The rise of small satellite platforms has brought a paradigm shift in the manner satellite Earth observation (EO) business is conducted, with service and pricing models changing rapidly. Satellite constellations, industry consolidation, and a rise in the availability of tools for analysing data (often called Big Data) are changing commercial satellite EO business. However, the business case of satellite EO services continue to be a puzzle for the industry due to various reasons, which has time and again prevented its large-scale commoditisation to markets beyond the government. But small satellite operators like Planet, Terra Bella, Spire, and BlackSky Global are changing the perception that one needs to invest in large satellites and have anchor tenant customers for succeeding in this industry.

NSR's

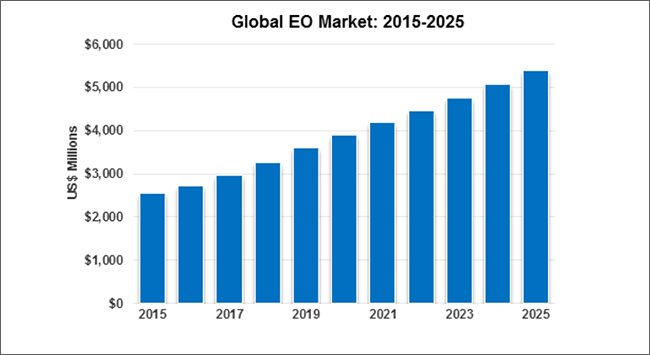

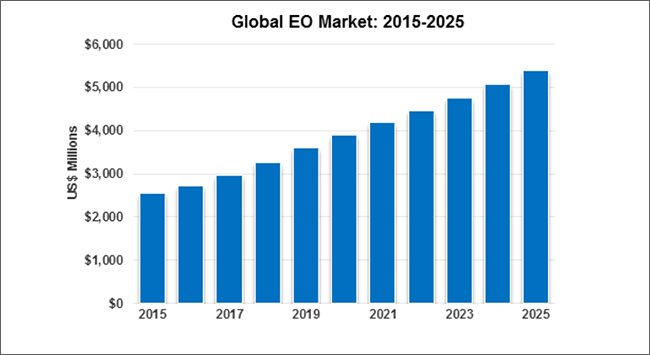

Satellite-based Earth Observation, 8th Edition report projected data, value-added services, information products, and big data analytics from satellite-based EO to represent a $43 billion opportunity over the next decade. Satellite EO market share is expected to grow rapidly in downstream services, especially in the wake of increased supply of high resolution data with high revisit frequency, driving demand for EO data and services across all verticals. But satellite operators are expected to be squeezed for margins on pure data sales as the competition increases with a looming oversupply situation, brought about by these cheap small satellite platforms and leading to trends such as industry verticalisation or a spate of mergers and acquisitions across the industry value-chain.

Source: NSR

Source: NSR

List of Selected Planned Small Satellite EO Constellations

| Company |

Country |

In-Orbit Satellites |

Planned # of satellites |

Type of Sensor |

Full Constellation deployment |

| Hera Systems |

USA |

0 |

48 |

Optical |

2020 |

| Planet |

USA |

51 |

150 |

Optical |

2017 |

| BlackSky Global |

USA |

0 |

60 |

Optical |

2019 |

| OmniEarth |

USA |

0 |

18 |

Multispectral (MS) |

2018 |

| Planetary Resources |

USA |

0 |

10 |

Hyperspectral |

2020+ |

| AxelSpace |

Japan |

0 |

50 |

Optical |

2020+ |

| IceEye |

Norway |

0 |

40 |

SAR |

2020 |

| Astro Digital |

USA |

0 |

16 |

Optical/MS |

2019-20 |

Source: NSR

The impact of these small satellites has been mostly felt on the adoption rate via an easier provision of end-to-end solutions, due to the lower costs of operations and setting up the infrastructure, which has turned the focus on services from products. While North American and European firms have come up strongly in the recent past, India remains oblivious to this growth story as the satellite EO industry expands further with the onset of Big Data analytics, combining image, weather, location and other datasets to provide enterprise services. Apart from ISRO and a few GIS companies like CropIn and Cyient, India has no notable commercial satellite EO firm despite its large IT industry presence, which caters to a global customer base.

If the success story of ISRO's satellite EO programme does not translate into a robust commercial industry, it would be a lost opportunity for India to attain leadership in this promising industry and especially with the government aggressively taking steps to integrate satellites into the digital economy. The Indian market is currently well primed for satellite EO services, with ISRO signing 170 MoUs with various public agencies for applications such as infrastructure monitoring, crop insurance, watershed development, asset management, and mapping. But the question ISRO and the government must ask is — can ISRO alone deliver to all the customers in a timely fashion?

< style="color: #163449;">The bottom line

NSR expects the trends such as small satellite platforms and data analytics to play a large role in democratising satellite image-based insights and become a part and parcel of everyday business processes by the next decade. The opportunity in the global satellite EO market is huge, and if India is to capitalise on it, the first step needed is to look for inspiration from ESA's Copernicus Program to build an ecosystem for commercial companies to come up and compete fairly in both domestic and global markets. The biggest challenge as per India's geospatial companies is the uncertainty in regulations, and the initial impetus to kick-start setting up a robust domestic commercial satellite EO industry will be to amend the Remote Sensing Data Policy of 2011.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

The rise of small satellite platforms has brought a paradigm shift in the manner satellite Earth observation (EO) business is conducted, with service and pricing models changing rapidly. Satellite constellations, industry consolidation, and a rise in the availability of tools for analysing data (often called Big Data) are changing commercial satellite EO business. However, the business case of satellite EO services continue to be a puzzle for the industry due to various reasons, which has time and again prevented its large-scale commoditisation to markets beyond the government. But small satellite operators like Planet, Terra Bella, Spire, and BlackSky Global are changing the perception that one needs to invest in large satellites and have anchor tenant customers for succeeding in this industry.

NSR's

The rise of small satellite platforms has brought a paradigm shift in the manner satellite Earth observation (EO) business is conducted, with service and pricing models changing rapidly. Satellite constellations, industry consolidation, and a rise in the availability of tools for analysing data (often called Big Data) are changing commercial satellite EO business. However, the business case of satellite EO services continue to be a puzzle for the industry due to various reasons, which has time and again prevented its large-scale commoditisation to markets beyond the government. But small satellite operators like Planet, Terra Bella, Spire, and BlackSky Global are changing the perception that one needs to invest in large satellites and have anchor tenant customers for succeeding in this industry.

NSR's  Source: NSR

Source: NSR PREV

PREV