For the first time in its history, India achieved annual exports of more than US$ 400 billion in 2021–22. The recently signed Free Trade Agreements (FTAs) with Australia and the United Arab Emirates and ongoing negotiations with the United Kingdom, the European Union, and Canada are certain to provide more incentives to Indian exporters. New Delhi’s reversal of policy to sign more trade agreements—after a hiatus of several years when such agreements were shunned for bringing too little benefit to India—is a welcome sign. These FTAs are being signed or negotiated with a list of usual suspects, countries that hold geopolitical and geoeconomic significance to India.

However, one region remains conspicuously out of sight in the corridors of power in New Delhi—Latin America. Although India enjoys Preferential Trade Agreements (PTAs) with Chile and Mercosur—a South American grouping consisting of Argentina, Brazil, Paraguay, and Uruguay—these are limited in scope and cover a small percentage of bilateral trade, with slightly lower import duties rather than duty-free access. Unlike FTAs or Comprehensive Economic Partnership Agreements (CEPAs), PTAs do not include investments, people-to-people exchanges, or services. So far, New Delhi has yet to negotiate an FTA with Latin America and has not shown any interest in doing so either. Unfortunately, the region’s exclusion in New Delhi’s geoeconomic calculations is by design: Latin America has always been the least visited region by Indian politicians, and the region receives far less attention in Delhi’s South Block (which houses the Prime Minister’s Office and the Ministry of External Affairs) in comparison to Asia (or any sub-region, including Central Asia), Africa, and Europe.

Although India enjoys Preferential Trade Agreements (PTAs) with Chile and Mercosur—a South American grouping consisting of Argentina, Brazil, Paraguay, and Uruguay—these are limited in scope and cover a small percentage of bilateral trade, with slightly lower import duties rather than duty-free access.

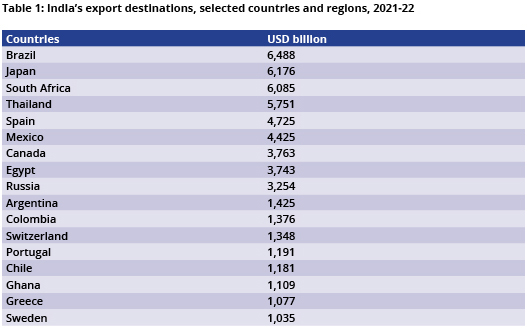

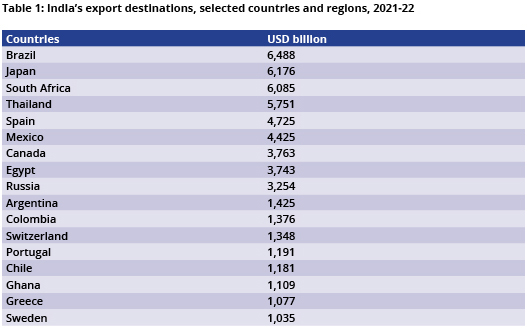

Yet, this has not deterred Indian companies, who have taken the lead to deepen India’s economic linkages with Latin America. Further, as Ambassador R. Viswanathan, India’s leading expert on Latin America, notes in a Financial Express article, “India’s exports to some of the distant Latin American countries are more than the exports to neighbouring countries or traditional trade partners with the same or more population”. Indeed, India’s exports to Brazil at US $6.48 billion are more than the exports to Japan (US $6.1 billion) or Thailand (US $5.7 billion)—both of which are FTA partners for India; exports to Mexico at US $4.4 billion are more than exports to Canada (US $3.7 billion) or Russia (US $3.2 billion). Latin America remains one of the main export destinations for India’s cars, motorcycles, pharmaceutical products, organic and inorganic chemicals, and textiles.

Table 1: India’s export destinations, selected countries and regions, 2021-22

Source:Ministry of Commerce & Industry, Government of India.

Source:Ministry of Commerce & Industry, Government of India.

Additionally, India imports vital resources from Latin America, including between 15 percent to 20 percent of India’s single-largest import item (crude petroleum oil), indispensable quantities of minerals like copper, silver and gold, and vegetable oils.

India’s private sector has thrived in Latin America, through trade as well as investments. Indian investments in the region are estimated between US $12 billion to US $16 billion, and most of it is in value-added sectors such as pharmaceuticals, automobiles, information technology (IT), energy and power transmission, and manufacturing. Indian companies are driven by two major factors to do business with Latin America:

- Latin America lies in the ‘Goldilocks zone’ for international business—it is a sweet spot between the highly regulated markets of the United States (US) and Europe, where competition is fierce and quality standards remain high, and the less-regulated markets of Africa, which have less purchasing power. The region’s pre-COVIC GDP per capita (PPP) of US $16,611 may be far less than the EU’s US $46,067, but it is more than double that of India’s (US $6,997) and four times that of Sub-Saharan Africa’s (US $4,041); if anything, the Latin American market can be compared with Southeast Asia, which has a similar GDP per capita (PPP) at US$15,082.

- Latin America remains an important part of emerging markets globally, with a steady and rising middle class. As a result, the region is the preferred export destination for India’s value-added, consumer products and inputs such as cars, motorcycles, pharmaceuticals, and chemical products. Many Indian companies in these sectors hold considerable market share in Latin America, and depend on the region for a healthy share of their global revenue. For instance, United Phosphorus Limited (UPL), an Indian agrochemical company, gets more revenue from Brazil than it does from India, while Bajaj is the market leader in Colombia and most of Central America.

India versus China in Latin America

India’s reach in Latin America is so deep in certain sectors, such as automobiles, pharmaceuticals, and IT, that it often out-competes even China in the region—which is startling since China is the largest trader and investor in numerous Latin American countries. Data and findings published by the author in a Woodrow Wilson Centre report titled “Latin America’s Tryst with the Other Asian Giant, India” show that Indian companies invest, export, and even employ more than China does in select sectors in Latin America.

Indian investments in the region are estimated between US $12 billion to US $16 billion, and most of it is in value-added sectors such as pharmaceuticals, automobiles, information technology (IT), energy and power transmission, and manufacturing.

This is particularly true in the pharmaceuticals space—throughout the 21st century, India has exported more pharmaceuticals products to Latin America than China, with the sole exception of 2021, when Chinese exports of COVID vaccines to the region outnumbered India’s. The region is also a major recipient of Indian pharmaceutical investment: 27 Indian companies operate 72 subsidiaries across Latin America, with 13 manufacturing plants. Many Latin American countries rely on India for cancer and HIV drugs, and much-needed vaccines.

In the automobile sector, India supplies more cars to the region while China exports more motorcycles and auto parts. However, Indian companies in the automobiles and auto parts sectors invest more and provide more employment than their Chinese counterparts in the region—a single Indian company, the Motherson Group, with 27 auto parts manufacturing plants in Latin America, employs 25,000 people in the region, more than all the Chinese automobile and auto parts companies combined.

Finally, Indian IT companies, which were amongst the first from India to enter the Latin American region, today employ more than 38,000 people in the region. Although they initially sought to benefit from the ‘nearshoring’ model—to service clients in the US and Canada—today they rely on Latin American clients. Indian IT companies even made inroads in smaller countries like Guatemala, where India’s HCL Technologies employs 2,230 people. These companies add significant value to the service sector and are a means to diversify away from Latin America’s dependence on commodity exports.

Yet, in other areas, India’s presence in Latin America is dwarfed by China’s. India’s annual trade of US$30 billion to US$50 billion with Latin America is a mere shadow of China’s US$400 billion. Chinese investments in the region, estimated to be roughly US$159 billion, and their loans of US$136 billion, can only be compared with the US and Europe.

India enjoys heaps of goodwill in the region, and unlike China, is a democracy that faces challenges similar to Latin American countries—of poverty alleviation, infrastructure development, frequent political battles, and a constant cycle of elections.

Still, the India–Latin America relationship holds significant promise. India enjoys heaps of goodwill in the region, and unlike China, is a democracy that faces challenges similar to Latin American countries—of poverty alleviation, infrastructure development, frequent political battles, and a constant cycle of elections.

One major difference separates New Delhi’s and Beijing’s approach to Latin America: China has for two decades formulated and updated its Latin America policy through official white papers and special envoys, while India has no official policy for Latin America, a region resigned to the last of India’s three concentric circles of foreign policy.<1> Given India’s renewed interest in FTAs and its outward-looking economic policies, this is an opportune time for New Delhi to frame a Latin America policy that could be a win-win for India’s automobile, pharmaceutical, IT, energy, and agricultural companies, while equally benefitting Latin America’s commodity exporters and the region’s value-added manufacturing and service sectors.

The views expressed are the author’s and do not reflect the opinions of the Colombian government.

<1> India’s foreign policy is often framed as operating in three concentric circles. The first circle refers to the neighbourhood (thus India’s ‘Neighbourhood first’ policy), the second includes the extended neighbourhood, particularly Asia, as well as strategic partners like the US and Russia, and the third and final circle includes the rest of the world, including Latin America.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV