Space is expensive, space is unrelenting and space is extremely challenging to have a system perform efficiently. A sector where engineering and management of missions are extremely complex due to the unrelenting environment and a 'fly right or forget' evolution of missions. Today, this conventional wisdom is being challenged with the walls for investments and the approach to engineering and management of space missions being redefined to embrace risk and mobilise disruptive and derivative technologies in a USD 300 billion industry.

Space 1.0

Space as a high-technology sector kicked off with government-backed investments with official institutions in the military and civilian realm developing core competence over decades of engineering. Space as an industrial complex is one that has grown with this competence being transferred to or encouraged to develop novel technologies in the industry, which enables the private sector to then diversify its offerings as well as expand its market reach. This process of initial capacity building in the industry can be deemed as Space 1.0, where the objective is to enable the trickling down of technology, processes, patents, which have been developed by taxpayer-funded research and development to an entrepreneurial foundation which can commercialise and spin-off.

Space 1.0 is a process of handholding the industry to reach a tipping point where there is a credible, reliable technology delivery capability established, while the government may further support this capacity building by buybacks of products and services for its own missions. Space 1.0 is a phenomenon that has been going on in India over the past four decades where the technology competence developed by the Indian Space Research Organisation (ISRO) is being transferred to Small and Medium-Scale Enterprises (SMEs), with encouragement from ISRO to buy back this competence converting the SME as a vendor in its missions.

Space 1.0 is a phenomenon that has been going on in India over the past four decades where the technology competence developed by the ISRO is being transferred to SMEs.

Today, the Indian space programme stands with a strong vendor base of 500 suppliers for its space transportation, spacecraft development and ground operations functions. With the increased demand for space-based services in the country, ISRO is now envisioning greater involvement of the Indian industry in the production of satellites and launch vehicles. To this end, the formation of a consortium of industries with ISRO for the development of the Polar Satellite Launch Vehicle (PSLV) has been initiated, while ISRO has also invited Indian industry to express interest in systems Assembly, Integration and Testing (AIT) of standard ISRO satellites.

Space 1.5

The encouragement that the industry is finding as a move further in the steps of capacity building can be deemed as Space 1.5. This exercise in technology/knowledge transfer provides the industry with the complete know-how in end-to-end development of space and launch systems. Although the entire technology will be that of ISRO, such a move will provide a foundation to build core competence in the industry which, at the same time, can be potentially used to diversify the offering from a user base perspective or a technology perspective. From a user base perspective for such systems, the immediate requirements from a medium-term perspective (five to seven years) may well arrive from defence users who have tremendously increased their utilisation of space-based capabilities for security purposes. Moreover, this will provide the Indian industry with the ability to design and develop advanced new-generation systems, which in the longer term (10 to 15 years) may well match or feature themselves as state-of-the-art systems in the world.

The emergence of Space 1.5 models in space transportation as well as satellite manufacturing in the upstream hardware realisation plans of ISRO is essentially a response to the increased demand for space-based services in the country both on the government as well as the private industry side. Recently, 170 projects ning over 60 central ministries/departments have been identified in the areas of natural resources management, energy & infrastructure, disaster & early warning, communication & navigation, e-governance & geospatial governance, societal services, and support to flagship programmes for potential utilisation of space technology-based tools. This largely ties with the conviction of the government to use space-based technology to create more transparent, efficient and scalable approaches to delivering services in government-to-customer (G2C), government-to-business (G2B), and government-to-government (G2G) interactions.

The emergence of Space 1.5 models in space transportation as well as satellite manufacturing in the upstream hardware realisation plans of ISRO is essentially a response to the increased demand for space-based services.

India has also experienced a stark rise in commercial services such as Direct-To-Home (DTH) with an annual percentage growth of 25.73 percent during the period from December 2010 to December 2015, which indicates a strong demand from the commercial space services segment to which ISRO is acting as a provider. Therefore, the rising demand from both the government as well as the private sector is gathering tremendous momentum and has led to the comprehensive roadmap ahead with 71 satellites to be built by 2021 and a target to increase the launch frequency of rockets to 12-18 annually. Therefore, Space 1.5 is mainly a volume driven phenomenon and different industry-government engagement models may emerge in each vertical of both upstream and downstream services with the primary goal of achieving this volume within the timeframe.

It is important to note that this nature of Space 1.5 will drive the use of much of the existing infrastructure that is already created by the government for further capacity building in the industry. The nature of capacity building will be more of a handover of activities to the private sector under the supervision of the space agency to ensure quality and reliability, which on one end will add a dimension of transfer of know-how to the industry, while the industry need not make substantial capital investments in setting up similar infrastructure for production. Space 1.5 in India is likely to take a more consortium approach of a number of vendors/SMEs since there is clearly no large space sector players in the private sector of the country which can take on the risk of such a project.

This void, in some sense, may be also due to the fact that the country only gained independence in an era where aerospace technology in the international scene had already modernised against the backdrop of world wars.

Post-independence, the sanctions against the country hindered growth and maturity of the foundation technology and know-how while the space sector enjoyed much more international collaboration and therefore leapfrogging in the development of the foundation technology. From an industry evolution perspective, the likes of Boeing and Lockheed Martin in the US could take on the functions of Space 1.5 in a more rigorous manner with larger functions due to the sheer size of their organisations with a sound heritage and financials which was built up over decades of expertise in the aerospace sector even before satellites or rockets were around.

From an industry evolution perspective, the likes of Boeing and Lockheed Martin in the US could take on the functions of Space 1.5 in a more rigorous manner.

Therefore, on the space transportation front, India might see an evolution of a Public-Private Partnership (PPP) model as a part of Space 1.5 that is quite unique in the international market and does not align with the likes of other models such as Ariane Space. The important difference in this PPP model against the ones already in the market is that the PPP model India is evolving is one that may be completely dedicated to achieving volumes for meeting local and international demand for reliable launch vehicles such as Polar Satellite Launch Vehicle (PSLV) and, eventually, Geostationary Satellite Launch Vehicle (GSLV). The function of development of new launch vehicles and making them operational will still lie entirely in the government realm. This is one key difference in the PPP model that is likely to evolve in India against that of Ariane Space or United Launch Alliance, where the PPP models have also expanded to develop new launch systems in addition to achieving volumes and serving national and international markets under the PPP umbrella.

Similarly, on the spacecraft development front, ISRO is fostering a capacity building programme with the industry by engaging a vendor to be involved in the realisation of two satellites which shall provide the industry with an end-to-end spacecraft AIT know-how while operating under the supervision of ISRO Satellite Centre. This again can be ticked off as a Space 1.5 step for the industry to gain experience in AIT functions which have been the function of the space agency for the past five decades. This will enable ISRO to use the private sector to meet the burgeoning demand which dictates about 10 to 12 satellites be flown every year for at least the next five years instead of substantially increasing its manpower base and infrastructure. Therefore, this step of capacity building on the spacecraft side is an important step of transferring the technology, project and quality management know-how to the industry for an end-to-end spacecraft. It is likely that this step will lead to the industry developing the spacecraft bus based on the type of mission while ISRO shall focus on the development of new technologies for the spacecraft/mission payload itself and integrate with the bus delivered by the industry. This is a model that is quite different from developed spacefaring nations such as the US, Canada, and EU, where end-to-end contracts are given to a single vendor, which again has been possible via a more historically evolved government-industry from the headstart in the 1900s.

Capacity building on the spacecraft side is an important step of transferring the technology, project and quality management know-how to the industry for an end-to-end spacecraft.

Much of the liberalisation of the space activities in major spacefaring countries has been based on providing encouragement to the private industry for capturing the rising demand for services on the downstream. The entry of the private sector has driven the year-on-year growth of the space sector based on services where today almost two-thirds of the USD 300 billion that runs in the space industry is captured by services. Therefore, active promotion of involvement of the industry in downstream activities is a crucial step in increasing the overall size of the space economy. For example, tele-education via satellites for the first time via the Satellite Instructional Television Experiment (SITE) by ISRO is one of the biggest successes in vetting a use case for satellite-based communications services. With the technology maturing (on both the consumer electronics segment as well as the satellite segment) from the time of SITE, the applications of satellite-based television have not only served in societal development but have also largely evolved as a commercial television services platform for service providers to broadcast news, advertisement, and entertainment. This demand, driven by the active engagement of the private sector in the downstream, has therefore provided the impetus for increased demand in terms of transponders.

While DTH is just one example, India has a large potential to evolve such services via the private sector which can already be witnessed in the year-on-year growth of services such as DTH in other downstream activities, given the fact that India operates one of the largest fleets of Earth Observation satellites capable of both in optical and radar as well as has its own regional navigation system. Therefore, the premise of Space 2.0 in India is to harmonise the relationship between the public and private sectors to evolve a space economy that not only drives societal development effectively but will go beyond to establish commercial service offerings that are scalable, creating more revenues for the country.

Space 2.0

The only way to break the conventional wisdom which says space is expensive, space is inaccessible, and space is only for large companies, is by closing the walls between engineering and business, which forms the foundation of Space 2.0. It is important to note that this approach to developing such a narrative is not exclusive to the conventional space agency developed technologies or missions. Indeed, to a large extent it is based on technology foundation developed by taxpayer-funded research. While conventional space agency approach is more inward-looking towards achieving targets based on national priorities, Space 2.0 is more outward looking with an intention to be globally disruptive in terms of offering a space product or service.

The global NewSpace phenomenon is one that is fledging on this trend where space entrepreneurs are funded by private capital to achieve a product or a service that has the potential to disrupt the barrier to access to space (in upstream) or offer a service at a price that potentially opens doors to addition of a large base of new consumers (on the downstream).

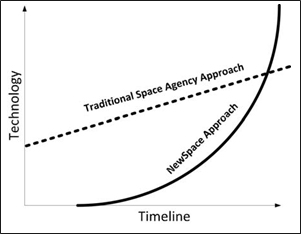

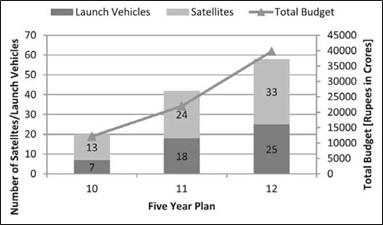

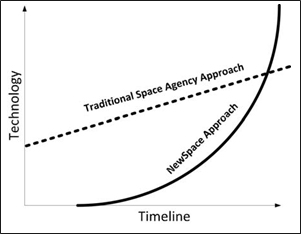

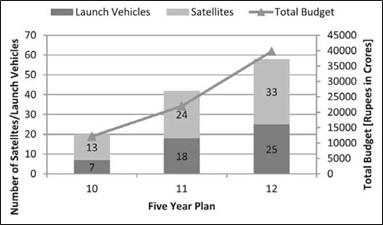

To understand this phenomenon a bit more, Figure 1 provides an illustration of what NewSpace companies are attempting to do. Traditional space agencies have a budget that is driven by a political will which, in turn, depends on geopolitical scenarios, where any steep rise in budgetary allocation has to be driven by a national will which has mostly occurred due to international competition. Therefore, typically space agencies may, at best, have had linear growth post the Cold War era. This also applies to India (Figure 2) where the budget increase has also witnessed a similar trend for investments in the space sector. Where NewSpace is trying to find value is in engineering their offering that enables a disruptive business model that will go in one step to what can be achieved in a typical space agency approach only with many folds of investment/timeline against that done by these private actors.

Figure 1: Expected growth of NewSpace vs. Traditional Space Agency

Figure 1: Expected growth of NewSpace vs. Traditional Space Agency

Figure 2: India’s space budget over past three Five-Year Plans

Figure 2: India’s space budget over past three Five-Year Plans

A prominent example in the current trends for such an effort is that of SpaceX which is now trying to achieve a Reusable Launch Vehicle (RLV) which the company expects to lower the cost of access to space by at least 30 percent while still being able to launch over a dozen launches a year. The approach taken by SpaceX is based on a business model that intends to disrupt the cost of access to space while achieving it by developing a disruptive technology that will create a barrier for its competition to match in the short or medium term of five to seven years. It is important to note that SpaceX's efforts are not completely independent or isolated from that of NASA. NASA provided much of the technology for engines for the company under a technology transfer programme to understand the foundation of building rockets. NASA also rescued SpaceX from going bankrupt by awarding its first launch contract.Where SpaceX has also possibly benefited in making its design for an RLV is in learning from the mistakes of the shuttle programme.

The key question is how this approach — where the financial risk is initially borne by private investments — which benefited from an active public-private partnership in learning about the foundation technologies to create a product that would otherwise take many folds more of investments in both time and money to achieve in a traditional space exploration approach? The answer lies in the approach to risk management in decision-making as well as the management matrix itself which are inherently different for a public institution that is held accountable for spending tax money against that of a private actor. The approach is therefore taken to management and realisation of such large-scale projects seems to change dramatically by NewSpace players where the priority in getting a product or service going is to get the most value for money, while a conventional space agency approach would be to prioritise decision making on reducing risk.

The very reason that private capital backs NewSpace is that these investors are ready to play with a risk vs reward quotient against a given opportunity in a much vigorous fashion that may be impossible to substantiate for a taxpayer-funded agency. In funding NewSpace entrepreneurs, private capital is risking returns while a conventional space agency will have no room for such risks. This is one reason why a government backed space agency would rather support a private actor who is willing to risk. One should also underscore the realities of a possible bubble in NewSpace in a sector that has already witnessed such a bubble being burst.

In funding NewSpace entrepreneurs, private capital is risking returns while a conventional space agency will have no room for such risks.

The understanding of these dynamics of institutional voids and organisational pressures by space programme managers, bureaucrats, policymakers, can help shape the creation of a Space 2.0 ecosystem in India. These typically are unchartered waters in India since the industry or the startup ecosystem in the space sector has still not entered into delivering any large-scale end-to-end space-based service or product. In the formation of a Space 2.0 ecosystem in India, it is imperative to understand the key differences in these realms and any policies shall have to augur with the viewpoint of what is best for the nation.

Space 2.0 India

Space 2.0 in India is a vision to develop an ecosystem that will encourage and enable SMEs as well as NewSpace entrepreneurs to take the next leap forward in the country to develop end-to-end products and services that are globally scalable. It is that stage where enterprises and startups in the country shall be able to leapfrog based on the five decades of experience and expertise gathered in space with offerings that complement the efforts of ISRO. It is empowering small businesses to scale their offering of products and services to integrate into the global space supply chain and compete internationally in the USD 300 billion industry.

Space 2.0 in India is a vision to develop an ecosystem that will encourage and enable SMEs as well as NewSpace entrepreneurs to take the next leap forward in the country to develop end-to-end products and services that are globally scalable.

There are several important developments that need to move ahead as India builds up to this sort of ecosystem. On the already established SME landscape in space, India needs to witness the Space 1.5 step of some of the SMEs or the large business houses in the country making stronger commitments to investment in the space sector in gaining sophisticated end-to-end system level knowledge. This will also need encouragement from ISRO to guide these first movers towards sustainable growth. There is a strong possibility of this occurrence since there is an inherent national demand that is driving the need for production of over a dozen rockets or satellites a year.

From a startup perspective, there is a need for mechanisms to evolve to engage with startup entrepreneurs who would want to build products and services with a vision to scale it to solve some of the major problems of the society such as global connectivity, clean energy, decision intelligence, among others. In order to build a sustainable private capital investment scenario, transparent and timeline oriented policies must be brought forth for both upstream and downstream products and services in at least the well established areas of communications and broadcasting, remote sensing, navigation and timing.

Space 2.0 is not just integrating products and services into the global space supply chain but also enabling opportunities for global collaborations that may not just be academic or technological, but will go further in solving the problems of financing and regulatory frameworks, working with networks investors and space lawyers around the world. Space 2.0 will also see the spill-over of technology products and services from government being a primary end-customer to a more market force driven B2B/B2C dynamic, which shall provide space entrepreneurs to scale offerings in the local markets as demand increases while potentially planning to expand their footprints to other markets.

An example of Space 2.0 effort is that of Astrome Technologies, a startup based in Bangalore trying to solve the problem of providing connectivity to the 70 percent of the country’s population who live in semi-urban and rural India via satellite based Internet. This has the potential to enable the country to leapfrog in achieving the vision of Digital India and can be extended to the regional grouping, SAARC, or other developing countries.

It is important to understand that the foundation and practice of establishing a fair and transparent space legislation and regulatory system can provide leeway to achieve a critical mass of linkages between upstream and downstream activities that can potentially expand the space economy of the country to many folds to what it is today. This can also serve in setting precedents for a future that may behold larger initiatives such as space mining, space tourism, and space solar power.

Developing an ecosystem that will support the rise of Space 2.0 in the country has the potential to make space the next big technological leap in the country after information technology and bio-technology. The words of Dr. A.P.J. Abdul Kalam, the former president of India, may yet prove omniscient: "The future generations will look at the Earth, the Moon and the Mars as a single economic and strategic entity." A Space 2.0 India revolution awaits.

This article originally appeared in the ORF publication Space India 2.0.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Space is expensive, space is unrelenting and space is extremely challenging to have a system perform efficiently. A sector where engineering and management of missions are extremely complex due to the unrelenting environment and a 'fly right or forget' evolution of missions. Today, this conventional wisdom is being challenged with the walls for investments and the approach to engineering and management of space missions being redefined to embrace risk and mobilise disruptive and derivative technologies in a USD 300 billion industry.

Space is expensive, space is unrelenting and space is extremely challenging to have a system perform efficiently. A sector where engineering and management of missions are extremely complex due to the unrelenting environment and a 'fly right or forget' evolution of missions. Today, this conventional wisdom is being challenged with the walls for investments and the approach to engineering and management of space missions being redefined to embrace risk and mobilise disruptive and derivative technologies in a USD 300 billion industry.

Figure 1: Expected growth of NewSpace vs. Traditional Space Agency

Figure 1: Expected growth of NewSpace vs. Traditional Space Agency Figure 2: India’s space budget over past three Five-Year Plans

Figure 2: India’s space budget over past three Five-Year Plans PREV

PREV