In recent years, the India-China bilateral relationship has been characterised by historical animosities and border disputes. Nevertheless, the economic ties have grown since the early 2000s and have been at the forefront of this relationship. Trade and investment have provided a cushion to this otherwise tricky relationship.

China forms an integral part of the global supply chain, and India too is heavily dependent on Chinese imports, ranging from a variety of raw materials to critical components.

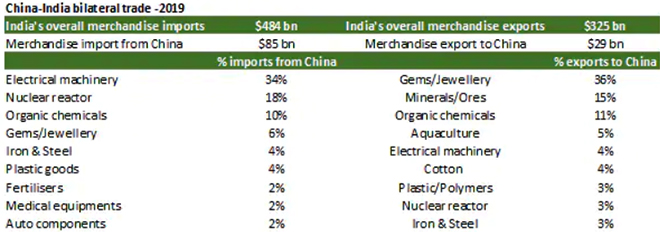

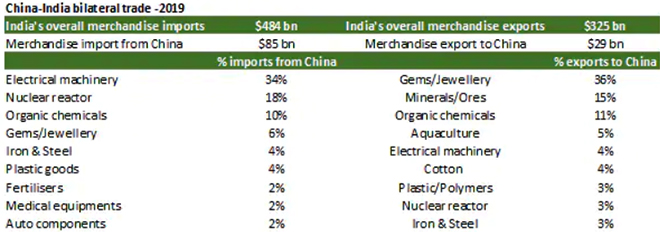

The bilateral trade that stood at US$ 3 billion in the year 2000 grew to US$ 92.68 billion in 2019. China was India’s second-largest trading partner in 2019 and emerged as the largest trading partner in the first half of FY 20-21. The bilateral trade declined by only 15% compared to a 32.46% decline in overall trade in 2020-21. China accounted for 5% of India’s exports and 14 % of India’s imports in 2019. This had led to a very high trade deficit of US$ 56.77 billion in 2019. Attempts have been made to reduce the India-China trade deficit through bilateral talks. The issue, for instance, was raised at the bilateral informal summit in Mahabalipuram, and both sides agreed to set up a new high level economic and trade dialogue mechanism to address this issue.

China forms an integral part of the global supply chain, and India too is heavily dependent on Chinese imports, ranging from a variety of raw materials to critical components. According to data from 2019, a staggering 70% of electronic components, 45% of consumer durables, 70% of Active Pharmaceutical Ingredients (APIs), and 40% of leather goods come from China. According to a response to a query in Rajya Sabha, India has the world’s third-largest pharmaceutical industry for which 2/3rds of its key ingredients come from China.

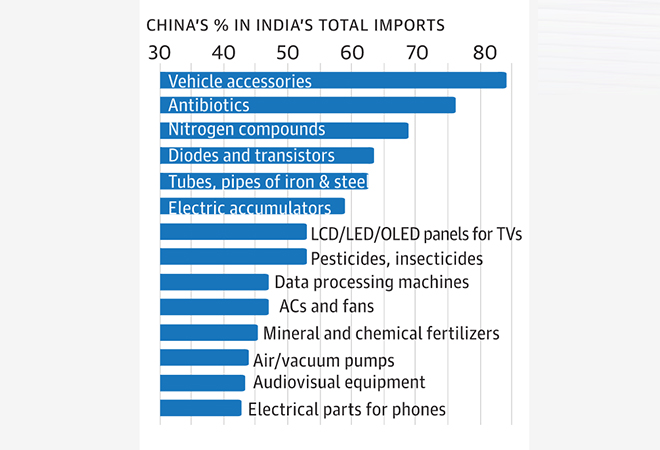

Source: Moneycontrol, CRISIL

Source: Moneycontrol, CRISIL

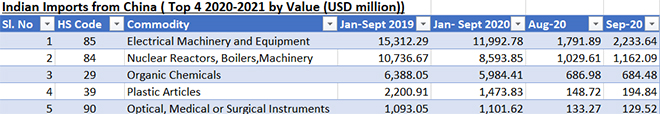

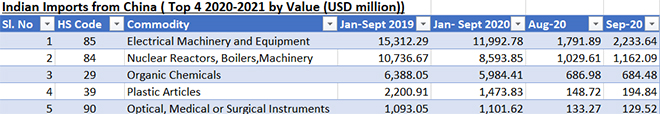

Lockdown in China led the trade to fall by about 12.4% to US$ 12 billion in 2020 for the first two months of the year compared to the same time period in 2019. The imports fell to record lows of US$ 3.2 billion both in April and May, the period of lockdown in India. Meanwhile, the Galwan Valley incident in mid-June led to calls for boycotting of Chinese goods. According to a survey conducted by Local Circles, 87% of Indian consumers were willing to boycott Chinese goods. One of the prime campaigns was to boycott Chinese goods for Diwali and it was seen that even in the Prime Minister’s home state of Gujarat in Ahmedabad, 80% of the decorative lights and LEDs sold in shops were still ‘Made in China.’ In July, Chinese imports increased to US$ 5.6 billion, to almost pre-lockdown levels.

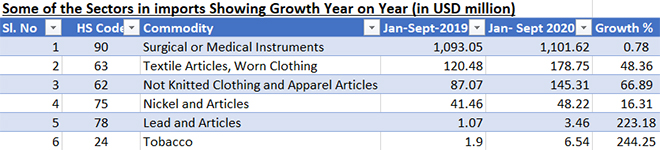

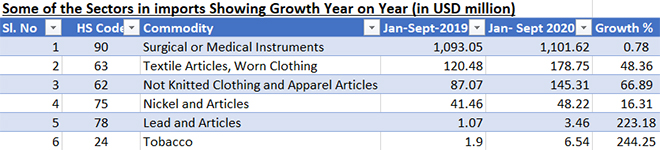

China’s share in India’s import basket has increased to 18.11% in the April-August period. The recovery of imports in July was led by organic chemicals, electrical machinery and equipment, pharmaceutical products, and medical equipment. The monthly trade of organic chemicals, electrical machinery, boilers, and machinery in September reached levels comparable to those from the previous year. Pharmaceutical product imports hit a record high this year at US$ 30.12 million in July showing a record growth of 50.32% compared to the previous year leading the Chinese exports to India. Various sectors including surgical or medical instruments have shown growth.

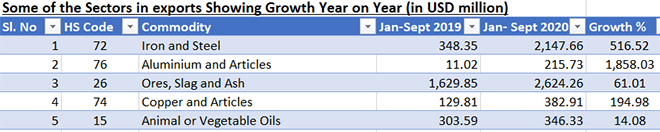

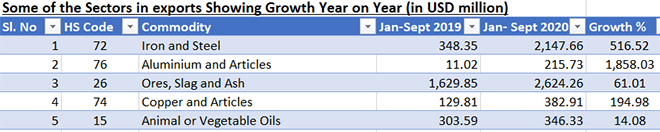

Mineral ores, mineral byproducts, organic chemicals among others formed the bulk of the exports from India to China in 2019-20. Exports to China have surged this year even after the Galwan Valley clash. Exports to China grew at a rate of 26.19% compared to a decrease in overall exports at 21.13% in 2020. Organic chemicals is one of the sectors where China has a 15% market share worth US$ 1.34 billion in the Indian exports. The exports of plastics to China from India have also increased by 71.8% to US$ 751.58 million from US$ 437.47 million. But this significant growth in exports to China has been led by a big increase in exports of iron and steel, with total exports to China at US$ 2.147 billion in Jan-Sept 2020, up from US$ 348.35 million in the same period last year. China’s share in the total exports stands at 9.1% in the April-August period up from 5.3% in 2019-2020.

Post-pandemic, China’s economy has managed to get back on track with a positive growth rate. This growth in domestic demand has led to this exponential growth in exports of iron and steel from India. One major difference that has been noticed is that Indian exports in this sector have moved away from raw material like ores to finished and semi-finished goods, highlighting the increased global competitiveness of Indian companies. China constituted around 90% of the Indian iron ore exports worth US$ 1.92 billion in the April-September period of 2020 with an 83.91% growth year on year.

Effect of the Galwan Valley incident

There has also been an effort to reduce India’s dependence on Chinese goods. The Indian Railways, for instance, cancelled an INR 471 Crore deal with a Chinese firm. Similarly, state-owned telecom firm BSNL was instructed not to use gear from Chinese firm Huawei for a network upgrade. The government has mandated all products to have the Country of Origin tag for products on the Government e-Marketplace in an effort to identify Chinese-origin goods. In early July 2020, the Ministry of Power restricted power supply systems and networks import from China citing cyber and security threats, which constitute about 30% of the total imports from China. In the last 10 years, 12,540 MW out of 22,420 MW of the supercritical power plants were built using Chinese equipment. India also extended safeguard taxes on imports of solar cells and modules as well as imposed anti-dumping duty on several goods. In July, India placed colour television sets imports under the restricted category, thus requiring a licence to import; and air conditioners under the prohibited category. The effects of these moves cannot be measured immediately.

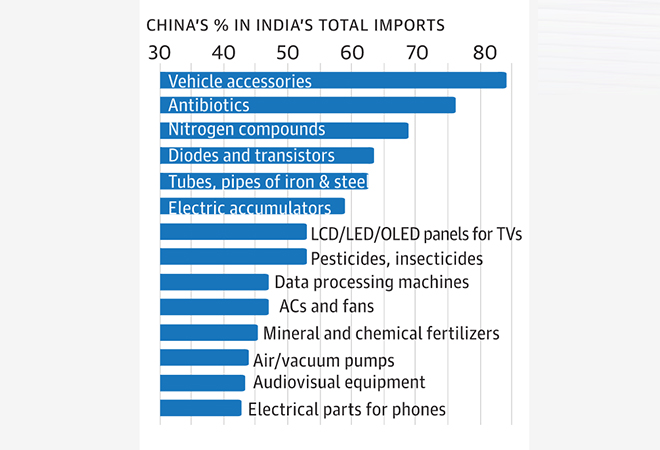

Chart depicts the imported products for which India depends on China the most.

Chart depicts the imported products for which India depends on China the most.

But the Indian economy is deeply intertwined with Chinese exports. China’s share in Indian imports for intermediate goods, capital goods, and final consumer goods is 12%, 30%, and 26% respectively. India depends on China in many key industries from electrical machinery and appliances to pharmaceutical drug API. In recent years, there have been certain mobile companies shifting their assembly lines to India, which is a step in the right direction but still, all the key high-end manufacturing components like the display, chipset, and memory are being imported from China. India has banned key imports in the electrical machinery sector citing the availability of technology in India but what needs to be seen is how competitive it is, quality and cost-wise.

India depends on China in many key industries from electrical machinery and appliances to pharmaceutical drug API.

Cost is a vital reason why Chinese products dominate markets across sectors. Products such as fertilisers are 76% cheaper, electronic circuits 23%, and data processing units around 10% cheaper if made in China. It will be hard to substitute or compete with those prices. Since the pandemic, there are calls to diversify the supply chain. The Indo-American Chamber of Commerce said that around 1,000 firms were planning to leave China but only 300 of them were serious about investing in India.

The current trade scenario suggests that the nationalistic notions of bringing China to its knees by boycotting Chinese goods has been a flop. The simple example that even a good as small as LEDs are still cheaper than Indian alternatives by almost 50% despite a 40% hike in prices of the Chinese goods is indicative of that. This indicates that India needs to undertake a series of reforms like land and labour reforms to foster growth and investment. India also needs to scale up domestic production in key sectors including electrical machinery and pharmaceuticals to replace those imports. Without any of these key reforms, the Prime Minister’s call for ‘Aatma Nirbhar Bharat’ will remain a mere slogan as it currently appears to be now and that is why we see a booming trade relationship between India and China after the Galwan Valley incident and will continue to see a significant dependence on China for the foreseeable future.

The author is Research Intern at ORF.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source:

Source:

Chart depicts the imported products for which India depends on China the most.

Chart depicts the imported products for which India depends on China the most. PREV

PREV