This article is part of the series — Raisina Files 2022.

A unicorn is a startup valued at or north of US$1 billion and aptly anointed because, just like the mythical creature, the rarity of such a wildly successful enterprise is improbable, but not impossible. Most companies that successfully transcend this much-coveted valuation do so by building a moat, either with a unique product or service, or a refined go-to-market strategy. They are either first to win a market or are best-in-class and can displace incumbent competition consistently. A company becoming a unicorn deserves the applause of the ecosystem as it is a robust signal of success. This is why the repeatable generation of this elusive outcome is an important indicator of the strength of a country's startup ecosystem.

India's first unicorn was MakeMyTrip which took ten years to become one in 2010.<1> Since then, India has generated unicorns at an accelerated pace, and startups are taking less time to join the club. Today, India has an estimated 98-103 unicorns; various industry analyses had identified 85<2>-90<3> unicorns at the end of 2021, while 13 companies have turned unicorn between January-March (JFM) 2022.<4> With 73 identified soonicorns<5> (companies approaching unicorn valuation with consistent growth metrics) in the pipeline already, ecosystem observers have estimated that India will have 200 unicorns by the 2024-25 timeframe.<6>

India currently ranks third globally in the number of unicorns, behind the United States at 487 and China at 301.<7> The nation has long left the United Kingdom, Israel, Singapore, Germany, and other ecosystems behind; the UK, with 39 unicorns presently, was ranked third previously. Israel ranks fourth after India now, with 53 unicorns.<8>

2021 has been an inflection point in India’s startup story, reflected by the doubling of its unicorn base. An overwhelming 46 of its 90 unicorns (at the end of 2021) arrived in 2021 itself.<9> India is not the only country to have witnessed this acceleration. 254 of the US’ 489 unicorns were added in 2021, as were 74 of China’s 301, 33 of Israel’s 53, and 15 of the UK’s 39.<10> Unforeseen utilitarian and lifestyle changes induced by the pandemic has accelerated what was already a fast-growing economic growth engine worldwide.

In business parlance, India's internet total addressable market (TAM) rapidly increased over 2021 as technology solutions became mainstream, consumers across the country embraced digital platforms in daily life, and India's business backbone used technology to strengthen their operations and support the shift towards a self-reliant economy. With 440 million millennials in the country,<11> the consumer internet opportunity is more extensive than previous "guesstimates". Over 830 million Indians are internet subscribers;<12> the affordability of data rates has unlocked access, democratised utility across the population, and is driving the rise of new economic growth engines.

2021 has, indeed, been a milestone year for the Indian technology ecosystem with Indian startups raising US$42 billion over 1,583 deals over the year.<13> It was also a record year for exits, mergers and acquisitions (M&As), and Initial Public Offerings (IPOs). The year set a new peak for tech exits, with US$17.4 billion being returned, which was twenty times the amount (US$847 million) returned in 2020.<14> Eleven startups raised over US$7.3 billion in their IPOs in 2021,<15> with most being sizably oversubscribed by retail investors. The Indian software product company, Freshworks, listed on the Nasdaq with a tremendous reception;<16> the first Indian IT services company to get listed on the US exchange was Infosys over 20 years ago.

Perhaps most interestingly, 2021 was when technology and digital platforms became mainstream in India's cultural fabric. An interesting anecdote from the industry is how Indian citizens can now order breakfast on their favourite food delivery app, and buy the company's shares before lunch on another listed tech company's brokerage app—something people in the US have always had the opportunity to do.<17> Feeding the retail investors' growing appetite, more than 20 companies have filed for their IPOs over 2022 and 2023. This process acts as a force multiplier of the value created in the technology startup ecosystem over the last decade, allows millions of Indians to participate in the growth, and frees up large pools of invested capital in returns that are highly likely to be reinvested in the next cycle.

This rapid growth of the ecosystem—indicated by its growing number of unicorns getting embedded in daily lives—is monumental. It signals that the startup ecosystem has established scale.

India’s Startup Ecosystem has Established Scale in the Knowledge Economy

The knowledge economy is driving growth in the 21st century. Material assets have characterised agricultural and industrial economies. However, knowledge economies use drivers like information, innovation, human capital, intellectual property, research and development, and focused creation of new specialisations to augment goods and services rapidly. Winning growth strategies in the knowledge economy-led era leverage technology, the internet, data, network effects, and other forces like artificial intelligence (AI) to capture market share, replace incumbent institutions and methodologies, and reap disproportionate gains. Today, in India, just like everywhere else, startups are leading the knowledge-economy surge.

From 2014 to 2021, Indian startups have collectively raised US$112 billion.<18> In JFM 2022, estimates suggest that US$11.8 billion has already been raised by 506 startups, which is 186 percent higher than the capital raised in JFM 2021.<19> The supporting ecosystem has also kept pace; there are over 250 quality accelerator-incubator systems, and about 500 institutional and 2,000 active investors.<20> Bengaluru, Mumbai, and Delhi-NCR have emerged as global centres of innovation.

With more than 66,000 startups<21> and over 100 unicorns, India is home to the third-largest startup ecosystem, behind only the US and China. Projections indicate that by 2025, India may well have over 100,000 startups that employ more than 3.5 million people and produce over 200 unicorns; with a total market value closer to US$1 trillion.<22> The pipeline of companies that will potentially become unicorns and go on to list in the public markets is also expanding rapidly.

The inflection point in 2021 is driven by the fact that startups became invaluable during the pandemic. They suddenly delivered every service, from bills and other payments, food and grocery deliveries, teleconsultations and medicine delivery, coordination of oxygen and other essentials, to education, entertainment, communication, the deployment of information and live updates digitally, and more. Indian startups proved that they were inevitably a deeper part of everyday life. Despite being cash-strapped, many startups stood behind their employees during the lockdowns with insurance coverage and benefits.

Today, citizens are grateful to the startups and companies that helped them access necessities during a panic-induced period in their lives. Consequently, they are now loyal customers of these companies. Indians have realised that increasing number of elements in their daily lives now depend on technology. The status quo of their wallet share and consumption behaviour has fundamentally shifted. The TAM of the paying Indian internet consumer has nearly doubled due to this shift towards digital products and services. The pandemic has proved that people in tier-II and tier-III towns would also pay for digital services.<23>

Post the pandemic, more Indian consumers are willing to remain paying subscribers for digital products like health services, video and audio entertainment, edtech, video games, and more. This is happening across the spectrum of consumer classes, from urban India to non-metro and small towns. The old assumption that only the 10-20 million Indians living in tier-I cities will pay for services has now been disproven by this post-pandemic behavioural shift. With the TAM expansion, the value of the market-leading unicorns in each of these spaces is also multiplying.

These companies have amassed millions of lifetime customers. Industry participants share that there will soon be close to 100 million Indians that are willing to pay for digital products and services.<24> This implies that, in a rapid upward shift, more startups can become US$100 million revenue businesses and make stronger claims for unicorn valuations. From Nykaa and Zomato to Licious and Mamaearth, in the consumer space, several startups have a larger number of present and potential customers now, and this is propelling them from being unicorns to becoming decacorns (startups with valuations north of US$10 billion).

India's fintech sector is producing some of the world's most revolutionary models for financial inclusion by fundamentally re-engineering how Indians earn, spend, save, and transact online. Startups such as PolicyBazaar, Oxyzo, Open, PhonePe, Jupiter, BharatPe, and others are leveraging technology and digital access to design distinctive platforms and products to capture market share and value. The surge in investment volumes into the stock market via new-age digital brokerage platforms like Zerodha and Dhan—that distribute mutual funds and Structured Investment Products—has also led to a record number of new retail investors allocating to this asset class.

Enterprise technology is another standout vertical that is re-engineering how India does business. As Indian corporations scale, many startups are building SaaS (Software-as-a-service) platforms to support their organisational operations at the enterprise level. In this space, India does not only rely on foreign enterprise tech companies, but also has robust homegrown solutions that design for India's needs. Companies such as Freshworks, Zoho, Darwinbox, BillDesk, Udaan, InMobi, and Betterplace have not only proven their value propositions in the country, but many of them are also global companies with diverse client bases across the world. The procurement of Indian tech is now much more extensive than initially assumed.

It stands to reason then that these sectors—e-commerce and consumer-brand, enterprise-tech, and fintech—lead in the number of unicorns, soonicorns, and combined sector valuations. Other fast-growing sectors include education-tech, agri-tech, logistics, and deep-tech. India's rapidly expanding club of unicorns and soonicorns has proved beyond doubt that the country's startup ecosystem has established scale in today's knowledge economy-led growth vectors.

A Snapshot of India’s Unicorn Club

Industry reports state that 85 unicorns were created till the end of 2021, with their combined valuation growing over US$283 billion.<25> These companies have cumulatively raised over US$75 billion in funding.

India has also produced five decacorns—Flipkart, Paytm, BYJU’s, Oyo Rooms,<26> and Swiggy (that recently joined this club in January 2022).<27> All five are prodigious acquirers of other startups as part of their strategy to continue expanding their platforms and offerings. While Paytm listed on the public market via its IPO in November 2021, the other four are in various stages of their IPO offerings in 2022.

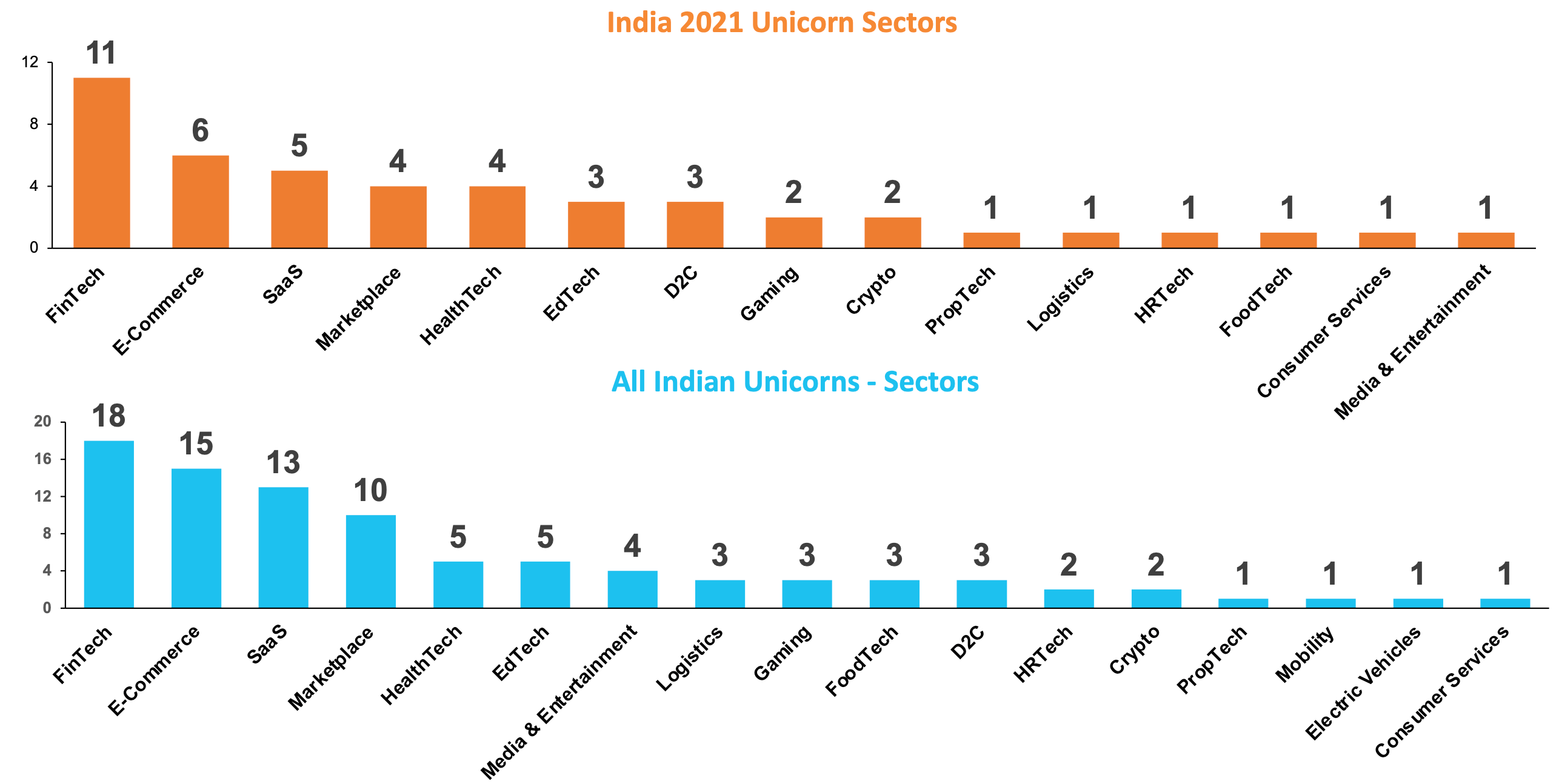

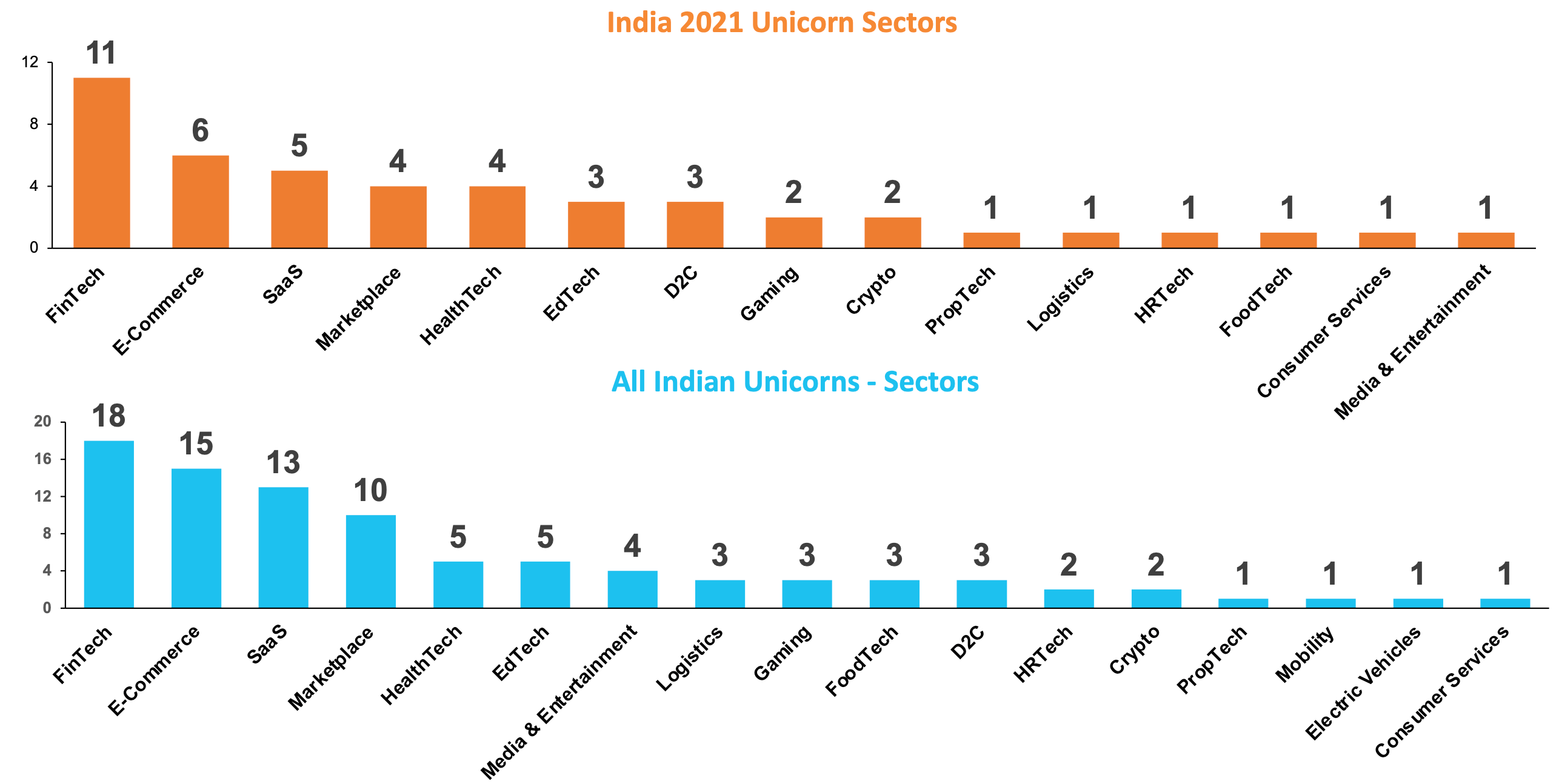

Unicorns by Sector

Startups in the fintech and e-commerce sectors dominate both the unicorn and soonicorn lists, while newer areas such as SaaS, consumer marketplace brands, health tech, and logistics are also seeing immense growth.

Fig: Indian unicorns by sector<28>

The 13 unicorns that achieved that status in JFM 2022 represent one of the most diverse sectoral cohorts so far, ranging from AI, data analytics, fintech, SaaS, and logistics to edtech, social commerce and marketplace, and gaming.<29>

Time-to-Unicorn

The average time for a company to become a unicorn is 7.8 years in 2021.<30> The inflection point in 2021 is evident here as well; the time-to-unicorn at the end of 2020 was 9.9 years. With 46 companies becoming unicorns at record pace in 2021, the average reduced by two years in a single year. With the addition of the 13 new unicorns in 2022, it is estimated time-to-unicorn has further dropped to 6.6 years.<31>

33 of India’s unicorns reached there in less than five years. Mensa Brands holds the record for the fastest unicorn, at six months.<32> With a lift in the quality of the founding teams, a larger pool of highly trained technical talent, and larger TAMs that are more easily accessible, this acceleration is also indicative of a fundamental orbital shift up in the Indian ecosystem.

Where are they?

Innovation occurs in clusters, and Indian unicorns are no exception. The top unicorn city is Bengaluru with an estimated 39 unicorns, a product of its booming startup culture. Bengaluru received 51 percent of the total inbound capital in 2021,<33> and has emerged as the seventh largest unicorn hub of the world, competing with more established ecosystems in the US and China.

Delhi-NCR is second with 30 unicorns and Mumbai is third at 18.<34> These three cities accounted for 80 of India’s 90 unicorns at the end of 2021, and have added more in 2022. This is unsurprising as an estimated 67 percent of all active startups are housed in these three locations.<35> Indian soonicorns, too, are largely in these three cities with an estimated 30 in Bengaluru, 17 in Mumbai and 12 in Delhi-NCR.<36>

It is encouraging to note that the rest of India is also seeing an acceleration of startup activity. Chennai and Pune both host 6 unicorns each, while Hyderabad has 2. Jaipur joined the list of unicorn cities in 2021 with CarDekho.<37>

IPO-bound

A natural growth vector for unicorns is to list on the public markets, and 2021 marked a record year for Indian tech IPOs. Eleven startups—EaseMyTrip, Freshworks, Nazara, Nykaa, Zomato, MapMyIndia, PolicyBazaar, RateGain, Fino, Paytm and CarTrade—raised over US$7.3 billion in their IPOs this year.<38> Freshworks made history by becoming the first Indian SaaS company to list on Nasdaq. While many of these companies turned unicorns before they went public, it is interesting to note that Nazara and MapMyIndia turned unicorns after their IPO by focusing on their growth.<39> Most of these IPOs were vastly oversubscribed, signalling that the retail Indian investor welcomes this opportunity to invest and participate in the Indian growth story.

More than 20 companies have filed for their IPOs targeting 2022 and 2023, and a fair number of them are already unicorns. Delhivery, Oyo, Pharmeasy, Mobikwik, Ola, BYJU’s, Pine Labs, Flipkart, Swiggy, PhonePe, and BigBasket are some of the now-household names that are IPO-bound in the next two years.

Indian markets proved in 2021 that they work competently. Despite having the third-largest ecosystem globally, the country lagged in tech IPOs compared to the US and China. The US has developed an efficient system that supports hundreds of IPOs every year. Over the last decade, China established its market framework well and is supporting larger volumes of IPOs every year. India was lagging, but the events of 2021 have served as a pull-up stimulus to increase the momentum.

Building Ecosystems via M&As

One of the several feedforward effects of unicorns in the ecosystem is that they build their own sub-ecosystems. If business is booming and the company is consistently growing, it is natural to expand into market adjacencies and explore M&A options. The number of M&A deals in the Indian startup ecosystem multiplied 2.5 times—206 in 2021 as compared to 82 in 2020<40>—and Indian unicorns featured prominently in the acquisition activity.

Mensa Brands was valued at US$1.2 billion in November 2021 and pioneers an umbrella approach to brand offerings. It also holds the record for most startups acquired in 2021, at 12. BYJU's comes next, having acquired 10 startups; followed by Upscalio, which acquired 8.<41> Unicorn companies are expanding their sphere of influence with increased customer offerings.

The M&A trend will accelerate, given both the demand and supply sides of the pipeline are expanding in India, and 2022 is already seeing that.<42> The number of companies with consistent growth and cash in hand to acquire smaller companies is steadily growing, as seen by the velocity of unicorn generation. There's an avalanche effect in India's total startup pool on the other side. Many work on niche value propositions that larger companies might find practical to acquire rather than create them in-house. The recent acquisitions of startups by Reliance and Tata are early indications of such consolidation at work.<43>

In India's vision of self-reliance—combined with the goals of growing into a US$5 trillion economy on the way to US$10 trillion in this decade—the technology-led startup ecosystem will be an invaluable economic growth driver. The record pace of unicorn generation is an encouraging sign of establishing this growth driver as a force-multiplier of economic activity; the ecosystem is providing valuable goods and services, creating numerous job opportunities, and expanding the Indian market in ways unforeseen even a decade ago. The new decade should see technology establish a deeper connection with the mainstream.

As of 25 March 2022. These include companies that have been acquired, bootstrapped (not venture funded), and listed on public markets. Two were subsequently devalued below US$1 billion after turning unicorn.

<1> “India Tech Unicorn Report 2021,” ORIOS Venture Partners.

<2> “2021 Year in Review,” Inc42 Media.

<3> ORIOS Venture Partners, “India Tech Unicorn Report 2021”

<4> Bhaswati Guha Majumder, “India's Unicorn Boom Continues in 2022: 13 Recorded So far, May Touch 100 This Year,” News18, March 25, 2022.

<5> Nikhil Subramaniam, “Meet The Next Indian Unicorns: The 73 Startups In Inc42’s Soonicorn List This Year,” Inc42 Media, January 8, 2022.

<6> TV Mohandas Pai, “India-A Startups Nation,” 3one4 Capital.

<7> ORIOS Venture Partners, “India Tech Unicorn Report 2021”

<8> “2021 Was The Best Ever Year For Israeli Tech: $25 Billion Raised And A Record Number Of Unicorns And Mega Rounds,” Start-Up Nation Central, December 13, 2021.

<9> ORIOS Venture Partners, “India Tech Unicorn Report 2021”

<10> ORIOS Venture Partners, “India Tech Unicorn Report 2021”

<11> Priyam Sharma, “The rise of the Indian millennial,” The Times of India, September 6, 2021.

<12> Inc42 Media, “2021 Year in Review”

<13> “Indian Tech Startup Funding Report 2021,” Inc42 Media.

<14> “India PE, VC investments, exit deals at all-time high in 2021: report,” The Economic Time, February 2, 2022.

<15> Nikhil Subramaniam, “From Nazara To MapmyIndia: Indian Tech Startups Raised Over $7.3 Bn Through IPOs In 2021,” Inc42 Media, December 20, 2021.

<16> Alnoor Peermohamed and Dia Rekhi, “Freshworks lists on Nasdaq after billion-dollar IPO,” The Economic Times, September 23, 2021.

<17> Darlington Jose Hector, “2021 proved that tier 2, 3 towns will pay for entertainment, education and other services, says 3one4 Capital's Pranav Pai,” Moneycontrol, December 20, 2021.

<18> Inc42 Media, “Indian Tech Startup Funding Report 2021”

<19> Jaspreet Kaur, “Most Active Investors In The Indian Startup Ecosystem In Q1 2022,” Inc42 Media, April 5, 2022.

<20> TV Mohandas Pai, “India- A Startups Nation”

<21> “The India Unicorn Landscape,” Invest India.

<22> TV Mohandas Pai, “India- A Startups Nation”

<23> Swarajya Staff, “Digital Payments Growing Rapidly In Tier-II, Tier-III Indian Cities: Razorpay Report,” Swarajya Magazine, August 10, 2021.

<24> “More Indian consumers will pay for digital services, says 3One4 Capital’s Pai,” Rest of world, March 22, 2022.

<25> Inc42 Media, “Indian Tech Startup Funding Report 2021”

<26> ORIOS Venture Partners, “India Tech Unicorn Report 2021”

<27> John Sarkar, “Swiggy raises $700 million at valuation of $11 billion,” The Times of India, Januray 25, 2022.

<28> ORIOS Venture Partners, “India Tech Unicorn Report 2021”

<29> Srishti Agarwal, “Here Are The 13 Indian Startups That Entered The Unicorn Club In 2022,” Inc42 Media, April 1, 2022.

<30> ORIOS Venture Partners, “India Tech Unicorn Report 2021”

<31> Agarwal, “Here Are The 13 Indian Startups That Entered The Unicorn Club In 2022”

<32> ORIOS Venture Partners, “India Tech Unicorn Report 2021”

<33> Inc42 Media, “Indian Tech Startup Funding Report 2021”

<34> ORIOS Venture Partners, “India Tech Unicorn Report 2021”

<35> TV Mohandas Pai, “India- A Startups Nation”

<36> Inc42 Media, “Indian Tech Startup Funding Report 2021”

<37> ORIOS Venture Partners, “India Tech Unicorn Report 2021”

<38> Subramaniam, “From Nazara To MapmyIndia: Indian Tech Startups Raised Over $7.3 Bn Through IPOs In 2021”

<39> ORIOS Venture Partners, “India Tech Unicorn Report 2021”

<40> Inc42 Media, “Indian Tech Startup Funding Report 2021”

<41> Inc42 Media, “Indian Tech Startup Funding Report 2021”

<42> Gunja Sharan, “Enterprisetech Unicorn Gupshup Marks 2nd Acquisition Of 2022, Acquires AI Startup Active.Ai,” Inc42 Media, April 5, 2022.

<43> Digbijay Mishra, “After BigBasket, Tata Digital acquires online pharmacy 1mg,” The Economic Times, June 11, 2021.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV