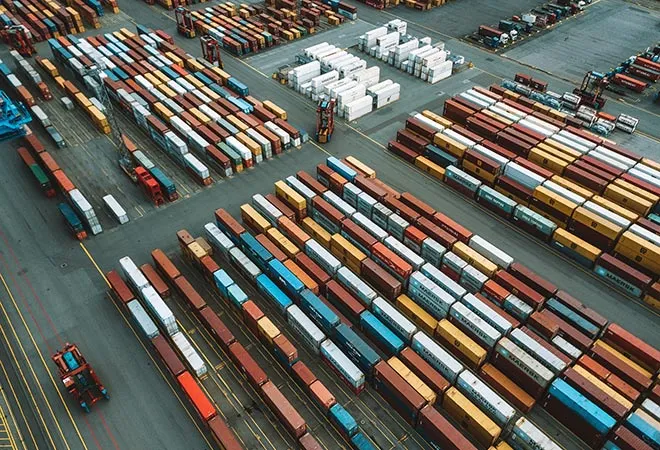

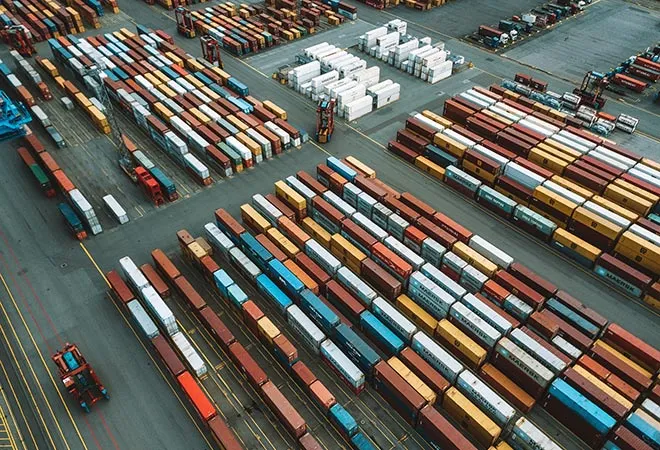

The COVID-19 pandemic has resulted in an unprecedented situation in the world. Supply chains in major industries such as aviation, pharmaceutical, medical equipment, etc. have got disrupted. One reason for this is because China is a major centre in the global value chains for these industries. The role of China as the central hub in many global value chains has brought losses of about $50 billion in global exports. Chinese suppliers are crucial for many industries that operate globally. There is a shortage of medical equipments such as N95 masks, personal protection equipment (PPE), medicines etc. as demand is far exceeding the supply. About half of the N95 masks are produced in China and Taiwan. Recently, the Indian government partially lifted the ban on the export of hydroxychloroquine (HCQ) medicine (which has shown anecdotal evidence of being effective against the coronavirus) after global demand for it increased. India produces 70% of the world's supply of HCQ.

The long-term effect on the supply chain is hard to predict. But two major changes may be anticipated going forward, namely vertical integration and geographic diversification. For example, India obtains 67.56% APIs from China which are valued at $2.4 billion and meets 90% of all API requirements from imports. Further, India’s dependence on API imports has increased over the years which stood at 0.3 % in 1991. The current situation may lead India to give new energy to the government’s plan to reduce dependence on Chinese firms, which currently only remains on paper, despite it even been considered a national security issue. The Indian pharmaceuticals sector had a foreign value added (FVA) of about 17.3 % in 2015 in its exports. It is claimed that one of the reasons India had to curtail its exports of certain pharmaceutical products was due to lower imports of APIs from China.

The long-term effect on the supply chain is hard to predict. But two major changes may be anticipated going forward, namely vertical integration and geographic diversification.

The current economic situation has been termed as the worst since the Great Depression of 1939. The IMF projects global growth in 2020 to fall by 3 percent. Global trade is expected to fall by 13% to 32 % in 2020 due to the pandemic crisis and the decline may be greater than the one experienced after the financial crisis of 2008. The current economic situation has further led to new tensions in the relations between the US and China, with the US president ordering firms to move out of China. Business around the world is already beginning to be impacted negatively. In the short run, to lower dependence on global value chains, significant investments would be required, which may not be feasible due to lack of funds. In this regard, the role of the policies of governments may provide some direction, Japan, for example, has taken measures to reduce its reliance on China as a manufacturing hub. It is willing to pay firms to relocate back to Japan. Japanese firms themselves are making future plans to diversify production across Southeast Asia. European countries are taking steps to nationalise companies to protect them from foreign take overs. Thus, the stimulus plan for revival may play an important role in shaping future supply chains. However, supply value chains cannot be established overnight. It takes time and effort to identify potential suppliers in areas of manufacturing, quality, capacity, delivery and cost. China is the central hub for a number of reasons such as lower taxes, good logistics, low wages. Further, such measures could escalate souring of ties between these powers and may lead to retaliatory measures from all sides. As countries are reconsidering their reliance on China, it is also interesting to note that China is becoming more vertically integrated. However, countries also acknowledge the fact that the access to Chinese market may be crucial for their economies to rebound after the crisis.

India may also benefit from the geographical diversification; it may be an opportunity that it can take advantage of. But for that, India needs to support its domestic industry and also take measures to make the business environment more attractive for foreign investments. India ranks behind Vietnam in the logistics performance index of 2018 that is released by World Bank every two years. Compared to India, even Vietnam benefitted more from the US China trade war. India can use this as an opportunity to reform its domestic sector and make it an attractive option for companies that may seek to reduce risk by diversifying away from supply chains that are centered on China.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV