This article is part of the series Comprehensive Energy Monitor : India and the World

In 2006, China overtook the USA to become the largest carbon dioxide (CO2) emitter. As pressure mounted on China to reduce emissions, it made the following statement during the visit of the US President to China in 2014: ‘China intends to achieve the peaking of CO2 emission around 2030 and make best efforts to peak early and intends to increase the share of non-fossil fuels in primary energy consumption to around 20 percent by 2030.’ Speaking at a World Resources Institute event in June 2015, Zou Ji, Deputy Director General, National Centre for Climate Change, China, underlined the importance of the joint announcement from the world's top two economies and emitters USA and China. He noted the significance of China's aim to peak emissions before reaching the income level of US $20,000-25,000 per person. Peaking emissions inevitably meant peaking coal use.

Peak coal projections

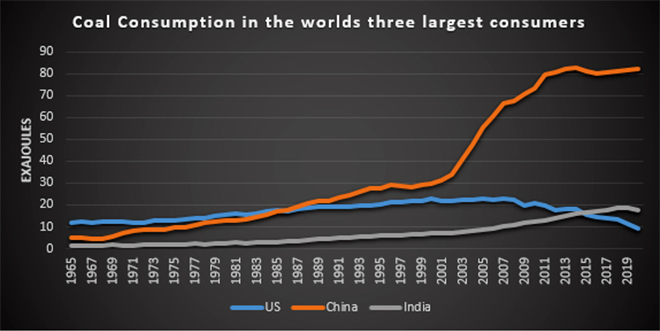

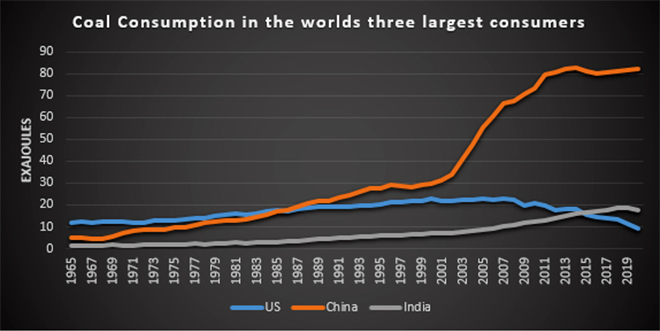

In 2014, the International Energy Agency (IEA) projected that China would remain the single largest coal consumer accounting for 51 percent of the global consumption, while India was expected to take the second place with 13 percent of the global consumption overtaking the United States in 2024. India overtook the USA as the second largest coal consumer in the world about a decade earlier in 2015. British Petroleum’s (BP) projections which reflected its ‘most likely’ scenario expected China’s coal demand growth to decelerate rapidly from 1.3 billion tonnes (6.1 percent a year) in 2005-15 to just 19.5 million tonnes (MT) (0.1 percent a year) in 2025-35.

BP expected China’s coal demand to peak around 2030 and for it to decline at 0.1 percent a year from then on. Both the IEA and BP gave credit to structural changes and policy measures such as China’s move from a manufacturing and industry driven economy to a service and domestic demand-driven economy along with efficiency improvements and stringent environmental policy for the rapid fall of coal demand in China. A report by Bernstein argued that China will stop importing coal by 2015 and that China’s coal demand will start declining by 2016. China imported 197.69 MT of coal in the first eight months of 2021 according to Reuters data. Though growth in coal demand from India was expected to continue well past 2030, India’s growth (in demand for coal) was not expected to be comparable in scale to the demand growth from China in the previous two decades.

Reports from climate-focused institutions were far more optimistic on peak coal in China. The March 2015 report of the climate action tracker (CAT) celebrated the ‘coal crash’ in the US and argued that the decline in demand for coal in Organisation for Economic Co-operation and Development (OECD) countries will not be made up by China and India. It pointed out that the price of seaborne thermal coal had weakened and much of exported production (mainly to China and India) would not cover costs and that the future price of coal was unlikely to show much improvement. Coal is currently (October 2021) trading at over US$260/tonne, an increase of over 375 percent compared to price in November 2020. The CAT analysis also pointed out that China’s coal consumption fell for the first time in 14 years by 2.9 percent in 2014 and predicted that China’s coal consumption would peak before 2020.

The Economist in its issue for March 2015 noted that China’s coal consumption decreased by 1.6 percent in 2014, despite economic growth of 7.3 percent. It observed that though the coal industry has capabilities to cope with cycles in the coal business, the slowdown in 2014 was a structural shift driven by (1) China following the western world in beginning to phase out coal (2) India increasingly producing its own coal and (3) gas displacing coal in most other coal consuming countries.

Current trends

China is the only major economy where coal demand increased in 2020. China’s 2020 coal consumption reached a new high of 2,829 MT of coal equivalent, exceeding what was thought to be the previous peak in 2014 and contradicting many expert predictions that China’s economic growth had already decoupled from coal consumption. Strong economic growth is driving electricity demand in 2021, while post-pandemic stimulus measures are boosting production of steel, cement, and other coal-intensive industrial products. The IEA expects coal demand in China to increase by more than 4 percent in 2021, keeping demand well above the 2014 peak and reaching the highest ever levels for China.

The Chinese coal power fleet (including combined heat and power, or CHP, plants) represent around one-third of global coal consumption. From late 2020 through to early 2021, coal’s share in the Chinese generation mix bounced back from record lows earlier in 2020. The rebound was bolstered by reduced hydropower availability in the dry winter period and rapidly growing demand. Since November 2020, coal’s share in power generation in China has increased, remaining above 64 percent until April 2021. Over the first four months of 2021, the share was 66.5 percent, higher than in the same periods in 2019 and 2020. Considering China’s recent pledge to achieve net-zero emissions by 2060, this seasonal shift back to coal highlights the challenge China faces, at least in the short to medium term, in reducing coal-fired generation even as electricity demand grows strongly.

In India, April 2020 marked the lowest point of coal consumption in many years as a significant economic slowdown in the second half of 2019 was followed by COVID lockdowns. The economic recovery since then led to a continuous rebound of coal consumption, with a 6 percent increase in the fourth quarter of 2020. Higher coal demand was also driven by a decline in generation from hydro, following 2019’s exceptionally high output. Coal consumption is demonstrating a strong economic rebound in 2021, driving up coal demand by almost 9 percent, which is 1.4 percent above 2019 levels.

In early 2021, coal-fired generation in India reached a monthly share of 79 percent in the mix, the highest level since early 2019, as demand growth was met by coal-fired generation as availability of hydropower and wind was low. Generation of electricity in India in the first quarter of 2021 was around 10 percent higher than in the same period in 2019. In January and February, it was 5 percent higher than in the same period in 2020, before COVID-19 restrictions started.

China and India are not exceptions to the trend of coal resurgence. Coal consumption is surging in gas-abundant United States and in gas-importing Europe. In both these mature energy markets, increase in the price of natural gas has forced some power generators to shift to coal driving up the price of coal. However, coal remained the cheaper option—including high carbon prices in Europe—given the phenomenal increase in the price of natural gas.

According to projections by the IEA, fossil fuel-based electricity is set to cover 45 percent of additional demand in 2021 and 40 percent in 2022. Coal-fired electricity generation, after declining by 4.6 percent in 2020, is expected to increase by almost 5 percent in 2021 to exceed pre-pandemic levels and grow by a further 3 percent in 2022 possibly setting an all-time high record. This indicates a discrepancy between current market trends and stated medium- and long-term climate protection targets.

Issues

The threat to energy security pushed global energy markets towards despised fossil fuels. Both highly controlled markets (as in India and China) and lightly regulated but decontrolled markets (Europe and the USA) were not capable of adapting to sudden surges in demand and decline in supply (renewable) without the aid of firm capacity from fossil fuels. This may be a transient phenomenon, but it raises some issues for India as it has embarked on deregulation of the electricity market in parallel with decarbonisation of supply. Achieving the perfect balance between maintaining enough electricity generating capacity to meet peak demand while not paying for idle power capacity is a complex problem for India’s power system. Too much capacity will add unnecessary cost and too little will risk blackouts. In the context of cost recovery, a problem unique to India is how costs for capacity will be recovered when current tariff is insufficient to recover cost of energy supply. Developments in advanced energy markets offer India a preview on the challenges in balancing the demand for energy security and the need for climate protection.

Source: BP statistical review of world energy

Source: BP statistical review of world energy

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV