Executive Summary

Riding on the climate commitments made at Paris, the world was well on its way to a temperature rise over 3 degrees Celsius above pre-industrial levels by 2100. With the window of opportunity for climate action fast closing, the 26th session of the Conference of the Parties (COP26), hosted in Glasgow in November 2021, was referred to as the “make-or-break” summit in the fight against climate change. With the announcement of the net-zero targets by major economies, such as China, and the US, global warming projections have improved. Climate change is one of the outcomes of the environmental debt that has accumulated over time due to the global failure to incorporate environmental costs into economic growth and development calculus.

India’s ambition to grow into a US$5-trillion economy by 2024-25 while also addressing this accumulated environmental debt will make it a decisive player on the global chessboard of climate-change mitigation. As the third-largest emitter, the second-most populated country (1.38 billion as of 2020 and estimated to reach 1.6 billion in 2048), and one of the fastest-growing economies, India is expected to emerge as a world leader in climate action for achieving global net-zero emissions by pursuing a 1.5 degrees Celsius compatible development pathway. Further, this development experience can prompt similar action by peer nations and make India their touchstone in resolving the trade-off between environmental sustenance and economic growth.

India’s green transformation—anchored in increased efficiency in technology and business models, as well as a growth in green infrastructure—must involve high-impact sectors such as energy, mobility, manufacturing, agriculture, waste management and buildings, given their contribution to India’s pressing environmental concerns, namely, greenhouse gas (GHG) emissions inventory of the nation; air, water and soil pollution; land degradation; water stress; and ecosystem and biodiversity losses. This green transformation demands a significant portion of India’s gross domestic product, approximately seven percent to eight percent annually, to be invested in green infrastructure as well as an annual climate-smart investment to the tune of US$300 billion. While there is no universally accepted definition of “green finance,” investments that take into consideration the environmental sustainability of economic activities, projects or assets financed by them may be broadly referred to as such.

At the global level, green private capital is abundant. The number of signatories to UN-backed Principles for Responsible Investment stood at 3,826 as of April 2021, representing US$121.3 trillion in collective assets under management; the number of sustainability indexed funds benchmarked to environmental, social, and governance indices were as large as 534, overseeing a combined US$250 billion by the end of the second quarter of 2020; and the current size of the impact investing market stands at US$715 billion, according to Annual Impact Investor Survey 2020. Yet, the share of international private finance in tracked green finance for 2016-17 and 2017-18 was as low as five percent.

The investment peculiarities of green projects involve risk-return characteristics beyond the financing capacities of conventional financial institutions and lenders, which are under stress in India. The amount of green investment required, the relative underdevelopment of the Indian financial market, the small pool of domestic institutional investors, and the tight investment regulations imposed on such investors make foreign private capital crucial for India’s green transformation. However, the high-risk perception becomes amplified in emerging economies and is one of the factors responsible for India’s inability to attract the requisite green finance investments. This perception is compounded to a certain degree by the absence of a national green taxonomy to standardise the notion of green finance and identify activities eligible for such finance. Consequently, green investments in India are susceptible to varied interpretations of green finance, increasing the likelihood of information asymmetry and, in turn, the risk of greenwashing.[1] Developing a green taxonomy will kickstart the process of transforming green finance “from a trickle to a flow” and help provide the resource base required to realise India’s green transition. A taxonomy characterised by a well-defined set of eligibility criteria can provide a clear understanding of and transparency about the environmental implications of the economic activities underlying financial instruments. It acts as a lighthouse for environmentally conscious investors in their decision-making and boosts their confidence in green investments. Financial institutions and companies can manage and track their environmental footprint in sync with the taxonomy, while the regulators can monitor these entities by mandating disclosures aligned with the taxonomy. Further, the Indian government can monitor its progress in contributing to the global net-zero vision and modify its action plan to correct any deviations.

This report employs an illustrative approach to establish a rulebook for guiding the development of a national green taxonomy for India. As a springboard from which to approach this effort, the document first reviews some existing taxonomies—Bangladesh, China, Climate Bonds Initiative, Egypt, European Union, Malaysia, Multilateral Development Banks-International Development Finance Club (MDB-IDFC) Common Principles, Mongolia, and the World Bank guidelines.

Some of the important insights derived from this exercise have become the guiding principles of the proposal presented in this document. These include:

- Addressing the pressing environmental challenges confronting India and thereby maximising the environmental gains accrued from implementing the taxonomy, without compromising India’s growth and development needs.

- Ensuring that the eligibility criteria is technology agnostic and must preferably be defined in a way that allows India to pursue to the best extent possible a development pathway aligned with a goal of 5 degrees Celsius.

- Making the eligibility criteria compatible with the broader intent of India’s nationally determined contributions (NDCs), major national plans and policies for environmental action. The taxonomy can enable more ambitious climate action than these NDCs, plans and policies.

- Broadly aligning the eligibility criteria with national environmental norms and standards. However, for the effective implementation of the taxonomy, these may be upgraded to be at par with international standards. New norms and standards may be created wherever needed.

- Harmonising with international taxonomies while taking into account specific domestic circumstances.

- Scheduling regular review and updates to incorporate changes in development levels, technology, policy, and standards that bear upon environmental sustenance, and environmental conditions.

The illustrative approach developed in this document distinguishes between two types of economic activities: (i) Critical economic activities that must satisfy the technical screening criteria to become eligible for green finance and (ii) Activities that enable the performance of type (i) activities, by which they become eligible for green finance and do not need to satisfy any technical screening criteria. The proposal develops technology-agnostic technical screening criteria for type (i) activities across sectors such as energy (power), manufacturing, transport, agriculture and livestock, waste and buildings.

For the energy (power), manufacturing and transport sectors, eligibility criteria are developed in terms of GHG emissions, air and water pollution, water consumption, and ecosystem and biodiversity losses. Cases that violate the quantitative thresholds of ecosystem and biodiversity losses will be ineligible for green finance. A Cumulative Environmental Impact Assessment is mandated for those in which the loss of ecosystem services and/or biodiversity is below the tolerable thresholds. For the power sector, thresholds are defined in the context of energy efficiency. For the buildings sector, technical screening criteria are developed with regard to energy efficiency and composite environmental performance, including water consumption, resource utilisation, and waste management. Eligibility criteria in the context of the waste sector are mostly qualitative in nature, classified across four broad categories—net GHG reduction; efficient use of scarce resources; source segregation and separate collection of waste; and pollution prevention and control.

Due to the heterogeneity of farms and the non-feasibility of tracking GHG emissions, air and water pollutants, and water consumption, adherence to the taxonomy requires demonstrating compliance to a pre-specified set of sustainable agricultural and livestock farming practices suitable for the Indian context. Sustainable agricultural practices include the use of organic bio-stimulants, scientific field management, efficient irrigation management and suitable crop-rotation patterns, prevention and early detection of diseases, elimination of sources of infection, economised use of pesticides and insecticides to enhance the soil environment and health, ensuring a good water vapour cycle, improving the soil microbiota, and efficient utilisation of fertilisers to enable the recycling of nutrients. Sustainable livestock farming practices include better pasture management, improvement in animal nutrition and genetics, improved manure management, fertiliser management, animal health planning, well-designed selection strategies, cross-breeding and artificial insemination to improve livestock productivity, and measures to minimise water pollution.

This document superimposes the proposed technology-agnostic technical screening criteria on the existing green pathways implemented in India to gauge their taxonomy alignment.

Technical screening criteria across all dimensions of environmental sustainability are additive, not substitutive, and must be satisfied simultaneously. Only (an iteration of) an activity that adheres to the thresholds across all environmental concerns relevant to that activity will be deemed as green and the investments utilised to achieve this adherence will be recognised as green finance; irrespective of whether that investment is expended to satisfy one or some or all of the environmental commitments. To avoid ambiguity in the definition of a broad economic activity, it is critical to identify the complete chain of sub-activities. Activities eligible for green finance can be distinguished into two distinct categories: those that already adhere to the screening criteria and those that fall short of the screening criteria but intend to adhere to them. Thus, investments used for projects undertaken and assets created as part of an economic activity that satisfies the eligibility criteria of the taxonomy qualify as green finance.

The financial market participants must demonstrate how the taxonomy was used in securing the environmental sustainability of the underlying investments for each financial instrument and delineate the environmental goals met by such investments, as well as the proportion of underlying investments that are taxonomy-aligned (expressed as a percentage of the investment into an instrument, fund or portfolio). The companies must further disclose, disaggregated by economic activity, the proportion of their revenues/ turnover and capital/operational expenditures aligned with the taxonomy as well as the environmental objectives achieved. Disclosures made by green-bond issuers and banks disbursing green loans must use the taxonomy as their point of reference. External verification of disclosures may be mandated to circumvent the risk of greenwashing.

The taxonomy proposed in this document focuses solely on climate change mitigation since the enormity of the subject necessitates a dedicated taxonomy for adaptation exercises. Future research in this area will focus on developing a taxonomy for the forestry sector, which must take into account the ecosystem services provided by forests and develop the criteria for afforestation, sustainable forest management and reforestation.

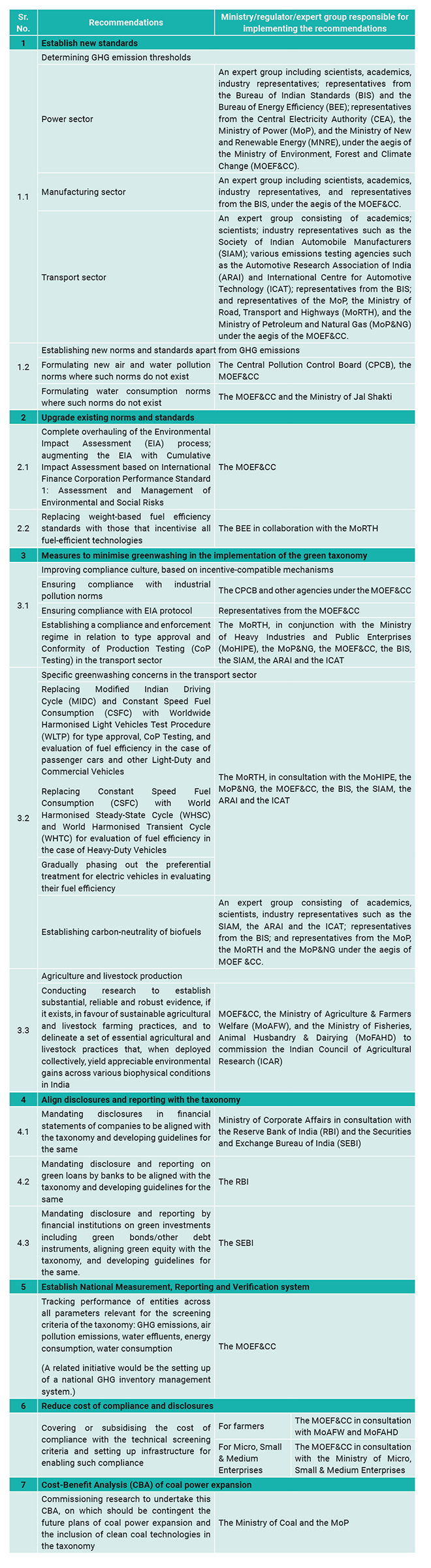

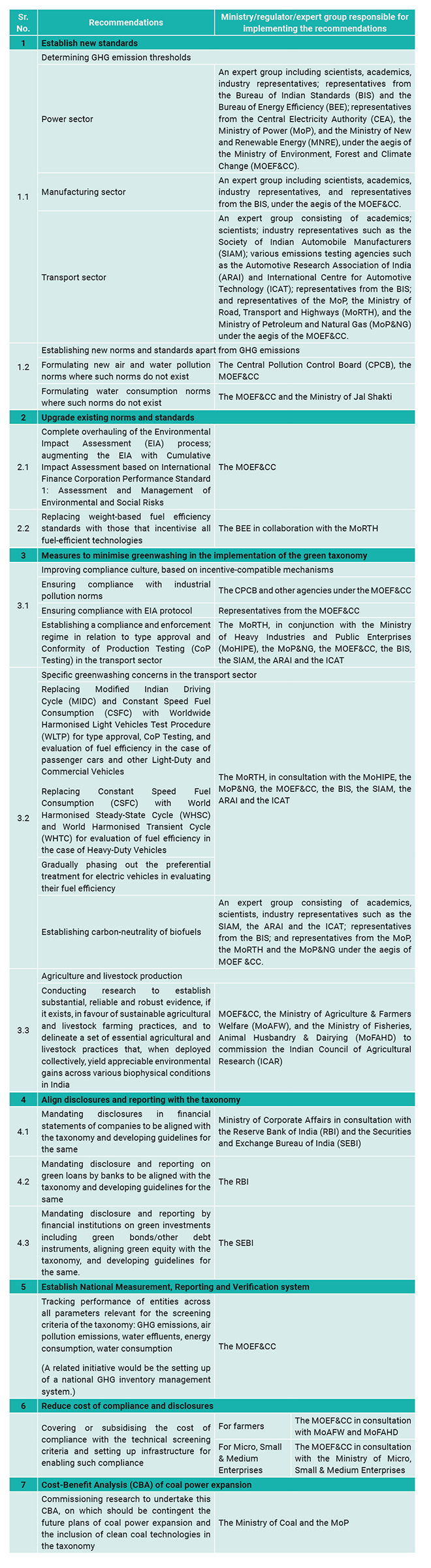

Table 1: Recommendations for the Effective Implementation of a Green Taxonomy in India

Read the full report here.

[1] False or misleading claims about the degree of environmental sustainability of an investment instrument.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

PREV

PREV