The relations between Myanmar and China have been a roller coaster ever since Myanmar became one of the first non-communist countries to recognize the People's Republic of China in 1949. But things began to change in the late 1980s when Myanmar faced increased western-led economic sanctions after a coup in 1988 and shortly after it, Myanmar introduced a number of economic reforms. It was under these conditions that the China–Myanmar relations started gaining momentum.

In terms of bilateral trade, China is the largest trading partner of Myanmar. China occupies the largest share in both imports and exports of Myanmar. According to data from 2019, the bilateral trade stands at about USD 12 billion out of the approximately USD 36 billion trade it conducts in total that roughly amounts to 1/3rd of the total. In 2019, China occupied a 31.7 % share in its exports and a 34.7 % share in its imports far ahead of any other country including India which doesn't even break into the top 5 in either category despite sharing a lengthy land border. Since 2001, Myanmar imports its largest share of goods from China. Imports from China mainly consist of machinery, metal products, vehicles, and telecommunication equipment.

In Myanmar’s exports to China, there are some goods which are important to China. For instance, refined tin that China imports from Myanmar is used for circuit-board soldering. 30-35 % of the overall tin concentrate required to produce refined tin comes from Myanmar despite China having the largest tin resources in the world. Similar is the case of rare earth metals, which is a group of 17 minerals used in manufacturing consumer electronics and military equipment. Myanmar accounts for around 12.5% of the global production and more than half of China's domestic supplies. The majority of the exports to China though consists of oil and gas which make up around 32% of the exports to China.

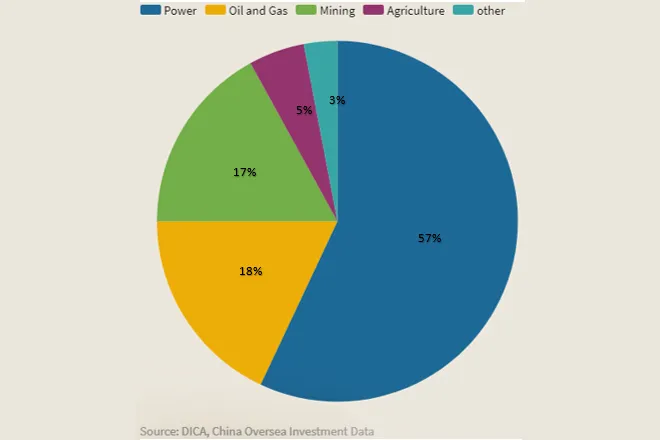

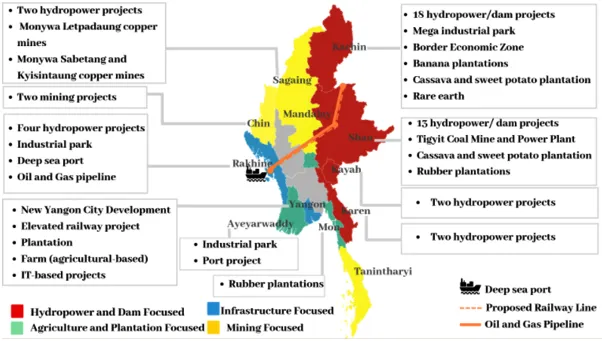

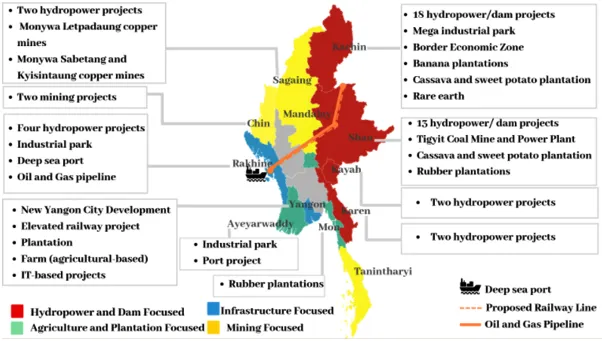

Myanmar is rich in oil and natural gas reserves. This combined with its geographical position has given it a vital role in China's plans. China constructed a natural gas and oil pipeline running in parallel which starts from Kyaukphyu City in Myanmar's Rakhine State to China's Yunan region constructed at a combined cost of USD 4.5 billion. China also constructed a 22 million tons annual capacity oil terminal at Kyaukphyu. The natural gas pipeline can account for 16.3% of China's total gas imports according to data from 2018. If utilized fully it has the potential to increase the dependency rate to 9.8%. The oil pipeline can account for 4.3% of China's total oil imports when operating at full capacity according to data from 2017. The main difference between this project and projects by other countries is that the Chinese company China National Petroleum Corporation owns a majority share of 50.9%. Interestingly enough it is in this project in which ONGC, GAIL are minority partners and in which the Government of India very recently approved additional investment. Also, China almost has a complete domination in the very important sector of electricity in Myanmar in both the renewable and non-renewable energy sectors with a variety of hydropower and coal projects which they are building and operating. China will be investing USD 2.57 billion in an LNG project at Mee Laung Gyaing one of the largest electricity projects in the country and is also expected to take be the main shareholder.

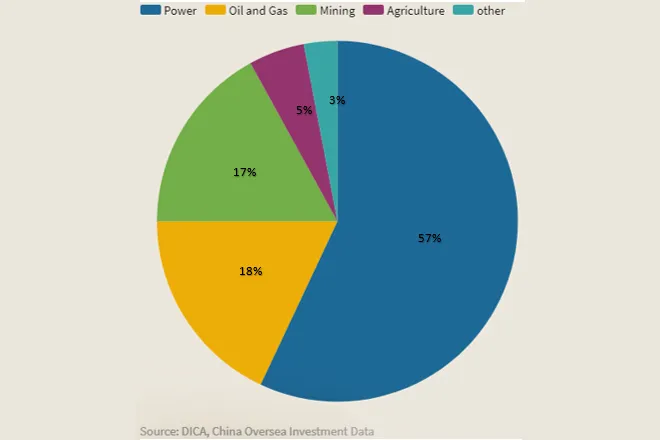

Fig: Chinese investment in Myanmar by Sector

China has been one of the largest sources of FDI (Foreign Direct Investment) for Myanmar which reached USD 21 billion as of March 2020. In recent years China began diversifying its investments into several sectors besides energy, oil, and gas. In 2020, China and Myanmar signed many projects under the Belt and Road Initiative. One of the major projects was the development of a deep sea port at Kyaukphyu for USD 1.3 billion. The area is also being developed as a Special Economic Zone. The Chinese consortium CITIC Group Corporation has a 70% majority share in the project. Besides this project, other projects like the development of 3 economic zones on the Myanmar-China border and the development of the new quarter for the city of Yangon were also announced.

Fig: Chinese investments, projects in Myanmar

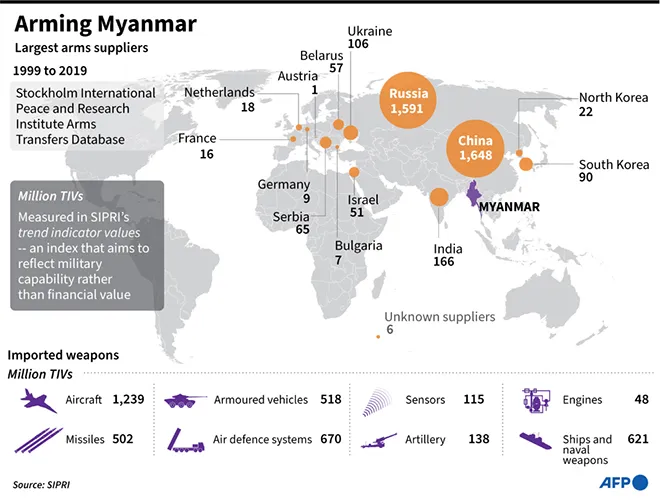

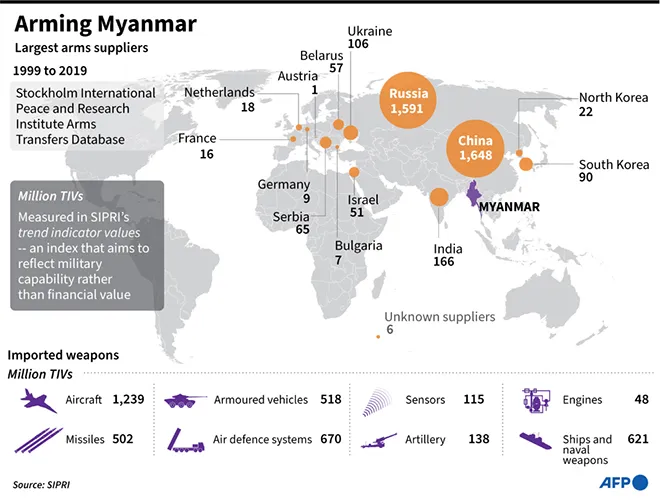

China has been one of the largest military suppliers of Myanmar since 1988. According to SIPRI database Myanmar spent USD 1.3 billion in arms from the Chinese between 2010- 2019. China also accounted for around 50% of major arms imports in 2014- 2019. It consisted of a variety of things including radars, warships, combat and trainer aircraft, armed drones, armored vehicles, and missiles among others. China also supplied 90% of military transport to Myanmar.

Fig: Myanmar’s Largest arms suppliers (Source SIPRI, AFP)

Myanmar’s position on the eastern coast of the Bay of Bengal and its land border with China which places it in a unique position as no other country to help cheap transportation of oil over land to China from its ports. Around 80% of the total oil imported by China flows through the Malacca Strait. This has stoked Chinese fears of its possible blockade by the US and its allies. It will also help with countering its strategic limitations posed by the first island chain to China’s eastern coast. The oil and gas pipeline from Kyaukphyu to China is a part of the larger solution to this problem which will give Beijing larger room to maneuver in the strategic sphere. The pipeline capacity may be further increased in the future to take in supply from the middle east given some reports that it might not be financially viable to transport oil through the CPEC (China Pakistan Economic Corridor) arm in Pakistan. The Gwadar port, part of the CPEC along with Kyaukphyu port gives China the benefit of strategically containing India and blocking its access both to the west and the east. The Chinese proposals to build roads from the Yunnan province to Myanmar and railway from Kunming to Kyaukphyu might worry India about the possibility of China bringing troops right to its borders.

Among the plethora of projects, the deep seaport at Kyaukphyu is the most strategically vital to China. It gives China access to the Indian Ocean and is uncomfortably near the Andaman Islands. The Chinese already have a lease of 50 years for the port which can be extended by another 25 years. There is increasing fear that Myanmar may not be able to repay China for all the projects. China has a majority share in most projects and could go the Hambantota way. China’s investment already forms 28% of Myanmar's GDP. Myanmar pays an interest rate of 4.5% to China, which is the highest it pays to any lending country. There is also fear that the port might be used for military purposes, with already an increase in the number of PLAN (People's Liberation Army Navy) ships, research vessels, and submarines being spotted in the Andaman Sea.

In the information age, data is the new oil. Besides the obvious infrastructure projects and investments, the Chinese companies have invested in retail and mobile payments and are facing no major competition. Alibaba has acquired the biggest e-commerce website in Myanmar and Huawei is working closely with KBZPay, one of the most used mobile payment platforms used in Myanmar. Huawei is also helping 'safe cities' in Myanmar by providing security systems that include facial recognition. Lack of legal compliance regulations raises issues of data privacy. This data can be used for propaganda and other purposes, thus playing a pivotal role in swaying public opinion.

Nevertheless, it will not be a cakewalk for China. There is a lack of trust on the Myanmar side due to China's historical role in supporting rebel groups in Myanmar by funding them or providing them with arms. These groups have also been accused of disrupting some Indian projects in Myanmar. Myanmar has long been aware of its excessive dependence on China and has been trying to reduce it since 2011 by canceling or stopping some Chinese projects like Myitsone Dam and the cancellation of the railway line to Kyaukphyu in 2015. Myanmar also negotiated with the Chinese to reduce the cost of Kyaukphyu project by almost 80% and to increase Myanmar’s share in the project from 15% to 30%. . Chinese projects are not popular among the people of Myanmar. There has been criticism over lack of transparency in its process and over unsustainable development models. It is often accused of blatantly flouting environmental norms, land seizures, and exploiting the resources of Myanmar. It was mass protests against the Myitsone Dam that finally led to its cancellation which was initially given a go-ahead despite an impact report by a joint team of researchers that concluded that it should not be built. There have been even reports of the Chinese government trying to pressurize the Myanmar media to reduce skepticism of China. It is also facing intense heat from the protestors currently and is accused of colluding with the Myanmar junta. Despite all this, it is not expected to affect Chinese investments adversely except maybe some renegotiations of agreements.

Sanctions effected in the 1990s on the junta government and the Rohingya crisis in 2018 have pushed Myanmar closer to China, despite its repeated attempts to move away from China. It remains to be seen how the current situation plays out in Myanmar.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV