SOLAR: MAKING HAY WHILE THE POLICY SUN SHINES

Non-Fossil Fuels News Commentary: April 2017

India

The extent to which India adds solar capacity declared on a monthly or even weekly basis is not only the perfect alibi for distracting western and domestic liberals from illiberal acts of the government but also a means to channel investment into sectors that would not be typically funded by the market. This month was no different with a number of news items reporting declarations by government officials on the extent of solar capacity added and how cheap solar power is in India.

India is reported to have added 5,525 MW solar power generation capacity in FY17 taking the total from this clean source to 12,288 MW. The country’s solar power potential has been estimated to be 748 GW. The government has envisaged 4,800 MW from rooftop solar and 7,200 MW from large scale solar power projects in the country. India has plans to add 5,000 MW of rooftop solar and 10,000 MW from large scale solar power projects in FY18. Among states, Andhra Pradesh tops the chart with largest cumulative solar generation capacity of 1,867 MW as on March 31, 2017 followed by Rajasthan and Tamil Nadu at 1,812 MW and 1,691 MW respectively. The Rewa Ultra Mega Solar Park is said to have achieved a landmark of ₹ 2.97/kWh solar tariff. Two sets of PPAs were signed by the project developers, Mahindra Renewables, ACME Solar Holdings and Solengeri Power, with the Madhya Pradesh government-owned distribution companies and the DMRC. Besides the PPAs, various agreements for land transfer and coordination were signed between the developers, Madhya Pradesh Power Management Company, DMRC, Rewa Ultra Mega Solar Ltd, New and Renewable Energy Department, Power Grid Corp and the department of finance in the Madhya Pradesh government. What is not said as loudly by the media is that the PPAs are ‘take or pay’ contracts where the buyers (both government owned) have to pay irrespective of whether they actually draw solar power. For those who remember the power sector in the 190s, ‘take or pay’ contracts signed by Maharshtra with Enron destroyed the finances of its distribution company. According to the world bank that is involved in the project the ‘take or pay’ contract is risk sharing at its best. Obviously the World Bank has not consulted the rate payer and tax payer who will ultimately pick up the bill. They may think that this is socialising risk at its best! Socialising risk is a technique perfected by illiquid banks after the financial crisis!

Promoting the Rewa project, the President of the World Bank said that it was better to move towards solar energy than to continue to build coal plants citing India’s massive efforts in solar energy which has made it “cost effective” and “quite competitive”. He said there was need to keep doing that as the options around the world, even in emerging markets, have gone down below three cents a kWh at which point it “becomes cost effective”. He said climate change issue continued to be a priority for the Bank. On coal, he identified six countries – China, India, the Philippines, Indonesia, Pakistan and Vietnam which are putting most of the coal-based carbon in the air.

In a bid to encourage the use of rooftop solar power, the MNRE has exempted customs and excise duties on materials used in solar rooftop projects of more than 100 KW capacity. The move is expected to cut down the overall cost of power generation through solar rooftop projects. Currently, grid tariff for rooftop solar hovers around ₹ 6/kWh. By 2022, India aims to achieve 40 GW of grid connected solar rooftops. So far, only about 500 MW have been installed and about 3,000 MW has been sanctioned. Apart from the private sector, the railways, airports, hospitals, educational institutions and government buildings have been spotted as potential solar rooftop sites. The MNRE had said that at least 5,900 MW power and annual financial savings of ₹8.3 billion can be achieved through rooftop solar projects in government properties. The key word here is government property not solar rooftop! As a later news item reveals few private households are interested in the scheme!

It was reported that India’s solar power prices may be set to fall below those of thermal (coal) energy. This is based on an expected cost of around ₹ 2.90/kWh for the solar power projects at Bhadla in Rajasthan that have received 51 bids. This price is less than the average rate of power generated by the coal-fuelled projects of India’s largest power generation utility, NTPC Ltd, at ₹ 3.20/kWh. SECI, which is running the bid process for 750 MW of solar power capacity at two parks, has received bids totalling 8,750 MW. The solar space has already seen a significant decline in tariffs from ₹ 10.95-12.76/kWh in 2010-11. The previous low was ₹ 3.15/kWh bid by France’s Solaire direct SA in an auction to set up 250 MW of capacity at Kadapa in Andhra Pradesh. Those who fully grasp the economics of solar power may put this item into the category of fake news because comparing base-load thermal power (always on) and intermittent solar power is like comparing apples and avocados!

It is probably because the common man in MP understood the difference between apples and avocados that he did not take up the MP Urja Vikas Nigam offer of solar panal installation with net metering in Bhopal. Under the net metering, non-conventional energy generated by individuals is first used in building as per requirement and surplus power is fed to the grid. Consumer gets paid back in terms of energy credits and adjustments in his bill against power transferred to the grid. The development also coincides with the SECI extending the bid-submission deadline for 1,000 MW grid-connected rooftop solar scheme for government buildings. SECI has received no bids for tenders for the scheme.

But the common man does take up solar options when subsidies are offered upfront as in the case of farmers in Peth, Surgana and Trimbakeshwar in Maharashtra. About 59 farmers across Nashik district have received solar agriculture pumps to gush out water from the ground for irrigation purposes. The dream became a reality after the government increased the ceiling of land holding by the farmers from 5 acres to 10 acres. The government had decided to provide a total of 130 solar power pumps for FY17. A total of 230 farmers applied for the scheme, of which the district collector headed committee selected 130 beneficiaries. Out of these beneficiaries, 79 were finalised and asked to pay the dues of their share. The DC power pumps are in demand as a result of which 43 such pumps were sought by the beneficiaries. The farmers who wish to apply for the scheme should fit the criteria of having up to 10 acre of land, no power connection within 500 meter and that once a beneficiary, the farmer can never apply for power connection from the MSEDCL. The scheme is different from the one subsidised by the ministry of new and renewal energy facilitated by the National Bank for Rural Development, which is not related to the MSEDCL.

The MP government would soon follow and provide nearly 18,500 solar-powered water pumps to farmers in the state at subsidised rates. MP Urja Vikas Nigam would be the nodal agency to make available the solar pumps to the farmers, New and Renewable Energy Department Principal Secretary. Chhattisgarh and Rajasthan governments had provided 11,000 and 10,000 solar pumps respectively to farmers at subsidised rates. The state energy department said in the last fiscal, the MP government provided power subsidy of ₹ 70 billion to farmers for use of the water pumps.

While Ministers hailed solar pumps as a means to nirvana for farmers (water for free!) those concerned about ground water depletion are making noises that free solar pumps will accelerate ground water depletion and lead to water scarcity!

Indian renewable energy companies have raised over $1.62 billion during the first quarter of 2017 in transactions ranging from VC funding, debt financing, project funding and M&A, according to data from Mercom Capital Group LLC., a global clean energy consulting firm. Transactions in Indian solar and renewable energy companies made up for nearly half of the total global funding raised by solar companies around the world in the first three months of 2017. The global solar sector raised total corporate funding of $3.2 billion in the first quarter of 2017—nearly double of $1.6 billion raised in the fourth quarter of 2016, Mercom said in a report. The growth in the first quarter is higher by 15percent when compared with the total corporate funding of $2.8 billion raised in the first quarter of 2016, the report said. In its study, Mercom tracked 233 new large-scale project announcements worldwide in the first quarter of 2017, totalling 12.7 GW.

Ind-Ra estimates a possible refinancing opportunity for more than ₹ 560 billion out of the total debt of 1.73 trillion across various infra sub-sectors in its portfolio till FY19. Of this, solar is expected to be in the forefront in terms of the number of deals with refinancing to the tune of 33 percent. Ind-Ra believes that the renewable energy sector, especially solar energy, would reduce its borrowing costs further by at least 100bp through bond issuances or bank loans. Around 45 percent of the potential refinancing candidates in Ind-Ra’s portfolio are from the renewables space. The sector is also likely to be benefited from the government’s thrust on the development of the second phase of 20 GW solar energy and evolving payment security mechanisms. However, the limited improvement in the current issues such as grid curtailments, receivable days, plant load factor volatility could hinder the refinancing prospects for renewables.

IWTMA said the wind power generation capacity in the country has crossed 32 GW mark. However, according to the CEAs report for March 2017, the installed wind power generation capacity is around 28.7 GW, lower than the ITWMA estimates. There should be at least 6 GW of capacity addition every year to meet the target of having 60 GW by 2022, IWTMA said. The government has decided to go through the bidding route as the first ever auction of wind power projects in February 2017, where power tariffs dropped to all-time low of ₹ 3.46/kWh. Wind power capacity of 1 GW was auctioned by the Solar Energy Corporation of India in February. Globally, India is at the fourth position after China, the US and Germany, in terms of wind capacity installation.

India is aiming to cut its oil products imports to zero as it turns to alternative fuels such as methanol in its transport sector. India is also planning to start 15 factories to produce second generation ethanol from biomass, bamboo and cotton straw as it aims to develop its mandate to blend ethanol into 5 percent of its gasoline. India imported about 33 MT of oil products over April 2016 to February 2017, up nearly 24 percent from the same period a year ago. The majority of the imports comprise petroleum coke and LPG. To cut the country’s carbon footprint, the government wants to raise the use of natural gas in its energy mix to 15 percent in three to four years from 6.5 percent now.

Issues relating to hydro power development in Arunachal Pradesh is said to have received some attention. The 2,000 MW Lower Subansiri project will be put on track immediately and there will no further delay. Fast tracking the Khuppi-Bomdila-Tawang 132 KV transmission line and Bomdila-Kalaktang 132 KV transmission line is also on the cards. Establishing a Centre of Hydro Power Excellence to build local engineering capabilities for project preparation, NERIST is also reported to be a priority for the government.

Hydro power generation in the country posted a marginal growth of under a percent in FY 17 after two-years of consecutive dip in FY 16 and FY 15 over the respective corresponding period. This year the CEA has fixed a target of 141 billion kWh of hydro power generation, an increase of 15.6 percent over the last financial year. The water based renewable energy generation stood at 122.3 billion kWh in FY17 compared to 121.3 billion kWh in FY16 primarily due to better precipitation in the country. The generation has been affected by scanty and scattered rains in the last few years in the country. The generation witnessed an increase of 0.77 percent in FY17 after it dropped by 6percent in FY16 and 4percent in FY15 compared to the respective corresponding period. Primarily, drought like conditions in South and low water level in reservoirs has affected the generation in the last fiscal. It has reduced availability of low cost power to states like Punjab and Haryana. The hydro generation missed the target of 134 billion kWh set by the CEA for FY17. The two-largest hydro power companies SJVN Ltd and NHPC Ltd surpassed the target set by the CEA by 4.8 percent and 2 percent in the last financial year. But the less rains during monsoon in FY17 to 3 percent and 2 percent lower generation in SJVNL and NHPC Ltd compared to FY16.

Forty three hydro-electric projects, with total generating capacity of 11,928 MW, are under construction. Out of these 43 projects, 16 are stalled due to financial constraints and other reasons. The total power generation capacity of the 16 projects is 5,163 MW and the anticipated completion cost of these projects would be about ₹ 523 billion while their original cost was about ₹ 270 billion.

Non-fossil fuels, renewables, nuclear and large hydroelectric power plants, will account for more than half (56.5 percent) of India’s installed power capacity by 2027, according to a draft of the NEP3. The draft notes that if India achieves its target to install 175 GW of renewable energy capacity by 2022, as committed under the 2015 Paris Agreement — it will not need to install, at least until 2027, any more coal-fired capacity than the 50 GW currently under construction. NEP3 outlines how the government expects the electricity sector to develop over the five years from 2017 to 2022, as well as the subsequent five years to 2027.

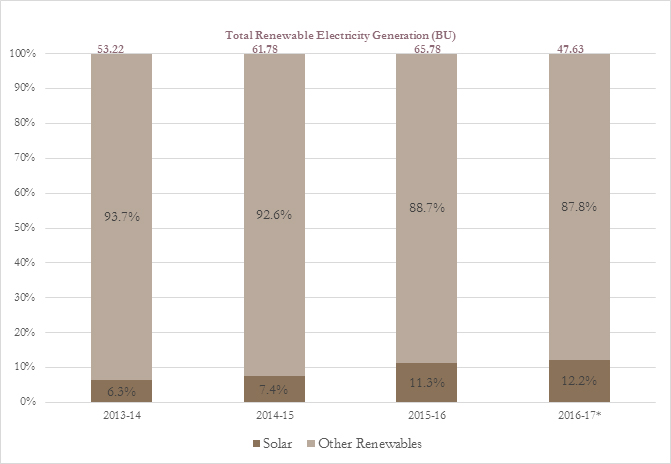

When the draft was released, India had installed just over 50 GW of renewable power capacity, of which wind energy made up 57.4 percent and solar 18 percent. This gave renewables a 15 percent share in total installed capacity of just over 314 GW, while coal made up 60 percent, the remaining being large hydropower, nuclear, gas and diesel. NEP3 projects that not only will the 2022 target be achieved, renewable power capacity will reach 275 GW in 2027. This is three times the projection made in NEP2, of 70 GW, and significantly more ambitious than publicly proclaimed targets. Comparing NEP3 with India’s INDC under the Paris Agreement reached at the COP21 to the UNFCCC in 2015 shows a higher level of ambition to reach a low-carbon economy faster. In its INDC, India had said it planned to achieve 40 percent cumulative installed capacity from non-fossil fuel-based energy resources by 2030. NEP3 is significantly more upbeat, predicting that non-fossil power will make up 46.8 percent of total installed capacity by 2021-22 and 56.5 percent by 2027 — 10 years from now. If the NEP3 target is met as per the projected timelines, total installed renewable capacity will surpass coal-based capacity around 2024. While all this sounds very nice if you are a fan of green energy, for those who are economically inclined the mere creation of capacity which involves a huge cost will not make much economic sense.

Moving on to nuclear energy, India signed three pacts with Bangladesh in the field of nuclear energy, second such deal with a South Asian neighbour. The pact entails knowledge sharing and training of Bangladeshi personnel in the area. The first agreement is the general cooperation pact for peaceful uses of nuclear energy. The second one was signed between the Atomic Energy Regulatory Board of India and its Bangladeshi equal Bangladesh Atomic Energy Regulatory Authority, which calls for exchange of technical cooperation and sharing of information in the field of nuclear safety and radiation protection. The third agreement focuses on Indo-Bangla collaboration regarding nuclear power plants in Bangladesh. Besides Bangladesh, India has signed civil nuclear deals with the United States, the United Kingdom, Russia, South Korea, Mongolia, France, Namibia, Argentina, Canada, Kazakhstan, Australia, Vietnam, Sri Lanka and Japan. After India and Pakistan, Bangladesh is the third South Asian nation which has plans to harness nuclear power.

India has taken over full operational control of Unit 1 of the Kudankulam Nuclear Power Plant. India signed a joint statement with Russia on the final takeover of the unit, formally marking the full transition. The agreement was signed between representatives of Nuclear Power Corp of India Ltd and the ASE Group of Companies, a subsidiary of Rosatom State Atomic Energy Corp of Russia. With the deal, the Russian and the Indian sides have confirmed fulfilment of all warranty terms and obligations of the contractor for the construction of Unit 1, Rosatom said. The commercial operation and the warranty period of Unit 1 started in December 2014. The warranty is typically for one year, which ended in December 2015. However, the final takeover agreement was delayed to ensure the reliability of the plant and equipment as this is the first of a series of six reactors. Unit 1 had encountered technical issues and was shut down briefly after it commenced power generation. On March 30, 2017, the joint protocol on provisional acceptance of Unit 2 of the plant was signed, which marked the start of its commercial operation.

Rest of the World

Global VC funding for the solar sector saw a 78 percent rise in the first quarter of 2017 with $585 million in 22 deals compared to $329 million raised in the same number of deals in the fourth quarter of 2016, the report said. The amount raised was also higher when compared to $406 million raised in 23 deals in the first quarter of 2016. There were 29 solar M&A transactions in the first quarter of 2017 compared to 20 transactions in the fourth quarter of 2016 and 14 transactions in the first quarter of 2016. About 7.4 GW of solar projects were acquired in the quarter compared to 5 GW in the previous quarter, Mercom said. However, residential and commercial solar funds dropped to $630 million sequentially from $1.5 billion, the report said.

In Japan the Governor of Saga province approved the restart of two reactors at the Genkai nuclear power plant, with each scheduled to go online as early as this summer. The decision to clear reactor 3 and 4 at the Kyushu Electric Power Co. facility in the town of Genkai is likely to draw strong reactions from municipalities and residents opposed to their reactivation amid persisting widespread concerns about the 2011 Fukushima disaster. The reactors in January passed the tougher safety requirements introduced in response to the nuclear disaster. All four reactors at the Genkai plant were halted by December 2011 in light of the Fukushima disaster. Kyushu Electric has decided to decommission the aging No. 1 reactor.

China is reported to be aiming for non-fossil fuels to account for about 20 percent of total energy consumption by 2030, increasing to more than half of demand by 2050, the NDRC said. The NDRC said CO2 emissions will peak by 2030 and total energy demand will be capped at 6 billion tonnes of standard coal equivalent by 2030, up from 4.4 billion tonnes targeted for this year.

According to Greenpeace which has taken it upon itself to pick on China, the amount of electricity wasted by China’s solar and wind power sectors rose significantly last year. China promised to improve what it called the “rhythm” of construction of power transmission lines and renewable generation to avoid “curtailment,” which occurs when there is insufficient transmission to absorb the power generated by the renewable projects. But Greenpeace said wasted wind power still rose to 17 percent of the total generated by wind farms last year, up from 8 percent in 2014. The amount that failed to make it to the grid was enough to power China’s capital Beijing for the whole of 2015, it said. Greenpeace said total solar and wind investment between now and 2030 could reach as much as $780 billion. But, rising levels of waste had cost the industry as much as 34.1 billion yuan ($4.95 billion) in lost earnings over the 2015 to 2016 period, it said. China produced 12.3 billion kWh of solar power in the first quarter of 2017, up 31 percent year-on-year but accounting for just 1.1 percent of total generation over the period, according to data. Wind rose to 62.1 billion kWh, 4.3 percent of the total, but was dwarfed by the 77.9 percent share occupied by thermal electricity.

The US said it would start an investigation into imports of biodiesel from Indonesia and Argentina for possible dumping and subsidization. The US International Trade Commission is scheduled to make a preliminary decision on whether such imports hurt US producers, the US commerce department said. The step, comes after some US biodiesel producers last month asked their government to impose anti-dumping duties on imports of biodiesel from Argentina and Indonesia that they say have flooded the US market and violated trade agreements. Total US biodiesel imports rose to a record 3.5 billion litres in 2016, according to US government data published in March. Argentina represented about two-thirds of US foreign imports, followed by Indonesia and Canada. Indonesia is also facing pressure in Europe, with its government filing a WTO complain against European Union anti-dumping duties on Indonesian biodiesel. Meanwhile, the European parliament voted to call on the EU to phase out use of palm oil in biodiesel by 2020. Indonesia, along with Malaysia, plans to send a joint mission to Europe next month to prevent the adoption of that resolution.

Morocco’s King Mohammed VI launched in the fourth and final stage of Noor Ouarzazate, the world’s largest solar plant. The Noor Ouarzazate IV power station in the southern province of Ouarzazate, spanned over an area of 137 hectares (1.37 square km), will be set up with over $75 million with PV technology. The power station, scheduled to start operating in the first quarter of 2018, will be built as part of a partnership involving the Moroccan Agency for Sustainable Energy (Masen), and a consortium of private operators led by the Saudi Arabian ACWA Power group and German development bank KfW. While the first station has started operating in 2016, the second and third power stations of Noor solar complex have reached a completion rate of 76 and 74 percent respectively. The mega project will generate 582 MW and provide electricity to over a million homes when completed by 2020. The plant represents a critical step in the Moroccan Solar Energy Program, which aims to generate 42 percent of its electricity needs through renewable energy by 2020 and 52 percent by 2030.

NATIONAL: OIL

Integrated expansion project boosts BPCL-Kochi Refinery

May 2, 2017. The major units commissioned recently at BPCL (Bharat Petroleum Corp Ltd)-Kochi Refinery under Integrated Refinery Expansion Project (IREP) are designed to enhance the company’s refining capacity by six million tonnes. Other units of IREP such as naphtha hydrotreaing and isomerisation will be completed in the next 2-3 months. The refining capacity has already gone up from 9.5 million tonnes and the company, this year, will process 14 million tonnes of crude compared to last year’s 11.8 million tonnes. The gross refining margin will also go up by $3.5 to touch $8.9 a barrel, thereby increasing profitability. The IREP project envisaged at an investment of ₹ 16,500 crore will also help the refinery to produce eco-friendly petrol and diesel complying Euro IV and V standards. Post-IREP, the refinery will produce diesel to the tune of 8 million tonnes a year.

Source: The Hindu Business Line

UP petrol pumps owners go on strike after STF crackdown

May 2, 2017. With the Uttar Pradesh (UP) special task force (STF) cracking down on errant petrol pumps across the state, their owners went on a strike here to protest against the action. Several petrol pumps in Uttar Pradesh had been caught by STF sleuths using electronic chips and remote controls to dispense a lower quantity of petrol and diesel to consumers. A number of petrol pumps, including one owned by UP Petrol Pump Dealers Association President B N Shukla, had been sealed after they were caught cheating consumers. A delegation of petrol pump owners later met Deputy Chief Minister Dinesh Sharma to explain their position. The sudden strike caused inconvenience to the people, who were seen lining up outside company-owned outlets, which were open. The STF had initiated the crackdown when it raided seven petrol pumps. According to the force, they were tipped off that an electronic chip was being installed at the petrol pumps helping them get a profit worth lakhs of rupees per month. The chip, costing around Rs 3,000, reduced the output by nearly five to 10 percent. It is attached with a wire which is linked with a remote control. The remote control sets the limit and if a customer purchases one litre petrol, he actually gets 940 ml or less. On an average, the petrol-pumps using this device were earning an undue profitRs 14 lakh per month, according to the STF. Oil Minister Dharmendra Pradhan had ordered inspection of all petrol pumps in UP and random checks elsewhere to detect short-selling of petrol and diesel by tampering with the system in dispensing units. Pradhan had said though the responsibility of right quantity of product dispensed lies with state governments as their weights and measures department installs seals on dispensing units, two officials of state-owned fuel retailers have been suspended following the raids.

Source: India Today

LPG price hiked byRs 2, kerosene by 26 paisa

May 1, 2017. Subsidised liquefied petroleum gas (LPG) price was hiked by aboutRs 2 per cylinder and kerosene rate by 26 paisa a litre as government looks to eliminate subsidy on the fuel through small hikes. LPG price in Delhi was hiked byRs 1.87 per 14.2-kg cylinder toRs 442.77 per bottle, according to state-owned oil firms. Oil firms had last raised price of subsidised cooking gas byRs 5.57 toRs 440.90 per 14.2-kg cylinder on April 1. This hike came as the state-owned oil firms on previous two occasions – February 1 and March 1 – did not effect any significant raise in prices in view of assembly elections in states like Uttar Pradesh.

Source: The Times of India

OIL notifies two discoveries in Assam

May 1, 2017. Oil India Ltd (OIL) has notified two hydrocarbon discoveries in the Upper Assam Basin. The discoveries were made during April in the wells Borbhuibil-1 and Lakwagaon-1. The well Borbhuibil-1 encountered multiple sands in Barail and Lakadong+Therria formations. On testing, a 15m Barail sand at a depth of 3,322m produced oil at the rate of 28 m3/d. A 10m Lakadong+Therria sand at a depth of 4,300m produced oil at the rate of 100 m3/d. In the well Lakwagaon-1, discovery of a gross column of 30m oil sand in Barail formation has been made which produced 42 m3/d of oil on initial testing. OIL said that the discoveries have opened up avenue for further exploration of already identified leads and prospects in the area.

Source: The Hindu Business Line

ONGC planning to bring Kutch offshore basin on stream soon: Sarraf

April 28, 2017. Oil and Natural Gas Corp (ONGC) is planning to bring on stream its Kutch offshore basin, the country’s eighth new basin, over the next 2-3 years, Chairman and Managing Director (CMD) DK Sarraf said. The Kutch offshore is a shallow water acreage where ONGC has reached appraisal stage. The oil and gas behemoth is aiming to complete appraisal process and move on for development of resources by mid-2017. The company has reportedly discovered more than one trillion cubic feet (Tcf) of natural gas in the Kutch offshore basin and is trying to establish 0.5 Tcf of additional natural gas. Seven out 26 sedimentary basins in India are currently under production. Cauvery basin was the last basin to come on stream in 1985. The new Kutch off-shore basin would provide respite to ONGC at a time when production has been declining from most of its mature and ageing fields, where the company has deployed Enhanced Oil Recovery (EOR) techniques to maintain production. He said EOR techniques have been deployed in most of ONGC’s blocks and the company is now focusing on cost-effective operations in offshore blocks. According to Petroleum Planning and Analysis Cell (PPAC), ONGC’s crude oil production in the last fiscal declined by 1.5 percent to 18.2 million tonnes (MT) as compared to 18.5 MT produced in 2015-16. The company managed to drill 501 wells last fiscal year, crossing the 500 wells mark for the first time in 23 years. ONGC had made 23 new discoveries last financial year, a 35 percent jump over 17 discoveries made in 2015-16.

Source: The Economic Times

India’s petroleum import bill rose 9 percent last fiscal, import dependency of crude rises to 82 percent

April 26, 2017. India’s gross petroleum import bill, including shipments of both crude oil and petroleum products, rose 9 percent last financial year to $ 80.3 billion on the back of seven percent rise in volumes and a three percent increase in the average crude price, according to the oil ministry data. Crude oil imports rose by more than five percent to 213 million tonne (MT) and the crude oil import bill increased by more than nine percent to $70 billion last fiscal as compared to $64 billion recorded in 2015-2016. India’s petroleum product imports by quantity rose by 22 percent last fiscal year to 36 MT from 29.5 MT in 2015-2016. In terms of value the country’s petroleum product import bill rose by five percent to $10.6 billion last fiscal year. The Indian basket of crude – that represents a mix of 71 percent Oman and Dubai grades and 29 percent of dated Brent – averaged $47.56 per barrel in 2016-17 as compared to $46.18 per barrel in the previous fiscal, according to the oil ministry’s technical arm Petroleum Planning and Analysis Cell (PPAC) data. The country’s self-sufficiency in petroleum products declined from 22 percent in 2013-2014 to 18 percent in 2016-2017 due to strong consumption growth and declining domestic production.

Source: The Economic Times

NATIONAL: GAS

IGL takes over two gas pipelines of GAIL to streamline infrastructure

May 1, 2017. Indraprastha Gas Ltd (IGL) said it has taken over two major steel pipelines of state-owned utility GAIL (India) Ltd to streamline operations and maintenance of gas pipeline infrastructure in the national capital. The pipelines, measuring 58.5 km, connect GAIL DESU terminal near ITO with Maruti terminal in Gurugram and Khera Kalan village near Rohini and form a major part of the network of supply of natural gas in the national capital. Delhi receives its natural gas supply from Hazira Vijaipur Jagdishpur (HVJ) pipeline of GAIL (India) Ltd, at two terminals — DESU terminal near ITO and Maruti terminal in Gurugram. GAIL had been operating 34 km long pipeline connecting Maruti terminal with DESU terminal traversing through Dhaula Kuan to ITO along Ring Road and 24.5 km long pipeline connecting DESU terminal and Khera Kalan near Rohini going along Outer Ring Road. IGL has laid its own 23 km long pipeline from Dhaula Kuan to Rohini to complete the natural gas loop around Delhi.

Source: The Economic Times

RIL, BP to acquire Niko’s 10 percent stake in gas block

April 30, 2017. Reliance Industries Ltd (RIL) and British energy giant BP Plc will acquire their cash-strapped partner Niko Resources’ 10 percent stake in gas discovery block NEC- 25 in the Bay of Bengal. In mid-2015, Niko had chosen to withdraw from the NEC-25 block and relinquish its interest to the remaining stakeholders. RIL is the operator of the block with 60 percent interest, while BP of the UK has the remaining 30 percent stake. Niko’s 10 percent interest will be split between RIL and BP in proportion to their equity stake. Gas discoveries in the North-East Coast block NEC-0SN-97/1 (NEC-25) hold recoverable reserves of 1.032 trillion cubic feet. RIL in March 2013 had submitted a $3.5 billion Integrated Field Development Plan for producing 10 million standard cubic metres per day of gas from the discoveries D-32, D-40, D-9 and D-10 in NEC-25 by mid-2019. The DGH has however refused to bring the development plan to the management committee for approval, disputing commerciality of D-32 and D-40 in the absence of Drill Stem Tests (DSTs). RIL-BP-Niko decided to relinquish D-40 and conduct DST on D-32. According to RIL, D-32 and D-40 hold an in-place reserve of up to 663 billion cubic feet capable of producing 170 million standard cubic feet per day. RIL has so far made eight gas discoveries in the block.

Source: The Hindu Business Line

NATIONAL: COAL

CIL production falls 4.8 percent in April

May 2, 2017. Coal India Ltd (CIL)’s production has declined 4.8 percent in April with the company achieving only 88 percent of the total target for the month. In April, CIL produced 38.44 million tonnes (MT) as against a target of 43.58 MT. The highest production came from its subsidiary Mahanadi Coalfields Ltd (MCL) which stood at 10.28 MT followed by Singareni Collieries Ltd (SECL) at 10.10 MT. However, despite fall in production the company saw an uptick in offtake during the month. The total provisional offtake of CIL rose by 6.1 percent in April to 45.29 MT in April. This, however, was lower than the target of 49.51 MT. Coal demand in the country has muted in the recent months following dwindling demand from the power sector. As per reports, around 69 MT coal is lying idle at pitheads.

Source: The Economic Times

Government asks CIL to expedite coal export to neighbouring nations

May 1, 2017. The government is nudging the world’s largest coal miner Coal India Ltd (CIL) to expedite the export of coal to neighbouring countries, including Bhutan, as India has surplus coal. Coal pithead is where the mine is located and the mined coal is kept usually before being transported to power companies. CIL has conveyed it to the coal ministry that it is exploring the possibilities of exporting coal to neighbouring nations, but nothing concrete has taken shape. The government had said CIL is examining opportunities to export coal with high ash content or high-grade fossil fuel to the neighbouring nations. CIL accounts for over 80% of domestic coal production.

Source: Business Standard

Government plans to cut coal imports for power PSUs to zero in FY18

April 30, 2017. Government has said it is aiming to bring down to “zero” thermal coal imports of power public sector units (PSUs) like NTPC in the current fiscal, a move that would reduce the country’s import bill by aroundRs 17,000 crore. The government would also slowly convince the private companies operating in the power space to totally stop the import of thermal fossil fuel. The government, Coal Secretary Susheel Kumar said, will also convince upon the private companies in the power sector to source coal through domestic sources as it is more reliable and prone to less price variations. The coal ministry, he said, will make available to the power PSUs the supply of thermal coal through domestic sources in sufficient amount which would prompt the companies to not resort to import of fossil fuel. The trend of fall in import of coal also continued in the 2016-17 fiscal. During the first 10 months (April-January), coal imports reduced by 2.59 percent as against the year-ago period, the government had said. However, import of coal is not solely dependent on the domestic production. It also depends on other factors like power plant designed on imported coal and insufficient availability of coking coal of required grade, the government had said.

Source: The Times of India

Commercial coal mining to lower power tariff: Coal Secretary

April 28, 2017. The opening up of commercial coal mining to private companies will bring in competition in the coal sector and reduce power tariff, Coal Secretary Susheel Kumar said. India is in the process of throwing open commercial coal mining to private firms for the first time in four decades, with the aim of shifting the world’s third-biggest coal importer towards energy self-sufficiency. The government, he said, wants to convey to potential investors that sustainable and efficient mining, not revenue maximisation, is the idea behind commercial coal auction. As per the Coal Mines Special Provision Act of 2015, the government can open up commercial coal mining for private players. With a chunk of population going without electricity, Kumar suggested that the government should ensure these people get power. The government plans to auction four blocks under commercial mining in the first phase. A group of secretaries has also suggested that the government should create competition for Coal India Ltd by opening up commercial coal mining.

Source: The Economic Times

NATIONAL: POWER

SC rejects Essar Steel’s plea seeking exemption from power dues in Gujarat

May 2, 2017. In a major setback to Essar Steel, the Supreme Court (SC) rejected their plea seeking exemption from payment of electricity dues to the Gujarat Government. A Bench of the apex court headed by Justice Arjan Kumar Sikri and also comprising Justice Ashok Bhushan, directed payment ofRs 1,038 crore of electricity dues by Essar Steel to the Gujarat Government. The Essar Steel has ready paid aroundRs 500 crore. The state government had first refused Essar group’s claims for duty exemption on electricity in 2003. Essar has been seeking electricity duty exemption for its power plant set up at Hazira but the Gujarat government had rejected its demand, as it sold power to other entities. The state government had first refused Essar group’s claims for duty exemption on electricity in 2003. It had asked the company to pay more thanRs 1,000 crore that was allegedly due. Essar group had then approached the Gujarat High Court which had last year asked the company to pay the electricity duty to the state government. It was also rejected by the Gujarat High Court. Essar then challenged it before the Apex Court, which also rejected its plea.

Source: Business Standard

Power supply to education department to be snapped for pending dues

May 1, 2017. Uttar Pradesh Power Corp Ltd (UPPCL) decided to disconnect the power supply to the education department here for reportedly not paying electricity bills ofRs 25.69 crore. Of the total pending amount, the primary education department alone has to payRs 23.76 crore. However, all government departments, except the education department have paid some part of their power bills. The power bill is highest with the primary education department as hundreds of schools and block offices are consuming power. According to UPPCL, power arrears cause problems in producing electricity.

Source: The Times of India

Haryana slapsRs 88.78 lakh penalty for power theft by staff

May 1, 2017. The Haryana government has cracked the whip on power theft by government employees, including officers, leading to detection of 343 power theft cases and slapping ofRs 88.78 lakh penalty. A total of 504 government residential premises across the state were raided by the operation and vigilance wings of the Uttar Haryana Bijli Vitran Nigam. The raids took place over the past two days and as many as 330 meters were picked up on suspicion of having been tampered with. The raids were part of a campaign to curb power theft, including that by government employees and officers. The maximum power theft cases were detected in Ambala circle (` 14.6 lakh), followed by Faridabad circle (` 10.86 lakh), Kaithal circle (` 9.51 lakh) and Gurugram circle (` 8.37 lakh).

Source: Business Standard

Thunderstorm hits several parts of Uttarakhand, power supply disrupted

April 30, 2017. A powerful thunderstorm, accompanied by rain and hail, hit several parts of Uttarakhand in the wee hours, uprooting trees and disrupting power supply at several places in the state capital and Mussoorie, while upper reaches of the state witnessed snowfall, resulting in dip in temperature. However, power supply to Dehradun and Mussoorie was restored after several hours of thunderstorm.

Source: The Times of India

Utility splits Gurgaon into two circles or streamlining power supply

April 29, 2017. Aiming to streamline the power distribution system and redress complaints, the Haryana government has bifurcated Gurgaon into two Circle 1 and Circle 2. The two circles would be headed by the two superintending engineers (SEs) respectively. The plan of bifurcation of the Gurgaon Circle was in the pipeline for over a year. The city circle of the Dakshin Haryana Bijli Vitaran Nigam (DHBVN) saw a realty boom in the past decade. The peak summer demand in past five years has gone from 950 MW to 1,500 MW in 2016. The number of consumers also increased from 2.50 lakh to nearly 4 lakh. The power distribution system in Gurgaon has drawn much criticism and ire from residents, especially in summer when tripping leads to power cuts for as long as 5 hours. The consumers have accused the DHBVN of not addressing their complaints.

Source: Hindustan Times

Rs3 per unit to be benchmark price for power in medium term: Goyal

April 29, 2017. The government is looking atRs 3 per unit as the benchmark price for power from all energy sources like thermal, solar and wind in the medium term. The government’s aim is to ensure power atRs 3 per unit irrespective of source in the medium term, Power Minister Piyush Goyal said. Goyal assured that there is no proposal to increase tariffs for farmers. Goyal stated that 100 GW of stranded and stressed assets have been revived through policy reforms and resource mobilisation. Power demand has increased by 6.5 percent last fiscal, even as India became power surplus for the first time. The DDU Gram Jyoti Yojana has reached 75 percent target to electrify 18452 villages, Goyal said. He said that two years of coal reforms have led to surplus supply for power plants and now focus is on ensuring better domestic coal quality and re-engineering processes so that legacy imported coal-based plants can use indigenous supply.

Source: The Economic Times

NTPC to resume power supply in Tamil Nadu after state clears some dues

April 27, 2017. NTPC Ltd has agreed to resume 1,000 MW power supply to Tamil Nadu power board from its thermal power plant in Vallur, which the company had stopped owing to non-payment of dues by the state. The Delhi-based power giant had stopped power supply to Tangedco and other power distribution companies in the southern part of the company owing to an overdue ofRs 1,156 crore. NTPC’s Vallur plant, which runs on a joint venture with Tamil Nadu Electricity Board, has three units of 500 MW each from where Tandegco gets about 70 percent of the generated power. Power supply from two of these three plants was suspended.

Source: The Economic Times

UP government will crack down on theft, ensure 24-hour supply

April 26, 2017. Uttar Pradesh (UP) Power Minister Shrikant Sharma said that the state government’s priority is to curtail electricity theft in order to ensure 24-hour power supply to paying consumers. He was in Modi Nagar of Ghaziabad to inaugurate an upgraded electricity substation and a new distribution substation. He announced a provision of 24-hour power supply to nine feeders in Loni, four in Modi Nagar and two in Sikanderabad. He said that the government has started a drive against power theft. He also reiterated the promise of Prime Minister Modi to provide power at cheaper tariffs to all by 2019.

Source: Hindustan Times

Maharashtra government mulls making public names of electricity thieves

April 26, 2017. The Maharashtra government will consider the idea of making public the names of people, who indulge in electricity thefts, state Energy Minister Chandrashekhar Bawankule said. Conceding that power thefts were taking place on a large scale in the distribution network of Maharashtra State Electricity Distribution Company Ltd (MSEDCL), he said. He said that due to the steps taken by the government, the percentage of power thefts has reduced. The MSEDCL has developed a mobile app, through which people can inform about the power thefts happening anywhere. He said that the work of laying underground electricity cables in Shirdi town would begin soon.

Source: India Today

Haryana CM unveils Electricity Bill Surcharge Waiver Scheme

April 26, 2017. Haryana Chief Minister (CM) Manohar Lal Khattar announced launch of the Electricity Bill Surcharge Waiver Scheme 2017. Under this scheme, consumers whose electricity bills are outstanding and who have not been able to avail the benefit of the earlier surcharge waiver scheme, are being given another opportunity to pay their outstanding dues. The consumers can pay their outstanding power bill without surcharge, either in lump sum or six equal bi-monthly installments along with current bills. Surcharge Waiver Scheme 2017 scheme has been made applicable with immediate effect and will remain in force till May 31. The scheme will be applicable to domestic and non-domestic consumers with connected load up to 2 KW in rural areas (connected or disconnected) and domestic consumers with connected load up to 2 KW in urban areas (disconnected only). Under the present scheme, on payment of the principal amount either in lump sum or installments, the surcharge amount of the consumer will be frozen. After payment of six bills in the first year, 40 percent of the surcharge amount will be waived. With the payment of another six bills in the second year, 30 percent of the surcharge amount will be waived and after payment of the bills in the third year, the remaining surcharge amount will also be waived. However, if the consumer at any time defaults in payment of three consecutive electricity bills after adoption of the scheme, the remaining surcharge amount will be revived. Consumers whose connections stand disconnected will be given a new connection after payment of the principal amount in lump sum or, as the case may be, the first instalment.

Source: NDTV

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Actis to invest $500 mn in green energy platform Solenergi

May 2, 2017. Private equity fund Actis LLP plans to invest around $500 million in its second green energy platform in India, Solenergi Power Pvt Ltd. Solenergi is among the successful bidders for the Rewa solar power project in Madhya Pradesh. Actis aims to take advantage of the country’s growing green economy which, in turn, is fuelled by the government’s ambitious clean energy goals. India plans to generate 175 GW of renewable energy by 2022. Of this, 100 GW is to come from solar power projects. Solenergi Power had placed a aggressive bid ofRs 3.30 per kilo watt hour to win a contract to build 250 MW capacity at Rewa. The other successful bidders are Mahindra Renewables Pvt Ltd and Acme Solar Holdings Pvt Ltd.

Source: Livemint

Coca-Cola’s Ludhiana bottling plant commission 100 KW Solar power plant

May 2, 2017. Ludhiana Beverages Pvt Ltd, an authorized franchise bottler of Coca-Cola announced the commissioning of a 100 KW solar power plant. The plant with an annual power generation capability of 1,32,000 KW will reduce its the carbon footprint by over 2 percent. Commissioning of solar power plant at Ludhiana Beverages is a testament to our commitment of growing our business in India without increasing greenhouse gas emission. The move supports Coca-Cola System’s goal to improve the environmental performance by reducing CO2 emissions across its value chain. The Coca-Cola System and its bottling partners are working towards a vision of reducing the carbon footprint by 25 percent by 2020 across its entire value chain of manufacturing, packaging, distribution and sourcing.

Source: The Economic Times

IIT scientists create low-cost solar cells using Jamun

April 30, 2017. Scientists at Indian Institute of Technology (IIT) Roorkee have used the juicy, delectable Indian summer fruit Jamun to create inexpensive and more efficient solar cells. Researchers used naturally occurring pigment found in Jamun as an inexpensive photosensitiser for Dye Sensitised Solar Cells (DSSCs) or Gratzel cells. Gratzel cells are thin film solar cells composed of a porous layer of titanium dioxide (TiO2) coated photoanode, a layer of dye molecules that absorbs sunlight, an electrolyte for regenerating the dye, and a cathode. These components form a sandwich-like structure with the dye molecule or photosensitizer playing a pivotal role through its ability to absorb visible light. Researchers extracted dyes from Jamun using ethanol. They also used fresh plums and black currant, along with mixed berry juices which contain pigments that give characteristic colour to Jamun. Uncertainty over the pace at which new large dams or nuclear plants can be built means strong reliance on solar power — an area where India has high potential and equally high ambition — to deliver on the country’s pledge to build up a 40 percent share of non-fossil fuel capacity in the power sector by 2030, researchers said. The research team is very optimistic that the process can easily be replicated for mass production of solar cells. The simplicity and cost effectiveness of the overall fabrication process, widespread availability of fruits and juices, and ease of extraction of anthocyanin dyes render them novel and inexpensive candidates for solar cells application, researchers said.

Source: The Hindu

30 percent of total power usage for Mumbai Metro from solar panels now

April 30, 2017. From May, Mumbai Metro One Pvt Ltd will source 30% of its non-traction energy requirement through solar panels which have been installed at Andheri and Ghtatkopar Metro stations. The initiative is a part of Mumbai Metro One’sRsGo Green Go Clean’ campaign launched to mark its second anniversary. Metro One’s annual auxiliary power requirement for non-traction use is approximately 11 MW. The solar photovoltaic plants are being set up on Renewable Energy Service Company. A power purchase agreement has been signed with the vendor to setup and operate the plant for 25 years on a fixed tariff ofRs 5.10 per unit. The entire rooftop solar power generating system will have an installed capacity of approximately 2.30 megawatt peak which will generate 3.2 million units per year.

Source: The Times of India

If India meets renewables target, no more coal power needed till 2027

April 29, 2017. As the prospects for coal-generated electricity recede globally, India is one of the last bastions of the world’s oldest, dirtiest energy source — although construction of new coal-fired power plants is faltering. From January 2016 to January 2017, development of coal-fired power capacity fell around the world, according to a March 2017 report titled “Boom and Bust”, released jointly by the Sierra Club, Greenpeace and Coalswarm. Using data from the Global Coal Plant Tracker, an online database developed by Coalswarm that identifies, maps and categorises every known 30 MW and larger coal-fired power generating unit and every new unit proposed since January 1, 2010, the report maps a global move away from coal and towards renewable energy. In China and India alone, construction activities that would add 68 GW — over a fifth of India’s total installed capacity — of additional coal capacity are frozen across 100 project sites, 13 of them in India. The primary reason for the slowdown in India is “reluctance of banks and other financiers to provide further funds”, the report said. Over half (56.5 percent) of India’s installed power capacity will be non-fossil fuel-based — renewables, nuclear and large hydroelectric — within 10 years. In India, as of February 2017, at least 15 coal-based thermal power projects with an aggregate capacity of 18,420 MW were stalled due to financial reasons, the power ministry said.

Source: The Economic Times

BHEL commissions 3 MW solar plant in Dadra and Nagar Haveli

April 28, 2017. Bharat Heavy Electricals Ltd (BHEL) said the company has commissioned a 3 MW solar power plant in the union territory of Dadra and Nagar Haveli. BHEL said it has executed the project on a turnkey basis Dadra and Nagar Haveli Power Distribution Corp Ltd. At present, BHEL is executive solar projects of total 180 MW capacity for various customers by offering engineering, procurement and construction services for both off-grid and grid interactive projects. The Delhi-based public sector company manufactures solar cells and modules at its units in Bengaluru.

Source: The Economic Times

Solar tariff wars heat up in India

April 28, 2017. At a time when addition of coal-fuelled power generation capacity has come to a standstill globally, India is seeing a race to the bottom in solar power prices. The latest was the record low tariff ofRs 3.15 per kilowatt hour. The tariff is expected to fall belowRs 3 a unit during auctions for the Bhadla solar parks in Rajasthan. The previous low wasRs 3.30 per unit for a 750 MW project at Rewa in Madhya Pradesh. India’s growing green economy has been fuelled by the government’s ambition around clean energy. India plans to generate 175 GW of renewable energy by 2022. Of this, 100 GW is to come from solar power projects.

Source: Livemint

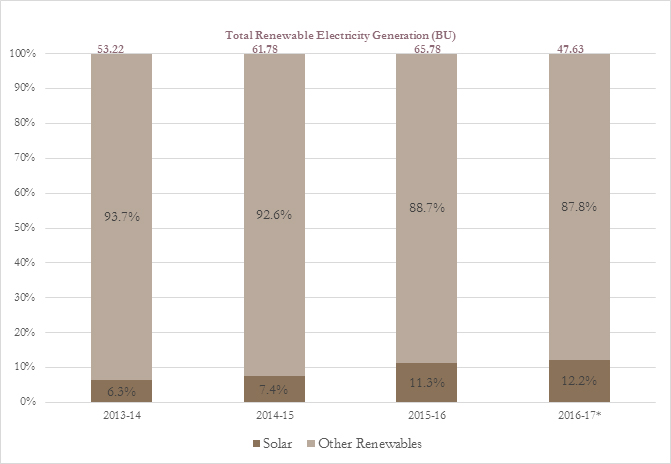

Wind power capacity addition outpaced predictions last year: ICRA

April 27, 2017. Capacity addition in the wind energy sector was much better than predicted by ICRA last year. This was largely attributable to a bunching up of commissioning in March 2017. This in turn was the result of removal of generation based incentive benefit and reduction in accelerated depreciation benefit with effect from April 1, 2017. These apart, independent power producers were trying to utilise the current feed in tariff regimes in states where it existed – the apprehension being that in future, tariff based bidding, as exemplified by the award of projects by Solar Energy Corp Ltd in February 2017, could largely replace feed-in tariff regime. ICRA has gathered from industry sources that distribution utilities in states like Andhra Pradesh, Rajasthan, Karnataka and Gujarat are evaluating competitive bidding mechanism for awarding wind power projects. The wind power capacity addition during FY2017 stood at 5.4 GW, increasing by 58% over the capacity addition of 3.4 GW achieved in FY2016. The solar power capacity addition stood at 5.5 GW in FY2017, reporting a significant jump of 83% as against the capacity addition of 3.0 GW in FY2016.

Source: The Economic Times

PM Modi launches hydro engineering college in HP

April 27, 2017. Prime Minister (PM) Narendra Modi laid the foundation stone of Hydro Engineering College at Bilaspur, Himachal Pradesh (HP). The college being set up by two power public sector giants NTPC Ltd and NHPC Ltd will provide Bachelor of Technology courses in mechanical, electrical, civil and computer science disciplines of engineering.

Source: The Economic Times

Solar installation to touch 10 GW as module prices fall further: Mercom

April 27, 2017. Solar installations in India is expected to reach approximately 10 GW as it becomes one of the most important solar markets in the world, after China and the United States, Mercom India has forecast. Fuelled by slowdown in China’s demand the industry is expecting module prices to decline slightly in the second quarter and a more pronounced fall in the second half of the year. Nevertheless, current installed capacity of domestic cells and modules is estimated at 3 GW and 8.4 GW respectively while operational capacity of solar cells and modules is 1.5 GW and 6.6 GW respectively. The Indian solar sector is seeing strong activity with cumulative installations reaching approximately 12.8 GW at the end of Q1 2017.

Source: The Economic Times

INTERNATIONAL: OIL

North America’s busiest oil dealmaker turns focus to production

May 2, 2017. After five years of snapping up more oil assets than any of its peers in North America, Crescent Point Energy Corp is turning its focus to getting more out of them. Chief Executive Officer Scott Saxberg said that rather than scouting for new assets to buy, the company is trying to keep a lid on costs, drilling new wells in the Uinta Basin in Utah and developing operations in the Bakken formation. From 2012 through last year, Crescent Point completed 15 acquisitions, the most of any oil explorer and producer on the continent. While the roughly $6 billion value of those takeovers ranked it fifth — overshadowed by megadeals from giants such as Devon Energy Corp. and Encana Corp — it still averaged about $402.5 million per transaction. The company’s first-quarter results may have started to change investors’ minds. Crescent Point’s funds flow from operations rose 13 percent to C$427.1 million. Production was the equivalent of 173,329 barrels of oil a day, topping some analysts’ estimates.

Source: Bloomberg

European Union adopts new rules to secure gas supplies

May 2, 2017. The negotiators of the European Parliament and European Council have reached a political agreement on new security of gas supply rules aimed at preventing gas supply crises. The new regulation introduces a solidarity principle – in the event of a severe gas crisis, neighbouring Member States will help out to ensure gas supply to households and essential social services – and a closer regional cooperation. Gas companies will have to notify long-term contracts that are relevant for security of supply.

Source: Enerdata

Russian daily oil production down in April

May 2, 2017. Russian oil output stood at 11 million barrels per day (bpd) in April, down from 11.05 million bpd in March, the energy ministry data showed. In tonnes, oil output reached 45.002 million versus 46.739 million in March. Gas production was at 54.17 billion cubic meters (bcm) last month, or 1.81 bcm a day, versus 58.79 bcm in March.

Source: Reuters

US Supreme Court sides with Venezuela over oil rigs claim

May 1, 2017. The United States (US) Supreme Court tossed out a lower court’s ruling that had allowed an American oil drilling company to sue Venezuela over the seizure of 11 drilling rigs in 2010 but allowed the business another chance to press its claims. Siding with Venezuela, the justices ruled 8-0 that a lower court that had given the go-ahead for the suit must reconsider whether claims made by Oklahoma-based Helmerich & Payne International Drilling Company can proceed. The company sued both the Venezuelan government and state-owned oil companies under a US law called the Foreign Sovereign Immunities Act, saying among other things that the property seizure violated international law.

Source: Reuters

Noble Energy’s loss smaller than expected as oil prices climb

May 1, 2017. Noble Energy Inc reported a smaller-than-expected adjusted quarterly loss as oil prices ticked up after a more than two-year slump, offsetting a decline in production. Brent crude prices LCOc1 averaged $54.57 per barrel in the first three months of the year, up 55 percent from a year earlier. Noble’s total operating expenses fell 12.7 percent to $1 billion.

Source: Reuters

Libya’s oil output hits 760k bpd, highest since 2014: NOC

May 1, 2017. Libya’s oil production has risen above 760,000 barrels per day (bpd), its highest since December 2014, the National Oil Corp (NOC) said. Chairman Mustafa Sanalla said the NOC was working on plans to increase production further. He has previously set a goal of boosting output to 1.1 million bpd by August. The NOC gave no breakdown for the latest production increase, but it is mainly due to the reopening of the major western field of Sharara. Sharara was producing more than 200,000 bpd before its operations were halted by pipeline blockades twice in the past two months, causing national output to drop to less than 500,000 bpd. The NOC said that the lifting of the blockade at Sharara would also allow production to resume at the nearby El Feel field, which can pump 80,000 bpd. Libya’s production remains well below the 1.6 million bpd the North African country was producing before a 2011 uprising, but gains to production remain vulnerable to political turmoil and armed conflict. Production has been repeatedly disrupted in recent years by stoppages and port blockades usually linked to demands for salary payments or funds for local development. Closures since 2013 have deprived Libya of more than $130 billion in revenue, according to the NOC. Some oil facilities have been badly damaged by previous fighting, and the NOC also faces major technical and financial challenges in returning them toward full capacity.

Source: Reuters

Iran self-sufficient in petrol production, aims to export

April 30, 2017. Iran said it was now self-sufficient in petroleum production as President Hassan Rouhani opened a refinery in the southern city of Bandar Abbas. The Persian Gulf Star refinery has the capacity to produce 12 million litres of Euro IV petrol. Once fully operational, the refinery will produce 36 million litres of petrol.

Source: Reuters

Saudi Arabia may cut June light crude prices to nine-month low

April 30, 2017. Top oil exporter Saudi Arabia is expected to cut the price of its flagship Arab Light by 40-50 cents a barrel in June to the lowest in nine months, a survey of Asian refiners showed. Official selling prices (OSPs) are expected to fall across the board for Saudi crudes sold to Asia in June, after a fall in the Middle East benchmark Dubai crude due to ample oil supplies, the survey of five refiners found. The June Arab Light OSP will drop by at least 50 cents a barrel. Demand from China and Japan has slowed as some refining units have yet to return from maintenance, while independent Chinese refiners are waiting for more import quotas to be issued by Beijing.

Source: Reuters

Iran gets positive output cut signals from OPEC, non-OPEC states

April 29, 2017. Iran’s Oil Minister Bijan Zanganeh said OPEC (Organization of the Petroleum Exporting Countries) and non-OPEC countries had given positive signals for an extension of output cuts, which Tehran would also back. The OPEC meets in May to discuss oil supply policy. Oil prices fell though they closed higher on growing hope that OPEC might agree to extend production cuts long enough to reduce a global crude glut.

Source: Reuters

Mexican oil regulator approves first onshore joint venture projects

April 28, 2017. Mexico’s first two onshore oil and gas projects to be developed by joint ventures between state-owned Pemex and new partners were approved by regulators. The auctions to pick Pemex’s partners for the two extraction projects covering the Cardenas-Mora and Ogarrio fields, both located in southern Tabasco state, will take place on October 4. In both tie-ups, Pemex will have a 50 percent stake, while the partners will have the remaining half and will be designated as the operators of the projects. Both projects feature existing infrastructure due to past Pemex work in the areas, as well as ongoing production. Cardenas-Mora features output of about 7,200 barrels per day (bpd) of crude oil, while Ogarrio produces about 6,600 bpd. The National Hydrocarbons Commission, Mexico’s oil regulator, has previously approved both deep water and shallow water joint ventures for Pemex, with the first one covering the company’s Trion deep water field won by Australian mining and oil giant BHP Billiton late last year. A landmark energy overhaul finalized in 2014, which ended Pemex’s monopoly over the production of oil and gas, permits the company to enter into first-ever joint ventures as a means to share risks and reverse a prolonged slump in crude output.

Source: Reuters

China’s oil stockpiling in first-half 2016 slows on tank shortage

April 28, 2017. China added 9.34 million barrels of crude oil to Strategic Petroleum Reserves (SPR), worth just over one day’s imports, during the first half of 2016, government data showed. Since 2015, China’s record amount of crude oil imports have been driven more by flows into the country’s independent refineries rather than government stockpiling. China boosted its SPR across nine bases by adding 1.28 million tonnes of crude oil in the first half of 2016, the commerce ministry said. By mid-2016, the government had 33.25 million tonnes of crude oil, equivalent to 243 million barrels, up from 31.97 million tonnes at the start of 2016. That equates to an average fill rate of 52,000 barrels per day (bpd). Based on data provided from China’s National Bureau of Statistics, the country had marked 43 million barrels during the second half of 2015, suggesting a fill rate of around 240,000 bpd.

Source: Reuters

How North Korea gets its oil from China

April 28, 2017. As the United Nations (UN) Security Council decides whether to tighten the sanctions screws on North Korea, the country’s increasingly isolated government could lose a lifeline provided by China National Petroleum Corp (CNPC). For decades, the Chinese oil giant has sent small cargoes of jet fuel, diesel and gasoline from two large refineries in the northeastern city of Dalian and other nearby plants across the Yellow Sea to North Korea’s western port of Nampo, five sources familiar with the business told Reuters. CNPC also controls the export of crude oil to North Korea, an aid program that began about 40 years ago. The crude is transported through an ageing pipeline that runs from the border town of Dandong to feed North Korea’s single operational oil refinery, the Ponghwa Chemical factory in Sinuiju on the other side of the Yalu river, which splits the two nations. President Donald Trump’s administration is focusing its North Korea strategy on tougher economic sanctions, possibly including an oil embargo, a global ban on its airline, intercepting cargo ships and punishing Chinese banks doing business with Pyongyang. North Korea imports all its oil needs, mostly from China and a much smaller amount from Russia. It bought about 270,000 tonnes of fuel, from gasoline to diesel, last year, according to China’s customs data. Crude oil exports from China to North Korea have not been disclosed by customs for several years, but the sources say it’s about 520,000 tonnes a year. In North Korea, diesel has been critical for farming, especially at this time of year, ahead of the planting season and also around October for harvesting. Gasoline is mainly used by the transport industry and the military, experts said.

Source: Reuters

Canada oil bets on tech, scale in face of foreign majors’ exodus

April 28, 2017. As global oil majors pull out of Canada’s oil sands, domestic companies are buying up assets and betting technology and economies of scale will enable them to turn a profit despite low crude prices. Global energy majors have sold off more than $22.5 billion worth of Canadian oil sands assets so far this year, concerned about depressed oil prices, high production costs and carbon emissions and limited pipeline access to market.

Source: Reuters

Oil discoveries fell to record low in 2016: IEA

April 28, 2017. New figures published by the International Energy Agency (IEA) show that global oil discoveries dropped to a record low of only 2.4 billion barrels in 2016, while sanctioned projects fell to their lowest levels in over 70 years. The trend in low oil projects has been attributed mainly to oil companies which have been cutting their spending on oil discoveries and projects. These two trend could continue this year as well, the report warned. The report stated that oil discoveries have fallen to 2.4 billion barrels last year, compared to an average of 9 billion barrels annually over the past 15 years. At the same time, conventional resources sanctioned for development last year also fell to 4.7 billion barrels, which was 30% lower than previous year. Final investment decisions have also dropped to the lowest level since the 1940s, the report noted. The slowdown in the activities of oil sector is claimed to be the result of reduced investment spending driven by low oil prices. It also adds concern to global energy security. Falling investments in oil sector also contrasts with the resilience of the US shale industry. In the US, there has been a rebound which increased investments sharply and the output increased and production costs also reduced by 50% since 2014. This growth has been a fundamental factor in balancing low activity in the oil industry.

Source: Energy Business Review

Russia reaches almost full compliance with oil output cuts

April 28, 2017. Russia’s oil production cuts have reached almost 300,000 barrels per day, Energy Minister Alexander Novak said. The Organization of the Petroleum Exporting Countries (OPEC), along with Russia and other leading non-OPEC producers, pledged to cut output by 1.8 million barrels per day (bpd) in the first half of 2017 to shrink bloated inventories and support prices. Novak said that on average, Russian oil production declined by 254,000 bpd from April 1-26 compared with the reference level of October. Saudi Energy Minister Khalid al-Falih said that Russia’s contribution to the output pact in April was good.

Source: Reuters

Trump aims to expand US offshore drilling, despite low industry demand

April 28, 2017. US (United States) President Donald Trump signed an executive order to extend offshore oil and gas drilling to areas that have been off limits – a move meant to boost domestic production but which could fall flat due to weak industry demand for the acreage. The order could open up swathes of the Atlantic, Pacific and Arctic oceans, as well as the US Gulf of Mexico, that former President Barack Obama had sought to protect from development after a huge BP oil spill in 2010. The president of the American Petroleum Institute (API) trade group welcomed the order, while API said the order could help the industry over the long term. The order directs the US Department of Interior to review and replace the Obama administration’s most recent five-year oil and gas development plan for the outer continental shelf, which includes federal waters off all US coasts. Obama had banned new oil and gas drilling in federal waters in the Atlantic and Arctic oceans, protecting 115 million acres (46.5 million hectares) of waters off Alaska and 3.8 million acres in the Atlantic from New England to the Chesapeake Bay.

Source: Reuters

China sets deadline for refiners to apply for oil import permits

April 27, 2017. China’s top state planner will stop accepting new applications from oil refiners to use imported crude oil from May 5, it said, amid growing concerns about domestic refining overcapacity that has led to record exports of fuel. China has allowed 22 independent refiners to import crude oil since 2015 with quotas totalling 81.93 million tonnes, or 1.64 million barrels per day, making up 12 percent of the country’s total crude oil imports, according to China Petroleum and Chemical Industry Federation.

Source: Reuters

Uzbekistan starts construction of $2.2 bn oil refinery

April 27, 2017. Uzbekistan started construction of a $2.2 billion refinery which will use oil imported from Russia and Kazakhstan. The state-run project in the Jizzakh region bordering oil-rich Kazakhstan will receive crude through a pipeline which has not yet been built. The Jizzakh refinery will produce more than 3.7 million tonnes of gasoline, more than 700,000 tonnes of jet fuel and about 300,000 tonnes of other oil products annually, to be sold both domestically and abroad. Uzbek President Shavkat Mirziyoyev had secured oil supplies from Russia and Kazakhstan during his visits to those countries. The Central Asian nation operates three refineries but has faced shortages of both crude oil and fuel.

Source: Reuters

Angola in full compliance with OPEC output cuts: Oil Minister

April 27, 2017. Angolan Oil Minister José Maria Botelho de Vasconcelos said his country was more than fully complying with OPEC (Organization of the Petroleum Exporting Countries) production cuts, and that he believed a deal to curb output would be extended beyond June. He said that Angola was implementing more than 100 percent of the cuts it committed to under the deal reached last year between the OPEC and other producers led by Russia. Under the deal, the producers agreed to cut output by 1.8 million barrels per day (bpd) for six months from January 1 to support the market and try to bring a supply glut into check. Asked about a preferred oil price for Angola, he said “$60 is not bad”.

Source: Reuters

Iran expects to sign first new IPC oil deal within a month: Deputy Oil Minister

April 27, 2017. Iran expects to sign its first oil deal under the new Iran Petroleum Contract (IPC) model within a month. In January, Iran said 29 companies from more than a dozen countries were allowed to bid for oil and gas projects under the IPC, which Tehran hopes will boost production after years of sanctions. But the IPC model has been delayed several times due to opposition from hardline rivals of President Hassan Rouhani. The IPC model ends a buy-back system dating back more than 20 years under which Iran did not allow foreign firms to book reserves or take equity stakes in Iranian companies.

Source: Reuters

INTERNATIONAL: GAS

Caspian gas pipeline’s Georgia section ready by mid-2018: BP

May 1, 2017. BP plans to complete by mid-2018 the Georgian section of a $40 billion strategic pipeline bringing Caspian gas from Azerbaijan into Europe. The so-called southern gas corridor, which is meant to reduce the European Union’s dependence on Russian energy, will start at Azerbaijan’s Shah Deniz II gas field and cross through Georgia, Turkey, Greece, Albania and Italy. It is the largest attempt so far to bring new supply sources to Europe. Around 10 billion cubic meters (bcm) per year of Azeri gas should reach Europe by 2020 through the Trans Adriatic Pipeline, with another 6 bcm destined for Georgia through the South Caucasus Pipeline and Turkey through the Trans-Anatolian Pipeline.

Source: Reuters

US President open to raising gas tax and negotiating tax overhaul plan

May 1, 2017. US (United States) President Donald Trump said he’s willing to raise the US gas tax to fund infrastructure development and called the tax-overhaul plan he released last week the beginning of negotiations. Trump released a tax plan that would cut the maximum corporate tax rate to 15 percent from the current 35 percent. The same reduced rate would apply to partnerships and other “pass-through” businesses. He said he is willing to lose provisions of his tax plan in negotiations with Congress but refused to specify which parts. He also repeated his call for a “reciprocal tax,” which would be aimed at imposing levies on imports to match the rates that each country charges on US exports. The Trump proposal also would eliminate the alternative minimum tax and the estate tax, cut individual income-tax rates and repeal an investment-income tax for high earners, fulfilling a conservative wish list from the past several years. The federal per-gallon taxes of 18.4 cents on gasoline and 24.4 cents on diesel were last raised in 1993. Since then, revenue from the fuel levies has declined as inflation robbed them of their purchasing power and the average fuel economy of a passenger vehicle increased by 12 percent, according to the US Department of Transportation.

Source: Bloomberg

Arrow Energy wins Australian gas pipeline license, but plan on hold

April 30, 2017. Arrow Energy, owned by Royal Dutch Shell and PetroChina, has been granted a license to build a natural gas pipeline in Australia’s Queensland state that could contribute to easing the country’s gas supply crunch. The 420 km (260 mile) pipeline is designed to carry gas from a coal seam gas project in Queensland’s Bowen Basin to the Gladstone area. There has been no final decision yet on the pipeline because the coal seam project has not been developed. Arrow is working on overcoming challenges with coal seam gas production in the Bowen Basin and does not know what impact that will have on the overall project’s schedule. The Bowen project was originally going to supply a liquefied natural gas (LNG) export project, which would have been the fourth on Queensland’s east coast, but Shell and PetroChina shelved that plan more than two years ago. Instead, Arrow’s gas could help ease a looming gas shortfall in Australia’s eastern market by supplying rival LNG projects, which have been blamed for taking gas out of the domestic market to help meet export contracts.

Source: Reuters

Total will invest $500 mn to produce shale gas in Argentina

April 27, 2017. Total SA will spend $500 million over three to four years to develop a shale-gas field in Argentina as the country’s government lures investors by pledging a minimum price. The French energy giant has given the go-ahead to develop the first phase of the Aguada Pichana Este license in the Vaca Muerta formation. To spur drilling at Vaca Muerta, one of the largest shale formations outside North America, the Argentine government has extended a program that ensures a minimum price for the gas companies produce until 2021. Total, already enjoying lower drilling costs following crude’s slump, has highlighted the need to get new projects off the ground to avoid a future shortfall in energy supply. The announcement on Vaca Muerta marks the first of 10 large final investment decisions on new oil and gas ventures that Total plans for this year and next. The company is budgeting as much as $17 billion a year in capital expenditure, including resource renewal, through 2020. Gas from the Vaca Muerta project will be treated at the existing Aguada Pichana plant, which will ramp up to its full daily capacity of 16 million cubic meters, or 100,000 barrels of oil equivalent, according to Total. The company produced 78,000 barrels of oil equivalent a day in Argentina last year, it said.

Source: Bloomberg

Australia backs off tax push against O&G industry