This is Part 1 of a two-part series. The second part will be published tomorrow.

This is Part 1 of a two-part series. The second part will be published tomorrow.

Climate crisis and the commitment of nations to adhere to the Paris Agreement may lead to the problem of stranded assets in coal. Stranded assets as per the definition of the International Energy Agency are assets that cease to earn an economic return much before the end of their economic life. The risk of stranded assets in the coal industry could be on account of a number of factors from shifts in demand towards renewables, lack of policy support from the government and lowering costs of investments in renewables. As per some estimates, the quantum of stranded assets globally could be as high as US$ 900 billion. This further raises questions about the financial consequences for corporates, banks and financial institutes that have resources locked in coal assets.

This has been acknowledged globally, institutions are seeking to limit or pull out of coal investments. More than 100 financial institutions have plans to move away from investments in the coal sector since 2013. 40% of top global banks and 20% global insurers have divested from coal investments. The trend continued in 2019 with insurers limiting their coal investments and underwriting of new coal projects. Many companies are now reassessing the long-term risks of investing in coal and exiting from coal investments.

Japan is the largest public funder of international coal projects, after China, and this has been part of its export strategy. It has faced criticism for its support of coal projects in Asia, including India. Recently, the government of Japan announced a new policy that will stop any future funding of coal projects abroad. Even individual firms have taken independent decisions to withdraw from coal investments. In addition to facing pressure to lower its carbon footprint, Japan faces a potential stranded assets problem worth US$ 71 billion.

South Korea is another major financer of overseas coal projects. The decision by Japan to end state support for coal projects has put pressure on South Korea to take more action to put a stop to funding coal projects abroad as well as to shift to cleaner fuels domestically. South Korea has invested about USS $10 billion from 2008 to 2018 in overseas coal projects. As part of the stimulus package to combat the economic downturn due to the pandemic, the Green New Deal with a focus on clean energy was announced. However, it was non-committal with respect to its investments abroad.

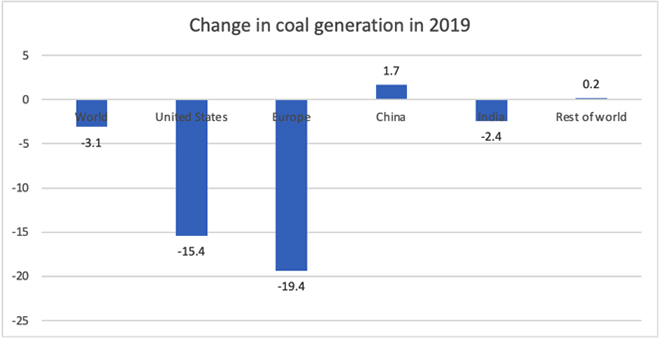

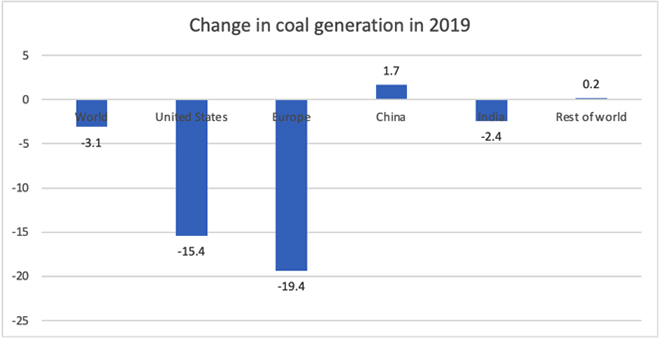

Global investment in coal projects declined by 75% in the last three years. In 2019, as shown in the figure below, coal generation fell by 3% for the world as a whole, a fall after three years of growth. In India as well, there was a fall for the first time in 2019.

Source: International Energy Agency

Source: International Energy Agency

But overall, the fall in coal investments has been more than compensated by a growth of coal-fired power sector by 63% in Asia, with many projects in the pipeline. Demand for coal is not expected to peak till at least another ten years. Asia dominates the demand for coal globally where it is the chief source of electricity generation. Vietnam has 32 GW of projects to add to the coal capacity of the country. As per their Power Development Plan, share of electricity generated by coal will increase from 33% in 2018 to 56.4% by 2030. While the share of renewable fuels will also increase, coal will remain the principal source of electricity. Similarly, coal will dominate India’s electricity generation with a share of 50% by 2030, even though it would be a fall from the current level of 72%. Further, the fourth tranche of the stimulus package announced measures that gave a boost to the coal industry in India. China has similarly, approved coal projects in the wake of the current economic crisis.

The huge demand for coal and the profit motive are the main reasons the sector continues to attract investments. But the growing risk of stranded asset may lead to a trend away from coal investments. As per study by carbon tracker, 40% of coal plants in China are now losing money.i Some companies risk losing more than their total capital in stranded assets. Newer methods are helping to more accurately estimate stranded asset risk and aid policymakers to frame stronger policies that restrict future coal investments and plan exits. Policies could require companies to improve transparency about the climate change risks associated with their investments.

Without adequate policy pressure, the sector will continue to attract investments as long as the returns are positive. Further, the level of investments in cleaner fuels is not at the rate that would enable it to meet the current consumption requirements of the world. Hence, coal and renewable fuels will co-exist for some time. However, going forward, stronger policy initiatives are required to gradually phase out coal investments and ensure faster adoption of cleaner energy.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This is Part 1 of a two-part series. The second part will be published tomorrow.

This is Part 1 of a two-part series. The second part will be published tomorrow.

Source: International Energy Agency

Source: International Energy Agency PREV

PREV