Quarterly estimates of India’s GDP (gross domestic product) for the second quarter (July-September) of 2020-21 are out. After a drastic slump of 23.9% in real GDP in the first quarter, a contraction of 7.5% in Q2 has brought respite to the economy. GDP at constant prices (2011-12) has been estimated at Rs. 33.14 lakh crore – compared to Rs. 35.84 lakh crore in Q2 of 2019-20.

After one of the strictest COVID-19-induced lockdowns in the world in Q1, a rebound in Q2 has been widely expected. However, a section of experts and the commentariat interpret this rebound as a “faster than anticipated” recovery of the economy. This interpretation is premised on the reasoning that existing government counter-recessionary measures are adequate to rescue the economy.

How realistic and plausible are these interpretations?

First, two quarters of this fiscal year have experienced a cumulative 32.4% contraction in the economy. If the cumulative sum of contraction in four quarters remains below 40%, then Indian economy will be able to keep the overall contraction below 10% in the fiscal year 2020-21. To achieve that, in at least one of two remaining quarters, the quarterly GDP growth must be positive. If both the quarters clock positive growth, then final contraction will be well below 10%.

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) projects that kind of a recovery. In the December outlook, it has revised real GDP growth upwards to (-)7.5% in 2020-21, buoyed by a projected (+)0.1% growth in Q3 and (+)0.7% growth in Q4. Moreover, it assumes (+)21.9% to (+)6.5% growth in the first half of next fiscal year. The notable point here is – the RBI feels that the economy is already out of contraction.

But, there are enough grounds to raise questions about these projections. The National Statistical Office, under the Ministry of Statistics and Programme Implementation (MoSPI), in the press release, mentioned that due to pandemic-related restrictive circumstances “some other data sources such as GST, interactions with professional bodies” were used as corroborative evidence to construct the estimates and these are “clearly limited” data sources. Therefore, the estimates are likely to be revised in the future. The revisions may be substantial this time.

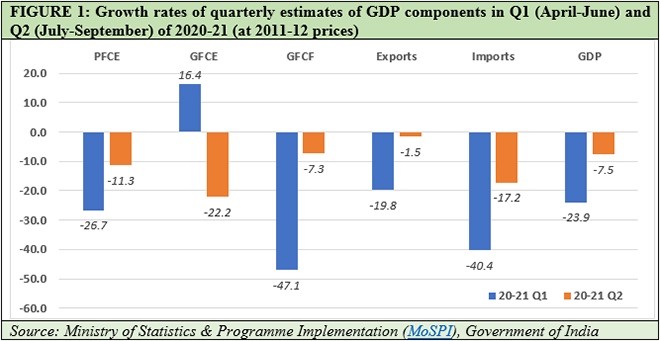

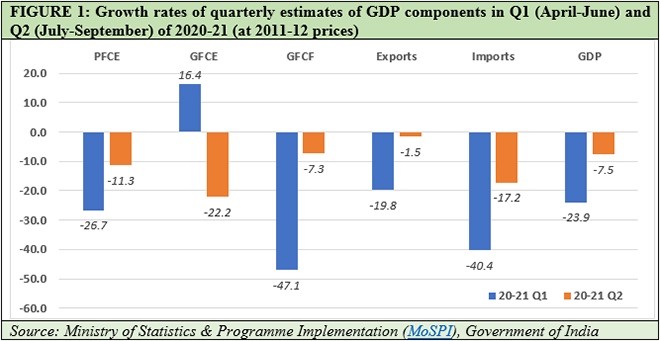

The lockdown created pent-up demand, a large part of which translated into a rebound in Q2. But the consumption, Private Final Consumption Expenditure or PFCE demand remains weak and negative, so does investment (Gross Fixed Capital Formation or GFCF). After restrictions were lifted, exports resumed and started normalising but there is negative growth still. A developing country like India needs a threshold warranted import growth to maintain sustainable output expansion (particularly in manufacturing), and a (-)17.2% growth is bad news. This is not a very good time to cut down government final consumption expenditure(GFCE), especially when the economy experiences a serious lack of demand. But Q2 sees a (-)22.2% growth in GFCE (Figure 1).

The lockdown created pent-up demand, a large part of which translated into a rebound in Q2. But the consumption, Private Final Consumption Expenditure or PFCE demand remains weak and negative, so does investment (Gross Fixed Capital Formation or GFCF). After restrictions were lifted, exports resumed and started normalising but there is negative growth still. A developing country like India needs a threshold warranted import growth to maintain sustainable output expansion (particularly in manufacturing), and a (-)17.2% growth is bad news. This is not a very good time to cut down government final consumption expenditure(GFCE), especially when the economy experiences a serious lack of demand. But Q2 sees a (-)22.2% growth in GFCE (Figure 1).

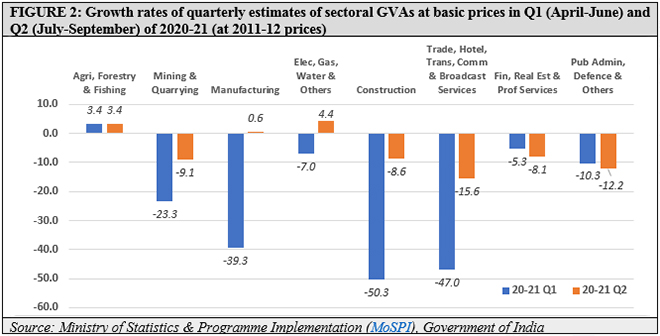

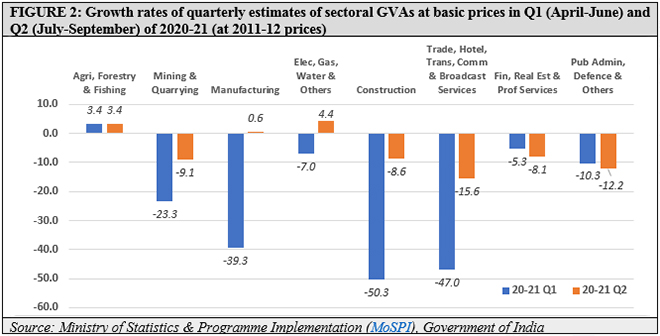

Sectoral results show agriculture, forestry and fishing segment maintaining positive growth. Electricity, gas, water supply and other utility services have also come back into positive. What is hailed as one of the important signs of recovery is the (+)0.6% growth in manufacturing (Figure 2). However, the Index of Industrial Production (IIP) for manufacturing growth is (-)6.8% for Q2. This implies that manufacturing GVA in Q2 is largely driven by cost rationalising factors, not so much by increase in actual production. In simple words, cost-cutting measures have been used to increase profit margins. This cannot be sustained in the long run as lack of demand will certainly decelerate the production, sooner or later.

Sectoral results show agriculture, forestry and fishing segment maintaining positive growth. Electricity, gas, water supply and other utility services have also come back into positive. What is hailed as one of the important signs of recovery is the (+)0.6% growth in manufacturing (Figure 2). However, the Index of Industrial Production (IIP) for manufacturing growth is (-)6.8% for Q2. This implies that manufacturing GVA in Q2 is largely driven by cost rationalising factors, not so much by increase in actual production. In simple words, cost-cutting measures have been used to increase profit margins. This cannot be sustained in the long run as lack of demand will certainly decelerate the production, sooner or later.

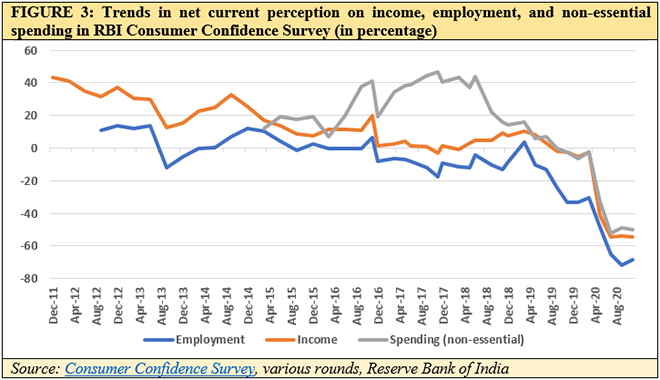

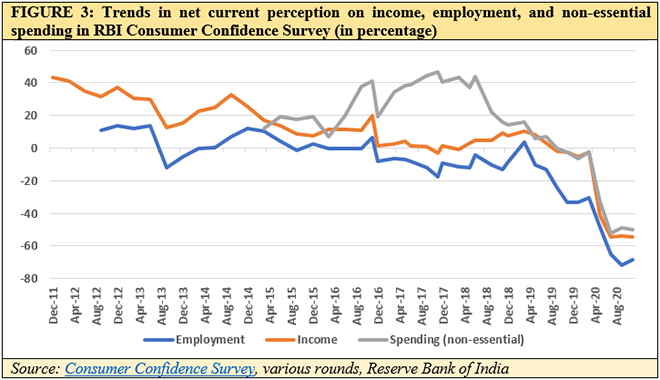

Meanwhile, the RBI has also released the November 2020 round of its Consumer Confidence Survey (CCS) – conducted in 13 major cities. It charts out consumer confidence and expectations on various macroeconomic indicators including income, employment, and spending. The results belie the overt recovery optimism stated by the MPC.

While the MPC asserts that the economy is already out of contraction, the CCS exhibits continuing fall in expectations of future income, employment and therefore in spending—particularly in non-essential spending (Figure 3). If these key drivers of demand in the economy are firmly in the red zone, then it is baffling to find the source of the MPC’s recovery optimism. If consumers’ expectations are overtly subdued, then that is bound to result in a lack of demand. That makes the MPC recovery narrative sufficiently suspect.

A re-opened economy may show some signs of rebound immediately, but the statistical jury is still out on the quality and nature of the rebound. The economy might be in a state akin to an out-of-water fish jumping on the floor.

A similar recovery narrative is being extended when the overall unemployment rate dropped to 6.51% in November from 6.98% in October, according to CMIE data. Though six large and relatively more industrialised states including Haryana, Rajasthan and Goa continue to report double-digit unemployment rates, the overall improvement in unemployment scenario acts as another evidence of that narrative.

However, the worrisome feature of last two months’ employment data is falling labour force participation rate (LFPR). The average LFPR in 2019-20 was 42.7% and was well above 42% before the lockdown. Now, it is falling continuously below 40%. The LFPR was 39.5% in the week ended 15 November and 39.3% in the week ended 22 November, as per CMIE data.

A consistently falling LFPR indicates that more and more able and eligible workers have stopped looking for employment opportunities due to adverse economic conditions. There is a recovery in employment of blue-collar workers in the last few months, particularly in e-commerce and logistics sectors. But white-collar formal employment scenario remains grim. If the number of people ordering online keeps on falling, the delivery labour force will start shrinking at some point. It is just a matter of time.

According to Care Ratings, employee cost dropped by 0.9% in Q2 of 2020-21 compared to a 6.9% growth in same quarter in the previous year – due to job and pay cuts. Apart from contributing very short-term benefits to company balance sheets and GDP estimates (as mentioned earlier), this adds nothing to sustainable long-term revival.

Intervention in the form of a large fiscal stimulus is the need of the hour. The sooner the government realises this, the better it will be for the economy.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

The lockdown created pent-up demand, a large part of which translated into a rebound in Q2. But the consumption, Private Final Consumption Expenditure or PFCE demand remains weak and negative, so does investment (Gross Fixed Capital Formation or GFCF). After restrictions were lifted, exports resumed and started normalising but there is negative growth still. A developing country like India needs a threshold warranted import growth to maintain sustainable output expansion (particularly in manufacturing), and a (-)17.2% growth is bad news. This is not a very good time to cut down government final consumption expenditure(GFCE), especially when the economy experiences a serious lack of demand. But Q2 sees a (-)22.2% growth in GFCE (Figure 1).

The lockdown created pent-up demand, a large part of which translated into a rebound in Q2. But the consumption, Private Final Consumption Expenditure or PFCE demand remains weak and negative, so does investment (Gross Fixed Capital Formation or GFCF). After restrictions were lifted, exports resumed and started normalising but there is negative growth still. A developing country like India needs a threshold warranted import growth to maintain sustainable output expansion (particularly in manufacturing), and a (-)17.2% growth is bad news. This is not a very good time to cut down government final consumption expenditure(GFCE), especially when the economy experiences a serious lack of demand. But Q2 sees a (-)22.2% growth in GFCE (Figure 1). Sectoral results show agriculture, forestry and fishing segment maintaining positive growth. Electricity, gas, water supply and other utility services have also come back into positive. What is hailed as one of the important signs of recovery is the (+)0.6% growth in manufacturing (Figure 2). However, the Index of Industrial Production (IIP) for manufacturing growth is (-)6.8% for Q2. This implies that manufacturing GVA in Q2 is largely driven by cost rationalising factors, not so much by increase in actual production. In simple words, cost-cutting measures have been used to increase profit margins. This cannot be sustained in the long run as lack of demand will certainly decelerate the production, sooner or later.

Sectoral results show agriculture, forestry and fishing segment maintaining positive growth. Electricity, gas, water supply and other utility services have also come back into positive. What is hailed as one of the important signs of recovery is the (+)0.6% growth in manufacturing (Figure 2). However, the Index of Industrial Production (IIP) for manufacturing growth is (-)6.8% for Q2. This implies that manufacturing GVA in Q2 is largely driven by cost rationalising factors, not so much by increase in actual production. In simple words, cost-cutting measures have been used to increase profit margins. This cannot be sustained in the long run as lack of demand will certainly decelerate the production, sooner or later.

PREV

PREV