The Russian invasion of Ukraine brought with it numerous concerns. A worsening humanitarian crisis and the threat posed by the ongoing war in Europe in food and energy security have ballooned its impact worldwide. However, the most pressing concern for the European Union (EU) has been the energy crunch which the continent faces ahead of the winter season. The war has brought to the fore Europe’s harsh reality of being reliant on Russian energy supplies. Hoping to coerce Russia into a withdrawal, the West imposed sanctions on Russia. This proved counterproductive; Russia shocked the global order by imposing self-sanctions and limiting gas supplies to its largest consumer—Europe. Gazprom, Russia’s state-owned energy corporation,

cancelled dividends for the first time in 30 years. The decades-long energy market-led influence Russia had on Europe led to the continent becoming overly dependent on Moscow for its energy needs.

Europe’s dependence on Russian energy

Despite attracting global criticism for funding a war on itself, Europe continues to be reliant on Russian energy supplies. An

analysis by the Centre for Research on Energy and Clean Air concluded that the Russian revenue from fossil fuel exports in the first 100 days of the war (February 24 to June 3) was €93 billion; 61 percent (approximately €57 billion) of this was imported by the EU. The bloc imports an estimated

84 percent of its natural gas consumption and

97 percent of its oil products. Russia is the primary source of these imports

accounting for 45 percent of natural gas, 25 percent of imported oil, and 45 percent of coal imports. The cost of these imports is estimated to be €400 billion per year and around €114 million per day. Whilst the transport sector is the largest consumer of oil in the EU, the power sector is the

largest consumer of gas.

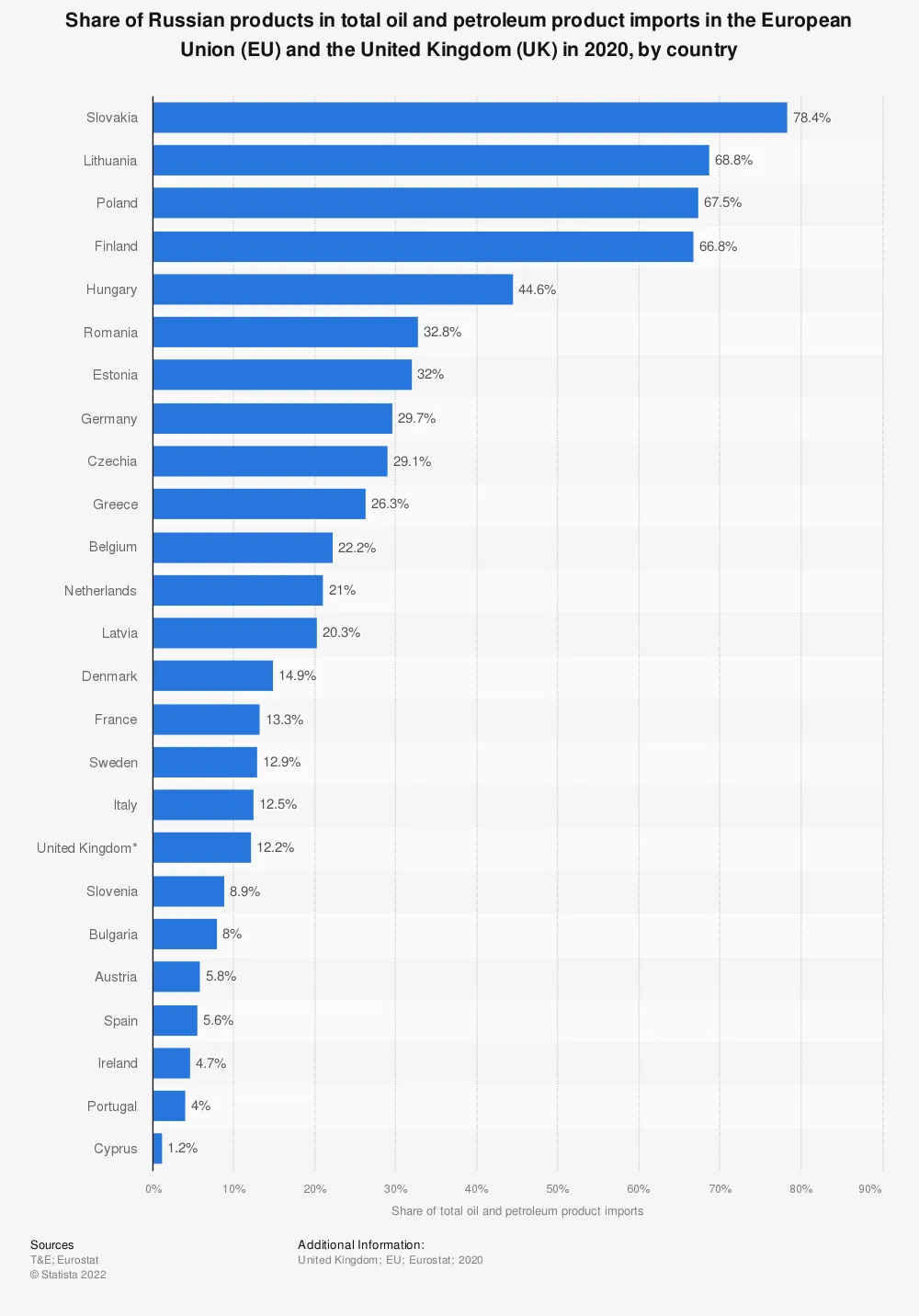

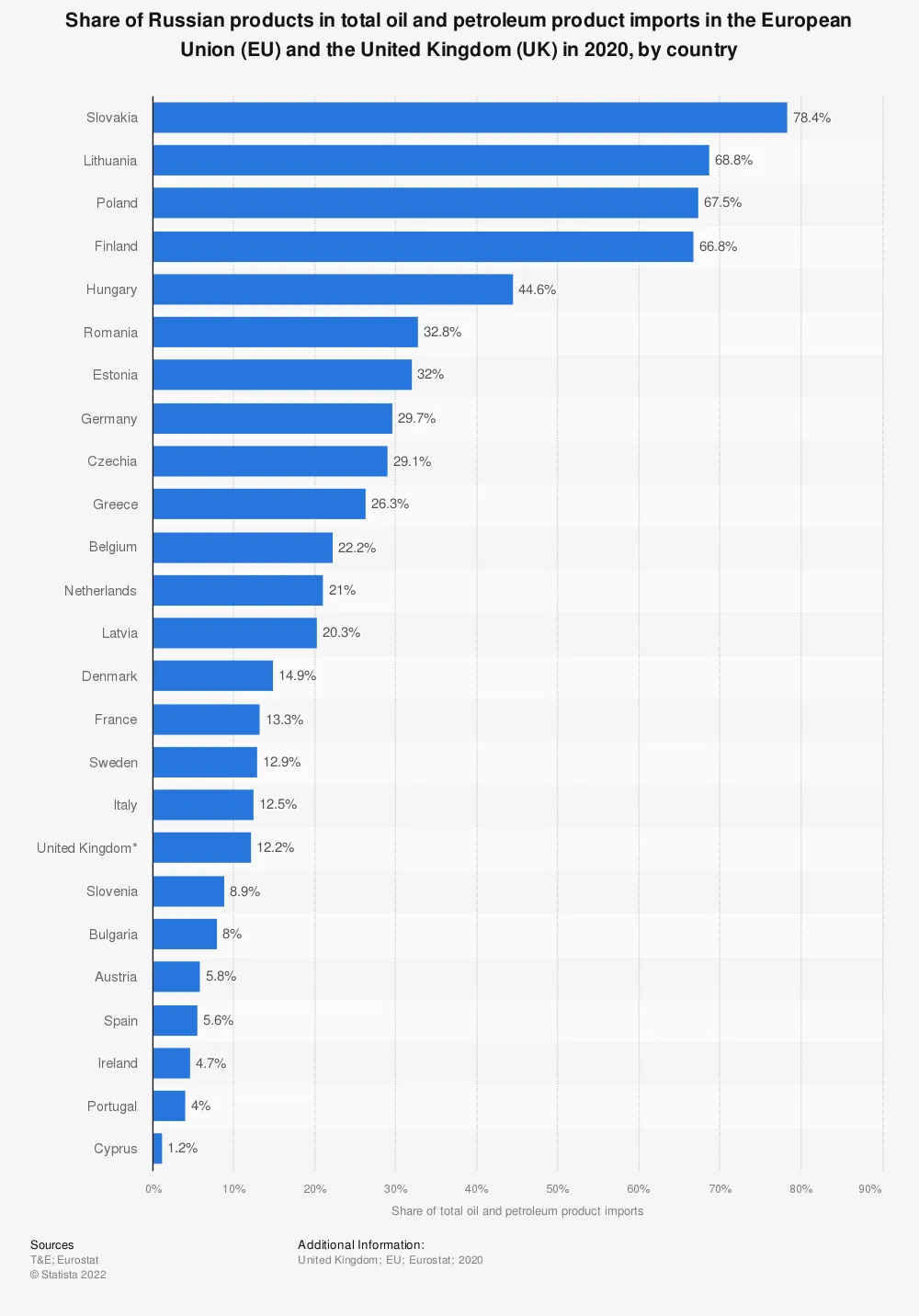

However, there is no homogeneity in the dependence on Russian oil within the EU. The largest importers of Russian oil include the Netherlands, Italy, France, and Finland. In terms of dependence, Slovakia is the most dependent member state followed by Lithuania, Poland, and Finland (See Fig. 1).

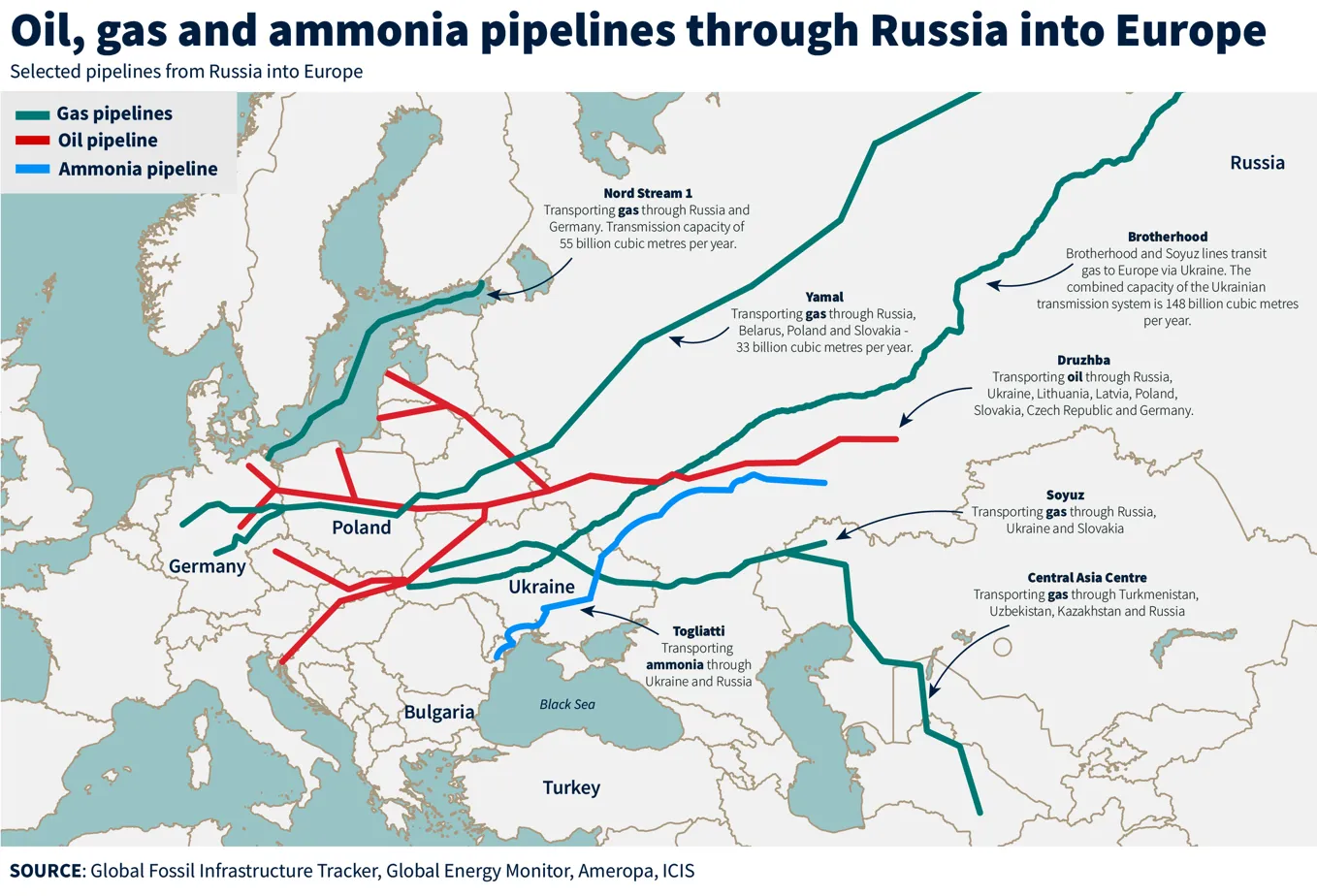

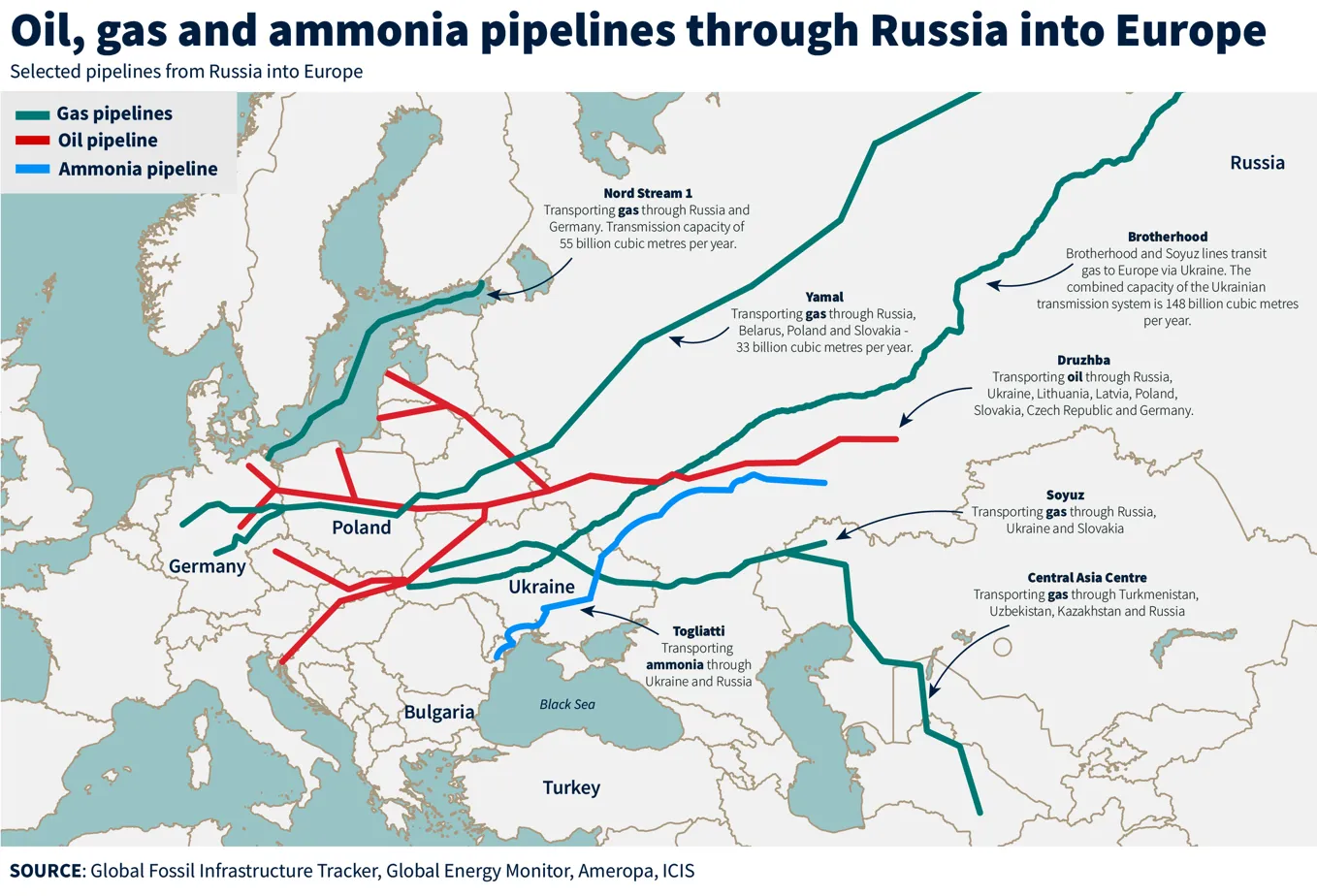

Natural gas is imported from Russia into Europe via four routes—Ukraine, Belarus-Poland, the Nord Stream 1 corridor connecting Russia to Germany via the Baltic Sea, and the TurkStream corridor linking Russia to Turkey via the Black Sea (See Fig. 2).

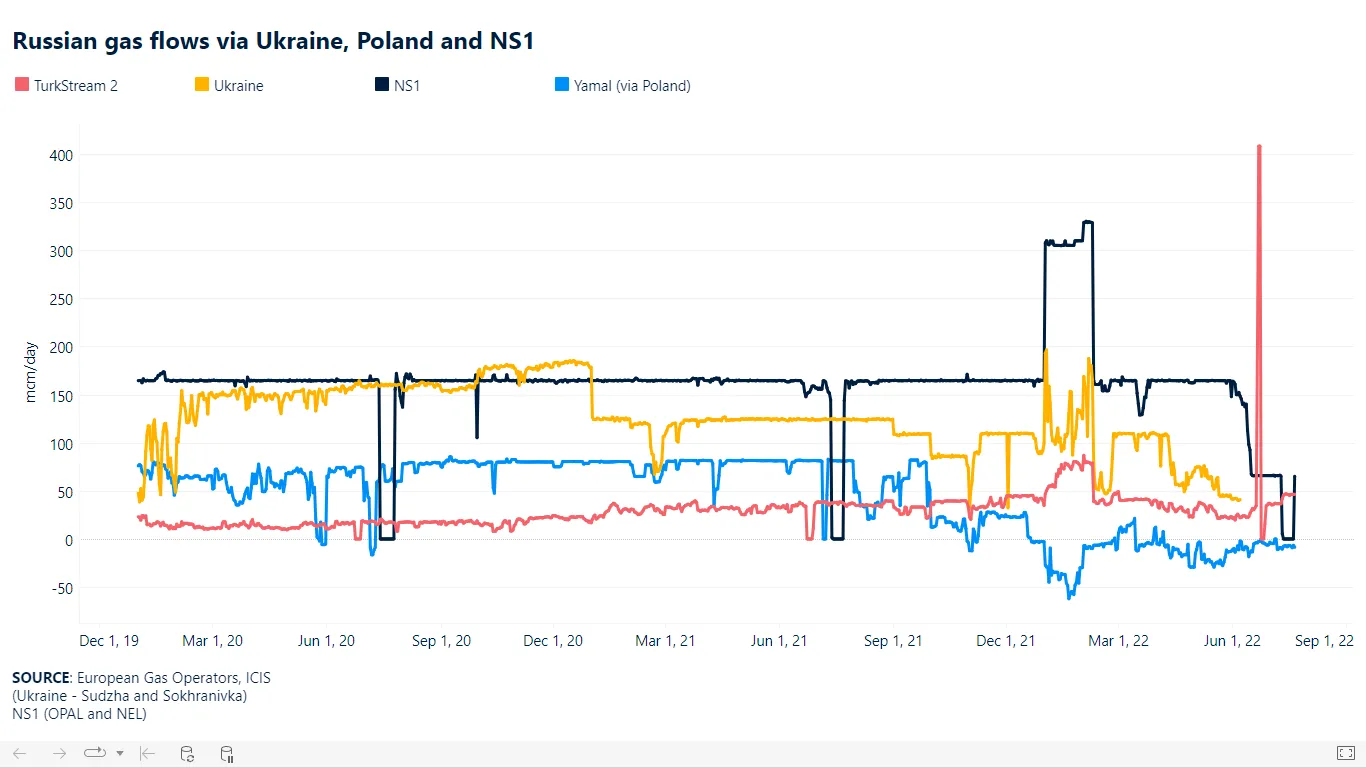

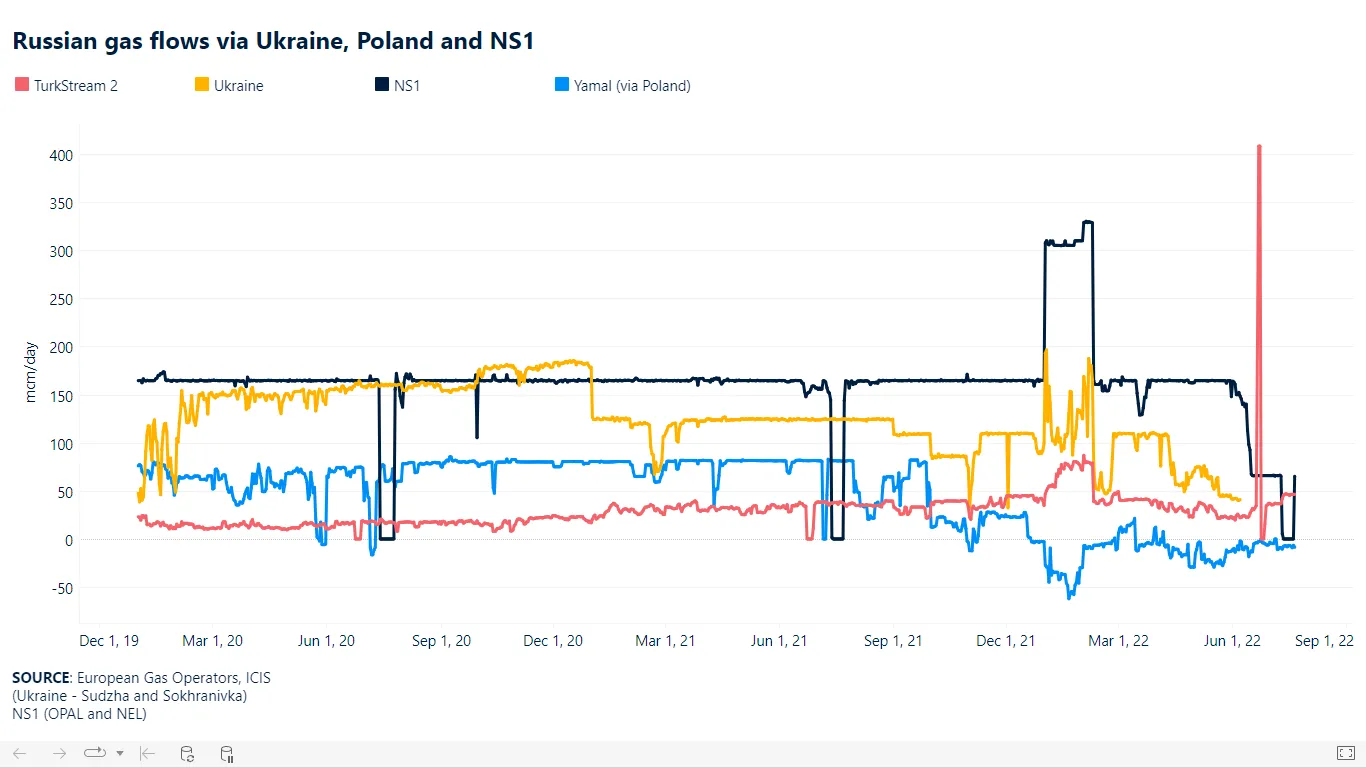

Throughout the year 2021, Russian supplies via these pipelines remained below optimum capacity. In 2022, Gazprom supplied only one-third of the gas it promised to deliver (See Fig. 3). Moreover, the Kremlin banned gas exports to several EU countries and reduced the level of gas flow through the Nord Stream I pipeline. Russia blamed the reduced transit levels on delays with turbine maintenance while imposing sanctions on

“unfriendly” buyers.

Russia has terminated natural gas exports to six countries since the war—Poland, Bulgaria, Finland, the Netherlands, Denmark, and Latvia. While gas transit to Latvia was

ceased citing breach of supply conditions,

Poland, Bulgaria, Finland, the

Netherlands, and Denmark denied payment in Russian Roubles. These six countries accounted for approximately 22.2 billion cubic metres (bcm) of Russia’s natural gas import volume. Furthermore, several parts of central Europe were affected by Ukraine’s

suspension of Russian oil transit; western sanctions imposed on Russia prohibited Kyiv from receiving Moscow’s transit fees. While the southern corridor of the Druzhba pipeline involving Slovakia, Hungary, and the Czech Republic was impacted, the northern corridor through Poland and Germany remained unaffected. In addition, gas transit to Germany, Italy, France, and Austria has also been restricted.

Countermeasures to reduce Russian dependence

The EU has already

suspended coal and fossil fuel imports from Russia. Efforts to completely stop Russian oil imports by 2023 and limit natural gas imports to only two-thirds of total energy imports are also being undertaken. Several European countries have undertaken significant steps to reduce their reliance on Russian energy. Germany managed to reduce its oil imports while Poland, along with the United States (US), consequentially

impacted Russia’s energy revenue by building a liquified natural gas (LNG) terminal in the Świnoujście port (Qatari and US operated). Simultaneously, Lithuania, Finland, and Estonia succeeded in reducing their Russian energy supply reliance by more than 50 percent. However, heavily dependent countries like Hungary have been calling for immunity against broader EU sanctions on Moscow.

Boosting the use of biogas alongside quadrupling hydrogen use by 2030 is being considered. Other recommendations involve domestic rooftop solar power panel installations that can generate a quarter of the bloc’s electricity consumption.

Suggestions from the European Commission involved replacing Russian gas with LNG to enhance supply security and import flexibility. This could prove significant to phase out Russian energy while easing energy shortages during gas supply interruptions. Furthermore, existing gas suppliers like Norway, Algeria, and Azerbaijan are being encouraged to increase their supply by the West. The EU has suggested Norway explore new oil and gas fields in the Arctic. An increase in LNG imports from the US, Qatar, and Australia have also been significant.

The EU is making a conscious attempt to increase its share of renewables. Boosting the use of biogas alongside quadrupling hydrogen use by 2030 is being considered. Other recommendations involve domestic rooftop solar power panel installations that can generate a quarter of the bloc’s electricity consumption.

Efforts to “accelerate the clean energy transition” has proven to be a challenge. Escalating fossil fuel prices placed against the need to reduce reliance on Russian energy ensured that the impact of the embargo on Russian energy imports would be limited.

Meanwhile, LNG, as Europe’s primary choice to phase out reliance on Russia, was widely criticised as it increases greenhouse gas emissions. Germany’s announcement to establish two new LNG terminals implied an extended period of reliance on fossil fuel-generated electricity; this could coerce Germany into a prolonged and unforeseen dependence on LNG. Some countries would witness a

shift to coal via temporary reactivation of coal plants securing power supply. This would imply skyrocketing carbon emissions as coal power generation produces almost

double the emissions than gas generation.

The Significance of REPowerEU during the transition

In response to the invasion, the

REPowerEU strategy has been planned to create an energy-independent Europe before 2030. The plan will reduce the bloc’s reliance on Russian natural gas imports while implementing measures to counter the soaring energy prices. REPowerEU advocates a

three-pronged strategy of improving energy efficiency, expanding the use of renewable energy, and securing non-Russian suppliers of oil and gas. Such a diversification of gas supplies accompanied by the boost to renewable energy sources in electricity generation will enable the EU to replace gas in heating and power generation. According to the European Commission, this implies a two-thirds reduction in the EU demand for Russian gas before the end of 2022.

REPowerEU advocates a three-pronged strategy of improving energy efficiency, expanding the use of renewable energy, and securing non-Russian suppliers of oil and gas.

Diversification of gas supplies will be done by shifting to LNG and pipeline imports from non-Russian suppliers. Additionally, biomethane and renewable hydrogen production and imports will also be undertaken via this effort of diversification. The proposal to fill the EU’s gas reserves to a minimum of 90 percent capacity by 1 October 2022 will be tough, given its present capacity is around

30 percent. Moreover, the plan mandates all EU member states to have a minimum level of gas storage. According to the Commission’s ‘Fit for 55’ proposal, by 2030, the annual fossil gas consumption will reduce by 30 percent that amounts to 100 bcm. Along with the REPowerEU’s contributions, this will be tantamount to 155 bcm of fossil gas use.

Short-term hurdles to transition

Although the EU’s heavy reliance restricts attempts of an overnight transition to renewables, it will make natural gas a critical source of energy. Hence, an urgent replenishment of gas reserves for 2023 is vital. Fast-tracking the diversification process will also ensure supply security during an interruption. Russia’s decision to reduce gas flow to Europe led to an unprecedented surge in the gas prices; this will force the EU to ration its energy consumption during winter. Despite the resort to LNG, their European processing units already operate at full capacity. Furthermore, Europe’s limited gas storage bodes ill given the 30 percent demand surge for gas during winters. Infrastructural restructuring to accommodate larger reserves is necessary.

Natural gas prices in 2022 spiked approximately six times their levels in 2021, but the EU’s sixth sanctions package lacked an embargo on the same. A support package reducing the impact of the energy poverty crisis will allow citizens to not have to choose between eating or heating. Meanwhile, the possibility of a further surge in oil prices have forced leaders to delay or backtrack on their commitments.

A support package reducing the impact of the energy poverty crisis will allow citizens to not have to choose between eating or heating.

Long-term hurdles to transition

The most significant long-term hurdle to transition is the EU’s sustainability goal. Given the nature of the EU climate goals, finding a renewable and sustainable alternative will be a Herculean task. European leaders are torn apart between the surging energy prices and their ambitious climate promises.

The use of renewable sources like wind, solar, and hydropower, although green and sustainable, cannot be absolutely depended upon. During periods of no wind or sunshine,

flexible non-renewable electricity generation will help meet public demands. The EU will need reliable suppliers to successfully transition from unreliable providers of volatile fossil fuels.

Joeanna is a research intern at ORF.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

The Russian invasion of Ukraine brought with it numerous concerns. A worsening humanitarian crisis and the threat posed by the ongoing war in Europe in food and energy security have ballooned its impact worldwide. However, the most pressing concern for the European Union (EU) has been the energy crunch which the continent faces ahead of the winter season. The war has brought to the fore Europe’s harsh reality of being reliant on Russian energy supplies. Hoping to coerce Russia into a withdrawal, the West imposed sanctions on Russia. This proved counterproductive; Russia shocked the global order by imposing self-sanctions and limiting gas supplies to its largest consumer—Europe. Gazprom, Russia’s state-owned energy corporation,

The Russian invasion of Ukraine brought with it numerous concerns. A worsening humanitarian crisis and the threat posed by the ongoing war in Europe in food and energy security have ballooned its impact worldwide. However, the most pressing concern for the European Union (EU) has been the energy crunch which the continent faces ahead of the winter season. The war has brought to the fore Europe’s harsh reality of being reliant on Russian energy supplies. Hoping to coerce Russia into a withdrawal, the West imposed sanctions on Russia. This proved counterproductive; Russia shocked the global order by imposing self-sanctions and limiting gas supplies to its largest consumer—Europe. Gazprom, Russia’s state-owned energy corporation,

PREV

PREV