Gas News Commentary: October - November 2016

India

The business media was pre-occupied with coverage of the ongoing battle between the private sector and the government over domestic gas production and contracts that governed them. However the scrapping of the $7 billion tender from GAIL (India) Ltd to hire newly built ships to ferry LNG from US following unwillingness of bidders to the 'Make-in-India' terms after a two year wait. GAIL was reportedly forced by the oil ministry to add the Make-in-India condition to its tender. GAIL wanted to time-charter nine newly built LNG ships of a cargo capacity of 150,000-180,000 m

3 to carry LNG from Sabine Pass and Cove Point LNG projects in US with supplies starting in December 2017. GAIL has an agreement to take 5.8 mtpa of LNG from US producers. Bids were sought in lots of three, with the condition that one of the three ships would be built at an Indian shipyard. Bidders reportedly said ‘no thanks’ to the condition as Indian shipyards neither had technology or experience of building the highly specialised LNG ships. GAIL is expected to hire LNG carriers from the global spot or current market to transport LNG. Among the bidders were a consortium of Mitsui OSK Lines, Mitsubishi Corporation-Kawasaki Kisen Kaisha Ltd (K Line) GasLog, Samsung Heavy Industries and Daewoo Shipbuilding. Some of the bidders had partnered with Indian companies.

Meanwhile, ONGC was reportedly continuing its pursuit of pricing freedom for natural gas produced in the country which is essential for boosting domestic output and developing India into a vibrant gas market according to ONGC. ONGC’s call echoes the demand from private sector players for pricing freedom. The effort to devise a formula for pricing natural gas based on a combination of international gas prices that were expected to keep prices high has failed as almost all international gas price benchmarks indicate low prices. Pricing freedom is allowed only for gas produced from blocks. Domestic gas prices have halved to $2.5/unit in two years, tracking global decline, dropping lower than ONGC’s average gas production cost of $3.5/unit. ONGC reportedly loses over $500 million in revenue and $340 million in profit annually for each dollar’s drop in local gas price. What holds gas prices back in India are electricity prices that are held at fixed levels for a wide range of social and political reasons. This is in complete contradiction to what generally happens in developed gas markets. In developed markets, electricity serves the high end of consumer energy demand such as lighting, refrigeration, entertainment, etc., that are elements of a modern economy that most consumers now consider a basic right. Consequently gas used for electrical generation is not as price sensitive as it is in other uses especially in countries that have stringent environmental regulations on power plant emissions. Gas price is sensitive only when it substitutes for oil at the low end of the scale in the boiler or black fuels market. In this segment of use, where gas, coal and fuel oils compete, demand is extremely price sensitive. When gas competes with gas from other sources (the so called gas to gas competition), gas thermal-equivalent prices fall below those of competing fuels, just as in the first segment gas prices are above those of alternative fuels. In the electricity and gas to gas competition markets, the gas market effectively decouples from other energy markets. In India this does not happen because at one end gas is kept out of the regulated electricity market by cheap domestic coal and at the other end there is no gas to gas competition.

Notwithstanding this conflict India was reportedly scouting for new LNG contracts globally as part of a push to secure cheap supplies for its under-utilized gas-fired power plants. Australia, Qatar and Iran were all in the target list. India’s gas-fired plants, amounting to about 25 GW run at less than a quarter of their capacity because of a shortage of the fuel at affordable prices. The minister in charge is said to have quoted a price range of $5-$5.50/mmBtu as affordable for power plants.

Rest of the World

The IEA’s Global Gas Security Review released recently called for more transparency into the LNG market, but it cautioned that LNG markets were less flexible than is commonly believed. According to the report, the share of LNG production capacity that is going offline due to lack of feedgas is growing, but security and technical problems also contribute to the issue. This resulted in the market having less extra capacity than assumed. Between 2011 and 2016, the level of unusable export capacity has doubled, disabling about 65 bcm of gas, which is equal to the combined exports of Malaysia and Indonesia, the world’s third- and fifth-largest exporters. The IEA expects the period of low oil and gas prices to further worsen the situation. In 2015, about 40 percent of LNG contracts had fixed destination terms, down from 60 percent for contracts signed up to the year 2014.

Pakistan is reported to have issued tenders seeking 240 cargoes of LNG through two separate tenders. The first tender invites bids from LNG suppliers for the delivery of 60 cargoes and the second for the supply of 180 cargoes delivered over a period of 15 years. Cargoes under both tenders are to be delivered to the LNG terminal operated by Pakistan GasPort Consortium at Port Qasim.

China is reported to be standing out as a bright spot for oversupplied LNG market. Imports over the first nine months of 2016 were 17.87 mt up 26.5 percent over the same period in 2015. This positive picture stands in contrast to Japan, the world's biggest buyer of gas where imports dropped 3.5 percent in the first eight months from year-ago levels. China's biggest LNG supplier was reported to be Australia, with imports jumping a massive 101.3 percent in the first nine months of the year to 8.13 mt. This puts Australia's share of China's imports at 45 percent, ahead of the 17 percent enjoyed by Qatar, the next biggest supplier. LNG spot prices in Asia was reported to have increased to $6.80/mmBtu up 70 percent from its low so far this year of $4/mmBtu in April.

Apparently US LNG is not making as big an impact as was expected in the lucrative Chinese market. This has led analysts to conclude that US LNG may struggle to compete in Asia. If so, the question that may be raised is whether GAIL’s deal with US LNG suppliers was as clever as it was thought to be?

NATIONAL: OIL

BPCL to export light diesel oil in rare move

November 22, 2016. Bharat Petroleum Corp Ltd (BPCL) will export a 35,000-tonne light diesel oil cargo from Kochi in southern India in a rare move. The state-owned refiner sold the cargo, which has a sulphur content of 1.5 percent, to Vitol. Shipping data shows the 'Teatrainy Bridge' is currently anchored at Cochin port and is expected to load a diesel cargo and head to Fujairah. This is likely the first time BPCL has exported such a cargo and it was sold through a tender. It can ship a couple of more cargoes but these exports will stop once a diesel-producing secondary unit at the Kochi refinery starts in January or February. The unit is part of the second phase of the Kochi refinery expansion. BPCL is expanding the refinery's capacity to about 300,000 barrels per day (bpd) from 190,000 bpd. The expansion was expected to be completed by October, but has been delayed to early 2017.

Source: Reuters

Sun Group, Adani among 42 firms to bid for discovered small oilfields

November 22, 2016. The government has received 134 bids for 34 of the 46 contract areas in an oilfield auction that closed with Sun Group and Adani Group bidding for some of the fields, a response the oil ministry described as “overwhelming”. India had sought bids for 67 discovered small fields, grouped into 46 contract areas, which were discovered by Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) but not developed for decades. The government took away these fields from the state firms and auctioned it under a new policy that allows contractors the freedom to market natural gas and cuts out bureaucratic micromanagement by introducing revenue-sharing between companies and the government. While 120 bids were received for all 26 onland contract areas on offer, only 14 bids were received for just 8 offshore blocks. All 12 contract areas without a bid were offshore. Of the 42 companies that participated in the auction kicked off in May, 32 are Indian private firms. Five foreign private companies, including Nippon Power Ltd and Hardy Exploration and Production, and five state firms, including Indian Oil Corp, Bharat Petro Resources and Prize Petroleum, have bid for some of the fields on offer.

Source: The Economic Times

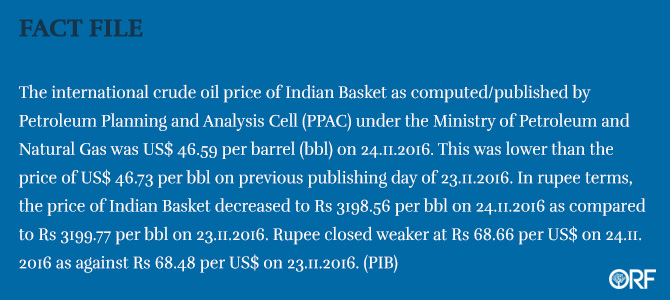

Govt to bear entire burden on sale of PDS kerosene and subsidized LPG for 2016-17

November 21, 2016. Oil Minister Dharmendra Pradhan said for the financial year 2016-17, it has been decided that the entire burden on sale of kerosene through public distribution system and subsidised liquefied petroleum gas (LPG) will be borne by the government. The under recovery of oil marketing companies (OMCs) on public distribution system (PDS) kerosene in the first half of 2016-17 stood at Rs 4, 123 crore while the subsidy on domestic LPG was Rs 4,557 crore. In the previous financial year, the under PDS kerosene recovery was Rs 11,496 crore and for domestic LPG it stood at Rs 16,074 crore. The prices of petrol and diesel have been made market determined by the Government effective June, 2010 and October, 2014 respectively. Since then, the public sector OMCs take decision on pricing of these products in line with their international prices and other market conditions.

Source: The Economic Times

Govt gets 6 more weeks to respond to Cairn Energy arbitration

November 20, 2016. India has won a six-week extension for replying to $5.6 billion claim sought by British oil explorer Cairn Energy plc for being slapped with aRs 29,047 crore retrospective tax demand. Cairn had in June field a 160-page Statement of Claim before a three-member international arbitration panel seeking quashing of the retrospective tax demand on a decade-old on an internal reorganisation of its India unit and sought $5.6 billion in compensation. India was to respond to that Statement of Claims by this month end but at a hearing earlier this month, the arbitration panel gave it time till mid-January to file the response. Cairn Energy had initiated the arbitration in March 2015 and the three-member arbitration panel had been constituted. But at a hearing last month, the government contended that the proceedings should be put on hold, sources said.

Source: Business Standard

IOC retail outlets in rural West Bengal start dispensing cash

November 18, 2016. Indian Oil Corp (IOC) retail outlets in rural West Bengal have started dispensing cash, the company said. It has already made the facility available in as many as 56 in the state along with 4 in Andaman. More than 150 such outlets spread across interior Bengal are likely to start dispensing cash by the end of 19 November. At present petrol pumps have been accepting currency notes of Rs 500 and Rs 1000 and will continue to do so till November 24, 2016. There is no shortage of petroleum products at the petrol pumps and consumers can purchase them as per their needs.

Source: The Economic Times

Iran overtakes Saudi Arabia as top oil supplier to India

November 17, 2016. Iran overtook political rival Saudi Arabia as India's top oil supplier in October, shipping data showed, just ahead of a producers' meeting this month to hammer out the details on output cuts aimed at reining in a global glut. Iran used to be India's second-biggest oil supplier, a position it ceded to Iraq after tough Western sanctions over its nuclear development programme limited Tehran's exports and access to finance. But India's oil imports from Iran have shot up this year after those sanctions were lifted in January. In October they surged more than threefold compared with the same month last year, rising to 789,000 barrels per day (bpd), according to ship tracking data and a report. That compares to 697,000 bpd supplied last month by Saudi Arabia. Over the whole January to October period, though, Saudi Arabia still holds India's top supply spot, at an average of 830,000 bpd versus Iraq's 784,000 bpd and Iran's 456,400 bpd. Iran's surge to the No.1 spot is due partly to less available crude from Saudi Arabia, which has increased its capacity to refine oil instead of just exporting more crude. Indian refiners including Reliance Industries Ltd, operator of the world's biggest refinery complex at Jamnagar, that had stopped imports from Iran during the sanctions period have also returned as buyers of Iranian oil. Iran produces almost 4 million bpd of oil and exports 2.4 million bpd. Tehran's exports dropped to 1 million bpd during sanctions, down from a peak of almost 3 million bpd in 2011, before tougher Western sanctions were implemented.

Source: NDTV

LPG price touches ` 3k per cylinder in Manipur on economic blockade

November 17, 2016. The ongoing United Naga Council (UNC)-sponsored indefinite economic blockade on national highways in Manipur has sent the price of cooking gas soaring with the price of one liquefied petroleum gas (LPG) cylinder touching Rs 3,000 in the grey market.

Source: The Economic Times

HPCL posts a profit of Rs 7 bn in Q2

November 16, 2016. Hindustan Petroleum Corp Ltd (HPCL) has posted a net profit of Rs 701.32 crore for the second quarter (Q2) of the financial year ended on September 30, compared to a net loss of Rs 317.13 crore for the corresponding period of the previous financial year. For the quarter under review, the company has registered 3.1 percent increase in gross sales to Rs47,750.60 crore compared to Rs 46,299.45 crore during the same period last year. Meanwhile, the combined gross refining margin (GRM) during the period July-September was $3.23 per barrel as compared to $2.74 per barrel during the corresponding previous period, primarily due to increase in cracks. During July-September 2016, the domestic sales of petroleum products have increased to 8.02 million tonnes from 7.78 million tonnes, registering a growth of 3.1 percent over the corresponding quarter of the previous year. The sales of petrol has increased by 9.3 percent, diesel by 1.1 percent, LPG by 14.6 per cent, aviation turbine fuel by 11.3 percent and lubes by 16.6 percent over the corresponding period of the previous financial year. HPCL is planning to raise Rs 6,000 crore through a bonds issue to finance their expansion plans. The company's board cleared the proposal to raise this amount from domestic as well as overseas markets within a period of 12 months. The board approved HPCL's plan to have 25 percent shareholding in the West Coast refinery. While Indian Oil Corp is set to get 50 percent stake in the Rs1,50,000 crore refinery, Bharat Petroleum Corporation Ltd and Engineers India Ltd are other two partners.

Source: Business Standard

NATIONAL: GAS

Govt taking steps to make India a gas-based economy: Oil Minister

November 21, 2016. Oil Minister Dharmendra Pradhan said the natural gas is one of the cleanest and most environment friendly fuels with extremely low carbon dioxide emissions as compared to coal and oil and added that the government was taking a number of steps to make India a gas based economy. Pradhan said the government was developing gas sources either through domestic gas exploration and production activities or through building up facilities to import natural gas in the form of liquefied natural gas. He said the government was working on gas pipeline infrastructure and secondary distribution network along with developing gas consuming markets like fertilizer, power, transport, industries etc. Fertilizer and power sectors are the major gas consumers in Indian gas market. They consume about 60 percent of total gas consumption at country level in FY 2015-16. In order to develop the gas consuming market, government has implemented fertilizer gas pooling scheme which has encouraged the utilization of installed fertilizer units in the country. On power sector, government has come up with a scheme to make operational the stranded gas based power plants on regasified liquefied natural gas (LNG). It has helped in reviving stranded power plants of around 16,000 MW capacity and saved them from becoming non-performing assets, the government said.

Source: The Economic Times

Commercial consumers rethink moving over to PNG in Kerala

November 18, 2016. The decision by Indian Oil-Adani Gas Pvt Ltd (IOAGPL) authorities to seek huge amount as security deposit from consumers seems to have put a ner in the works of the much hyped city gas project. Many consumers, especially with commercial connections, are now having a rethink over switching to piped natural gas (PNG). The IOAGPL snapped PNG connection to government medical college as the latter was reluctant to pay the security of Rs 5.18 lakh. They disconnected the PNG supply to commercial establishments in the campus that served three hostels and a Kudumbashree-run canteen. Of these, two hostels a BSc nursing hostel and a general nursing hostel permanently shifted to LPG after disconnection. The hostel for MBBS students also may soon go back to LPG. Many industrial units in Cochin Special Economic Zone (CSEZ) had plans to secure PNG connections to run their factories. Now, they are having a rethink. K K Pillai, president of CSEZ Industries Association said disconnecting PNG supply to medical college is a serious issue. This has forced the CSEZ companies to reconsider their demand for PNG connection. Besides a few domestic connections given during the inauguration of the city gas project on February 20, 2015, the IOAGPL couldn't make much progress. During the inauguration of the city gas project, the authorities had declared that 50,000 households in the district will get PNG in the next four or five years. There were also plans to roll out compressed natural gas (CNG) outlets in the city. But nothing concrete has happened so far.

Source: The Economic Times

NATIONAL: COAL

India aims to boost low grade coal sales while global prices high

November 21, 2016. India is trying to boost sales of its low-quality coal by offering more of the fuel at home and initiating steps to lower freight costs, while global prices are high, with the government hoping the moves will help cut imports. Coal India Ltd (CIL) has sharply boosted output in the past two years but has struggled to sell all of that due to softer domestic demand and the availability of superior-grade foreign coal at competitive rates, until recently. Coal Secretary Anil Swarup met Railways Minister Suresh Prabhu to discuss lowering the charges to move coal in some routes to lure private firms away from foreign coal. Daily dispatches of coal had already jumped by a fifth this month to around 1.6 million tonnes and the company is set to make a record amount of coal available to be sold through auctions. The company typically sells only 10 percent of total output through auctions to private companies but the government has relaxed that limit.

Source: Reuters

83 cancelled coal mines allocated so far: Goyal

November 21, 2016. The coal ministry announced that 83 coal mines have been allocated to be used for Power, Steel, Cement and Captive Power Production as well as for sale of coal. The government has so far successfully auctioned 22 coal mines to the non-regulated Sector and nine coal mines for specified end use power under the provisions of the Coal Mines (Special Provisions) Act, 2015. Coal Minister Piyush Goyal said that out of the 17 coal mines auctioned, mining operations have commenced in 10 schedule II mines. The Supreme Court had cancelled 204 coal mines due to irregularities in awarding the coal mines by the government. All the mines currently being auctioned off by the government are a part of the cancelled group. Goyal said that rest of the Schedule II coal mines are in the process of starting mining operations after obtaining necessary statutory clearances as well as appointment of mining contractor. Revenue amounting to ` 2,779.36 Crores has been generated till October, 2016 from the allocation of 83 coal mines. The revenue is being deposited with the coal bearing State concerned.

Source: The Economic Times

India's coal production rose 13 percent over 2 fiscal yrs: Goyal

November 21, 2016. India's coal production increased 13 percent from 565 million tonnes in 2013-14 to 639 MT in 2015-16, power, Coal Minister Piyush Goyal said. The minister said coal imports have fallen nine percent to 199.88 million tonnes in 2016. Goyal said that a roadmap has been prepared by Coal India Ltd (CIL) to substantially enhance production of coal by 2019-20. This includes capacity addition from new projects, use of mass production technologies and identification of existing on-going projects with growth potential. Coal is the biggest contributor to the total value of mineral production in the country.

Source: The Economic Times

SC refers Jindal's plea to other bench hearing coal scam cases

November 18, 2016. The Supreme Court (SC) said that a petition by industrialist Naveen Jindal, challenging framing of charges against him in a coal block allocation scam, would come up before a bench which is hearing the coal scam cases as one of the two judges wanted to recuse from the matter. The bench did not make it clear as to which of the two judges wanted to recuse from the hearing the matter. Besides Jindal's plea, several other accused who are facing prosecution in separate coal scam cases have also moved the apex court challenging framing of charges against them. A special court, set up by the apex court to exclusively deal with coal scam related cases, had framed charges against Jindal and others, including former Minister of State for Coal Dasari Narayan Rao and ex-Jharkhand Chief Minister Madhu Koda, in the Jharkhand's Amarkonda Murgadangal coal block allocation case.

Source: The Economic Times

Govt has auctioned coal linkages of 22 mt for non-regulated sectors so in current fiscal

November 17, 2016. Around 22 million tonnes (mt) of coal linkages have been auctioned till October in the ongoing fiscal for the non-regulated sector, including cement and sponge iron. There is an increase of about 10 million tonnes per annum in coal linkage to the non-regulated sector, Coal Minister Piyush Goyal said. Goyal said the coal-based generation as well as consumption of coal have been consistently increasing during preceding years. However, the government is now focusing on capacity addition of renewable energy sources to meet the demand and reduce dependence on coal for generation of electricity.

Source: The Economic Times

National: Power

Gujarat state discoms collect Rs 20 bn in power bills

November 22, 2016. With state-run electricity companies accepting demonetized currency notes from its customers for payment of electricity bills, four Gujarat government owned power distribution companies (discoms) have registered increase in their collections as on November 19, 2016. In order to ease the burden on customers, these state discoms have been permitted to accept old currency notes for both outstanding dues and advance payments for future consumption of power. Discoms will accept old currency notes till November 24, 2016. According to the data provided by Gujarat Urja Vikas Nigam Ltd (GUVNL), the cumulative power bill collectionits of its subsidiaries, as on November 19, stood at Rs 2,002 crore as against Rs 1,849 crore in October 2016 and Rs 1,665 crore in November 2015. While Pachim Gujarat Vij Company Ltd collected Rs 666 crore and Dakshin Gujarat Vij Company Ltd Rs 671 crore, the power bill collections of Uttar Gujarat Vij Company Ltd and Madhya Gujarat Vij Company Ltd stood at Rs 331 crore and Rs 279 crore respectively. Gujarat Energy Transmission Corp Ltd and others mopped up ` 55 crore as on November 19. Many customers offered to make advance payments of higher amounts, but according to the Gujarat Electricity Regulatory Commission norms, discoms were limited to receiving cash payments of up to Rs 20,000. Any amount above Rs 20,000 has to be paid through cheque.

Source: The Times of India

Vedanta looks to raise captive power generation capacity by 1.2 GW

November 22, 2016. Vedanta Ltd is looking at increasing its captive power generation capacity by 1,200 MW amid rising production. The company is considering setting up 350 MW super-critical units in joint ventures at its different production bases in the country. Vedanta has an electricity generation capacity of nearly 9,000 MW of which 200 MW comes from wind and the rest from thermal. Nearly 60% of the 9,000 MW is for captive use, the remaining is sold in the market. Vedanta is looking at various models for procuring quality power supplied steadily at competitive rates. Vedanta has already invited an expression of interest and is evaluating the pros and cons of various models. Around 3,554 MW of the total capacity, meant for commercial sale, is running at around 70%. The remaining 5,194 MW is for captive usage, where capacity utilisation has risen with the rise in production. In Jharsuguda in Odisha, Vedanta has a power generation capacity of 3,615 MW of which 600 MW is for commercial sale while the rest is for captive use. The commercial capacity utilisation is around 80%. At the Talwandi Sabo Power project in Punjab, the entire capacity of 1,980 MW is for commercial sale on a long-term basis. The project recently saw a dip in power sales but capacity utilisation has now risen to 90%.

Source: The Economic Times

Gurgaon power department all set to invest Rs 2 bn to maintain and upgrade feeders

November 22, 2016. Power woes of residents in private colonies are likely to be resolved soon. The power department is all set to invest Rs 200 crore to upgrade and maintain the feeders installed in builder areas and group housing societies. The power department said around Rs 1 crore is required to upgrade and maintain one feeder on an average. As of now, residents in builder areas and housing societies are facing outages for hours owing to insufficient infrastructure, over-loaded and erratic supply. The power department said builders, who should take care of power infra maintenance in plotted colonies and group housing societies, pass the responsibility to resident welfare associations. Power distribution companies have been working on other ways to ensure circuits and cables don't break under excess load. Also, workers have many a time complained that they don't get necessary equipment to tackle outages and erratic supply.

Source: The Economic Times

Govt mulls central transmission entity

November 21, 2016. Government is looking at creating a separate entity to function as a dedicated central transmission utility with operational and financial authority. At present, Power Grid Corp discharges the Central Transmission Utility (CTU) functions. Its arm Power System Operation Corp (PSOC) manages the electricity grid in the country. PSOC ensures integrated operation of regional and national power systems to facilitate transfer of electricity within and across regions and trans-national exchange of power. Power Minister Piyush Goyal said that during the April-October period of the current fiscal, 2.67% of coal and lignite based thermal units could not generate electricity at all. During 12

th Plan (2012-17) till September 2016, he said, a total of 3,000 MW of inefficient thermal generating capacity has been retired. This will result in better utilisation of more efficient plants. Goyal said that as reported by the states, there were 18,452 un-electrified census villages in the country, as on April 1, 2015. Out of these, 10,628 villages have been electrified as on October, 31, 2016 and the remaining 7,824 un-electrified villages are targeted to be electrified by May, 2018. As per Census 2011, out of 1,678 lakh rural households in the country, 750 lakh were un-electrified. However, 249.89 lakh BPL households have been released connections under Deendayal Upadhyaya Gram Jyoti Yojana, including Rural Electrification component, as on October, 31, 2016, he said. Goyal said that the 23,273.5 MW capacity of coal and lignite based thermal power generating units were un-utilised due to its non-schedule from beneficiaries as on November 14, 2016. The un-utilised capacity of gas and other liquid/multi fuel power stations cannot be quantified as it depends on availability of gas, he said.

Source: Business Standard

IIT Madras to develop multi-village microgrid models for efficient, green power supply

November 21, 2016. IIT Madras recently said it will collaborate with industry to develop a more efficient, cheaper and cleaner way to ensure power supply to villages through the use of microgrids. The government of India is looking at a generation capacity of 40 GW in the next five years through grid connected (GC) solar photovoltaic (PV) rooftops and small scale solar PV plants. And, IIT Madras and power and automation technology company ABB India will further this plan through a collaboration to develop a system that will operate multiple microgrids, with or without a grid connection, to transmit electricity reliably to small villages. This system will also enable the integration of individual solar PV rooftops to the microgrid of a village.

Source: The Times of India

UP govt gives nod to power projects worth Rs 7.6 bn

November 19, 2016. Uttar Pradesh (UP) government approved power projects worth Rs 768.42 crore which include Rs 125 crore for improvement of power supply infrastructure in the city. While Rs 77 crore has been approved for removal of overhead power cables and laying of underground cables in Chowk, Rs 48 crore have been cleared for underground cabling of power cables from Charbagh station to Bapu Bhawan and from DM residence to Hazratganj. Several other power projects were also granted approval, including Rs 44 crore for removal of overhead power cables and laying of underground cables in several localities of Badaun and Rs 138.60 crore for removal of overhead power lines and laying of underground cables in crowded market areas of Meerut, Ghaziabad, Saharanpur and Moradabad.

Source: The Economic Times

Haryana launches VDS for power consumers

November 19, 2016. Haryana government launched a Voluntary Disclosure Scheme (VDS) 2016 for declaring tampered or defective meters for all categories of consumers having sanctioned load up to five KW. The scheme shall remain in operation from November 20 to December 31, 2016, Chief Minister Manohar Lal Khattar said. The cases of such consumers, who voluntarily declare tampering of meter or meter being defective, shall be decided as per the provisions of the scheme. Khattar said the consumers would be charged on nominal consumption basis as per their sanctioned load for last one year on current normal tariff only, instead of twice the tariff along with compounding charges. The cases of defective meters, including burnt meters, shall also be covered under the scheme, Khattar said. No checking will be carried out during the period of operation of the scheme for consumers having load up to 5 KW and no meter having similar load will be seized and sent to the lab for testing during this period. The state also launched Surcharge Waiver Scheme- 2016 for small domestic and non-domestic consumers (having sanctioned load up to 2 KW) in rural areas. The scheme will also cover small domestic consumers of up to 2 KW load in urban areas whose connection has been disconnected for non-payment. The consumers, whose cases are at present in court, will not be covered under this scheme. However, if the consumer withdraws the case, this scheme will be applicable.

Source: The Indian Express

CESC extends power distribution operations to Bharatpur, Rajasthan

November 17, 2016. CESC, an RP-Sanjiv Goenka Group Company which serves 3.1 million customers in Kolkata, has started its distribution franchisee operation at Bharatpur. This is the group’s second distribution operation in Rajasthan – the one at Kota, Rajasthan had begun in September this year. According to A.N Singh, chief executive officer, CESC Rajasthan, while the recently formed Bharatpur Electricity Supply Ltd (BESL) has taken over the technical operations and maintenance responsibility at Bharatpur with effect from November 16, full-fledged commercial activities will begin from December 1, this year. Bharatpur city currently has more than 52,000 power consumers with annual energy sales amounting to 230 million units.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/CLIMATE CHANGE TRENDS

Engaged with all members of NSG: India

November 22, 2016. India said it was engaged with all the members of Nuclear Suppliers Group (NSG) for its entry into the 48-nation grouping, days after its hopes to secure a membership were dashed after a NSG meeting in Vienna did not make a headway on the issue. China, which blocked earlier India's entry during a NSG Plenary in Seoul in June on the ground that it has not signed the NPT, has held two rounds of talks with India about its admission into the group. Beijing's stand for a non-discriminatory criteria is regarded significant as Pakistan, a close ally of Beijing, too has applied for the NSG membership along with India. At the Vienna meeting of the NSG, members talked about the technical, legal and political matters relating non-NPT members accession to the NSG. India has been maintaining that NPT membership was not essential for joining the NSG, as was the case with France.

Source: The Economic Times

CPCB readies action plan to fight bad air

November 22, 2016. After being rapped for not adopting any emergency smog control measure, the Central Pollution Control Board (CPCB) is preparing an action plan that will be submitted to the Supreme Court on November 25. To draft the plan, the board has depended on the air quality index (AQI) calendar that shows the seasonal shift in air pollution levels. The calendar shows the period from November to February to be the worst with the highest number of very poor and severe levels. CPCB will propose not to allow any maintenance work in the city during these four months. It is, however, not considering stringent measures such as hiking parking fees or banning diesel cars that other cities like Paris and Beijing adopt as part of the emergency alert system. The AQI calendar shows September and October as moderate, March to May as poor and August as usually satisfactory. The Environment Pollution Control Authority (EPCA) submitted a note to the apex court earlier this month on the measures taken by cities across the world to control air pollution. Paris, for instance, doesn't allow diesel cars into the city during smoggy days, Beijing restricts 80% of government-owned vehicles on 'red alert' days, or after three consecutive days with very poor air quality, it shuts kindergartens and schools, and asks factories to cut emissions. EPCA recommended that two consecutive days of 'severe' air quality should be tackled by making public transport free, doubling parking charges, banning diesel vehicles, shutting down construction activities, and imposing odd-even measures like road rationing. The Centre for Science and Environment said the plan should be good enough to tackle various grades of air quality and should not leave any polluting source out.

Source: The Times of India

1 GW solar power to be added before the end of fiscal

November 21, 2016. The Telangana power utilities are gearing up to add 1,000 MW more through solar energy to the grid before the end of the current financial year. The utilities have already floated tenders for setting up of solar plants and they received enthusiastic response from the bidders in this regard. The Telangana utilities have already added close to 1,000 MW to the grid through renewable sources, predominantly solar, after the announcement of comprehensive solar power policy. As part of the policy, the utilities have decided not to collect cross subsidy and wheeling charges from the developers besides ensuring reimbursement of value-added tax (VAT). The addition of 1,000 MW more would come as a breather to the State which had initially faced difficulties in the power sector. The State had entered into long term power supply contract with neighbouring Chhattisgarh to overcome the shortages with supply costing over Rs 4 a unit. The State presently has generation capacity of over 4,300 MW through thermal (2,282.5 MW) and hydel (2,081 MW) while works are in progress for capacity addition of 960 MW including 600 MW through thermal energy and 360 MW through hydel power. The utilities have decided to utilise the existing infrastructure for evacuation of power generated through the solar plants.

Source: The Hindu

RInfra bags Rs 36.7 bn order from NLC India

November 21, 2016. Reliance Infrastructure Ltd (RInfra) has won an EPC order for Rs 3,675 crore from NLC India Ltd for setting up two lignite based Circulating Fluidized Bed Combustion (CFBC) thermal power projects with a capacity of 250 MW each. The power projects will be set up at Barsingsar and Bithnok of Bikaner district in Rajasthan. NLC's thermal power stations are South Asia's first lignite fired and India's first pithead based power station. NLC operates five thermal power stations with an aggregate capacity of 3,240 MW in the states of Tamil Nadu and Rajasthan.

Source: Business Standard

Delhi to get its largest Waste-to-Energy power plant in a fortnight

November 21, 2016. The national capital is likely to get its third and largest Waste-to-Energy power plant within the next fortnight. The 24 MW capacity plant has been set up at a cost of ` 46 crore by civic body North Delhi Municipal Corp (NDMC). NDMC is planning to officially inaugurate the Narela-Bawana plant, near the Haryana border, by the beginning of December. Apart from the project cost, NDMC will also spend around ` 36 crore for waste management. The plant, set up with technical assistance of experts from Austria, would process 1,300 tonne of waste every day. Hyderabad-based Ramky Group will operate the new plant. The company was awarded the contract to collect garbage from households and separate it into biodegradable and non-biodegradable waste. Delhi currently has two working waste-to-energy plants in Ghazipur and Okhla. The Ghazipur plant receives more than 1,200 tonne of waste everyday generating 12 MW of power. The Okhla project uses around 1,300 tonne of waste producing 16 MW electricity.

Source: The Economic Times

Develop rice varieties to cope with climate change: Swaminathan

November 21, 2016. Stating that rice is going to be the future crop and the "food security saviour", renowned agriculture scientist M S Swaminathan said there is no time for scientists to relax but develop varieties that can better adapt to climate change and boost rice yields. No doubt introduction of the first "semi-dwarf rice variety IR8" by International Rice Research Institute (IRRI) way back in 1967-68 and subsequent other varieties triggered Green Revolution in India, but much more need to be done as the country's rice yields are very low at 3.5 tonnes/hectare despite being the second biggest rice producer, he said. Swaminathan, who is known as Father of India's Green Revolution, however, cautioned scientists to develop such farm technologies which are economically sound. This month marks the 50 years of the world's first high- yielding rice variety 'IR8' that sparked the Green Revolution in Asia and saved the region from famine in the 1960s and 70s.

Source: Business Standard

84 percent of solar cells, modules imported from China in FY16

November 21, 2016. About 84% of solar cells and modules imports were from China alone in 2015-16. As much as $1.96 billion worth of solar cells and modules were imported from China alone against the total imports of these worth $2.34 billion in 2015-16, New and Renewable Energy Minister Piyush Goyal said. India had imported solar cells and modules worth $820.95 million in 2014-15 including $603.34 million imports from China alone. Similarly, out of the total imports of other photocells of $64.57 million, $49.96 million were from China alone in the last financial year. Total windmills imports were $727,741 which includes $190,096 from China alone. Goyal said that government is providing support to domestic manufacturers through a provision of reserving some capacities for domestic cells and modules which give assured market to domestic manufacturers. Anti-dumping duty on some countries will still leave scope for imports from other countries and does not give assured market for domestic manufacturers, he said. The government has set an ambitious target of adding 175 GW power generation capacities by 2022 from renewable sources, including 100 GW of solar, 60 GW of the wind, 10 GW from biomass and 5 GW from small hydroelectric projects.

Source: Business Standard

Andhra Pradesh CM commissions 5 MW Solar power plant

November 21, 2016. Andhra Pradesh Chief Minister (CM) N Chandrababu Naidu commissioned a 5 MW solar power plant on the Polavaram right canal bund at Gollagudem village in West Godavari district. The plant, set up at a cost of ` 37.58 crore in 37 acres, will produce 8.06 million units of power annually. The Centre has extended a capital subsidy of ` 7.50 crore for this plant. Andhra Pradesh, which commissioned the country’s first solar park with a capacity of 250 MW in Anantapuramu district this year, currently has an overall installed capacity of 1000 MW of solar energy.

Source: The Hans India

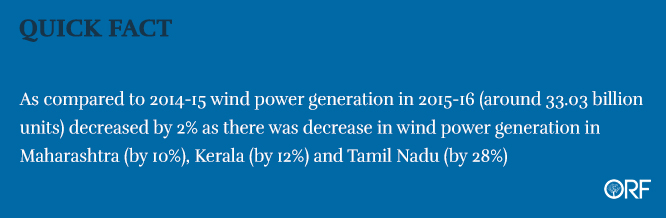

Renewable energy capacity increased by 14.3 GW in the last 2 yrs

November 21, 2016. A capacity of 14,300 MW of renewable energy has been added during the last two and half years in the country. The ministry of new and renewable energy announced that 5,800 MW of solar power, 7,040 MW of wind power, 530 MW of small hydro power and 930 MW of Bio-power has been added to the grid connected renewable power in the past two years. The government has taken initiated various policies to promote renewable energy in the country including: development of power transmission network through green energy corridor project and incorporating measures in integrated power development scheme (IPDS) for encouraging distribution companies and making net-metering compulsory.

Source: The Economic Times

India's solar power capacity crosses 10 GW

November 18, 2016. India has achieved a major milestone in solar power capacity addition. Cumulative solar capacity, including rooftop and off-grid segments, has crossed 10,000 MW in the country. The pace of sector activity has picked up tremendously in the last two years because of strong government support and the increasing price competitiveness of solar power, according to a report by Bridge to India, a global solar energy consulting firm. India is expected to become the world’s third biggest solar market next year, after China and the US. An average annual capacity addition of 8-10 GW per annum is expected from next year. Some key themes can be observed in the growth of the Indian solar market so far. Among the states, Tamil Nadu has the highest installed capacity, followed by Rajasthan, Andhra Pradesh, Gujarat, Telangana, Madhya Pradesh and Punjab. These seven states collectively accounted for more than 80 percent of total installed capacity as of mid-November 2016. Some of the larger power consuming states such as Maharashtra and Uttar Pradesh are way behind in the sector. The report said that the solar park scheme has also been instrumental in tackling the two major issues of land acquisition and power evacuation for project development.

Source: The Hindu Business Line

International: Oil

Baytex buying northern Alberta heavy oil assets for $48.3 mn

November 22, 2016. Mid-sized Canadian oil producer Baytex Energy Corp has agreed to buy heavy oil production assets in the Peace River region of northern Alberta in a deal worth C$65 million ($48.35 million), the company said. The predominantly heavy oil assets are adjacent to Baytex's existing Peace River lands and would add around 3,000 barrels of oil equivalent per day (boepd) to its total production of 67,000 boepd, the Calgary-based company said. The deal includes 3,000 boepd of production that has been shut in due to subdued oil prices and regulatory requirements. Baytex said bringing those volumes back online would cost around C$30 million, and it expected to restart that production over the next few years as long as crude prices were "favorable."

Source: Reuters

Sweden's Lundin Petroleum finds more oil in Norwegian Arctic

November 22, 2016. Lundin Petroleum has found additional oil and gas in the Norwegian Arctic, the Swedish company and the Norwegian Petroleum Directorate said. The find is located some 60 km (37 miles) from Lundin's Alta find, which the company estimates could contain up to 400 million barrels of oil equivalent, and 20 km from the Johan Castberg discovery which contains up to 600 million barrels of oil. Oil companies such as Statoil and Lundin have great hopes that the Norwegian Arctic, which is much less explored than the North Sea, could contain significant new oil and gas resources. Others are less enthusiastic, however, with Royal Dutch Shell, Total and Eni not participating in the latest oil licensing round organized by Norway, which focused on the Arctic. The only find in production in the Arctic Barents Sea is Eni's Goliat, but others are in development, such as Statoil's Johan Castberg field. Lundin will next drill a prospect called Filicudi, also located in the Barents Sea, which the firm estimates could contain up to 258 million barrels of oil equivalent.

Source: Reuters

Trump’s day one vow can alter energy rules but not market forces

November 22, 2016. President-elect Donald Trump can deliver on his promise to remove restrictions on United States (US) energy production hours after taking office, even though it will take more than the stroke of a pen to rewrite the shifting economic landscape for coal, oil and gas. The incoming president has a short list of actions he can take on his own -- and experts say even those won’t generate immediate results. Trump can order federal agencies to stop writing new regulations and pull back those that haven’t yet taken effect, including potential leak detection requirements for existing oil wells. Oil and gas companies that could benefit from relaxing rules governing drilling and production on federal land include Anadarko Petroleum Corp, Occidental Petroleum Corp and Continental Resources Inc. The American Petroleum Institute said lawmakers and the president should prioritize work against an "avalanche of regulations or other policy-setting activities that could discourage production."

Source: Bloomberg

Canadian oilwell drilling to jump in 2017

November 22, 2016. Drilling in Canada's oil and gas fields will pick up in 2017 because of more favorable pricing after two years of record low activity, an industry group said in its annual forecast. The Canadian Association of Oilwell Drilling Contractors said a more stable United States (US) benchmark crude oil price would lead to a 31 percent increase in the number of wells drilled to 4,665 next year from an estimated 3,562 by the end of 2016. The industry group forecast operating days would rise 21 percent to 48,980 in 2017 but expects the fleet to drop by 55 drilling rigs to 610.

Source: Reuters

Japan shares rise for ninth day as oil rally overshadows quake

November 21, 2016. Japanese stocks extended their winning streak to a ninth day as a rally in oil companies overshadowed concerns following a magnitude 7.4 earthquake off the coast of Fukushima. Oil explorers were the biggest gainers for a second day, buoyed by higher crude. Prices rose after Iran and Iraq signaled that a group of oil-producing countries would reach a supply-cut deal. Japan’s largest oil and gas explorer Inpex Corp advanced 1.7 percent while Japan Petroleum Exploration Co. added 2.5 percent.

Source: Bloomberg

Scope for OPEC deal makes oil short-term buy: Goldman

November 21, 2016. Goldman Sachs Group Inc raised its oil-price forecast for early next year, while Russia, Iran and Iraq separately signaled optimism that producer nations will be able to reach a deal to limit output at OPEC’s next meeting on November 30. Goldman is now "tactically bullish” on the likelihood of an OPEC agreement and expects oil prices in New York to average $55 a barrel during the first half of 2017, up from previous estimates of $45 and $50 for the first and second quarters, analysts said. The outlook comes amid growing signs that members of the OPEC and Russia will be able come to an agreement to curb production ahead of the producer group’s meeting at the end of the month. Goldman Sachs now forecasts that OPEC will put in place a short-term cut to 33 million barrels a day, while Russia will freeze production. In the second half of 2017, stronger demand growth and lower output from high-cost countries will help balance the market, analysts said. Goldman said it still expects West Texas Intermediate prices to average $52.50 a barrel next year and Brent crude $54.

Source: Bloomberg

Rowan, Saudi Aramco to form JV to operate offshore drilling rigs

November 21, 2016. Rowan Companies Plc said it was forming a joint venture (JV) with Saudi Arabian state oil giant Saudi Aramco to operate offshore drilling rigs in the country. Rowan said it would provide three jack-up rigs and Saudi Aramco two when the JV begins operations in the second quarter of 2017. Both companies would contribute $25 million as working capital, Rowan said. Rowan will supply two more rigs in late 2018 and Saudi Aramco will make a matching cash contribution. Rowan said the rigs would receive contracts for an aggregate 15 years, renewed and re-priced every three years, provided that the rigs meet the technical and operational requirements of Saudi Aramco. Nabors Industries Ltd had said that it would form a joint venture with Saudi Aramco to operate onshore drilling rigs.

Source: Reuters

Canada oil sands Asia export dream faces port bottleneck

November 20, 2016. The bullish view for Suncor Energy Inc, Cenovus Energy Inc and other Canadian energy producers calls for Prime Minister Justin Trudeau by next month to approve a major pipeline expansion to the west coast, boosting sales of land-locked oil sands crude to Asia. But a growing number of shipping brokers and physical oil traders warn that any new influx of oil will hit a bottleneck in Vancouver, because of the port's inability to accept the megaships that dominate oil trade globally. Middle Eastern producers already ship oil ship to Asia far more cheaply, thanks to the bigger vessels they employ. And United States (US) Republicans winning out in this month's election have revived hopes that TransCanada Corp could build the Keystone XL pipeline to the US, sidestepping Vancouver altogether. The decision in front of Trudeau is whether to expand Kinder Morgan Inc's 300,000 barrel per day (bpd) Trans Mountain pipeline, which carries Alberta crude to Vancouver. The project, fiercely opposed by many environmentalists and aboriginal groups, would increase total capacity to 890,000 bpd. Currently, some 98 percent of Canadian crude exports reach the United States, where it sells at a discount to world prices. Vancouver is the only west coast port where it can be sold on to Asia.

Source: Reuters

Oil may rise to $55 if all producers cooperate: Iran

November 19, 2016. Iranian Oil Minister Bijan Zanganeh expressed optimism about an upcoming Organization of the Petroleum Exporting Countries (OPEC) meeting and said crude prices could jump to $55 a barrel if an agreement is reached and non-OPEC producers cooperate. The OPEC is moving closer toward finalizing its first deal since 2008 to limit oil output, with most members prepared to offer Iran significant flexibility on production volumes. Iran has been the main stumbling block for such a deal because Tehran wants exemptions as it tries to regain oil market share after the easing of Western sanctions in January.

Source: Reuters

Tesoro to acquire Western Refining for $4.1 bn

November 18, 2016. Unites States-based oil refiner Tesoro has entered into an agreement to buy Western Refining for $4.1 bn to create a highly integrated and geographically diversified company. The acquisition is expected to offer a strong platform for earnings growth and cash flow generation for Tesoro. The deal is expected to improve the integrated refining, marketing and logistics operations of both companies. Following the completion of the acquisition, the company will have ten refineries, a refining capacity of over 1.1 million barrels per day.

Source: Energy Business Review

Glencore seeks $550 mn to raise stakes in Kurdish oil game

November 18, 2016. Glencore is seeking to raise $550 million from investors via a debt issue guaranteed by oil from Iraqi Kurdistan in an attempt to secure a big slice of the high-risk - and high-reward - market in a region at war with Islamic State. Kurdish oil has been targeted by European traders over the past two years, during an industry downturn, since Erbil began selling oil independently from Baghdad. It has been relatively cheap due to the potential for supply disruptions and threats from Iraq's central government to sue anyone touching the crude. The government of the autonomous Kurdish region in Erbil has borrowed around $2 billion from Glencore's rivals such as Vitol, Petraco and Trafigura to be repaid in oil. The companies have all borrowed money from banks and lent it to Erbil at their own risk. Glencore expects to enter into a new 5-year agreement with the government of Kurdistan to buy its crude, with deliveries rising from one cargo in January, to two in February-March, four in April and six from May onwards.

Source: Reuters

Jan-Sept oil output at Azeri projects up to 644k bpd: BP

November 18, 2016. Oil output from BP-led oilfields in Azerbaijan rose in the first three quarters of 2016 to 644,000 barrels per day (bpd) from 640,000 bpd in the same period last year, BP-Azerbaijan said. January-September natural gas production stood at 8 billion cubic metres (bcm) and condensate output was 1.9 million tonnes, up from 7.2 bcm of gas and 1.66 million tonnes of condensate in the same period last year.

Source: Reuters

Drawing closer to OPEC on output: Russian Energy Minister

November 18, 2016. Russian Energy Minister Alexander Novak said after meeting Organization of the Petroleum Exporting Countries (OPEC) counterparts he was more confident a deal could be reached between Moscow and the group on output to help lift world oil prices. Novak said he had a productive meeting with Saudi Energy Minister Khalid al-Falih in the Qatari capital, which is hosting a summit of gas exporting countries. Novak said an output freeze is one of the options under discussion, though he declined to give details or reveal at what level output would be frozen. He said he was confident OPEC can reached agreement in Vienna on November 30 when it is due to meet to finalize a preliminary deal on output, but he said for Russia it was important the group stick to its agreements.

Source: Reuters

Trump's empty threat to stop buying Saudi oil

November 17, 2016. President-elect Donald Trump is very unlikely to restrict imports of crude oil from Saudi Arabia despite threats to do so issued during the election campaign. The prospect of an import ban on Saudi crude is one of those things he said that should not be taken seriously but was meant to galvanize support from oil workers hit by the downturn. Trump warned that he would be prepared to stop buying oil from Saudi Arabia unless the kingdom provided ground troops to fight Islamic State. He also insisted the kingdom and other Gulf oil producers should compensate the United States for the enormous cost of providing them with military protection. Trump said the United States "desperately needed" oil from the Gulf a few years ago but now was on the verge of achieving energy independence thanks to the shale revolution. The United States has always had a complicated relationship with Saudi Arabia and other members of the Organization of the Petroleum Exporting Countries.

Source: Reuters

Wisting Arctic discovery may exceed 1 bn barrels: OMV

November 17, 2016. Energy firm OMV's Wisting discovery in the Barents Sea, the northernmost oil find off Norway, could contain more than one billion barrels of oil equivalents, it said, potentially making it the largest find in the Norwegian Arctic so far. OMV and its partners continue to explore the area and aim to decide on whether to develop the discovery in 2019 or 2020, OMV's Norway chief David Latin said. The company so far estimates recoverable resources of between 200 million and 500 million barrels of oil equivalents, but this is still a preliminary number. Partners in the Wisting discovery are OMV, Norway's Statoil , Japan's Idemitsu and Norwegian state oil firm Petoro.

Source: Reuters

Venezuela taps China credit line for $2.2 bn oil output push

November 17, 2016. Venezuela said it would tap $2.2 billion from a Chinese credit line to boost oil output at joint ventures with China National Petroleum Corp, in a boost for the South American country's struggling oil industry and a show of unity with a key ally. CNPC and Venezuela's state oil company PDVSA will seek to boost production in the OPEC country by around 277,000 barrels per day (bpd), President Nicolas Maduro said. Funds will come from a credit line of up to $9 billion with China, Maduro said. The agreement will be a boon to Venezuela's oil industry, which has seen its production tumble this year amid a steep recession. Venezuela has borrowed over $50 billion from China under a financing arrangement created by late socialist leader Hugo Chavez in 2007, in which a portion of its crude and fuel sales to the world's second-biggest economy are used to pay down loans. The increased oil output at the joint ventures would boost shipments to China to over 800,000 bpd, Maduro said.

Source: Reuters

Oil demand won't peak before 2040, despite Paris deal: IEA

November 16, 2016. The International Energy Agency (IEA) expects global oil consumption to peak no sooner than 2040, leaving its long-term forecasts for supply and demand unchanged despite the 2015 Paris Climate Change Agreement entering into force. The IEA's central scenario assumes demand will reach 103.5 million barrels per day (bpd) by 2040 from 92.5 million bpd in 2015, for which India will be the leading source of demand growth and China will overtake the United States to become the single largest oil-consuming nation.

Source: Reuters

Norway's DNO signs Iran oil field deal

November 16, 2016. Norwegian oil and gas company DNO is to study the development of an oil field in Iran, becoming the second western company after France's Total to sign an energy deal in the country since the lifting of sanctions. DNO said it had signed a memorandum of understanding with the National Iranian Oil Company (NIOC) to conduct a study on the development of the Changuleh oil field in western Iran. Changuleh, discovered in 1999 but never developed, is estimated to hold more than 2 billion barrels of oil, the company said. DNO has operations in North Africa and the Middle East, particularly in Iraqi Kurdistan. Total signed a deal with NIOC to further develop the South Pars gas field in the Gulf, the world's largest field which extends into Qatari waters.

Source: Reuters

International: GAS

US unveils 5 year O&G leasing plan for OCS

November 21, 2016. The Unites States (US) Department of Interior (DOI) and the Bureau of Ocean Energy Management (BOEM) have unveiled a five-year offshore oil and gas leasing plan for the country’s Outer Continental Shelf (OCS). The 2017-2022 plan offers 70% of economically recoverable resources in the OCS while ensuring protection of regions with critical ecological resources, including the Arctic. The government plans to offer 11 potential lease sales including 10 lease sales in the Gulf of Mexico and one lease sale in the Cook Inlet off the southern coast of Alaska. According to Interior Department’s technical analysts, the Beaufort and Chukchi seas, which form one of the most prospective basins in the world, are estimated to hold 23.6 billion barrels of oil and 104.4 trillion cubic feet of natural gas.

Source: Energy Business Review

Tokyo Gas signs location swap deal with British utility Centrica

November 21, 2016. Japanese gas supplier Tokyo Gas Co said it has signed a memorandum of understanding with British utility Centrica for a location swap of liquefied natural gas (LNG) to cut transportation costs. A location swap of LNG is still rare globally, but it is expected to grow in number in Japan as cutting procurement costs is essential for city gas suppliers ahead of the full city gas retail market liberalisation from next April. Tokyo Gas will supply Centrica with up to 700,000-800,000 tonnes per annum of United States (US) shale LNG - from Cove Point project in Maryland - starting possibly from late 2018, when Cove Point production stabilises, Tokyo Gas said. In return, it will receive the same volume of LNG procured in Asia Pacific markets from the British firm. The two have not decided how long the location swap would last, Tokyo Gas said. Tokyo Gas, which has a contract to buy 1.4 million tonnes per annum of LNG for 20 years from Cove Point, was considering using four ships to transport LNG from the US shale gas project.

Source: Reuters

Italgas sees no risks to gas tender reforms from Italy referendum

November 21, 2016. Italy's biggest gas distributor Italgas does not believe the country's referendum on constitutional reform in December will affect new rules to streamline gas distribution, its chief chief executive officer Paolo Gallo said. Italy's gas distribution sector is highly fragmented with more than 200 operators. The new rules, which will reduce so-called concession areas to just 177 from almost 7,000, aim to make the industry less complex. Italgas, the third biggest gas distributor in Europe, is looking to increase its market share to about 40 percent from the current 34 percent. Italgas could consider buying smaller gas distributors across Italy to boost growth but only after the new concession tenders are awarded, Gallo said. The company has previously said it expects the 177 tenders to take place over the next 4-5 years.

Source: Reuters

Israel gas partners close to $4 bn Leviathan financing

November 21, 2016. The companies that own the rights to Israel’s largest natural gas pool are close to securing the $4 billion financing needed to develop the field. With a large export contract already in hand, obtaining funds is the next milestone for the explorers looking to tap the Leviathan pool, led by Unites States-based Noble Energy Inc and billionaire Yitzchak Teshuva’s Delek Group Ltd. The partners signed a $10 billion deal with Natural Electric Power Co. of Jordan two months ago. The Leviathan partners will decide on a strategy to deploy the funds in December, Delek Drilling LP said.

Source: Bloomberg

ConocoPhillips seeks to sell Alaska Kenai LNG export terminal

November 18, 2016. ConocoPhillips, the largest independent United States (US) oil producer, said it was in the process of selling its Kenai liquefied natural gas (LNG) export terminal in Alaska. The plant entered service in 1969 and for 47 years was the only LNG export terminal in North America, ConocoPhillips said. Nearly all of the LNG produced at the plant has been sold to Japan. ConocoPhillips said its efforts to market the Kenai plant are consistent with regular reviews of assets to ensure the company is optimizing its portfolio. In 2016, ConocoPhillips Alaska has a capital budget of nearly $1 billion and has accepted delivery of two new drilling rigs this year. In 2015, the Kenai plant operated for six months, ConocoPhillips said, liquefying 20 billion cubic feet of gas and delivering six cargoes. It has the capacity to liquefy 0.2 billion cubic feet per day of gas, according to federal energy regulators.

Source: Reuters

Peru considers rescinding Odebrecht's natural gas pipeline contract

November 18, 2016. Peru is considering rescinding Odebrecht SA's $5 billion natural gas pipeline contract after the Brazilian company's attempt to sell its majority stake in the project got snagged on corruption concerns. Odebrecht, entangled in a vast corruption investigation in neighbouring Brazil, must exit the pipeline project in order for a group of banks to disburse a $4.1 billion loan needed to finance its construction.

Source: Reuters

Petronas achieves first gas for floating LNG facility

November 18, 2016. Malaysia's state-owned oil firm Petronas has achieved first gas for its first floating liquefied natural gas (LNG) facility Pflng Satu from the Kanowit gas field, offshore Sarawak. The flare tower of Pflng Satu was ignited by introducing gas from the KAKG-A central processing platform at the field. The company said that the development proves company’s technological aspirations to unlock gas reserves in Malaysia’s remote and stranded gas fields. Petronas said the first gas milestone signified the commencement of commissioning and startup for the floating LNG facility. Petronas said that the facility will soon progress towards commercial operations and first cargo.

Source: Energy Business Review

Gas demand to grow in 2017 but more slowly: Qatar

November 17, 2016. Demand for natural gas will grow in 2017 but at a slower rate than in recent years, Qatar's Energy Minister Mohammed Saleh Al Sada said ahead of a meeting of exporting countries. Sada said ministers of the Gas Exporting Countries Forum (GECF) would discuss "long-term strategy" at meeting in Doha. The Doha-headquartered GECF is made up of 12 countries, including Russia, Algeria, Libya and Venezuela who between them account for more than 40 percent of global gas output. Qatar is currently the world's biggest LNG exporter but could soon be overtaken by Australia.

Source: NDTV

China's flurry of gas measures to lift investment, third-party access

November 16, 2016. Sweeping moves by China to boost transparency in the natural gas sector will encourage private investment in pipelines and terminals, industry experts say, as part of Beijing's drive to nearly triple the fuel's role in China's energy mix. The world's top energy user is planning to boost the use of natural gas since it emits just half of the greenhouse gases that burning coal produces. The country, the third-biggest gas user globally, wants gas to supply about 15 percent of its total energy by 2030, from just under 6 percent currently. But a lack of transparency in transportation costs has curbed investment in pipelines and storage facilities by the private sector and control by state energy companies has limited third-party access to trunk pipelines and receiving terminals. The National Development and Reform Commission (NDRC) starting in mid-October made a series of policy announcements that include setting a lower investment yield for pipeline investment, allowing storage operators to negotiate rates directly with customers and removing price controls on gas used for fertilizer production. Starting in 2017, the investment yield for trunk pipelines that connect provinces will be set at 8 percent for systems with 75 percent capacity utilization or higher, down from 10 to 12 percent previously, the NDRC said.

Source: Reuters

International: Coal

Indonesia sees coal exports halving by 2019 as domestic demand grows

November 18, 2016. Indonesia aims to halve coal exports over the next three years as domestic demand grows and production falls, the energy ministry said. Coal exports are expected to drop to 160 million tonnes in 2019, down from a forecast 308 million tonnes this year, Hersonyo Wibowo, who heads the coal division at Indonesia's energy ministry, said. The world's top thermal coal exporter aims to produce 419 million tonnes of coal this year but it was not immediately clear how the government planned to limit production, the bulk of which is currently shipped to China and India. Demand for coal at Indonesia's power plants, meanwhile, is expected to climb to 119 million tonnes in 2019, up from the 86 million tonnes that are expected to be consumed domestically this year, Wibowo said.

Source: The Economic Times

China reverses coal mining curbs as winter approaches

November 17, 2016. China adopted new rules to stimulate coal production to counter surging prices and Premier Li Keqiang said the country had to balance demand for heating over winter with efforts to tackle pollution. Li's comments came after state planner the National Development and Reform Commission (NDRC) ruled that all coal mines that abide by production safety rules can operate 330 days a year rather than 276 days previously. Analysts and traders said the new limit marked a major step from Beijing to help boost coal supplies. The NDRC capped domestic mining earlier this year in a campaign to reduce excess capacity but this triggered a surge in the price of coal. Li told a meeting of the National Energy Commission that reports directly to the cabinet that China must increase the clean and efficient use of coal. Higher coal prices have been hurting consumers in China and concerns about supply were growing ahead of expected strong demand during winter. The new limit will be effective until the end of the winter heating season, NDRC said.

Source: Reuters

International: Power

New Pekanbaru power plant to start working in December

November 22, 2016. Three years after the beginning of construction, the Tenayan coal-fired power plant (PLTU) in Pekanbaru, Riau, is set to commence operations next month, with President Joko "Jokowi" Widodo scheduled to attend the firing-up ceremony. State electricity company PLN said the power plant, which is designed to generate up to 2 x 110 MW of electricity, was scheduled to start on December 9. To boost the country's electrification ratio, President Joko "Jokowi" Widodo's administration wants to build enough new power stations to produce an additional 35,000 MW of electricity by 2019.

Source: The Jakarta Post

Minnesota Power’s Great Northern transmission line secures final regulatory approval

November 18, 2016. Minnesota Power’s Great Northern Transmission Line has secured the Presidential Permit from the United States authorities to deliver clean energy from Canadian hydropower resources to Minnesota consumers. Construction of the 500kv line along the international border between Manitoba and Minnesota is likely to begin in early 2017. Total project cost has been estimated in the $560-710 mn range by Minnesota Power which will bear an estimated cost between $300-350 mn.

Source: Energy Business Review

Dana agrees to acquire majority stake in Italian power-transmission supplier

November 18, 2016. Dana Inc has agreed to buy the power-transmission and fluid-power businesses of Italy’s Brevini Group S.p.A., the company said. Dana, based near Toledo, Ohio, plans to buy an 80 percent share in the Brevini businesses, with an option to purchase the remaining 20 percent by 2020.

Source: Automotive News

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

South Africa slows nuclear plans as rating assessments loom

November 22, 2016. South Africa delayed plans to build nuclear power plants as economic growth stalls, easing spending concerns as the country faces the risk of being cut to junk by credit-rating companies. The new timeline sees the first additional nuclear power plant coming on stream in 2037, compared with an earlier proposal of 2023. A total of 20,385 MW of nuclear energy will be added to the national grid by 2050, according to the Department of Energy. The government previously said it wanted to generate 9,600 MW of energy from as many as eight reactors that should begin operating from 2023 and be completed by 2029.

Source: Bloomberg

EDF in talks on offshore wind partnership in China

November 22, 2016. The renewable energy unit of French state-owned utility EDF is in talks with Chinese companies about a possible partnership to build offshore wind parks in China, the company said. EDF chief executive officer (CEO) Jean-Bernard Levy said the firm wants to nearly double its renewable energy capacity worldwide to more than 50 GW by 2030 from about 28 GW. EDF Energies Nouvelles CEO Antoine Cahuzac said that EDF will target areas with growing power needs like Latin America, China, India and sub-Saharan Africa.

Source: Reuters

Canada plans to phase out coal-fired power plants by 2030

November 22, 2016. The Canadian government has announced plans to phase out its coal-fired power plants by 2030, as part of its efforts to reduce its greenhouse gas emissions. The plan will involve speeding up timelines in the existing regulation under the Canadian Environmental Protection Act. Canada Minister of Environment and Climate Change Catherine McKenna said that the plants, located in four provinces, generate nearly 10% of the country's total CO

2 emissions. Shutting down all the coal-fired plants will eliminate the equivalent in emissions of 1.3 million cars from roads, or five megatons of greenhouse gas emissions, she said. Currently, 80% of Canada's electricity is produced from clean sources such as hydroelectric power, nuclear, wind and solar. McKenna has set a goal to make 90% of Canada’s power generation to emit no greenhouse gas emissions by 2030. The UK government announced plans to phase out coal-fired power plants by 2025, as it switches to generating energy from renewable sources.

Source: Energy Business Review

Top China steel city orders more plant closures in pollution fight

November 22, 2016. China's top steelmaking city has ordered many of its industrial factories to curb production or even close for as long as four months through to March in a bid to clear the skies of smog. Tangshan, a city in northern Hebei province, will seek to reduce steel production by requiring producers to cut emissions by as much as 50 percent from November 15 to December 31. The city will also close all cement plants and coal-fired power plants that did not reach the minimum emission standards for four months from November 15. Tangshan will also limit the times vehicles can drive in the city between November 23 and March 15.

Source: Reuters

New way to turn waste CO2 into road-ready diesel fuel

November 22, 2016. Scientists have developed a new way turn carbon dioxide (CO

2) into diesel fuel for existing vehicles, a breakthrough that may revolutionise the automobile industry and bring us a step closer to eliminating greenhouse gas. The benefits are two-fold, researchers said. The process removes harmful CO

2 from the atmosphere and the diesel can be used as an alternative fuel to gasoline. Researchers showed direct CO

2 conversion to liquid transportation fuels by reacting with renewable hydrogen (H

2) generated by solar water splitting. The currently existing catalysts, used for the reactions of H

2 with CO

2 are limited mostly to low molecular weight substances, such as methane or methanol. Besides, due to the low value of these catalysts, the reduction effects of CO

2 is generally low. However, the new delafossite-based catalyst converts CO2 into liquid hydrocarbon-based fuels (eg diesel fuel) in one single step. These fuel samples can be used by existing diesel vehicles, like trucks and buses. This new delafossite-based catalyst, composed of inexpensive, earth-abundant copper and steel is used in a reaction between CO

2 emissions of industrial plants and H

2 generated from solar hydrogen plant to produce diesel. Diesel fuels have longer chain of carbon and hydrogen atoms, compared to methanol and methane, Yo Han Choi, from the Ulsan National Institute of Science and Technology (UNIST) in South Korea, said.

Source: Business Standard

Global Trumpism seen harming efforts to reduce climate pollution

November 21, 2016. Populism is drawing momentum from environmentalism in the United States (US) and Europe, threatening the world’s effort to rein in climate change. Donald Trump’s election in the US, the United Kingdom Independence Party and Marine Le Pen’s ascent in France all represent a break with political leaders who made the environment a priority. All three are skeptical climate change is happening and are resistant to international projects like the United Nations (UN) global warming talks.

Source: Bloomberg

SoftBank’s clean-energy goals find welcome in Mongolia’s desert

November 21, 2016. SoftBank Group Corp plans to build more wind projects in Mongolia as the company’s chairman, Masayoshi Son, pushes to connect countries across Asia with transmission lines to supply cheap, clean energy. The Tokyo-based company’s first wind farm in Mongolia is a 50 MW project being developed with Newcom LLC in Mongolia’s Gobi Desert. SoftBank is looking into two more wind projects in Mongolia, with plans to possibly add 200 MW of solar and wind at the site of its first project.

Source: Bloomberg

Chinese solar firm to build plant in Chernobyl exclusion zone

October 21, 2016. Two Chinese firms plan to build a solar power plant in the exclusion zone around the Chernobyl nuclear reactor, which has been off limits since a devastating explosion contaminated the region with deadly radiation in 1986. GCL System Integration Technology (GCL-SI), a subsidiary of the GCL Group, said it would cooperate with China National Complete Engineering Corp on the project in Ukraine, with construction expected to start next year. The 1 GW plant was part of the group's plan to build an international presence, GCL-SI said. In a bid to protect farms from urban encroachment, China has been trying to encourage the use of damaged or contaminated land for solar and wind power projects, with plants now operating in subsidence-hit regions of Shanxi, the country's top coal province. China is the world's biggest solar power generator, with 43 GW of capacity by the end of last year.