In mid-May 2022, El Salvador’s President Nayib Bukele hosted what has been dubbed the first “

Davos of Bitcoin”, in the presence of central bankers from 44 developing countries. Seen in isolation, this event may seem fringe and insignificant, but when seen in the context of the

erosion of dollar dominance, high global inflation, great power conflict, and talks of

changing world order, the Bitcoin event is a sign of the emerging interest around a contender for the next global reserve currency.

By suppressing Bitcoin adoption today, India (and China) could be making similar errors with grave implications for their future. Bitcoin is the hardest money ever invented due to its absolute mathematical scarcity and other nations cannot be stopped from adopting it. Therefore, being an early adopter is India’s rational strategy in the national interest.

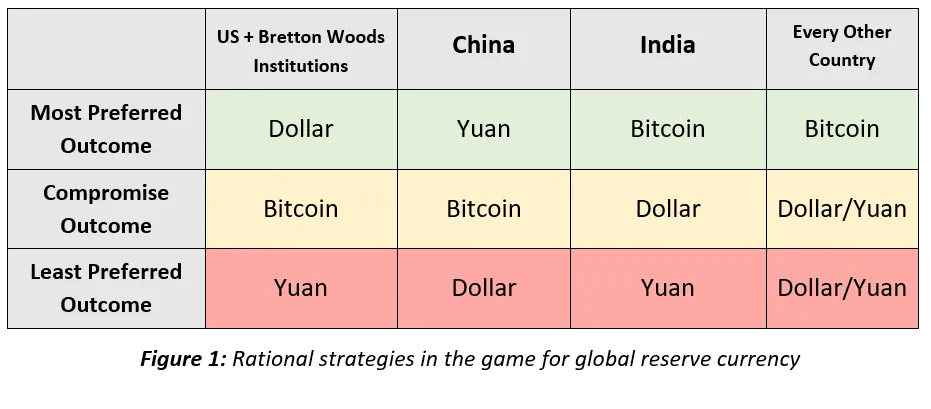

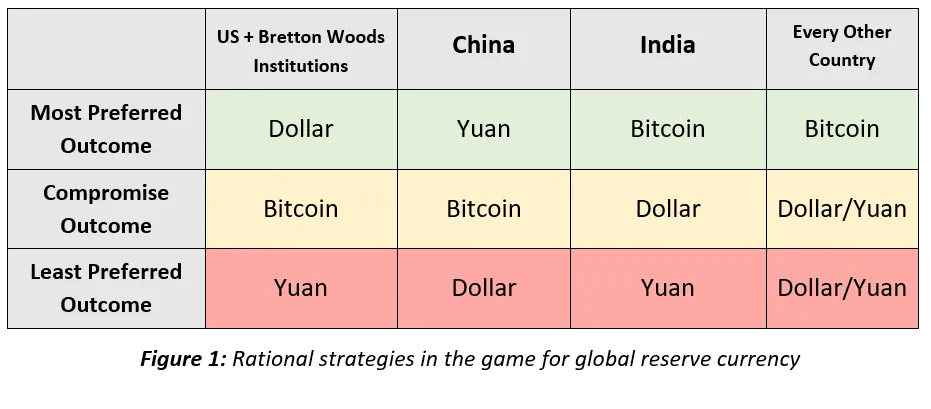

The power games between the US dollar, the Chinese yuan, and open-source Bitcoin for the global reserve crown will be an intriguing geopolitical episode of this decade. Bitcoin has more ground to cover before it defeats the veterans, but it does offer something unique to the world: Decentralised globalisation, with individual sovereignty and collective security for nations. Every country, except the United States (US) and China, has a rational incentive to use the neutral Bitcoin network for global trade. When the dominoes keep falling around them, Bitcoin can become a

rational compromise for the US and China too.

Figure 1: Rational strategies in the game for global reserve currency

Figure 1: Rational strategies in the game for global reserve currency

This incentive structure is an unprecedented opportunity for non-aligned developing nations to leapfrog global superpowers in financial innovation, by being the first movers to a harder monetary standard. But many developing countries will likely miss this opportunity, some due to

irrational strategies formed by information asymmetry; some due to

intransigent central banks who want to retain control of monetary policy; and others due to

push-back from the Bretton Woods institutions, the US, or China. As a sovereign nation whose interests are better served by a neutral reserve currency, India has a rational incentive to be an early mover on Bitcoin adoption. But the regulatory environment is complicated by conflicts of interest amongst some key domestic and foreign stakeholders in the Indian economy. Therefore, the executive, legislature, and judiciary have to play strong oversight roles in aligning India’s cryptocurrency regulations with its national interest and constitutional values.

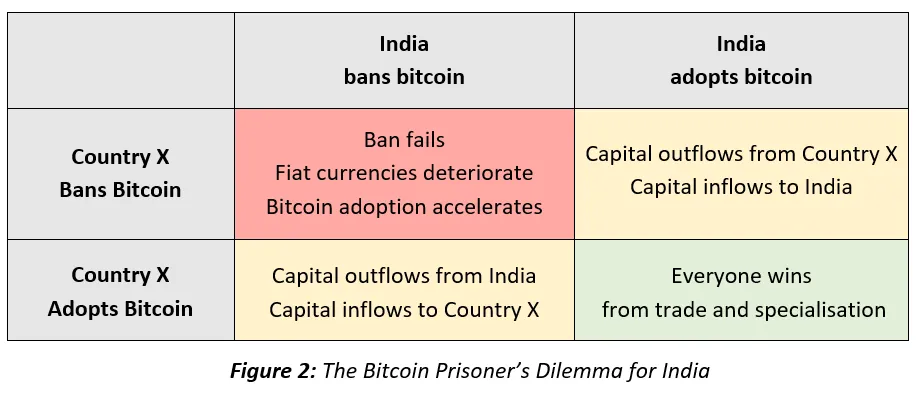

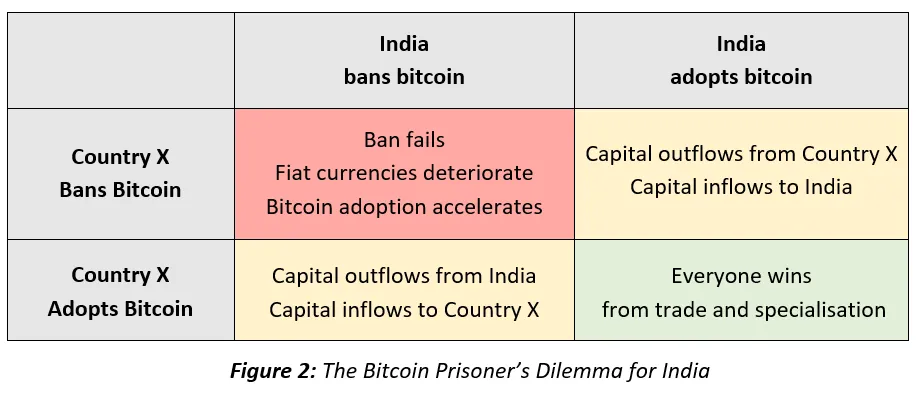

The Bitcoin prisoner’s dilemma

The prisoner’s dilemma can be used to gauge probable outcomes based on rational strategies and expectations amongst players. As a pure

monetary good with no other utility right now, Bitcoin’s adoption and price discovery are functions of this game-theoretic interplay amongst market participants.

Figure 2: The Bitcoin Prisoner’s Dilemma for India

Figure 2: The Bitcoin Prisoner’s Dilemma for India

Every country in the world faces the

same dilemma with Bitcoin. So the game matrix of Figure 2 is repeated between multiple players, with the following outcomes:

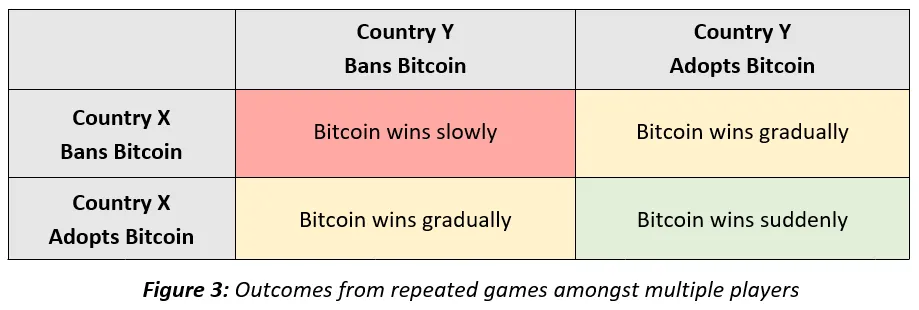

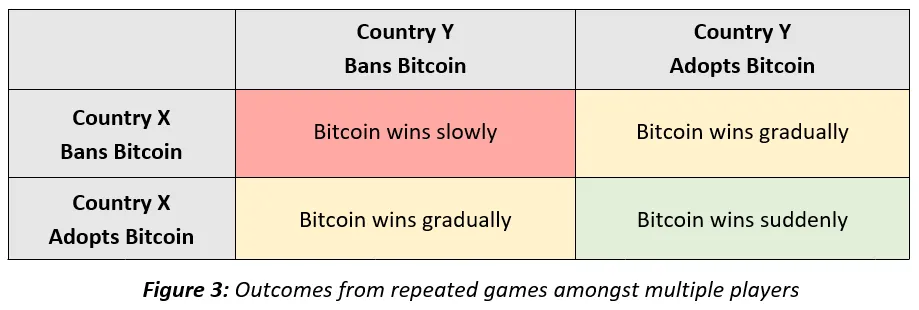

Figure 3: Outcomes from repeated games amongst multiple players

Figure 3: Outcomes from repeated games amongst multiple players

Now consider what happens when this outcome matrix becomes more apparent to the players over time: More and more countries will see the rational incentive in adopting the inevitable, likely precipitating a sudden move. So the Bitcoin adoption curve amongst nations started off slowly (with most countries looking to ban it), then moved gradually (with

some countries adopting it) and is gearing up to move suddenly (with many countries adopting it) over this decade. In the 2010s, early individual and institutional investors saw

asymmetric returns with Bitcoin. In the 2020s, early

geopolitical investors can become more prosperous and powerful with it, whilst laggards are likely to suffer from capital outflows and strategic weakness.

India has a rational incentive to be an early mover on Bitcoin adoption. But the regulatory environment is complicated by conflicts of interest amongst some key domestic and foreign stakeholders in the Indian economy.

Bitcoin’s strategic import lost in “crypto” noise

Only Bitcoin (other cryptocurrencies have single points of failure) is important for India’s national security, financial sovereignty, and energy independence in the 21

st century. The Bitcoin network is anti-fragile, secured by

military-grade cryptography, and its adoption incentives are similar to nuclear technology, early movers are likely to gain an asymmetric edge over geopolitical rivals.

We can learn from history; in the second half of the 19

th century, as much of the world moved to a harder gold standard,

India and

China stayed on a silver standard. This gradually eroded their terms of trade and led to strategic weakness and economic backwardness that lasted for decades. By suppressing Bitcoin adoption today, India (and China) could be making similar errors with grave implications for their future. Bitcoin is the

hardest money ever invented due to its absolute

mathematical scarcity and other nations cannot be stopped from adopting it. Therefore, being an

early adopter is India’s rational strategy in the national interest.

The current

dollar-based global financial system does India no favours. On the contrary, India has to endure the worst

second-order effects of

American monetary policy: The current spate of

high inflation, for example. Further, as showcased by Russia, a sovereign’s foreign assets are

not really sovereign; and international payment rails are

not really neutral. Consequently, the dollar’s global power is

now eroding—recent geopolitical events, the

history of reserve currencies and

diminishing American incentives from dollar dominance—all hint at a

significant transition underway in global finance. As the dollar-based system contracts or implodes in a

spate of currency crises, countries close to the Bitcoin escape hatch could be better positioned to survive and thrive in the new era of decentralised globalisation.

Whilst most of the “crypto industry” is speculative technology at this point, bundling Bitcoin with the rest would be a grave policy error that could set India back by decades.

So it was significant that on 4 March 2020, the

Supreme Court overturned the Reserve Bank of India’s ban on cryptocurrencies, observing that the circular was “manifestly arbitrary, based on non-reasonable classification, and it imposes disproportionate restrictions”. The Court accepted that the ban was a restriction of the right to practice any profession, or to carry on any occupation, trade or business as contained in Article 19(1)(g) of the Indian Constitution, and considered whether this was sufficiently imposed in “the interest of the general public” under Article 19(6).

The Government of India is now working on a bill to regulate the “crypto industry”, which will be presented in the Parliament later this year. Whilst most of the “crypto industry” is speculative technology at this point, bundling Bitcoin with the rest would be a grave policy error that could set India back by decades.

Key arguments

- Classification: Bitcoin is fundamentally different from every other digital currency or asset class at the technological, financial, geopolitical, and legal levels. Bitcoin is a “digital synthetic commodity” analogous to (but better than) gold. Every other digital token is like shares in a speculative technology company.

- Financial sovereignty: For both nations and individuals, Bitcoin removes the need for financial intermediaries, with a permissionless and decentralised architecture. As a sovereign nation with individual liberties, Bitcoin aligns with our constitutional values and democratic ethos.

- Hard money: India’s national interest lies in adopting Bitcoin as part of its strategic financial reserve. A digital rupee backed by “digital gold” would move India to a hard money standard, which could prevent runaway inflation, and unlock a new era of capital accumulation, economic growth and prosperity.

- Global reserve: Bitcoin could replace gold and the US dollar as the global reserve commodity and currency respectively over the next 10-15 years. Nation-state game theory, the history of money, network effects of technology and current geopolitical events all point to that inevitable outcome.

- Geopolitical strategy and national security: India’s move to a Bitcoin Standard would checkmate the rise of the Chinese yuan, which hopes to replace the US dollar as the global reserve currency. The yuan winning this race would be a disaster for India’s national security and financial sovereignty. With Bitcoin, India can pre-empt and disrupt that outcome.

- Energy independence: Bitcoin mining incentivises abundant electricity production by anchoring the rollout of grid infrastructure and acting as a flexible load buyer. Cheap but intermittent renewables are particularly incentivised and could herald a new era for India as a renewable energy superpower.

- Remittances: India was the world’s largest recipient of foreign remittances at US$87 billion in 2021. Bitcoin’s Lightning Network enables instant remittances at near-zero fees from anywhere in the world.

- Regulatory sandbox: The Indian government should identify a special district where Bitcoin developers, merchants, and users can experiment with the technology without having to pay prohibitive taxes.

Cautionary notes

- Volatility: Like barely understood internet stocks at the turn of the millennium, the wider cryptocurrency market is currently in its early adoption phase, rife with prodigious price swings, failed experiments and shadowy schemes. Bitcoin itself continues to grow in hype cycles, reminiscent of the NASDAQ in the early-2000s. Its current trading pattern is strongly correlated to high-growth technology stocks, signalling that the market still thinks of it as a risk-on asset and not a safe haven like gold. To protect itself from volatility whilst still being an early mover, a geopolitical investor should have a long-term view based on Bitcoin’s fundamentals, coupled with a cost-averaging strategy.

- Thin liquidity: In 2021, Bitcoin reached a market capitalisation of US$1 trillion in only 12 years of existence—the fastest growth trajectory in the history of any asset or currency. But that is still thin liquidity for a global reserve the foreign exchange markets had a daily trading volume of US$6.6 trillion in 2019. If a medium or large-sized nation were to announce a Bitcoin acquisition in advance, that could immediately trigger a hype cycle, driving up prices and inflating the cost of acquisition. A prudent strategy for any nation would be to buy under the radar in the bear market (like the one we are in currently) and go public only after a full round of acquisition is complete.

- Energy intensity: Bitcoin mining will likely be key to India’s cybersecurity and financial sovereignty in the near future. But mining is an energy-intensive and highly competitive global industry, with miners naturally gravitating to regions with the cheapest and most abundant power supply. India’s power infrastructure and pricing are currently not suited to sustain large-scale Bitcoin mining operations. But it does present a great opportunity for both the public and private energy giants, as well as start-ups in the renewable energy Successful models globally can be studied and then adapted for Indian conditions: Energy-rich Texas and Wyoming in the US, British Columbia in Canada, and some Middle-Eastern countries are the early movers in the mining space.

- Money laundering and criminal financing: Money laundering accounted for 0.05 percent of all cryptocurrency transaction volume in 2021, according to a report by Chainalysis. The inherent transparency of the Bitcoin blockchain which keeps a publicly available digital record of every transaction in perpetuity makes it a poor choice for cybercriminals if law enforcement agencies are up to speed with their technology. As the report notes, much of the cybercrime now happens on the more anonymous and arcane “decentralised finance” (DeFi) platforms.

- Education: In India, both public and elite education around Bitcoin is still at a nascent stage. Bitcoin is not just a new technology, it’s a new way of looking at moneys. An inter-disciplinary Bitcoin curriculum should cover the following subjects: engineering, finance, accounting, computer sciences, cryptography, etc. As we transition into a new form of money, we need to build the academic infrastructure that can guide the accompanying economic and societal transformation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

In mid-May 2022, El Salvador’s President Nayib Bukele hosted what has been dubbed the first “

In mid-May 2022, El Salvador’s President Nayib Bukele hosted what has been dubbed the first “

PREV

PREV