This is the twenty seventh part of the series

This is the twenty seventh part of the series The China Chronicles.

Read all the articles here.

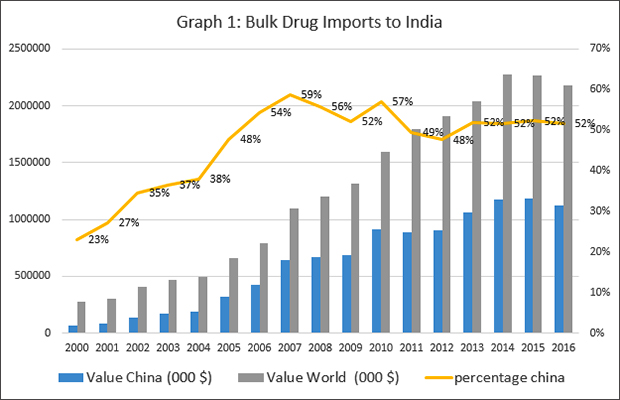

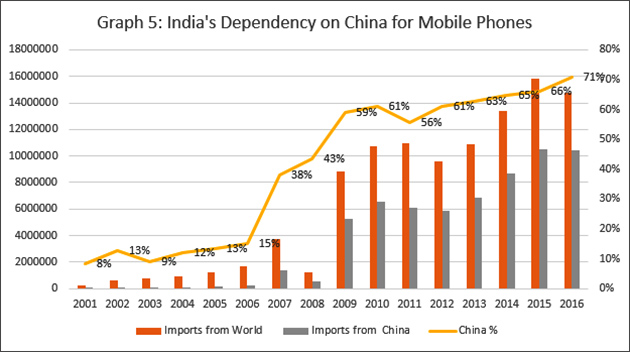

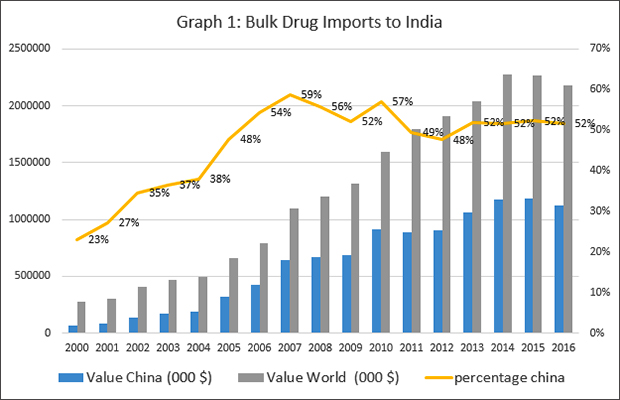

Ever since China undermined India's Nuclear Suppliers Group (NSG) bid, regular calls to boycott Chinese goods are made in India. That many such appeals are made on social media using Chinese made phones is a good example of the interlinked nature of a globalised world. India may be the "pharmacy of the world", but a substantial part of the bulk drugs that are used to manufacture the medicines that India is famous for, come from China. As Graph 1 shows, from about 23 per cent in 2000, Chinese imports peaked in 2007 at 59 per cent and are currently at 52 per cent. Among certain types of bulk drugs, the proportion of imports from China is even higher. Given the strained relationship between the countries, this exceptional dependence has received policy attention in the past, and trimming bulk drug imports from China is a focus of policy discussions within the government and the media.

Source: Comtrade Database

Source: Comtrade Database

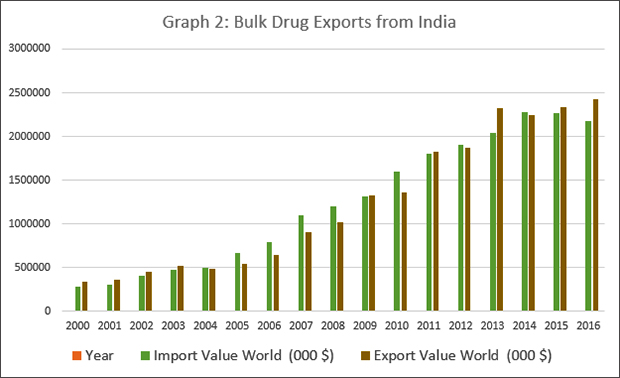

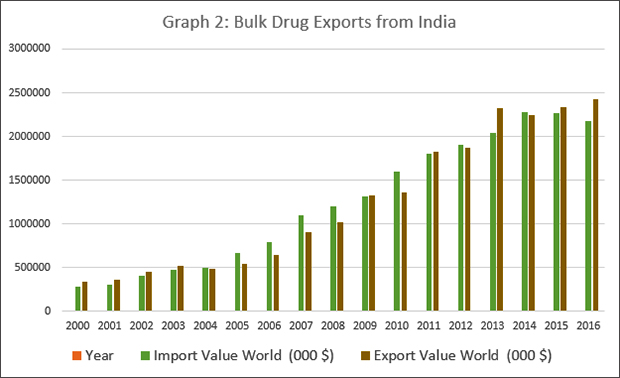

However, this familiar narrative often ignores the strengths of the Indian pharmaceutical sector. More importantly, it fails to mention that India is a major exporter of bulk drugs as well. Graph 2 shows that between 2000 and 2016, exports of bulk drugs have expanded many times over. Rather than being a hapless manufacturer of medicines who depends on China for all its raw material requirements, India actually is a big exporter of bulk drugs itself. In fact, the latest data shows that in bulk drugs, India has a favourable balance of payments — in other words, India exported more bulk drugs than it imported, by a margin of USD 247,647, 000 in 2016. Nine out of the 17 years between 2000 and 2016, India exported more bulk drugs than it imported, driven primarily by outsourcing of bulk drug production by MNCs.

Source: Comtrade Database

Source: Comtrade Database

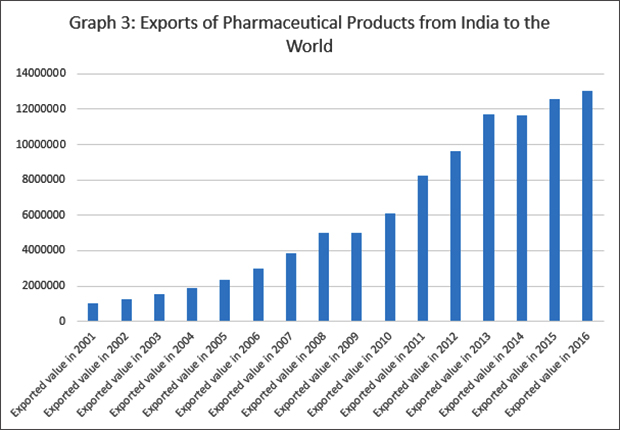

India’s pharmaceutical industry

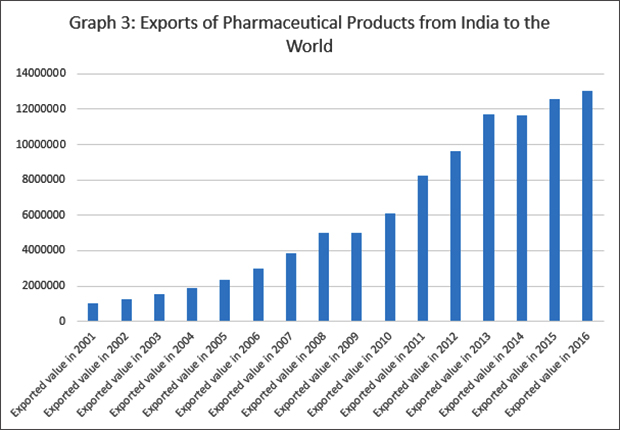

Over the last three decades, India has achieved remarkable improvements in health outcomes, although the absolute levels remain low. Comparatively low medicine prices is a major reason why India was able to improve the health status of its population even at an incredibly low level of public spending in health. Research shows that at the time of independence, the Indian pharmaceutical industry had a low production base, heavy dependence on imports, domination by foreign firms and high prices of drugs. Today, India has one of the largest pharmaceutical industries in the world. It is the third largest producer of medicines in terms of volume, and 14th in terms of value. The growth of the Indian pharmaceutical industry reflected in the growth of exports as shown in Graph 3 has been carefully driven by policy interventions at different levels. The current value of India’s exports of pharmaceutical products alone is about six times that of bulk drug imports. In all, at present, formulations make up the majority of exports and bulk drugs comprise of most of imports.

Source: International Trade Centre Database

Source: International Trade Centre Database

In terms of exports of formulations to the United States of America, a leading pharmaceutical market, India is the top trade partner in terms of volume and fourth in terms of value. China, on the other hand, was seventh in terms of volume and 18th in terms of value. India is host to the most number of USFDA approved plants outside the USA. In the year 2016, India accounted for 22 per cent of overall USFDA approved plants across the globe. China, on the other hand, has only half the number of USFDA approved plants.

Given the high number of USFDA approved plants, International companies outsource their production to India to contain their costs. India is responsible for 60 per cent of the global vaccine production, 30 per cent of UNICEF's annual supplies, 60 per cent of global supply of ARV drugs, and upto 80 per cent of annual UN purchases of vaccines. Medicines are fourth among India's top 10 export commodities in terms of value between 2014 and 2016, according to the International Trade Statistics Yearbook 2016.

China in India's pharmaceutical policy

It is not often discussed that the prices of medicines were brought under statutory control for the first time in India because of Chinese aggression. It was done in the wake of India's war with China in 1962. When it comes to bulk drugs, looming war alone is not seen as the risk factor: many things could go wrong. Experts say that during the Beijing Olympics in 2008, China closed down many bulk drug production units to manage environmental pollution, a price rise of around 20% followed in India.

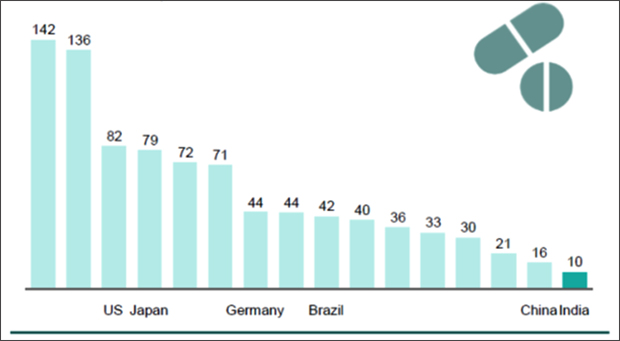

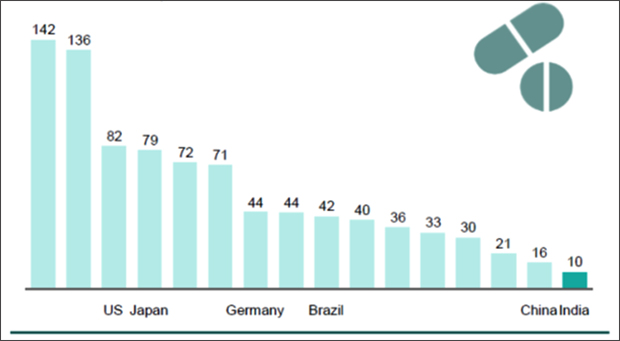

Those Indian firms dependent on a single country for much of their import requirements should not take away from the fact that there is a thriving bulk drug manufacturing industry in India. Cipla manufactured the first Indian bulk drug way back in 1960. As Graph 4 shows, Indian companies are also among the most cost competitive, internationally. Chinese plants have unit conversion costs of 60 per cent higher than Indian plants.

Graph 4: Unit conversion costs of the most competitive plants in countries (Average cost per tablet, USD)

Source: http://ficci.in/spdocument/20712/Final-Realizing-Make-in-India-Vision.pdf

Source: http://ficci.in/spdocument/20712/Final-Realizing-Make-in-India-Vision.pdf

However, in the case of some commoditised bulk drugs, riding on economies of scale and strong government support, Chinese firms established price leadership. In the aftermath of India's trade liberalisation, which abolished industrial licensing, removed restrictions on imports and took away the mandatory requirement of local production of bulk drugs, companies in India naturally moved away from producing bulk drugs, which required little innovation and offered only thin profit margins. Due to lower electricity costs and cheaper labour costs, complemented with subsidies (tax holidays and low interest loans) from the government and better technology, Chinese firms were a natural choice for their low cost product. Instead of a hapless producer dependent disproportionally on a giant for its supply of bulk drugs, perhaps Indian firms need to be seen as an agile industrial force, trying to maximise the low costs available for the time being.

Availability of low cost Chinese bulk drugs worked for Indian firms, which were exploring opportunities of shifting to the 'low volume — high priced', regulated markets, while retaining their traditional 'low volume — high priced' markets in Asia, Africa and Latin America. Moving away from manufacturing low-margin bulk drugs was the most sensible thing to do, when a strong government was backing the competitors with monetary incentives and subsidies.

India's reply to China's extensive subsidy regime within the bulk drugs sector cannot be replicating the same in India. Moreover, blanket rejection of substantially low cost inputs available to the pharmaceutical industry and opting for costly alternatives such as mandatory local production can affect India’s global competitiveness, put pressure on domestic drug prices and have impact on access. In other words, any such policy affecting current levels of competitiveness will have strong opportunity costs.

Current situation: Crisis or evolution?

Diversifying risks is an important policy objective. However, a part of the transformation within the pharmaceutical sector needs to be seen as a natural evolution of the Indian industry itself. A considerable amount of pharmaceutical production in India is due to outsourcing of bulk drug production by MNCs based out of developed countries because it was a low margin business requiring substantial investments in environmental controls. It can be argued that Indian pharmaceutical industry, in a similar fashion, is emulating these developed countries and shifting the low-value bulk drugs production to China, to focus more on high-value 'specialty' bulk drugs and formulations.

Industry acknowledges that the dependence is driven by cost alone — Chinese bulk drugs are almost 50 to 60 per cent lower than Indian products. It does not make economic sense to produce them domestically if such a wide margin exists. Industry reports indicate that while difficult-to-manufacture bulk drugs give bargaining power to suppliers, producers of commoditised, low margin bulk drugs do not have that power. An export-oriented industry embracing its comparative advantage to produce formulations is a desireable outcome, instead of wasting resources on producing the same product at a higher net cost.

Given the fragile peace at the border, while reducing dependence on China for a substantial part of the bulk drugs supply may be required at the end, import substitution using heavy state support and subsidies must be reconsidered as a response strategy. Competitive provision of non-market advantages to their respective bulk drugs producers by China and India will be self-defeating.

Indian pharmaceuticals are an outward looking, export oriented industry, which should face the challenges of the globalised marketplace. As cost is the primary advantage that China has, developing a bulk drugs manufacturing base in India or elsewhere at relatively short notice need not be a major challenge for India as it is often made out to be, should such a need arise where cost is not a concern. Notably, major Indian generic companies still produce bulk drugs in-house for their key products, and have only out-sourced commodified bulk drugs to China. In addition, just as China is a major seller of bulk drugs to India, India is a major market of Chinese products too. Thus, any unilateral action will involve substantial costs on both trade partners.

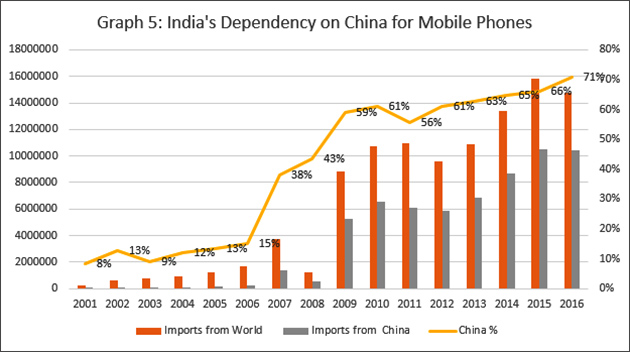

According to UN's International Trade Statistics Yearbook (2017), for the year 2016, China was India's top partner for merchandise imports, accounting for 14.9 per cent of India's total imports. The next biggest partner was Saudi Arabia with just 6 per cent. Getting back to the telephone example at the beginning of this article, in about just two decades, China's share of mobile phone imports — at the heart of India's ongoing information revolution and digital inclusion initiatives — rocketed from 8 per cent to a very high 71 per cent. Is anyone complaining?

There is indeed no room for complacency while dealing with China, but as a big market for Chinese goods, that should not prevent us from using China to our advantage.

Source: International Trade Centre Database

Source: International Trade Centre Database

The way forward

Regional Comprehensive Economic Partnership (RCEP) negotiations in Hyderabad put the focus on access to medicines. Hyderabad, a major centre for bulk drug manufacturing in India, was in the news also for the wrong reasons linked to pharmaceutical pollution and the emergence of superbugs. Apart from industry seeking comparative advantage in production of formulations, Indian bulk drug manufacturing decline was also a direct result of environmental law enforcement as well as the government's efforts after 2005 at ensuring better compliance with good manufacturing practices (GMP), affecting many small and medium sized firms.

The Katoch Committee Report on Bulk drugs in 2015 admitted that bulk drugs manufacturing is one of the most polluting industries. In addition, studies have shown that in India, making small and medium enterprises (SME) GMP compatible will cost at least ₹2 million per SME firm, a binding constraint to most such firms. In a bid to promote the Make in India initiative, 2015 was declared the year of bulk drugs; and the Katoch committee suggested in the same year mega bulk drug parks as an alternative to tap into economies of scale. However, lack of financial assistance has prevented the initiative from taking off.

The response from the Indian bulk drug manufacturers to such challenges remained predictable — requests to increase import duty on Chinese goods, and to be more lenient towards pollution, which cannot offer a sustainable solution. Possibly what can be done is to work optimally within the global trade regime and harmonise import duties in such a way that Indian manufacturers take advantage of the highly subsidised Chinese product, while at the same time, government revenue from imports support long-term risk diversification tactics including domestic manufacturing.

Any unthinking reaction is unwarranted, and a wait-and-watch approach has merits. Interestingly, bulk drug manufacturing industry in China is going through a similar churning as its Indian counterpart, with a shift away from commoditised bulk drugs with low profit margins. A recent WHO study states that confronted with new environmental and regulatory restrictions, many Chinese bulk drug manufacturers are themselves considering moving production activities outside China.

Given this complex situation, other options should be actively explored by India as well, along with encouragement of domestic manufacturing. Given India’s role as a regional leader, the thriving pharmaceutical trade and friendly relations with Africa, a possibility is to diversify the "China risk" by expanding the geography of bulk drug suppliers; including by assisting other countries in Asia and Africa develop production capacity. Till then, letting the Chinese subsidise drug access in India and the world may not be a bad idea at all.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This is the twenty seventh part of the series The China Chronicles.

Read all the articles

This is the twenty seventh part of the series The China Chronicles.

Read all the articles  Source:

Source:  Source:

Source:  Source:

Source:  Source:

Source:  Source:

Source:  PREV

PREV