The Open Credit Enablement Network (

OCEN) is an emerging digital public good (DPG) that has the potential to democratise and transform India’s digital lending landscape. Designed as a framework of Application Programming Interfaces (APIs), OCEN could be integrated with a wide range of digital platforms and apps. It aims to empower individuals and micro, small, and medium enterprises (MSMEs) by directly delivering financial products to them, thereby eliminating their dependence on traditional lenders. OCEN is being developed by iSPIRT, an Indian software industry think tank, and could be instrumental in building a credit marketplace, or more broadly, a digital ecosystem of lenders and loan service providers (LSPs).

India has already emerged as a

leader when it comes to creating digital public infrastructure and goods that provide development solutions at the population scale. For instance, Aadhaar has provided Indians with a foundational identity, the Unified Payments Interface (UPI) has accelerated financial inclusion, and the CoWIN platform has helped drive India’s COVID inoculation programme. In April 2022,

Aadhaar enrolment reached 1.33 billion, and the number of Aadhaar-based transactions crossed 73.5 billion. Today, around

400 million people in India are using the UPI; as of August, it had facilitated

6.5 billion transactions worth INR 10.72 trillion within the country; and it is now being used in

other countries as well.

OCEN is being developed by iSPIRT, an Indian software industry think tank, and could be instrumental in building a credit marketplace, or more broadly, a digital ecosystem of lenders and loan service providers (LSPs).

OCEN could eventually reach a similar scale of adoption and reach, revolutionising the credit value chain, and boosting the digital economy. Indeed, as a DPG-in-development, it is further strengthening its alignment with the

nine elements that have come to define DPGs, including platform independence and data privacy and security.

Why formalise the credit system and what role could technology play?

The lack of ‘expansionability’ of the traditional lenders has created a credit gap of around

US $380 billion in the Indian MSME sector. Even the credit card industry has not sufficiently been able to penetrate the massive Indian market. Despite the industry’s impressive growth in recent years, only 3 percent of the population has a formal credit card today, and this number is largely limited to the country’s tier 1 cities.

Acquiring a loan currently requires LSPs to shoulder a host of responsibilities. These include sourcing, identity verification, underwriting, disbursement, recollections and dispute management. Each of these is a process unto itself and their execution impacts the profits earned by an LSP. Taking these processes online would reduce the time and cost of loan disbursements and could reflect in more favourable interest rates charged by lenders.

How might OCEN help?

The new technology, OCEN, bundles these lending processes and executes them online. It automates screening processes to decide on loan-worthy customers and the onboarding of new borrowers. These processes are being streamlined further by integrating the verification process with Aadhaar’s existing eKYC system.

In September 2022, 25.25 crore eKYC transactions were done through the platform, raising the total number of transactions to 1,297.93 crore.

OCEN could eventually reach a similar scale of adoption and reach, revolutionising the credit value chain, and boosting the digital economy.

Digitalising credit systems is also expected to help democratise them by connecting loan providers with customers who are not part of any formalised credit system. OCEN can also be used by non-bank small-scale lenders, thus expanding the scope of lending and borrowing.

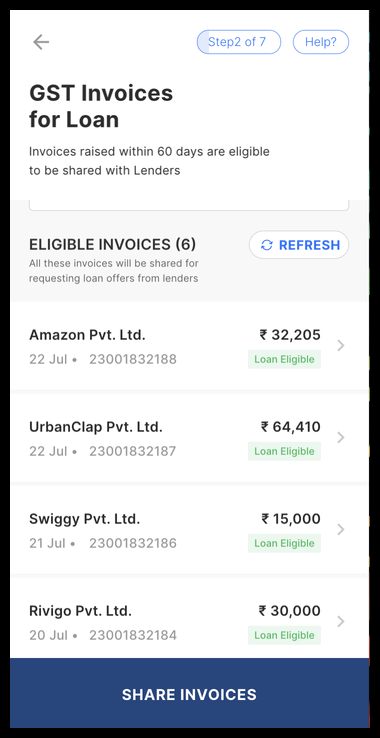

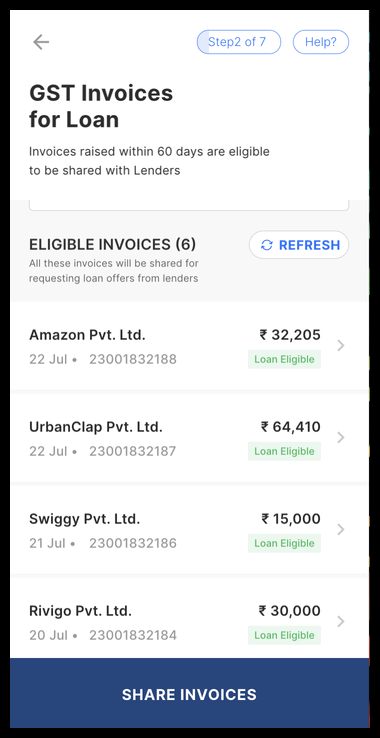

An example on the iSPIRT website reflects the list of lenders available for a customer. The OCEN API can be integrated with e-commerce websites, digital marketplaces, and other apps to help secure a loan while making a purchase.

Image showing multiple borrowing options provided to a customer

Image showing multiple borrowing options provided to a customer

A wider adoption of the technology in the marketplace will bring borrowers more diverse and personalised options. Borrowing money would not be limited to the assets and incomes owned by a person, one of the biggest hurdles that has limited the growth of traditional lending.

Potential challenges

Since OCEN will involve credit and a likely increase in the number of borrowers, there may be a probable rise in the incidence of loan defaults. Resolving this may require the creation of a task force, a system for online dispute resolution, and a digital ombudsman. These mechanisms will create the confidence necessary for more private players to enter the space and for the technology to be adopted on a wider scale.

Transparency with respect to loan-related data could pose a challenge. With an increase in data, companies will come to possess a list of defaulters who might then be excluded from the lending process. It is important that lending processes should not become exclusionary, and that every effort is made to provide potential borrowers the loans they seek.

Borrowing money would not be limited to the assets and incomes owned by a person, one of the biggest hurdles that has limited the growth of traditional lending.

Cybersecurity risks should not be ignored either. Recently, the data of around

110 million users of Mobiwik, a fintech startup, was sold on the dark web. The data included names, phone numbers, email addresses, addresses, GPS locations, and mobile-device-related details. Other similar instances of data breaches in India and elsewhere draw attention to the need to make digital platforms and processes more secure. In the current absence of a law on data protection in India, stakeholders will need to be especially congnisant of risks associated with data privacy, confidentiality, and security. Finally, a lack of technical know-how could lead to online theft and financial fraud. Thus, targeted digital literacy programmes must accompany the rollout of new technologies and platforms.

Conclusion

Seen in the broader context of the rapid growth of fintech in India, OCEN presents exciting new possibilities for growth and transformation.

Fintech is among the fastest growing sectors in India, with startups in the space receiving funding worth US$9.8 billion in 2021. Around 10 fintech companies have scaled up as unicorns in 2021, and the fintech market is

expected to grow to US$ 84 billion by 2025. India’s other major instances of DPGs–the Aadhaar and UPI–have experienced massive scale and success. There appears to be every reason to believe that OCEN too will emerge as another uniquely Indian success story in the years ahead.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

The Open Credit Enablement Network (

The Open Credit Enablement Network (

PREV

PREV