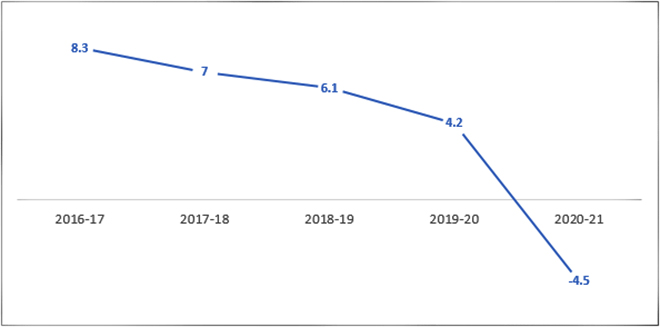

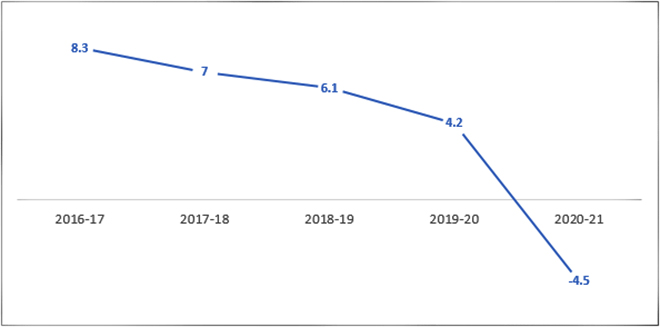

Covid-19 has left the world in great health and economic stress affecting both lives and employment. The global economy is facing an unprecedented slump. Since the Indian economy was dealing with a downturn long before the health crisis hit us, India is under a bigger strain. While the slowdown led to a mere 4.2% growth rate in FY19-20, the emergence of the Covid-19 virus and the onset of the lockdown put India under deep distress taking away many lives. The economic situation is especially grim such that despite rolling out a relief package worth Rs. 20 lakh crores, the India’s forecasted growth rates for FY20-21 were slashed to -4.5% by IMF.

While many hoped that the lifting of the lockdown, implying easing of the supply shock, will lead to a V-shaped recovery for the country, this did not happen. In light of the following, this article argues that the pandemic was only the trigger for such a deep downturn, while the real root of the problem – the problem of inadequate demand – is still left to be addressed. Without that, a sound recovery will be impossible.

The problem of inadequate demand

Indian economy has been experiencing a slowdown since 2017-18, as is evident in figure 1. The reasons cited by the government for the slowdown have ranged from lower industrial growth to falling private consumption to low global growth. Undeniably, there is validity in all these claims – but all of them are rooted in decreasing domestic demand.

Figure 1: Real GDP Growth

Source: IMF World Economic Outlook Update June 2020

Source: IMF World Economic Outlook Update June 2020

Aggregate Demand is the sum private consumption, private investment, government expenditure and net exports. Domestic demand requires the consideration of the first three. As stated above, India was already facing a slump in private consumption. Furthermore, the slowdown in private investment reached a sixteen-year low in September’19 and the government’s capital expenditures have been decreasing as a percentage of India’s GDP. Inevitably, demand fell.

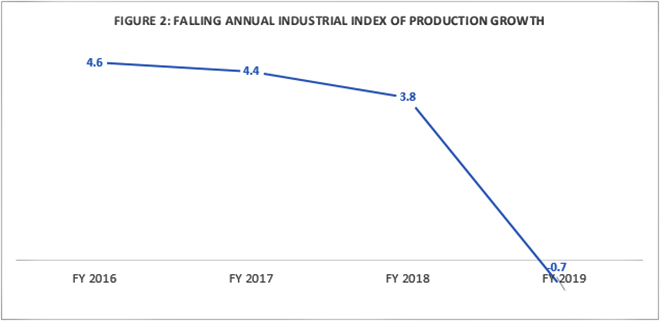

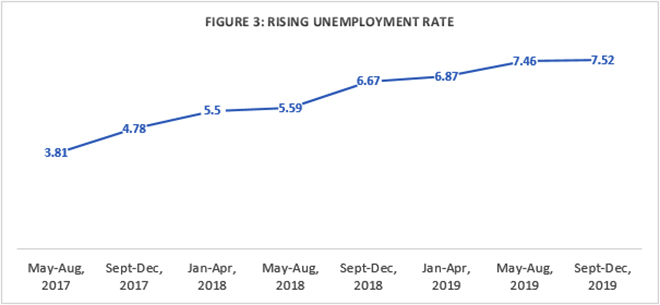

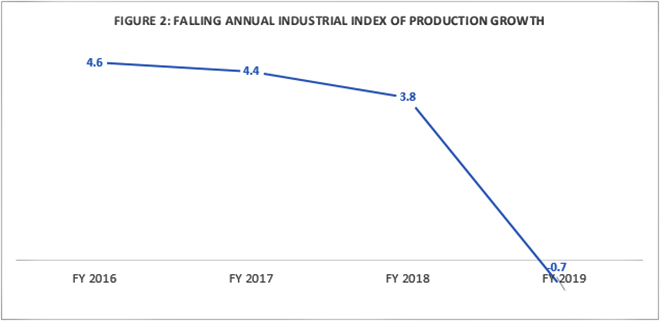

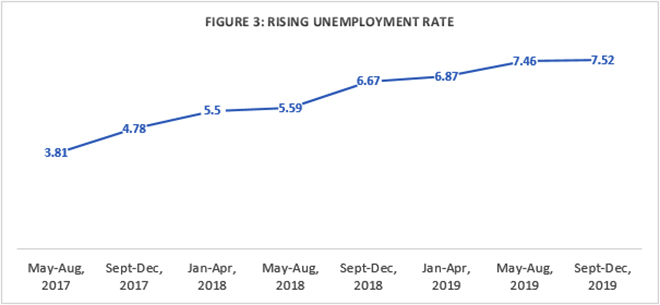

Now, as Keynes explained, when demand for goods and services fall, production is adjusted accordingly. To cut costs due to lower production and sales, wages are lowered, and people are laid off. As unemployment starts to rise, the people who lost jobs, further cut down on their consumption and the economy finds itself in a vicious cycle. The course of this was evident in India even before the pandemic or the lockdown (See Figure 2 and 3).

Source: MOSPI

Source: MOSPI

Source: CMIE Unemployment Data

Source: CMIE Unemployment Data

The only way to get out of this vicious cycle was to stimulate demand; however, the steps taken by the government (like slashing corporate taxes, bank recapitalization and mergers, GST rate cut, amongst others), prior to the pandemic, were mostly supply-oriented.

When the pandemic hit

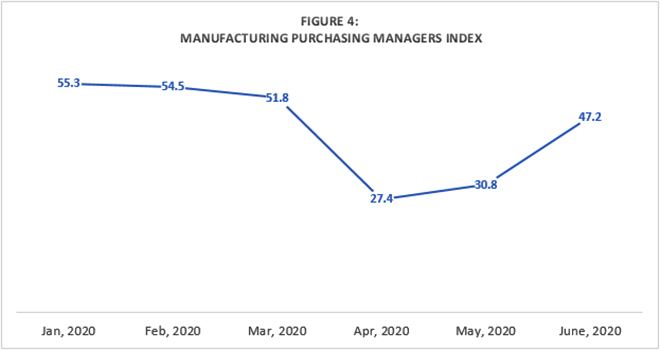

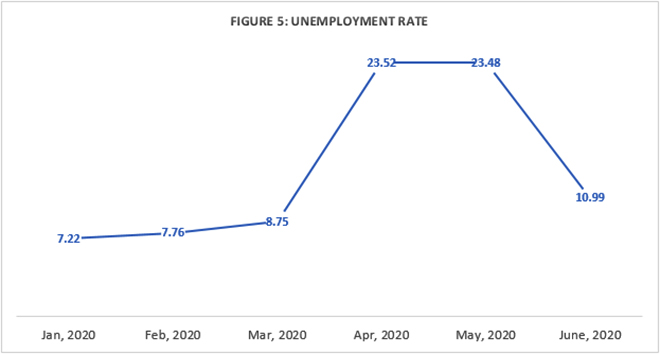

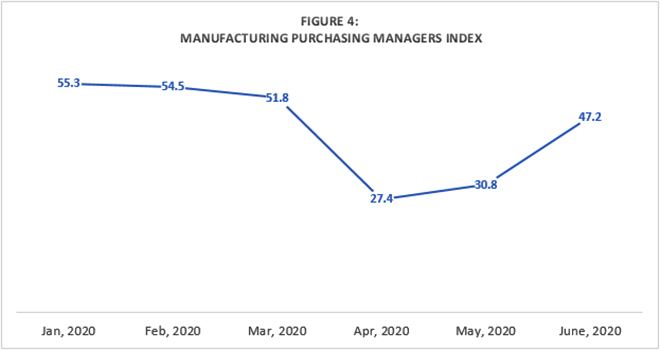

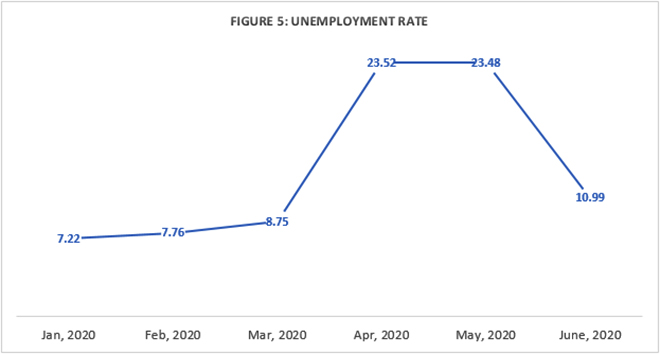

Given the demand problem was left unaddressed, the onslaught of the virus aggravated it. The lockdown to contain the virus led to closure of all manufacturing units and services that did not cater to essential items. This distress of the Indian economy was thus, magnified as the circle of low demand, production cuts and rising unemployment were intensified in the lockdown. As showcased below, the PMI fell down to 27.4% and Unemployment rose to 23.5% in April 2020 (the first month of complete lockdown).

While expectations prevailed that the lifting of the lockdown will lead to a rapid V-shaped recovery as supply shock is eased, that did not happen. Certainly, the indicators recovered a little as the lockdown restrictions eased in May. Manufacturing PMI rose from a mere 27.4% in April to 30.8% in May to 47.2% in June, though that still implied a contraction. The unemployment rate went down from its extreme high levels of above 23% in April and May to almost 11% in June – as indicated in Figure 4, 5. However, the growth was still stunted despite the ‘Unlock’ and way below the already marginal pre Covid-19 figures.

Source: IHS Markit India Manufacturing PMI

Source: IHS Markit India Manufacturing PMI

Source: CMIE Unemployment Data

Source: CMIE Unemployment Data

This slow march to recovery has led many to believe that once covid-19 is contained, the V-shaped recovery India is hoping for, will come knocking. However, scepticism over the anticipated V-shaped recovery is still valid, especially given the rising Covid-19 cases, the inadequate fiscal response - that didn’t address the demand problem appropriately, and limited fiscal space.

India’s relief package

While the Prime Minister’s Atmanirbhar Package claimed to be worth 10% of India’s GDP, the actual fiscal cost to the government (considering only the new relief measures) was just 0.75% of the GDP. Furthermore, it was extensively focused on easing supply, restoring liquidity and building capacity, while addressing the real root of the problem – inadequate demand – was missed.

The issue of demand stretched so far that even good measures like extending credit to MSME and small vendors could not be very successful because of underlying obstacles rooted in inadequate demand. For instance, while, banks to begin with were disinterested in lending to small players, lower demand faced by MSMEs did not create any valid reason for these entities to borrow more. This is because, usually, firms demand for credit given higher demand expectations or new investment. Despite lifting of the lockdown, MSMEs were functioning below full capacity given low demand -- which, then, makes it unlikely for MSMEs to demand loans until there is a rampant increase in demand.

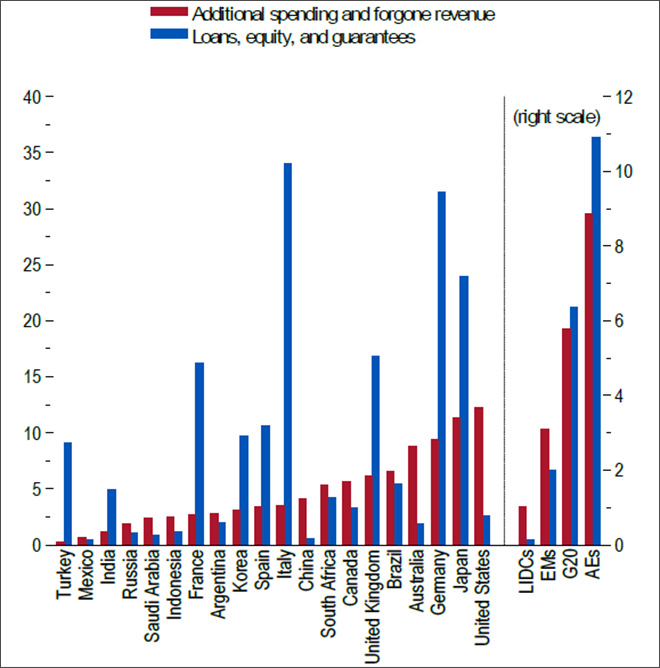

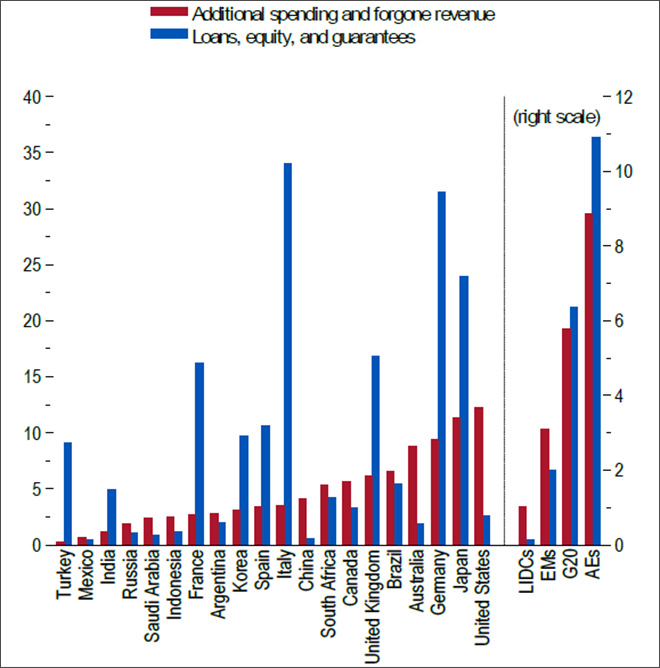

While only focusing on supply and liquidity gaps without paying adequate attention to demand in general, would anyway lead to inappropriate and incomplete effects, the need to remedy the demand problem was more intense in India, given that the country was already facing low domestic demand. Even those G-20 countries which had healthy economies and soaring demand pre-covid indulged in a demand-focused fiscal stimulus to fight the pandemic. Whereas in India’s case, the fiscal measures which would have catered to addressing the demand problem more rapidly – like cash transfers, unemployment benefits, etc (indicated in red in Figure 6) – are well below those in both its developed and developing counterparts.

Figure 6: Country Fiscal Measures in Response to the COVID-19 Pandemic (% of GDP)

Source: IMF World Economic Outlook Update June 2020

Source: IMF World Economic Outlook Update June 2020

Conclusion

Undeniably, the Covid-19 has put India in a rather tough spot. At one hand, the government revenues have fallen leading to less fiscal space to spend; while on the other hand, the inability to spend and failure to support demand-inducing measures, in a crisis like this, will plausibly worsen the already bleak future that lies ahead.

However, a failure to invest in demand at this crucial stage might haunt India in the longer run. Having been in motion for quite some time, the slowdown having been triggered by the pandemic, could lead to a prolonged downturn leading to massive health and economic costs. If not addressed urgently, the problem of inadequate demand could prove to be fatal for growth.

End Notes

This period includes a week of the lockdown.

Since, consumption was being driven by credit growth, the crisis in the NBFC is said to have led to slump in private consumption. This, however, proves that the only thing keeping consumption up was easy lending conditions, implying a weak real demand due to insufficient income growth.

Government capital expenditure has been growing in absolute numbers, but not at as a proportion of GDP - which is how their impact on the economy is measured.

Marginal figures owing to the already present slowdown in the economy.

Those favouring this motion believe that by the next year, things will look better.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: IMF World Economic Outlook Update June 2020

Source: IMF World Economic Outlook Update June 2020 Source: MOSPI

Source: MOSPI Source: CMIE Unemployment Data

Source: CMIE Unemployment Data Source: IHS Markit India Manufacturing PMI

Source: IHS Markit India Manufacturing PMI Source: CMIE Unemployment Data

Source: CMIE Unemployment Data Source: IMF World Economic Outlook Update June 2020

Source: IMF World Economic Outlook Update June 2020 PREV

PREV