The landmark Comprehensive Economic Partnership Agreement (CEPA) was recently signed between India and the United Arab Emirates (UAE). It is a landmark agreement because it’s the UAE’s first comprehensive strategic partnership with any country, and it is India’s first Free Trade Agreement (FTA) in a decade. The partnership has come out with numerous objectives and initiatives, and one of the primary objectives is increasing the bilateral non-oil trade to US$ 100 billion in the next five years. Currently, the trade between the two countries is US$ 60 billion. The UAE is India’s third largest trade partner after the USA and China and the second largest export destination.

The agreement will give India greater access to the Middle East and North Africa (MENA) region. It will also serve as a template for a similar agreement with other Gulf Corporation Council (GCC) countries—Saudi Arabia, Qatar, Kuwait, Oman, and Bahrain. Both the nations are striding ahead for a new age partnership.

The countries have declared establishing a joint hydrogen task force with special focus on green hydrogen. Both the countries have determined to cooperate in the implementation of the Paris Agreement, by scaling up technologies under different agencies such as International Renewable Energy Agency and International Solar Alliance. Moreover, they have agreed to collaborate in education sector to further encourage and support innovations. For the first time ever, India will set up an overseas Indian Institute of Technology (IIT) in the UAE.

Both the countries have determined to cooperate in the implementation of the Paris Agreement, by scaling up technologies under different agencies such as International Renewable Energy Agency and International Solar Alliance.

Furthermore, in the area of health, India’s drug manufacturing industry will get an entrepôt in the UAE. The agreement provides automatic registration and marketing authorisation which will reduce the time barrier to 90 days for drugs that are approved by a developed country. In addition to that, the countries have come together to focus on food security issues. The UAE has vast stretches of arable and uncultivable land which makes the country dependent on food imports. The partnership envisages to mitigate the UAE’s food security concern through the ‘Food Security Corridor Initiative’ under which the countries will build infrastructure and dedicated logistic services, connecting farms to ports to final destinations in the UAE.

Moreover, the pact will reduce tariff to zero duty for 90 percent of products exported by India to the UAE which will be beneficial for labour-intensive sectors like textile, apparel, leather, jewellery, engineering goods, pharmaceutical, medicines, and agriculture, generating 10 lakh jobs in India. India’s jewellery sector is also projected to benefit by CEPA. The Indian jewellery market currently pays 5 percent duty to UAE, under the agreement, India will get duty free market access to the UAE, increasing the jewellery export to US$ 10 billion by 2023.

The partnership envisages to mitigate the UAE’s food security concern through the ‘Food Security Corridor Initiative’ under which the countries will build infrastructure and dedicated logistic services, connecting farms to ports to final destinations in the UAE.

There is good news for India’s plastic industry as well. Currently, the UAE imports plastic worth only US $ 400 million from India vis-á-vis its requirement of US $9 billion. According to Sribash Dasmohapatra, the Executive Director of the Plastics Export Promotion Council (PLEXCONCIL), India’s plastic industry is expected to get a boost through this agreement.

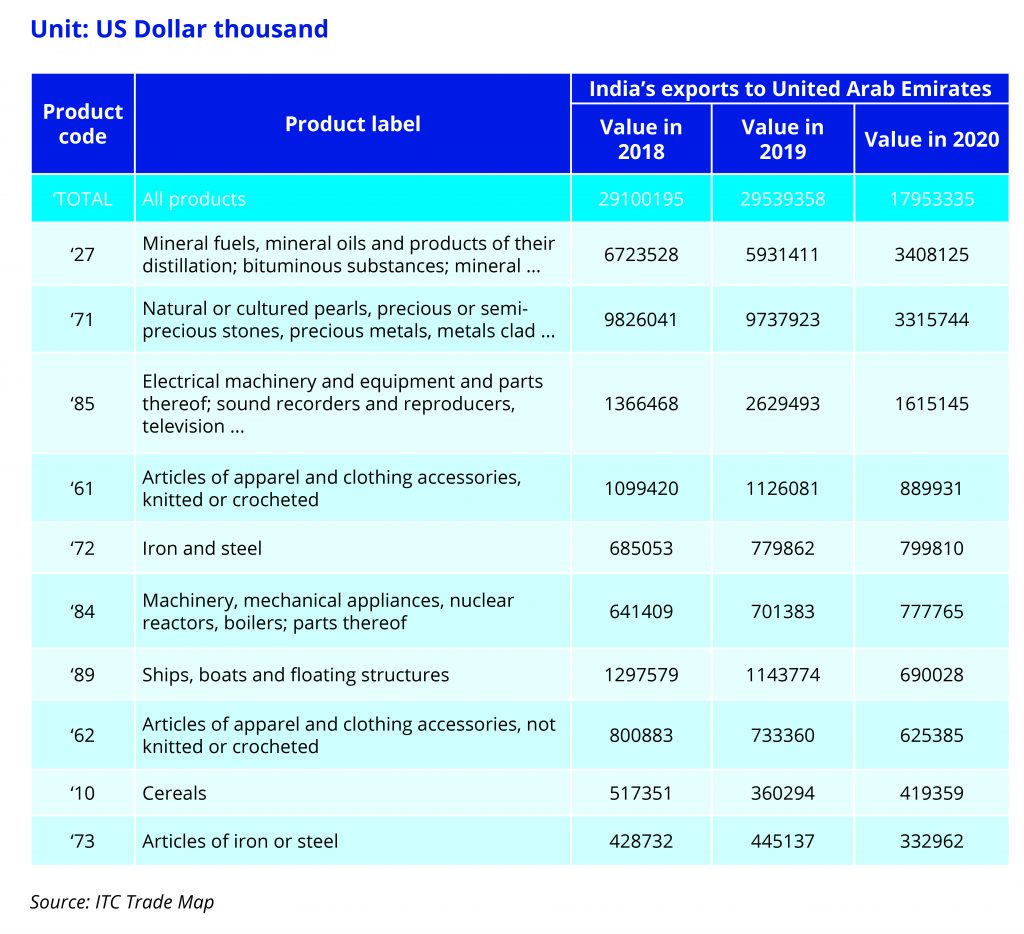

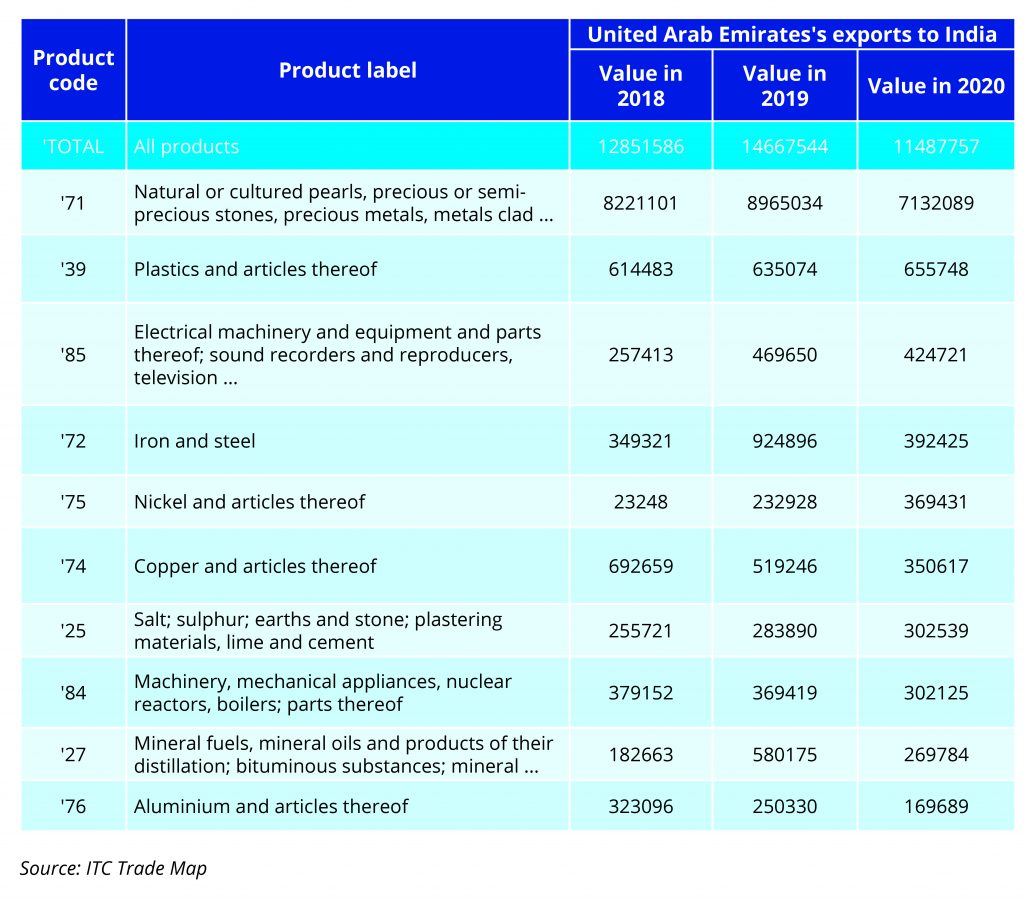

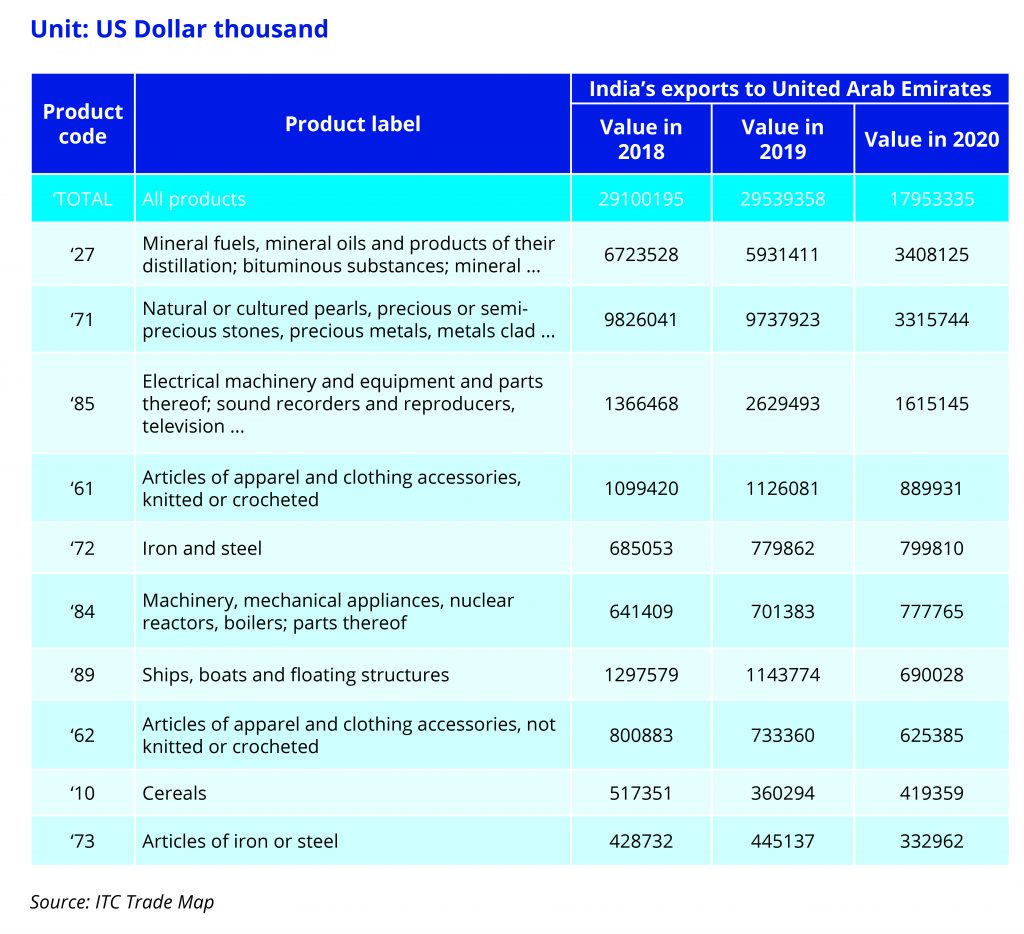

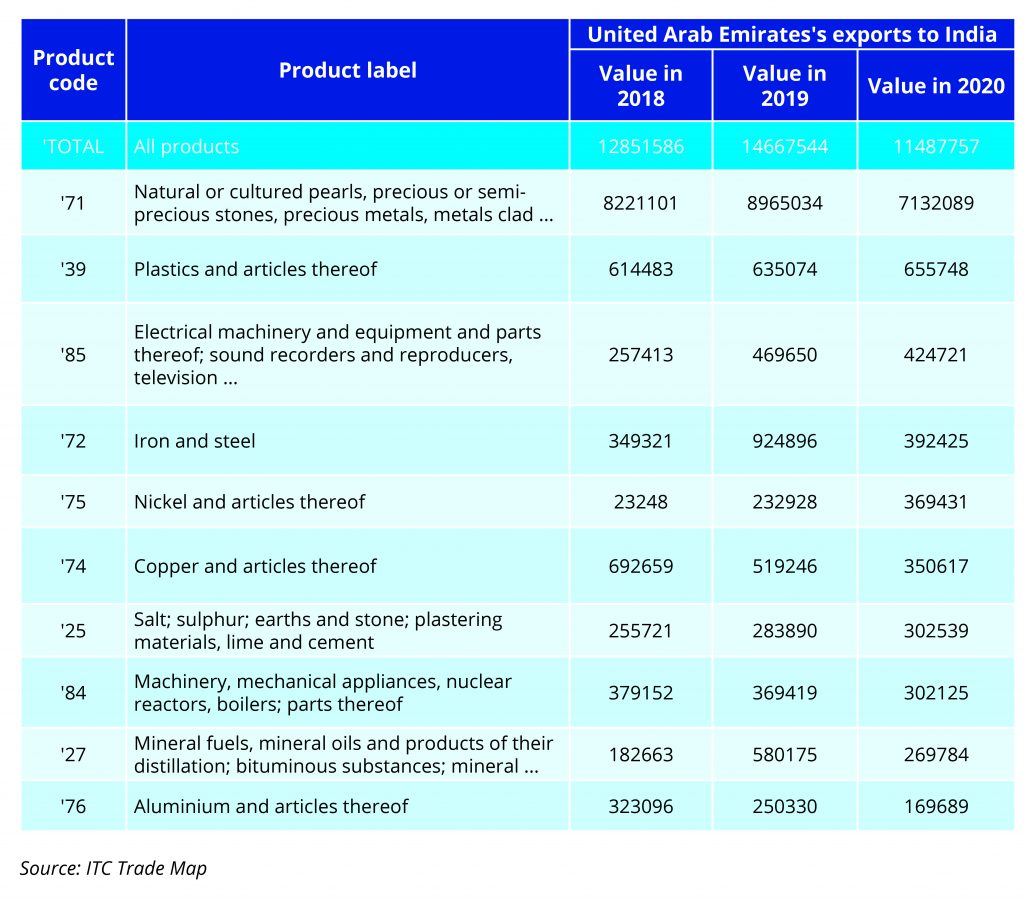

However, to maximise the gains from the comprehensive partnership between India and the UAE, the countries need to enhance Global Value Chain (GVC) participation. Looking at the top 10 traded products between both the countries, it is elicited that the top product lines haven’t changed from 2018–2020 and trade is happening in common product lines such as mechanical appliances, electrical equipment, iron and steel, precious and semi-precious metals, and mineral fuels. This denotes limited diversification of products, and that value chain integration is limited to only the top traded products.

A study by the Indian Council for Research on International Economic Relations (ICRIER) in 2020 on India’s GVC integration talks about India’s limited participation in GVCs. India’s GVC participation index is around 40 percent, and its backward and forward participation is also low, at 22 and 19 percent respectively. India fares poorly in international efficiency indices such as the Logistics Performance Index (LPI), which hampers its competitiveness in the global market. India ranks 44th in 160 countries with respect to LPI, which is below many of its competitors such as China, Taiwan, Vietnam, Thailand, etc. A similar study conducted by Asia Development Bank (ADB) shows that India’s top GVC export destinations are the USA, Singapore, China, Indonesia, Japan, Germany, France, Turkey, Italy, and South Korea. The UAE, despite being one of the biggest export destinations for India, does not appear on the list. Establishing India Mart and encouraging investments by the UAE and Indian companies for specialised industrial and advanced technology zones in Abu Dhabi, integrating local value chains of the existing and future specialised economic zones in areas of logistics and services, pharmaceuticals, medical devices, agriculture, agri-tech, and steel and aluminium are welcome steps in the direction of integrating value chains between both the countries.

The pact is expected to enhance backward and forward participation, but India requires a more holistic approach to increase its GVC participation. According to aforementioned study by ICRIER, India needs policies to boost Foreign Direct Investments (FDI) not just for domestic market, but also to build greater GVC linkages. The study stresses on formulating policies that nurtures lead firms of the country. Other important areas of reform suggested in the study are reduction of the administrative burden associated with custom clearances, traceability of products, and mutual recognition of standards along the value chains. Therefore, to take complete advantage of the comprehensive partnerships, India needs to move from spasmodic approach to a more wholesome approach for better value chain integration.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV