The Vision 2030 report on natural gas infrastructure by the Petroleum and Natural Gas Regulatory Board (PNGRB) released in 2013 stated that “realistic demand” for natural gas will grow at a CAGR (compounded average growth rate) of 6.8 percent to 516.97 mmscmd (metric million standard cubic meters per day) in 2020-21. Gas-based generation was to contribute to roughly 46 percent of the demand, whilst the share of fertiliser sector was expected to fall from 25 percent in 2013 to about 20 percent in 2021. The share of the CGD (city gas distribution) segment was expected to increase from 6 percent to about 9 percent in the same period, whilst industry was to account for a share of about 7 percent in 2020-21. Petrochemicals were to contribute 15 percent, while iron & steel about 2 percent by 2020-21. According to the report, “realistic demand” considered limiting factors that were likely to restrict growth. The reality in the early 2020s could not have been more different.

When the government shifted to a new pricing formula for domestic natural gas in 2015 the price of domestic gas supplied to the fertiliser industry increased to about US$4.66/mmBtu (on a gross calorific value basis), but fell to about US$2.99/mmBtu in March 2022.

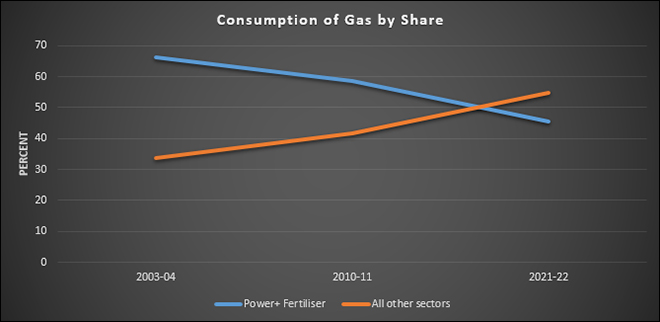

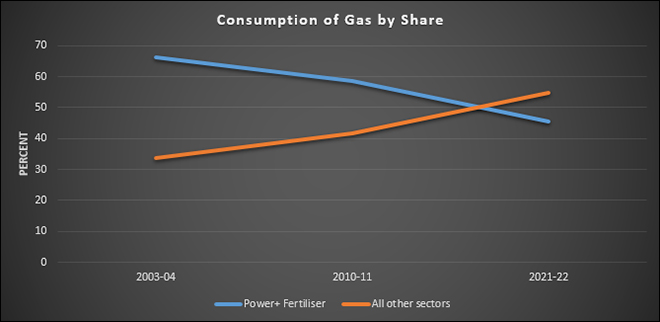

Natural gas consumption fell from 2011-12 levels primarily on the account of the reduction in domestic gas availability. Consumption picked up only in 2015-16, as liquified natural gas (LNG) was relatively cheap and imports grew. Natural gas consumption matched consumption levels of 176.58 mmscmd in 2011-12 only in 2019-20 with consumption of 175.74 mmscmd. Though consumption has started growing after the end of pandemic-related lockdowns, it is nowhere near projected levels. Another stark deviation from the projections is the sectors that would contribute to growth. The fertiliser sector is the largest consumer of natural gas today accounting for about 30 percent of consumption. The power sector which was expected to be the largest consumer of gas has fallen to third place accounting for only about 15 percent of consumption in 2021-22, while CGD which was expected to account for only about 9 percent of consumption has the second largest share in consumption accounting for about 20 percent in 2021-22. Different factors influenced consumption growth of natural gas in the fertilisers and CGD which account for 50 percent of consumption.

Fertiliser Sector

The fertiliser sector is prioritised in gas allocation policy, a system of rationing scarce domestic natural gas. Though prioritisation continues, the volume of domestic gas that can be allocated to the fertiliser industry (and other priority industries) has been declining because of the decline in the production of natural gas. In 2012-13, over 76 percent of total gas consumed by the fertiliser industry was domestically produced. In contrast over 68 percent of the natural gas used for fertiliser production was imported LNG in 2021-22.

Fertiliser is sold to farmers at a 70 percent discount to the cost of production and the fertiliser industry receives the difference as subsidy. Until 2015, the fertiliser industry was supplied with domestic natural gas at a price of US$4.2/mmBtu (net calorific value basis) under the administrative price mechanism (APM). When the government shifted to a new pricing formula for domestic natural gas in 2015 the price of domestic gas supplied to the fertiliser industry increased to about US$4.66/mmBtu (on a gross calorific value basis), but fell to about US$2.99/mmBtu in March 2022. The formula-based price for domestic gas has since been increased to US$6.10/mmBtu and the price of imported LNG is hovering around US$20-35/mmBtu. As fertiliser production is critical for the agriculture sector gas price increases are absorbed by government subsidies. Pooling of gas prices (domestic and imported) for the fertiliser industry allows uniform price for all fertiliser plants irrespective of the share of LNG they use.

Many fertiliser plants that historically used naphtha as feedstock have switched or are about to switch over to natural gas use which will drive consumption of gas.

Additionally, the investment of about INR 500 billion for the revival of closed fertiliser plants and the investment in the 2,650 km Jagdishpur-Haldia & Bokaro-Dhamra natural gas pipeline, known as ‘Pradhan Mantri Urja Ganga’ for a ‘second green revolution’ as the government put it, is driving consumption of natural gas. Many fertiliser plants that historically used naphtha as feedstock have switched or are about to switch over to natural gas use which will drive consumption of gas. Analysts highlight increase in fertiliser subsidies on account of increase in imported LNG prices and recommend a switch to greener options, but change is not likely in the near term given the complex strategic nature of food production.

City Gas Distribution Sector

In 2007, PNGRB (Petroleum and Natural Gas Regulatory Board) planned to expand CGD networks from 30 to over 3000 cities in India to supply CNG (compressed natural gas) for transport and piped natural gas (PNG) connections to households and industries. In October 2015, India had a total of 1026 CNG stations and over 3 million PNG connections. In March 2022 there were 4013 CNG stations (GAGR 21.51 percent) and over 9 million PNG connections (CAGR 17.16 percent). The national gas grid is to be expanded to about 35,000 km from the current 20,000 km. After completion of 11th CGD auction, 96 percent of India’s population and 86 percent of its geographic area is expected to be covered under CGD network. The claim that 86 percent of the population is covered under CGD only implies potential access and not actual use. There are 300 million LPG connections compared to 9 million (or about 3 percent) PNG connections.

In 2021-22, 48 percent of CGD consumption was sourced from LNG imports. Unlike the fertiliser industry the CGD industry can, in theory, pass on increase in the price of gas to consumers. However domestic consumers of PNG are price sensitive which limits the ability of CGD operators to allow full pass through of increase in LNG import costs to consumers. Industrial consumers are also price sensitive, and they can switch to cheaper alternatives if pollution mandates are not enforced.

Issues

Strategic goals unrelated to the energy and environmental concerns are driving growth of consumption in the fertiliser segment. Since the time of the green revolution, domestic production of fertilisers has benefited from policies that support the twin goals of food security and protection of farmer incomes. This has meant prioritising the availability of natural gas, key input for fertiliser production, to the fertiliser industry, and subsidising the price of natural gas to limit the price of fertilisers. Consumption of natural gas in the fertiliser segment irrespective of price is driven by the expectation that subsidies from the government will cover for overall increase in input prices. Though the fertiliser industry has complained that government guarantees are inadequate and do not materialise on time, it is a credible assurance that the industry implicitly depends on. Labelled moral hazard in economic theory, this is not a guarantee that can be extended to all gas consuming sectors.

Consumption of natural gas in the fertiliser segment irrespective of price is driven by the expectation that subsidies from the government will cover for overall increase in input prices.

In the case of CGD, drivers of consumption are energy and environment related. Initially consumption was driven by concerns over urban pollution caused by liquid transportation fuels and court enforced mandates to use alternatives such as natural gas that were expected to reduce pollution levels. Later the prospect of replacing subsidised bottled LPG for cooking in households provided the impetus for expanding PNG connections. This not only reduced the subsidy burden on LPG but also freed up LPG cylinders for distribution in rural areas which proved to be politically valuable. Another factor that facilitated growth of gas as transportation fuel was its price competitiveness over substitutes derived from oil. Gas that is lightly taxed compared to heavily taxed petroleum products such as petrol and diesel made gas a cheaper option as fuel for transportation. Industrial use of natural gas over cheaper options such as coal and petcoke is promoted by environmental mandates.

These factors have contributed to the growth of gas consumption by CGD sector, but they may not be sustainable in the long term. The value of gas as a competitive fuel may be eroded as the share expensive imported LNG in CGD continues to increase. Inadequate returns from domestic connections may also inhibit expansion of CGD. Transaction costs in CGD such as the cost of customer acquisition is high. In densely populated cities it is as high as INR 15,000 per customer and could be higher in less densely populated towns. Access to land and right of way also inhibit expansion of PNG pipeline network. The policy to offer open access in pipelines to competing CNG suppliers may reduce investment in CGD networks. However, in the short-term growth momentum in the CGD sector is likely to be sustained, especially if its competitiveness over petroleum is maintained.

Source: PPAC

Source: PPAC

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV