Non-fossil fuels news summary for the months of June and July

India

India’s tryst with nuclear power appears to be caught between the approval that India’s leaders convey to international nuclear suppliers for any number of new nuclear plants that they will be allowed to build in India and the disapproval that it encounters from local masses for these proposed plants. The latest reported is the proposed nuclear power plant at Kovvada in Andhra Pradesh. The international nuclear supplier is Westinghouse which was promised the opportunity of building six nuclear plants in India (including the Kovvada plant) when leaders met in Washington during the first week of June. The script for the Kovvada plant is playing out as it did in the neighbouring state of Tamil Nadu: The politician who has to win a local or State election expresses solidarity with the local people mobilised to oppose the plant by well-meaning but often ill-informed civil society organisations. What the politician is looking for is votes but once he gets the votes from the protesters and comes to power, he swiftly reverses his stand and embraces nuclear power. What the politician wants when he is in power are electricity, money and largesse from the Central Government. The poor masses who put their faith in the politician are quietly sent to jail on sedition charges. But there is one notable number quoted by the left parties agitating against the Kovvada plant that needs a closer look. If the capital cost of the plant is ₹480 million (about USD seven million) per MW is anywhere close to the truth it is definitely a reason to rethink the plant.

Towards the end of June, the second unit of the Kudankulam nuclear power plant that the Russians are building in Tamil Nadu was reported to be ready to generate power. Unit I of the much delayed Kudankulam plant currently contributes 1000 MW or roughly one fifth of India’s 5780 MW nuclear power generating capacity. Unit I of the Kakrapar Atomic Power Plant in Gujarat has been shut down since March on account of a leak.

The Nuclear Power Corporation of India Ltd (NPCIL) got its first nuclear insurance policy providing a risk cover of ₹15 billion at a premium of ₹1 billion. The policy is said to comply with the provisions of the Civil Liability for Nuclear Damages Act.

On the fusion front, India was reported to have started delivery of components for the International Thermonuclear Experimental Reactor (ITER) project. Other countries involved in the project are European Union, China, Japan, South Korea, Russia and the US. Private companies are reported to be building components including Cryosat, cooling water systems, vessel in-wall shielding blocks, radio frequency heating sources, cryo-distribution and cryolines, power supplies, diagnostic neutral beam system and diagnostic systems for the project. December 2025 is the new schedule for the completion of the project. On the whole nuclear power is moving ahead slowly and steadily in India.

On hydropower, there was news of a comprehensive policy to boost hydropower projects being devised by policy makers. Provisions such as viability gap funding, including hydro-power projects with capacity greater than 25 MW in renewable purchase obligations are to be included in the new policy. Power generated from hydro-power is currently charged at cost plus basis which inhibits efficiency. It appears that the industry is looking for long term assurance on tariff.

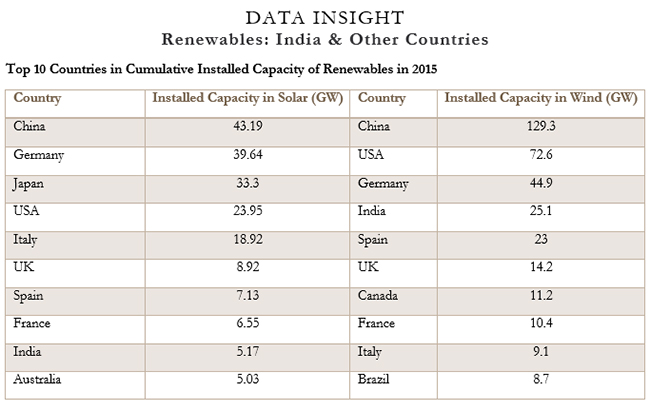

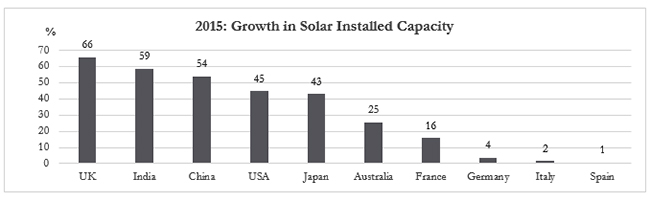

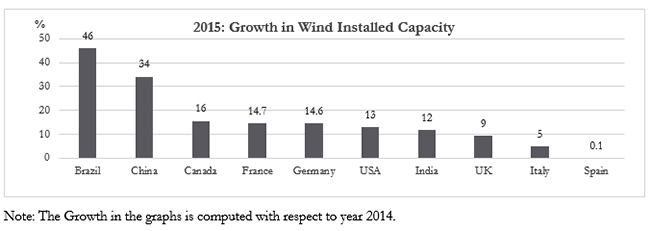

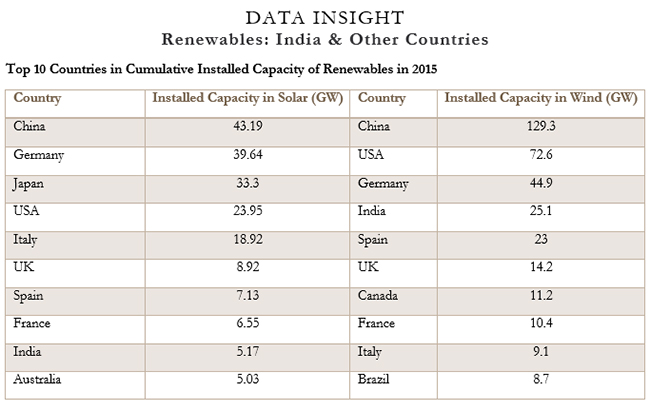

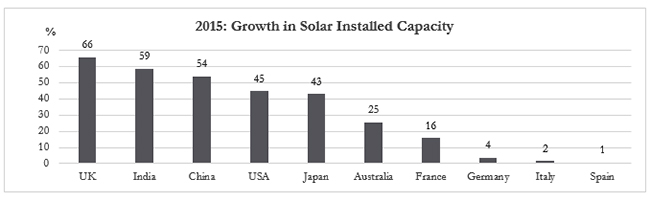

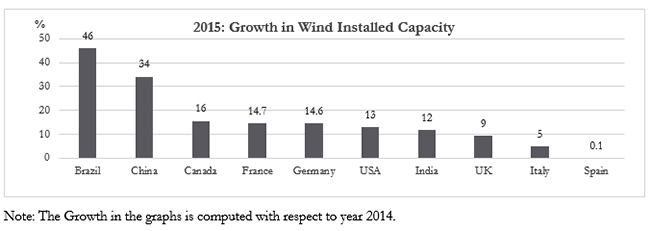

On new renewables such as solar and wind, there was a flood of news on how renewables are reining on policy, rhetoric, investment, investment commitments and capacity additions. The most important in June probably was the commitment of USD one billion loan for India’s solar mission by the World Bank during the visit of the World Bank President to India. India is the largest client of the World Bank with loans of about USD 4.8 billion between 2015 and 2016. India expects investment of over USD 160 billion in renewable energy in the next decade. The German Development Bank KFW has already agreed to offer India low-interest loans of around €1 billion over the next five years to fund roof-mounted solar panels and the construction of solar energy farms and self-contained solar power facilities not connected to the grid.

Greenpeace India continued its war on coal with the request to the Indian government that it should not delay halting its expansion plans for coal plants. The trigger was the report from the International Energy Agency (IEA) that said 85% of particulate matter and almost all of the sulphur oxides and nitrogen oxides result from fuel combustion. According to the report, around 60% of global combustion-related sulphur dioxide emissions originate from coal.

Tata Group, India’s biggest conglomerate was reported to be following a shadow carbon price in the group as many oil & gas companies such as Statoil ASA of Norway are doing. Statoil, Europe’s biggest natural gas producer currently has a shadow price of $50/tonne of CO2. The benchmark European Union carbon price was around $6 per tonne or less in June-July 2016.

Rest of the World

According to the IEA, global addition to nuclear power capacity in 2015 touched 10.2 GW the highest growth in 25 years driven by construction of new nuclear power plants mainly in China. This news came just after the second unit at the Changjiang nuclear power plant on China’s Hainan province was connected to the grid. The 650 MW Pressurised Water Reactor (PWR) is being built as a joint venture between China National Nuclear Corporation (CNNC) and China Huaneng Group using home grown technology. But there was disappointing news for nuclear power supporters from the developed World. It was reported that California’s last nuclear power plant was scheduled to be closed by 2025 under an accord ending three decades of debate fuelled by the State’s anti-nuclear movement. Production at the Diablo Canyon nuclear plant in California was expected to be replaced with solar power and other energy sources that do not produce greenhouse gases. The plant currently meets 9% of the State’s electricity demand. While renewable energy and anti-nuclear activists were behind the closure, the increasing competitiveness of power generation from natural gas and the slowing down of demand for power were thought to be among reasons for the declining interest in nuclear power.

But there was good news from Sweden. In June, the Swedish Parliament agreed to abolish a tax on nuclear power as it said that it recognised the role of nuclear power in helping Sweden to eventually achieve a goal of 100% renewable generation. The Social Democrats, the Moderate Party, the Green Party, the Centre Party and the Christian Democrats are said to be in agreement over this tax cut. This tax cut will allow for the construction of up to 10 new nuclear reactors at existing sites that will replace plants as they retire. A variable production tax on nuclear power introduced in 1984 was replaced by a tax on installed capacity in 2000. Vattenfall which operates Sweden’s nuclear plants said that profitability will be a challenge even with the tax benefit on account of low electricity prices and falling demand.

On the technology front, some developers of cost-competitive small modular reactors (SMRs) say that SMRs could take 50% of the global new build coal market by 2040, 30% of the gas market in non-gas producing countries and 30% of the market for new renewable energy plants. Small will probably become beautiful as far as nuclear energy is concerned.

Hydro-power made some gains in June. The first unit of South Africa’s 1332 MW Ingula pumped-storage hydroelectric project owned and operated by Eskom began commercial operations in June. The Ingula pumped-storage project is located on the Great Escarpment geological formation in the Little Drakensberg range and it straddles the border of the Free State and KwaZulu-Natal provinces in South Africa. Construction of the USD 3.5 billion facility began in 2006 and all four of Ingula’s units are scheduled for commercial operation in 2017. According to Eskom, when the project is fully-commissioned it will be able to respond to demand increases on the national grid within 2.5 minutes The Ingula facility will be Africa’s newest and largest pumped-storage scheme and the 19th largest in the World.

Greenpeace went after China again accusing it of building another 200 gigawatts (GW) of coal-fired power capacity despite tough new measures designed to cut the use of fossil fuels and tackle overcapacity. China’s total thermal capacity was reported to have grown by 7.8% in 2015 to 990 GW, outstripping a 0.5% increase in consumption. 24 GW went into operation in the first five months of 2016. China is currently estimated to have around 200 GW of excess capacity which is almost equal to India’s total capacity for power generation. Greenpeace said efficiency measures would see 110 GW of coal-fired power projects suspended and up to 70 GW retired by 2020, but changes in regulations last year meant there were still another 295 units under construction, with a total capacity of 200 GW. China is expected to ban all new approvals for coal-fired power plants until 2018 as part of its new 2016-2020 five-year plan for the energy sector. China is also reported to be planning a cap on coal-fired capacity at around 1050 GW by the end of 2020. Total large-scale thermal power capacity, more than 90% of which is coal based stood at 1015 GW. Average utilisation rates at China’s mostly coal-fired thermal power plants fell to 44.8% in the first five months, down from 49.4% last year, when they were already at their lowest since 1978.

There was yet another report, this time from Barclays saying that fossil fuel assets are likely to be stranded. The report said that the industry risked losing USD 33 trillion in revenue over the next 25 years as global warming may drive companies to leave oil, natural gas and coal in the ground. However fossil fuel investments also received positive news from Norway which announced that it could capture carbon dioxide from an industrial plant, transport it by ship and inject it into an empty North Sea oil and gas reservoir for USD 900-1500 million by 2022. The IEA has said that deployment of carbon capture and storage (CCS) technology is critical to reducing carbon emissions but wide adoption of the technology has been frustrated partly due to high costs. In 2014, Canada’s Saskatchewan Power opened the world’s first coal-fired power plant retrofitted with CCS. There are now 15 large-scale CCS projects in operation, according to the Global CCS Institute, an Australian-based lobby.

Rapid growth in wind and solar power in South Australia was reported to be increasing the likelihood of blackouts and soaring prices for industries as cheaper renewables had pushed traditional thermal power plants to close. South Australia uses wind farms and rooftop solar panels for 40% of its power, more than any part of the country. South Australia’s two coal-fired power stations have shut since they could not compete with cheaper wind power and 15% of its gas-fired power capacity is now mothballed. Without a local coal-fired power plant to provide voltage control on the grid industries may need to temporarily disconnect power lines to ensure stability to the rest of the network. As in the case of oil, a glut is said to be building up in PV module manufacturing in China which will reduce the price of solar panels everywhere in the World.

The call from enthusiastic students of New York University to divest from fossil fuel investments was rejected by its board of trustees as it would ‘limit its choices in investment and would not reduce the amount of capital available to those companies’. Other Universities that have declined to divest from fossil fuels include Cornell University, Stanford University and Yale University.

NATIONAL: OIL AND GAS

Upstream

India, US discover major natural gas reserve in Indian Ocean

July 26: A joint expedition by India and the US discovered a major deposit of natural gas in the Indian Ocean, offering the potential to significantly expand energy production in a region that’s currently a big importer. India’s Ministry of Petroleum and Natural Gas and the US Geological Survey struck a large, highly enriched deposit of natural gas hydrate — an icy form of the fuel — in the Bay of Bengal off the country’s east coast, potentially the first producible reserve of its kind in the waters. The discovery also comes as countries like India and China seek to slash their dependence on higher polluting energy sources like coal, which releases twice the heat-trapping emissions as natural gas when burned. The discovery follows an exploration of the region from March to July of last year. While earlier finds of hydrate accumulations were unlikely to be producible, formations in sand reservoirs like the one announced are the most easily tapped with existing technologies. The next step is to determine whether production from the Bay of Bengal site is economic.

Source: Bloomberg

Expro wins $17 million well testing contract from ONGC

July 26: Expro, an international oilfield services firm, reported that it has won a $17 million well testing contract from Oil and Natural Gas Corp (ONGC) for work on the latter’s upstream assets in India. Under the 3 year contract, Expro will work on ONGC’s assets throughout western and eastern India, including offshore Mumbai, onshore Rajamundry and the Krishna Godavari basin. The contracts comprise of Expro’s 15K and 10K surface well testing packages for high pressure high temperature and conventional wells, and will be fully supported from its local facilities. Two sets of 15K surface well test packages will be delivered for 10 offshore and 22 onshore wells in eastern India, while 4 sets of 10K packages will be delivered offshore Mumbai, including the provision of a Well Test Supervisor and Operator on a call-out basis. The 10K packages will be used for production testing of exploratory wells, and testing, flow back and measurement of worked-over and platform wells. The onshore package will be deployed for the testing of exploratory and completed wells onshore at Rajahmundry.

Source: RigZone

RIL, BP spend 45 billion to maintain gas output at KG-D6

July 24: Reliance Industries Ltd (RIL) and its partner BP of UK have invested over ₹4500 crore in the flagging eastern offshore KG-D6 block to maintain gas output at current level despite the steep natural decline that has set in the seven-year old fields. RIL-BP are currently producing from Dhirubhai-1 and 3 gas field and MA oil and gas field, three of the over one-and-half dozen discoveries made in the Bay of Bengal Block KG-DWN-98/3 or KG-D6. The fields, which began gas production in April 2009, hit a peak output of 69.43 million standard cubic meters per day in March 2010 before water and sand ingress shut down well after well. The block is currently producing 8.7 million standard cubic metres per day (mmscmd). Currently, RIL-BP are in the process of sidetracking (drilling) two of their existing wells and drilling away from the water to increase recovery of gas. The existing and enhanced production from these fields only get the price as per the formula that was approved in November 2014. RIL-BP have started working developing R- Series and satellite discoveries. A field development plan (FDP) approved in 2013 envisages $3.18 billion investment in R-Series or D-34 gas field to produce 13-15 mmscmd of gas for 13 years. RIL-BP recently submitted FDP for two other discoveries D-29 and 30, which formed part of R-Culster.

Source: Business Standard

India’s crude oil production fell 4.5 percent in June

July 22: India’s crude oil production fell 4.5 percent in June following a sharp drop in output at fields operated by private firms. Crude oil production at 2.96 million tons (mt) in June was lower than 3.1 mt produced in the same month last year. While Oil and Natural Gas Corp (ONGC) produced 2.75 percent less crude oil at 1.85 mt, fields operated by private companies saw output drop by almost 8 percent to 975,890 tons. Crude oil production at private fields was lower because of natural decline at Cairn India-operated Mangala oil-field in Rajasthan and BG-operated Panna/Mukta fields while under-performance of Bhagyam oil-field well in Cairn’s RJ-ON-90/1 block in Rajasthan. Also, Reliance Industries’ KG-D6 well under-performed due to sand ingress and water loading. Crude oil production in the first quarter, April-June, of the current financial year was 3.3 percent lower at 9 mt. Natural gas production dipped 4.5 percent to 2.59 billion cubic meters (bcm) on back of drop in output from private firm operated fields like KG-D6 of RIL. During the quarter, natural gas output dipped over 6 percent to 7.7 bcm. Refineries produced 3.51 percent more fuel at 20.16 million tons in June and about one percent higher in April- June at 60.27 mt.

Source: EnergyWorld

Cairn India to invest in existing projects

July 22: Cairn India, the petroleum exploration arm of London-listed Vedanta Resources, plans to continue investing in its existing projects to enhance domestic hydrocarbon production despite tough operating conditions and uncertain economic environment mainly because of strong demand outlook for the commodities. Based on the International Energy Agency’s World Energy Outlook, by the year 2040, 91% of India’s demand for oil and 49% demand for gas would be met by imports. Cairn India’s Rajasthan block has significant national importance as it has considerably helped reduce country’s crude oil imports. The company operates over 27% of domestic crude oil production.

Source: Business Standard

Downstream

IOC in talks to buy GSPC’s stake in Mundra LNG terminal

July 25: Indian Oil Corp (IOC) is in talks to buy debt-laden Gujarat State Petroleum Corp (GPSC)’s stake in the under-construction ₹4500 crore Mundra LNG import terminal in Gujarat. GSPC is looking to exit the five million tonnes a year terminal project, which is likely to be completed by 2017. It has offered its 50 percent stake in the terminal to IOC. With a view to expand its gas business, IOC is keen to buy a stake in the Mundra terminal, but does not want GSPC to exit the project completely. IOC wants the state government entity to remain as a part of the project for smooth operations. The terminal is not connected with any pipeline for shipping gas to consumers. To lay a pipeline to the nearest grid, it would require state government support and with GSPC on board, it could be done easily, according to IOC. IOC is keen to take half of GSPC stake and wants the Gujarat government entity to keep the remaining 25 percent. GSPC LNG, a unit of GSPC, holds 50 percent interest in the project. Adani Group holds 25 percent while the remaining 25 percent is to be bid to a strategic partner. It will be selling five million tonnes a year LNG terminal together with storage and re-gasification facilities over an area of 28 hectares on the coast. India Gas Solutions Pvt Ltd — the equal joint venture between the Reliance Industries Ltd (RIL) and Europe’s second largest oil firm BP — and Oil and Natural Gas Corp (ONGC) are the other two firms shortlisted to pick up 25 percent stake earmarked for the strategic partner in the project. Initially, eight firms including state gas utility GAIL India had expressed interest to buy the stake, but only three were finalised. Essentially, GSPC was looking at a partner which can bring in LNG or can consume the imported liquid gas. While BP is a producer and trader of LNG, RIL’s twin refineries at Jamnagar in Gujarat as well as its large petrochemical plants are huge consumers of gas. ONGC also is a big consumer of the fuel.

Source: Business Standard

Transportation and trade

India’s top gas utility seeks to defer Gazprom LNG contract

July 25: GAIL (India) Ltd is seeking to defer a 20-year contract to buy liquefied natural gas (LNG) from Gazprom PJSC until the Russian company’s Shtokman project begins production, the South Asian country’s biggest gas transporter said. GAIL signed a contract in 2012 to buy 2.5 million metric tons a year of LNG from Gazprom starting in 2018 and 2019. The Russian exporter was to supply LNG from the Shtokman project under the contract, according to GAIL. Now that the Arctic project is on hold, Gazprom has offered to supply LNG from other sources, the GAIL said. The Indian company is insisting on supplies from Shtokman and has said it will consider lifting LNG from other sources at a renegotiated price that is closer to spot-market rates. GAIL is struggling to find buyers for its gas amid an abundance of cheap alternative power generation supplies, including coal. The price of spot LNG to Asia during the past year has fallen 28 percent amid a global glut.

Source: Bloomberg

Policy and performance

ONGC, Cairn India demand halving of cess on crude oil

July 26: Oil and Natural Gas Corp (ONGC) and private sector Cairn India have demanded halving of cess on domestic crude oil production saying their burden has actually gone up after Finance Minister Arun Jaitley’s Budget exercise aimed at reducing the levy. ONGC paid ₹4500 per tonne cess on crude oil it produced from almost all its fields including prime Mumbai High, till February 2016. In Budget for 2016-17, Jaitley changed the cess from specific levy to an ad valorem rate of 20 percent of crude oil price. However, at the current oil prices, ONGC and other oil firms like Cairn are paying more than ₹4500 per tonne cess. The two firms have made representation to the government saying the ₹4500 per tonne equals to 20 percent ad valorem duty when oil price crosses $44 per barrel. And with oil prices ruling higher, the net impact of an exercise which was aimed at giving relief to domestic oil producers, is that they have to pay more now, they said. Historically, the Oil Industry Development (OID) cess was first levied in 1970s at the rate of ₹60 per tonne. Over the next decades it was hiked few times. It was ₹900 per tonne, when India opened up its economy in 1991 and was doubled to ₹1800 in 2002. In 2006, it was hiked to ₹2500 per ton when international oil price was $60 per barrel. It was further hiked to ₹4500 per ton in 2012 when oil prices were over $100 per barrel. But when international oil prices slumped to decade low, putting question mark over fresh investments in exploration, Jaitley proposed to move to ad valorem rate of 20 percent. The move was to give relief to upstream firms but has turned out to be reverse, they said. ONGC and other upstream players have sought reduction in cess to eight to 10 percent as the purpose of Budget exercise to rationalise the cess has been defeated even at current moderate crude prices. In a low crude oil price regime, cess imposes a significant economic burden on producers, they said. During 2005-06, when the crude oil prices had increased from an average of $40 per barrel to $60 per barrel, OID cess was increased from ₹1800 to ₹2500 per tonne from March 1, 2006.

Source: Firstpost

Saving 900k lives drives India’s spending on cleaner fuel

July 26: State-owned oil marketing companies have since May distributed 1.8 million liquefied petroleum gas (LPG) connections under a new program targeting the extremely poor. The government’s aim overall is to increase penetration to 80 percent, adding 100 million connections, over three years, according to Indian Oil Corp (IOC). The renewed focus on safer cooking options will drive LPG use up from records as the government tries to reduce the more than 900,000 premature deaths the Institute for Health Metrics and Evaluation attributed to household air pollution in 2013. It will also make India more import dependent and strain infrastructure. To cope, Hindustan Petroleum Corp Ltd estimates it and its peers will need to invest ₹100 billion ($1.5 billion) over the next few years to build new plants, expand old ones and lay pipelines, plus additional outlays on improving port capacities. Prime Minister Narendra Modi’s government has earmarked ₹80 billion to provide free LPG connections to women from families living below the poverty line, adding to at least two other programs aimed at reducing the use of fuels such as wood and cow dung. The indoor and near-home pollution generated by burning these is the leading cause of premature death in India after high blood pressure, according to the University of California. LPG consumption was already growing at a steady clip in India as it spread from urban, to semi-urban and rural areas. Usage has climbed at an average of seven percent annually since 2000, touching a record 19.5 million tons in 2015-16, according to government data. Overseas purchases have grown more quickly and are poised to overtake domestic supply this fiscal year, according to the Ministry of Petroleum and Natural Gas. Some experts fear the government’s push to accelerate LPG adoption will be hampered by inadequate port and pipeline infrastructure, while new projects will face delays in approvals as well as hurdles to land acquisition and right of way.

Source: Bloomberg

Centre will not force Tamil Nadu to implement CBM project: Oil Minister

July 23: The Centre would not force Tamil Nadu (TN) to implement coal-bed methane (CBM) project, Oil Minister Dharmendra Pradhan said. After formally the commissioning of Mounded Bullets at the CPCL refinery, he said the Mounded Bullets facility would enhance the safety and storage capacity of LPG at the refinery.

Source: India Today

ONGC faces 3.9 billion additional royalty burden, OIL stares at 11 billion

July 22: Oil and Natural Gas Corp (ONGC) will have to shell out ₹392 crore and Oil India Ltd (OIL) over ₹1100 crore after the government ordered them to pay royalty at gross crude oil price and not the net rate they actually realise. Of the ₹392.50 crore, about ₹300 crore would go to Assam and another ₹91.86 crore to Andhra Pradesh. ONGC is already paying royalty at revised terms to Gujarat — the third major oil producing state. For OIL, which produces most of its crude oil in Assam, the liability would be ₹1100 crore to ₹1150 crore. As per government mandate, ONGC and OIL offers discounts on crude oil to make up for a part of the losses refiners suffer on selling cooking gas (LPG) and kerosene at government controlled rates. These discounts also covered diesel till October 2014 when the price of the fuel was deregulated. So in effect, ONGC/OIL would raise a gross bill based on the prevailing international oil price but their actual realisation was less than that after accounting for the subsidy discount. However, producing states felt ONGC and OIL need to pay royalty on gross billing. Gujarat High Court in November 2013 ruled in favour of the state government and ONGC was asked to pay about ₹10,000 crore in past royalty dues. This prompted other oil producing states, particularly Assam, to demand a similar treatment. Till the time Congress ruled Assam, Oil Minister Dharmendra Pradhan maintained that the state government will have to approach the judiciary to get similar relief. With this order, Assam stands to get more than ₹1400 crore as additional royalty from ONGC/OIL. Andhra Pradesh will get about ₹92 crore extra royalty from ONGC due to this decision. According to the Oil Field Act, ONGC/OIL are required to pay 20 percent royalty on price of crude oil it extracts from on land oil blocks to the state governments.

Source: Business Standard

BPL families in cities may get extra LPG cylinder

July 20: Food and Civil Supplies Minister U. T. Khader has said that the department is urging the government to allot an additional LPG cylinder each to below poverty line (BPL) families in the city. These families have been given LPG connection in lieu of kerosene. Those in the rural areas will be given the option of choosing either an additional cylinder or two solar lights. Khader said that there is a demand from families in urban areas to restore kerosene supply as they need it for cooking in the event of their LPG cylinder turning empty. Families in rural areas also need kerosene for lighting lanterns when there is a power shutdown. Khader said that all BPL families living in urban areas have been given LPG gas connection and each family has been given one LPG cylinder. Khader said that the government will bear the cost of the additional LPG cylinder and installation of solar lights.

Source: The Hindu

NATIONAL: POWER

Generation

Focussing on getting stuck projects operationalised: Essar Power

July 24: Essar Power said its focus is on getting stuck projects operationalised and profitable. The company is burdened with ₹20,369 crore debt and is evaluating possibilities of reducing it. Esaar Power has said it is planning to fully operationalise its 1200 MW Mahan project in Madhya Pradesh as well as its two captive gas-based plants in Gujarat. It has two captive gas-based plants in Hariza in Gujarat with a capacity of 500 MW and 515 MW each, which are currently shut for want of fuel. The 500 MW Bhander plant in Hazira was commissioned in 2006 and commenced full commercial operations in 2008, but due to high fuel price, the firm shut the plant three years ago.

Source: India Today

NHPC and BHEL join hands for overseas hydroelectric projects

July 22, 2016: NHPC Ltd and Bharat Heavy Electricals Ltd (BHEL) have agreed for joint development of hydroelectric projects in overseas markets. Presently, NHPC is engaged in the construction of five projects aggregating to a total installed capacity of 4290 MW including 1000 MW (Pakal Dul HE Project) being executed through JV company. Ten projects of 7151 MW are awaiting clearances and government approval for their implementation including three projects of 1186 MW to be executed through subsidiary/joint venture companies.

Source: Business Standard

Nuclear-power generation capacity to be hiked three times in 10 years: Singh

July 21: Government plans to increase the nuclear power generation capacity of the country by three times in ten years, Union Minister Jitendra Singh said. He said the government aims to increase the capacity for power generation by three times in ten years. Singh said that a three stage nuclear power programme has been devised to efficiently utilise the large reserve of thorium in the country.

Source: Financial Express

Transmission, distribution and trade

PGCIL approves investment proposals of 27.3 billion

July 21: Power Grid Corp of India Ltd (PGCIL) has approved investment of ₹2731 crore in various projects, including setting up of a transmission system for solar park at Bhadla in Rajasthan for ₹1429.38 crore. The company approved as many as 11 proposals in its meeting held, PowerGrid said. The transmission system for solar park at Bhadla in Rajasthan at an estimated cost of ₹1429.38 crore with commissioning schedule of 30 months form the date of investment approval is among the approved proposals. The investment approval also include transmission system strengthening for independent power projects in Chhattisgarh and other generation projects in Western region at an estimated cost of ₹333.17 crore with commissioning schedule progressively by March, 2019.

Source: India Today

Policy and performance

Vodafone M-Pesa ties up with Punjab power utility

July 25: Vodafone M-Pesa, a mobile money transfer platform, has tied up with Punjab State Power Corp Ltd (PSPCL) to enable consumers pay their electricity bills instantly. Vodafone M-Pesa offers customers a cashless, secure platform for electricity bill payments with the largest network of agents (or CashIn Points) to enable digitisation of money for cash holding population, the company said. This facility is aimed at driving financial inclusion further along with providing the state electricity utility subscribers in Punjab the benefit and comfort of making payments instantly. As an added benefit, new users of M-Pesa can earn five percent cashback on the payment made through the App.

Source: The Hindu Business Line

Hinduja commissions one GW thermal power project in Vizag

July 25: Hinduja National Power Corp Ltd (HNPCL), part of the Hinduja Group, said it has commissioned its 1,040 MW Power project at Visakhapatnam. The power plant consists of two units of 520 MW each. According to HNPCL, Unit-1 started supplying power to the grid in January 2016, and that currently both units are operational. HNPCL said the entire power generated by the project is being sold to state-owned southern and eastern power distribution companies of Andhra Pradesh.

Source: Business Standard

Power deficit 0.9 percent in April-June quarter this fiscal: Power Minister

July 25: Overall power deficit during the April-June quarter this fiscal was 0.9 percent while the peak deficit was 2 percent. As per information given by states/UTs to the Central Electricity Authority, the gap between demand and supply of electricity has been brought down to the lowest ever 2.1 percent during 2015-16 which has further reduced to 0.9 percent during 2016-17 (April-June, 2016), Power Minister Piyush Goyal said.

Source: Business Standard

Power sector acquisitions to get cheaper next year: CESC

July 24: R. P. Sanjiv Goenka Group flagship CESC Ltd is expecting acquisition opportunities in the power sector to get cheaper over the next 12 months. In 2009, CESC acquired Dhariwal Infrastructure Ltd’s 600 MW Chandrapura thermal project in Maharashtra. However, the project now has accumulated losses of ₹600 crore, but is expected to turn revenue positive once a Power Purchase Agreement for 150 MW is signed over the next three months.

Source: The Hindu Business Line

Centre gives nod to MCL’s coal washery project in Odisha

July 24: The Centre’s green panel has recommended environment clearance to state-owned Mahanadi Coalfields Ltd (MCL) to establish a 10 million tonnes per annum capacity coal washery in Talcher district in Odisha. Coal India arm MCL has proposed setting up of ‘Jagannath Coal Washery’ with 10 million tonnes per annum capacity in an area of 30 hectare at Hensmul village in Talcher district. MCL’s coal washery proposal was taken up for discussion in the recent meeting of the Expert Appraisal Committee (EAC) set up under the Union Environment Ministry. As per the rule, the ministry gives final green clearances to the projects based on the EAC recommendations. MCL has plans to set up total five coal washeries in the state. It aims to contribute 250 million tonnes of coal to the one billion tonnes coal production target of Coal India by 2020.

Source: Economic Times

China can cooperate with India in nuclear sector

July 22: Describing China as an “important player” in the nuclear sector, Wenling, a senior researcher of the Chinese State Council Research Office, has said it is one of the areas where it can cooperate with India, a remark which comes amidst growing strain between the two countries over the Nuclear Suppliers Group (NSG) issue. Wenling also made a strong pitch for long-term visas for Chinese nationals visiting India, which she said would boost bilateral trade and investments. India’s NSG membership bid hit a roadblock when the plenary of the 48-nation held in South Korea last month decided against accepting India’s application after China and some other countries opposed entry of a non-NPT signatory into NSG.

Source: NDTV

Power Minister to consult states over amending Electricity Act

July 20. Power Minister Piyush Goyal said he will reach out to states to seek their support for a proposed amendment in the 2003 Electricity Act that would allow multiple power delivery utilities to compete in the same area, thus improving the

quality of services and driving down power bills. As per the proposed change, a power distribution company which already has supply network in a region will allow competing businesses in electricity retailing to use its network for a user-fee so that all the players compete for the same customer. While the infrastructure owner will get a return for their wire business as decided by the power regulator, competition will determine the price of power sold to consumers.

Source: Live Mint

INTERNATIONAL: OIL AND GAS

Upstream

Pompano gas production ramps up again

July 26: Stone Energy Corp is again producing oil and natural gas from the Pompano platform in the Gulf of Mexico. Stone didn’t have a direct interest in the plant, but the facility processed approximately 20 million cubic feet per day (MMcf/d) to 25 MMcf/d gross gas from Pompano. The gas curtailment restricted oil flow from Pompano to approximately 70 percent of previous production rates. The company negotiated an agreement to send natural gas from the Pompano field to an alternate market, Stone said. The company currently is producing oil and gas from Pompano at volumes similar to its second quarter 2016 production average rate of around 11,000 barrels per day (bpd) and approximately 21 MMcf equivalent gas and natural gas liquids per day.

Source: RigZone

British oil major BP pursues new projects despite profit miss

July 26: British oil major BP will forge ahead with at least three more new projects this year, its Chief Executive Officer (CEO) Bob Dudley said, despite the British oil major reporting a 45 percent drop in second-quarter earnings that prompted a cut in its 2016 investment budget to below $17 billion. Dudley said that BP could make another three final investment decisions this year, having already signed off on the expansion of its Tangguh liquefied natural gas (LNG) plant in Indonesia and the Atoll offshore gas project in Egypt. A gas project in India, the second phase of the Mad Dog deepwater oil field in the Gulf of Mexico and a Trinidad project could all get the green light, he said. BP’s projects pipeline is expected to add 500,000 barrels of oil equivalent a day by the end of 2017, with a further 300,000 bpd by the end of the decade.

Source: Reuters

China’s biggest oil field posts first half profit on cost cuts

July 26: China National Petroleum Corp (CNPC) said its Changqing oil field, the country’s biggest crude and gas producer, rebounded from losses earlier this year to post a first-half profit amid reduced spending. Oil and gas equivalent output from the field reached 26.5 million tons in the first six months of the year, on its way to meeting the 50-million-ton annual output target, CNPC said. China’s total crude production dropped 4.6 percent to 101.59 million tons in the first six months of the year, the lowest since 2012, according to data from the National Bureau of Statistics. Brent, the global oil benchmark, averaged near $41 a barrel in the first half of this year, about 30 percent lower than the same period a year ago.

Source: Bloomberg

Fracklog in the biggest US oil field may all but disappear

July 22: The number of dormant crude and natural gas wells in the US stopped growing in the first quarter — and may all but disappear in the nation’s biggest oil field should prices hold steady. Crude in the $40 to $50 a barrel range may wipe out most of the fracklog in Texas’s Permian Basin and as much as 70 percent of the inventory in its Eagle Ford play by the end of 2017. Drillers that expanded operations in US shale fields found that sidelining wells was the easiest way to cut costs when oil and gas prices plunged. US oil producers extended the biggest shale drilling revival since last summer as rigs targeting oil and gas in the US rose by 7 to 447, according to Baker Hughes Inc.

Source: Bloomberg

Engie said to offer exploration assets from Europe to Africa

July 21: French utility company Engie SA is pushing ahead with a plan to sell its exploration unit, offering assets that span Europe to Africa as the company works to reduce its exposure to oil and gas prices. The company is planning to sell its upstream operations globally including businesses in the UK, Norway, Algeria, Egypt, Germany and Asia, the people said, asking not to be named because the deliberations are private. Engie said that it will offload as much as € 15 billion ($16.5 billion) in assets and cut 1 billion euros of costs by 2018. The company sold a 30 percent stake in the exploration and production business to China Investment Corp for € 2.3 billion in 2011.

Source: Bloomberg

Total seen unlikely to fight ExxonMobil over South Pacific gas

July 20: Total SA is unlikely to challenge ExxonMobil in a bidding war for explorer InterOil Corp, the French firm’s partner in a gas field in Papua New Guinea, analysts said. ExxonMobil topped an offer from Oil Search which was backed by Total. ExxonMobil and Total both want to simplify the ownership of the Elk-Antelope gas field by taking out InterOil’s 36.5 percent stake. This would clear the way for the majors to tie together their rival gas export projects, PNG LNG and Papua LNG. Total said it was the operator of Petroleum Retention Licence 15, the joint venture developing the Elk-Antelope gas field in Papua New Guinea. Analysts said it made more sense for Total to let ExxonMobil take over InterOil.

Source: Reuters

Low crude prices dim hopes for big revenue boost from new Ghana oilfield

July 20: In the depths of Ghana’s fiscal crisis in 2014, policymakers looked forward to a time when a new oil field would open to boost the economy. The drop in the crude price to under $50 a barrel reduces the short-term boost to government revenue from the offshore Tweneboa-Enyenra-Ntomme (TEN) field at a moment of triumph for Tullow and its partners, who include Ghana National Petroleum Corp. TEN should ramp up production to around 50,000 barrels per day within weeks of coming on stream by the end of August.

Source: Reuters

Downstream

Vietnam province scraps $20 billion refinery project with Thai PTT

July 25: Vietnam’s Binh Dinh province has scrapped a $20 billion refinery and petrochemicals plant with Thai oil company PTT due to delays in getting construction of the project going. PTT had said it would postpone the project and re-assess it later in the year. PTT had studied the possibility of investing in central Vietnam for more than four years and had aimed to start construction this year in partnership with Saudi Aramco, the world’s biggest oil producer. The development plan included a 400,000 barrel per day refinery and an olefins and aromatics petrochemical plant with an annual output of five million tonnes.

Source: Reuters

Mexico’s Pemex says Cadereyta refinery partially restarted

July 25: Mexico’s state-owned oil company Pemex said its Cadereyta refinery partially restarted operations, allowing it to resume production. The refinery in the northern state of Nuevo Leon has started producing gasoline, Pemex said. Cadereyta, one of Pemex’s six domestic refineries, can process up to 275,000 barrels of crude oil per day.

Source: DownstreamToday

US refinery profits set for worst year since start of shale boom

July 22: US independent refiners such as Valero Energy Corp and Phillips 66 look set to post another quarter of disappointing earnings, putting the industry on track for its worst year since the US shale boom began in 2011. The companies had hoped to rebound from a weak first quarter on the back of strong US gasoline demand. But while US motorists have taken to the highway in record numbers, refiners have been undone by record supplies of gasoline and diesel products.

Source: Reuters

Transportation and trade

Total signs agreement to supply LNG to Japan’s Chugoku Electric

July 26: France’s Total reported that it has signed a binding Heads of Agreement with Japan’s Chugoku Electric to supply liquefied natural gas (LNG) for a period of 17 years commencing in 2019. Under the agreement, Total will supply Chugoku Electric with up to 0.4 million tons of LNG per year, with the supply sourced from its global portfolio.

Source: DownstreamToday

Petrobras to reduce role in Brazil’s natural gas industry

July 26: Petroleo Brasileiro SA (Petrobras) said it plans to scale back its role in Brazil’s natural gas industry by selling or sharing control of pipelines and opening its liquefied natural gas (LNG) terminals to third parties. Petrobras is in the middle of a plan to sell about $15 billion of assets by the end of this year to reduce its nearly $130 billion of debt, the largest in the oil industry, and focus investments on giant new offshore oil fields south of Rio de Janeiro, some of the world’s largest discoveries in decades. Brazil is also looking to expand the use of natural gas and the number of players in the gas market. Large amounts of new gas are expected to become available as new offshore fields come on line. Some companies have been hampered in their ability to exploit new resources or make projects such as power plants viable by Petrobras’ dominance of the gas transport system and a lack of clear rules, the IBP, Brazil’s oil industry association has said.

Source: Reuters

Russia, Turkey discuss renewal of TurkStream project, no decision yet

July 26: The delegations of Russia and Turkey discussed the resumption of the TurkStream project aiming to build a natural gas pipeline from Russia to Turkey, but no decision was reached yet, Russia’s Deputy Energy Minister Yury Sentyurin said.

Source: Reuters

As market sours, LPG-carrying ships anchor off Singapore

July 25: Last year, liquefied petroleum gas (LPG) supplied to Asia was being snapped up by petrochemical makers. Now, after a flood of US exports into the region, the market is awash with LPG and supplies are being stored in ships anchored off Singapore. At least four Very Large Gas Carriers (VLGCs) are parked off Singapore, including the “BW Carina” and “Berge Nantong”, both of which have been there for at least a week, shipping data showed. Some of the vessels are expected to stay until September, traders said. Middle East supply is also high with at least four other vessels, of between 53,000 and 59,000 deadweight tonnage, provisionally booked to load LPG from Qatar, Yanbu and Ras Tanura. US LPG exports to Asia hit a high of 1.5 million tonnes in May, breaking a previous record of 1.1 million tonnes in February, IHS data showed.

Source: Reuters

Russian stocks see day’s gains wiped out by weakening oil market

July 25: Russian stocks fell as a downward lurch in oil prices obliterated the boost from rising profit at the nation’s largest retailer and a JP Morgan Chase & Co. recommendation for bullish positions in anticipation Russia will return to economic growth next year. Crude will rise to $55 per barrel by the end of the year, spurring a return to growth in 2017 after the nation spent two years mired in a recession caused by the collapse of the price of oil, it’s biggest export, JP Morgan said.

Source: Bloomberg

Nigeria talks to militants as avengers strike gas pipeline

July 25: The Movement for the Emancipation of the Niger Delta (MEND) started talks with Nigeria’s government, even as another militant group claimed to have blown up a pipeline in the oil-rich region. The negotiations “will seek to find solutions to the short, medium and long-term future of the Niger Delta region,” MEND said. While Nigeria’s presidency said it’s talking to militants, that doesn’t appear to include the Niger Delta Avengers, the rebels claiming responsibility for the attacks on oil infrastructure this year. The Avengers, who in February shattered a seven-year peace with a campaign of sabotage that’s cut crude output and starved the government of revenue, said they blew up a gas pipeline belonging to the Nigerian National Petroleum Corp.

Source: Bloomberg

Libyan deal to end oil ports blockade still needs signing

July 25: Libyan Petroleum Facilities Guard (PFG) commander Ibrahim Jathran said he was ready to end a blockade at key oil terminals, but the UN-backed government still needs to sign an agreement for exports to resume. A deal was thrown into doubt when the head of Libya’s National Oil Corp (NOC) in Tripoli, Mustafa Sanalla, wrote to the UN Libya envoy saying that it would set a “terrible precedent” to make payments to Jathran, who he blamed for the loss of some $100 billion in export revenue. Sanalla said the NOC would not lift force majeure at export terminals if a payout went through due to the risk that the corporation would face liabilities over losses stemming from the blockade.

Source: Reuters

Schlumberger sees oil supply deficit if demand growth holds

July 22: Schlumberger Ltd, the world’s No. 1 oilfield services provider, said it expects a “significant global supply deficit” of crude oil, assuming steady growth in demand, given the sharp decline in spending on exploration and production. Schlumberger reported a better-than-expected adjusted profit for the second quarter, and said it was considering rolling back pricing concessions.

Source: Reuters

First US LNG shipment to cross expanded Panama Canal

July 22: The United States (US) will ship its first liquefied natural gas (LNG) cargo through an expanded Panama Canal. The waterway shaves distances between export plants dotted along the Gulf of Mexico and Asia to 9,000 miles from 16,000, allowing US producers to better compete in one of the world’s biggest gas consuming markets. The size of most LNG tankers had previously prevented them from squeezing through, forcing them to sail around South America instead. Royal Dutch Shell’s Maran Gas Apollonia tanker loaded up at Cheniere Energy’s Sabine Pass LNG export plant in Louisiana and will arrive at the Panama Canal on July 25, according to Kpler LNG, a shipping analysis firm.

Source: Reuters

Saudi Arabia regains top ranking in China crude supply

July 21: Saudi Arabia, the world’s biggest oil exporter, regained its position as China’s top crude supplier in June, after losing out to Russia in the previous three months, customs data showed. China imported 4.569 million tonnes of crude from Saudi Arabia in June, or 1.112 million barrels per day (bpd), data from the Chinese customs showed. The amount was down 14.2 percent on the year but compared with 961,000 bpd in May, according to the data. Saudi imports edged up 0.24 percent in the first six months of the year versus a year ago, to average 1.06 million bpd.

Source: Reuters

Iraq oil exports set to rise in July, despite leak

July 21: Iraq’s oil exports are set to rise in July, according to loading data and an industry source, putting supply growth from OPEC’s second-largest producer back on track after two months of declines. Exports from southern Iraq in the first 21 days of July have averaged 3.28 million barrels per day (bpd), according to loading data. That would be up from 3.18 million bpd in June. The increase comes despite a pipeline leak that shipping and trade sources said prompted a brief suspension of loadings at two of the southern terminals. The Iraqi oil ministry said the leak was repaired. The south pumps most of Iraq’s oil. Iraq also exports smaller amounts of crude from the north by pipeline to Turkey.

Source: Reuters

TransCanada seeks to lure shippers with gas line toll cut

July 21: TransCanada Corp is preparing to gauge interest this fall in a cheaper service for customers using its pipelines to move natural gas across Canada following months of talks with producers. The company is discussing the potential for new 10-year transportation contracts from Alberta to Ontario that would cost 40 to 50 percent less than a current comparable toll, the Calgary-based company, said. If a so-called open season process moves forward as planned, shipments under the new rates could start in late 2017, the company said.

Source: Bloomberg

Chevron says Gorgon LNG export plant output to resume shortly

July 20: Production should resume shortly at Chevron Corp’s $54 billion liquefied natural gas (LNG) Gorgon export plant in Australia, the company said. Start-up activities at the plant are under way, Chevron said.

Source: Reuters

Policy and performance

Hedge funds in new cycle of oil short-selling

July 26: Hedge funds have been liquidating their former record bullish position in crude futures and options putting downward pressure on oil prices in recent weeks. But now the liquidation of old long positions is being replaced by the establishment of new short positions as fund managers try to capitalise on the downward cycle in prices. The net bullish position has been reduced by 197 million barrels from a recent high of 650 million in the middle of May and 210 million barrels from an earlier record of 663 million at the end of April.

Source: Reuters

EnBW lowers gas prices from October

July 26: EnBW, Germany’s third-largest utility, said it would lower gas retail prices from October 1, ahead of the winter months, and committed to not raising prices until at least April 2018. EnBW has about 200,000 gas customers, most notably in and around Stuttgart, the capital of the German state of Baden-Wuerttemberg, EnBW’s major shareholder. Under the new pricing arrangements, a typical four-person household will save about 12 percent, or €174 ($191.30) a year, EnBW said.

Source: Reuters

China end-June crude oil stocks up 0.5 percent on month

July 25: China’s commercial crude oil inventories at the end of June rose 0.5 percent from the previous month, while refined fuel stocks fell 2.9 percent from end-May. The government rarely discloses levels of either commercial or strategic oil stocks, making it difficult to gauge real demand in the world’s second-largest oil consumer.

Source: Reuters

Suncor isolates pipeline leak at Alberta plant: AER

July 22: The Alberta Energy Regulator (AER) said a leak at a diluent pipeline at Suncor Energy Inc’s base plant near Fort McMurray, Alberta has been shut and isolated. Suncor estimates about 20 cubic meters of diluent was released from the pipeline, according to the AER. However, the energy regulator could not confirm the estimate. The pipeline is used for transporting diluent from Suncor’s base plant to its Firebag plant for blending with bitumen at its Firebag plant, AER said. The AER said the incident occurred approximately 26 kilometers north of Fort McMurray.

Source: Reuters

Indonesia plans to start building strategic oil reserves this year

July 21: Indonesia plans to start installing tanks for its strategic petroleum reserves (SPR) and filling them this year with the goal of covering 30 days worth of emergency stocks eventually, the Energy Minister Sudirman said. He said the ministry has the necessary funding to purchase and store around 1.6 million barrels of crude at current prices. That represents 1-1.5 days worth of emergency reserves, according to the ministry. The government is working on identifying the location for the storage, and whether state-owned Pertamina or another company will operate it. Over the next five years, Indonesia wants to build up its SPR to cover 30 days worth of crude, estimated at around 45 million barrels.

Source: Reuters

Russia oil sector tax plan expected back on track from 2017: Energy Minister

July 20: The Russian oil sector next year should return to a previously agreed tax plan, with oil export duty going down and mineral extraction tax (MET) rising further, Russian Energy Minister Alexander Novak said. Facing low oil prices and western sanctions that left holes in the state budget, the Russian government opted this year to postpone a plan to cut oil export duty. Novak said the planned changes would get back on track next year. He said the coefficient used to calculate oil export duty, which was kept at 42 percent this year, will come down to 30 percent from January 1, 2017. Export duty for fuel oil is calculated under a separate system. That duty is set at 82 percent of oil export duty for 2016, with a plan for it to rise to 100 percent in 2017. Novak said at the moment, there were no plans to change that planned increase for next year. The tax system in place stimulates exports of oil and high-quality oil products where the margin is higher, while making exports of heavy products almost prohibitive.

Source: Reuters

INTERNATIONAL: POWER

Generation

Construction begins on 2 GW Jimah East Power project in Malaysia

July 26: Construction work has started on the proposed RM12bn ($2.6 billion) Jimah East Power plant project in Jimah, Port Dickson, about 60km south of Kuala Lumpur in Malaysia. The 2000 MW ultra-supercritical coal-fired power plant will feature two greenfield power units at the Port Dickson strategic site, which is said to be a crucial to the security of power supply in Peninsula Malaysia.

Source: Energy Business Review

FirstEnergy will retire 856 MW of coal-fired units in Ohio in 2020

July 26: United States power utility FirstEnergy has announced the decommissioning of five coal-fired units totalling 856 MW at two power plants in Ohio.

Source: EnerData

Sanctions hinder Russian efforts to build power plant

July 21: A state tender for a company to build and operate a power plant in southern Russia attracted no bids partly because firms feared falling foul of EU sanctions should any electricity be diverted to nearby Crimea. The plant is one of the last in Russia to be offered under a special financial arrangement, now being phased out, where the operator receives a guaranteed profit margin for 15 years, protecting them from market fluctuations.

Source: Reuters

Transmission, distribution and trade

France and Ireland sign MoU on 700 MW power interconnection project

July 25: The French and Irish power transmission network operators RTE and EirGrid have signed a Memorandum of Understanding to progress their Celtic Interconnector project to the next phase of its development. The proposed Celtic Interconnector would be a €1 billion sub-sea power interconnection project with a transmission capacity of 700 MW.

Source: EnerData

Nigeria’s TCN plans to invest $4.6 billion in power grid by 2020

July 22: The Transmission Company of Nigeria (TCN) plans to invest an additional NGN 1,360 billion (US$4.6 billion) within the next four years to upgrade the country’s electricity transmission network. This additional investment is part of the company’s projection in the Multi Year Tariff Order 2015.

Source: EnerData

Policy and performance

Alberta plans legal challenge over canceled power deals

July 26: Alberta’s provincial government plans to legally challenge electricity producers’ ability to terminate power-purchase arrangements in an effort to minimise losses to consumers.

Source: Bloomberg

China met 29 percent of its coal capacity reduction target

July 26: China’s effort to cut coal overcapacity in the first half of the year reached 29 percent of its full-year target. The country reduced capacity by 72.3 million metric tons in the six months through June, compared with a full-year target of 250 million tons.

China’s attempts to cut overcapacity won’t subside despite prices having rebounded, the National Development and Reform Commission (NDRC) said. Separately, China will strictly control coal consumption and reduce emissions from coal-fired plants, the NDRC said.

Source: Bloomberg

South Korea to pick spent nuclear fuel site by 2028

July 25: South Korea plans to select a site for permanent storage of its high level radioactive waste by 2028, and will also consider storing spent nuclear fuel overseas, the government said.

Source: Reuters

RENEWABLE ENERGY AND CLIMATE CHANGE TRENDS

National

Mumbai, far interiors to bear brunt of climate change

July 26: Maharashtra, including Mumbai, is set to get significantly warmer and wetter in the next few decades, according to projections by The Energy and Resources Institute (TERI), which could have profound implications for crop growth, water resources, and disease. Temperature is expected to rise by 2030. But there will also likely be greater climatic variations across the state — which means different regions will have different experiences. Climate modelling was done in collaboration with the UK Met Office to predict temperature and rainfall for 2030, 2050 and 2070 compared to 1970-2000. The analysis projects that annual mean temperature will go up by more than one degree Celsius across the state by 2030, with the western parts of Vidarbha, northern Maharashtra — includes Nashik, Dhule and Nandurbar — and Marathwada seeing the biggest increase. In these regions, annual mean temperatures could go up by as much as 1.4 1.6°C compared to increases of 1-1.2°C in the Konkan and Pune regions. Maximum temperature increases follow a similar geographical pattern. On the other hand, south-west and north Maharashtra will see some of the biggest increases in minimum temperatures. That means that south Konkan, as well as Mumbai, Thane, and parts of Nashik, will have noticeably warmer nights in the near future.

Source: The Times of India

WTO body ruling in India-US solar case by September

July 25: The appellate body of the World Trade Organization (WTO) is expected to give its verdict on an appeal by India in its solar mission dispute with the US by September. India had in April appealed against a WTO panel’s ruling that the country’s power purchase agreements with solar firms are inconsistent with international norms. The appellate body can uphold, modify or reverse legal findings and conclusions of a panel and its reports. If the body’s ruling goes against India, the country will have to comply with the order in six-seven months. The US had won a ruling against India at the WTO in February after challenging the rules on the origin of solar cells and solar modules used in India’s national solar power programme. Such a move prompted India to point at violations of some of the WTO provisions by the US in the latter’s own renewable energy sector. India also decided to file 16 cases against the US at the WTO, as certain US programmes in the renewable energy sector are “inconsistent” with the WTO norms.

Source: Financial Express

National lab policy for renewable energy soon

July 25: The ministry of new and renewable energy is in the process of finalising a national lab policy to set norms for testing, standardisation and certification of renewable energy related products, and define the infrastructure required for testing centres. The policy document is in the final stage of being prepared and is expected to be complete in a month’s time. Currently, there are only three laboratories for testing solar equipment in the country — Gurgaon-based NISE and two private laboratories in Bengaluru, owned by Germany-based TUV Rhineland and US-based UL.

Source: Economic Times

Government mulls issuing fitness certificates for diesel vehicles over 10 years old

July 23: The Delhi government hinted that it was mulling issuing of fitness certificates to diesel vehicles that are between 10 years and 15 years old to allow them to ply outside the National Capital Region (NCR) for the time being. The move comes a day after the National Green Tribunal (NGT) ordered de-registration of vehicles older than 10 years and 15 years in a phased manner. The Tribunal said that diesel vehicles that were 15 year old should be de-registered first and not get a No Objection Certificate for plying outside the Delhi NCR region. Only de-registered diesel vehicles that are less than 15 years old should get No Objection Certificate for plying in select areas outside Delhi NCR, to be decided by States where vehicle density is less. The first phase of this plan, according to the government, will take about four to five months.

Source: The Hindu

Solar power tree developed for generation of electricity

July 22: The Ministry of Science and Technology has come up with a ‘Solar Power Tree’, an innovative way to generate electricity using solar power in a limited space. Developed by the Central Mechanical Engineering Research Institute, Durgapur, a laboratory of the Council for Scientific and Industrial Research, the Solar Power Tree model is actually designed like a tree with branches made of steel to hold the photovoltaic panel.

Source: Economic Times

Top fossil fuel players back PM Modi’s goal to shore up India’s clean energy sector

July 22: India’s biggest energy companies are moving beyond their roots in fossil fuels to invest in renewables, backing Prime Minister (PM) Narendra Modi’s goal to build up alternatives to the most polluting forms of energy. Indian Oil Corp (IOC) along with Oil India Ltd (OIL), are working to build a 1 GW solar farm in Madhya Pradesh, according to the state agency responsible for implementing energy policy. The oil companies join India’s largest conventional electricity generators like NTPC Ltd and Tata Power Co., which are aiming to be the biggest players in clean energy.

Source: Economic Times

Suzlon to build 59 MW wind park in Madhya Pradesh under new order

July 21: Indian wind turbine maker Suzlon said it has received an order for a 58.8 MW wind project in the state of Madhya Pradesh. Under the terms of the contract, in addition to supplying turbines Suzlon will also build, commission, operate and maintain the wind farm. The services contract has a term of 12 years. The plant will use 28 of Suzlon’s S97-120-metre hybrid towers, each with a rated capacity of 2.1 MW.

The wind park is expected to be finalised by March 2017. It will be capable of producing enough electricity to meet the annual power consumption of about 32,000 local homes.

Source: SeeNews

Gujarat HC notice to govt on PIL on Santhalpur solar park

July 20: The Gujarat High Court (HC) issued notice to the state government in response to a PIL alleging corruption in contracts for the development work at the country’s largest solar power project in Santhalpur tehsil of Patan district. The project is the first in Asia with generation capacity of 500 MW of solar power.

Source: Economic Times

Global

Munich’s utility singles out offshore wind in renewable push

July 26: Stadtwerke Muenchen (SWM), Germany’s biggest municipal utility, plans to expand its presence in the booming offshore wind sector, its Chief Executive Officer (CEO) Florian Bieberbach said. Despite its small size, SWM has emerged as a serious player in Europe’s renewable industry, having already spent about €3 billion ($3.3 billion) on renewables. The group, which powers Munich, Bavaria’s capital and Germany’s third-largest city, spends about €400 million a year on renewables, about 40 percent of its total investments.

Source: Reuters

EPA clears path to regulate carbon emissions from US aircraft

July 25: The US Environmental Protection Agency (EPA) paved the way for new curbs on emissions from passenger jets by ruling that greenhouse gases from airplanes endanger public health. The finding, which requires the EPA to regulate greenhouse gas emissions from aircraft under the federal Clean Air Act, removes a hurdle to implementing internationally agreed rules on airliner pollution in the United States, the world’s biggest domestic travel market.

Source: Reuters

NBET signs $1.7 billion deals to purchase 1.1 GW of solar power

July 22: Nigeria Bulk Electricity Trading (NBET) has signed agreements with 14 contractors to purchase power 1125 MW of solar energy. Under the terms of the NGN521.9 billion ($1.76 billion) power purchase agreements (PPAs), NBET will receive power from the planned 14 solar projects, starting in 2017. Nigerian Power, Works and Housing Minister Babatunde Fashola said that the government intends to generate 30% of its total power from renewable sources by the end of next decade.

Source: Energy Business Review

Suncor’s emissions goal seen challenging even without total cuts

July 22: Suncor Energy Inc plans to hold total greenhouse gas emissions at current levels through 2030 even as it boosts crude production by targeting a reduction in carbon output per barrel. By cutting emissions per barrel by about 30 percent, the oil-sands producer will be able to cap its greenhouse gases at about 21 megatons a year, according to the company. Suncor Chief Executive Officer Steve Williams has set out to make oil sands production cheaper, as well as less carbon intensive, in a bid to make the company the “supplier of choice” amid rising global demand for petroleum. Still, there’s no plan to reduce Suncor’s total emissions, even as carbon becomes one of the most important considerations facing oil producers.

Source: Bloomberg

UK said to release offshore wind auction rules in August

July 21: The UK will set green-energy auction rules next month in a move to boost confidence among offshore wind developers eyeing investments. The new Department for Business, Energy and Industrial Strategy is expected to set its auction budget in August and accept bids later this year. The auction parameters will define the maximum price developers can bid to generate power. The rules could help show that the UK remains on track to double offshore wind capacity to 10 GW by 2020 after it abolished the Department of Energy and Climate Change.

Source: Bloomberg

Lithium rivals SQM and Albemarle sign environment deal

July 21: SQM and Albemarle’s Rockwood, two of the world’s biggest lithium producers, have agreed to work together on “environmental administration” of the giant Chilean salt flats where they operate, SQM said.

Source: Reuters

Tengda plans $1.5 billion hydrogen fund for fuel cells, vehicles

July 20: Tengda Construction Group Co., which builds municipal infrastructure projects in China, plans to form a 10 billion yuan ($1.5 billion) hydrogen industry fund to finance fuel cells and vehicles powered by the gas. The Taizhou, Zhejiang-based company agreed to partner with Chang’An International Trust Co., Oriental Patron Financial Group and Bestone Asset Management Co. for the fund, it said.

The fund will invest in technologies to purify and store hydrogen, Tengda said. President Xi Jinping’s administration wants five million “new-energy vehicles” — either fully electric or hybrids — hitting roads by 2020 to cut emissions and to reduce the reliance on imported oil.

Source: Bloomberg

Dominion Virginia Power to build 21 MW DC solar plant in Virginia

July 20: The US Department of Navy (DON) and Dominion Virginia Power have unveiled plans to develop a 21 MW direct current (DC) solar facility at the Naval Air Station (NAS) Oceana in Virginia Beach, Virginia. It is the second solar project that the navy department has partnered with Dominion. Dominion Virginia Power will construct, own, operate and maintain the 21 MW solar facility for 37 years.

Source: Energy Business Review

UK seen needing $39 billion more to tackle climate change

July 20: Britain’s ambition to virtually eliminate its greenhouse gas pollution will cost 30 billion pounds ($39.4 billion) more to achieve because the government abandoned plans to spur carbon capture and storage technology. The Treasury’s decision to cancel a one billion pound CCS competition in November is likely to delay the commercial roll-out of the technology until 2030, according to a report by the National Audit Office. Former Prime Minister Da id Cameron’s government ended the CCS competition in November, even though the party’s 2015 election manifesto listed the funding among its measures to tackle climate change.

Source: Bloomberg

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Ashish Gupta, Vinod Kumar Tomar and Dinesh Kumar Madhrey

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV