Coal News Commentary: August - September 2016

India

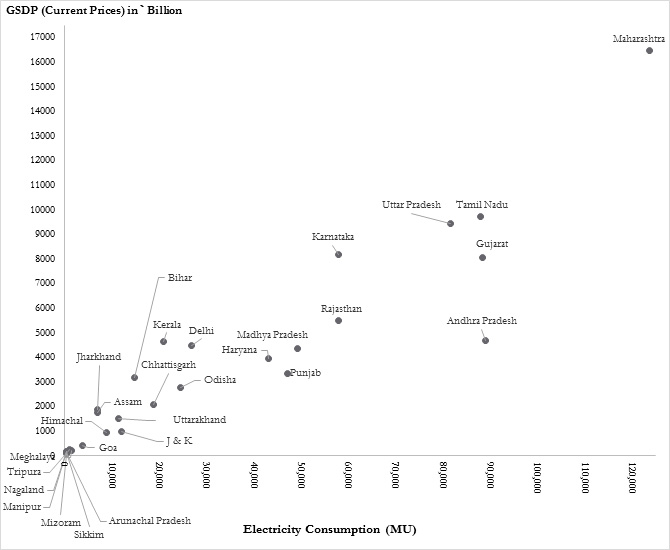

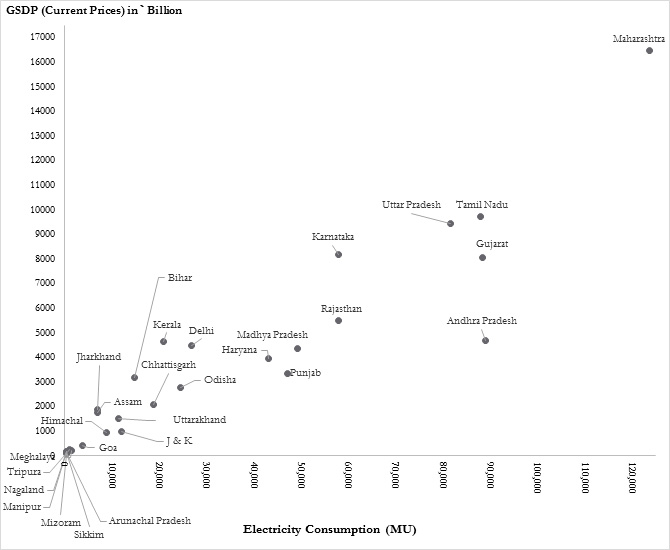

For those of us wired to criticise the government for perennial scarcity of coal, these are challenging times. There is apparently so much coal in India that the MoC is looking at export markets. CIL was reported to be in ‘deep consultation’ with Bangladesh to export coal as there was a ‘sharp decline in demand for coal as well as an inventory of over 80 MT at the pitheads and power plants’ according to the MoC. India has signed an agreement with Bangladesh to construct a 1,320 MW coal-fired power plant, the biggest project under bilateral cooperation. But the probability of this venture succeeding is not very high. The geo-politics of climate change has painted coal as a villain and the geo-politics of South Asia tends to paint India as the villain. The combination of the two (coal from India) has proved to be irresistible to both political and climate change entrepreneurs who are busy constructing colourful conspiracy theories. The reality is that India is big and not bad and coal is cheap but not clean. But South Asian economies have kept their people in abject poverty that they cannot pay for less dirty (there is no such thing as clean energy) energy. Burning cheap Indian coal to climb out of energy poverty will not just ensure South Asia’s energy security but also drive economic growth in the region. Consumption of cheap energy is established as the cause of economic growth by academic studies.

The rating agency Fitch said that India was well on its way to boost self- sufficiency in coal with a 5.1 percent year-on-year output growth in the first half of 2016. The higher prices of seaborne coal has apparently prompted power plants to increase the use of domestic coal causing imports to drop by 13.1 percent year on year. The agency also said that the doubling of clean energy cess increased demand for high-caloric-value coal, with increased imports from South Africa and Australia at the expense of low-grade Indonesian coal. According to a PricewaterhouseCoopers report India would have to spend $149 billion (four times India’s annual defence budget) to increase coal production to 1.5 BT by 2020. Many have cited this as the reason to scale down coal production. But this is wrong headed thinking. Spending more to fight energy poverty might actually contribute to more national security than armoured tanks and fighter jets.

Meanwhile a report from the industry body Assocham stated the obvious when it said that India would have to reduce dependence on coal fired electricity and work on climate friendly transport and urban planning and also keep up the pressure on the rich nations to fulfil their obligations for contributing $100 billion for technology development and transfer to reduce carbon emissions. Anyone who knows the political economy of India and the geopolitics of climate change will know that both - reducing coal use in India and getting rich countries to pay up - are close to impossible. As long as we live in a world that rewards only economic performance cheap will be more valuable than clean.

The announcement by the Indian Railways that it will rationalise coal tariff by reducing long-distance transportation rates while raising it for short distances and impose a terminal surcharge of ` 110/tonne at loading and unloading for distances beyond 100 km was not received well by coal consumers. Given that the average lead distance of coal shipments is declining (486 km in FY 16 versus 545 km in FY15) it makes sense to increase short distance tariff for coal.

Rest of the World

Just as India is seeking to double coal production by over 500 MT in the next 2-3 years, China is reportedly aiming to reduce 500 MT of coal production (9 percent of its capacity) capacity in the same period. According to Bloomberg, China can produce 5.7 BT of coal but only 3.9 BT was in operation. China is also said to have suspended approvals of new coal mines for the next three years to reduce over-capacity. But the Chinese are also reportedly increasing thermal coal imports as the 40-percent increase in prices for Australian thermal coal suggest. The Australian price rise is seen to be the result of a regulatory change in China, where the annual hours miners can operate were cut to 276/year from 330/year in 2015 to reduce rampant overcapacity and industrial smog.

Chinese imports have apparently pushed the premium over Europe to more than $10/tonne offering miners with easy access to the Atlantic and Pacific basins opportunities for arbitrage. Australian cargoes from its Newcastle terminal, a benchmark for Asia/Pacific, currently cost $70/tonne. European import prices into Amsterdam, Rotterdam or Antwerp are reportedly at $58/tonne due to strong competition from renewables and cheap natural gas. China which has been indulging in coal price arbitrage is expected to increase supply by 200,000 tonnes/day if prices gain for two consecutive weeks and climb above $75/tonne. Coal is also reported to be leading a surge in trading volumes on west European energy exchanges in the first half of this year as traders took advantage of low commodity prices. Wholesale trading of coal on the exchanges soared 46 percent from a year earlier to 3.5 BT.

NATIONAL: OIL

India set to buy Iran oil for emergency reserves

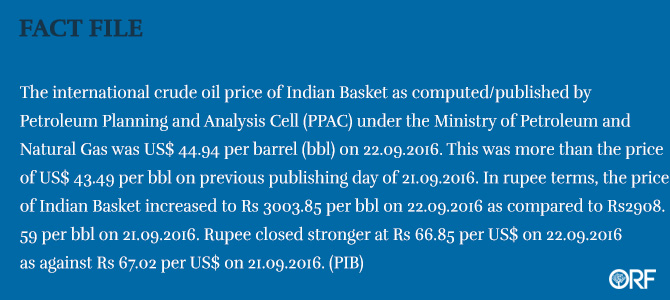

September 20: India is set to buy 6 million barrels of Iranian crude for its strategic oil reserves as negotiations with the United Arab Emirates' national oil company for supplies are stuck over commercial terms. Such purchases by the world's No.3 crude importer would boost Iran's drive to ramp up its oil shipments as it looks to regain market share following the lifting of sanctions over its disputed nuclear programme. Oil markets have been keenly focused on Iranian export volumes over the last few weeks as they get closer to pre-sanction levels - a milestone that Tehran has said is a precondition for discussing a global output freeze to boost crude prices. India, seeking to hedge against energy security risks as it imports about 80 percent of its oil needs, is building emergency storage in vast underground caverns to hold a total of 36.87 million barrels of crude, enough to cover almost two weeks of demand. India would buy 6 million barrels of Iranian Mix crude from the National Iranian Oil Co in October and November to fill half the Mangalore storage facility in the south-western state of Karnataka. State firm Bharat Petroleum Corp will buy 4 million barrels in two very large crude carriers (VLCCs) and Mangalore Refineries and Petrochemicals Ltd will import 2 million barrels. The step comes as Iran's daily crude exports to India surged to the highest level in 15 years in August. India in 2014 began talks to lease part of its strategic storage to Abu Dhabi National Oil Co (ADNOC). Under such a deal, India would have first rights to the stored crude in case of emergency, while ADNOC would be able to move cargoes to meet any shift in demand.

Source: Reuters

IOC's investment plans not to affect credit profile: Fitch

September 19: Indian Oil Corp (IOC)'s Rs1.8 lakh crore capital investment plan over the next six years will not affect the company's credit profile, Fitch Ratings said. IOC had said its capex would be Rs 1.7-1.8 lakh crore over the next six years, including around Rs15,000 crore in the current fiscal and around Rs 25,000 crore each in 2017-18 and 2018-19. Fitch said it has not factored in IOC's investment in the proposed mega refinery project in coastal Maharashtra though. This project is planned along with the other state-owned oil-marketing companies - Bharat Petroleum Corporation Ltd and Hindustan Petroleum Corporation Ltd.

Source: Business Standard

September 30, last date to get LPG linked with Aadhaar

September 19: Those who have still not linked Aadhaar with their LPG connections need to do it before September 30, as their parked subsidy amount (with banks) for the period between July and September will lapse after September end. As per earlier instructions of the Union ministry of petroleum and natural gas, people have to buy cylinder at the non-subsidised (market) rate and later have to get subsidy credited into their account. For this, they had to either link their bank account numbers or Aadhaar number to their LPG connection number to get the subsidy credited into their account. From July 2016, the ministry has mandated linking connections with Aadhaar. People who had linked earlier need not worry but those who had linked only bank account numbers need to get Aadhaar linking too. The government gave these people a buffer time of three months to get the Aadhaar linking done and released their three months' LPG subsidy into respective banks. However, the banks were asked to hold on to the release of subsidy till the time consumer links Aadhaar with the connection. Once Aadhaar card is connected before September 30, the three months' subsidy would be released.

Source: The Times of India

Mangalore Refinery under lens for alleged excise duty evasion

September 18: Mangalore Refinery and Petrochemicals Ltd (MRPL), a subsidiary of Oil and Natural Gas Corp, has come under the scanner of central revenue authorities for alleged excise duty evasion of at least Rs 10 crore. The Directorate General of Central Excise Intelligence here has started a probe in the case and sought certain clarification from the Mangalore-based MRPL. The case relates to alleged wrong classification of mixed xylene -- a clear colourless aromatic hydrocarbon liquid having sweet odour -- produced by it. Mixed xylenes are extracted or distilled from reformate, a stream derived from the refining of high-octane motor gasoline.

Source: India Today

Petrol price up by 58 paise a litre; diesel cut by 31 paise

September 16: Petrol price was hiked by 58 paise a litre while diesel rate was cut by 31 paise per litre in line with international trends. Petrol+ will cost Rs 64.05 a litre from midnight as against Rs 63.47. Similarly, diesel will cost Rs 52.63 a litre as compared to Rs 52.94 a litre. This is the second increase in rates of petrol this month while in case of diesel it wipes away a part of the hike effected earlier this month. Petrol price+ was last hiked on September 1 by a steep Rs 3.38 per litre and diesel by Rs 2.67 a litre. The current level of international product prices of petrol and diesel and rupee-US dollar exchange rate warrant increase in selling price of petrol and decrease in selling price of diesel, the impact of which is being passed on to the consumers with this price revision, Indian Oil Corp (IOC) said.

Source: The Times of India

Petrol, diesel monthly consumption at new high

September 15: Consumption of petroleum products grew at the quickest pace on a monthly basis in five years during August, rising 11.4% year-on-year (y-o-y) to 15.8 million tonnes. It increased 9.5% y-o-y on an average in the preceding three months. The ban on diesel vehicles in the NCR (National Capital Region) and increased sales of two-wheelers and passenger vehicles led to a surge in petrol consumption that hit a new high, analysts tracking the sector said. Diesel and petrol led the way, growing at 14% and 25% on a y-o-y basis respectively during the month. Diesel consumption surged to a near-five-year high on a monthly basis in August, primarily driven by commercial transportation. In June 1976 crude oil was $ 51/- and after 40 years it is hovering around $ 42/- Indeed Modi govt is very lucky to churn out more tax from the people.

Source: The Times of India

India's new motorcycle owners drive gasoline boom

September 15: India’s gasoline consumption is growing rapidly as millions of additional households buy motor cars and especially motorcycles as a status symbol amid growing prosperity. Gasoline consumption averaged 550,000 barrels per day between June and August, an increase of nearly 15 percent from 480,000 bpd a year earlier. Gasoline consumption hit a new record of 600,000 bpd in August, according to the Ministry of Petroleum and Natural Gas. The number of registered vehicles on India’s roads has been doubling every seven years and hit 182 million in 2013, according to the Ministry of Road Transport and Highways.

Source: Reuters

Petroleum products to come under GST regime

September 14: Petroleum products, including crude and some intermediate products, could be taxed under the proposed goods and services tax (GST), a move that will reduce the imperfections in the new levy and also narrow the inflationary impact of the tax. A proposal favouring imposition of a modest tax on these products is being examined and is expected to be taken up by the newly constituted GST Council where the government will try and convince states of its merit. The idea is to have some minimal tax of about 2-3 percent so that seamless flow of credit is not broken and cascading is removed. These products are at present proposed to be covered within the GST but zero rated till the time the council decides to impose a tax. States will continue to have freedom to levy local sales tax on it. States have been opposed to a change in tax regime for petroleum goods, an easy way of quickly mopping up revenues if needed. But now thinking has veered around to having some minimal tax from the beginning as it could help in bringing down the overall tax rate and allow the industry to get credit. The Arvind Subramanian committee has recommended a standard GST rate of around 18 percent. There are concerns GST could stoke inflation. Some policymakers are in favour of rate as low as 16 percent. Tax at marginal rate would not hurt consumers much but will benefit industry in a big way. The government has put implementation of GST, which seeks to replace plethora of central taxes including excise duty, service tax, cesses and state taxes such as value-added tax, octroi, entry tax with a single levy, on fast track and the newly set up GST Council will meet to take a call on crucial issues.

Source: The Economic Times

Indian govt seeking investors for 67 small oil, gas fields

September 14: Some companies interested in small discovered fields being auctioned by the oil ministry are keen to explore adjoining areas also but government officials say they can expand their exploration area subsequently with a competitive bid under the new licensing policy. The government is seeking investors for 67 small oil and gas fields in an auction that is underway and allows participants until October 31 to place their bids. The government is hosting roadshows in India and key global financial centres such as London and Singapore to showcase the opportunity these fields offer and explain in greater details the nuances of the new policy governing these fields. Some of the potential investors have raised concern about the smaller size of the contract areas on offer and urged the government to consider offering a bigger area. The private sector executive has been involved in the country's oil and gas sector for two decades and said the contract areas offered under previous bid rounds were in hundreds of square kilometres while in this it is mostly just a few square kilometres, making it less attractive. On the other hand, officials say that a proven field cannot be considered less attractive than a bigger exploration area where oil and gas has not been discovered. About 40 of the 67 fields being offered are less than 25 square kilometres in area. Nearly 20 are less than 10 sq km with one field being as small as 2.35 sq km. All 67 fields have been grouped in 46 contract areas that are being auctioned. The oil ministry said some investors have indeed raised this concern but the government will not be able to do anything about it. The additional areas surrounding these discovered fields will be auctioned in future separately for exploration under the government's new exploration policy, Hydrocarbon Exploration and Licensing Policy (HELP).

Source: The Economic Times

IOC announces Rs 1.8 tn investment plan in next 6 yrs

September 14: Announcing its plan of investing ` up to 1.80 trillion across verticals in next six years, Indian Oil Corp (IOC) said it also is talks with foreign entities to co-invest in the investment that includes setting up a mega refinery in coastal Maharashtra. IOC said about Rs 50,000 crore will be invested in setting up refining capacity where it plans to add at least 24 million tonnes per annum over the next five years, followed closely by marketing infrastructure including new plants, new terminals, LPG import infrastructure and pipelines. IOC will be investing Rs 15,000 crore in the current fiscal and will accelerate to over Rs 25,000 crore each over the next two fiscals. It has budgeted for a Rs 72,000 crore investment over the next three years. IOC said the ambitious project to set up the largest refinery project in the country in coastal Maharashtra is on and the state government has shown six potential sites where it can come up. IOC, which is taking leadership in the project that is estimated to cost Rs 1.76 trillion, will be holding a 50 percent stake in the refinery while the remaining will be split evenly between its sister companies HPCL and BPCL. IOC said working of the entire modern refinery complex will help bolster its gross refining margins by up to $3 per barrel.

Source: Business Standard

NATIONAL: GAS

NGT asks govt to make its stand clear on shale gas exploration

September 20: The southern bench of the National Green Tribunal (NGT) directed the State government to submit its stand in next three weeks on shale gas exploration allegedly undertaken by the Oil and Natural Gas Corp (ONGC) in the Cauvery delta region. ONGC said that the oil ministry, had entrusted the ONGC with R&D efforts for exploring and assessing the potential of shale gas in the sedimentary basins under its operation. Accordingly, in the Cauvery basin, one location was identified in Kuthalam for preliminary investigation. ONGC was at present carrying out only geophysical or seismic surveys in Tiruvarur for oil exploration which doesn’t cause any harm.

Source: The New Indian Express

GAIL may scrap tender for hiring LNG vessels

September 19: GAIL (India) Ltd will likely scrap the tender for hiring liquefied natural gas (LNG) ships after failing to negotiate acceptable terms with bidders in what would hurt India's ambition to build high-tech LNG carriers at home under the 'Make in India' programme. GAIL had issued a tender last September seeking to charter at least nine LNG vessels to bring home from the US up to 5.8 million tonne of gas annually from early 2018. Successful bidders were supposed to locally build a third of all ships they make under the Make in < style="color: #000000">India plan. GAIL received bids from two Japanese consortiums after the deadlines for submissions were extended more than once. GAIL is now running out of time to hire ships as the supplies of its contracted gas from the US will start flowing in a little more than a year. The bidders for GAIL ships had to tie-up with shipbuilders who would in turn partner local shipyards. Vessels from foreign shipyards had to be delivered between January and May 2019 and from Indian shipyards between July 2022 and June 2023. An LNG vessel on average costs about $200 million.

Source: The Economic Times

Need to promote natural gas-based fuel cell technology: Oil Minister

September 18: More than half the power requirement here of IT multinational Intel's Indian subsidiary is produced from fuel cells using natural gas, Oil Minister Dharmendra Pradhan said. GAIL (India) Ltd and US-based Bloom Energy signed an agreement to deploy revolutionary natural gas-based fuel cell technology to generate electricity. Gas is already being supplied by GAIL for energising a multi-megawatt Bloom Energy project at the Technology Park. The technology is currently being used by over 100 of the Fortune 500 companies that are diversified majors in IT, Telecom, retailing, e-commerce and consumer goods.

Source: The Economic Times

Mahanagar Gas increases prices of CNG, PNG

September 18: Mahanagar Gas Ltd (MGL) has revised its rates for compressed natural gas (CNG) and domestic piped natural gas (PNG) upwards after the Maharashtra government hiked VAT by 1% to 13.5%. MGL supplies CNG to 4 lakh vehicles, including public transport and BEST buses and piped gas to 8 lakh households in Mumbai. In view of increase in VAT rates from 12.5% to 13.5% by the Maharashtra government from 17 September, MGL is constrained to revise its CNG and domestic piped gas prices to the extent of revised tax implication, the company said.

Source: Livemint

NGT asks Haryana, UP to mull installation of CNG pumps in NCR

September 15: The National Green Tribunal (NGT) asked Uttar Pradesh (UP) and Haryana governments to mull over the possibility of installing CNG stations in NCR while refusing to grant permission to over 10- year-old diesel vehicles to ply in these areas. It asked both the States to consider the proposal after it was informed that there was no CNG station in Karnal and Meerut. The NGT directed UP and Haryana to inform it about the stand of both the State governments by October 1, the next date of hearing. The tribunal was hearing petitions filed by a Meerut-based Transport Union and Karnal Independent Schools Association seeking permission to ply diesel vehicles over 10 years old until adequate number of CNG filling stations are set up in their city that falls in the NCR. The school association has sought permission for its members to ply diesel school buses over 10 years old till CNG installation and fitment kits are made available. On July 18, the green panel had directed authorities in Delhi-NCR to cancel the registration of all diesel-powered vehicles which are more than 10 years old.

Source: The Hindu

PM Modi should also offer safer cylinders to poor, not just cooking gas

September 15: Narendra Modi’s government is helping lakhs of poor families take clean cooking gas to their kitchens. Kitchen accidents, including cylinders blowing up and stove bursts, kill about 4,000 people every year in the country. In the 14 years to 2014, the toll from gas cylinders and stove bursting stands at about 53,000 people, some 41,000 of them women, according to National Crime Records Bureau (NCRB) data. Composite cylinders will be launched by Hindustan Petroleum in the Western states of Gujarat and Maharashtra in the next few months. In the first phase, it’s going to be just about 5000 cylinders, a small number given that India has 17 crore active cooking gas consumers and plans to add 3 crore this fiscal year. Prime Minister (PM) Narendra Modi should direct state oil firms to give away these safer composite cylinders to poor households being offered cooking gas connection under the Pradhan Mantri Ujjwala Yojana because they need it the most due to safety reasons.

Source: The Economic Times

Petroleum ministry moots market price for CBM gas

September 14: In a boost to hydrocarbon exploration firms Reliance Industries Ltd (RIL) and Oil and Natural Gas Corp (ONGC), the oil ministry has proposed to offer market price for natural gas produced from the coal bed methane (CBM) blocks. RIL is targeting to start production of CBM from its Sohagpur (West) block in Madhya Pradesh in FY17, while state-run ONGC is developing the Bokaro block in Jharkhand. The oil ministry has proposed a revised policy for CBM blocks which is in similar lines to the policy rolled out for the ongoing auction of 67 discovered small and medium oil and gas fields. The Narendra Modi government has unveiled a policy for the small fields that provide an investment opportunity in already discovered fields with no signature bonus, no requirement of prior technical experience and no mandatory work programme. The new policy is based on revenue sharing contract model with the aim of simplifying the operating regime and making it more transparent. In addition, the explorers would get market price for the hydrocarbon produced.

Source: The Financial Express

India, Russia explore building of 'energy bridge' for Russian gas supply

September 14: India's Ministry of External Affairs (MEA) announced that the country and Russia have agreed during the 22nd Session of the India-Russia Inter-Government Commission on Trade, Economic, Scientific, Technological and Cultural Cooperation (IRIGC-TEC) to launch an industry level Working Group to create an "energy bridge" -- or pipelines -- for potential Russian gas supplies to be transported to the energy deficient South Asian country. Strong growth in domestic energy demand together with inadequate supply from local oil and gas fields have led India to depend on foreign petroleum supplies, including Russia. According to BP Statistical Review of World Energy, India consumed 4.159 million barrels per day of crude oil in 2015, while domestic production stood at 876,000 barrels per day, with imports providing around 78.9 percent of the country's oil demand. Like oil, India depended on gas imports to bridge the supply gap.

Source: Rigzone

ONGC starts selling gas at ‘premium’

September 14: Oil and Natural Gas Corp (ONGC) has started selling natural gas from its East Coast field at a premium price of $6.61 per million British Thermal Units (mmBtu), to be the first to benefit from the government’s policy to reward production from difficult fields, reports Siddhartha P Saikia in New Delhi. In March, the government had allowed higher price for new gas production from deep, ultra deep-water and high pressure, high temperature areas. The current gas price for regular fields is $3.06 per mmBtu on a gross calorific value basis. The price of domestic natural gas is currently decided based on a formula approved by the Modi government in October 2014, which is linked to select global indices. However, the government in March 2016 approved a mechanism that allows pricing freedom to gas production from high pressure, high temperature, deep and ultra-deep water blocks. The only caveat is the ‘market price’ is subject to a ceiling to be derived from landed cost of alternate fuels such as fuel oil, naptha, LNG and coal. The new pricing formula will apply to gas projects already discovered but are yet to commence production because of un-remunerative pricing of the commodity.

Source: The Financial Express

Niko raises $300 mn using KG-D6 block as mortgage

September 14: The A P Shah panel's recommendation of levying a penalty on Reliance Industries Ltd (RIL) for producing gas that migrated from adjoining field of Oil and Natural Gas Corp (ONGC) has come at a time when its partner Niko Resources is uncertain about funding further development of the Krishna Godavari-D6 (KG-D6) block. The Canadian company, which owns a 10 percent stake in D6, raised about $300 million first-ranking security over the company's participating interest in the block. For this, it put KG-D6 under mortgage. The company has got the Reserve Bank of India's approval, while the oil ministry is yet to give its clearance. RIL and its partners BP and Niko plan to develop the four satellite fields of D-2, D-6, D-19 and D-22 in the KG-D6 block. The consortium currently produces natural gas from Dhirubhai-1 and 3 (D1&D3) and oil and gas from MA1 field in the KG-D6 block. The gas output from RIL's KG-D6 asset is around 8 million standard cubic meter now. According to experts, raising money over hydrocarbon assets is a global practice. The company has backed RIL on the issue of gas migration from the fields of ONGC in KG-D6 to RIL's fields. For Niko, revenue from natural gas sales in India has dropped from $74,292 last year to $63,555 as on March 31 this year. Revenue from oil and condensate too dropped from $21,225 last year to $8,583 till March 31.

Source: Business Standard

NATIONAL: COAL

NTPC calls for utilisation of Badarpur plant surplus coal

September 18: NTPC has requested the government to allow surplus coal at its Badarpur thermal power plant in Delhi to be utilised for a power unit in Madhya Pradesh. A call on the request may be taken after receipt of recommendation from the Ministry of Power. The Cabinet in May allowed flexibility in utilisation of domestic coal for reducing the cost of power generation. Power Minister Piyush Goyal had said that the relaxed norms for utilisation of domestic coal could result in bringing down the cost of power generation by 40 to 50 paise per unit. In the next four to five years, it could lead to savings of ` 25,000-30,000 crore per year.

Source: Business Standard

Rajasthan HC reserves order on plea by Chhattisgarh coal company

September 15: Rajasthan High Court (HC) has reserved the order on a petition by Chhattisgarh Power and Coal Ltd which alleged that the Rajasthan Vidut Utpatan Nigam Ltd (RVUNL) has tailor-made tender conditions to suit the present supplier for the supply of coal to the Chabara power plant. RUVUNL has made tender conditions in such way that it suits the present supplier, Hind Energy and Coal Ltd.

Source: The Economic Times

Court asks CBI for coal report by September 28

September 15: The Central Bureau of Investigation (CBI) was directed by a Special Court to file by September 28 its status report on further probe in the Amarkonda Murgadangal coal scam, in which Congress functionary and industrialist Naveen Jindal, ex-minister of state for coal Dasari Narayan Rao, former coal secretary H C Gupta and others are accused. Special judge Bharat Parashar fixed the matter for September 28 after CBI, which was supposed to file the report, sought time from the court for filing the report on the grounds that investigation was ongoing in the matter.

Source: The Economic Times

NTPC's Farakka plant gets green panel nod for coal supply

September 14: An Environment Ministry panel has given permission to state-run NTPC for transporting imported coal to its Farakka Thermal Power Plant in West Bengal via national waterways for another 6 months till January 2017. In July 2014, NTPC was given temporary permission to transport imported coal, up to 1.5 million tonnes per annum (MTPA), for one year.

Source: The Economic Times

National: Power

Jharkhand changed power policy to help Adani: Opposition

September 20: Jharkhand's opposition parties have alleged that the Raghubar Das government has changed the power policy of 2012 to benefit Adani Power in the state. The Jharkhand cabinet had made some changes in its 2012 power policy. As per the earlier policy, any power company setting up plant in Jharkhand was bound to provide 25 percent of the generated power to the state. Of the 25 percent 13 percent was to be provided at fixed rate by the Jharkhand Electricity Regulatory Commission while the remaining 12 at the production cost rate. Under the new policy, the power company will now provide 12 percent power at production cost only if the Jharkhand State Mineral Development Corp provided coal at cheaper rate. The opposition parties have alleged that the BJP government in the state made the changes to help the Adani group's power company. Adani Power has refused to provide power to the state at production rate.

Source: Business Standard

JSW Energy-Jaiprakash deal for 500 MW Bina plant gets CCI nod

September 19: The Competition Commission of India (CCI) has approved Sajjan Jindal-promoted JSW Energy's purchase of the 500 MW Bina thermal power plant from Jaiprakash Power Ventures. Under the deal, announced in July, JSW Energy will buy 100 percent stake in the special purpose vehicle (SPV) -- Bina Power Supply Ltd (BPSL) -- to which 500 MW power plant is to be transferred.

Source: Business Standard

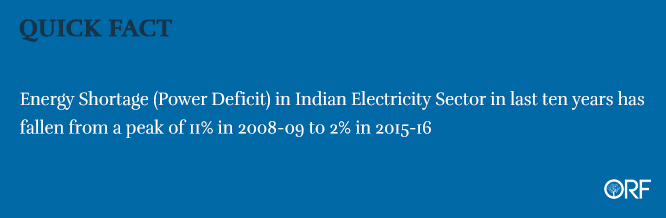

States to get Centre's financial support for free power scheme

September 19: The Centre will extend financial support to states to enable them to offer new electricity connections free of cost to everyone. At present, electricity connections to only below poverty line (BPL) families are offered for free. The Union power ministry has proposed to extend the free connections scheme to all in line with the Centre's goal to achieve 24x7 power for all by March 2019. Rural Electrification Corp (REC) is working on a scheme to provide long-term loans to states that agree to offer free new electricity connections. The scheme will be a key issue for discussion when Union Power Minister Piyush Goyal meets state power ministers during the two-day conference of power ministers starting October 7 in Gujarat. REC is working on a scheme for financing the power distribution companies so that they could release new electricity connections to households. The scheme covers funding of expenses like laying of lines to give access to electricity, installation of meters and other accessories. As per the plan, the distribution companies will have to get new connection plans approved by REC, which will reimburse expenses incurred by power utilities in giving electricity access to households.

Source: The Economic Times

IT-enabled power distribution to save Rs 100 bn annually

September 18: Government aims to save as much as Rs 10,000 crore annually by leveraging information technology to ramp up its power distribution network in urban towns by January 2019. The power ministry is likely to award the works to have IT-driven power distribution in as many as 2,636 towns across the country by December this year. The entire work will take at least two years after the award of works. IT enabled power distribution systems helps discoms reducing aggregate technical and commercial (AT&C) losses. Besides IT driven power distribution system provides consumers a host of services like online bill payment, applying for new connection and knowing status of power supply situation in these towns in real time basis.

Source: Business Standard

Gujarat to continue with LED distribution scheme: Energy Minister

September 18: Gujarat government will continue to distribute LED bulbs in the state after Prime Minister Narendra Modi lauded the scheme aimed at conserving electricity, Energy Minister Chimanbhai Shapariya has said. The BJP government will continue with the scheme after the Prime Minister lauded its efforts in conserving power through distribution of energy-saving LED bulbs, he said. The state government has set a target of providing LED bulbs to 1.21 crore households more at subsidised rates across the state in the next one year, he said.

Source: Business Standard

Coal price increase may push up power tariffs

September 18: Electricity consumers may end up paying more as Power distribution companies (discoms) may increase power tariffs. This is due to the hike in coal price and levy of coal terminal charge. Power discoms and energy experts estimate a 10-14 paise per unit increase in electricity tariffs starting this October as discoms may choose to pass the increased power generation cost to the consumers. The cost of power generation in the state had firmed up by 5% to 7% after the public sector giant Coal India Ltd raised coal prices by 6.3% few months back and the ministry of railways started levying coal terminal charge for loading and unloading of coal.

Source: The Economic Times

Kudankulam works for record 207 days at a stretch

September 17: Unit 1 of Kudankulam Nuclear Power Plant (KNPP) has operated uninterrupted for more than 200 days for the first time since it was commissioned in 2014, generating about 4,700 million units of electricity, KNPP site director R S Sundar said. Sundar said that a nuclear plant in Rajasthan holds the record in the country for running continuously for more than 700 days, while the world record stands at over 900 days. Heysham II nuclear power plant on northwest coast of England holds the record. With Unit 2 attaining criticality recently, the director said it will begin commercial operations by December 2016 when it reaches its full capacity of generating 24 million units a day, thereby doubling the total electricity generation.

Source: The Times of India

Dabhol power plant to be split into power, gas companies

September 16: The Maharashtra government granted approval for the demerger of Ratnagiri Gas & Power Pvt Ltd (RGPPL) into two separate companies for viability and prevent it from being declared as a non-performing asset (NPA). The decision was taken at a cabinet meeting presided over by Chief Minister Devendra Fadnavis and comes around a year after the RGPPL board had approved the demerger plan. Built by the erstwhile US firm Enron, the ` 12,000 crore, 1,967 MW Dabhol Power Project, as it was known at the time, was closed since December 2013 but revived in November last year by the central government as RGPPL under a JV between the NTPC Ltd and GAIL (India) Ltd. Post-revival, the RGPPL currently generates 500 MW power which is supplied to the Indian Railways.

Source: Business Standard

Price of LED bulbs drops to Rs 38

September 14: Prices of LED bulbs being distributed by state-run Energy Efficient Services Ltd (EESL) under a government programme have fallen to one-tenth of their rates two years ago. EESL has received bids at Rs 38 for a 9-watt LED lamp. Fourteen companies participated in the tender opened for procuring five crore LED bulbs. Prices of LEDs procured by EESL under the Unnat Jyoti by Affordable LEDs for All (Ujala) scheme have been consistently falling. The company had in March received bids at Rs 55 per piece. The company had purchased the LEDs at Rs 310 in 2014. LED bulbs are available in the market at Rs 90-100 a piece. Prime Minister Narendra Modi had in his Independence Day speech said the government was distributing LED bulbs for Rs 50 a piece against the earlier price of Rs 350. EESL has so far distributed 15 crore LED bulbs across the country through Ujala.

Source: The Economic Times

Increased efficiency and timely tariffs revision critical for UDAY’s success: ICRA

September 14: State-owned distribution utilities will benefit from the Ujwal Discom Assurance Yojana (UDAY) scheme in FY2017 but stricter focus on efficiency and timely tariff revisions is critical for their sustained financial turnaround, said ICRA in a recent study. UDAY was launched by the centre to improve performances of the state power distribution companies. Till now 16 states and union territories have signed memorandum of understanding for participating in UDAY. De-leveraging and refinancing under the scheme is expected to improve liquidity and profitability profile of Discom's in the near term. However, ICRA notes that state electricity regulatory commissions in only 20 out of 29 states have issued tariff orders for FY2017 so far, indicating moderate progress in terms of issuance of tariff orders for the year.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Rays power launches 100 MW Uttarakhand solar project

September 20: Solar power service provider Rays Power Infra Pvt Ltd announced the launch of its 100 MW project in Uttarakhand. The project is expected to be commissioned by February, 2017. It will be executed by Rays Power Infra on turnkey basis - from land acquisition to commissioning -- the company said in a press release. It also said that instead of forcing farmers to sell their land, Rays Power Infra has devised a model where farmers can also become a part of the project, and as a result, will enable the solar company to acquire 500 acres of land in such a difficult terrain. The 100 MW project is spread over a sprawling area in Tehsil - Bhagwanpur in Roorkee district of Uttarakhand. It comes under Uttarakhand Renewable Energy Development Agency s (UREDA) competitive bidding for 2015-16, it said.

Source: The Economic Times

Industry committed to meet BS VI emission norms: SIAM

September 19: Automobile industry body Society of Indian Automobile Manufactures (SIAM) said that the Indian auto sector is committed to adhere to the BS (Bharat Stage) VI emission norms by 2020. According to SIAM, the auto industry has accepted the challenge in view of the rising concerns on vehicular pollution, especially in the metro centres. The industry is fully committed and ready for implementing BS IV across the country on 1st April 2017 and was now waiting for the fuel availability on a pan India basis.

Source: Business Standard

75 kW rooftop solar power plant at Vikas Bhawan

September 19: Making an eco-freindly move to utilize solar power, UP New and Renewable Energy Development Agency (UPNEDA) took the initiative to install the first 75 kilowatt (kW) rooftop solar power plant at Vikas Bhawan. The plant has been made functional but it will be used after the installation of meters within two days. Another 100 kW solar power plant would be installed at the commissioner's office building soon. The process of equipping many other government buildings with solar power is also in progress. Solar power packs comprising three lights and a fan (solar-powered) have also been distributed in villages under Lohiya Gram Awaas Yojna. From 2012-2014, 628 solar power packs had been installed while installation of other 563 is underway.

Source: The Times of India

Landed solar module prices drop 15 percent in three months, leads to glut: Bridge to India

September 19: Landed solar module prices in India has dropped by nearly 15 percent to $0.36/Watt in just three months. This drop is the result of a steep fall in component prices globally and could lead to a major supply glut says solar sector analysis firm Bridge to India. The Indian government is keen to promote domestic manufacturing and as much as 2,500 MW of new domestic capacity is expected to come up by next year through new facilities and expansions. However, global supply glut and steep fall in prices do not portray a healthy environment for new investments in the sector.

Source: The Economic Times

Solar manufacturers at ease over WTO ruling upholding US complaint against India

September 19: Solar manufacturers are unfazed by the WTO's upholding of the US complaint against India as the ruling was along expected lines, but project developers who import equipment are worried that the government may retaliate by imposing duties. The appellate body of the WTO upheld two earlier rulings by a WTO committee against the domestic content requirement in the Jawaharlal Nehru National Solar Mission (JNNSM). The JNNSM includes a provision stipulating that 10 percent of the modules used in India's solar plants should be domestically manufactured. Since India-made modules are unable to compete with foreign ones, both on price and technology, agencies like NTPC and Solar Corp of India have been holding separate auctions with a domestic content requirement (DCR) provision, where the subsidy provided by the government as well as winning tariffs are significantly higher than in open auctions. The US's complaint is also curious considering that its solar exports to India are fairly low.

Source: The Economic Times

'Nuclear power will help India attain energy security'

September 18: Developing nuclear energy sources is the only way to bring energy security in India, the former chairman of Maharashtra Electricity Regulatory Commission (MERC), V P Raja, said. Raja said that both India and Tamil Nadu have a major role to play in making India energy secure. He said that there are some anti-nuclear elements in the country, but people should see countries like France that is 80% dependent on nuclear power and Japan that is 30% dependent. , and support setting up of infrastructure for nuclear power in India.

Source: The Times of India

Air pollution claiming a life every 23 seconds in India

September 18: Future of air we breathe is nightmarish. Present stats from WHO report states 1.4 million people in India die pre-maturely due to air pollution, which accounts to one life is given up every 23 seconds. Come 2030 and fuels we use today would have made air so toxic with pollutants that it would be close to impossible to live and move without oxygen kit as a permanent burden and part of lifestyle. Renewable energy catering to humungous needs in the near future seems far sighted and for now cleaner fuels like Natural gas may be the only answer that can avert the impending destruction. Hawa Badlo launched 'Time Bomb' video, with GAIL (India) Ltd's active support, to sensitize people about the need to go for the radical fuel alteration. The campaign aims to educate people of the fact that India is sitting on ticking time bomb named pollution and if they delay in reforming fuel use, they are bound to reach a point of no return. The air catastrophe would wreak havoc on coming generation. Hawa Badlo's video 'Time Bomb' presents the horror that 2030 India might be, if pollution is allowed to pile up unabated.

Source: The Times of India

MYSUN announces a market place to solarize 10 million rooftops by 2022

September 18: Driven by the mission to bring solar energy to every person's life, MYSUN, an engineering and technology-based marketplace for everything solar, has announced the commencement of its operations in India. MYSUN is envisioned as a one-stop solar marketplace that helps consumers understand and evaluate their solarisation potential and associated savings. It creates a convenient and guided buying environment for consumers by providing competitive pricing, rated vendors, quality standards, advanced engineering tools and financing options, all at one unique platform www.itsmysun.com

Source: New Kerala

Adani Green setting up country’s largest tracker-based PV solar project in Punjab

September 17: Adani Green Energy is setting up the country's largest tracker-based photo voltaic solar project of 105 MW in Bhatinda, Punjab. The renewable-energy arm of the Adani Group company has tied up with San Francisco-headquartered Nextracker to use more efficient technology for its projects in India and overseas. According to Adani Green, the tracker technology provided by Nextracker helps maximise energy yield and leads to cost savings. The technology enables movable PV panels to follow trajectory of the sun for a higher energy output. The developers of the technology claim 10-25% increase in energy output compared with the fixed panel projects, depending on location of the project. Adani's Punjab project is expected to be commissioned in October this year, almost six months ahead of schedule. Adani has around 800 MW of renewable energy projects in operation. The company's solar capacity includes a 648 MW project at Ramanathapuram district in Tamil Nadu which is currently the world's largest single-location solar power plant. The company has a pipeline of 1.2 GW solar PV and 300 MW wind power projects in India, and is set to become the largest renewable power generation company in India.

Source: The Economic Times

India, China to work against climate change

September 17: India and China, taking mutual responsibility for the melting snow caps of the Himalayan mountain ranges, discussed the environmental challenge on the sidelines of the 8th Brazil, Russia, India, China and South Africa (BRICS) environment ministers meeting held in Goa. Environment ministers of BRICS countries and working groups had discussions on various topics related to the environment and it was decided to share technology to improve the quality of water, air and waste management. Environment Minister Anil Dave said the snow caps of the Himalayan mountain range are melting and added that countries around the range were not responsible for the phenomenon, but that it was the result of global climate change. The areas for mutual cooperation agreed upon are abatement and control of air and water pollution, efficient management of liquid of solid waste, climate and conservation of biodiversity. China has suggested a meeting of technocrats in April 2017 to take the same forward. The BRICS countries resolved to set up a platform for innovation, knowledge-sharing and capacity-building, including a common website and network of technical institution, and to undertake joint projects in areas of mutual interest. Climate change was discussed at length and Dave said all countries agreed to go ahead with sustainable development goals till 2030.

Source: The Times of India

Adani set to overtake Tata in solar power

September 16: Armed with 648 MW of solar power plants in Tamil Nadu and many upcoming projects in other states, Adani group is all set to replace Tatas as the top solar power generation firm in the country in the next two years. As per a study done by Mercom Capital Group, 11% of solar power projects in the country are with Adani. The company has projects in Tamil Nadu, Jharkhand, Odisha, Uttar Pradesh, Gujarat and Madhya Pradesh. The group is expected to overtake Tata Power, which, at present, leads in solar power generation installed capacity in the country. Adani, which has only 5% of the total installed solar power capacity now, is fast heading towards the top slot with a total installed capacity of 2GW. Following Adani is ReNew Power and SunEdison. The Adani Group entered the solar power sector just over two years ago. The top 20 solar power producers account for almost 80% of projects under development. Of all the states, Adani is setting up the largest solar power project in Tamil Nadu. The company's project is coming up at Kamudhi in Ramanathapuram district with a capacity of 648MW.

Source: The Economic Times

Suzlon bags 52.5 MW order from OIL

September 16: Suzlon Energy Ltd rose as much as 2.8 percent to Rs 16.4, after the company bagged its first ever order from government owned Oil India Ltd (OIL). The 52.50 MW capacity project will be commissioned in the states of Gujarat and Madhya Pradesh by June 2017, the renewable energy provider said in its media release. Once completed, the project will provide power to 28,000 households and offset 0.11 million tonnes of carbon dioxide emissions annually.

Source: Bloomberg

Environment Ministry to begin indigenous research for finding alternative to HFCs

September 16: The Ministry of Environment, Forest and Climate Change (MOEF&CC) announced ambitious collaborative research and development programme to develop next generation, sustainable refrigerant technologies as alternatives to HFCs (Hydro Fluoro Carbons). The MoEF&CC, along with the Department of Science and Technology (DST), Council of Scientific & Industrial Research (CSIR) has also decided to create a corpus fund for this research programme, with Industry also committing to contribute to the effort.

Source: The Hindu Business Line

West Bengal govt plans small solar parks

September 15: The West Bengal government has decided to create multiple small solar parks. About five acres of land was required for 1 MW of Solar power, State Power Minister Shobhondeb Chatterjee said. He said the state government would continue to focus on renewable energy and would attend the Union Power Ministry-convened conference on renewables. The minister said 100 percent electrification was already complete in 11 districts and by March 2017, work would be complete for the entire state. Chatterjee was confident that the 1,000 MW Turga hydel power project would take off shortly once environmental clearances were in place.

Source: The Hindu Business Line

Waaree Energies forays into floating solar PV market

September 15: Solar panel manufacturer Waaree Energies announced a strategic partnership with 4CSolar, making its entry into floating solar PV market. This strategic tie-up will enable Waaree Energies and 4CSolar to provide scalable solutions for lakes, reservoirs, canals and off-shore solar projects in India. 4CSolar has developed patent-protected technologies to enable highly reliable, low-cost and eco-friendly installations of floating solar power plants on lakes, dams, and near-shore seawater.

Source: Business Standard

Adding hydro can take India's clean power to 225 GW by 2022

September 15: Government is considering reclassifying large hydro power plants as renewable projects, Power Minster Piyush Goyal said, adding that it can help India achieve clean power capacity of 225 GW by 2022. Removing the distinction between small project (up to 25 MW) and large hydro project can help India projecting that its installed renewable energy capacity would be 225 GW by 2022. Of the 305 GW installed power generation capacity, 43 GW comes from large hydro projects (above 25 MW) and 44.23 GW from other renewable power generation capacities. Goyal was of the view that if these large hydro projects are included in the renewable segment then the total installed capacity of clean and green power would be 225 GW by 2022 after achieving the target of 175 GW set by government. As per experts, besides better projection of India's renewable energy capacities, it would help the hydro power sector as it would be able to access incentives being provided to renewable energy projects by the government.

Source: The Economic Times

UNIDO-MNRE project pushes for new solar thermal tech in industries

September 15: A concerted effort has been initiated by the Ministry of New and Renewable Energy (MNRE) and the United Nations Industrial Development Organisation (UNIDO) to encourage use of new solar technologies to enable energy-intensive industries to bring down their energy consumption. The GEF (Global Environment Friendly)-UNIDO-MNRE project has thus far covered 11 States in the country seeking to popularise Concentrating Solar Thermal (CST) technology, backing companies to make their processes more efficient, funding them and sharing technological know-how, UNIDO said. UNIDO said the industrial consumption is responsible for 28 percent of India’s total energy, where a small part is met with electricity and the rest is by fossil fuels, indicating a large amount of energy is used in the industries to meet thermal energy requirement.

Source: The Hindu Business Line

International: Oil

Oil market stabilization deal may last one year: OPEC chief

September 20: A possible deal to support oil prices by the world's leading producer countries may last for one year, the secretary-general of Organization of the Petroleum Exporting Countries (OPEC) chief Mohammed Barkindo said. OPEC and non-member producers including Russia are discussing a deal to stabilize the market by at least freezing output, although key details such as the timing and baseline for any deal have yet to emerge. Russia and members of the OPEC hold an informal meeting in Algiers on September 28. Algeria's energy minister said any OPEC move to freeze output would help balance the market for at least six months. Several producers have called for an output freeze to rein in a supply glut that triggered a price collapse in the last two years, hitting their income. Previous talks on an output freeze collapsed in April.

Source: Reuters

US motorists wasted billions on premium gasoline last year: AAA

September 20: U.S. consumers wasted billions of dollars last year filling their cars with costly premium-grade gasoline for no tangible benefit, according to a study by the country's leading motorist advocacy group. The report by Heathrow, Florida-based AAA comes as low pump prices and a growing economy enticed U.S. motorists to buy more premium-grade gasoline in June than in any month since 2003, according to the U.S. Energy Information Administration.

Source: Reuters

Encana sells $1 bn of shares eyeing Permian expansion

September 20: Encana Corp, the Canadian oil and natural gas producer, is selling about $1 billion of shares to fund drilling in Texas next year and repay debt. The company agreed to sell 107 million shares at $9.35 apiece through underwriters led by units of Credit Suisse Group AG and JPMorgan Chase & Co., Calgary-based Encana said. Encana joins producers including Crescent Point Energy Corp in tapping equity investors in recent weeks to fund drilling as U.S. crude is up about 65 percent from its February low. Most of Encana’s investment next year will be targeted toward increasing output in the Permian Basin in West Texas, the largest U.S. oil field. One of Canada’s largest gas producers, Encana has increasingly focused its attention on boosting oil and petroleum liquids production from shales including the Permian, where it established a position with the 2014 purchase of Athlon Energy for $7.1 billion. The company said it aims to double the number of wells on stream in the Permian in 2017, compared to this year.

Source: Bloomberg

Technip says awarded ENOC refinery expansion contract

September 19: French oil services company Technip said it has been awarded an engineering procurement and construction contract by Emirates National Oil Company (ENOC) that plans to expand its Jebel Ali refinery by 50 percent. Technip said the expansion project is estimated at about $1 billion and the project will increase refining capacity by 70,000 barrels per day after completion. The expected date for commercial production is the fourth quarter of 2019, it said.

Source: Reuters

Tethys increases oil production in Oman

September 19: Swedish energy company Tethys Oil AB announced that its share of production, before government take, from Blocks 3 and 4 onshore the Sultanate of Oman increased to 387,174 barrels of oil, or 12,489 barrels of oil per day (bopd), in August. Tethys’ share of production from the blocks amounted to 368,628 barrels in July, which corresponds to 11,891 bopd. The Oman-focused oil producer recorded an output of 1.096 million barrels during the second quarter of 2016, which was similar to the company’s production of 1.101 million barrels of oil during 1Q, and marks a slight increase from Tethys’ output rate of 997,904 during the fourth quarter of last year. The company’s full year production in 2015 was 3.539 million barrels of oil. Tethys is one of the largest onshore oil concession holders in the Sultanate of Oman with a current net production of around 12,000 barrels of oil per day, according to Tethys. The company has exploration and production assets onshore Lithuania and France.

Source: Rigzone

Indonesia eyes 22 percent rise in crude output from Exxon's Cepu block in 2017

September 19: Crude oil output from Exxon Mobil's Cepu block in Indonesia is targeted to reach 200,000 barrels per day (bpd) in 2017, the head of Indonesia's upstream oil and gas regulator said, up from a target of 163,910 bpd for this year. The chief of regulator SKKMigas Amien Sunaryadi said the increase from Cepu was needed to support a nation oil production target of 815,000 bpd for 2017, just below its 2016 target of 820,000 bpd.

Source: Reuters

Curacao inks deal with China firm to run Isla refinery

September 19: The government of Curacao has signed a preliminary agreement with China's Guangdong Zhenrong Energy to operate the aging Isla refinery and invest some $10 billion in upgrading the facility, according to an agreement made public. Venezuelan state oil company PDVSA has for decades operated the refinery, which opened in 1918, under a lease agreement. But the cash-poor PDVSA has been reluctant to invest some $1.5 billion that Curacao authorities requested several years back to modernize the 335,000 barrels per day facility. Located just 50 kilometers northwest of Venezuela, the Isla refinery is a strategic facility for PDVSA to store and ship Venezuelan oil destined for the Asian market. China in the last decade has become one of the top buyers of Venezuelan crude and fuel through an oil-for-loans financing agreement. Unlike many facilities in Venezuela, terminals at Isla and neighboring Bullenbaai can receive large tankers, such as Very Large Crude Carriers that can transport up to 2 million barrels of oil to China. The current lease agreement with PDVSA stipulates that if neither party ends the agreement two years before its expiration, it is automatically renewed for another 10 years. The current lease expires on Dec. 31, 2019. This year it won approval from Myanmar authorities to build a $3 billion refinery in the Southeast Asian country in partnership with local parties including the Energy Ministry.

Source: Reuters

Venezuela says global oil supply exceeds demand by 10 percent

September 19: Global oil supply of 94 million barrels per day needs to fall by about a tenth if it is to match consumption, Venezuela's Oil Minister Eulogio Del Pino said. Del Pino, whose country is pressing for OPEC and non-OPEC producers to reach a deal to bolster crude prices, said a "fair price" would be around $70 per barrel. Venezuela's President Nicolas Maduro said that OPEC and non-OPEC countries were close to reaching a deal to stabilize oil markets.

Source: Reuters

Petrobras expected to cut investment, output in 2017-21 plan

September 19: Brazil's heavily indebted state-led oil company Petroleo Brasileiro SA (Petrobras) will likely cut planned investment by about a sixth and its 2020 output goal by 14 percent under a five-year strategic plan scheduled for release before markets open, according to analysts. Petrobras is expected to announce a 2017-2021 capital budget of $82.7 billion, or an average of $16.6 billion a year, according to the average estimate of eight analysts surveyed. That would be Petrobras' smallest five-year capital budget since 2006 and 16 percent less than the Rio de Janeiro-based company's 2015-2019 plan revised in January. The cuts would be part of Chief Executive Officer Pedro Parente's fight to curb the company's nearly $125 billion of debt, the largest of any company in the global oil industry, and focus spending on crude oil exploration and production needed to pay for it. When combined with a promise to sell $15 billion of oilfields, pipelines and other assets by year-end and $43 billion through 2018, Parente said he hoped the plan would focus cash on the company's portfolio of giant offshore oil discoveries south of Rio de Janeiro.

Source: Reuters

Iran supports any move to stabilize oil market: Rouhani

September 18: Iran's President Hassan Rouhani said Tehran supports any move to stabilize the global oil market and lift prices, the Iranian oil ministry said. Iran has been boosting its oil output after the lifting of Western sanctions in January. Tehran refused to join a previous attempt this year by OPEC and non-members such as Russia to stabilize production, and talks collapsed in April. OPEC members will meet on the sidelines of the International Energy Forum (IEF), which groups producers and consumers, in Algeria on September 26-28. Non-OPEC producer Russia is also attending the forum. OPEC will probably revive talks on freezing oil production levels when it meets non-OPEC nations in Algeria. Saudi Arabia and Russia agreed to cooperate in oil markets, saying they could limit future output.

Source: Reuters

Shell starts new heart cut splitter at Netherlands refinery

September 16: Shell formally marked the start-up of a new aromatics unit at its Pernis refinery in Rotterdam, the Netherlands, the company said. With a capacity of 404,000 barrels per day, Shell Pernis is Europe's largest integrated refinery/chemicals site, according to Shell.

Source: Downstream Today

Discovery made in Cara prospect offshore Norway: Tullow Oil

September 16: Tullow Oil Norge AS announced that an oil and gas discovery has been made in the Cara prospect offshore Norway. Located in license 636, the well encountered a gas column of 167 feet and an oil column of 196 feet. The operator of the license, ENGIE E&P Norge AS estimated that the find could hold between 25 and 70 million barrels of oil equivalent. The partners in control of the discovery will now evaluate the possibility of linking this discovery to existing infrastructure at the nearby Gjøa field.

Source: Rigzone

Pluspetrol, partners in Peru offer three natural gasoline cargoes

September 16: Argentina's oil firm Pluspetrol and its partners in Peru have launched a tender to sell three cargoes, of 300,000 to 450,000 barrels each, of natural gasoline for delivery October 2-28 at Pisco port. Bids for this tender will be received until September 21 and they must refer to naphtha prices from Japan or Northwest Europe. Offers indexed to natural gasoline prices from Mont Belvieu, Texas, will also be accepted.

Source: Reuters

Iran crude exports hit five-year high near pre-sanctions levels

September 16: Iran's August crude oil exports jumped 15 percent from July to more than 2 million barrels per day (bpd), closing in on Tehran's pre-sanctions shipment levels of five years ago. The strong demand for Iran's crude in Asia and Europe has enabled it to raise its oil output to just over 3.8 million bpd as of this month, still shy of the 4 million bpd level Tehran says is a precondition for discussing output limits with Saudi Arabia and Russia. The crude exports have climbed from 1.9 million bpd in June and 1.83 million bpd in July, the schedules showed. Iran's August exports are the highest since January 2012, boosted by record purchases from the world's third-largest oil importer India and a 48 percent jump that brought European sales to 630,000 bpd, tanker loadings for last month also showed. Iran's crude exports excluding condensate to Asia in August were 1.48 million bpd, up from 1.40 million bpd in July and roughly steady to this year's previous peak in April. Loadings headed for India reached a likely record of nearly 600,000 bpd last month, according to data stretching back at least 15 years, up 150,000 bpd from July, and topping 564,000 bpd loaded for China. Japanese loadings were nearly 230,000 bpd, compared with about 92,000 bpd for South Korea. Iranian oil was also loaded for Turkey, Greece, and Spain, and exports to Italy more than doubled from the previous month to 87,000 bpd, according to the schedules. To further boost its exports, Iran expects to complete the building of a terminal by year-end for a new grade.

Source: Reuters

US to offer 47 mn acres for O&G exploration in Central Gulf of Mexico

September 16: The US Bureau of Ocean Energy Management has announced that it will offer nearly 47 million acres offshore Louisiana, Mississippi, and Alabama for oil and gas (O&G) exploration and development in a lease sale. The proposed Central Gulf of Mexico Lease Sale 247 is scheduled to happen in New Orleans in March of 2017. The eleven sales, which were aimed at increasing domestic oil and gas production, conducted in the past netted over $3 bn. The latest sale will comprise approximately 8,878 blocks, located from three to about 230 miles offshore. In July, the bureau announced plans to offer 23.8 million acres for oil and gas exploration and development offshore Texas.

Source: Energy Business Review

Shell agrees $80 mn sale of remaining Danish downstream business

September 15: Royal Dutch Shell has agreed an $80 million sale of its remaining Danish downstream business, including its Fredericia refinery, to Denmark's Dansk Olieselskab, the company said. Shell, which wants to sell $30 billion worth of assets, will continue a long-term agreement to provide crude oil and feedstocks to the 70,000 barrel a day refinery and to offtake some of its products, it said. The deal is expected to complete next year.

Source: Reuters

NOCs to retain investment dominance: IEA's Birol

September 14: National oil companies (NOCs) will continue to dominate upstream oil and gas investments if oil prices remain at current low levels, creating a new dynamic in the market, the International Energy Agency (IEA)'s executive director, Fatih Birol, said. NOCs, which include huge state-run firms Saudi Aramco, China's CNPC and Mexico's Pemex, have raised their share of upstream investments to a 40-year high of 44 percent, the IEA said. International oil companies (IOCs), which include Anglo-Dutch Shell, U.S. heavyweight ExxonMobil and France's Total, have been forced to scale back investments as weak prices squeeze profit margins. NOCs have also made cuts but less severely than independent companies. IEA figures show more than $300 billion of upstream oil and gas money has been slashed in 2015 and 2016, an unprecedented amount. The largest cost cuts came from North American independent companies Apache, Murphy Oil, Devon Energy and Marathon, which reduced spending by around 80 percent between 2014 and 2016, the IEA said.

Source: Reuters

Scottish O&G production increases 21.4 percent

September 14: Scottish oil and gas (O&G) production increased by 21.4 percent this year, compared to 2014-15, according to official figures from the Scottish Government. In the financial year 2015-16, O&G production in Scotland, including Scottish adjacent waters, is estimated to have been 70 million tons of oil equivalent. In 2015-16, operating expenditure, excluding decommissioning, on oil and gas production in Scotland is estimated to be $8.9 billion (£6.8 billion), down 6.7 percent compared to the previous year.

Source: Rigzone

Det Norske increases production guidance for 2016

September 14: Norway-focused exploration and production company Det norske oljeselskap ASA announced that it has increased its production guidance for 2016. Det norske’s production, excluding effect of a proposed merger with BP Norge AS, is expected to average between 62,000 and 65,000 thousand barrels of oil equivalents per day (boepd) this year, up from a previous guidance of between 55,000 and 60,000 boepd.

Source: Rigzone

International: GAS

Icahn dumps more than half his stake in gas giant Chesapeake

September 20: Billionaire investor Carl Icahn said his decision to cut his stake in shale driller Chesapeake Energy Corp by more than half to 4.6 percent was for tax reasons. Icahn began amassing significant amounts of Chesapeake stock during the second quarter of 2012, when the shares traded between about $12.60 and $22.40. Icahn Enterprises LP has declined almost 30 percent in the past 12 months, hurt in part by energy investments including Chesapeake and natural gas exporter Cheniere Energy Inc. A heavy debt load and weak energy prices have weighed on Chesapeake, the second-largest U.S. natural gas producer. Icahn said that he sold part of his stake for tax reasons, and remains confident in the company’s leadership.

Source: Bloomberg

Europe’s biggest natural gas producer is running out of fuel

September 16: The European Union’s biggest natural gas producer is running out of reserves. The Netherlands, also the region’s largest trading hub for the fuel, has used up almost 80 percent of its natural gas reserves, Dutch statistics office CBS said. Production fell 38 percent over the previous two years and is set to fall further as the government limits extraction because of earthquakes in Groningen, the province that houses the EU’s largest gas deposit, it said. The nation of about 17 million people is struggling to contain tremors linked to gas production by a joint venture of Exxon Mobil Corp and Royal Dutch Shell Plc that has damaged thousands of homes. The government budget has been hit by the caps on extraction and declining wholesale prices, with gas accounting for just 3 percent of state income in 2015, down from 9 percent two years earlier, the CBS said. The Netherlands produced 3.85 trillion cubic meters (136 trillion cubic feet) of gas since the discovery of the Groningen deposit in 1959, more than total global production last year, and has 940 billion cubic meters of reserves, CBS said. Groningen gas production was capped at 27 billion cubic meters in the gas year that started October 1, 2015. Parliament approved a government proposal to lower the cap to 24 billion cubic meters a year for five years.

Source: Bloomberg

Gas production restarts at ONHYM pipeline in Morocco

September 16: Gas production has restarted at an Office National des Hydrocarbures et des Mines (ONHYM) owned and operated gas pipeline spur in Morocco, following the completion of gas pipeline repairs. This pipeline spur was used to transport approximately 30 percent of the gas produced in the Sebou field, which is owned by Circle Oil Maroc, which operates the field with a working interest of 75 percent, and ONHYM, which holds the remaining 25 percent interest. The pipeline was closed whilst repair work was designed and implemented. The repair was carried out by Circle without incident, on schedule and slightly under budget. Production was restarted through the repaired pipeline on September 15.

Source: Rigzone

US natural gas market rebalancing well underway

September 16: The U.S. natural gas market is well on the way to rebalancing as unusually high air-conditioning demand coupled with strong underlying consumption growth absorbs the record inventories left at the end of last winter. Anticipating a tighter market in 2017, hedge funds and other money managers amassed the largest net long position in natural gas futures and options for more than two years by the end of August.

Source: Reuters

Japan's Hokkaido gas to start operations at new LNG tank

September 16: Japanese city gas supplier Hokkaido Gas Co Ltd said its newly built 200,000-kilolitre No.2 liquefied natural gas (LNG) tank at its Ishikari LNG terminal would start operations by accepting the first delivery of gas from an LNG tanker. The LNG storage capacity at the terminal in northern Japan increased to 380,000 kl from 180,000 kl with the addition, which enables the fully-laden LNG tanker to be unloaded at the terminal, the company said. It previously had to unload gas at two ports due to lack of capacity.

Source: Reuters

Canada hasn’t sought Petronas guarantee on gas plant: Trudeau

September 16: Prime Minister (PM) Justin Trudeau’s government will decide on final approval of the Pacific NorthWest gas project without any guarantee Petroliam Nasional Bhd. (Petronas) will actually proceed, Canada’s Natural Resources Minister Jim Carr said. The company’s final decision will also hinge on any conditions -- and costs attached to them -- the government places on its approval, Carr said. Trudeau plans to approve at least one pipeline in his first term and is said to favor the Trans Mountain project.

Source: Bloomberg

Naftogaz says charter change threatens gas purchases from Europe

September 16: Ukraine has changed the charter of Naftogaz in violation of a deal with foreign creditors, in a move that could hold up a $500 million loan for vital gas purchases from Europe, the state-run energy firm said. The European Bank for Reconstruction and Development (EBRD) expressed concern after Naftogaz said the economy ministry transferred control of the company's gas transport arm, in violation of corporate governance principles. The economy ministry said its move was in accordance with a Western-backed plan to separate the different businesses of Naftogaz, which operates in every part of the gas sector, from production to transport to sales.

Source: Reuters

Total looks beyond Bolivia's Incahuasi to regional gas market

September 16: Oil and gas giant Total could start the second phase of its Incahuasi gas project in Bolivia as early as 2017 if the right market conditions and incentives for investments are in place, the company's director for the Americas Michel Hourcard said. The $1.2 billion Incahuasi gas and condensate project which will officially be inaugurated, began production at three wells in August. Total aims to ramp output to more than 7 million cubic meters of gas per day by the end of September, about 10 percent of Bolivian production, from 5.2 million as soon as a compressor is added to increase pressure, Michel Hourcard said. The Bolivian government of President Evo Morales has said Total has committed about $800 million for phase two. Incahuasi is expected to reassure the market over the Andean nation's ability to meet both export and internal gas demand. Hourcard said about 90 percent of the gas from Incahuasi was destined for export, mostly to Argentina and Brazil via a 100 kilometre pipeline.

Source: Reuters

Statoil to supply some LNG to Baltic countries

September 15: Statoil is to supply some liquefied natural gas (LNG) to small capacity LNG terminals in the Baltic Sea through Lithuania's Klaipeda LNG terminal, Statoil said, after the Norwegian company signed an LNG deal with subsidiaries of Lithuanian state-owned energy group Lietuvos Energija. The floating LNG terminal at Klaipeda started operations in 2014 as part of Lithuania's efforts to reduce dependency on Russian gas. It has struggled to attract business because Latvia and Estonia are not buying its gas. Statoil is so far the only supplier to the terminal. Gazprom was previously the only supplier to Lithuania but this year Statoil will supply more than the Russian company. The Klaipeda terminal expects to accept 14 LNG tankers in the year to October 1.

Source: Reuters

Russia's Gazprom expects agreement on Turkish Stream pipeline in October

September 15: Russia's Gazprom expects Russia and Turkey to sign an agreement next month that will allow construction of the offshore section of the Turkish Stream gas pipeline to start in late 2017, Deputy Chief Executive Officer Alexander Medvedev said. Talks on the project were halted last year after Turkey shot down a Russian air force jet and Russia retaliated with trade sanctions. But since then, Moscow and Ankara have made significant progress towards restoring relations. The project envisages two links, with the first line, with a capacity of 15.75 billion cubic meters, designed for supplying the Turkish market, and the second line intended to pump gas onwards to Europe. Medvedev said Gazprom is now discussing with a range of European Union energy firms ways of delivering gas from the Turkish-EU border to European countries.

Source: Reuters

Eni reached record production at Nooros gas field in Egypt

September 15: The Italian-based oil and gas company Eni has reached record high gas production from Nooros field in the Nile Delta offshore in Egypt. Just one year after gas discovery, the company is producing 700 million cubic feet per day (20 million cubic meters per day) from 7 wells. With the drilling of additional wells, the field is expected to increase production by 25% to around 160,000 barrels of oil equivalents per day in the spring of 2017. The Nooros field is estimated to holds a potential of 15 billion cubic meter of gas in place with upside, plus associated condensates.

Source: Enerdata

Oman-Iran gas pipeline cost to rise due to new route