The Reserve Bank of India-led Monetary Policy Committee (MPC) brewed a storm in a teacup by

continuing its accommodative monetary policy stance—retaining the Repo rate (the cost of borrowing from the RBI) at 4 percent and the Reverse Repo (the cost of depositing funds with the RBI) at 3.35 percent.

The MPC is a device, initiated in 2016, to broaden and professionalise decision-making, beyond the prodigious talent available within the RBI which, incidentally, is the first statutory, autonomous, regulatory institution in India, in existence since 1935. The MPC meets at least quarterly to review the functioning of monetary policy and determine changes. The RBI members are evenly balanced by three outside experts—government nominees. In the event of a tie, the Chair (Governor of the RBI) has the casting vote. More importantly, an institutional mechanism has developed which transparently shares the thinking behind decisions and records dissenting views—a robust and useful gold standard for good governance.

An institutional mechanism has developed which transparently shares the thinking behind decisions and records dissenting views—a robust and useful gold standard for good governance.

RBI’s lonely stand

Motivations vary behind the widespread incredulity amongst financial analysts at the affrontery of the RBI in continuing an accommodative stance when the pack leader—the Federal Reserve of the United States—has announced a hardened stance in 2022. Unless Indian interest rates keep pace, goes the argument, the minimum interest rate margin, necessary to alleviate the higher risk perception of investors, would be eroded, leading to a flight of capital from India.

2013 remains firmly etched in the Indian memory when a similar reversal of the accommodative stance by the Federal Reserve resulted in a precipitous fall of the INR. The RBI presently aims to keep its own interest rate policy accommodative “for as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy”.

That is a worthy but burdensome objective. Mitigating the COVID-19 impact is the easy part. Not all of the mitigation is in domestic hands. Broken global supply chains, higher commodity prices, and the eye-watering cost of international transportation, can only come to heel as the world heals. This is an external shock in which we are mere price-takers. Similar higher costs due to disruption within India are already trending down as the vaccination rate increases, herd immunity levels are reached, and the mutations become less deadly, if more infectious.

Broken global supply chains, higher commodity prices, and the eye-watering cost of international transportation, can only come to heel as the world heals.

Walking the tight rope of conflicting objectives

“Reviving growth on a durable basis” could usefully be looked at in two separate buckets. First, the GDP needs to get back to where we were before the pandemic hit. The growth rate had trended down to 3.7 percent in 2019-20, the last “normal” year. Growth expectations per the first advance estimate (National Statistical Office January 2022) are for a GDP (constant terms) of INR 129.74 trillion in FY 2022 which would be INR 1.18 trillion higher than in FY 2020. This is the growth cushion available, should growth be lower than the expected 9.2 percent. So, the “recovery” phase ends on 31 March this year, conditional to there being no further, unforeseen pandemic-like disruptions.

In the second bucket lies the growth revival to which the RBI has committed itself. It is here that disagreements commence. How does one define a revival of growth? If we were to lapse back into the FY 2018- 2020 trend of 5 percent growth, would the RBI’s objectives have been achieved? Where then does the role of accommodative monetary policy end and the role of targeted fiscal policy commence?

The dissenting view of the lone MPC member, against continuing accommodative monetary policy, is based on the downsides from excess liquidity sloshing about for an extended period, escalating asset prices, and adding to fiscal complacency. There is also the possibility of slipping seamlessly from one shock to another, particularly when uncertainty abounds around confrontational geopolitics and the future path of the pandemic.

The dissenting view of the lone MPC member, against continuing accommodative monetary policy, is based on the downsides from excess liquidity sloshing about for an extended period, escalating asset prices, and adding to fiscal complacency.

Our record in rolling back liquidity post a fiscal crisis is not perfect. The fiscal deficit, post the 2009 Global Financial Crisis (6.6 percent of GDP in FY 2010) never did come down below 3.5 percent (FY 2017) to the elusive 2 percent, despite supportive low oil prices. The marginally lower deficit of 3.4 percent of GDP in FY 2018 lacks credibility being massaged data, pushing expenditure on food subsidy off-balance sheet as incremental Food Corporation of India debt to be repaid in subsequent years. The logic is sound that it is not the extent of liquidity infusion but the risk of not being able to reign in deficits over an extended period, that risks the loss of fiscal discipline becoming an embedded, toxic habit.

The fear of high inflation because of an extended, uncertain period of high fiscal deficits cannot be ignored. But the interplay between monetary policy and supporting fiscal policy should not be overlooked either. The RBI is sanguine that inflation will trend downwards from 5.6 percent in December 2021 to an average of 5.3 percent by end FY 2022 on the back of good harvests and 4.5 percent in the next fiscal FY 2023. The dissenting member is right that at 4.5 percent inflation would still be 0.5 percent above the target of 4 percent. In addition, unknown shocks could disrupt this assessment, pushing it to above the prescribed outer bound of 6 percent with negative consequences.

Fiscal policy to the rescue in taming inflation

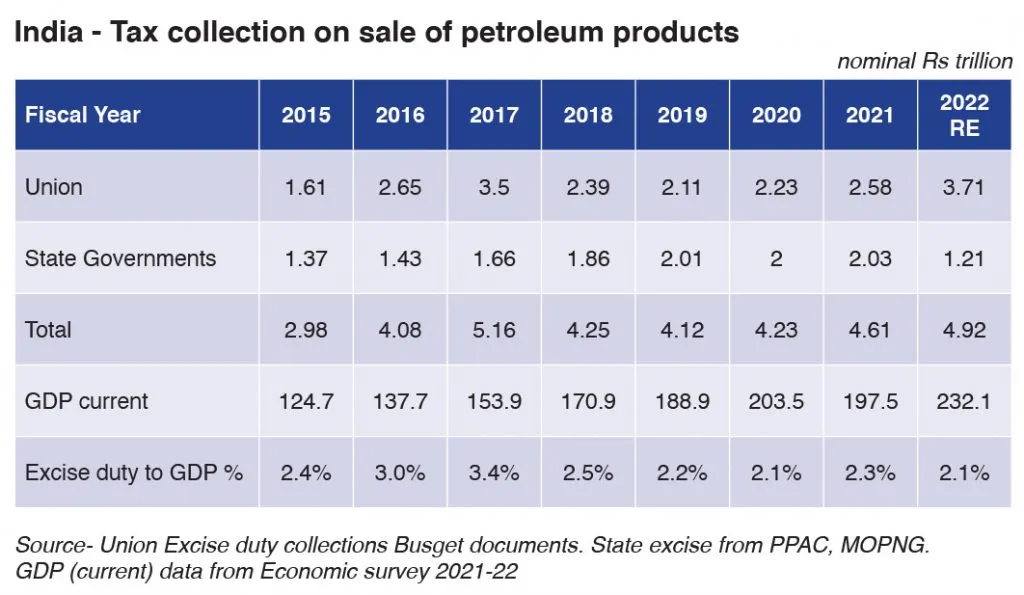

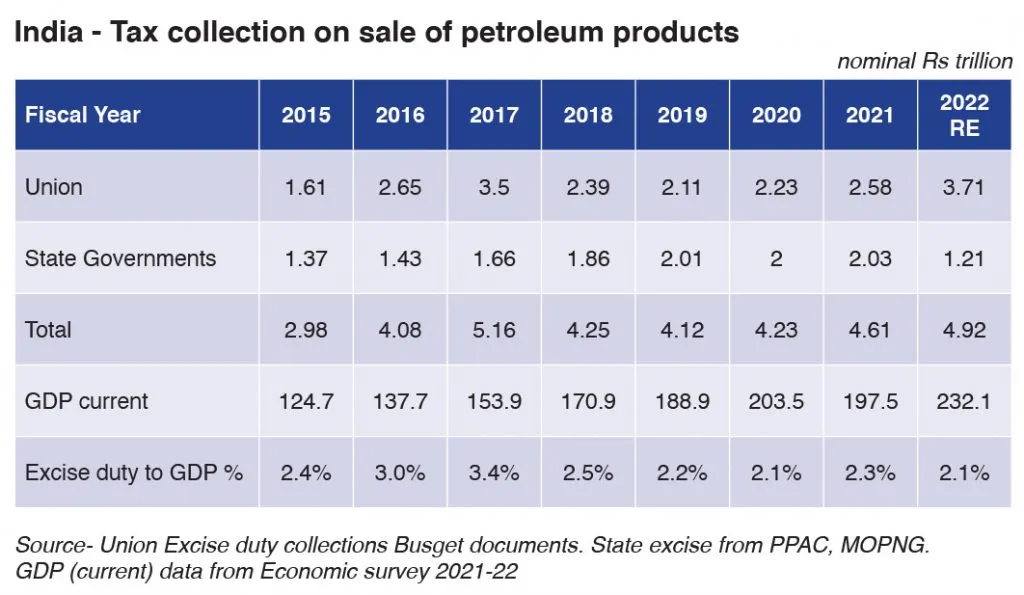

Adding countercyclical fiscal policy to the quiver of arrows for taming inflation, could bridge the gap between the sanguine approach of the RBI and the furrowed brows of the dissenting MPC member. The table below traces the amount of tax collected by the Union government and the state governments on the sale of petroleum products over the period FY 2015 to FY 2022.

As a percentage of GDP, excise duty, and cess collected by the Union and state governments on the sale of petroleum products remained within a range of INR 2.5 to 2.1 percent of GDP, barring FY 2016 and 2017 when 3 and 3.4 percent of GDP was collected. During the pandemic years (FY 2021 and 2022), tax flows from petroleum products became a mainstay of cash-strapped governments, which resorted to “tax gouging” a source of indirect tax, relatively “invisible” to all, but the more affluent end-consumers who own motorised transport.

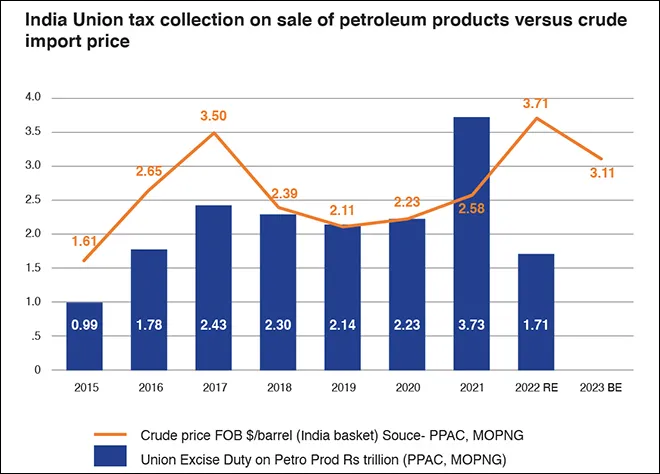

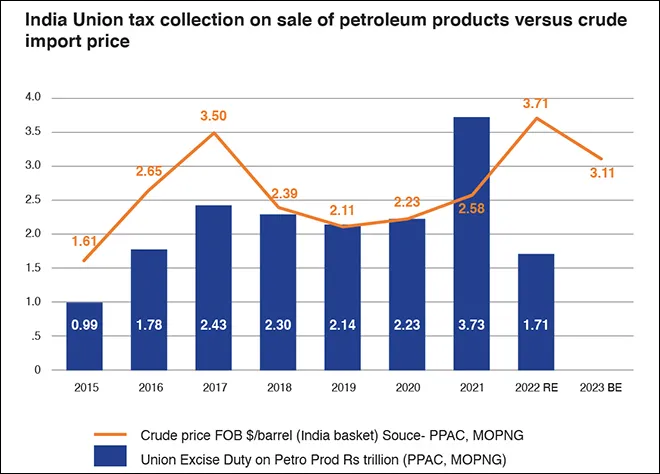

The graph below illustrates how tax on the sale of petroleum products levied by the Union government moved in a countercyclical pattern to the price of imported crude (which accounts for more than 80 percent of domestic consumption) till 2019.

The newly-elected BJP government in 2014 got a reprieve from FY 2016 to FY 2018, when crude prices moderated from the highs of the earlier years. This opportunity was used to increase taxes on the sale of petroleum products. The tax collected over the four years FY 2015 to 2018 was equal to 1.7 percent of the aggregate GDP. This was partly used to reduce the fiscal deficit by 1 percent of GDP from 4.5 percent in FY 2015 to 3.5 percent by FY 2018— a virtuous allocation.

During the pandemic years (FY 2021 and 2022), tax flows from petroleum products became a mainstay of cash-strapped governments, which resorted to “tax gouging” a source of indirect tax, relatively “invisible” to all, but the more affluent end-consumers who own motorised transport.

But the trend for high receipts from this tax on petroleum products continued, including during the pandemic years, increasing from INR2.39 trillion in FY 2018 to INR3.71 trillion in FY 2022(RE)—an increase of 55 percent versus nominal GDP growth between these two years of 35 percent. An opportunistic increase in tax to keep consumer prices stable, in an era of falling oil prices, is savvy fiscal management. But if continued when the price of imported fuel is also increasing (FY 2022, 2023) it risks inflation.

The fiscal cushions

The upside is that a fiscal cushion is available to moderate inflation by reducing the tax on petroleum products given surging Goods and Services Tax receipts and import duties in FY 2022 (RE). “Fuel and Light” has a weight of 6.84 in the inflation index. Union excise duty has a share of 28 percent in the retail price of petrol at INR 100 per litre in Delhi (3 February 2022). A downward reduction in tax amounting to INR 10 per litre of petrol could reduce inflation by 0.6 percent if the direct prices of other inputs remain stable. The deflationary indirect benefits in diesel—a transport fuel—would be additional.

A downward reduction in tax amounting to INR 10 per litre of petrol could reduce inflation by 0.6 percent if the direct prices of other inputs remain stable.

The FY 2023 Budget seems aligned with this proposition. Union tax revenues on petroleum products are estimated at INR 3.11 trillion—16 percent lower than the current year. A matching sacrifice by state governments could provide a second cushion against inflation. Such co-ordination between the fiscal and monetary authorities is not explicit but can be read between the lines of possible strategies, should the need arise.

The Governor of RBI, possibly, sleeps well at night because of this fiscal cushion. There are downsides to the RBI being cozy with the government—especially when the sector it regulates, is dominated by publicly-owned behemoths. But the upside of an inside track in government is also an asset.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

The Reserve Bank of India-led Monetary Policy Committee (MPC) brewed a storm in a teacup by

The Reserve Bank of India-led Monetary Policy Committee (MPC) brewed a storm in a teacup by

PREV

PREV