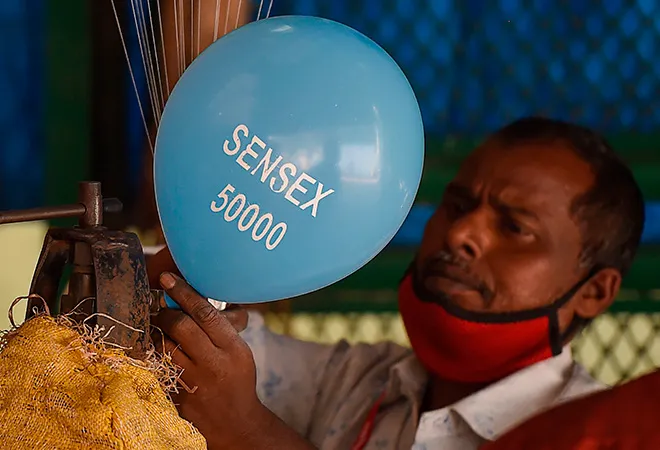

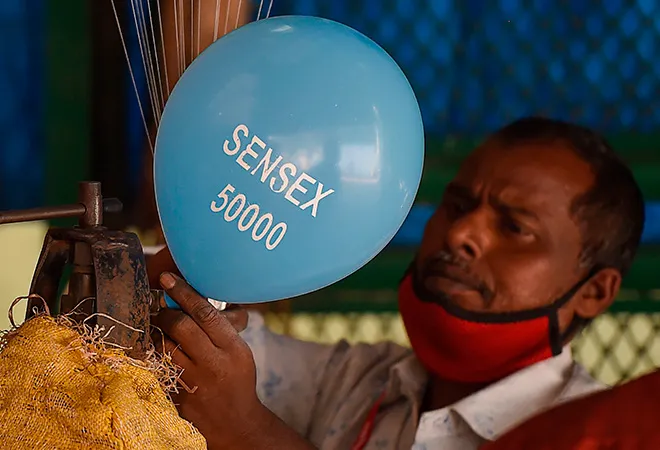

At 9:16 a.m. on 21 January, the Sensex breached the 50,000 mark for the first time. That’s a rise of 21.6 per cent or 8,887 points in the past 12 months. These were no ordinary 12 months — they contained within them a never-seen-before across-the-board uncertainty, leaving no sector untouched; they displayed the highest GDP contraction; they provided a global context in which nations were united by recession. From falling sales and wiped-out businesses to rising job losses and brutal salary cuts, everything that could go wrong did.

And yet, through these economically frightening times, the Sensex continues to sail on. True, there was a massive fall in its value over two months between 24 January 2020 and 24 March 2020, when it crashed by more than a third, or 35.9 per cent, articulating the early advent of a pandemic panic. But after that, despite all the gloom and doom, the Sensex has continued to rally on. Since 24 March, it has risen by 87.4 per cent; if it rises by another 6.7 per cent or 3,348 points, the value of the Sensex would have doubled in less than a year.

This rise belies all logic.

Or does it?

There are three ways to look at this number.

First, it shows how the assets underlying the Sensex change. Between 1985 and 2021, the composition of the Sensex has changed 35 times. That is, the companies that comprise this index have moved in and out, depending on a range of reasons from company performance to sectoral interests. There are only six companies that were part of the Sensex in 1985 present in the index today — Hindustan Unilever, ITC, L&T, Mahindra and Mahindra, Nestlé, and Reliance Industries. Stars of yesterday, such as ACC, Bombay Dyeing or Century Spinning, are out. Companies in sectors of tomorrow, such as TCS, Sun Pharmaceuticals, and HDFC Bank, are in.

This doesn’t mean the companies that have been ejected out are bad. It’s just that investors do not think they will be able to deliver the returns that other companies can. The valuation of companies is largely a function of the collective expectation of investors. High performance is the only constant. The 30 that comprise the Sensex or the 50 that are part of the NSE Nifty, therefore, are India’s best performing companies at scale. Again, a smaller company may individually deliver better returns, but it may not have the scale to absorb the might of domestic and global investors.

Second, it shows how investments work. When the Sensex fell by a third of its value, several investors sold thinking it would crash further. No doubt, such a fall can be unnerving. But the fall due to the Made in China virus is nothing compared to what happened in end-2007. Between December 2007 and March 2009 — a total of 27 months — the Sensex consistently lost 59.9 per cent of its value, from 20,287 to 8,198 during the Trans-Atlantic financial crisis. In the next 19 months, the Sensex rose by 2.5 times and returned to the 20,000s. But if you are unprepared for such volatility, you’re better off being out of the market — no return is worth losing sleep over.

The magic of the Sensex lies in looking at it as a long-term asset. Throughout its four-decade-long existence beginning 3 April 1979, there has not been a single five-year period during which the Sensex has not recovered its value. Expand the period and all you see is a performance that reaches new heights. If we just take the past 10 years, the lowest compounded annual growth rate of the Sensex has been 9.6 per cent (over the past six years), which beats a fixed deposit by a wide margin. Apart from the 21.6 per cent rise over the past 12 months (12 months is not a good time period within which to evaluate an equity rise), the biggest rises have occurred over two years, four years and five years (see table). Over the past nine years, Rs 1 lakh invested in the Sensex would have almost tripled to Rs 2,98,720.

| Sensex Returns |

| Time period |

Sensex rise * |

Value of Rs 100 |

| 1 year |

21.6% |

121.61 |

| 2 years |

16.9% |

136.70 |

| 3 years |

11.8% |

139.68 |

| 4 years |

16.6% |

184.96 |

| 5 years |

15.8% |

208.67 |

| 6 years |

9.6% |

173.08 |

| 7 years |

13.4% |

241.55 |

| 8 years |

12.1% |

248.74 |

| 9 years |

12.9% |

298.72 |

| 10 years |

10.2% |

263.06 |

| * CAGR |

And third, the Sensex is a reflection of the economic stature of India. The valuations may not match investor expectations. They may be higher or lower than what is perceived to be fair based on historical data. But at an aggregate, the market value of the 30 companies that comprise the Sensex has been rising, more or less in tune with India’s GDP. In 2011, India’s GDP was US$1.82 trillion and the market capitalisation of all listed companies on the BSE stood at US$1.5 trillion. On a GDP of US$2.7 trillion, the market capitalisation stands at US$2.7 trillion. India’s markets are broadly corelated with India’s GDP.

In the past 12 months, the market capitalisation of Indian companies has raced ahead of its underling GDP. Whether the GDP catches up or the values fall remains to be seen. If historic trends are analysed, the current price to earnings (PE) multiple of the Sensex, at 34.4 times, is more than 10 points higher than the average PE over the past decade — it was 17.1 in 2013, 18.7 in 2015, 20.6 in 2017 and 23.7 in 2019. For a PE multiple of 34.4 times to sustain, the earnings of the 30 companies will have to rise by a third. Given the contraction over the past 12 months and the vaccines-led revival on a lower base ahead, the chances of an earnings catch up cannot be ruled out but are not certain either.

At 50,000, the Sensex captures all the three sides of the triangle — the underlying companies reflecting the best India has to offer, the time investment horizon with which to examine equities, and the long-term rising India story. Add the liquidity in the global financial system looking for investment destinations as well as the democratisation of returns to households through systematic investment plans and combine them with the vaccine of hope, and the Sensex at 50,000 suddenly makes sense.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV