This article is part of the series Comprehensive Energy Monitor: India and the World

This article is part of the series Comprehensive Energy Monitor: India and the World

If momentum in the shift to low-carbon energy sources is measured in terms of the volume of media coverage,

electrifying mobility will clearly take the top spot. Each day, energy sector news across all media platforms is dominated by

sales growth figures for electric vehicles (EVs), long lists of

new entrants in each segment of the EV value chain, plans of

traditional vehicle manufacturers from within and outside India to enter the Indian EV sector, the list of companies setting up

charging stations across the country and most importantly,

policy pronouncements from central and state governments that promote adoption of EVs, through subsidies, tax breaks and other incentives. The message conveyed is that once issues such as the availability of charging infrastructure, range anxiety of EV adopters, and the initial high price of EVs are addressed there would be a

Cambrian explosion in EV adoption in India.

According to Deloitte Touché Tohmatsu, sales of EVs in India are likely to jump to

1,644,000 units in FY25 and go up further to 15,331,000 units by 2030.

Electric two and three-wheeler sales in India are expected to

account for 50 and 70 per cent, respectively of the total sales by 2030, a report jointly prepared by the Automotive Component Manufacturers Association (ACMA) and McKinsey. The EV industry is predicted to cross the 9 million units per annum mark by the year 2027 according to a report by the Indian Private Equity and Venture Capital Association (IVCA) in partnership with EY and IndusLaw. The

Council on Energy, Environment and Water (CEEW) predicts that EV passenger vehicles could comprise 30 percent of the new vehicle sales in India by 2030 and 75 percent in 2050.

NITI Aayog predicts that electric two-wheeler sales in the country will jump to 22.01 million by 2031 from 0.23 million in 2021.

A joint report by NITI Aayog and Technology Information, Forecasting and Assessment Council (TIFAC) optimistically forecast 100 percent penetration of electric two-wheelers in the Indian market by 2026-27.

The EV industry is predicted to cross the 9 million units per annum mark by the year 2027 according to a report by the Indian Private Equity and Venture Capital Association (IVCA) in partnership with EY and IndusLaw.

According to the VAHAN dashboard of the Ministry of Road Transport and Highways, the growth in sales of EVs in the first of the current financial year was

330 percent year-on-year (YoY). The reduction in the number of petrol and diesel-based vehicles from a peak of

26 million vehicles in 2018-19 to

17.5 million in 2021-22 and the increase in registration of EVs from 130,000 to 230,000 in the same period is cited as the basis for a shift in preference for EVs. However, given that more than

70 percent of all vehicle registrations in 2021-22 were for two-wheelers and within the class of EVs over

95 percent of vehicle registrations were for two and three-wheelers, the shift may be driven more by policy and less by customer preference. One key issue that is missing in the optimism over EV adoption is the impending loss of petroleum tax revenue for the state and central governments when mobility is electrified.

Revenue from Petroleum Taxes

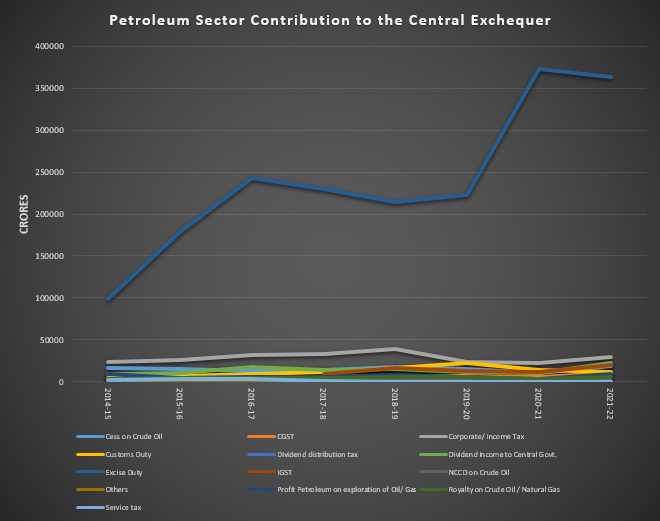

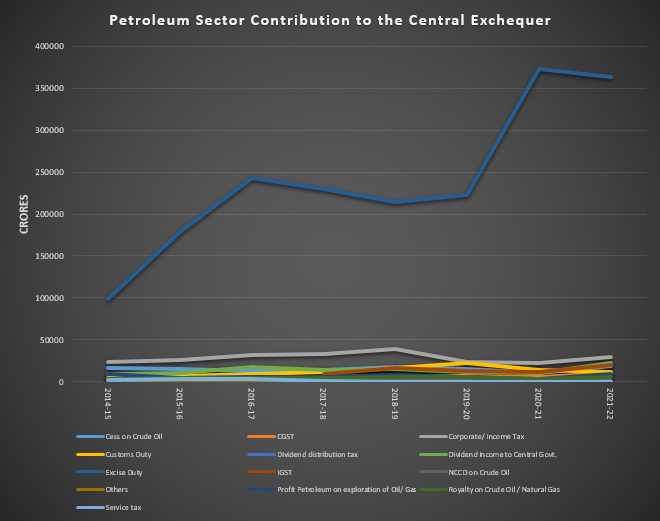

In September 2022, central taxes (primarily excise) accounted for

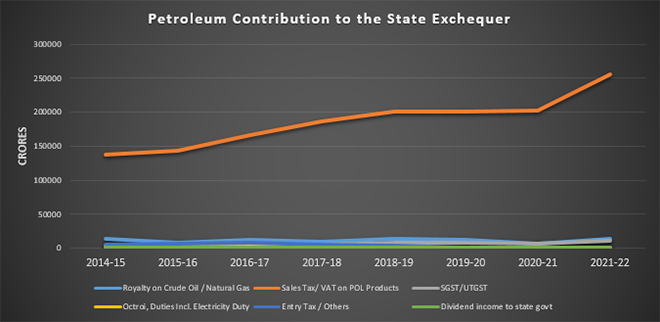

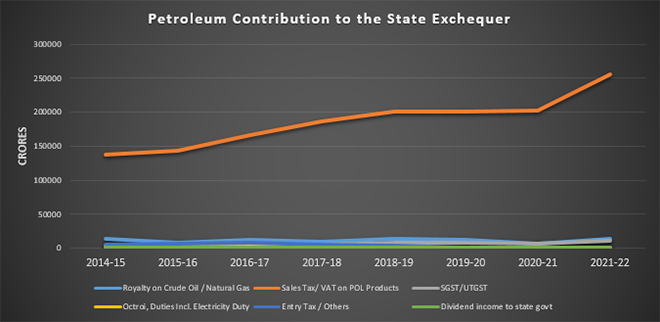

20 percent and state taxes (Value added tax or VAT) accounted for

16 percent of the retail price of petrol (in Delhi). For diesel central tax take accounted for about

18 percent and state taxes about

15 percent of the retail price. Excise collection from the retail price of petrol and diesel makes the largest contribution to the central exchequer and its share in the total contribution from the petroleum sector. This contribution has been increasing since 2014. In 2014-15, excise collection made up

57.5 percent of the revenue contributed by the petroleum sector to the central exchequer. In 2021-22, the share of excise in the total revenue contributed by the petroleum sector to the

central exchequer was 73.7 percent. Likewise, VAT collection makes the largest contribution to the revenue from the petroleum sector to the state exchequer. In 2014-15,

VAT accounted for 85 percent of the total contribution from the petroleum sector to the state exchequer. In 2021-22, the share of VAT in the total contribution of the petroleum sector to the state exchequer was

90 percent.

Source: PPAC

Source: PPAC

Petroleum taxes, duties and other levies collected by the central government has increased by over

290 percent from about

INR1259 billion in 2013-14 to

INR4923 billion in 2021-22 and its share in total revenue receipts of the central government has increased from

15 percent to 27 percent. Petroleum taxes and duties collected by the state government have increased by over 85 percent from about

INR1524 billion in 2013-14 to about

INR2821 billion in 2021-22. However, the share of petroleum taxes in total revenue receipts of state governments has decreased from

10 percent to 8 percent in the same period. When road transport is completely electrified, the federal and state governments will lose these generous revenue receipts from the production and consumption of petroleum products. Alternative options for raising revenue have so far not received the attention that the promotion of electric mobility has received.

Replacing Petroleum Revenue

The options available for replacing petroleum tax revenue are

carbon taxes, road pricing, congestion charges, and electricity taxes. Taxing electricity production and consumption is not a realistic option for India for many reasons. Electricity is not a net revenue contributor to the state exchequer as is petroleum. Electricity is essential for vital needs such as lighting and communication and taxing electricity will make lighting and communication a luxury for many households. Taxing electricity will also undermine the argument that electric mobility is cheaper than mobility supported by petroleum products.

The transition to electric mobility will take time to percolate through all of India’s vehicle fleet notwithstanding predictions of an explosive change. This means petroleum tax revenue will erode only gradually over time which will give time to adapt to a new tax policy. One of the most suitable options for replacing petroleum tax revenue in India is to tax the

distance travelled. The tax can be higher for private vehicles which will ensure public transport remains affordable for the poor. Shifting from taxes on fuels to taxes on distances driven can contribute to

more sustainable and equitable tax policy over the long term, improving environmental, social and mobility outcomes.

Source: PPAC

Source: PPAC

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This article is part of the series

This article is part of the series

PREV

PREV