This article is part of the series Comprehensive Energy Monitor: India and the World

Background

In 2011, the International Energy Agency (IEA) brought out a

special report titled “Are we entering a golden age of natural gas?” The IEA’s expectation of a golden age of natural gas, though cautious as captured by a question mark, was based on assumptions of (i) an increase in gas use in China, (ii) greater use of natural gas in transportation, (iii) slower growth in nuclear power capacity, and most importantly (iv) an optimistic outlook for gas supply from unconventional gas resources at relatively low cost. That year, natural gas production from the United States at

617.4 billion cubic meters (BCM) exceeded natural gas production from the Russian Federation (616.8 BCM), until then the world’s largest gas producer. Increasing the share of natural gas in the global energy basket was expected to reduce carbon emissions as well as local pollution, diversify energy supply (from secure sources such as the US), and thus, increase energy security, act as back-up capacity for intermittent renewable-based power generation and

increase overall energy supply to meet the growing needs of China and India that were rapidly urbanising.

Consumption Trends: Global

Though environmentalists have not necessarily welcomed the idea of a golden age for natural gas, gas has done well compared to most other fuels barring renewables in the period 2011-2019 (2020 was an unusual year for energy consumption). If renewables are treated as outliers as they receive financial and policy support that other fuels do not, natural gas comes out as the best performing fuel with a growth of over

20 percent in 2011-2019. In this period, primary energy consumption grew by about 12 percent, hydropower consumption by over 15 percent, oil consumption by over 10 percent while coal consumption

declined by 0.54 percent. The IEA report projected that the share of natural gas in the global primary energy basket would increase from about

22 percent to over 25 percent by 2035. In 2021, the share of natural gas in the global primary energy basket was close at

24.7 percent.

China’s growth was driven by strict mandates to substitute coal with natural gas and also by the investment in infrastructure such as pipelines.

Most of the growth in natural gas consumption in 2011-19 occurred in countries that were net

exporters of gas such as the US (28.9 percent), Iran (46.1 percent), and Canada (16.48 percent) but China, a net importer of natural gas was an exception with gas consumption growing by over 138 percent. In the US the share of natural gas in its primary energy basket increased from 25 percent to over

32 percent in 2011-2019 and in China it increased from about 4.8 percent to 7.8 percent. China’s growth was driven by strict mandates to substitute coal with natural gas and also by the investment in infrastructure such as pipelines.

Consumption Trends: India

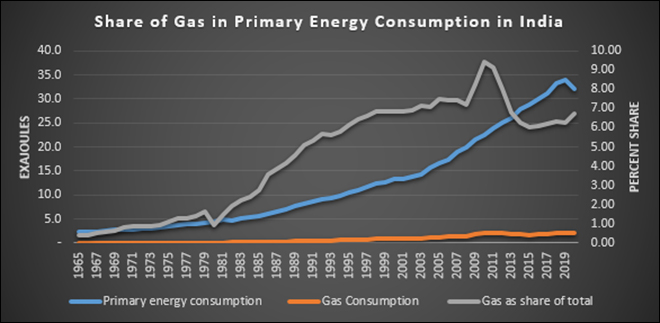

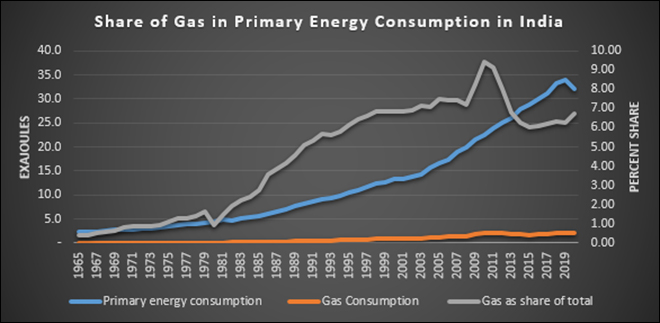

The idea of making India ‘

a gas-based economy’ was initiated in 2016, when the dream of a golden age of gas was fresh and promising. The quantitative task under this narrative was to increase the share of gas in India’s primary energy basket from about 6 percent in 2016 to 15 percent by 2030. The

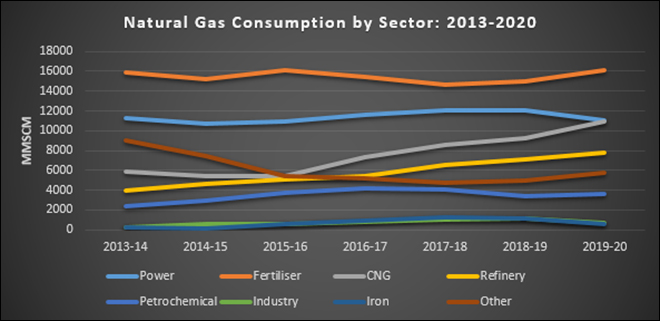

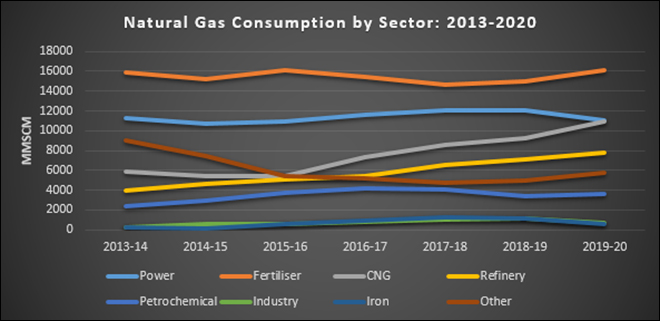

IEA report pinned its hope for a golden age for gas on consumption growth in India along with China. But India did not live up to the expectations. Natural gas consumption fell by about

1 percent in 2011-2019 and the share of gas in India’s primary energy basket fell from its peak of 9.4 percent in 2010 to

6.29 percent in 2019 (share without biomass in total primary energy consumption). Between 2013-14 and 2019-20, consumption of natural gas in power generation fell

marginally by over 2 percent and consumption from the fertiliser segment increased only slightly by just over 1 percent. These two segments that accounted for over

42 percent of consumption in 2019-20 are showing flat or negative growth which explains the slow growth of gas consumption. However other segments have shown phenomenal growth in the same period. CNG (compressed natural gas) consumption (including transportation) grew by over

1,700 percent, industries by over

160 percent, refining by over 96 percent, petrochemicals by over

40 percent and sponge iron by over

310 percent. Unlike other countries in which gas consumption was driven by power generation, India leans heavily on growth in household and transportation segments served by CNG. Unlike the power and fertiliser segments consumers (vehicles and households) are dispersed which increases transaction costs. This slows down overall gas consumption growth.

Source: Ministry of Petroleum & Natural Gas, MMSCM: metric million standard cubic meters

Source: Ministry of Petroleum & Natural Gas, MMSCM: metric million standard cubic meters

Challenges in India

The share of natural gas in India’s energy basket increased marginally to

6.7 percent in 2020, despite the overall decrease in energy consumption primarily because of the fall in global liquefied natural gas (LNG) prices. It is unlikely that this trend will be sustained in 2021 given the phenomenal increase in international gas prices in the second half of the year. In the early 2000s, consumption of natural gas, led by the power and natural gas segments, increased mainly because of the availability of affordable domestic gas from the east coast of India. When production of domestic gas fell from this region, consumption declined with it. This points to two key challenges that inhibit gas consumption growth in India: High price and high transaction costs in growth segments like CNG. Substitution of gas for biomass used as fuel for cooking reduces emission of black carbon (soot) and carbon monoxide. In transportation, substitution of gas for liquid petroleum fuels reduces exhaust emissions—that is the primary cause of fog in Northern India—and in power when gas is substituted for coal, it reduces carbon emissions by half. As many

industry experts have pointed out, to improve the pace of India’s dash for gas, at least a fraction of the policy and financial support that renewable energy receives needs to be extended to natural gas which reduces carbon emissions in all segments of end use. In addition, natural gas does not pose the problem of intermittency in power generation from renewables that requires expensive stand by power.

Source: BP statistical Review of World Energy 2021

Source: BP statistical Review of World Energy 2021

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV