This article is part of the series Comprehensive Energy Monitor: India and the World

This article is part of the series Comprehensive Energy Monitor: India and the World

There is a large body of literature on different decarbonisation pathways for India and for the rest of the world. These range from the International Energy Agency’s (IEA)

450 ppm (parts per million) scenarios to projections targeting a

100 percent renewable energy (RE) system by 2050. Most of the forecasts call for the

elimination of coal or at least a substantial decrease in the share of coal that is used for power generation. In most simulations,

natural gas replaces the contribution of coal in the short term with

RE backed up with storage taking over in the longer term. Reasonably

low prices for natural gas and a substantial improvement in the cost and robustness of storage that would address the challenge of intermittency of RE not only across hours but also across days, months and seasons underpin these projections. Developments in

energy markets in 2021 and in the first half of 2022 have challenged both these assumptions.

Demand for energy, particularly the demand for power rebounded after the end of the pandemic-related shutdown in late 2021. In 2021, global electricity generation

grew by a record 1,577 terawatt-hours (TWh), an increase of 6.2 percent over 2020. The price of liquefied natural gas (LNG) used for power generation in

European and

Asian markets increased to unprecedented highs and power generation from RE did not meet expectations. Energy supply disruptions following the conflict between Ukraine and Russia in early 2022 took LNG prices even higher leaving coal as the only option for dispatchable and affordable power even in the tough markets of

Western Europe and North America that have explicit policies to phase out coal.

Reasonably low prices for natural gas and a substantial improvement in the cost and robustness of storage that would address the challenge of intermittency of RE not only across hours but also across days, months and seasons underpin these projections.

In 2021, global coal consumption growth of

6.3 percent was higher than that for natural gas or for oil. Coal met

51 percent of the increase in demand for electricity in 2021, the largest amongst fuels. China accounted for

3.7 exajoules (EJ) of the increase in energy derived from coal whilst India accounted for

2.7 EJ. Together these two traditional coal users accounted for over

70 percent of the increase in coal consumption growth offsetting global RE growth of over

15 percent in 2021 that accounting for just over

5.1 EJ of energy. After

10 years of steady decline, coal consumption grew in both North America and Europe in 2021 though traded thermal coal prices were the highest since 2008 at US

$121/tonne (t) in 2021. An increase in coal consumption may be short-lived, but it underscores challenges that the grand project of the energy transition is likely to encounter in the future.

India

In India, the unexpected

increase in coal demand has meant that the government had to issue directives that contradicted some of its earlier policy goals. For example, in February 2020, the government wanted coal plants to replace imported coal with domestic coal stating that it plans to end thermal

coal imports by 2023 towards its strategic goal of self-reliance. When it became clear that domestic coal supply was unable to keep up with the increase in demand, the government issued an order in

May 2022 that thermal power generating companies (including those that were designed to use domestic coal) that they would have to source imported coal to meet up to

15 percent of their demand and sternly warned that domestic coal supply will be reduced substantially to power generators that fail to source imported coal by

mid-June 2022. Going against the (

Reserve Bank of India (RBI) directive to stop financing working capital requirements of imported coal-based power plants, the government directed

PFC (power finance corporation) and REC (rural electrification corporation) to offer short term working capital funds to these plants even if they are subject to insolvency suits or under the national company law tribunal (NCLT). As the price of imported coal is more than three times that of domestic coal, the government allowed

pass through of higher costs to the consumer. India also

relaxed environmental regulations to increase the supply of coal. In 2020 (calendar year

), coal accounted for about 72 percent of power generation in India and in 2021 (CA) coal accounted for over 74 percent of power generation. How short-term measures to increase coal supply will play out in the longer term is not clear, but they will definitely leave a mark India’s energy security and decarbonisation pathways.

As the price of imported coal is more than three times that of domestic coal, the government allowed pass through of higher costs to the consumer.

China

China’s electricity demand increased by over 10 percent in 2021 that led to severe electricity shortages around the same time India was going through its coal crisis. Power outages lasted for days. Industries and households were asked to reduce electricity consumption. Global supply chains suffered because of supply disruptions originating in China. The revival of the economy after the pandemic, reduced coal imports from Australia and Indonesia, persistence of the pandemic in coal producing regions of China and curbs on coal-based power generation plants to meet China’s climate commitments were said to be behind the crunch. This was despite the fact that raw coal (thermal and coking coal) production in China exceeded 4 BT (billion tonnes) in 2021. China’s thermal coal consumption in 2021 was 86.19 EJ (just over 2.9 BT) more than the peak consumption of 82.43 EJ (2.8 BT) in 2013. However, the share of coal in power generation fell from 63 percent in 2020 to 62.5 percent in 2021 because of the supply shortages. There is evidence that the energy crunch has revised China’s approach to energy security with high efficiency low carbon coal-based power generation forming the backbone of a flexible low carbon energy system. China is projected to construct more coal-based power plants accounting for more than half of the new power plants globally. As of January 2022, 158 GW (giga watts) of new pre-permitted coal-fired power capacity have been announced making up 57 percent of the global pipeline.

Europe

A year ago (July 2020) coal prices in Europe were around US$50/t which was considered reasonable by the coal industry. Rising natural gas prices, EU (European Union) carbon prices of about €26/t and the increase in crude oil prices were said to be behind the increase in coal prices. In July 2022, the price of seaborne coal in Europe was US$365/t after touching the historic high of US$425/t in late June 2022. Despite the price increases coal was cheaper compared to natural gas and more importantly it was available. In 2021, Europe as a whole recorded a growth of 5.9 percent in coal consumption compared to an annual decline of 4.6 percent in the period 2011-2021. In Germany coal consumption grew by 17.5 percent in 2021 and by 20.5 percent in France. By October 2022, Germany is expected to revive 10 GW of coal-based power generation capacity. This would mean a 100 percent increase in Germany’s coal imports but less than a day’s coal production in China. In the pandemic year of 2020, the EU celebrated the fact that for the first time the share of RE in power generation at 38 percent was higher than that for fossil fuels at 37 percent. In 2021 the share of RE in power generation fell to 37 percent matching the share from fossil fuels. The embrace of coal by the EU in general and Germany, in particular, exposes what Robert Bryce has labelled the “iron law of electricity”: most countries want energy at any cost, even at the cost of decarbonisation.

India and China have regulated growth markets for energy and emphasis on coal were driven mostly by policy to address domestic coal and power shortages.

United States

Coal has been in terminal decline in the USA since 2007 when coal-based power generation peaked. Between 2007 and 2020 coal based power generation fell by 61 percent. But in 2021 coal-based power generation increased by over 15 percent accounting for 22 percent of power generation compared to a share of 20 percent in 2020. The driver of the shift towards coal in the USA was the price of natural gas as in the case of the EU. The share of natural gas in power generation decreased from 40 percent in 2020 to 38 percent in 2021. Though it is widely believed that the shift to coal will be short lived in the USA, the latest supreme court ruling that limits the federal authority to control power plant emissions may give coal some momentum.

Challenges

The energy markets of China, the USA, Europe, and India accounted for over 61 percent of primary energy consumption in 2021. In the USA and Europe, the price of natural gas has increased by over 500 percent in 2021-22 is driving the shift in favour of coal. These are mature energy markets where growth in energy consumption has peaked and the competition between fossil fuels (gas and coal) is largely driven by market forces. India and China have regulated growth markets for energy and emphasis on coal were driven mostly by policy to address domestic coal and power shortages. Irrespective of the differences in economic status of countries and in the governance of their energy markets, the tilt towards coal shows that the goal of energy security and affordability were important for all countries. The statement by Germany’s green party representative that the decision to use coal was bitter but necessary captures the sentiment. The road to decarbonisation is likely to be paved with more bitter but necessary stones of fossil fuels. Cleaning those stones may offer a more rational path to decarbonisation.

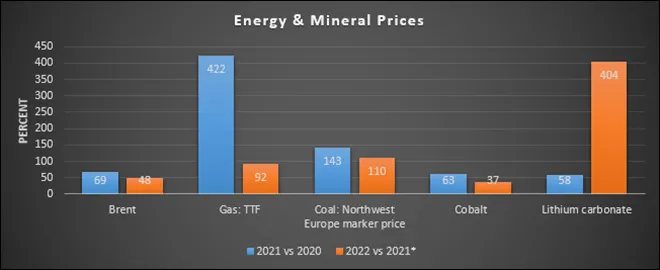

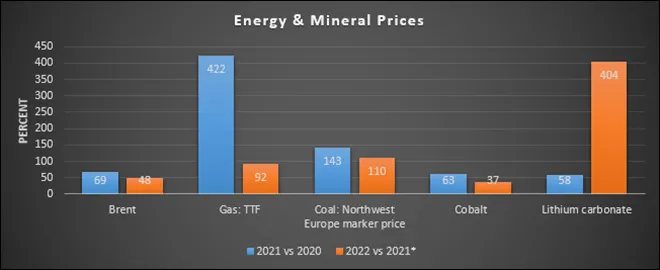

Source: BP; * First quarter of 2022

Source: BP; * First quarter of 2022

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This article is part of the series

This article is part of the series

PREV

PREV