This is the 86th article in the series

This is the 86th article in the series The China Chronicles.

Read the articles here.

The US-China trade war began with the imposition of 25% tariffs on steel products in March, 2018, but the tariffs were non-country-specific. A series of tariffs followed – specifically on Chinese goods, and then China started retaliation. Officials of the two countries recently met in Shanghai without making any breakthrough. Trump has threatened to impose 10% tariffs on $300 billion worth of Chinese goods in the beginning of September, 2019.

How will the US tariff imposition impact the steel industry in China and consequently the global steel market?

China is the largest steel exporter in the world, with a total share of 13.5% of global world exports in 2018. In terms of value, it represents 2.2% of the total exports from China. In the 1990s, China produced 4% of the global steel output, today it produces over 50% of the global output. China’s steel industry employed about five million people in 2016.

While the world steel production has virtually stagnated, China’s production has been expanding even recently. In 2019, China has increased its steel production by 13% till now, as compared to 2018. How important China is to the global market of steel and to its own economy can be made out from these facts.

Importance of US steel market for China

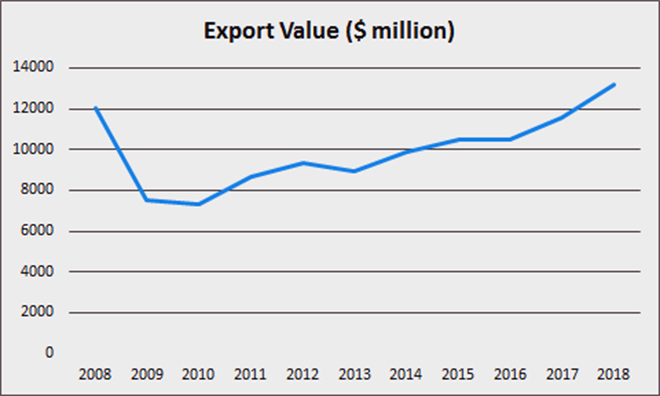

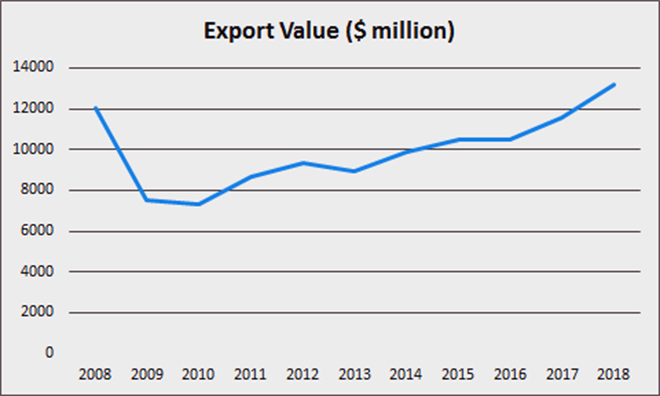

The US is China’s largest trading partner with bilateral trade at $737.1 billion in 2018. The following diagram shows the Chinese exports of iron and steel products into the US since 2008.

Data Source: USITC Dataweb

Data Source: USITC Dataweb

Chinese steel exports to the US has shown an upward trend, after a decline as a result of the 2008 crisis. But with the imposition of more tariffs, the effects on steel exports are now quite evident in recent data. In year-to-date (YTD) 2019 (through March), the U.S. imported 7.4 million metric tons of steel, a 5% decrease from 7.9 million metric tons in YTD 2018.

However, the USA is not among the top 10 steel export markets of China. Other non-US major markets in the steel sector may provide China with some cushion effect, but the country is widely expected to look at newer geographical directions for future steel exports.

New directions of China’s steel export

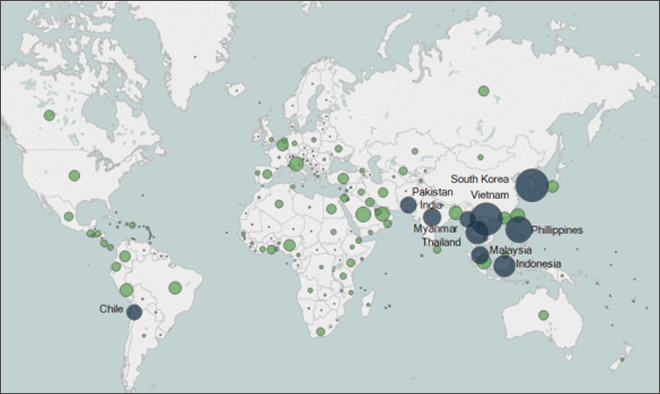

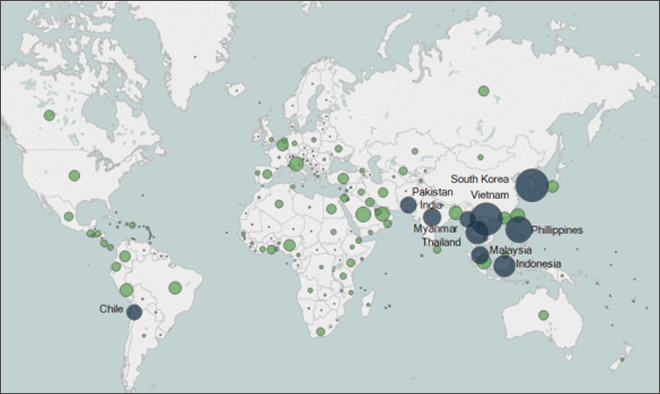

There has been a change in the direction of overall export since the early 1980s, where Asian countries have become prominent trade partners. This shows a high degree of multilateralism. The following data show the volume of steel exports from China to the top 10 steel markets in 2017. In terms of volume, exports to the top ten markets represents 51% of the total steel exports.

The following map shows the top markets for exports of steel mill products in 2018 from China.

Source: Global Steel Trade Monitor of the International Trade administration.

Source: Global Steel Trade Monitor of the International Trade administration.

All the top 10 market destinations are developing countries with 9 of them being in Asia. The USA, on the other hand, is the 25th destination when it comes to Chinese steel exports. Further, steel demand has peaked in China. It is weak in North America, Europe and Japan but demand in the developing countries is expected to be stable in near future. So, China would look to export more in these developing countries. The importance of Asia and other developing countries for Chinese steel exports, therefore, is very clear.

However, there is an apprehension about China dumping steel into these developing countries. These countries are likely to experience a surge in steel imports. For example, steel imports into India surged 67% in April-May as a result of diversion of steel supplies internationally. Other countries have started imposing safeguard or retaliatory measures to protect domestic producers. For instance, the European Union has approved safeguard measures on steel due to a surge in steel imports.

According to the World Steel Association, global steel demand in 2018 increased by 2.1%, slightly slower than in 2017. This is on account of the slowing global economy. The steel demand in developed countries is expected to decelerate further to 0.7% in 2020. On the other hand, the steel demand in developing countries is expected to grow by 2.9% and 4.6% in 2019 and 2020 respectively. There is surely a positive expectation of steel demand in developing countries. China will definitely try to target these markets.

On the supply side, China is looking to curb its excess steel capacity. According to the Supply-Side Structural Reforms (SSSR) released in late 2015, China aims to modernise the steel production and reduce the excess capacity in steel industries within the next three to five years by 100-150 million tons. This was on account of excess capacity that affected corporate profitability, as well as an effort to implement tougher environmental measures to curb pollution. China has shut more than 150 million tonnes of steel capacity in the past three years as part of a campaign to modernise its economy. On account of this, there may be diversion via exports, of the excess steel production to other developing nations where demand is still growing.

What next?

Does it mean that Chinese steel companies are trying to produce less?

Chinese steel giants like Baowu Group are analysing plans to relocate blast furnaces from Xinjiang Province to Cambodia in a move to shift excess capacity overseas. This is in order to maintain similar production levels despite domestic measures to curb industrial slack. Growing demand for steel on account of the construction boom in Cambodia is an additional factor. The firm is also contemplating creation of new production facilities in Pakistan and Chile. So, other developing country destinations will play a significant role in the future direction of the steel exports in China.

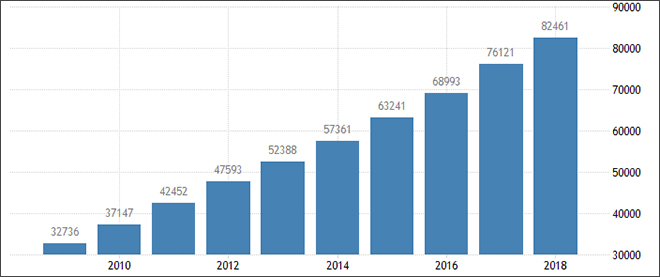

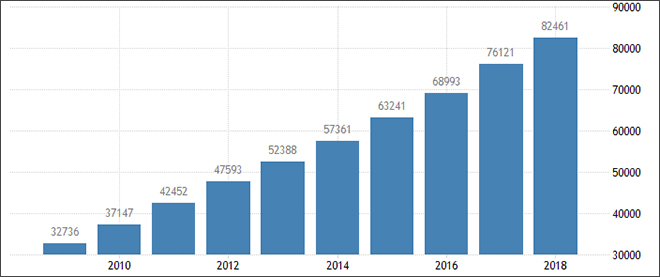

An upward movement of wage rates in Chinese labour market is also one of the primary push factors for geographical shifts to other countries, where the relative wage rates are still on the lower side. Like Baowu, quite a few more are expected to follow that route. Wages in China have been continuously growing over the past few years, reaching an all-time high in 2018.

Data from tradingeconomics.com. The data shows Chinese Yuan per year.

Data from tradingeconomics.com. The data shows Chinese Yuan per year.

The imposition of tariffs by the US may act as a factor that may lead to a diversion of export of Chinese steel to other developing countries. This, however, may lead to retaliatory tariffs from other countries due to dumping, leading to a geographically wider trade frictions. There have been multiple anti-dumping and countervailing cases in the USA as well in other countries against the Chinese steel sector. With sluggish global growth and slowing Chinese economy, the concerns of increase in steel imports bill and Chinese dumping are expected to be a common concern in the developing world.

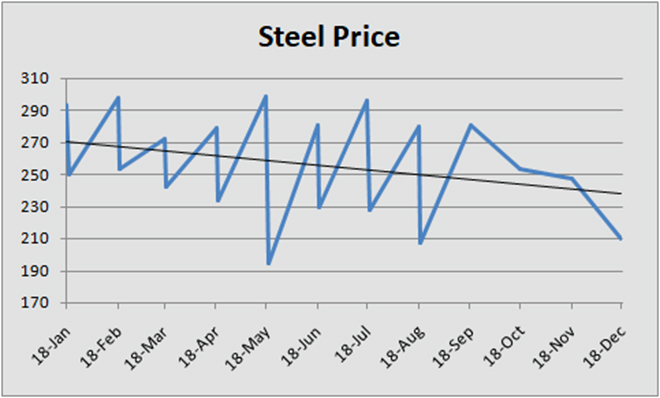

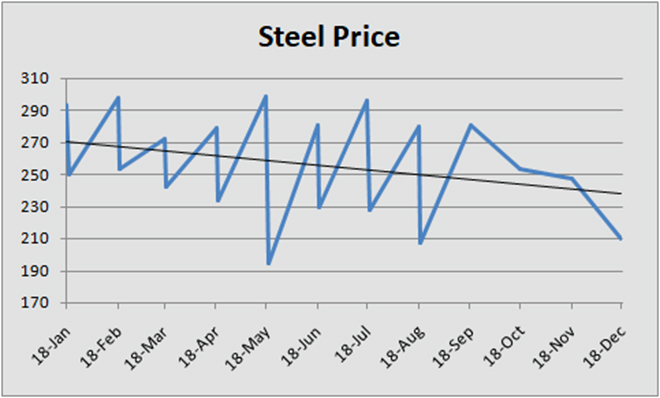

Prices of steel globally are impacted by the level of Chinese production because of its high share in world production. If the US tariff imposition results into a supply glut from Chinese steel manufacturers and possible dumping, international prices of steel would fall. Initial trends in that direction can be seen in the data, as shown in the graph below. The trend line shows that the prices of steel has fallen from January 2018. There has been a fall of 29.4% in the price of steel by the end of the year 2018.

Dow Jones Iron & Steel data

Dow Jones Iron & Steel data

In conclusion, the US tariffs will impact the export of steel products to the US market from China. Given the change in China’s trade direction on account of its domestic steel policy as well as higher wage rates, there may be a rise in Chinese steel exports to developing countries. This can result in over-supply and dumping of steel in developing world. Instances of dumping may subsequently lead to further trade tensions and latest data clearly show the likelihood of things going towards that direction. For India in particular, the steel tariffs may have a direct impact on the export of steel products to the US, however since India’s share in the import of steel by the USA is small, ideally the impact should be limited. However, indirect effects can stem from the impact these tariffs would have on other countries exporting to the US. In such a situation, these countries will look for newer markets for their steel exports, which could lead to a surge of steel imports into India, as is also indicated by recent data, and this holds the potential to distort India’s domestic steel market.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This is the 86th article in the series The China Chronicles.

Read the articles

This is the 86th article in the series The China Chronicles.

Read the articles  Data Source: USITC Dataweb

Data Source: USITC Dataweb Source: Global Steel Trade Monitor of the International Trade administration.

Source: Global Steel Trade Monitor of the International Trade administration. Data from tradingeconomics.com. The data shows Chinese Yuan per year.

Data from tradingeconomics.com. The data shows Chinese Yuan per year. Dow Jones Iron & Steel data

Dow Jones Iron & Steel data PREV

PREV