Market participants’ plea for removal of Commodity Transaction Tax (CTT) ever since it came into existence in July 2013 on non-agricultural commodity derivatives trading in India has gone unheeded so far. In Union Budget 2020-21, things went further south for the commexes with CTT being extended on sale of index futures and options in goods.

This was a retrograde step from the perspective of the government’s mandate of creating an enabling business environment through improving ‘ease of doing business’; rather it increases the “cost of doing business”, and goes against the visions of Make in India and Aatmanirbhar Bharat, as it deprives the domestic commodity-based enterprises from effective risk-management platforms. Probably, India is the only country apart from Taiwan having CTT.

There is no denying the fact that this tax completely defeats the initial purpose for which commodity derivatives trading was allowed in the new millennium: risk management or hedging, and price discovery. This is revealed in a recent study conducted by us at the Observer Research Foundation.

The impact of CTT

The study entailed an analysis of open access daily trading data (volume, prices, etc) from January 2006 to December 2019 of Multi Commodity Exchange (MCX) of India (which dominates the non-agricultural domain of commodity derivatives) for five non-agricultural commodities: aluminium, copper, crude oil, gold and silver. The impact of CTT on volume and volatility was checked, and eventually its role in hedging at the micro level, and price discovery at the macro level.

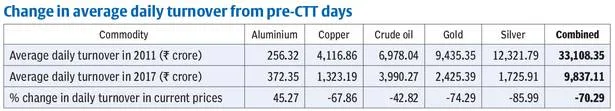

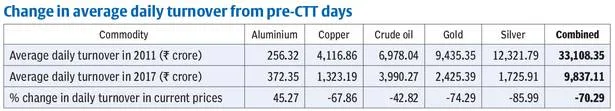

As estimated and shown in the Table, volumes in 2017 declined substantially as compared to 2011, a representative year prior to the imposition of CTT, and a normal year prior to the MCX going for its IPO. For these commodities, the overall decline is around 70 per cent — a result of an increase in the cost of hedging due to CTT.

Discover Customer 360, the world’s #1 CRM. Connect to your customers in a more intelligent way by uniting sales, service, marketing, commerce, IT, and analytics.

Sponsored By Salesforce

Also, liquidity through the Hui-Heubel ratio, which reveals the reciprocal of liquidity, was measured. Liquidity of trading essentially reflects on how fast a trader can enter or exit from the market at a desired price. A higher Hui-Heubel ratio reflects lower liquidity. Interestingly, the results do not show much change in the liquidity measures of the selected commodities.

However, the impact on hedging efficiency is palpable. Hedging effectiveness measured in terms of the Ederington formula reveals how effectively a hedger can hedge against the risks posed by price volatility in the physical market. All these non-agricultural commodities under consideration are affected by forces of international trade, finance, geo-economic and geo-political developments.

Therefore, the more effectively the futures prices mirror the physical market dynamics, the more effective is risk management. Our estimates show that crude oil, gold and silver have recorded a decrease in hedging efficiency as a consequence of CTT, while there is no change in the hedging efficiency in aluminium; copper’s hedging efficiency, however, shows a rise.

We have also tested the impact of CTT on price discovery with the Garbade-Silber econometric framework. Price discovery is the phenomenon where a market, through incorporation of various forms of information from the physical market and the commodity economy as a whole, helps in creating reference prices for other markets. This helps primary producers, market intermediaries and corporates, among others, in their critical extraction, storage and marketing decisions.

Future of physical market

Hence, it is expected that an efficient futures market should reflect on the future of the physical market. Our econometric framework revealed that the price discovery function declined for copper, gold and silver due to CTT imposition, though the same is not true for crude and aluminium.

However, one needs to note here that the crude oil variety imported in India does not really match with the one traded in the commex, and aluminium has substantially low volume to really have any impact in physical trading.

In any case, the negative impacts of CTT argued here are pretty well evidenced. A 2008 EPW paper — ‘Commodity Transaction Tax: A Recipe for Disaster”, September 27’ — shows on the basis of a scenario analysis that there is a case of existence of “Lafferisation” (with the revenue generated from CTT being lower than the direct and indirect revenue loss due to the lower turnover and its cascading impacts on incomes), with the possibility of critical point being reached at between 10 and 15 per cent volume loss.

As noted, the volume loss in the non-agricultural segment is already to the tune of around 70 per cent. Considering the fact that these commodities comprise more than 80 per cent of turnover, there is a high chance of revenue loss than garnering revenue on the part of the government. The case of removing the CTT therefore rests here.

This commentary originally appeared in The Hindu | Business Line.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV