Overhaul, not patchwork; good, not perfect; green shoots, not forest. The assimilation of 44 Union labour laws into four codes and 1,458 sections into 480 (a fall of 67 percent or the removal of two out of three sections on average) by Parliament should, if the baton of intent is taken up by state legislatures enacting their rules in the race of growth and prosperity, deliver a business environment more in tune with the future. The debate around the Codes has been largely in tune with India’s parliamentary processes — the laws include

174 out of 233 recommendations of the three standing committees on labour. They put India on a faster and less hostile superhighway to growth. On the labour front, that future includes the gig economy, reduced compliances, and less paperwork. But finally, the devils of execution details will lie in the Rules that state governments will enact in their respective legislative assemblies.

This essay gets under the skin of four labour legislations and concludes that the reforms are a first step towards a future-ready India. Given the low expectations over the past seven decades, these are laudatory first steps that need to be refined over time and across geographies of labour jurisdictions. Each of the four new laws oversees a specific aspect of organised work — three laws around disputes and collective bargaining; four laws around wages and salaries; nine laws around social security; and 13 laws around safety and health (the balance 15 laws were repealed in 2016 and 2017).

The Code on Wages, 2019. This law, enacted on 8 August 2019, consolidates four laws, around wages and remuneration. These are

The Payment of Wages Act, 1936;

The Minimum Wages Act, 1948;

The Payment of Bonus Act, 1965; and

The Equal Remuneration Act, 1976. The Code enables the Union government to fix a floor wages, upon which the minimum wages will be set by Union and State governments — they must be higher. It also has provisions for overtime; manner of paying wages (coins, notes, cheques, or electronic) and period (daily, weekly, fortnightly or monthly); deductions for fines, absence, accommodation, or recovery of advance); annual bonus (the higher of 8.33 percent or Rs 100), including a share of gross profits; and preventing gender discrimination.

The Code on Wages, whose draft rules were published 7 July 2020, expands the coverage of labour laws for gig workers, freelancers, home based workers and other workers in unorganised sector. workers here will now be eligible for minimum wage, social security, health and safety. Rules will articulate the implementation of specific schemes. The code is silent on minimum wages for workers in the unorganised sector. the fixed term employment (FTE) will be entitled to several benefits, such as gratuity, payment of bonus that doesn’t require a minimum work period of 30 days, and earned leave eligibility immediately on joining (one day for every 20 days of work).

On the regulatory side, the law reduces the number of annual returns from three to one, which is an excellent move. It also proposes to reduce the number of registers from 12 to four, another step in the right direction. The introduction of a national floor wage to ensure a minimum national standard is another good step; State governments will have to fix their minimum wages above this standard. Further, all wages payable to employees on their termination, retrenchment or resignation needs to be settled in two working days. This will increase the administrative pressure on operations and increase compliance burden on the employer.

The Industrial Relations Code, 2019. This law, enacted on 23 September 2020, consolidates three laws around worker-management disputes and collective bargaining. These are the

Trade Unions Act, 1926; the

Industrial Employment (Standing orders) Act, 1946; and the

Industrial Disputes Act, 1947. This law consolidates the three laws above relating to trade unions, conditions of employment in industries, and investigation and settlement of industrial disputes. For companies wanting to shut down or retrench workers, they need to take permission from the government only if the number of workers is 300, against 100 earlier.

The Industrial Relations Code reduces the number of registrations under the Trade Union Act, 1926 and the Industrial Employment Standing Order Act, 1946 to one, from two. It makes provisions to create a reskilling fund, under which the employer will have to contribute 15 days’ salary of a retrenched employee to the fund, the proceeds of which will be used to train and reskill the employee. This will increase the financial cost of the employer and increase the compliance burden as payments will need to be made and records will need to be maintained.

The applicability threshold for retrenchments or layoffs has been increased to 300 from the current value of 100. Employers can use model industrial employment standing order up to 300 employees. The need to create a customised and certified standing order arises only after 300 employees. This reduces the compliance burden as procedures are complex and require multiple interfaces with the department.

As far as management-unions disputes go, the law has brought a greater degree of accountability into the system, with a notice of 14 days before going on strike. This will help employers plan better, initiate negotiations and conciliatory measures to mitigate the situation. Further, the unions will not be allowed to strike during conciliation and arbitration proceedings, a good step. A process to recognise trade unions has been laid out — a trade union that enjoys the support of 51 percent or more employees on the muster.

The Occupational Safety, Health and Working Conditions Code, 2019. This law, enacted on 23 September 2020, consolidates 13 laws that govern the safety, health and working conditions of labour. These are the

Factories Act, 1948; the

Mines Act, 1952; the

Dock Workers (Safety, Health and Welfare) Act, 1986; the

Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996; the

Plantations Labour Act, 1951; the

Contract Labour (Regulation and Abolition) Act, 1970; the

Inter-State Migrant workmen (Regulation of Employment and Conditions of Service) Act, 1979; the

Working Journalist and other Newspaper Employees (Conditions of Service and Miscellaneous Provision) Act, 1955; the

Working Journalist (Fixation of rates of wages) Act, 1958; the

Motor Transport Workers Act, 1961; the

Sales Promotion Employees (Conditions of Service) Act, 1976; the

Beedi and Cigar Workers (Conditions of Employment) Act, 1966; the

Cine Workers and Cinema Theatre Workers Act, 1981.

Flexibility has been embedded into this law. It empowers state governments to exempt any new factory from the provisions of the Code in order to create more economic activity and employment — through an executive order. Further, the law proposes to bring down the number of licences from 12 to one. It sees the entry of the ‘appointment letter’ to all employees, which several employers do not provide. It entitles women to work during the night shift, with written consent, but has outsourced the responsibility for their safety to the employer. Contract workers employed through unlicensed contractors will be treated as direct employees of the company.

The law gives protections to migrant workers, the tragic images of which we saw during the COVID19 lockdowns — State governments will need to maintain records of all such workers. Specific registers may be required which will be clarified in the rules. Migrant workmen will get a journey allowance once a year to visit their home. A dedicated helpline to resolve their grievances will be set up. They will also have access to public distribution system).

The Code on Social Security, 2019. This law, enacted on 23 September 2020, consolidates nine laws that oversee social security of workers. These are the

Employees’ Compensation Act, 1923; the

Employees’ State Insurance (ESI) Act, 1948; the

Employees Provident Fund and Miscellaneous Provisions Act, 1952; the

Employment Exchanges (Compulsory Notification of Vacancies) Act, 1959; the

Maternity Benefit Act, 1961; the

Payment of Gratuity Act, 1972; the

Cine Workers Welfare Fund Act, 1981; the

Building and Other Construction Workers Welfare Cess Act, 1996; and the

Unorganised Workers’ Social Security Act, 2008. This law recognises the temporary nature of employment, takes into its fold unorganised workers, gig workers (means a person who participates in a work arrangement and earns outside of traditional employer-employee relationship) and platform workers (a form of employment in which organisations or individuals use an online platform to access other organisations or individuals to solve specific problems or to provide specific services in exchange for payment), and makes social security provisions for them.

From four registrations on social security, this law reduces them to one. Even better, all other returns — 24 under provident fund, four under employment exchanges, one under maternity benefits, two under ESI and at least five more returns under other laws — have converged into one. While the legislative aspiration is clear, the implementation path is not. Further, there are at least 10 different registers today, and there is no clarity on how many of these will be finalised. Section 45 enables the Union government to frame schemes for unorganised workers, gig workers and platform workers and the members of their families for providing social security benefits. Again, this Section makes the enabling provisions but the final execution will be framed under Rules.

Over to state legislative assemblies

For a country that has nourished a hostile habitat for entrepreneurs for decades, these four laws bring the first green shoots of legislative change. India’s businesses function in a regulatory universe of 1,536 Acts that demand 69,233 compliances and 6,618 filings across the Union and State governments. Of these, almost a third (30 percent or 463) of the laws and almost half (47 percent or 32,542) compliances come under the labour category. Statistically, almost all the compliances (97.1 percent) are governed by State governments and 937 by the Union government.

< lang="EN-GB">Of the 63 million enterprises in India, only 12 million (or less than one in five) have registered under the goods and services tax; 1 million (or 1.5 percent) have registered for social security; only 0.5 million pay social security actively; only 70,000 or 0.1 percent have with revenues of more than Rs 5 crore; and 22,500 (0.04 percent) have a paid up share capital of more than Rs 10 crore. In other words, over the past seven decades of Independent India, the legal constraints on businesses have created a disproportionately large number of micro enterprises that employ less than five employees on average. If we want to see how a nation’s polity smothers its own economic well-being, look no further than India’s business laws.

The new laws look beyond and legislate on the changing work structures. While making incremental changes in the regulatory compliance infrastructure of India, it expands it to include gig workers, work from home, freelancers, fixed term employment. It attempts to reduce the multiplicity of returns — there are 2,745 different formats of returns and registers across the Union and States around labour that entrepreneurs need to fill and file — and redundancy, duplication of information delivery, and overlap of inspectors. It also attempts to cuts down the Inspector Raj. Effectively, it seeks to end the complex maze of laws, compliances and filings that has created a parallel government in the form of corrupt rent-seeking system of inspectors.

While courageous, these labour reforms are only the first step. The onus is now on states to use this opportunity and thoroughly review the rules and reduce duplication, overlaps and redundancy thereby reducing the regulatory burden. Further, the states need to talk to one another and create standardisation of the regulatory regime, such that enterprises can comply with certainty and uniformity across the country rather than being subject to inconsequential local nuances leading to complexity — remember, the 21st century businesses of scale see the world as their market, not just the municipality, the district, the state or even the country.

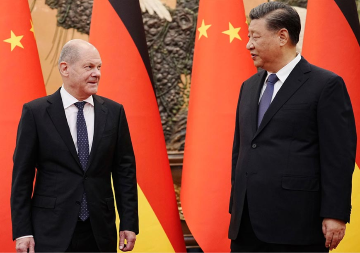

The states need to enable enterprises in their jurisdictions towards that scale. They must translate the legislative intent that will get sharpened over time — as the Goods and Services Tax or the Insolvency and Bankruptcy Code currently are — into a reality that attracts entrepreneurs from India and the world. In particular, they must address and invite corporate refugees from China. Already, job creation is a political narrative; into this, state governments must embed value and wealth creation. In the shifting sands of global realignments and the ongoing recreation of global value chains away from China, states must competitively position their geographies in particular and India in general as a manufacturing destination. The four Codes have prepared the groundwork for future reforms; it is up to states to make India future-ready.

The overhaul of labour laws help expand and strengthen labour but with flexibilities to entrepreneurs. They may not be perfect but are on the journey to perfection. And the green shoots of growth, now enacted by Parliament must be watered and nourished towards growth by state legislative assemblies.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Overhaul, not patchwork; good, not perfect; green shoots, not forest. The assimilation of 44 Union labour laws into four codes and 1,458 sections into 480 (a fall of 67 percent or the removal of two out of three sections on average) by Parliament should, if the baton of intent is taken up by state legislatures enacting their rules in the race of growth and prosperity, deliver a business environment more in tune with the future. The debate around the Codes has been largely in tune with India’s parliamentary processes — the laws include

Overhaul, not patchwork; good, not perfect; green shoots, not forest. The assimilation of 44 Union labour laws into four codes and 1,458 sections into 480 (a fall of 67 percent or the removal of two out of three sections on average) by Parliament should, if the baton of intent is taken up by state legislatures enacting their rules in the race of growth and prosperity, deliver a business environment more in tune with the future. The debate around the Codes has been largely in tune with India’s parliamentary processes — the laws include  PREV

PREV