The changing dynamics in the Indian economy

The Indian economy has traditionally been considered a supply-constrained one. However, ever since the reforms of 1991, reports suggest that the Indian economy has transitioned from a supply-constrained economy to a demand-constrained one—which essentially means remedial measures should be focused on policies aimed at demand factors, rather than supply-side interventions only. The current economic contraction should not be written off as a one-time effect of the COVID-19 crisis but rather as a continuation of the existing trends in falling aggregate demand augmented by the pandemic.

Traditionally, all capitalist economies have been demand-constrained economies. This is because of the presence of a natural rate of unemployment or the availability of a “reserve army of labour”. In contrast to this, classical socialist economies have a central planning system, ensuring that there is no excess capacity in the production system, resulting in a supply-constrained economy. India, having adopted a mixed economy after her independence, faced a peculiar problem in the initial years. There was considerable underutilised capacity in the industrial sector but the agricultural sector, particularly foodgrains production, remained largely supply-constrained.

IIndia, having adopted a mixed economy after her independence, faced a peculiar problem in the initial years.

The demand-related issues for the Indian economy can be empirically verified from observing the changes in parameters such as unemployment rates, inventory ratios, the degree of capacity utilisation, and inflation rate. The unemployment rate, for example, had doubled in the years 2017-2019. Similarly, for a resource-constrained economy, increase in demand would cause prices to increase, as the economy is an efficient one (full employment of capital and labour). At least this has been the case for India in the agricultural sector. However, in the period of 2016-2019, consumer food price inflation has averaged year-on-year at a rate of 1.3 percent, compared to the decade of the nineties and the period between 2008 and 2016 where it averaged at around 9.8 percent, indicating a slackening in aggregate demand conditions even before the pandemic hit.

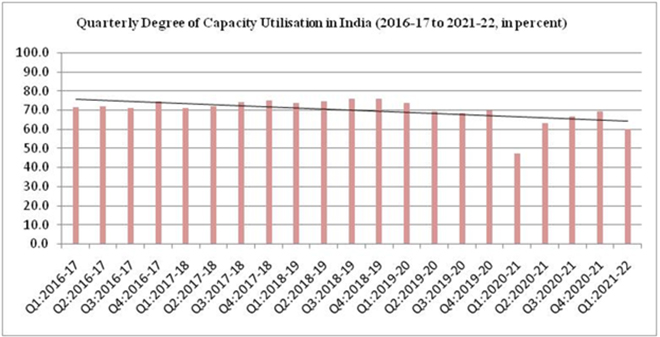

Capacity utilisation, consumption demand, and investor confidence

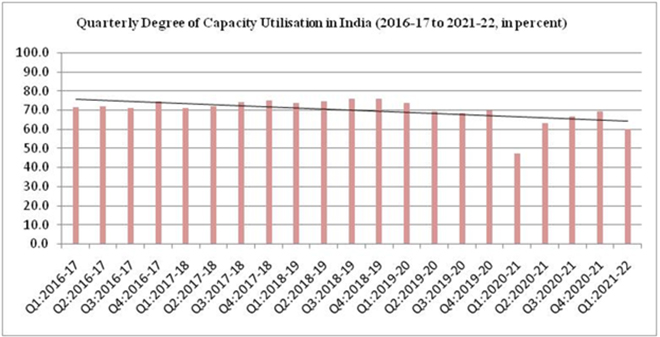

The degree of capacity utilisation, measured as a ratio of the actual output produced in the economy to the potential output that can be produced given the resources of the economy, is a good measure of the existing excess capacity in an economy. For India, the RBI conducts periodic surveys across manufacturing industries to measure their degree of capacity utilisation which serves as an indicator of the level of demand for manufactured goods in India over a given period. Over the period 2016–17 to 2021–22 (Q1), the degree of capacity utilisation in Indian manufacturing industries has remained below 75 percent, with a declining trend over the years. During the first quarter of 2020-21, there was a massive dip in this ratio; however, it is largely attributed to the lockdown measures announced by the government. But, even after the restrictions were eased, the capacity utilisation in manufacturing has failed to recover fully.

Figure 1: Quarterly Degree of Capacity Utilisation in India (2016-17 to 2021-22, in percent)

Source: Authors’ own, data from: OBICUS Survey on the Manufacturing sector, RBI

Source: Authors’ own, data from: OBICUS Survey on the Manufacturing sector, RBI

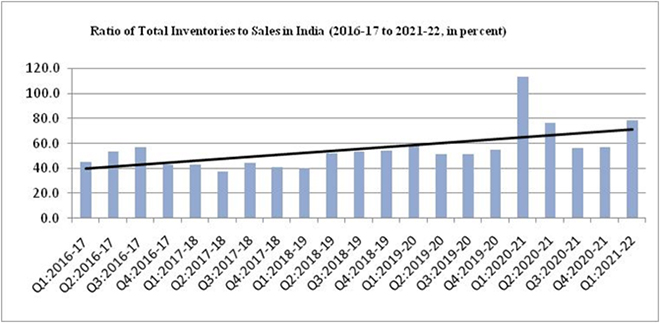

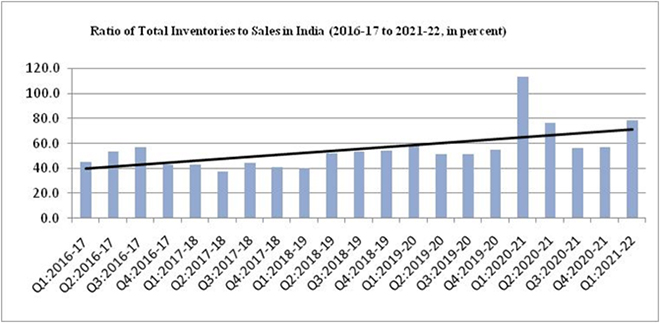

Moreover, the ratio of total inventories to sales in manufacturing industries has also seen a rising trend over the same period. This can be observed due to two plausible phenomena, namely, higher growth in production of final goods/ raw materials compared to growth in sales or decline in sales despite adequate production. Higher growth in production compared to sales would, however, also reflect in a rising degree of capacity utilisation over that period, which has not been the case. This indicates that there has been an actual fall in consumption demand in the manufacturing sector leading to a decline in sales. In this context, unfortunately it is only rational for businesses to withhold any future investments until the existing excess capacity is subsumed in the production processes.

Figure 2: Ratio of Total Inventories to Sales in India (2016-17 to 2021-22, in percent)

Source: Authors’ own, data from: OBICUS Survey on the Manufacturing sector, RBI

Source: Authors’ own, data from: OBICUS Survey on the Manufacturing sector, RBI

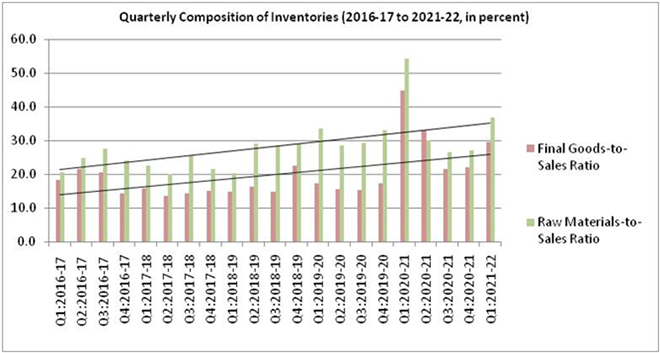

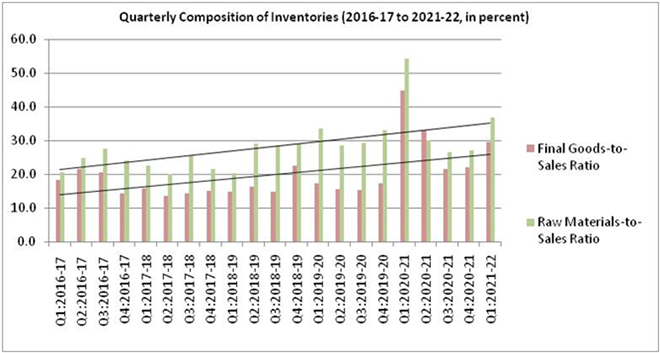

A closer inspection of the composition of inventories corroborates our understanding of this business sentiment. The total inventories-to-sales ratio is further decomposed into final goods inventories-to-sales ratio and raw material inventories-to-sales ratio. While both the ratios have shown an increasing trend over the past few years, the rate of increase in raw material inventories has been sharper compared to the final goods inventories. Declining sales has led several firms across industries to incur large operating losses, ultimately forcing them to shut their operations and establishments. From 2016-17 to 2021-22 (Q1), the raw material inventories-to-sales ratio has increased relatively steeply. This rise in the ratio is indicative of, not only slackened demand conditions, but also adequate supply of resources over the period. A more interesting fact is reflected through a comparatively lower and relatively less steep increase in the final goods inventories-to-sales ratio over the same period. Despite adequate supply of raw materials, inventory accumulation and excess capacity, the production of final goods has remained arrested. Hence, in the current scenario, businesses are not only weary of future investment prospects but also reeling under the pressure of excessive inventory accumulation. While declining investment rates is a cause of concern in the medium- and long-run, in the present context, this apparent arrest of production of final goods has major implications for the Indian labour market, which directly spills over on the aggregate consumption demand in the economy.

Figure 3: Quarterly Composition of Inventories (2016-17 to 2021-22, in percent)

Source: Authors’ own, data from: OBICUS Survey on the Manufacturing sector, RBI

Source: Authors’ own, data from: OBICUS Survey on the Manufacturing sector, RBI

Even with some high frequency indicators suggesting a revival in demand accompanying simultaneous easing of lockdown restrictions as well as pick-up in vaccination pace, the RBI has been careful in its growth projections for the remaining quarters. While the initial rise in consumption demand may be a result of pent-up demand reaching the markets with the ebbing of the pandemic, it is crucial to sustain and further stimulate this consumption demand. This will not only directly translate into economic growth in the short- and medium-run but also incentivise private investments in response to higher capacity utilisation propelling the economy into a higher growth trajectory. Until now, which the central bank has pointed out as well, there has only been a slight increase in capacity utilisation which does not deliver much for the prospects of new investments. Hence, an adequate revival of consumption demand is crucial for achieving sustainable economic growth.

A more interesting fact is reflected through a comparatively lower and relatively less steep increase in the final goods inventories-to-sales ratio over the same period.

Whither to in 2022?

The Indian economy is also currently faced with worrying trends of inflationary pressure fuelled by sustained high prices of products in manufacturing and fuel and power categories. Until now, while the central and state governments continued efforts towards economic revival, higher revenue collection from relatively higher fuel taxes provided a buffer to the flailing fiscal situation. This path now seems relatively difficult to manage. Moreover, upward inflationary pressures can also adversely affect the central bank’s attempt to affect economic recovery through low lending rates, thereby, posing a threat to private investments. Therefore, striking the critical balance between revival of consumption demand and controlling inflation will be important. Simultaneous consumption-led growth alongside increase in productive capacity will be crucial to the achievement of the envisaged economic recovery.

Following from the Union Budget 2021, there will also be high expectations from the budget in 2022 in terms of enhancing productive capacity and enabling greater capacity utilisation to set the stage for the pandemic-induced economic recovery processes. Finally, as we end the year 2021 with new fears of the Omicron variant, the year 2022 will be one of the most crucial years for the Indian economy to establish if it has learnt some lessons (in the last two years) in being pandemic-smart with respect to the restrictions, lockdowns, and market uncertainties, or will the situation worsen further as it grapples to deal with an impending third bout.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV