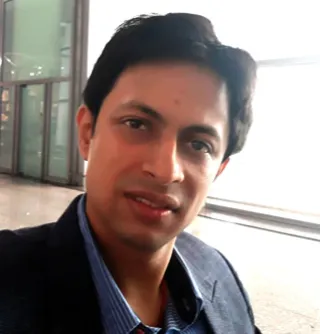

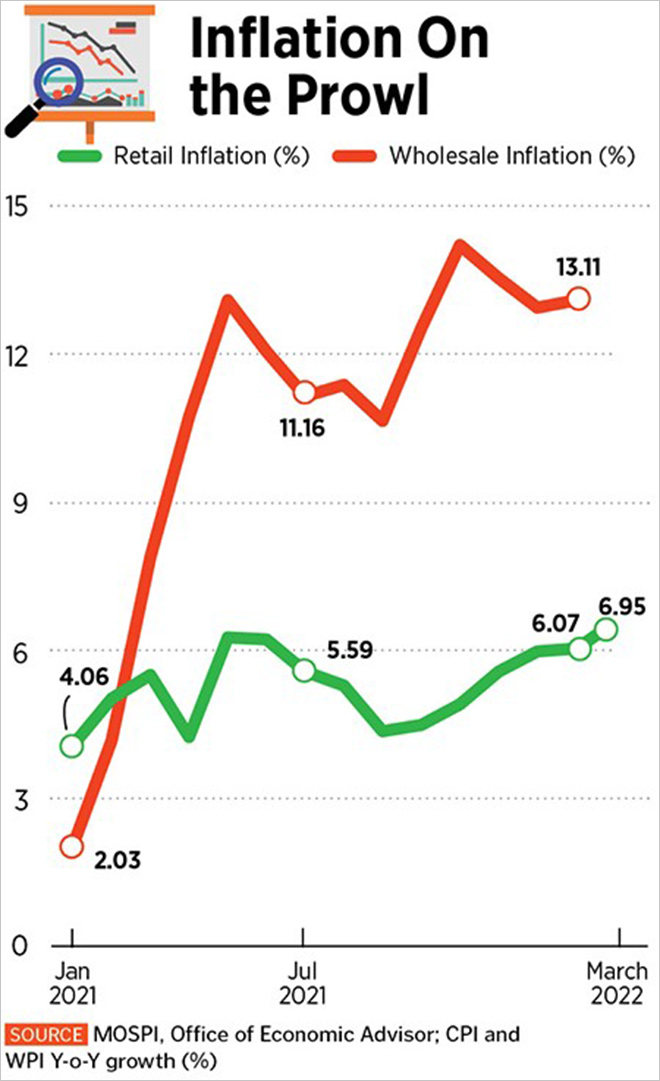

Slashing its economic growth forecast for India and the whole South Asian region by 70 basis points and a percentage point respectively, in the backdrop of the Ukraine crisis, the World Bank cited the detrimental effect of “high oil and food prices caused by the war in Ukraine” on real incomes. The World Bank expects this imported inflation, along with the lingering economic impact of the pandemic on labour markets, to restrict household consumption. It is also likely that the Reserve Bank of India (RBI) may have to hike interest rates in light of the possibility of retail inflation breaching the upper limit of RBI’s target band of 2-6 percent for three successive quarters (Figure 1).

Figure 1: Retail and wholesale inflation rates in India.

According to a Bank of America report dated 12 April, “Unfavourable base effects in case of other food items are expected to push headline CPI inflation further up to 7.3 percent in April”. On the other hand, a note by Kotak Mahindra Bank predicts average FY2022-23 inflation at 6.2 percent and states that “the pass-through of elevated commodity prices is likely to continue both in agriculture and non-agriculture products, and the persistence of supply-chain disruptions will likely continue posing significant upside risks to inflation”.

Resilient and robust

Despite the prevailing environment of gloom and doom, however, the present article argues that the Indian economy is displaying and shall continue to display resilience. The arguments presented derive largely from the long-term structural robustness of the economy, which is expected to provide durability to the India story notwithstanding the current (largely transient) headwinds.

For starters, India’s services exports have hit an all-time high of US $250 billion in FY 2021-22, in spite of travel, tourism, aviation and hospitality sectors suffering severely due to the ongoing COVID-19 pandemic. In fact, India’s merchandise exports surged 43 percent to a record US $418 billion in FY2021-22 compared to US $292 billion in FY2020-21, driven by shipments of petroleum products, engineering goods, gems and jewellery, and chemicals. These have contributed to a sturdy current account, and expectations of spectacular improvement in the export-to-GDP ratio.

Then there is optimism on the capital account front given the return of foreign institutional investors in the Indian equity space, driven by inexpensive valuations, after six months of sustained outflows, where around INR 1.48 lakh crore was withdrawn from the equity segment. “Turnaround in global markets, cooling off in hostilities between Russia and Ukraine, attractive levels in individual stocks, and correction in crude oil prices were some of the factors that helped reverse the selling trend”, claimed Deepak Jasani, Head of Retail Research, HDFC Securities.

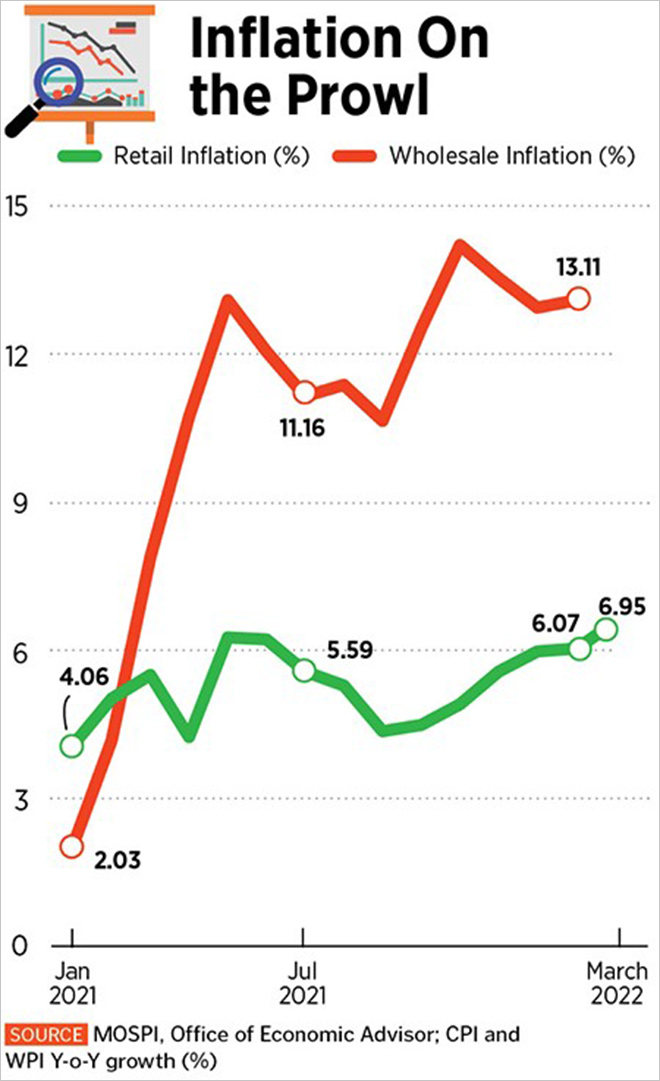

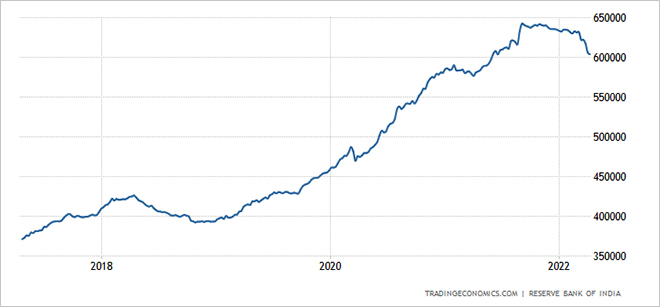

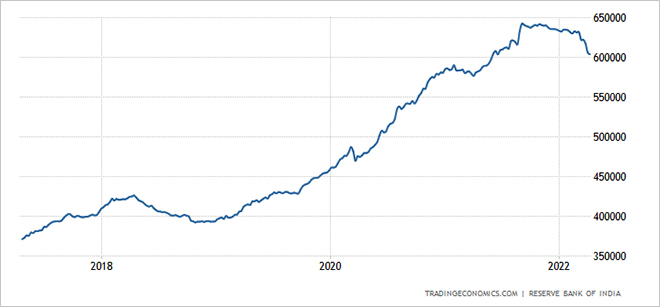

It is no wonder, then, that the Indian rupee has not looked anything close to replicating its 2013 taper tantrum (Figure 2). In fact, the stability of the rupee could be a symptom of a stronger and more balanced economy, with a more robust external sector which can better absorb volatility in oil prices. CLSA has, therefore, predicted a stable range for the Indian rupee over the next year, without substantial depreciation, despite the United States’ Federal Reserve winding down its monetary stimulus. Other symptoms of this underlying economic strength can be identified in terms of robust foreign exchange reserves and import cover (Figure 3).

Figure 2: Movement in INR versus 1 US$, including the taper tantrum episode.

Figure 3: India’s foreign exchange reserves.

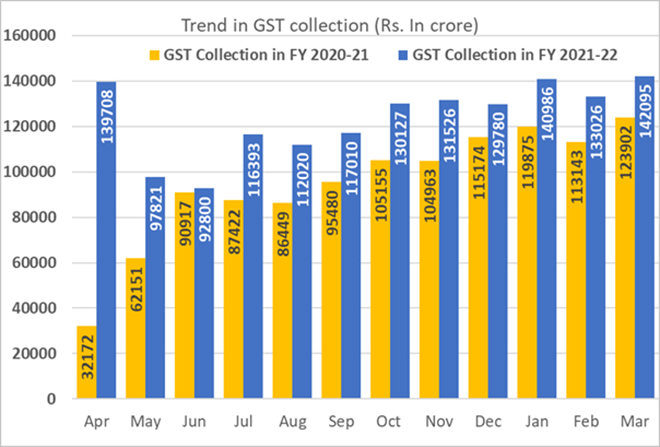

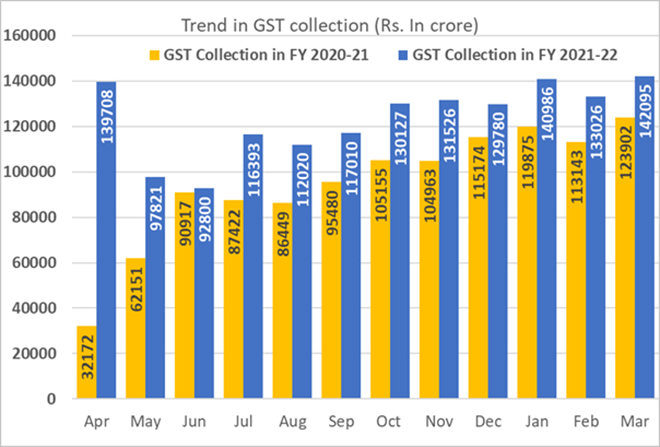

When it comes to tax collections, India is expected to witness record-high GST collections amounting to INR 1.5 trillion in April, after managing a record INR 1.42 trillion in March (Figure 4). This has enabled the government to maintain fiscal deficit within reasonable, though not ideal, limits.

Figure 4: Monthly YoY comparison of GST collections between FY2020-21 and FY2021-22 (GST Collection In March 2022: Breaks Previous Records ).

Private sector capital expenditure revival is also expected during the second half of the current fiscal, driven by complementarities with public capital expenditure which has been pegged at INR 7.5 lakh crore for FY2022-23 in the Union Budget, representing a 35.4 percent increase over the INR 5.5 lakh crore for FY2021-22. In fact, private sector bets on an Indian economic recovery are already witnessing a spike with total investment project announcements hitting a record of INR 19.3 lakh crore during FY2021-22, nearly 78 percent above pre-pandemic levels. It comes as no surprise then that the Indian banking sector is expected to witness robust loan growth this year (Figure 5).

Figure 5: YoY growth rates of loans disbursed by Indian banks.

And while India’s import bill for edible oil is likely to increase by US $2 billion because of the war in Ukraine, the Indian economy’s ability to resist imported inflation is greater than ever on the back of its soaring exports of both services and merchandise, its improved import cover and foreign exchange position, robust tax collections, a favourable investment outlook—both foreign and domestic, as well as a well-capitalised financial sector.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV