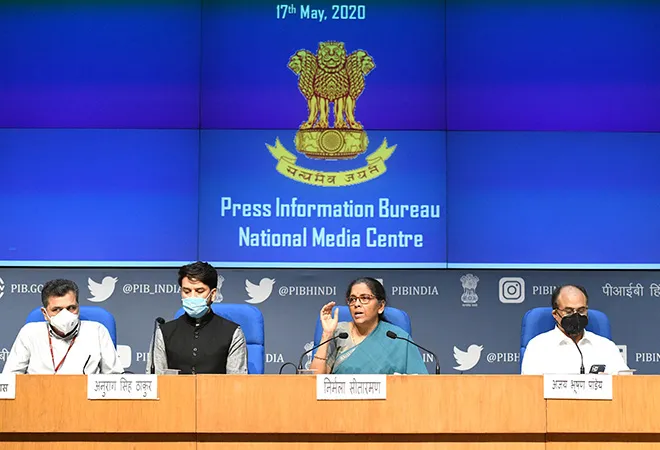

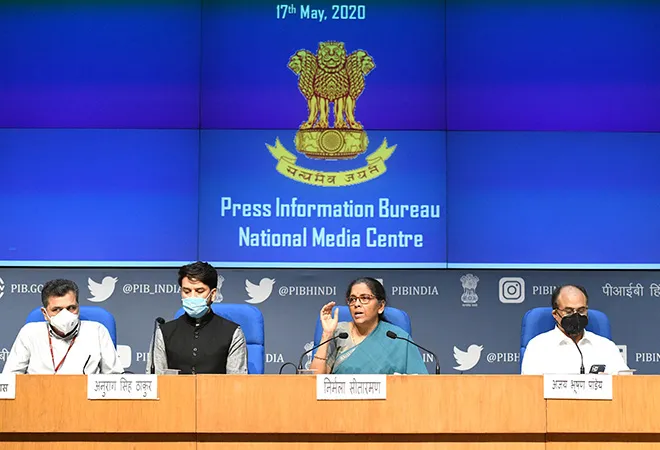

In her fifth and final tranche of announcements on 17 May 2020, Finance Minister Nirmala Sitharaman offered policy measures with which to deal with the COVID19 crisis. While she prefaced her presentation with two quotes from Prime Minister Narendra Modi’s 12 May 2020 address to the nation – “COVID19 is a message and an opportunity” and “land, labour, liquidity and laws” – what we see in her climactic set of policy measures is a mix of reform, financial relief, good policy loosening, bad policy measures, and finally, ideological manoeuvrings that are out of tune with a crisis package. Political conversations dominate the economic discourse. Most important, she answers the questions around the Rs 20 lakh crore number that Modi had announced.

The numbers, first

Sitharaman said the value of the “Overall Stimulus provided by Atmanirbhar Bharat Package” stands at Rs 2,097,053 crore (or almost Rs 21 lakh crore), as indicated by Modi. Broken into two broad parts (current five-part package and earlier measures including those from RBI), the amounts are as follows:

|

Overall Stimulus provided by Atmanirbhar Bharat Package

|

| Part 1 |

5,94,550 |

| Part 2 |

3,10,000 |

| Part 3 |

1,50,000 |

| Parts 4 and 5 |

48,100 |

| Earlier measures |

1,92,800 |

| Actual RBI measures |

8,01,603 |

| Total |

20,97,053 |

As far as debates go, we need to remember that India is a country with a per capita income of Rs 2,000, a tax-GDP ratio of 17% and does not have the ability to print money without causing hyperinflation. To compare India’s package with what the Western world is doing is unfair – their per capita incomes are more than $30,000, tax-GDP ratios are more than 30% and the number of people are a fraction of India’s. As India’s problems are unique, so will the solutions. While the Rs 20 lakh crore figure has been achieved, over the next few days, these numbers will be tested, questioned. These will be rich debates – whether fiscal deficit matters at all, whether printing money is necessary, whether it is enough, what the alternatives are.

Reform

Even though Sitharaman did not specify it, the ‘reform’ measure in her 24-slide presentation was around education. To be fair, it is not a ‘reform’ but a policy directive that could reform education with some tinkering. India’s top 100 universities will be permitted to automatically start online courses by 30 May 2020. We hope this means the education bureaucrats will enable – not allow but enable – these universities to grant degrees online. While the world has moved on, India is lagging in this aspect. The technology is in place, so is the connectivity.

If the government permits universities to deliver online education, with degrees being conferred to students, it could take top quality education to the last student standing. Until we see it happen on-ground, we hold our enthusiasm. But if it happens, India could theoretically be a global education hub. Already, several universities across the world have stated that they will be conducting the next two semesters online. Such a reform should enable Indian universities to follow through. This reform seems to have been signed with trembling fingers: why only top 100 universities, why not all? If it is to experiment as a pilot project, fine; if it is a return to decontrol with control, we are back to square one.

Financial relief

The most important measure in terms of impacting the maximum number of citizens as well as in financial outflows is the Rs 40,000 crore increase in the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS). The budgetary allocation for MGNREGS had been cut by 13.4% in Sitharaman’s 2020-21 Union Budget. This addition, therefore, is 65% higher than what was budgeted. It will go far longer to deliver an income to migrants returning to their villages. Apart from income security, it could help create a larger number of durable and livelihood assets including water conservation assets. This is big.

Good economic policy loosening…

Decriminalising minor violations such as technical and procedural defaults is a good and timely measure. That it has been done by leaning on COVID19 crisis is timely. We hope decriminalising the shortcomings in corporate social responsibility reporting, inadequacies in board reports, delays in holding annual general meetings and so on will continue in the post-crisis world as well. The majority of compoundable offences sections will be shifted to internal adjudication mechanisms. Finally, seven compoundable offences will be dropped. Further, companies will now be allowed to list directly in ‘permissible’ (why attach this fine-print now?) foreign jurisdictions. There will be lower penalties for defaults for small companies, one-person companies, and start-ups.

Health is the other area where Sitharaman offered some good policy measures. These include having one infectious diseases hospital in every district. This is an investment into a future, which expects that COVID19 will not be last pandemic. It is also using the downtime to plan for a better health future. But public expenditure on health to be increased is a financial copout. Today, with technology and tele-medicine, we can get more out of the same rupee. By announcing the expenditure, the government playing into last century’s debate around a percentage of GDP rather than what the spending can deliver. It confuses outcomes with inputs, and needs a rethink in the way it approaches a technology-driven healthcare system. So, by all mean hike the health spend – but make the rupee go farther.

…and bad economic policy loosening

The minimum threshold to initiate insolvency proceedings under the Indian Bankruptcy Code will be raised to Rs 1 crore, from Rs 1 lakh. This, Sitharaman said, would insulate micro, small and medium enterprises (MSMEs). Why? If a company defaults, why should it be allowed to get away? This is economic virtue-signalling to give an impression that the government stands with the small, who have been, are and will remain beautiful, even if they breach contracts or default. There is a big moral hazard here – the banks and other creditors will pay the price for managing this hazard. The suspension of fresh initiation of insolvency proceedings of up to one year or excluding COVID19-related debt from the definition of ‘default’ is a needed loosening in such times.

But providing a regulatory radar under which small companies can do what they want is bad policy, bad precedent. It is an incentive to stay small. It is back to the pre-1991 era, when 836 items of production were reserved for production in small-scale enterprises, now renamed MSMEs. These, according to Rakesh Mohan, included clothing, shoes, toys, hand tools, and dinnerware – all consumer goods that led the East Asian manufacturing push in the 1960s, 1970s and 1980s and delivered a high per capita income to those nations. Now, instead of small scale reservation, the government is offering small scale regulation. The unstated objective and the unintended consequences remain the same: stay small and uncompetitive.

Ideological confusion

The entire slide focussing on public sector enterprise (PSE) policy is an idea we don’t understand. Sitharaman proposes a complicated grid of first listing strategic sectors and then ensuring that at least one PSE functions within those sectors. The number of PSEs in strategic sectors will be from one to four. If there are more, they will be merged or privatised.

This is an ancient obsession and a partial return to Nehru-Gandhi’s commanding heights. If we presume this idea of government-owned enterprises driving strategic areas is here to stay, why hang it under a tranche that is aimed at managing the crisis? The government should be focussing on ensuring outcomes from PSEs, making them more efficient. After all, how many more exchequer-financed firms like BSNL or Air India does India need? And if indeed the idea is to control the strategic sectors, the policy direction should be to push them towards delivering cutting-edge research, say in creating a Made in India 5G or 6G equipment, or in the area of space like the outstanding Indian Space Research Organisation. The sole ray of hope in this idea: the 12 public sector banks could be reduced to four.

Political fine-print in Union-State relations

Sitharaman’s proposals will ignite a political debate around the Union-State relations. On the one hand, she has granted a greater flexibility to States to raise monies through borrowings. Against the initial ceiling of 3% of gross state domestic product (GSDP), she has allowed them to raise 5% of GSDP. This, even though States have so far borrowed only 14% of their limit, with 86% of the authorised borrowings unutilised. This, she said, has been done because States have been asking for this special increase. From Rs 6.41 lakh crore, States will now be able to raise Rs 10.69 crore, a rise of Rs 4.28 lakh crore.

But this flexibility comes with a fine-print. While the first 0.5% of additional borrowings will be unconditional, the next 1% will be in four parts of 0.25% each across four reforms around universalisation of ‘One Nation One Ration card’, ease of doing business, power distribution, and urban local body revenues. Each quarter of a percentage point will be linked to “clearly specified, measurable and feasible reform actions”. The last 0.5% will be allowed if milestones in three out of the four reforms would be achieved. We see this as a nudge to States to work on reforms. While the BJP-governed States will fall in line, expect political opposition from others.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV