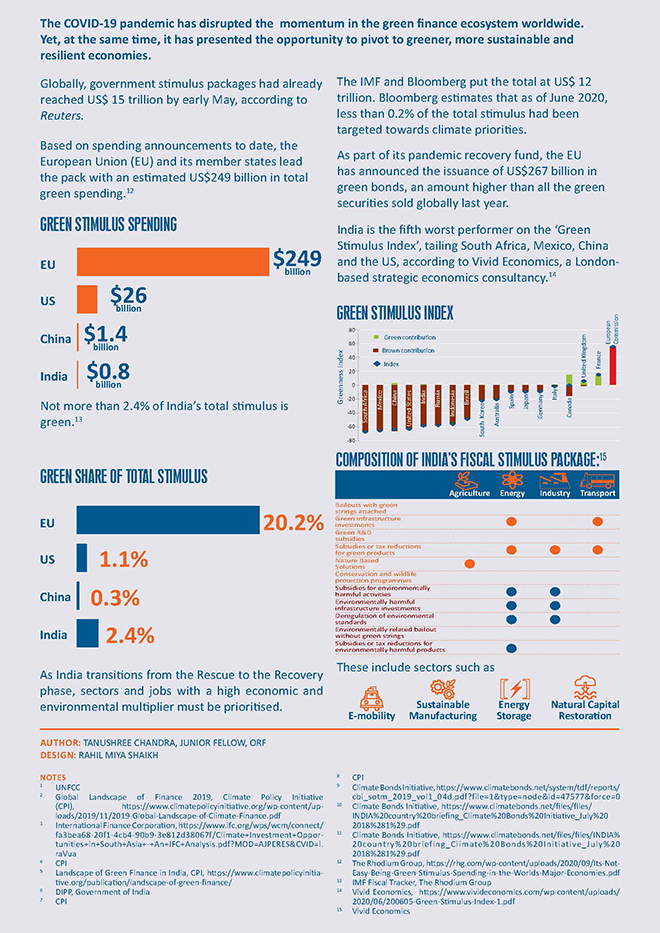

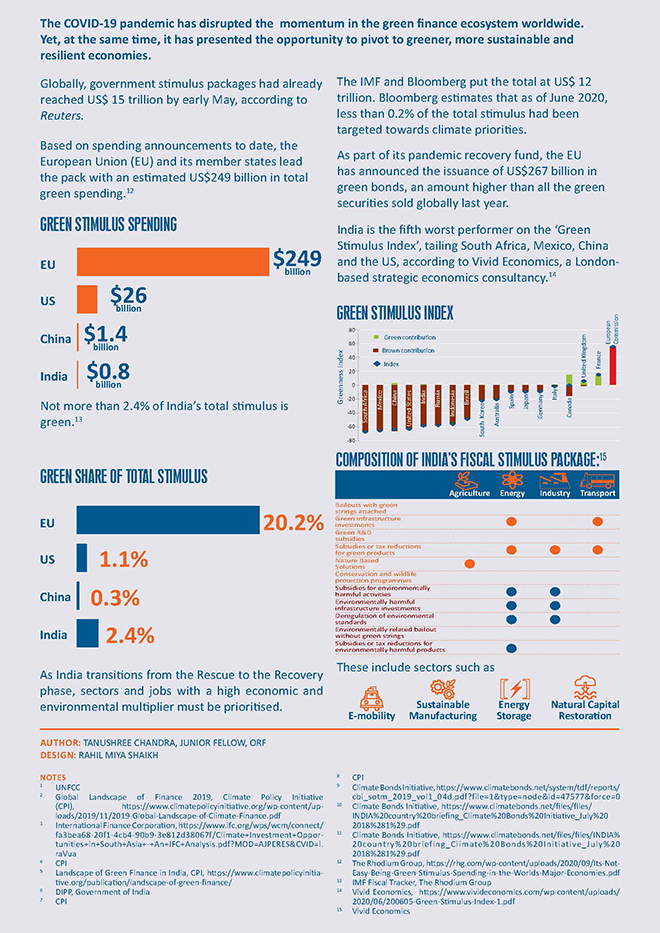

The year 2020 was hailed as a watershed for climate finance, and discussions are expected to reach their crescendo at the COP26 negotiations in Glasgow in 2021 . As the COVID-19 pandemic has precipitously derailed the global green agenda, the need to redirect attention to climate change has become more pronounced.

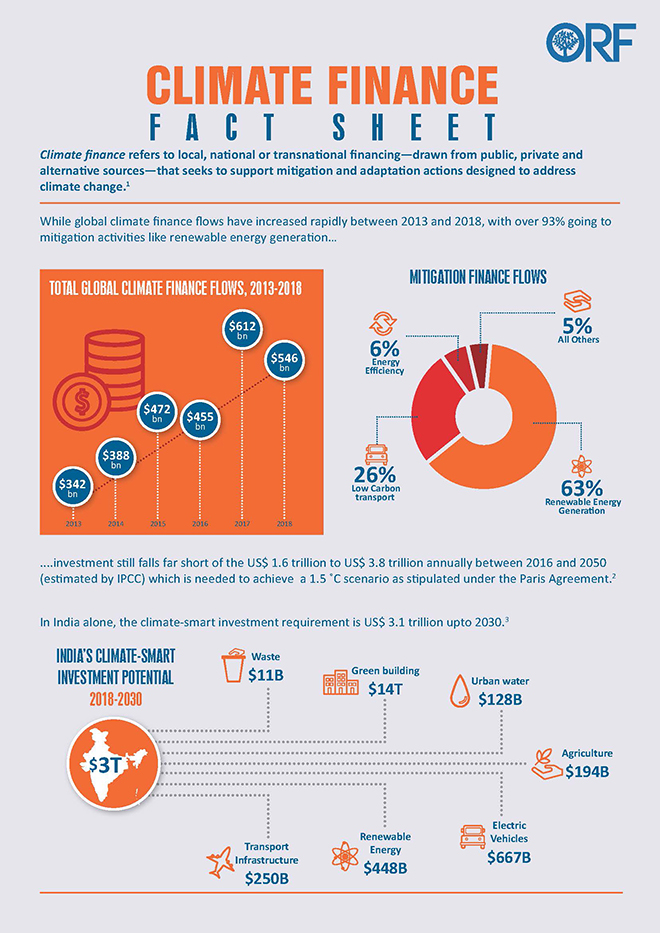

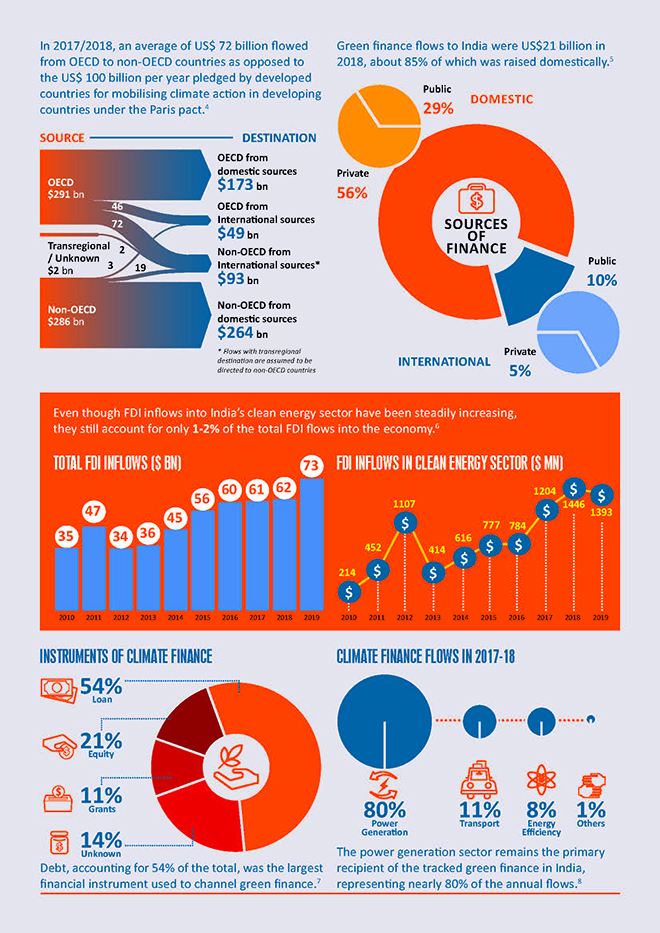

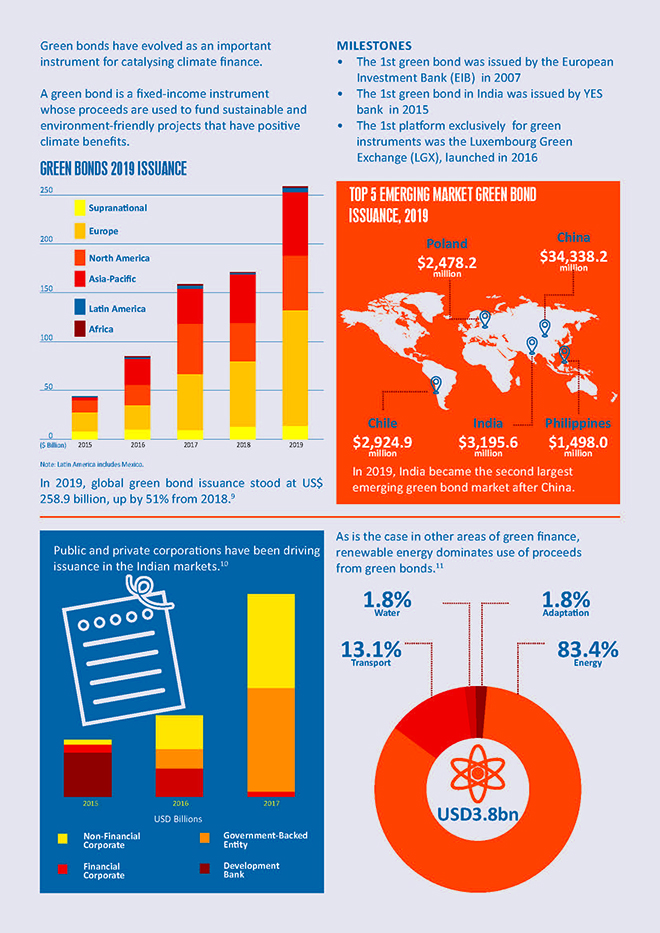

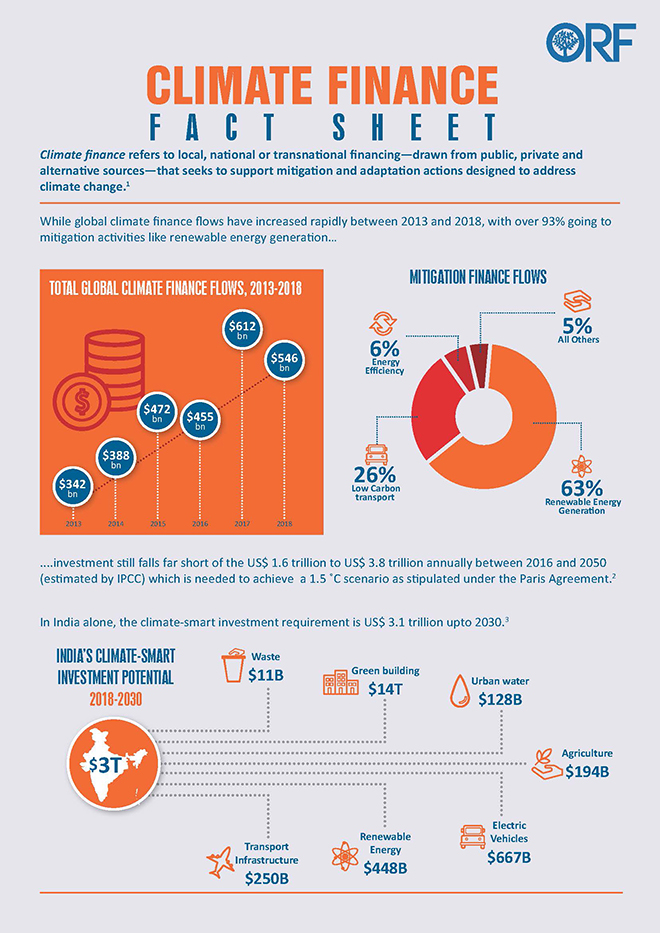

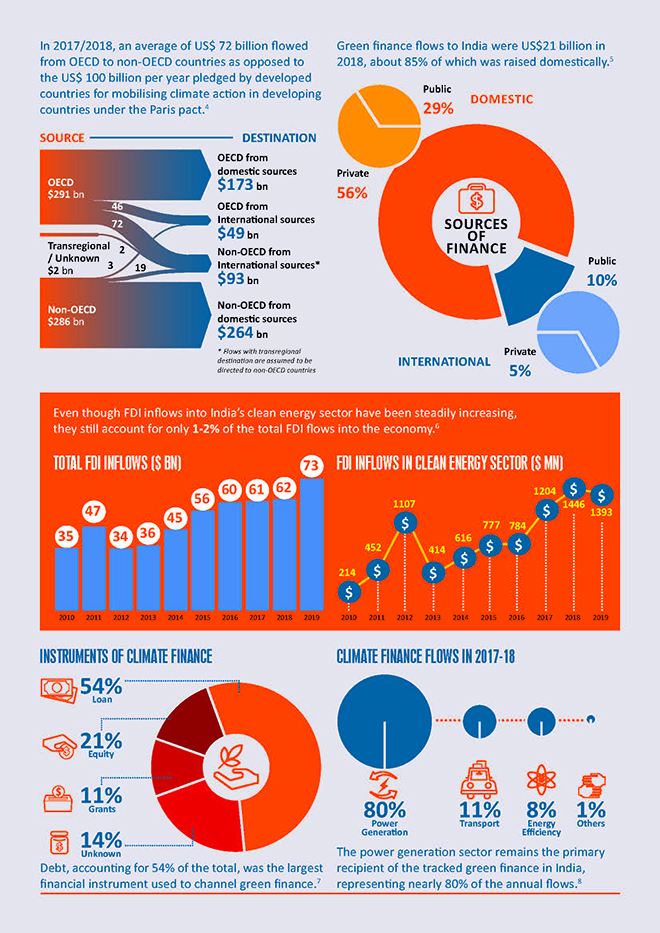

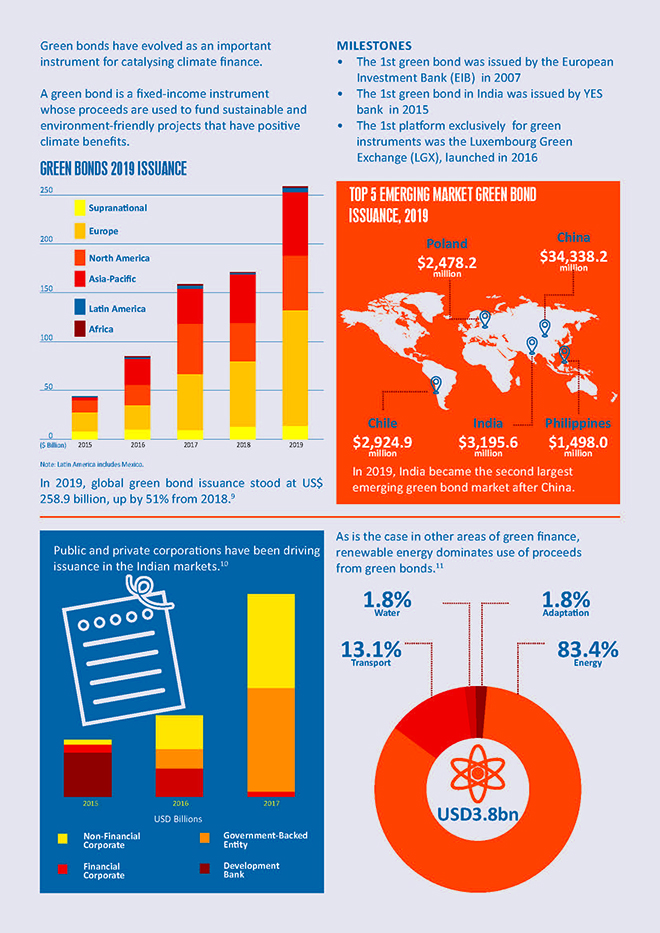

A key lever of global climate action is climate finance—or the local, national or transnational financing, drawn from public, private and alternative sources of financing, that seeks to support mitigation and adaptation actions that will address climate change. The COVID-19 crisis has significantly altered the climate finance landscape: public funds available for green infrastructure have reduced sharply as government budgets are being diverted to relief programmes. With rising risk perception for green infrastructure projects, private capital flows are also likely to be much more constrained, thereby widening the financing gap. As countries seek to climate-proof their post-pandemic economies, strengthen resilience, and address gaps in social justice that were revealed by the pandemic, they must craft strategies to effectively scale their green bond markets, leverage international debt capital markets, and harness blended finance to achieve these inter-linked objectives.

This factsheet summarises and examines the key trends shaping the global and Indian climate finance landscape.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV