India is increasingly going grey and by 2050, around 20 per cent of the population will be old. There were 100.3 million senior citizens (60 and above) in 2011 which is 8.6 per cent of the population. In 2050, there will be 324 million elderly. Around 9 to 10 percent of all women are over 60 years and 8.2 percent of men are over 60.

But in today’s India, the main problem is how to utilise the demographic dividend and give jobs to the youth who are joining the labour force at the rate of 1 million a month. It is very important that the youth are employed. It is the young who mainly support the elderly in Indian society. The elderly dependency ratio is at 14.2 per cent – the ratio of the number of people aged 60 years and above to the number of people aged between 15 and 59. India’s problem is not as serious as Japan’s ageing population (dependency ratio is 42 per cent) but it ought to be addressed in a focused manner.

Read | < style="color: #960f0f">Staring at stagflation, a difficult year ahead for India

Numerous problems are surfacing regarding the elderly in our society and lack of economic independence is central. Most people in India work hard to earn money in their working life to save for their old age. Many people are lucky enough to get a pension after retirement but most do not have a pensionable job. Majority of workers (90 percent) are in the informal sector and they have no pension or gratuity at the end of their working life. When they grow old, they have to depend on their children or relatives. To make sure that there is no mistreatment of the elderly in the hands of the relatives and children, the government passed an Act in 2007: Maintenance and Welfare of Parents and Senior Citizens Act which makes it obligatory for the younger generation (children and relatives) to provide maintenance to senior citizens and parents. Still, one hears of many cases of abuse by children towards their elderly parents. Many times, their property is grabbed and the parents are turned out of the house. Worst is that in a nuclear family, there is no one to reprimand bad behaviour of sons and daughters towards the elderly.

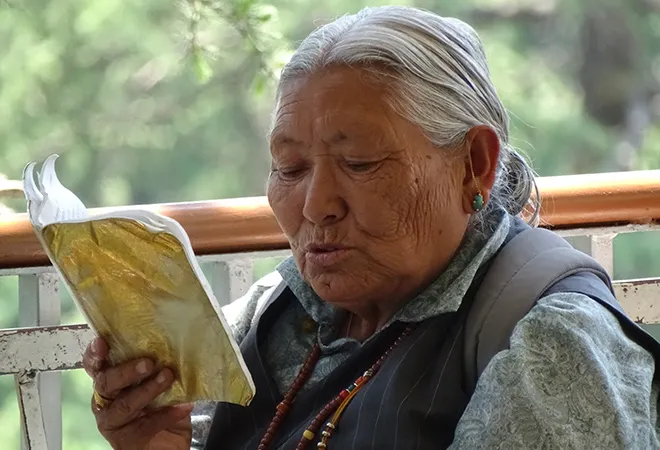

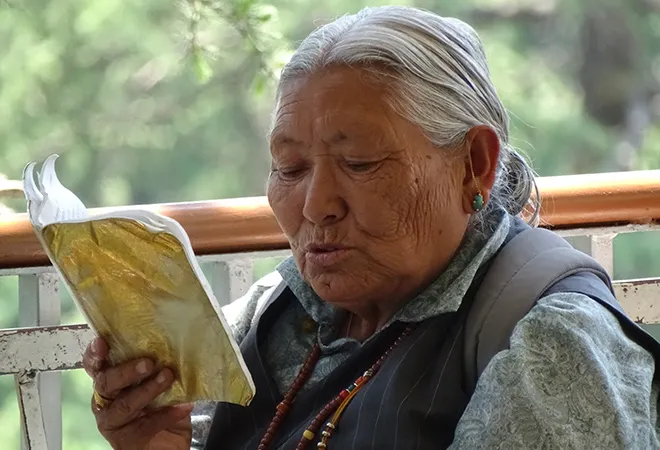

Two thirds of the aged live in the villages and majority (73 percent) are illiterate or semi -literate. Most elderly women of today have been homemakers and have never worked. In villages, older women have worked in menial or farm jobs or were employed in the informal sector. Most women in the villages therefore are not economically independent in their old age. Worst off are widows, not to mention the elderly widows of Vindravan who live in penury as cast offs. Less than 20 percent of women are economically independent whereas majority of men are economically independent in their old age. Women are doubly disadvantaged than men when they are old.

Read |< style="color: #960f0f">

‘Make in India’ by hand

The elderly in India are losing their status and dignity also, because as India globalises, the traditional values of respecting the elderly for their experience and gathered knowledge is diminishing fast and the youth are not reverential towards the elderly any more. According to philosopher Martha Nussbaum of the University of Chicago, the stigma regarding ageing is due to fear of death and ‘aging people are indeed closer to death on average than younger people and at least some of the stigmatised characteristics are indeed signs of this nearness (age spots and wrinkles)”. Even in the west, the elderly are facing a lot of problems but less in the European Union where the social security system looks after them.

In every Union Budget, there is some mention of senior citizens. But this is mere tokenism because most of the tax sops are for the middle and upper middle class tax paying senior citizens. Out of the three per cent of the population that pays income tax, only a small percentage of the elderly have taxable incomes. Recently, Prime Minister Modi announced in his New Year’s speech that interest rate of 8 per cent will be granted on savings of senior citizens on deposits of up to Rs. 7.5 lakhs with monthly income of interest earning. But the lock- in period of 10 years makes this inconvenient. Similarly, according to the previous budget, a senior citizen can receive interest incomes under 197 A of the Income Tax Act of Rs 3 lakhs and Rs 5 lakhs if he or she is above 80 years of age. Deductions under section 80D of Rs 30,000 is allowed on health insurance premium paid by senior citizens. Also under section 80 DDB, deduction towards medical treatment for senior citizens from specified diseases has been raised from Rs. 60,000 to Rs. 80,000. There is also service tax exemption on premium paid by senior citizens on Varishtra Bima Yojna. While these efforts should be lauded, these schemes are not enough to take care of the vast ageing population below the poverty line (51 million). They need housing and healthcare most urgently.

Read | < style="color: #960f0f">Making India’s first federated tax effective

According to Help Age India report, the ongoing National Programme for Health for Elderly is being implemented in 13 out of 600 districts in India. There is no government welfare scheme for the elderly poor except for the Indira Gandhi National Old Age Pension Scheme. There has to be better health care and a universal pension scheme for all senior citizens to give them more dignity and status in the last years of their lives. India spends 0.032 percent of the GDP on pensions.

There is a dearth of old age homes for the middle class and the poorer sections. While the private sector is building fancy old age homes which only the rich can afford, the average middle class or poorer person has few options if he or she chooses to live alone independently. Around 20 million elderly live alone regardless. The IPOP (Independent Programme for Older Persons) is supposed to provide housing by way of old age homes built by the State governments. But instead of expanding, the number of such homes has decreased -- from 269 in 2912-14 to 137 in 2014-15. More home care providers for the elderly are needed and better tax exemptions for the elderly should come in the forthcoming Budget.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

India is increasingly going grey and by 2050, around 20 per cent of the population will be old. There were 100.3 million senior citizens (60 and above) in 2011 which is 8.6 per cent of the population. In 2050, there will be 324 million elderly. Around 9 to 10 percent of all women are over 60 years and 8.2 percent of men are over 60.

But in today’s India, the main problem is how to utilise the demographic dividend and give jobs to the youth who are joining the labour force at the rate of 1 million a month. It is very important that the youth are employed. It is the young who mainly support the elderly in Indian society. The elderly dependency ratio is at 14.2 per cent – the ratio of the number of people aged 60 years and above to the number of people aged between 15 and 59. India’s problem is not as serious as Japan’s ageing population (dependency ratio is 42 per cent) but it ought to be addressed in a focused manner.

Read | < style="color: #960f0f">

India is increasingly going grey and by 2050, around 20 per cent of the population will be old. There were 100.3 million senior citizens (60 and above) in 2011 which is 8.6 per cent of the population. In 2050, there will be 324 million elderly. Around 9 to 10 percent of all women are over 60 years and 8.2 percent of men are over 60.

But in today’s India, the main problem is how to utilise the demographic dividend and give jobs to the youth who are joining the labour force at the rate of 1 million a month. It is very important that the youth are employed. It is the young who mainly support the elderly in Indian society. The elderly dependency ratio is at 14.2 per cent – the ratio of the number of people aged 60 years and above to the number of people aged between 15 and 59. India’s problem is not as serious as Japan’s ageing population (dependency ratio is 42 per cent) but it ought to be addressed in a focused manner.

Read | < style="color: #960f0f"> PREV

PREV