

Australia’s plan to control domestic natural gas prices, which producers say will deter development of new supply, is expected to boost the prospects for proposed LNG import terminals but potentially defeat the government’s aim to cut energy bills. Parliament is set to pass legislation to cap gas prices at A$12 (US$8.4) per gigajoule (GJ) for a year and then require a "reasonable price" for domestic sales after the cap expires. Industry players say the plan, which surprised producers, will hurt investment in new supply as the "reasonable" price based on cost of production plus an agreed return on capital would fail to reflect exploration and development risks - which in turn would open a window of opportunity for LNG imports. Australia, despite being among the world’s top two LNG exporters, faces gas shortfalls from 2026 in its most populous states, New South Wales and Victoria, as supply is drying up in the offshore fields that have long supplied them. LNG supply, potentially from Western Australia, Papua New Guinea or the United States, for example, would however raise energy prices as LNG is more expensive.

Australia’s biggest natural gas producers warned that the government was putting supply at risk, escalating an outcry after the government landed a surprise proposal to control prices beyond a one-year cap. In the first move that could hit supply, global major Shell paused accepting bids for gas under a plan to boost supply for Australia's populous east coast in 2023 and 2024 while it assesses the government’s proposal. The government announced a 12-month cap on gas and coal prices to keep a lid on bills for households and businesses hit by soaring global energy prices following Russia’s invasion of Ukraine. But producers are more concerned about the government’s proposed long-term "reasonable pricing" regime that would

set gas prices at the cost of production plus an agreed profit margin after the one-year price cap expires.

News Highlights: 4 – 10 January 2023

National: Oil

India’s fuel demand hits nine-month high in December

9 January. India’s fuel demand reached a nine-month high in December, helped by strong industrial activity and a rise in gasoline consumption due to an uptick in passenger vehicle sales. Consumption of fuel, a proxy for oil demand, was about 4 percent higher than the previous month, and rose 3.1 percent year-on-year to 19.60 million tonnes (MT) in December, data from Indian oil ministry’s Petroleum Planning and Analysis Cell (PPAC) showed. Sales of diesel, which account for about four-fifths of India's refined fuel demand, rose 6.5 percent in December from a year earlier to 7.78 MT, while sales of gasoline, or petrol, rose 5.9 percent to 2.98 MT, the PPAC data showed. On a daily basis, consumption of gasoline rose marginally in December compared to the previous month. Cooking gas or liquefied petroleum gas (LPG) sales increased 3.9 percent in December to 2.58 MT, while naphtha sales edged up 0.5 percent to 1.11 MT.

India sticks to demand for increased share in Vedanta oil block

4 January: The Government of India will stick to its demand for a 10 percent increase in its

share of the revenues from Indian conglomerate Vedanta’s Barmer oil and gas block. The Supreme Court has been hearing a dispute between Vedanta and the federal government related to an extension of the production-sharing contract for the Barmer asset in the western state of Rajasthan.

National: Gas

India’s gas consumption target faces risks over price volatility: Fitch Ratings

10 January: Price volatility and infrastructure constraints are expected to challenge

India’s target of increasing natural gas share in the overall energy basket to 15 percent by 2030, from 6 per cent in 2017, despite resilient demand from city gas distribution networks and rising domestic production, Fitch Ratings said. Progress on the target has been minimal - 6 per cent share in 2021 - as the natural gas growth has not managed to outpace total energy demand growth. Demand for natural gas from price-sensitive industrial and power sectors may be limited in times of rising prices, as they switch to cheaper alternate fuels, Fitch Ratings said in a report. Further, the rating agency said India’s inadequate gas pipeline infrastructure and potential execution delays in some projects under construction may delay natural gas demand growth.

National: Coal

MCL supplied 143.4 MT of coal till December this current fiscal: Coal India

10 January: Coal India Ltd

(CIL) said that its arm MCL supplied 143.4 million tonnes (MT) of coal till December in the current fiscal, the highest among all the subsidiaries of the coal behemoth. Mahanadi Coalfields Ltd (MCL)’s supplies accounted for 28.2 percent of the total off-take of 507.8 MT from CIL. MCL’s coal off-take peaked to 146.12 MT on 5 January, overtaking the total supplies that the company registered for full year of FY21. This achievement was attained 85 days before the current financial year comes to an end. MCL’s supplies ending FY21 were 146 MT. Against the contracted quantity of 81.5 MT to its customers in the power sector, the actual supply from MCL was 102.7 MT till December of FY23.

CBI court orders further probe into Jharia coal blocks bidding process

8 January: A Special CBI court has ordered further investigation into why three companies, including Adani Enterprise, were

allowed to bid for a coal block in Jharkhand when they didn’t meet eligibility criteria. Special Judge Arun Bhardwaj had in December last year asked the CBI to answer if there was a conspiracy by the members of a tender committee constituted by the Steel Authority of India (SAIL) to give undue favours to three companies — AMR India, Lanco Infratech and Adani Enterprise Ltd — which despite not having a technical criteria for mining were allowed to bid for developing coal blocks in Jharkhand‘s Jharia coal fields.

Coal India, trade unions sign pact for 19 percent minimum guaranteed benefit

4 January: Coal India Ltd

(CIL) and trade unions have agreed to a 19 percent minimum guaranteed benefit of the monthly emolument, benefitting 2.38 lakh non-executive workers. The MoU between CIL and trade unions was signed in Kolkata. The MGB of 19 percent is on the emoluments as of 30 June 2021, which include basic pay, variable dearness allowance, special dearness allowance and attendance bonus. The Telangana-based Singareni Collieries Company Ltd (SCCL) was also the other signatory to the MoU.

National: Power

Electricity reaches Kashmir village after 75 years, elated locals thank government

10 January: Under a centrally-sponsored scheme, residents of a tribal area in Tethan in Dooru block,

Anantnag district of south Kashmir received electricity connection after almost 75 years. The electricity has reached this remote village with a population of just 200 people under the centrally sponsored PM Development Package scheme. Residents of Tethan located on the hills of Anantnag were delighted when the first bulb lit in the village for the first time after almost 75 years. For 75 years, the people of this village relied on traditional wood for their energy needs and used lamps and candlelight. Electricity department said electricity had been brought to the village through a fast-track process.

UPPCL proposes 18 percent tariff hike for urban domestic consumers

10 January: Your power bill may soon put an added burden on your monthly budget. The UP Power Corporation Limited (UPPCL) submitted a proposal with the UP Electricity Regulatory Commission

(UPERC), suggesting a hike of around 18 percent in power tariff for urban domestic consumers. Confirming the development, highly placed sources in UPERC said that the proposed tariff would be subjected to a rigorous scrutiny before the new power tariff is announced after two months. Power tariff in UP was last increased in 2018-19. According to the proposal submitted by the UPPCL, an average hike of around 16 percent has been proposed for various categories of consumers. For industries, rate has been proposed to be increased by 16 percent, while in case of agricultural consumers, a hike of 12 percent has been proposed. The increase in power tariff for industries has been proposed even as the state seeks to attract investments through the Global Investor Summit. A hike of around 17 percent has also been proposed for the life line category consumers -- rural/ urban poor who are provided power at a low rate.

New power subsidy policy for industries in Marathwada & Vidarbha: Maharashtra deputy CM

9 January. Deputy Chief Minister (CM) Devendra Fadnavis said the state government was formulating

a new power subsidy policy for the industries in Marathwada and Vidarbha regions. Fadnavis said that concerns related to the power at Aurangabad Industrial City (AURIC) would be addressed by considering the differential tariff system, which he said would be less than the prevalent tariff system. Fadnavis said Aurangabad and Jalna are the future of industries in Maharashtra by virtue of the edge these cities have because of the Samruddhi expressway and the upcoming dry-port.

UJALA scheme brings about energy revolution in India

6 January. The UJALA (Unnat Jyoti by Affordable LEDs for All) scheme is aimed at promoting the efficient usage of energy at the residential level by using energy-efficient appliances and aggregating demand to reduce the high initial costs. Also known as the LED-based Domestic Efficient Lighting Programme (DELP), it is considered the world’s largest programme. With the rising energy bills and resulting crisis due to the war in Europe, it becomes even more important for a nation like India that is dependent on many other countries for its fuel and energy to establish itself as a self-sufficient player at the global stage. As part of the Saubhagya Yojana to provide electricity to every household in the country, the

Government of India decided to arrange for low-energy consumption through the UJALA scheme. Given the importance of lighting in any manufacturing setup, educational institution, security and connectivity sectors, the scheme was launched in the year 2015 recognising the cost and sustainability benefits of energy-efficient lighting. In eight years, nearly 37 crore LED bulbs, 72 lakh tube lights and 23.5 lakh energy-efficient fans have been distributed, saving approximately INR200 bn per year. Prior to 2014-2015, the electricity bill used to be higher due to the use of outdated bulbs despite the lower demand for electricity. Requiring a solution that would reduce power consumption, and improve lighting but still reduce overall costs, the UJALA scheme has been successful in achieving these objectives.

Indore: Power consumption by industries up 10 percent

5 January: Electricity consumption by industries across various industrial belts in Indore and nearby areas jumped about 10 percent in the calendar year 2022 on a year-on-year basis due to increase in new industrial connections and rise in demand from units. Industries in Indore and adjoining areas consumed around 6.61 bn units in the year 2022 as against 5.91 bn units in 2021, according to discom (distribution company). Industries of Pithampur, Indore and Dewas are the major industrial belts of this region and these areas consume over 70 percent of the total electricity supplied to industrial belts. Total HT connections in industrial areas have increased to 4130 of which 3000 connections are near Indore. As per the initial demand estimates from industries for the new financial year submitted to discom, major jump in electricity consumption is likely to be witnessed in Indore, Dhar, Dewas, Ujjain and Ratlam. Industrialists expect a rise of another 10-12 percent in electricity demand in the ongoing year in industrial belts due to functioning of new factories in industrial belts.

Gujarat: No power tariff hike proposed for 2023-24

5 January: In a major relief to residential, commercial, agricultural, and industrial consumers, four state-run power distribution companies (discoms) have not proposed any hike in power tariffs for the upcoming fiscal year. To revise tariffs, discoms are required to file petitions with the Gujarat Electricity Regulatory Commission (GERC). All the state-run discoms the Madhya Gujarat Vij Company Limited, Paschim Gujarat Vij Company Limited, Dakshin Gujarat Vij Company Limited, and Uttar Gujarat Vij Company Limited refrained from revising tariffs for the fiscal year 2023-24, according to the petitions. The last time that

GERC approved a power tariff hike for discoms was in 2015-16

Winter chill pushes Delhi’s power demand to 5.2 GW, highest in 3 years

5 January: The prevailing cold conditions pushed

Delhi’s peak power demand to a record high of 5,247 MW, more than the peaks during winters in the past two years. According to the State Load Dispatch Centre (SLDC) Delhi data, peak power demand of the city clocked 5,247 MW at 10.56 am. The peak demand had crossed the 5,000 MW-mark (5,126 MW) this winter. The peak demand of 5,247 is the highest so far this winter. It is more than the peak power demand clocked during the winters of 2022 (5,104 MW) and 2021 (5,021 MW) yet lower than 5,343 MW in the winters of 2020. The surge in power demand was mainly due to increased heating needs of the people that normally formed 50 percent of the total demand, power distribution company said.

Provide power subsidy to weavers in the state: UP CM Yogi

5 January: Uttar Pradesh (UP) Chief Minister (CM),

Yogi Adityanath said that power subsidy should be provided to the 2.5 lakh weavers in the state for improving their productivity and economic wellbeing. He said that the power corporation should start taking preparatory measures to offer the subsidy to weavers which, in turn, would also help in preventing electricity theft. The Minister reviewed a presentation regarding the MSME Weaver Scheme and discussed issues related to the consumption of electricity and the subsidy provided to the sector with the officials.

Noida to get three new power substations by 2024

4 January: Given the growing population and rising demand during peak summers, the Uttar Pradesh Power Transmission Corporation Limited

(UPPTCL) is working on constructing three new substations for Noida which are expected to come up by 2023 and 2024. These include two 132 kilovolt (kV) substations in Sector 115 and Bhangel near Sector 110 and another 220kV substation in Sector 45. While the Sector 115 and Sector 45 substations are expected to be ready by August and September respectively, the substation at Bhangel will be ready by March 2024. A third substation of 220 kV is under construction in sector 45. Built at a cost of about INR800 mn, this substation is expected to be ready by September this year. Meanwhile, UPPTCL has completed work on two more substations of 132 kV capacity in sectors 63 and 67.

India, ADB sign US$220 mn loan to improve power sector in Tripura

4 January: The Asian Development Bank (ADB) and the government of India have signed a US$220 million loan agreement to improve energy security, quality of supply, efficiency, and

resilience of power sector in Tripura. After signing the loan agreement, the project would support the government of Tripura’s efforts to strengthen its power sector through replacement of inefficient power plants, strengthening of the distribution network and installation of smart meters that would help increase generation capacity, reduce distribution losses and to meet the increasing electricity demand to boost the state economy.

National: Non-Fossil Fuels/ Climate Change Trends

TGBL joins hands with PMC to extract clean, green hydrogen from waste

9 January: The GreenBillions Limited (TGBL) joined hands with The Pune Municipal Corporation

(PMC) to set up its first plant in India to extract green hydrogen from biomass and municipal solid waste. This project aims to demonstrate the technological and financial feasibility of waste to hydrogen generation. The upcoming plant in Pune will be managed by its wholly-owned subsidiary Variate Pune Waste to Energy Pvt. Ltd. (VPWTEPL). The company will also utilise the municipal waste of 350 tonne per day (TPD) of Pune to generate hydrogen for a period of 30 years, TGBL said. Refuse derived fuel (RDF) extracted from the waste would later be used to generate hydrogen with the help of Plasma gasification technology. The waste will comprise biodegradable, non-biodegradable and domestic hazardous waste and would be segregated at the TheGreenBillions’s facility in Pune using optical sensor technology. In the meantime, the firm is also in talks with other state municipalities across India to implement and set up similar plants in the future. Generating hydrogen can help India achieve its decarbonisation goals while significantly reducing emissions from waste disposal.

Ayodhya to get 10 solar ferries on Saryu river to promote tourism

8 January: The Ayodhya Development Authority

(ADA) will add a fleet of 10 solar ferries to take the tourists around the temple town. The ADA is planning to upgrade the infrastructure, and introducing swanky solar ferries will be a step in that direction. Solar panels will be installed on the roofs of the ferries along with a waterproof lithium battery. A minimum tenure of five years will be offered to the agency with an option to extend the memorandum of understanding between the two parties to 15 years.

Rajasthan: Industries to pay less consent fee for captive solar plants

8 January. In a move to encourage industrial units to install captive solar power plants, Rajasthan State Pollution Control Board

(RSPCB) has excluded the capital cost of solar power plants from the overall cost of the units’ capital investment for the purpose of calculating consent fee under the Water (Prevention and Control of Pollution) Act, 1974 and Air (Prevention and Control of Pollution) Act, 1981. For establishing a new industrial unit, the owners used to obtain consent from RSPCB under the two Acts and had to pay a consent fee, which was calculated on the overall capital investment of the units, including the cost of the solar plant. As per the latest order issued by RSPCB, the consent fee will now be calculated by excluding the cost of solar plant from the overall capital investment in the industrial units. PSPCB said the decision would promote green energy in the state.

Andhra Pradesh looks to become leader in green energy

8 January. Andhra Pradesh

(AP) is taking big strides in attracting investments in green energy. The state is giving a tough fight to the states which were so far known as hubs for green energy plants. The state secured fourth spot in generation of green energy in 2022 and it is going to be the leader in the next two-three years as the state government has lined up several big-ticket projects in renewable energy sector. According to the data compiled by the Centre, AP added 1,261.54 megawatt (MW) to the existing power generation through green energy during 2022. Centre said all the states together added nearly 30,000 mw through green energy during 2022, which is a significant growth. Interestingly, this additional generation through green energy is exclusive of big hydel projects.

Punjab to install solar panels in all state government buildings: Arora

6 January: In order to equip all state government buildings with solar photovoltaic (PV) panels, Punjab New and Renewable Energy Sources Minister Aman Arora directed heads of all departments to expedite the process to issue NOC so that panels can be installed at the earliest. Arora said the government is fully committed to strengthening the clean energy infrastructure for ensuring clean environment to people of the state. This environment friendly move will go a long way to decarbonise the power sector as Solar PV has become the most preferred source of renewable power due to the benefits that it offers. Arora said this ambitious project will be executed under Renewable Energy Services Company (RESCO) Mode and Punjab Energy Development Agency

(PEDA) has already installed solar PV of a total capacity of 88 MW on the rooftops of various government buildings and these have been successfully generating clean and green energy.

SECI extends date to submit bids for 10 MW solar project in Rajasthan

6 January: Solar Energy Corporation of India Limited (SECI) has extended till 9 January the last date to submit bids for operation and maintenance of

a 10 MW ground-mounted solar power project at Badi Sid in Rajasthan. The earlier last date was 2 January 2023. The revised date and time for bid submission is 9 January 2023 till 2 pm, and the bids will be opened at 4 pm on the same date, SECI said.

Environment ministry recommends expansion of Okhla waste-to-energy plant for clearance

6 January: The Expert Appraisal Committee (EAC) of the Ministry of Environment, Forest, and Climate Change has recommended the

expansion of the Okhla waste-to-energy plant for environmental clearance. In a meeting held on 30 November, the minutes of which were uploaded in December, the EAC for thermal power projects considered the proposal for the expansion of the plant from its existing capacity of generating 23 MW to 40 MW of electricity. From its current capacity of processing 1,950 tonnes per day (TPD) of waste, the expansion will involve the processing of an additional 1,000 TPD, taking the total to around 2,950 TPD. The expansion of the waste-to-energy plant at Okhla is among the MCD’s plans to deal with around 4,731 TPD of waste that is not processed, and therefore, ends up at landfills.

NTPC arm inks MoU with HPCL for development of renewable energy projects

5 January: NTPC Ltd said that its wholly owned subsidiary, NTPC Green Energy (NGEL) has signed a non-binding Memorandum of Understanding (MoU) with Hindustan Petroleum Corporation Ltd (HPCL) for development of renewable energy based power projects. The state-run power major said that its arm has inked a non-binding

MoU with HPCL for development of renewable energy based power projects to tap business opportunities in renewable energy and supply of 400 MW round the clock renewable power for requirements of HPCL. This MoU marks the first step for NGEL and HPCL to collaborate and cooperate in the field of development of renewable energy projects which shall help HPCL in meeting its clean energy commitments, the company said.

International: Oil

China issues second set of 2023 oil import quotas, up from 2022

9 January: China issued a second batch of 2023 crude oil import quotas, raising the total for this year by 20 percent compared to the same time last year. According to the document from the Ministry of Commerce, 44 companies, mostly independent refiners, were given 111.82 million tonnes (MT) in import quotas in this round. Combined with the 20 MT in 2023 quotas granted to 21 refineries in October, that takes the total for this year to 131.82 MT, up from the 109.03 MT issued in the first batch for 2022. The second batch of quotas for 2022 was released in June last year. China, the world’s biggest oil importer, allocated some 2023 quotas earlier than usual to shore up the sluggish economy by encouraging refiners to boost operations. Zhejiang Petrochemical Corp (ZPC), which operates China’s biggest privately-owned refinery site, was granted the largest quota of this batch at 20 MT, on par with last year’s issuance, according to the documents. Hengli Petrochemical received a quota of 14 million tonnes and Shenghong Petrochemical’s newly started 320,000 barrels per day (bpd) refinery received 8 million tonnes. Hengli won a quota of 4.83 million tonnes in the first batch in October. Global oil futures benchmarks Brent and West Texas Intermediate both gained than US$2 a barrel, on optimism for future fuel demand as China dropped its zero-COVID restrictions and began unfettered travel across its borders.

BP raises oil investments in the US as inflation hits

4 January: BP PLC said it planned to expand investments in the Gulf of Mexico and Texas, where it has its two top US (United States) oil and gas production operations. The increase comes as inflation costs hit the industry and as the White House calls on oil companies to expand oil supply to reduce fuel prices for consumers. The London-based company plans to increase spending in its US onshore oil and gas business, mostly in Texas, by 41 percent to US$2.4 billion in 2023 from US$1.7 billion last year, it said. BP said it planned to raise its Gulf of Mexico investment to an average of US$2.3 billion a year in 2023 to 2025 from US$2 billion per annum in the past five years. Despite that boost, BP reduced its offshore production plans in the Gulf to around 350,000 barrels of oil equivalent per day (boed) in the mid-2020s from the 400,000 boed previously planned for the period.

OPEC oil output rises despite production target cuts

4 January: Organization of the Petroleum Exporting Countries

(OPEC) oil output rose in December, a survey found, despite an agreement by the wider OPEC+ alliance to cut production targets to support the market. The OPEC pumped 29.0 million barrels per day (bpd) last month, the survey found, up 120,000 bpd from November. In September, OPEC output had been its highest since 2020. December’s rise was led by recovering output in Nigeria, which has been battling for months with crude theft and insecurity in its oil-producing region. Many Nigerian crude streams produced more in December, the survey said. OPEC+ had been boosting output for most of 2022 as demand recovered. For November, with oil prices weakening, the group made its largest cut to production targets since the early days of the COVID-19 pandemic in 2020.

International: Gas

In 2023, China’s appetite for LNG set to rise amid tepid demand across Asia

5 January: China’s liquefied natural gas (LNG) demand is forecast to recover in 2023 as the country emerges from COVID-19 controls to become the bright spot in Asia’s consumption for the super-chilled fuel. China’s demand is set to rebound to between 70 million and 72 million tonnes in 2023, 9 percent to 14 percent higher than in 2022, Rystad Energy, Wood Mackenzie and ICIS analysts said.

Tokyo Gas unit nears US$4.6 bn deal to buy US natural gas producer

4 January: A unit of Tokyo Gas Co Ltd is in advanced talks

to buy US (United States) natural gas producer Rockcliff Energy from private equity firm Quantum Energy Partners for about US$4.6 billion, including debt. If consummated, the deal would be the latest move by a Japanese entity to secure gas in jurisdictions perceived as friendly, the importance of which has risen for the import-dependent Asian nation after supply markets for the commodity were roiled by Russia’s invasion of Ukraine. Rockcliff produces more than 1 billion cubic feet per day of natural gas from the Haynesville shale formation, which stretches across Louisiana and East Texas. Quantum originally backed the Rockcliff management team with a US$350 million investment in 2015. Japan’s biggest city gas supplier is in the midst of a portfolio reshuffle aimed at moving resources to growth areas. In October, Tokyo Gas agreed to sell its stakes in a portfolio of four Australian liquefied natural gas (LNG) projects for US$2.15 billion to a unit of US investment firm EIG. Russia’s invasion of Ukraine has cut gas supply flows to Europe and led European nations to import record amounts of LNG cargoes, straining global supplies and elevating prices. Resource-poor Japan has been working to diversify from Russia’s Sakhalin project, which accounts for 9 percent of Japan's total LNG imports of 74.3 million tonnes (MT) per year. Japanese companies inked several deals on 28 December to receive LNG supplies, with a preliminary agreement lasting up to 10 years with Oman LNG and a 20-year deal with US-based Venture Global. In 2021, Japan imported 7.1 MT of LNG from the US, accounting for 9.5 percent of its total imports.

International: Coal

China boosts coal output, eases Australia ban to bolster energy security

9 January: The increasing need to secure energy supplies after easing

COVID-19 restrictions has pushed China to gradually resume Australian coal imports and urge domestic miners to boost their already record output. The lifting of the unofficial ban on Australian coal imports, which were halted in 2020 in a fit of Chinese pique over questions on COVID’s origins, is the clearest sign yet of the renewed ties between them. China purchased more than 30 million tonnes (MT) of coking coal and nearly 50 MT of thermal coal from Australia before buying stopped. Without Australian supplies, Chinese buyers turned to Indonesia for thermal coal, and Mongolia and Russia for coking coal, but struggled to obtain the high quality coal for power generation and steel production that Australia used to provide.

Protest at German village to block coal mine expansion

8 January: Protesters gathered in the west

German village of Luetzerath to challenge the extension of an open-air coal mine they say runs counter to the country's climate commitments. Protesters participated in a walk around the village, which is slated for destruction to allow for the extension of a neighbouring open-air coal mine. Energy giant RWE also agreed to stop producing electricity with coal in western Germany by 2030, eight years earlier than previously planned. The struggle over Luetzerath comes as Germany has restarted mothballed coal power plants amid an energy crisis triggered by the Russian invasion of Ukraine. Despite resorting to coal to ease the pressure on gas-powered plants, Germany says it is not wavering from its aim of exiting coal power in 2030.

International: Power

Sri Lanka cabinet approves new electricity tariff without saying what it is

9 January: Sri Lanka’s cabinet approved new electricity tariffs to reflect the cost of coal and power generation to take effect this month, Power Minister Kanchana Wijesekera said, without saying how much higher they would be. Sri Lanka raised electricity tariffs by 75 percent last August and a cabinet proposal to raise them by a further 25 percent had been under consideration. The 25 percent proposal had sparked widespread criticism from opposition political parties, unions and Sri Lanka’s power regulator. Sri Lanka has a state-run power monopoly, the Ceylon Electricity Board, which has incurred massive losses. The government has committed to increasing power prices to reduce losses and put public finances on a sounder footing.

International: Non-Fossil Fuels/ Climate Change Trends

Britain produced record amount of wind power in 2022: National Grid

6 January: Britain’s wind farms contributed a record 26.8 percent of the country’s electricity in 2022 although gas-fired power plants remained the biggest source of power, National Grid data showed. Britain has a target to reach net zero emissions by 2050 which will require a huge scale-up of renewable power generation such as wind and solar. The share of wind power in Britain’s electricity mix last year was up from 21.8 percent in 2021, the data showed, as more wind projects came online. The world’s largest offshore wind farm, Hornsea 2 off the Yorkshire coast in the North Sea, became fully operational in August 2022. The wind farm can generate enough electricity to power around 1.4 million homes.

US EPA tightens soot standards for first time in decade

6 January: The United States (US) Environmental Protection Agency

(EPA) will tighten national air quality standards for fine particle pollution emitted from vehicles and industrial sources for the first time since 2012, the EPA said. Fine particulate matter, or soot, comes from sources ranging from power plants to cars and trucks and refineries. It causes lung and heart damage and has been found to disproportionately affect low-income communities, according to the EPA.

Germany lagging emissions goals despite renewables boom

4 January: Germany’s carbon dioxide emissions held steady last year, jeopardising its climate targets as higher use of oil and coal offset lower energy consumption and record renewables output, data from climate think tank Agora Energiewende showed. Germany’s 2022 energy consumption fell by 4.7 percent year-on-year to the lowest since its reunification, thanks to spiking energy prices, mild weather and a government appeal for citizens to save energy in light of a sudden drop in Russian gas imports. Despite renewable energy reaching a record 46 percent share in Germany’s electricity mix, the greenhouse gas emissions of Europe’s biggest economy were around 761 million tonnes (MT) last year, missing a target of 756 MT and falling behind the 2020 benchmark of a 40 percent cut compared to 1990, Agora said.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV