Introduction

The question of what constitutes ‘money’ has repeatedly been raised across history. In more contemporary times, it was economist Stephanie Bell (2001) who had listed the multiple functions that money must discharge: “a numeraire, a medium of exchange, a store of value, a means of payment, a unit of account, a measure of wealth, a simple debt, a delayed form of reciprocal altruism, a reference point in accumulation, an institution, or some combine of these?.”[1] Many of these functions (for instance, as means of payment) are necessarily socially mediated. There is no prima facie reason to believe that the nature of exchange must be commercial in the sense that receiver of the money is to give in exchange another good or services – that is “give value for value”.

The form of money has evolved over time—from stone money of the Yap in the Western Caroline Islands of Micronesia[2] to paper money of the present. This paper is about the digitalisation of fiat money, a subject that has gained greater attention in recent years. Already, countries like Sweden and China have begun embarking on their pilot digitalisation projects; other countries are ideating their own frameworks. The paper proposes an architecture for India that largely retains all the properties of a paper currency, with only one limitation—i.e., the lack of complete anonymity when cash is transferred peer-to-peer.

The next section describes two main views about the origin of money and how cryptocurrencies like Bitcoin can be described as the digital realisation of one of those views. The subsequent section then argues that cryptocurrencies cannot be considered as ‘currency’ or even ‘money’ because of their failure to replicate all the features of a paper currency. The rest of the paper explores a recommended blueprint for a Central Bank Digital Currency (CBDC) that can be issued by the Reserve Bank of India.

The Origin of Money

The debate about the origin of money and its defining features is as old as the time of ancient Greece.[3] There are two fundamental and contrasting views about the origin of money and its evolution to fiat currency, and the debate is centred around two disciplines: economics and anthropology.

The Economist’s View

The dominant economic view about the origin of money was first conceptualised and set against a logical framework by Austrian economist Karl Menger, in his book, “On the Origins of Money” published in German in 1892.[4] This view can be called “transactional cost minimisation”. While accepting that “cattle, skins, cubes of tea, slabs of salt, cowrie-shells, etc.”[5] did function as a medium of exchange in many societies, the fundamental question that Menger was seeking answer to was “why it is that the economic man is ready to accept a certain kind of commodity, even if he does not need it, or if his need of it is already supplied, in exchange for all the goods he has brought to market.”[6] To resolve this conundrum, Menger ideated a generic feature of any produced goods – that is its “saleability”. He writes: “The theory of money necessarily presupposes a theory of the saleableness of goods.”[7] A commodity having “almost unlimited saleableness” becomes money in a society through a natural process of optimisation of transactional cost involved in barter.

The circularity of this definition of money is obvious. Why “cattle” or “cowrie-shells” attain “maximum saleability” in one society or another is a question that Menger has no answer to. It must be a social consensus arrived at either from a top-down or bottom-up approach. In other words, “the nature of money is basically that of pure social convention, and its essential characteristic is its acceptability.”[8] Nevertheless, Menger’s views resonated with most mainstream economists and sophisticated models have been constructed to demonstrate how transition from a barter-based economy to a money-using economy is a natural outcome when transaction cost minimisation is a goal of rational economic agents.[9]

Beyond the “transactional cost optimisation” paradigm, many economists have used “search-theoretic” models to demonstrate why “commodity money appears endogenously as an equilibrium outcome” when “agents choose optimal trading strategies.”[10],[11] An alternative perspective for the emergence of money in an exchange economy has been provided by Alchain (1977) who argued for “the costliness of information about the attributes of goods available for exchange that induces the use of money in an exchange economy.”[12] Banerjee and Maskin (1996) bring out this point formally by developing a Walrasian model of money and barter.[a],[13] In the context of these equilibrium-seeking models, “fiat money” comes out as a welfare-enhancing medium of exchange under certain conditions.[14],[15],[16]

Many of these equilibrium models do not address the question of why money earns interest. In finance, interest is considered as the time value of money. It follows that time must be an essential component in models that explore the “store of value” properties of money. The “overlapping generations consumption-loan model” introduced by Paul Samuelson is one of the earliest attempts to demonstrate why fiat money can have value when time is incorporated into the model.[17] The other models in this genre are “cash-in-advance” and “money-in-utility-function.”[b]

This paper seeks to provide a blueprint for introducing digital cash as another form of fiat money and, thereby, substituting paper currency. The digital cash will co-exist with the digital money that already exists in the form of bank deposits. This paper argues that the replacement of fiat money by any cryptocurrency—which are based on Blockchain technology and third-party validation framework—is not workable as a medium of exchange. Historically, money emerged not only to address the problem of “double coincidence of wants” but also to meet the need of community to create and redeem obligations to each other. Thus, if technology permits, only the digital form of fiat money can be a viable solution.

The Anthropologist’s View

Most anthropologists who have examined use of money in the so-called “primitive societies” have questioned the historicity of the “transactional cost optimisation” view about the origin of money. Paul Einzig (1966), in his book Primitive Money, after chronicling the use and form of money in ancient periods dating back to 5,000 years, concluded: “If there is one conclusion that emerges forcefully from the examination of the evidence regarding the role of primitive money, it is that the true meaning of money can only be grasped if it is viewed not as a mere technical device but as a social institution of fundamental importance.”[18]

Keith Hart (1986) has made a case for reconciling the two views about money. The title of his lecture is Heads or Tails? Two Sides of the Coin. He argued: “Look at a coin from your pocket. On one side is ‘heads’—the symbol of the political authority which minted the coin; on the other side is ‘tails’—the precise specification of the amount the coin is worth as payment in exchange. One side reminds us that states underwrite currencies and that money is originally a relation between persons in society, a token perhaps. The other reveals the coin as a thing, capable of entering into definite relations with other things, as a quantitative ratio independent of the persons engaged in any particular transaction. In this latter respect money is like a commodity and its logic is that of anonymous markets.”[19]

The study of exchange behaviour in primitive societies shows that unit of account and medium of exchange need not be the same commodity. Ridgeway (1892) concluded his study of origin of metallic currency by noting: “Although certain pieces of gold called talents were in circulation among the early Greeks, yet all values were still expressed in terms of cows.”[20]

Anthropologists like Mauss (1950) have contested the very notion that all exchanges of goods must have an underlying cost-benefit calculus. In his highly influential book, Gift, he wrote: “Things sold still have a soul. Hence it follows that to make a gift of something to someone is to make a present of some part of oneself. The exchange of presents did not serve the same purpose as trade or barter in more developed communities. The purpose that it did serve was a moral one. The object of the exchange was to produce a friendly feeling between the two persons concerned, and unless it did this, it failed its purpose.”[21]

The anthropological examination of the origin of money has brought to the fore the significant role non-commercial exchanges played in the evolution of money, from “Kula armbands, potlatch coppers, cows, pig tusks, Yap stones,”[22] to metallic currency and finally, the paper currency. More importantly, this alternative narrative has highlighted the role of debt obligation in midwifing something that can enable accounting and settlement for debt. It needs no emphasis that creditor-debt relationship is much more important in real life than buyer-seller relationship.[23],[24] It is therefore no wonder that the state—the largest debtor in most nation-states—has to be the only issuer of fiat currency so that the state can control its own debt.

The state’s unilateral ability to pare down the real value of its debt by issuance of fiat money has been the most important criticism against the exclusive “legal tender” attribute of fiat money. The Nobel Laureate economist, F.A. Hayek (1990), called for denationalisation of currency because if “we want free enterprise and a market economy to survive … we have no choice but to replace the government currency monopoly and national currency systems by free competition between private banks of issue.”[25] When Satoshi Nakamoto outlined his protocol for introducing private decentralised digital currency, he offered the same argument in favour of non-state currency: “The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”[26] Cryptocurrencies like Bitcoin, Ethereum, and XRP have gone much beyond Hayek’s vision of denationalisation of money as issuance of this “medium of exchange” is driven by an algorithm on which people must repose their trust and not on bank notes to be issued by private banks.

Cryptocurrencies and Money

A cryptocurrency like bitcoin is a cryptography-based software protocol that allows peer-to-peer transfer of “values” without any financial intermediary such as banks. To be considered as a “currency” or even as a digital medium of payments like bank deposits, there has to be a “unit” and a well-defined process of “issuance”. The beauty of the cryptocurrencies like Bitcoin is that its issuance process is also part of the protocol. Although the original protocol of Bitcoin has put a limit to its issuance in terms of number of units, there is no inherent technical reason for enforcing such a ceiling on issuance process. For example, Ether, the second largest cryptocurrency by market cap, has no such limit. This is not necessarily a handicap for Bitcoin, as it can be divided into any number of smaller values. Today the smallest unit is called Satoshi, 100 million of which adds up to one bitcoin. However, a limit to issuance is a desirable attribute for those who are ideologically opposed to a state’s power to issue a fiat currency without limit.

Technologically, cryptocurrencies are based on four basic technologies of which three have been known to the software community for long: Public Key Cryptography; Consensus algorithm for a distributed peer-to-peer computer network; and one-way hash function. The fourth pillar of technology underlying cryptocurrencies is the Blockchain technology for keeping account of all payment transactions. (A brief summary of the Bitcoins protocol is given in Annex A. This cryptocurrency has been the pioneer as well as the most valuable currency in terms of market capitalisation of its outstanding stock.)

The following paragraphs outline some of the basic features of cryptocurrencies that would prevent it from being considered as an acceptable medium of exchange, not to speak of as a store of value.

Third-party verification

The exchange of fiat currencies between two parties does not need any third-party verification. Even if a note is counterfeit, the onus of verification lies with the payee. For any cryptocurrency, third-party verification is essential. Since third-party verification is not a costless function, there is every likelihood that small-value transactions may remain as orphan transactions, waiting for inclusion as a validated transaction in a blockchain. An anonymous reviewer of a first draft of this paper has referred to Lightning Network (LN) which adds another layer to the Bitcoin network that allows two parties to transfer bitcoins without waiting for validation and subsequent inclusion in a blockchain. This helps to reduce latency for completion of a small transaction quickly and with negligible or zero fee. Ultimately, however, the settled transactions done on Lightning Network have to be included in a blockchain. Ferenc Beres and others (2019) have used an LN traffic simulator to examine the viability of such zero or negligible fees for participation of most router nodes in LN. The authors have concluded that unless traffic on LN increases significantly, the present fee structure is not sustainable.[27] Furthermore, an opening transaction between two parties must be made on-chain in order to use the LN. The moot point is that it is not possible to use any cryptocurrency as bearer instrument like a paper currency.

Valuation of Cryptocurrencies

A committee of IFRS Foundation[c] has pointed out why the currently available cryptocurrencies including Bitcoin cannot be treated as financial assets: “This is because a cryptocurrency is not cash … Nor is it an equity instrument of another entity. It does not give rise to a contractual right for the holder and it is not a contract that will or may be settled in the holder’s own equity instruments.”[28] Thus, valuation is based on “cost less impairment.” Impairment is measured by “decreases in market value, determined by taking quoted prices from various digital currency exchanges with active markets, whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.”[29] It is possible that broker-traders who are active in various crypto exchanges are in a position to value their inventory of cryptocurrencies but it cannot be a requirement for holding a medium of exchange by the general public.

Applicability of Anti-Money Laundering Regulations

The Financial Action Task Force (FATF) has highlighted that, with respect to cryptocurrencies, “responsibility for AML/CFT compliance and supervision/enforcement may be unclear.” Furthermore, customer and transaction records may be held by different entities, often in different jurisdictions, making it more difficult for law enforcement and regulators to access them…. And importantly, components of a virtual currency system may be located in jurisdictions that do not have adequate AML/CFT controls.”[30]

Blockchain as a database

The main attraction of blockchain as a record-keeping database is that it is immutable: once a block is created and put in the chain, there is no possibility of tampering with it. However, a database has many other requirements apart from being tamper-proof. For one, it should be possible to query a database. There is no easy way to query a blockchain database. Each block in the chain only saves the Hash value of the earlier block. For example, when a patient’s medical records are stored in a blockchain database, it would be a time-consuming and difficult job to retrieve information when it is required urgently.

To be sure, researchers across various countries are working on this problem and experimenting with potential solutions. What this essentially requires is to build a query layer over and above the blockchain to extract data from blocks and re-organise the extracted data in the database to provide various query services through an application layer.[31] This layer called Application Programming Interface (API)s are needed to access the block; Ethereum provides such an API.[d]

Scalability of Cryptocurrency Networks

The number of daily transactions of Bitcoin has now reached around 450,000 globally while Ethereum has clocked around 3.1 million transactions per day.[32] The number of miners operating on Bitcoin networks is estimated to be around 1 million and the number of validators for Ethereum is around 200,000. For Ethereum, the average productivity of validators is 15.5 transactions per day and per validator.

As against this volume of transactions of the two leading cryptocurrency network, the UPI network managed by the National Payment Corporation of India handled around 136 million transactions per day in the month of October 2021.[33] Even assuming a dramatic increase in productivity of validators (62 transactions per validator[e]), the required number of validators would be more than 2 million. In order to achieve higher scalability, a cryptocurrency will have to assemble more validators, more computing resources, and more fees to be paid by transactors.

Ease of use and cost of using a cryptocurrency as a medium of exchange

As a medium of exchange, Bitcoin is extremely inconvenient to an ordinary user. A cash transaction can happen without any discernible latency and a counterfeit note can be quickly detected, too—for a high-value note, it may take a minute or two. Meanwhile, the average time taken to verify the authenticity of a Bitcoin transaction is 10 minutes.[34] The lightning network may reduce this substantially, but the process involved to use this is far from simple.[35] More importantly, the amount of computing resources it takes to verify the authenticity of a single transaction is not negligible. The people who are logged in to the Bitcoin network and engaged in this verification process voluntarily expect to get a fee for their efforts. When A sends a Bitcoin amount to B, A attaches a fee (represented by a string of bytes) to be paid to the person who validates the transaction and includes in a block first.

An article in the NASDAQ website[36] has reported that Bitcoin miners generated more than USD 56 million on average per day in April 2021. This revenue is earned for mining less than 400,000 transactions on average per day. Therefore, any cash transaction less than USD 100 would be prohibitive if it is to be carried in the Bitcoin world. Even transacting on Ethereum network is not free. Under the Ethereum 2.0 protocol, a validator has to lock 32 ETH to register as a validator.[37] This amounts to between USD 100,000 to 150,000, depending on the price of a day. A validator’s income will vary between 4.6 percent to 10.3 percent of the staked amount, depending on the total amount of ETH in the network stakes.

Risk of investment in Cryptocurrency

Cryptocurrencies would be the riskiest asset to hold for any reasonable period of time. USD prices of 1 Bitcoin has moved from USD 144.54 to USD 34235.19 between 29 April 2013 and 6 July 2021. The price of Bitcoin has registered more than a 2-percent change on a daily basis in 43 percent of the trading days covered in this period. Such high volatility of an exchange rate (Bitcoin-USD) will deter any rational investor to invest in any BTC-denominated security. For a comparison, we looked into weekly USD-INR exchange rate between 11 November 2011 and 13 August 2021. The number of weeks registering change in the rate of more than 2 percent accounted for only 7.7 percent of total number of weeks. Indeed, a number of statistical analyses of Bitcoin price data have noted “bubble-like” behaviour of Bitcoin exchange rate with USD.[38]

Another recent study has analysed the drivers of price volatility of Bitcoin and reached the following interesting conclusion: “Altogether, our results show that volatility and its jump component are driven mostly by bitcoin-specific risk factors: regulation and hacking attacks on cryptocurrency markets. Unlike traditional assets, bitcoin is almost uninfluenced by general macroeconomic news, thus leading us to the conclusion that bitcoin is only weakly connected to the overall economy via the forward-looking component.”[39],[40] Overall, Bitcoin has failed to address and improve upon the perceived deficiencies of national fiat currencies as they currently exist. This is not to say that the underlying technology of Bitcoin does not hold promise. The present article provides a mechanism, using some components of this technology, to replace central bank paper currency with central bank digital currency while retaining the fundamental features of paper currency.

Features of Fiat Currency

The most important feature of a central bank note is that it is a freely negotiable bearer bond and a legal tender in the hand of its holder. It does not require any third-party verification. Counterfeiting a central bank note is not impossible but difficult and costly. The central bank neither authenticates any transaction made with that particular note nor does it keep any record of that transaction. In other words, the anonymity of transactors is generally maintained. The note remains as a liability on the book of the central bank until it comes back to it, either for reissue or its destruction. The physical nature of the note ensures that no double-spending is possible with the same note by its current holder. In case of digital cash, the main issue that a central bank has to resolve is the issue of double spending without depending on third-party verification of the same.

The digital currency issuance mechanism outlined below is a mobile phone-based system. There is no compelling reason to believe that the same system cannot be implemented on a specially designed smart card with embedded chip. The system outlined below is described within the currency management framework of the Reserve Bank of India (RBI). With some adjustments, the same can be customised by any central bank. The following section reviews the initiatives that are underway in the central banks of many other countries.

CBDC Proposals: Three Variants

The Bank of International Settlement (BIS)[f] released a survey on central bank digital currency in January 2019,[41] identifying four key properties of money: issuer (central bank or not); form (digital or physical); accessibility (widely or restricted); and technology. It describes three variants of CBDC:

- The central bank acting like a bank allowing people to open account with the central bank and transfer values between account holders. “This would be widely available and primarily targeted at retail transactions (but also available for broader use).” This is called an account-based CBDC.

- The second variant would be like cash—a “general purpose”, “token-based” variant. A token-based system is also called “value-based” system as each token represents a certain amount of value in the monetary unit of existing central bank currency.

- The last form of CBDC would be “a “wholesale”, “token- or value-based” variant—i.e., a restricted-access digital token for wholesale settlements (e.g. interbank payments, or securities settlement)

The Committee on Payments and Market Infrastructures of BIS summarised the features of these various types of CBDC in a working paper (2018) in the following way:[42]

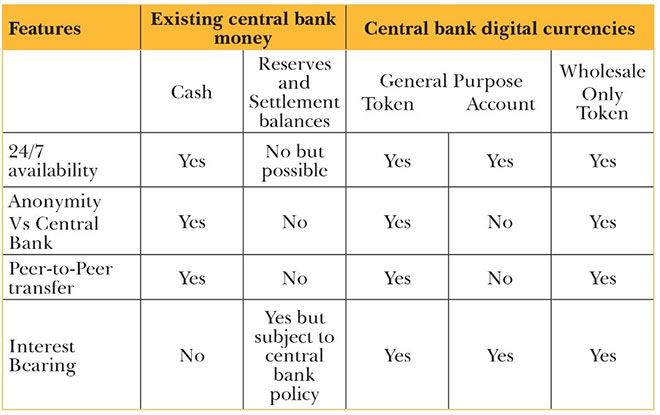

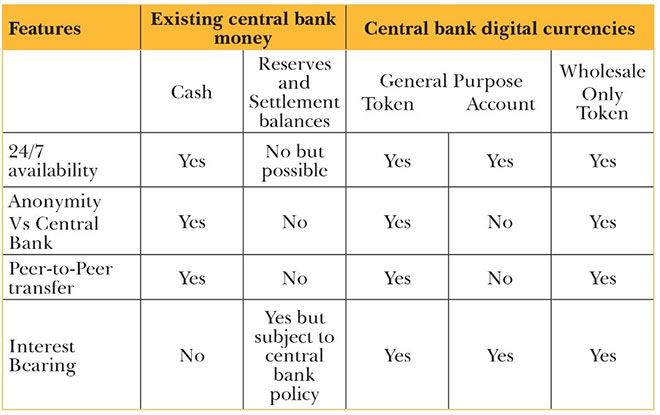

Table 1. Key Design Features of Central Bank Money

Source: BIS paper (No: d174) by Market Committee Central bank digital currencies, March 2018 p6

Many central banks are currently engaged in debates about the feasibility and desirability of introducing CBDC in any of the three forms. A few of them have started implementing their own. The third BIS survey (January 2021) on the status of CBDC initiatives by various central banks notes that interest of Central Banks in CBDC is on the rise: “About 60% of central banks (up from 42% in 2019) are conducting experiments or proofs-of-concept, while 14% are moving forward to development and pilot arrangements. Not surprisingly, these general trends encompass large differences across jurisdictions and types of economies. Also, stepping up CBDC work does not prejudice the policy decision of whether or not to actually launch a CBDC, but it does demonstrate a strong interest.”[43] In India, the RBI has announced that it will introduce CBDC by the end of December 2021. The format of CBDC that RBI is going to adopt has yet to be spelt out.[44]

RiKsbank of Sweden has started a pilot in 2020 to introduce e-krona. In this pilot e-krona has been “designed as a token, which means that it is a uniquely identifiable digital unit of value with the attribute that it can bear the value of Swedish krona”[45]. A token is a digital string representing a particular value amount in units of krona. This means an end user can load her payment instrument- a mobile app or a card-with any amount. When an end user wants to transfer a part of this amount (say 60 krona out of 100 krona represented by a token) then two other participant nodes in the E-Krona Network have to chip in to enable the requested transaction to go though. One participant, say a payment service provider or a bank verifies that the sender has requisite e-krona balance and a notary node (operated by the central bank) authenticates that no double spending is involved. The entire process resembles a pre-paid card based payment process with only one difference –the issuer of the card is the central bank. Every token is for one time use whereas every paper currency can support multiple transactions till it becomes unusable and returned to the central bank for destruction. Undoubtedly, this is an inefficient digital form of paper currency. Each token represents a particular value, as if it is micro-account held by a user. There is no concept of denomination and any draw down from this micro account must be reconciled with new tokens to be generated from a single transaction.

One disadvantage of this protocol concerns its scalability. It will be costly to implement this mechanism in a country like India where number of currency notes is around 22 billion pieces. Even assuming that 50 percent of the currency are held for transactional purpose, and each note supports at least 1 transfer of values every month, this would be 11 billion transactions of values to be verified by a central bank in a month.

Macroeconomic Implications of CBDC

The account-based system of CBDC has been the focus of various studies to investigate the potential macroeconomic impacts of CBDC in a market-driven economy. Most of these studies use the Dynamic General Stochastic Equilibrium (DGSE) model of market-based competitive economy. Unlike cash which is a non-interest bearing liability of a central bank, these models assume CBDC as interest-bearing access to a central bank’s balance sheet. Based on a simulation exercise, Barrdear and Kumhof (2016) predict two beneficial impacts if CBDC attains a level of 30 percent of GDP: (1) “an increase in the steady-state level of GDP of almost 3%”; (2) making available “[a] second policy instrument that controls either the quantity or the price of CBDC in a countercyclical fashion” and thereby contributing to “the stabilisation of the business cycle.”[46] Keister and Sanches (2019) argue that an interest-bearing CBDC “promotes efficiency in exchange because it lowers the opportunity cost of holding money, thereby increasing the demand for real money balances.”[47] David Andolfatto, Senior Vice President at the Federal Reserve Bank of St. Louis, has welcomed CBDC as it “serves to promote financial inclusion.”[48]

According to Rogoff,[49] it is the existence of paper currency that “makes it difficult for central banks to take policy interest rates much below zero.” A negative interest rate may be required when an economy is faced with the kind of deflationary pressure that the developed economies experienced during the financial crisis of 2007-08. If an interest-bearing CBDC becomes the main format for issuance of currency, then “paying a negative interest on reserves (basically charging a fee) would be trivial.” Discontinuation of issuance of paper currency is also desirable, Rogoff argues, because “there is a significant body of evidence that a large percentage of currency in most countries, generally well over 50%, is used precisely to hide transactions.” Since this underground economy has significant negative impact on tax collection effort of government, leading thereby to higher tax rate on formal economy, introduction of CBDC, in any format, will lead to higher GDP growth.

An interest-bearing CBDC’s risks to the economy

If all private economic agents can have interest-bearing account with central banks and can carry out all monetary transactions using that CBDC, it will directly compete with non-interest-bearing demand deposits liability of private banks. Its impact on the profitability of private banks and delays in transmission of monetary policy changes remain as an open question. The resulting possibility of banking sector dis-intermediation has also been noted by Adrian and Mancini-Griffoli (2021).[50]

The payment system efficiency enhancing impact of issuance of CBDC of any variant has also been noted by many authors. The increasing concentration of payment system in the hands of a few multinational technology giants is a high source of risk to the stability of the financial system. Since digital payment is the future, CBDC provides a tool to the central banks to participate in the retail payment system and regulate it effectively.

When the issuance of CBDC is through an account-based system, during the downturn phase of a business cycle, the credit flow to the real sector by both banks and non-bank financial institutions may be adversely impacted due to “flight to safety” movement from bank and to some extent, non-bank deposits. Whether it would be possible to mitigate the risk by charging fees on CBDC account holders is a political question that a central bank has to grapple with.

Account-based CBDC is a direct substitute of demand deposits of banks and may adversely impact existing payment service providers. This is because existing payments service providers facilitates transfer of fund from one bank to another without the transactors accessing their bank accounts directly. In the presence of universal CBDC, the viability of these service providers will be questionable if transfer of CBDC funds are free. The resulting creeping monopoly of the central bank is likely to engender a systematic risk if CBDC fails, even for a few minutes.

A central bank’s main source of income is seigniorage that it earns by issuance of currency. If issuance of interest-bearing CBDC reduces the amount of seigniorage, it may impact the financial independence of a central bank. The amount of reduction would depend on a number of factors such as the share of CBDC in total currency in circulation, and the amount of paper currency hoarded for non-transactional purpose. The protocol proposed in this document does not carry any such risk.

Regulation of CBDC

The regulation of CBDC would be a matter of concern if this is issued as an interest-paying account balance maintained with the central bank. In India, a payment bank has a limit to acceptance of deposit from its retail customers. If the account-based CBDC issuance activity of the central bank is without limit then that would surely lead to closure of most of the payment banks. Even if the CBDC pays lower interest than what is paid by a payment bank, the default risk of a payment bank has to be factored in for deciding the spread between CBDC-related deposit and the deposit of a payment bank. The moot point is – can a regulator regulate itself?

RBI Currency Management Framework

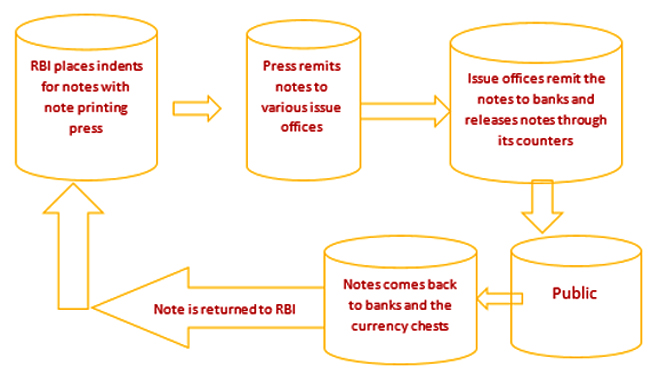

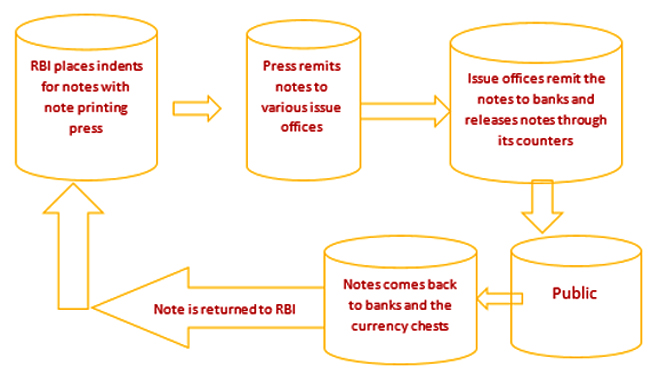

RBI carries out its currency management function through its 19 Issue Offices located across the country. There is a network of 4,281 currency chests and 4,044 small coin depots in selected commercial bank branches. These chests store currency notes and rupee coins on behalf of RBI. The note distribution mechanism is summarised in Figure 1.

Figure 1. The Currency Supply Chain Framework of RBI

Source: The author’s own personal knowledge as an ex-RBI officer

For issuance of digital currency, each currency chest would function as a data centre for hosting the ledger book of notes issued from it. Similarly, each issue office of RBI would have a copy of the entire ledger book of notes. A folio would be opened in the note ledger book when the first time a specific note is issued. Each data centre will have complete inventory of wallets issued by RBI. A wallet could be a mobile app downloaded on a person’s mobile phone or it could be a smart card to be issued by RBI.

Every bank branch would have a digital cash dispenser. Any wallet holder would be able to replenish their wallet with digital currency by pairing it with the dispenser via Bluetooth or NFC communication channel. Similarly, every ATM would have similar facility. Cash dispensation from bank branch or ATM would require Aadhaar-based biometric verification of wallet. For cash transfer between wallets of two individuals, this verification is not a requirement. The important point to note here is that today also no one can send or receive cash through the internet. Similarly, a person holding digital cash can send digital cash to another person having the authorised wallet through some form of NFC or near field communication. It should be clearly understood that we are trying to replicate the function of paper money and not creating an alternative payment system based on digital cash.

Architecture for an Indian CB Digital Currency: Author’s Proposal

The protocol for issuance of eINR

The following points outline the proposed protocol for RBI’s digital currency.

- RBI would maintain ledgers of each currency note in a distributed database.

- Currently RBI issues notes through its Issue Offices. The distributed database will be created according to issue departments of RBI. Each Issue Office of RBI will be able to issue new digital currency and destroy old digital currency. Destruction of old digital currency would help RBI keep the number of entries in the ledger folio of a particular note within a limit. Every issue office would maintain record of all notes issued by it as well as copies of corresponding records of three neighbouring issue offices.

- Each currency chest will have a database of notes received by it from RBI’s Issue department.

- Each currency chest will also have replicated database of its three nearest neighbours.

- The system will issue new digital currency when an account holder like a bank or a government department wants to withdraw cash from its account with RBI. Since we are expecting parallel run of the physical cash and digital cash for some time, this facility would be optional, to start with. An account holder at RBI can withdraw cash or digital currency according to its discretion.

- The account holder will specify how much of its cash withdrawal would be in digital form. This facility would be provided for an interim period when both forms of currency would be in circulation.

- To incentivise issue of digital cash, RBI may reward an account holder with an amount that could be related to the cost of producing physical cash[51].

- RBI is banker to the Central and State Governments. It also functions as banker to the banks and thus enables settling of inter-bank obligations. These large account holders of RBI would get digital cash in their ‘Jumbo Wallet’ which would be a server in the account holder’s custody. It would be like a till holding cash-equivalent of a currency chest. An authorised person can withdraw e-INR from the till as and when required.

- The RBI’s Note ledger would comprise ledger folios of each currency notes issued.

- Each record in the Note ledger would comprise the following attributes: (1) a sequential number, (2) unique identity / s no of a note, (3) hashed value of the note serial number, (4) identity of the issue department, (5) denomination, , (6) time stamp of transaction, (7) hashed value of identity of paying wallet (first time payer would be RBI), (8) hashed value of identity of receiver wallet, (9) active flag, (10) hashed value of first 9 attributes, (11) hash value of the first 9 attributes of earlier transaction record of the same note. The identity of a wallet is described below.

- RBI will also maintain database of each wallet downloaded from its website.

- The wallet database will have a header record with the following attributes: (1) IMEI number of each phone, (2) Aadhaar No. of the phone owner, (3) timestamp of successful downloading of the wallet, (4) the GPS location of the phone at the time of downloading of the wallet, (5) a unique private key generated for each wallet, and (6) the corresponding unique public key generated for each wallet. This data would also be hashed and encrypted with RBI’s private key and will be part of the header record. RBI’s public key would also form part of the header record. The private and public key of each wallet would be generated by RBI at the runtime. The hashed value of attributes 1 to 6 would be the identity of each wallet.

- Each wallet will have its own database of transactions. Each record in the transaction database will represent a note that has been loaded into the wallet. Each record will have the following attributes: (1) unique identity of the note, (2) note denomination, (3) digitally signed (with the private key of the paying wallet) hashed value of the concatenated string of serial no and denomination, (4) digitally signed ( with the private key of the paying wallet) hash value of concatenated string of attributes 1 and 2 of the header record with private key of payer wallet, (7) public key of the paying wallet, (8) timestamp of last transaction( i.e. timestamp of receipt of the note , (9) timestamp of the payment transaction, (10) payment status (paid or unpaid), (10) hashed value of the earlier transaction of the note(attributes 1,2,3,4,5).

- A transaction between two wallets would involve “note data” transfer from the paying wallet to receiving wallet. Such transfer can also happen with QR codes. Every note that gets transferred from the payer’s wallet to the recipient’s wallet would essentially mean transfer of the entire record from the former to the latter. In the process of data transfer two insert / update activities take place in the receiver’s and payer’s wallet, respectively. The receiver’s wallet inserts a new note record while the payer’s wallet updates the concerned note’s existing record with a “sent” flag for the spent note.

- Once the receiving wallet gets a new e-Rupee note, it checks the authenticity of the note by calculating hash value of the concatenated string of attribute 1 and 2 of step at 13. In the payer’s wallet the status flag would get changed to “paid” while in the receiver’s wallet it would continue to have the status flag as “unpaid”.

- Any wallet would have a limit in terms of number of records / notes. When the database has reached its limit then the wallet would have to be uploaded to RBI through a bank counter/ ATM. The protocol may require either complete deletion of records in the existing wallet or downloading of a new wallet has to be downloaded.

- At any point of time a single wallet would be subject to 2 limits: holding limit of number of transactional records, and total value of a single transaction. For a high-value transaction, two-factor authentications would be required. Both paying wallet as well as receiving wallet has to simultaneously establish connection with RBI and get their credential verified.

- As and when the number of records in a wallet’s transactional database reaches its limit, the database has to be downloaded in an ATM or at a bank branch. The wallet would be purged of the all transaction records with status as “paid”. The wallet holder then can download more eINR from an ATM or from a bank brunch. RBI will update its ledger book of individual notes thus uploaded from each wallet.

- Any fraudulent transactions identified in the process of uploading would get notified and through an automated forensic audit, the perpetrator of fraud would get identified.

Downloading of Wallet

- The user sends an sms to a designated number with the Aadhaar details of the sender. RBI would send a link to the phone and clicking on the same the app would be automatically downloaded. To activate the app, the user has to sign-in with their Aadhaar credentials. For additional security one may think of incorporating biometric signature of the wallet holder as another feature of the wallet; every use of the downloaded wallet would require signing in biometrically by the wallet holder.

- The wallet will recognise another wallet in its vicinity using NFC technology. Alternatively, Bluetooth technology for pairing two cell phones can be also used. Both wallets would then exchange their digital identity and verify them with public keys of both and RBI’s public key. After two wallets have been paired, the payer’s / payee’s wallets would prompt the respective wallet owners to initiate the intended actions on their part. The payer will have to initiate payment action and would type in the amount of money to be paid. The wallet would automatically prompt for denominations – a built-in program would provide the best possible composition nearest to the amount indicated by the payer. The payer would have the right to change the composition and the resulting total value.

- Once the payer approves payment, the required data transfer takes place without seeking any third-party verification at that time. For a transaction above a certain threshold value, at the discretion of the transactors, the receiver’s wallet may be connected with Aadhaar database for biometric authentication.

- If any wallet holder commits fraud by hacking the wallet’s database and changing the header record, it would be considered as an act of counterfeiting of notes. As and when any receiver uploads data to RBI website, the same would get immediately detected when RBI updates its ledger folio of notes involved. The concerned wallet holder would be notified with the fraudulent transactions and details thereof.

- For merchants, wallets can function like mPOS (mobile point of sales) machine. A merchant’s wallet would authenticate the payer’s wallet and notes therein by directly connecting to RBI’s ledger of notes.

Functioning of the System

A downloads the mobile app/wallet from the RBI website. A visits an ATM or bank branch and loads their wallet with required e-Rupee. On a single day, A would not be allowed to load their wallet with more than a certain amount of e-Rupee. The cash dispenser would be configured accordingly.

A wants to pay, say one thousand rupees, to B; A keeps their wallet-bearing mobile phone next to B’s wallet and taps the application on their mobile. The respective apps recognise each other and A keys in the amount to be disbursed to B. If A does not have the required denominations, then the application would give the nearest amount higher than that amount and the same can be sent to B, who will then pay back the balance.

Transactions at a merchant establishment

A merchant establishment can use standard mobile-based ‘Jumbo wallet’ with higher note-holding capacity. Otherwise, a merchant establishment can have an appropriately configured POS machine to receive money from a e-Rupee wallet. The merchant’s machine will have an app that will require any user to sign up by providing necessary credentials. The POS machine will generate a QR when a customer connects their wallet with the POS machine. After reading the QR, the customer’s wallet sends the money that the QR has requested. If the merchant’s machine receives surplus money, the relevant amount gets returned to the customer’s wallet instantly.

The additional feature of the POS machine would be the facility to transfer the digital cash to the bank account of the merchant. This transfer can be scheduled or initiated by the merchant manually. When the transfer is scheduled, the amount can be pre-configured as an absolute amount or as per a pre-configured formula.

Reconciliation with RBI Ledger of Individual Notes

As noted earlier, every wallet can be refilled only at an ATM or a bank counter. Any refill will be automatically preceded by uploading of all spent notes to the bank’s currency server. The currency server will automatically transfer data pertaining to these notes to the RBI issue department server connected to this bank’s currency server. RBI’s note database will continue to update its note ledger. There is no technological need to withdraw any digital note from circulation. If RBI wants to withdraw notes of a certain age from circulation, then whenever any wallet is presented to a bank’s ATM or counter, all unspent notes above that threshold will be replaced by a new digital note of the same denomination by the bank. That unspent note will be transferred to the RBI server and will be replaced at the bank’s server by a new digital note by RBI.

Loss of Wallet

In case of loss of a wallet, the holder of the wallet would be required to register the loss with RBI and provide their mobile phone and Aadhaar numbers. RBI would broadcast the IMEI number of the wallet to all mobile service providers, thus blocking any further use of the mobile. In due course, the stolen wallet can be traced and, in case of theft, required action by law enforcement agencies can be initiated. If a fraudster wants to use a stolen wallet by replacing the original header record, it would need to replace all unpaid notes’ records with values consistent with corresponding values of the new fraudulent header record. This would be very costly and may not be worthwhile. Furthermore, it would not be possible to download any further notes from an ATM or a bank branch.

Cost of Issuing eINR

As of end-March 2017, around 201 billion pieces of notes including coins (one rupee and above) were in circulation in India. In that year, the country’s adult population (15 years and above[g]) was estimated to be around 916 million. If all adults hold one wallet each, the estimated size of all header records would be around 320 GB—not a large number by any yardstick. The size of transaction database, assuming 1,000 transactions for each note during its lifetime, would be around 71 petabyte or .07 Exabyte. Amazon Redshift Spectrum Query service charges $5 per Terabyte of Query. If in the extreme case we assume that all notes are transacted once every day of one year, then the cost would be around USD 132 million or INR 862 crore. Taking storage cost, it would be well below the cost of printing notes that RBI incurs today.

Conclusion

The form, use, issuance mechanism, and legality of money has evolved over time in step with technological innovations, changes in the topology of social network and complexity therein. With the advent of the internet, money’s representation in the virtual world has become a necessity—one that cannot be subsumed under the digital payment system that has been in existence for more than 70 years. The digitalisation of bank money through introduction of core banking system is also five decades old. The new requirement is to create a digital form of cash.

This paper has argued that cryptocurrencies like Bitcoin in its current form cannot be a replacement of paper currency. At the same time, the underlying technologies of these cryptocurrencies are of immense potential and if paper money has to be replaced by any digital form, then use of these technologies would be needed. This paper has proposed a blueprint for digital cash. The protocol has been suggested in the context of currency management system of the Reserve Bank of India but there is no reason why this cannot be implemented in other jurisdictions. The suggested protocol replicates all the features of paper currency.

Endnotes

[a] Leon Walrus was a French-born mathematical economist who formalised an economic model of multiple buyers and sellers demanding/supplying some goods or services at different price points but ultimately arriving at a price which can be called market price. Since there is finally a market price for each good and service, the model is called Walrasian General Equilibrium model. Money here is the numeraire in which prices are quoted in this auctioning process.

[b] The mainstream economic model is a model of real economy with no role of money. The consumers do not derive utility for having money. The budget constraint that a consumer faces is a constraint in nominal terms with no role of money. But consumption and payment for labour need not be simultaneous. So in a given period people must enter with some cash to pay for consumption. Accordingly, the consumers must be endowed with some cash to begin with. The amount of cash-in-hand thus imposes a constraint for consumption. Such a model is known as “cash-in-advance” model. Alternatively, if people derives utility for holding “money”, then money becomes a form of asset that people would like to hold. So an economic agent’s utility function will have money as one of the argument. Such a model is called “money-in-utility” function model.

[c] About IFRS foundation, the organization’s website says The IFRS Foundation is a not-for-profit, public interest organisation established to develop a single set of high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards—IFRS Standards—and to promote and facilitate adoption of the standards..

[d] An application programming interface (API) is a software application that allows a computer to computer connection between end user of data with the data repository maintained by data provider. When we buy a railway ticket online the app that allows this purchase uses a specific API. The Blockchain API establishes a similar connection between an end user with a blockchain node.

[e] A 4.5 times increase in productivity is assumed. There is no specific reason for such an assumption but it may be a good starting point to underline the fact that there would be no significant reduction in manpower resources by adopting the Bitcoin type of payment system.

[f] The Bank of International Settlement (BIS) is an “international organisation that serves central banks and other financial authorities across the globe to support their pursuit of monetary and financial stability through international cooperation. It also acts as a bank for central banks”. It is owned by 63 central banks.

[g] The Indian Population Census provides data in the age group of 15-19 and so on. We are taking 15 and above as adult population. This gives us higher estimate of total adult population .

[1] Stephanie Bell, “The role of the state and the hierarchy of the money”, Cambridge Journal of Economics 25, (2001): p150

[2] The islanders’ monetary system was studied by the anthropologist William Henry Furness III and has been quoted by Milton Friedman in his Stanford University working paper titled “The Island Of Stone Money” (1991). The apparent similarity of “stone money” and Bitcoin has been explored by Scott M. Fitzpatrick & Stephen McKeon in their 2020 paper “Banking on Stone Money: Ancient Antecedents to Bitcoin” published in Economic Anthropology 2020; 7: 7–21

[3] Scott Meikle, “Aristotle on Money”, Phronesis, 39, No. 1 (1994). Meikle notes that Aristotle identified money’s primary origin as solving the problem of double coincidence of wants. While noting that money is also used by pure traders, who are justly discredited according to Aristotle because it involves “people taking things from one another”. Most interestingly, Aristotle found it is justified to hate money lenders who are involved in “breeding of money from money “ p27

[4] Karl Menger. On The Origins of Money, trans. C.A. Foley (1892; repr., Ludwig von Mises Institute ,2009) 489

[5] Menger, 12

[6] Menger,12

[7] Menger,21

[8] Xavier Cuadras-Morató , “Can Ice Cream Be Money?: Perishable Medium of Exchange “, Journal of Economics 66, No. 2 (1997), 106

[9] Giuseppe Mastromatteo and Luigi Ventura, “The Origin of Money: A Survey of the Contemporary Literature”, International Review of Economics 54, 2007 pp195-224. “This survey attempts to illustrate the contribution to solving the problem of the origin of money offered by the literature on transaction and information costs inspired by Menger’s monetary theory” 195

[10] Cuadras-Morató, 106

[11] . Peter Rupert, Martin Schindler, Andrei Shevchenko, and Randall Wright, “The Search-Theoretic Approach to Monetary Economics: A Primer”, Economic Review Q4 (2000), Cleveland Fed

[12] . Armen A Alchian, “Why Money?”, Journal of Money, Credit and Banking 9, No. 1, Part 2 1977, 139

[13] Abhijit V. Banerjee and Eric S. Maskin,” A Walrasian Theory of Money and Barter”, The Quarterly Journal of Economics 111, No. 4 (1996), 957

[14] Nobuhiro Kiyotaki and Randall Wright, “On Money as a Medium of Exchange” Journal of Political Economy 97, No. 4 (1989), quote “We find that equilibria are not generally Pareto optimal and that introducing fiat currency into a commodity money economy may unambiguously improve welfare” p927

[15] S. Rao Aiyagari and Neil Wallace, “Fiat money in the Kiyotaki-Wright model” Economic Theory 2.(1992)

[16] Benjamin Klein, “The Competitive Supply of Mone”, Journal of Money, Credit and Banking 6, No. 4 (1974). Klein also highlights the information cost of assessing quality of a money: “Significant economies of scale probably exist in the production of information about reliability of a money…. Since information about anticipated quality (predictability of prices) is a major determinant of the monetary-service flow from a money, we can therefore expect these considerations to be paramount and the value of a single quality product in the industry to be substantial.” 444

[17] Paul A. Samuelson, “An Exact Consumption-Loan Model of Interest with or without the Social Contrivance of Money”, Journal of Political Economy, 66, No. 6 (1958), pp. 467-482

[18] Paul Einzig, Primitive Money in its Ethnological, Historical and Economic Aspects (second ed. 1966) 489

[19] Keith Hart,” Heads or Tails? Two Sides of the Coin”, Man, New Series 21, No. 4 (1986), 638

[20] William Ridgeway, The-origin of metallic currency and weight standards, (1892, sourced from Google digital copy). It is not easy to understand how a society values various commodities and objects. This quote from Zend Avesta of Ancient Persians and reproduced in Ridgeway is revealing “he ( physician) shall heal the priest for the holy blessing; he shall heal the master of an house for the value of an ox of low value ; he shall heal the lord of a borough for the value of an ox of average value ; he shall heal the lord of a town for the value of an ox of high value ; he shall heal the lord of a province for the value of a chariot and four; he shall heal the wife of the master of a house for the value of a she ass; he shall heal the wife of the master of a borough for the value of a cow ; he shall heal the wife of the lord of a town for the value of a mare; he shall heal the wife of the lord of a province for the value of a she camel ; he shall heal the son of the lord of a borough for the value of an ox of high value ; he shall heal an ox of high value for the value of an ox of average value; he shall heal an ox of average value for the value of an ox of low value ; he shall heal an ox of the low value for the value of an sheep; and he shall heal a sheep for the value of a meal of the meat.” 26

[21] Marcel Mauss, The Gift The form and reason for exchange in archaic societies, trans. W.D.Halls (1950, repr. Taylor & Francis e-Library, 2002 ). 84

[22] George Dalton , “Primitive Money” , American Anthropologist New Series,, No. 1 (1965), p 59

[23] Michael Hudson, “The Archaeology of Money: Debt versus Barter Theories of Money’s Origin” in Credit and State Theories of Money: The Contributions of A. Mitchell Innes, ed. L. Randall Wray (Edward Elgar ,2004) writes: “MONEY HAS evolved from three traditions, each representing payment of a distinct form of debt. Archaic societies typically had wergild-type debts to compensate victims of manslaughter and lesser injuries. It is from these debts that the verb ‘to pay’ derives, from the root idea ‘to pacify.’ Such payments were made directly to the victims or their families, not to public institutions. They typically took the form of living, animate assets such as livestock or servant girls. Another type of obligation took the form of food and related contributions to common- meal guilds and brotherhoods. This is the type of tax-like religious guild payment described by Laum (1924), who in turn was influenced by G.F. Knapp. Neither of these types of payment involved general-purpose trade money.” P 99

[24] A. Mitchell Innes, “What is Money?” in Randal Wray (2004) writes: From the earliest days of which we have historical records, we are in the presence of a law of debt, and when we shall find, as we surely shall, records of ages still earlier than that of the great king Hamurabi, who compiled his code of the laws of Babylonia 2000 years BC, we shall, I doubt not, still find traces of the same law. The sanctity of an obligation is, indeed, the foundation of all societies not only in all times, but at all stages of civilisation; and the idea that to those whom we are accustomed to call savages, credit is unknown and only barter is used, is without foundation. From the merchant of China to the Redskin of America; from the Arab of the desert to the Hottentot of South Africa or the Maori of New Zealand, debts and credits are equally familiar to all, and the breaking of the pledged word, or the refusal to carry out an obligation is held equally disgraceful” 30

[25] F. A. Hayek, Denationalisation of Money -The Argument Refined: An Analysis of the Theory and Practice of Concurrent Currencies, (Institute of economic affairs, 1990) p130

[26] Satoshi Nakamoto , “Bitcoin: A Peer-to-Peer Electronic Cash System”, Decentralized Business Review(2008)

[27] Ferenc Beres, Istvan A. Seres, and Andras A. Benczur, “A Cryptoeconomic Traffic Analysis of Bitcoin’s Lightning Network”, arXiv:1911.09432 [cs.CR]. In another paper on the Bitcoin Lightning Network (BLN) has concluded the following:

“The Bitcoin lightning network is a sort of ‘layer 2’ protocol aimed at speeding up the Blockchain, by enabling fast transactions between nodes. Originally designed to allow for cheaper and faster transactions without sacrificing the key feature of Bitcoin, i.e. its decentralisation, it is evolving towards an increasingly centralised architecture, as our analysis reveals” from Jian-Hong Lin et al , “Lightning network: a second path towards centralisation of the Bitcoin economy” , New J. Phys.(2020) 22 083022

[28] Information on financial statements Holdings of Cryptocurrencies—June 2019.

[29] Tatiana Morozova, Ravil Akhmadeev , Liubov Lehoux et al , “Crypto Asset Assessment Models in Financial Reporting Content Typologies “ Entrepreneurship and Sustainability Issues (online) vol 7 Number 3 (2020).

[30] The Financial Action Task Force (FATF), Virtual Currencies Key Definitions and Potential AML/CFT Risk, (June 2014) 9-10

[31] Zhe Peng Haotian Wu, Bin Xiao, Songtao Guo , “VQL: Providing Query Efficiency and Data Authenticity in Blockchain Systems”, IEEE 35th International Conference on Data Engineering Workshops(2019): DOI 10.1109/ICDEW.2019.00-44

[32] https://coinmarketcap.com/ ; also data can be seen from Bitcoin USD (BTC-USD) Price, News, Quote & History – Yahoo Finance

[33] https://www.npci.org.in/what-we-do/upi/product-statistics

[34] see https://coinsutra.com/bitcoin-transfer-time/

Bitcoin Average Confirmation Time (ycharts.com)

[35] . See Bitcoin’s Lightning Network: 3 Possible Problems ( https://www.investopedia.com/tech/bitcoin-lightning-network-problems/ )

[36] https://www.nasdaq.com/articles/bitcoin-miners-brought-in-%2456-million-per-day-in-april-2021-05-04

[37] See https://ethereum.org/en/eth2/staking/

[38] Adrian (Wai-Kong) Cheung, Eduardo Roca and Jen-Je Su, “Crypto-Currency Bubbles: An application of the Phillips-Shi–Yu (2013) methodology on Mt. Gox bitcoin price”, Applied Economics 47 No23 (2015). The study concludes the following: Our study therefore confirms what investors, financial journalists and other participants in the bitcoin market have been saying – that bitcoin has been in a bubble over its relatively short existence. P2356

[39] Eng-Tuck Cheah, John Fry, “Speculative bubbles in Bitcoin markets? An empirical investigation into the fundamental value of Bitcoin”, Economics Letters 130 (2015). Quote from this article:

“Firstly, as with other asset classes, Bitcoin prices are prone to speculative bubbles. Secondly, the bubble component contained within Bitcoin prices is substantial. Thirdly, the fundamental value of Bitcoin is zero” 35

[40] Štefan Lyócsaa, , Peter Molnár, Tomáš Plíhal , Mária Širanová , “Impact of macroeconomic news, regulation and hacking exchange markets on the volatility of bitcoin” , Journal of Economic Dynamics & Control 119 (2020) p19

[41] Christian Barontini and Henry Holden, “Proceeding with caution – a survey on central bank digital currency” BIS Papers No 101 (January 2019)

[42] Bank of International Settlement: Committee on Payments and Market Infrastructures-; Markets Committee, Central bank digital currencies, March 2018 p6

[43] Codruta Boar and Andreas Wehrli , “Ready, steady, go? – Results of the third BIS survey on central bank digital currency” , Bank for International Settlements: Monetary and Economic Department, BIS Paper No 114, January 2021

[44] Rabi Sankar T . “Central Bank Digital Currency – Is This the Future of Money” Reserve Bank of India (2021).

[45] Sveriges Riksbank, E-krona pilot Phase 1, April 2021

[46] Barrdear, J., & Kumhof, M. “The macroeconomics of central bank issued digital currencies”, Bank of England Working Paper No 605, July 2016. P3; Also published in Journal of Economic Dynamics and Control (May 2021)

[47] Todd Keister and Daniel Sanches, “ Should Central Banks Issue Digital Currency?” Working Paper19-26 , Federal Reserve Bank of Philadelphia Research Department (June 2019) p3

[48] David Andolfatto , “Assessing the Impact of Central Bank Digital Currency on Private Banks “ Federal Reserve Bank of St. Louis; Working Paper 2018-026A”

[49] Rogoff Kenneth S (2014). “Costs and benefits to phasing out Paper currency”, Working Paper 2012.

[50] Tobias Adrian and Tommaso Mancini-Griffoli, “The Rise of Digital Money”, Annual Review of Financial Economics, Monetary and Capital Markets Department, International Monetary Fund, Washington 2021: Quote” Returning to disintermediation risks, the first, and most likely, scenario is that e-money and b-money will coexist. Moreover, e-money providers might recycle many of their client funds back to banks as certificates of deposit or other forms of short-term funding . Clearly, from the banks’ standpoint, the outcome is not optimal. First, they would swap cheap and stable retail funding for expensive and runnable wholesale funding, thereby requiring them to rebalance their assets to meet regulatory requirements. Second, they could be cut off from client relationships. And third, they could lose access to valuable data on customer transactions. In addition, funding from e-money providers might be concentrated in a few large banks (though it would eventually trickle down to other banks), so smaller banks might feel greater funding strains or at least experience greater volatility in funding” p69

[51] RBI annual report provides the direct cost of printing currency note and its remittances to various currency chests; for 2019-20 and 2020-21 the respective costs were: 4465 and 4067 crores. This cost does not include the cost of currency management within RBI. Issue departments of different offices of RBI, that manage supply chain of currency notes, accounts for a significant percentage of clerical grade employees of RBI. See also https://www.thehindubusinessline.com/money-and-banking/it-costs-the-rbi-more-to-print-a-20-note-than-a-50-bill/article25438914.ece

Annexure: Bitcoin Protocol:

For a bank transfer both the sender and receiver must have bank accounts for the transaction to be successful. Since transfer happens by debiting an account and crediting another account, the problem of double spending is non-existent. All other electronic payment systems like Google pay, Paytm etc. are essentially bank transfers. Even a wallet to wallet money transfer can happen if both the parties are on the same platform. But the sender has to put legal money in their wallet either transferring it from her bank account or from some other wallet.

Bitcoin is not just a money transfer protocol but much more than that. It is designed to create its own currency called BTC and then create an ecosystem for spending that currency by a holder of the same by buying goods or services from another person who is ready to receive payment in BTC. So BTC is different from national currencies like USD or INR because it has no national identity nor it is a legal tender of any nation state. Thus Bitcoin must function like a currency as well as a payment system.

Currency functions:

- Issuance of currency and determination of denominations of issued currency.

- Incorporating features in the currency issued that allows detection of any counterfeit copy of the currency

- Holding, receiving and spending a currency are different functions and need not take place in the same time and space.

Payment Enabling Function:

- Alice should be able to pay any amount of BTC that she is in possession to Bob and only Bob.

- Unlike a physical currency like USD or INR, for which issuance happens in specific denominations, bitcoin is issued in any fraction of one BTC. So a holder of certain amount of BTC can send any fraction (up to 1/(10)^8) of BTC to another person. Thus Bitcoin protocol cannot transfer some specific notes that is in possession of Alice to Bob, the recipient. Like a bank it must have the functionality of reducing the amount of BTC in possession of Alice and crediting the same amount to Bob’ holding of BTC.

- Alice will not be able to send the same BTC to two persons. In other words, double spending is not possible

- Since Bitcoin as an application performs dual role -an issuer of currency and a payment service provider – the protocol must also maintain a ledger of all its issued currency and transactions made by the holders of BTC.

Technology Stack of Bitcoin protocol:

- A network of computer: The Bitcoin protocol runs on a network of computer. Anybody can download “bitcoin client” – an app that is available on Google Play store or Apple App store. Once a person activates the app on her device, she gets connected to the network. Each device connected to the network is called a Node. The Bitcoin software provides the functionality of communication between all nodes. There is no central server that controls all the nodes. The software is open source and can be used by anybody to start a new cryptocurrency

- Blockchain-a distributed Database: Bitcoin protocol requires a ledger of all transactions undertaken by all the nodes. This ledger is kept in new database type called Blockchain. For example, a local administration may keep a register of all property related transactions (buy / sale/ mortgage etc.). So when a person wants to buy a property he or she gets a search done on the register to know the current status of the property. Now suppose the register is a public document and maintained fully or partially across many databases. Since it is a publicly accessible distributed database, technically any alteration of data is subject to publicly verifiable audit trail and can be detected quickly provided any transaction can be recorded with a verifiable signature of the initiator of a transaction. Blockchain is the technology that helps to maintain a public ledger through a distributed publicly accessible database

As the name suggests this database is based on two concepts namely – block of data and chain of blocks. A block is a collection of confirmed records of transactions. We need to understand the meaning of “confirmed record”. Transaction in Bitcoin network between nodes are broadcasted to all nodes in the network. It is the responsibility of these nodes at large to verify and certify that validity of a transaction. This verification process is called mining and voluntary. A miner is required to put a group of validated transactions in a block and broadcast to the network. This new block must get chained to the existing chain of blocks that represent the ledger of all validated transaction till that period. The ledger is distributed in the sense that every node has right to have a copy of the entire history all transactions. The challenge that such a publicly shared ledger must address is – how to ensure trust and integrity in this database when it is created by an unknown number of miners with no guarantee for their bonafide. This is achieved by innovative application of many well-known technologies.

- Public key cryptography: Information security is the most critical requirement of financial transactions in a digital mode. Encryption-decryption is the standard technique of secured two-way communication through Internet. If M is the message to be sent, then a key K is a mapping of M to another message C. C is called cipher which can be retransformed to M easily provided we know the K. The Public key cryptography consists of two keys- a public key and a corresponding private key. The public key is as the name suggests can be distributed to all and sundry. But the private key must be kept confidential in the safe and secure custody of sender of a message. In the Bitcoin protocol these two keys are conjointly generated using a mathematical algorithm called Elliptic Curve Digital Signature Algorithm (ECDSA). A message encrypted with a public key can be decrypted only by using the conjoint private key. Similarly, a message encrypted with a private key can be decrypted by the conjoint public key only. So if Alice wants to send some amount of BTC to Bob she will encrypt the transaction message with her private key so that the entire network having access to her public key would be able to read the transaction details. But if someone wants to send a encrypted message to Alice only for her to view it, then the sender has to encrypt with the public key of Alice.

- Hashing: Hashing is an algorithm that maps an object data to a fixed size string of integer values. When any data object is transmitted from one computer to another over a network, then one has to be reasonably confident that source data and destination data are identical. If two different data objects result in the same hash output, then it would be called an instance of hash collision. A good hash algorithm is such that the probability of occurrence of hash collision is very low. A good hashing algorithm is a kind of one-way function. It means given an input the function will generate a unique output, but given that output it is computationally extremely hard to get back the original input. In Bitcoin protocol, the integrity of data object called block is maintained by the hashing algorithm called SHA-256.

- Proof-of-work: When a ledger book is maintained centrally, the central authority is responsible for verifying the genuineness and validity of transaction before a new entry is added to the ledger. In the absence of such an authority and when anybody can try to add a new entry to the distributed ledger, how does such verification can be done? It is, therefore, necessary to devise a mechanism through which all the participants in the network of transactions like Bitcoin should agree that any new transaction is authentic and can be added to the chain. A kind of consensus about the authenticity of a new transaction must be worked out. This is an old problem in distributed database management system. Proof-of-work is one algorithm to arrive at such a consensus. It works like this. A single participant can announce that he or she has been able to prove that a new transaction in the network is genuine of otherwise. This is the hard work. If a mathematician says he or she has proved Fermat Last Theorem, the hard work is done by the claimant. But other mathematicians can easily look into the proof offered and can say the proof is valid or not. This is much simpler. The person who is the first claimant of proving the theorem would be called a Miner and would receive reward for the effort made.The first thing that other miners would like to know that the first claimant is serious about her claim. This is proved by the computational effort she has undertaken. So the claimant has an arbitrary mathematical puzzle to prevent anybody from gaming the system. Others in the network can easily verify that the puzzle is really solved.

- Bitcoin address: In the bitcoin network, identity of wallet holder is not a name but a string of bits. A sender of bitcoin is expected to generate a new Bitcoin address each time she decides to send or receive a payment. Apart from being a security measure, it helps to provide very strong anonymity to both parties in a transaction. A bitcoin wallet provides the functionality of generating a new address by using the wallet holder’s private key.

References:

- Agur, I., Ari, A., & Dell’Ariccia, G. (2021). Designing central bank digital currencies. Journal of Monetary Economics.

- Armelius, H., Guibourg, G., Johansson, S., & Schmalholz, J. (2020). E-krona design models: pros, cons and trade-offs. Sveriges Riksbank Economic Review, 2, 80-96.

- Armstrong, W. E. (1924). Rossel Island money: a unique monetary system. The economic journal, 34(135), 423-429.

- Auer, R., & Böhme, R. (2020). The technology of retail central bank digital currency. BIS Quarterly Review, March.

- Bailey, R. (1995). A History of Money: From Ancient Times to the Present Day. In: JSTOR.

- Bank, N. (2018). Central bank digital currencies. Norges Bank Papers, 1, 2018.

- Barontini, C., & Holden, H. (2019). Proceeding with caution-a survey on central bank digital currency. Proceeding with Caution-A Survey on Central Bank Digital Currency (January 8, 2019). BIS Paper(101).

- Barrdear, J., & Kumhof, M. (2021). The macroeconomics of central bank digital currencies. Journal of Economic Dynamics and Control, 104148.

- Belk, R. W., & Wallendorf, M. (1990). The sacred meanings of money. Journal of economic Psychology, 11(1), 35-67.

- Bindseil, U. Issuing a digital euro. Keynote speech Legal aspects of the ECB’s response to the coronavirus (COVID-19) pandemic–an exclusive but narrow competence 9, 172.

- Bordo, M. D., & Levin, A. T. (2017). Central bank digital currency and the future of monetary policy. Retrieved from

- Bordo, M. D., & White, E. N. (1991). A tale of two currencies: British and French finance during the Napoleonic Wars. The Journal of Economic History, 51(2), 303-316.

- Dabrowski, M., & Janikowski, L. (2018). Virtual currencies and central banks monetary policy: challenges ahead. Monetary Dialogue. Policy Department for Economic, Scientific and Quality of Life Policies. European Parliament. Brussels.

- Dalton, G. (1965). Primitive Money 1. American anthropologist, 67(1), 44-65.

- de la Rubia, C., & Kirchner, R. (2019). Central bank digital currencies: A survey of the key issue (Policy Paper Series-PP/01/2019). German Advisory Group.

- Dyson, B., & Hodgson, G. (2021). DIGITAL CASH-Why central banks should start issuing electronic money. Positive Money. http://positivemoney.org/wp-content/uploads/2016/01/Digital_Cash_WebPrintReady_20160113.pdf

- Einzig, P. (2014). Primitive money: In its ethnological, historical and economic aspects: Elsevier.

- Fitzpatrick, S. M., & McKeon, S. (2020). Banking on stone money: ancient antecedents to bitcoin. Economic Anthropology, 7(1), 7-21.

- Friedman, M. (1991). The island of stone money: Hoover Institution, Stanford University Stanford, CA.

- Friedman, M. (1994). Money mischief: Episodes in monetary history: HMH.

- Goldstein, J., & Kestenbaum, D. (2010). The Island of Stone Money. NPR, NPR, 10.

- Goodhart, C. A. (1998). The two concepts of money: implications for the analysis of optimal currency areas. European Journal of Political Economy, 14(3), 407-432.

- Grierson, P., Stewart, B., Pollard, J. G., & Volk, T. R. (1983). Studies in numismatic method: presented to Philip Grierson: CUP Archive.

- Hart, K. (2005). 10 Money: one anthropologist’s view. A handbook of economic anthropology, 160.

- Hudson, M. (2004). 5. The Archaeology of Money: Debt versus Barter Theories of Money’s Origins. Credit and State Theory of Money, 2004 Scanned by Arno Mong Daastoel arno@ daastol. com 2005-11-01 Note: In chapter 2 and 3, I have used the original pagination of Innes, and excluded the new pagination of Wray., 93.

- Koning, J. (2016). Fedcoin: A central bank-issued cryptocurrency. R3 Report, 15.

- Laureate, N. An Analysis ofthe Theory and Practice ofConcurrent Currencies.

- Mastromatteo, G., & Ventura, L. (2007). The origin of money: A survey of the contemporary literature. International Review of Economics, 54(2), 195-224.

- Mauss, M. (2002). The gift: The form and reason for exchange in archaic societies: Routledge.

- McAndrews, J. J. (2020). The case for cash. Latin American Journal of Central Banking, 1(1-4), 100004.

- Meikle, S. (1994). Aristotle on money. Phronesis, 39(1), 26-44.

- Menger, K. (1892). On the origin of money. The Economic Journal, 2(6), 239-255.

- Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Decentralized Business Review, 21260.

- Orlean, A. (1992). The origin of money. In Understanding origins(pp. 113-143): Springer.

- Peebles, G. (2010). The anthropology of credit and debt. Annual review of Anthropology, 39, 225-240.