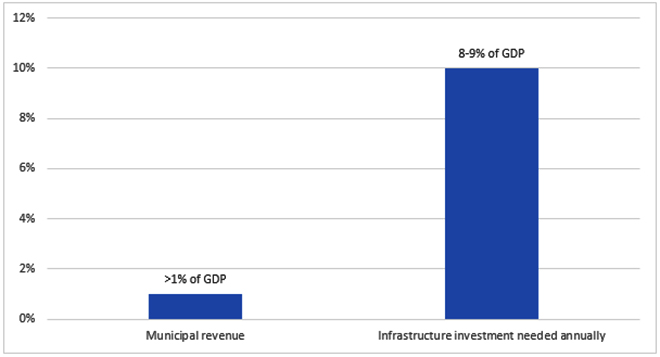

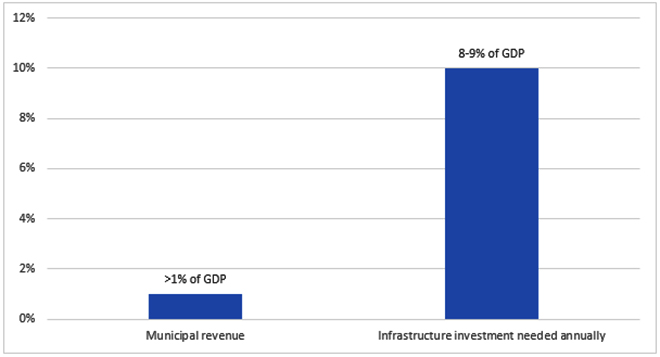

The economic stimulus in the fifth tranche has increased the borrowing limit of states from 3% to 4.5%. Although the initial 0.5% is unconditional, any further increase is conditional on reforms in four key areas, one of which is related to urban local bodies’ revenues. This is an opportunity for the much-needed reforms to the financial structure of the urban local bodies (ULB). These bodies play a crucial role in the delivery of basic services and for the creation of infrastructure. As per the economic survey of 2019-20, India requires $1.4 trillion investment in infrastructure by 2024-25. The bulk of this will be focused on the urban areas. The COVID pandemic has increased the stress on health infrastructure and the need to invest more.

Estimates from various sources.

Estimates from various sources.

Due to the large investment required, access to the market by urban local bodies to raise funds has become both necessary and a feasible alternative in the future. In developed countries, municipal bonds are a major source of funding for urban financing. Further, since infrastructure projects have long gestation periods, municipal bonds provide an effective way to match the structure of the asset liability. Ahmedabad Municipal Corporation was the first to make a public offering in 1998. Since 1998, local bodies in other cities like Nashik, Nagpur, Ludhiana, and Madurai have accessed the capital markets through municipal bonds. However, the share of municipal bonds in the total debt market is still insignificant, only 1% of urban bodies financial needs are met through municipal bonds as against 10% in the US.

One of the main challenges faced by most of the smaller urban bodies while accessing capital markets, is the low credit worthiness, on account of slow governance reforms, poor accounting standards and low institutional capabilities.

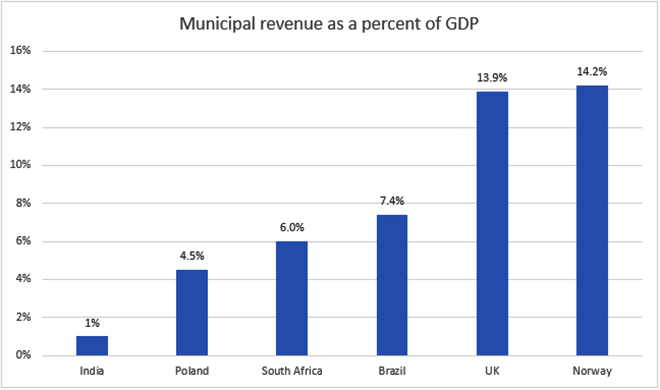

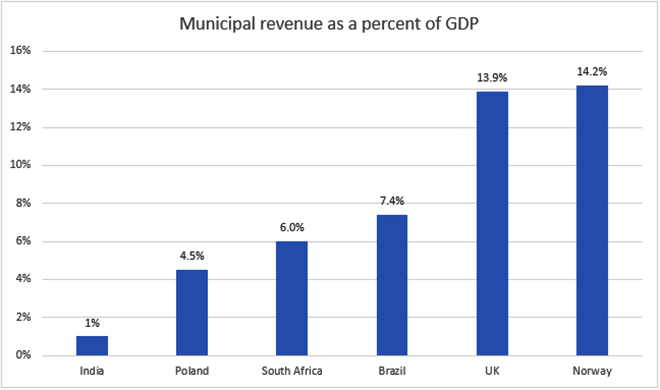

Direct access to capital markets has been feasible for only financially strong, large municipal corporations. One of the main challenges faced by most of the smaller urban bodies while accessing capital markets, is the low credit worthiness, on account of slow governance reforms, poor accounting standards and low institutional capabilities. Despite various initiatives such as (FIRE-D) Project in 1994, tax incentives, Pooled Finance Development Scheme, the development of the municipal bond market has not been satisfactory. There have been various factors that have limited the growth of the municipal bond market but importantly it reflects the state of finances in these institutions. The following graph shows a comparison of municipal revenue as a percent of GDP across different nations. India lags behind even developing countries such as Mexico, South Africa that have a share of 7.4% and 6% respectively.

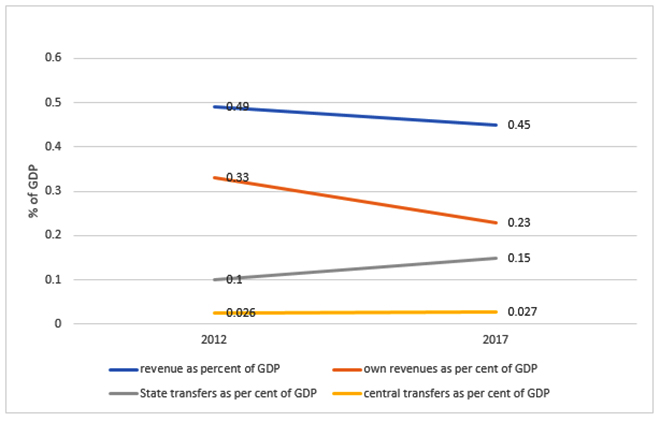

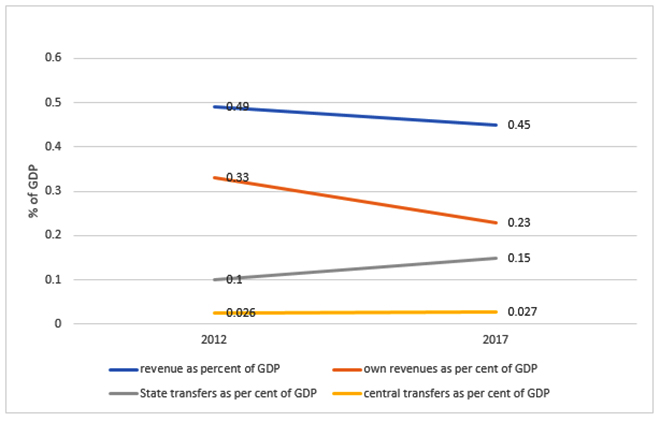

According to a study by ICRIER on 37 municipalities, the dependence on transfers from the Centre and the state has increased between 2012 to 2017, while the share of total revenues and ‘own’ revenues has fallen, as shown in the graphs below. Share of own revenues is a measure of the efficiency of the revenue administration.

Further, municipal revenues are not a buoyant source of revenue; the rate of growth of per capita municipal revenue, from 2012-13 to 2017-18, is half that of the rate of growth of GDP in the same period. The current pandemic has further put strain on the balance sheet of the Centre and of the states. The share of tax devolution to the states out of the total central revenue pool has fallen to 26% for 2020-21 as against nearly 30% for the 2015-19 period. Municipal bonds can help local bodies directly raise money while reducing their dependence on state or central grants. There has been a policy push in recent times both from the Centre as well as SEBI to encourage municipal bonds. Last year, the government decided to bring in uniform reporting system based on international standards. This is the first time that the Ministry of Housing and Urban Development is creating a database of audited annual accounts for local bodies, helping them gain credibility and attract private finance from the markets. The current economic stimulus gives incentive to state governments to push reforms that would bring better governance and help improve their financial status and thus aid in increasing the credit worthiness of urban local bodies. According to estimates by CARE, large municipalities could raise close to Rs. 1,500 crore every year through municipal bond. In the long run, urban local bodies will require to tap the market so that they are able to efficiently deal with the increased demands of a growing population.

The current economic stimulus gives incentive to state governments to push reforms that would bring better governance and help improve their financial status and thus aid in increasing the credit worthiness of urban local bodies.

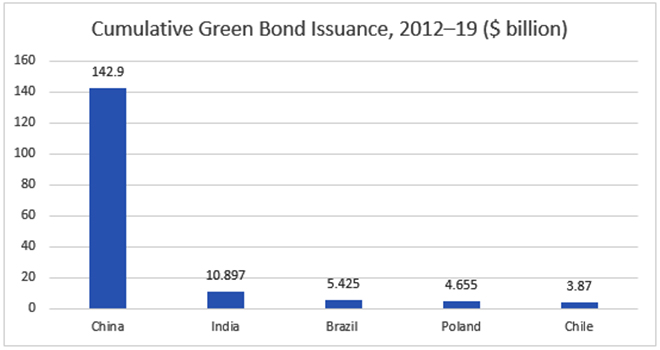

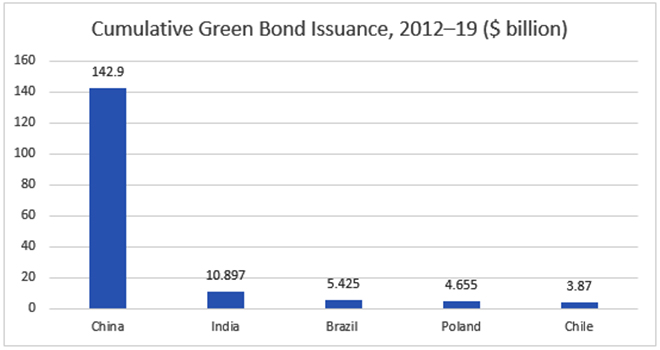

The pandemic has also underlined the realities of the danger of climate change and there are clear parallels that highlights that we can no longer take it lightly and any economic reform must take into account the environment. Thus, it is imperative that reforms in the state of finances of ULBs go hand in hand with adopting green policies, so as to focus on clean and climate resilient infrastructure. Moreover, this will be in line with India’s targets under the ‘Nationally Determined Contribution’, and the launch of national missions such as Smart Cities Mission and National Solar Mission. India has become the second largest market in green bonds as shown in the graph below. India’s climate-smart investment potential through 2030 is estimated at $2.1 trillion. As per the Emerging Market Green Bonds Report 2019, the global market green bonds outperformed global aggregate bond benchmarks in 2019.

Source: Emerging Market Green Bond Report 2019

Source: Emerging Market Green Bond Report 2019

However, in India the bulk of these bonds are issued by public and private companies. Thus, green bonds present an opportunity for municipalities to raise funds from the market and also have a positive environmental impact. Reforms in areas of tax, non-tax, governance, accounting standards are urgently required in urban local bodies to address the growing mismatch between responsibilities and the financial and institutional capabilities of these bodies. The current stimulus presents that opportunity, that would in the long run, help these institutions to be more financially independent and better place them to leverage their own finances to raise funds from the market.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Estimates from various sources.

Estimates from various sources.

Source: Emerging Market Green Bond Report 2019

Source: Emerging Market Green Bond Report 2019 PREV

PREV