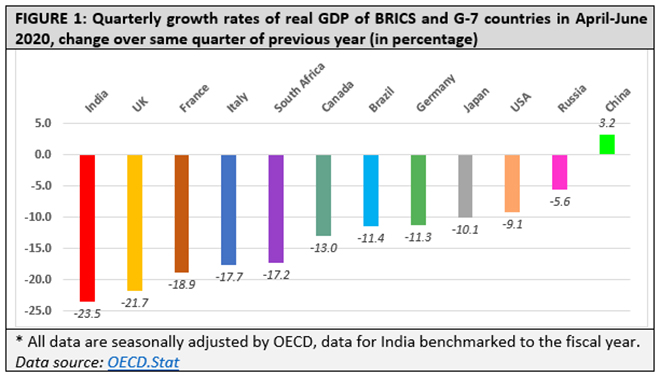

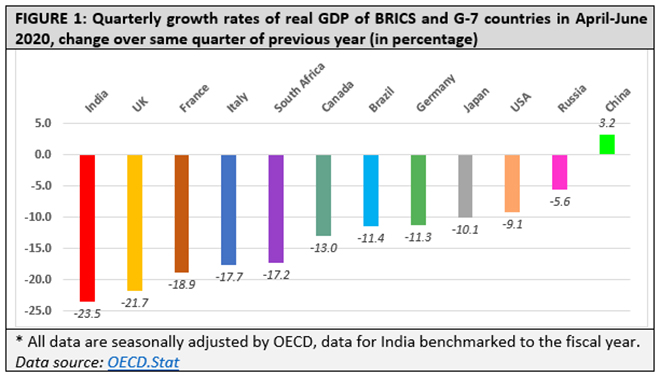

The actual estimates of real GDP (gross domestic product) growth rates of major economies for April–June quarter of 2020 are now officially out. As expected, almost all countries experienced contractions in their real GDP, except for China.

Among the G-7 and BRICS countries, India is the worst hit with a 23.5% contraction. France, Italy, South Africa, Canada, Brazil, Germany and Japan experienced double-digit contractions in their respective GDPs. The US economy contracted by 9.1% and despite stringent government response Russian GDP contracted by 5.6%. One of the most unexpected contraction, in spite of relatively less stringent government response to the pandemic, occurred in the UK where the quarterly growth rate plunged by 21.7%. China is the only country to have a positive growth rate in this quarter, at 3.2% (Figure 1).

These large contractions in all major economies came as a shock to many. Many international reputed agencies including International Monetary Fund (IMF) projected much less impact of the pandemic and resultant restrictions on economic growth, even in the month of April this year.

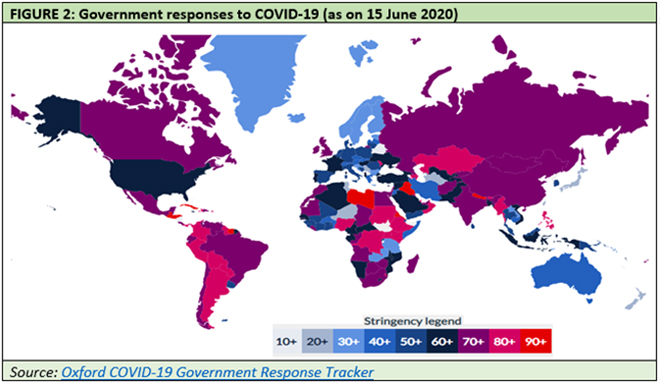

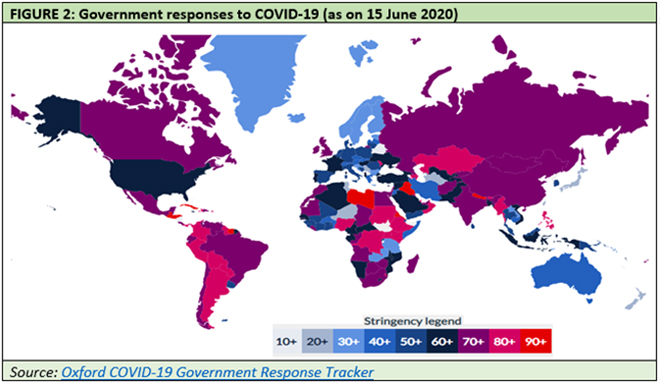

There has also been an expectation that the countries that employed more stringent measures to deal with the pandemic are likely to be impacted more in economic terms. The policy choice between public health and economy was fiercely debated in some of these countries.

Germany started the quarter with high stringency but lowered the stringency level around the middle of the quarter, but still contracted by 11.3%. The UK remained at a moderately stringent level compared to others (around 70.0 in the stringency scale) in the second half of the quarter but still its GDP crashed by 21.7% in this quarter. India’s stringent measures (in April–May) and the largest drop in GDP among these countries, and late implementation of American stringent measures and its economy going down by less margin probably would still encourage linking stringency with economic downfall (Figure 2).

However, the April–June quarter GDP results have sprung quite a few surprises as well. Russia, in spite of employing relatively more stringent government response, contracted relatively less at 5.6%. Japan, on the other hand, started the quarter with less stringent response but still contracted by 10.1%. With relatively less stringent response to the pandemic, GDP of France contracted more than the GDP of Italy in this quarter. With sufficient stringent measures throughout this quarter and still managing to clock a positive growth rate, China remains the biggest outlier within BRICS and G-7 countries.

Trying to link stringency in government response and subsequent margin in fall of GDP, thus, probably would be premature at this stage. First glance at the data, on the contrary, hints towards the pre-pandemic state of affairs in these economies that decided the corresponding falls in GDP. The nature of restrictive measures adopted and their impact on economy require a closer and deeper scrutiny. The jury is still out on this.

Meanwhile, principally because of this chaos the forecasting agencies all over the world are struggling to comprehend the full impact of this pandemic on economy. The growth projections estimated at the beginning of this pandemic are consistently failing to predict the reality.

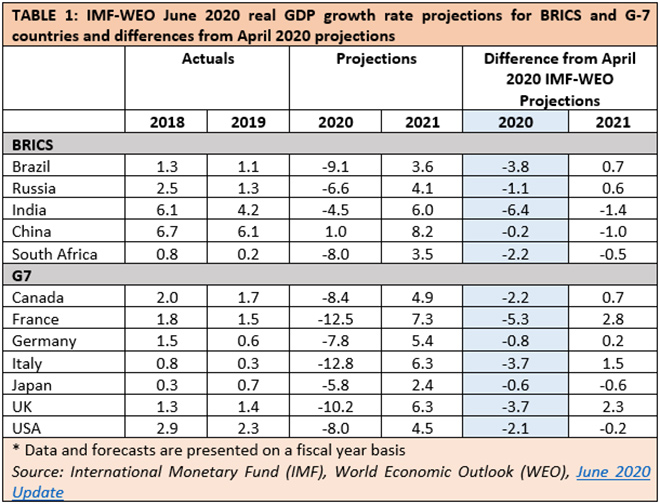

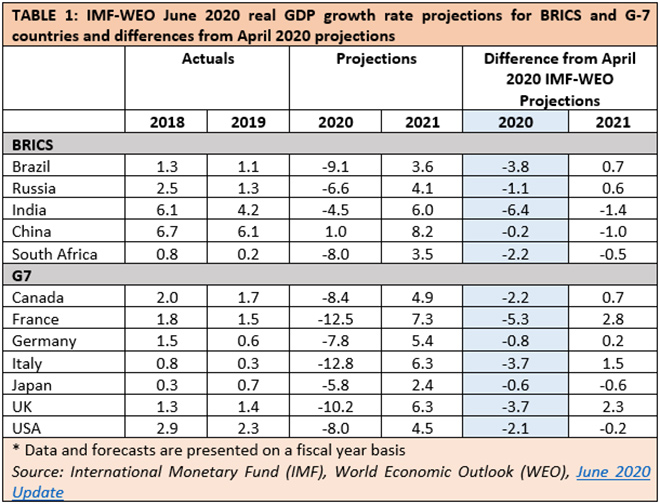

IMF predicts the real GDP growth rates of different countries periodically in its World Economic Outlook (WEO) updates. The yearly growth rates are also usually re-worked and adjusted. If the difference between IMF-WEO yearly projections in April 2020 and June 2020 are observed for the BRICS and G-7 countries (penultimate column of Table 1), the forecasts clearly are way out of the mark. These data and forecasts are on a fiscal year basis. In June, IMF has widely revised the yearly projections that were made in April.

Under normal circumstances, a non-negligible upward bias of any real GDP growth rate forecasting estimate varies between 0.5% to 0.6%. But these are not normal times, and one may consider the predictions to go wrong by a full percentage point. Even by that yardstick, in the first quarter of the fiscal itself nine countries’ yearly real GDP growth predictions have already gone beyond that error limit. In India’s case, the difference is the largest. IMF-WEO yearly real GDP growth rate projection made in April slipped by -6.4% in June. Here, the most crucial point to remember is that IMF June updates did not have the access to the first quarter actuals of these countries in current fiscal year. Still the estimation slippages are so much. Next update in October is likely to worsen these gaps.

More importantly, IMF is not the only agency struggling to predict real GDP growth. All predictions are going wrong this year, and in almost all cases the main problem is over-prediction.

The supply chains are disrupted, productions are taking place sporadically, input and output demands are uncertain and volatile. On the demand side – unemployment increased across the countries, purchasing power diminished, consumption demand has taken a hit, investment demand naturally slumped, and there is no immediate possibility of overall export demand going up anywhere in the world. So, the inherent chains of economic growth drivers are severely broken in both demand and supply sides.

In such a situation, the usual forecasting models (which depend on those growth drivers) are likely to go haywire. That is what is happening currently in all global forecasting endeavours.

Forecasting predictions are extremely useful in policy making under normal circumstances. But the pandemic has temporarily made these predictions visibly unreliable. Pinning hopes on faltering growth projections now is unwise, and also has the potential to push any economy into recession or prolonged stagnation. Growth slippages in both projected and actual GDPs are very high for India, signifying the high recession and/or stagnation risks in the longer run.

Injecting demand into the system by fiscal stimulus measures and protecting the economy by bolstering the domestic consumer markets are a safer route to take, instead of relying on faulty forecasts. At least for the next one year, that seems to be the wiser and better path for Indian economic policy making.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV