For the second most populous country in the world, the health expenditure in India is amongst the lowest at 3.54 percent of the Gross Domestic Product (GDP). Of this, the share of public expenditure is about 1.28 percent of the GDP, indicating that healthcare in India is largely privately owned. In such a market, health financing tools become an important social security measure. It not only enables access, but also generates demand for improved healthcare and ensures financial risk protection. An efficient health insurance market, therefore, reduces the ‘out of pocket’ healthcare expense burden on individuals, which can otherwise push households into poverty. But, in India, the ‘out-of-pocket’ expense on healthcare is a high 62 percent, which is indicative of the fact that health insurance in India is producing sub-optimal outcomes.

Building a robust health insurance market to enable access to healthcare was one of the drivers for the government to open up the insurance sector to private participation in 2000. The Insurance Regulatory and Development Authority of India (IRDAI), which came into existence as a result of privatisation, was handed the dual role of developing as well as regulating the insurance sector.

Ailing private health insurance sector

But two decades later, the report card for commercial health insurance ranks poor. Commercial health insurance is headlined not only by under-penetration—only 137 million lives were covered in FY20—but also market failure. The growing instances of market failure can be evidenced through health risk selection (cream skimming), shallow coverage, high administrative costs and low burning ratios.

A huge part of the problem is the unmet need to build and strengthen a regulatory structure in the healthcare sector, the lack of which is currently impeding the way the private insurance market is working in the country. This is one of the reasons why despite increasing medical costs, health insurance has seen fewer clients. This is also why health insurance cover continues to focus narrowly on hospitalisation expenses (in-patient care) instead of the broader spectrum that includes preventive healthcare and out-patient costs which is essential for long-term sustainability of health financing.

A huge part of the problem is the unmet need to build and strengthen a regulatory structure in the healthcare sector, the lack of which is currently impeding the way the private insurance market is working in the country. This is one of the reasons why despite increasing medical costs, health insurance has seen fewer clients

Even within this narrow scope of coverage, and despite important reforms to make health insurance more comprehensive, health insurance products come with complex constructs laced with waiting period exclusions, exclusions in terms of non-payable items, and other contractual disallowances compounding information asymmetry further leading to market failure. This is also why health insurance sees the highest bucket of complaints after life insurance policies. In fact, a huge number of the complaints in health insurance originate while making a claim, pointing to a lack of understanding on the part of the insured.

Figure 9: Complaints by policy type

| Total complains in 2019-20 |

215,205 |

| Policy type |

Share of complaints ( percent) |

| Conventional life insurance policy |

63.36 |

| Health insurance policy* |

1.18 |

| Others |

1.89 |

| Pension policy (other than unit linked) |

2.31 |

| Unit linked insurance policy |

8.03 |

| Health insurance policy |

14.32 |

| Motor insurance |

5.73 |

| Others |

2.36 |

| Fire |

0.44 |

| Crop |

0.23 |

| Marine cargo |

0.1 |

| Engineering |

0.02 |

| Marine hull |

0.02 |

| Credit |

0.01 |

| *Health insurance policies sold by life insurance |

| Source CAB FY20 |

|

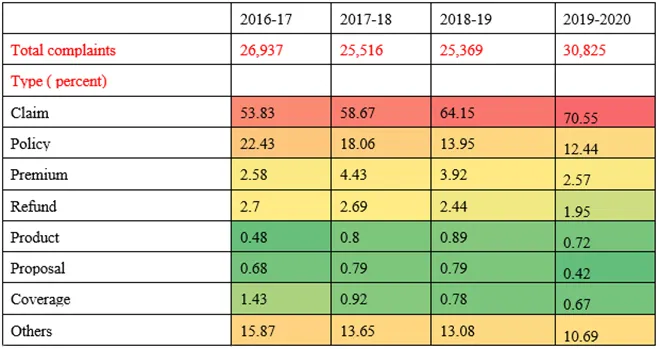

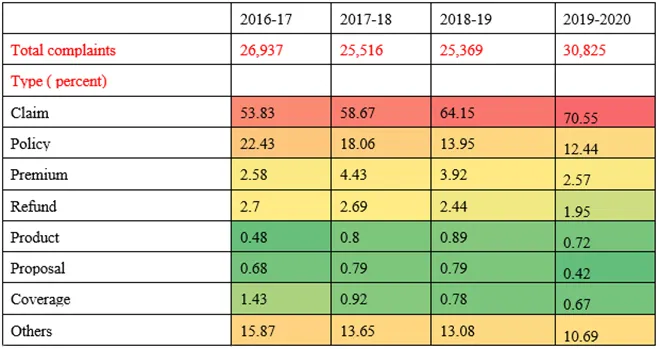

Figure 12: Breakup of health insurance complaints

CAB FY19 and FY20

CAB FY19 and FY20

The Insurance Ombudsman too, in its annual report for FY19, has pointed out unhealthy selling practices and the casual approach to filling up proposal forms and non-disclosure of terms and conditions as the genesis of most complaints. While the point of sale may see a casual approach towards non-disclosure of personal medical information, verification of pre-existing conditions or previous claims history in case of ported policy, point of claim is followed by thorough scrutiny by the insurer. Front-ending underwriting at policy issuance instead of a claim can reduce customer grievance to a large extent.

Sour claims experience can push customers towards lapsing their policies and it’s important to study the impact of market failure on lapsation; but there exists no data in the public realm. Persistency of health insurance policies, acceptance rate of the insured (percentage of applied customers that were actually insured), claims settlement rate (segregated into retail and group buckets) are some of the important markers to assess the performance of an insurance company, but public disclosure documents mandated by the insurance regulator don’t have such customer facing data sets yet.

Looking at persistency across age groups is also important from a pricing standpoint. Health insurance pricing for retail still remains in the clutches of legacy lethargy and high embedded cost of distribution. Retail health insurance has always followed an ‘age-band pricing’ approach where policyholders in a particular age band pay an identical premium and see their premium jump as they move bands, especially amongst higher age groups. Adding to this is the premium revision by insurers, usually in a block of two-four years to keep pace with medical inflation. These factors together can see premiums jump to as high as 50 percent on renewal leading to large risks of selective lapsing. It’s important to insulate the older cohorts from pricing shocks and at the same time encourage younger people to buy health insurance, yet despite regulatory nudges insurers have not adopted differential pricing where customers who have been with the insurer for long benefit cost-wise.

Retail health insurance has always followed an ‘age-band pricing’ approach where policyholders in a particular age band pay an identical premium and see their premium jump as they move bands, especially amongst higher age groups. Adding to this is the premium revision by insurers, usually in a block of two-four years to keep pace with medical inflation

In addition, the high cost of acquisition in retail health insurance that further reduces the risk premium (cost of insurance) for insurers, necessitating regular premium hikes. Regulations allow a 15 percent payout to insurance intermediaries. This is, however, not a one-time payout but a recurring one and that too on a premium that increases overtime. High administrative cost is one of the reasons why insurers don’t pass on the benefits of a low claims ratio in the retail bucket to the customers.

Urgent need to resuscitate

Even after 20 years of privatisation, the health insurance market in India is fairly nascent going by the number of people covered. It is, therefore, important to address issues of market failure early on. Health insurance reforms need a two-pronged approach. There needs to be a more collaborative effort on the part of the government to fix the larger healthcare ecosystem in terms of some regulatory oversight the will give insurance industry the confidence to step out of their comfort zone. But, even within the health insurance sector, there is enough scope for improvement. For example, while the product construct remains largely focused on in-patient coverage, care set-up or the route of administration or manner of hospitalisation still form the basis of eligibility for insurance claims. Insurance needs to evolve towards ‘episode of care’, especially in critical illnesses where if an ailment is insured, coverage should be extended to all treatment modalities for it.

Hence, it is important to have a health committee that can identify indications of right drugs and procedures to enable avoidance of unnecessary lines of treatment or excesses. On similar lines, the insurance regulator did propose setting up a health technology assessment committee, but it’s yet to see the light of day. Pricing of health insurance policies too needs immediate attention for a healthy long-term persistency. This again needs regulatory intervention in terms of reviewing intermediary costs and pushing the industry towards a more dynamic pricing structure. Work is also required on a transparent benchmark that captures medical inflation, facilitating regulatory monitoring of pricing, and making price hikes more predictable and transparent.

Improving public disclosures is again important and perhaps the easiest to implement. This will not only supply information to the market but will also increase competition. There is huge scope for improvement in the health insurance market, and the work needs to begin with the insurance regulator. There is a growing need for the regulator to review and expand capacities for proactive regulations and enforcement.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV