Natural Growth in Natural Gas Demand

Gas News Commentary: January 2017

India

India’s largest LNG importer Petronet has apparently signed an agreement with Petrobangla to set up a $950 million LNG import project in Bangladesh. The terminal is expected to have a capacity of 7.5 MTPA and is located at Kutubdia Island in Cox’s Bazar. A 26-km pipline is envisaged to connect it to the consumption markets. The project is projected to come online by 2020 and it envisions future expansion. Supply of LNG through small barges and LNG trucks to users which are not connected by gas grid is also under consideration. The preliminary agreement signed this month is expected to be followed up by a formal pact. Petrobangla is likely to become part of the joint venture building the LNG project with a 26 percent stake but Petronet is currently seeking only assurance from Petrobangla that it will buy the gas for project securitisation.

GAIL (India) Ltd is expected to participate in the project to implement the pipeline that is to be laid to connect the import facility with consuming markets. It was reported that IOC could also join if city gas projects are to be developed. Gas demand in Bangladesh is projected to more than double to 45 MT from the current 20 MT in next 20 years. The question that comes to mind is this: how will a project that involves an Indian company located in one of the islands in an ecologically sensitive zone reported to be under threat from human activity be received by the local population. The message from the Rampal power project with very similar challenges does not offer much hope.

Upstream company ONGC was reported to be expecting peak output of about 5 MMSCMD from its Vashishta gas field in KG basin by July 2017. Vashishta and S1 gas fields, located in the KG Offshore Basin off the east coast of India, began operations in September 2016. A production of 1.1 MMSCMD from the fields currently will increase to 5 MMSCMD by July. The fields were developed under a greenfield deepwater development project at an investment of $751.65 million. The Vashishta field is estimated to produce 9.56 BCM over a period of nine years with peak production reaching 3.55 MMSCMD during the first five years. The S1 field is expected to deliver 6.22 BCM over a period of eight years with a peak production of 2.2 MMSCMD for the first five years.

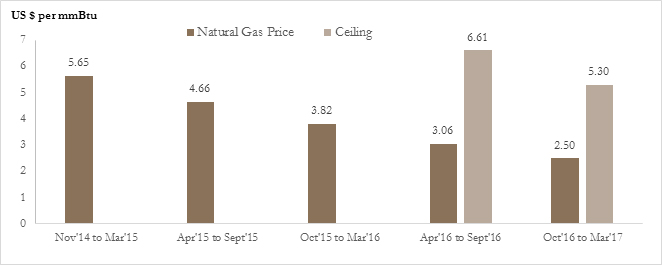

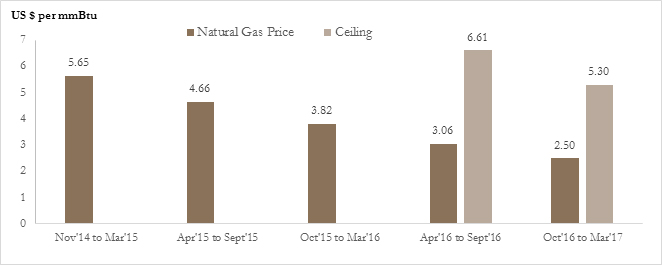

As part of the Vashishta and S1 field development, ONGC is drilling four wells and shipping the gas from them through a sub-sea pipeline to an onshore terminal at Odalarevu in Andhra Pradesh. The Vashishta field lies in water depths varying between 500 meters and 700 meters and about between 31 and 35 km from the Amalapuram coast. While the Vashishta field is a free gas field with estimated reserves of 12.92 BCM the S1 field lies to the east of G-1 field and is a free gas field with estimated reserves of 10.37 BCM. Vashishta is the first field in the country to get the premium price for gas. In March 2016 the government had allowed higher price for new gas production from difficulties areas like deep sea, ultra deepwater and high pressure, high temperature areas. When ONGC started production the premium price was $6.61/mmBtu against a cap price of $3.06/mmBtu for regular fields. Other gas producers are likely to rush in to cash in on the provisions of higher price of gas. The fact that the definition of difficult field is subject to interpretation may facilitate the case for higher prices.

The premium price for period between October 2016 and March 2017 was cut to $5.3/mmBtu based on benchmark rates in gas surplus economies. The rate for regular gas price also declined to $2.50/mmBtu.

Rest of the World

Despite uneasy relations between Europe and Moscow, Gazprom’s gas supplies to European consumers are projected to set a new record in 2016. In 2015 Gazprom delivered 158.6 BCM of gas to Europe and Turkey. In 2016 this is expected to increase by 12 percent to 180 BCM. Gazprom’s exports to the EU-28 in 2016 are estimated at around 153 BCM. Global natural gas exports of Gazprom went up from 195.7 BCM in 2015 to 210 BCM in 2016.

As EU-28 gas demand increased by around 6 per cent to 447 BCM last year out of which a third was reportedly from Gazprom. 20 BCM out of 30 BCM increase in Europe’s gas imports in 2016 were reportedly covered by Russia. Some analysts see this as evidence of Europe’s trust over Russian gas.

Gazprom prices were reported to be comparable to or even lower than record-low European spot prices. At $4/mmBtu Russian gas was reportedly 20 percent less than the spot price at the UK NBP hub, the largest gas trading hub in the EU. Domestic natural gas prices in the US NYMEX were about $3.33/mmBtu which is lower than European prices, but when liquefaction, regasification and transportation costs of about $4/mmBtu is added US LNG would be more expensive than pipeline gas from Gazprom.

Closer to home, Asian spot LNG prices were reportedly buoyed by new purchases and tenders. The price of LNG for February delivery rose to $9.75/mmBtu. Though Japanese and Chinese demand had decreased Korea Gas Corp was reportedly open to possible purchases despite having secured a recent shipment from Angola and contracted for winter cargoes in December via a tender. Gail India, which launched a tender to buy three cargoes between January-March, decided to just award the February shipment at an estimated price in the mid to high $9/mmBtu range. This was seen as a slack demand in a market.

As expected the US is projected to become a net energy exporter over the next decade due to rising natural gas exports and falling petroleum product imports according to the EIA. While the US has been a net energy importer since 1953, declining energy imports and growing exports that started over the past year will allow that trend to switch by 2026. In late 2015, the US government lifted a decades-old ban on US crude exports, while natural gas exports from the Lower 48 began in 2016.

NATIONAL: OIL

India to become the fastest oil consumer by 2035

January 26, 2017. India’s oil consumption growth will be the fastest among all major economies by 2035, BP Statistical Review of World Energy said. India, Asia’s second-biggest energy consumer since 2008, had in 2015 overtaken Japan as the world’s third-largest oil consuming country behind US and China. While energy consumption will grow by 4.2 percent per annum — faster than all major economies in the world — India’s consumption growth of fossil fuels would be the largest in the world. India, it said, will overtake China as the largest growth market for energy in volume terms by 2030. Its share of global energy demand increases to 9 percent by 2035, accounting for the second largest share among the BRIC countries with China at 26 percent, Russia at 4 percent and Brazil at 2 percent.

Source: The Economic Times

Odisha may cut IOC’s Paradip sop

January 26, 2017. The Odisha government has served a notice to Indian Oil Corp (IOC), indicating it wants to withdraw fiscal incentives given to the central government-owned refiner-marketer’sRs34,000 crore Paradip refinery, a move that will hit profitability of the state’s largest investor and shake business confidence. If withdrawn, the incentive that will bite IOC most is an 11-year value-added tax (VAT) deferment on products from the refinery sold within the state. The company said considering a 4.5% growth in sales in the state, the VAT deferment would be worthRs8,000-11,000 crore as per the net present value. The refinery started commercial production last year. The state government’s contention is that the refinery doesn’t need incentives since its profitability has increased due to a higher capacity configuration and low global oil prices. The refinery was originally planned with a capacity of processing 9 million tonne a year but then revised to 15 million tonne, keeping the state government in the loop. IOC said that the Paradip refinery, which started commercial production last year, is yet to achieve net profit on standalone basis.

Source: The Economic Times

India to fill Mangalore strategic reserve with UAE oil

January 25, 2017. India signed a deal with the United Arab Emirate (UAE) that allows the Gulf OPEC country to fill half of an underground crude oil storage facility at Mangalore that is part of New Delhi’s strategic reserve system. New Delhi announced a series of pacts with the UAE ranging from defense, trade, maritime cooperation to energy after a meeting between Prime Minister Narendra Modi and Abu Dhabi’s Crown Prince Sheikh Mohamed bin Zayed al-Nahyan. UAE’s Abu Dhabi National Oil Company (ADNOC) will store about 6 million barrels of oil at Mangalore, taking up about half of the site’s capacity, said Sunjay Sudhir, joint secretary for international cooperation at the Indian oil ministry. The crude supplies will begin in the last quarter of this year, Sudhir said. The two sides had discussed ways to advance their energy ties through specific projects, including long-term supply contracts and joint ventures in energy, Modi said. India in 2014 began talks to lease part of its strategic storage to ADNOC. Under those discussions, India was to have first rights to the stored crude in case of an emergency, while ADNOC would be able to move cargoes to meet any shift in demand. India has already filled the other half of the Mangalore storage in Karnataka state with 6 million barrels of Iranian oil.

Source: Reuters

NATIONAL: GAS

AG&P, Hindustan LNG to build gas terminal in Andhra Pradesh

January 30, 2017. AG&P (Atlantic, Gulf and Pacific Company), and Hindustan LNG, a Hyderabad-based LNG import terminal development company, have signed a Memorandum of Understanding (MoU) to supply tolled gas to power stations in the East Godavari region of Andhra Pradesh. AG&P is a leading global integrator of LNG infrastructure solutions, including LNG terminals and related supply chains. Under the agreement, AG&P will provide an integrated solution to deliver regasified LNG through a new LNG import terminal that it will design and build at a port in Andhra Pradesh. The MoU would pave way for a fully integrated solution for tolled gas in India, including design, construction, financing, operations and maintenance of the new terminal, which will ensure a reliable and low-cost supply to power producers, fertiliser plants, cold storage and other industries in Andhra Pradesh and other markets along the east coast.

Source: The Hindu Business Line

ONGC to invest $5.1 bn for developing oil finds off Andhra Pradesh coast

January 27, 2017. Oil and Natural Gas Corp (ONGC) signed an MoU with Andhra Pradesh government for investing $5.07 billion in developing oil and gas finds off the state’s coast by 2019-20. ONGC will invest $5.07 billion in bringing to production 10 oil and gas discoveries in the Bay of Bengal block KG-DWN-98/2 (KG-D5), which sits next to Reliance Industries’ flagging KG-D6 fields. First gas production is envisaged by June 2019 and oil would start flowing from March 2020. Gas from the offshore field will be brought via sub-sea pipeline to Andhra Pradesh before being transported to end users. The 7,294.6 sq km deep-sea KG-D5 block has been broadly categorised into Northern Discovery Area (NDA – 3,800.6 sq km) and Southern Discovery Area (SDA – 3,494 sq km). The NDA has 11 oil and gas discoveries while SDA has the nation’s only ultra-deepsea gas find of UD-1. These finds have been clubbed in three groups – Cluster-1, Cluster-II and Cluster-III. Gas discovery in Cluster-I is to be tied with finds in neighbouring G-4 block for production but this is not being taken up currently because of a dispute with Reliance Industries over migration of gas from ONGC blocks. From Cluster-II a peak oil output of 77,305 barrels per day is envisaged within two years of start of production. Gas output is slated to peak to 16.56 million standard cubic meters per day by end-2021.

Source: The Economic Times

NATIONAL: COAL

India cedes top coal importer spot back to China as growth trend stalls

January 30, 2017. India has surrendered its status as the world’s top importer of coal back to China, with its overseas purchases in 2016 falling to less than 200 million tonnes. The question now is whether lower Indian coal imports is the new reality, or if last year was just a blip. India’s coal imports last year totaled 194.93 million tonnes, according to vessel-tracking and port data. This was 5.4 percent lower than the 206.6 million tonnes recorded for 2015, and also less than the 255.5 million tonnes imported by China last year, according to customs data. India’s rapid growth in coal imports came amid strong economic growth and struggles by state miner Coal India Ltd (CIL) to lift output to meet its ambitious targets. India’s coal production has been rising, although CIL may battle to reach a target of 575 million tonnes for the 2016/17 fiscal year that ends on March 31. Output for the April to December period was 378 million tonnes, a rate that if maintained for the final three months of the financial year would see production closer to 504 million tonnes. Nonetheless, India’s Coal Secretary Susheel Kumar said that the miner is expected to raise its output to 660 million tonnes in the 2017/18 fiscal year, and to 1 billion tonnes by 2020.

Source: Reuters

JSPL secures 0.5 MTPA coal supply for sponge iron units

January 30, 2017. Jindal Steel and Power Ltd (JSPL) said it has secured long-term coal linkage of 0.5 million tonnes per annum (MTPA) for its sponge iron units. The company, in August 2016, had secured long-term coal linkage of 1.18 MTPA for power plants in Chhattisgarh.

Source: The Economic Times

SAIL in talks with CIL over coking coal price hike

January 30, 2017. Worried over domestic coking coal price hike effected by Coal India Ltd (CIL), Steel Authority of India Ltd (SAIL) said it is in negotiations with the miner on the issue as it is difficult for the company to absorb the increase. CIL arm Bharat Coking Coal Ltd this month increased the prices of coking coal by about 20 percent. Another subsidiary of the world’s largest miner Central Coalfields Ltd has also increased price of metallurgical coal this month. The panel which will be constituted will have members from both the state-owned firms. SAIL too is a state-owned firm and is a prime consumer of coking coal as well as a major customer of CIL’s metallurgical coal. The price of various grades of coking coal of CIL varies betweenRs2,400 andRs5,050 per tonne. Asserting that SAIL was unable to recover its cost of production, he said there was a lot of pressure on its operations. The global coking coal price which was at $80 per tonne in January last year rose to $283 per tonne in December, Indian Steel Association Secretary General Sanak Mishra said. However, in early January, global price of metallurgical coal came down to $193 per tonne, Mishra said.

Source: The Economic Times

CIL to allow buyers to lift coal within 3 yrs under e-auction

January 25, 2017. Coal India Ltd (CIL) is planning to offer its e-auction buyers an option to lift the purchased coal any time in the next three years. According to the company, the move will not only increase sales but also cut inventory costs of its customers. For now, the option will be offered only to power firms. Last year, the company had allowed customers to lift coal within six months of the date of purchase. The company is currently working out the amount of coal it will offer for such sales and is in discussion with its subsidiaries. Some power producers are said to be flush with coal because they have supply contracts with CIL, while others that set up an estimated 31 GW of capacity after 2009 are fuel starved.

Source: The Economic Times

NATIONAL: POWER

TariffAlarm: A technology that can cut your energy bills

January 31, 2017. Energy monitoring company Energyly has launched ‘TariffAlarm’, a device that can help consumers limit their electricity use and thereby, save on billing. Electricity distribution companies in states like Tamil Nadu and Delhi charge different rates per unit for domestic consumers. Citing an example, Energyly said in Tamil Nadu if a home user consumes 500 units he paysRs1200 atRs2.40 per unit. However if he consumes 501 units he paysRs2,100 at a rate ofRs4.10 per unit. Around 70 percent domestic consumers come within the 450 to 520 units consumption slab. The problem is most of them do not know when they cross from 500 to 501 and end up payingRs800 extra. TariffAlarm claims it solves this problem by fixing this gadget after the meter and before the power main switch. The home user can set the number of units say 450 or 470 units. TariffAlarm is a patent pending product and has bagged the runner-up prize in the Make-in-India hackathon conducted by Indian Institute of Technology, Bombay last year.

Source: The Economic Times

Lenders put 55 percent stake in GMR Rajahmundry Energy on the block

January 30, 2017. A consortium of lenders led by IDBI Bank has put on sale 55 percent stake in a GMR—built gas based power project in Andhra Pradesh which they had acquired last year following debt restructuring. Lenders had last year converted a part of their debt into equity in GMR Rajahmundry Energy, that operates a 768 MW natural gas-based power plant at Rajahmundry in Andhra Pradesh. Following the conversion, lenders got 55 percent stake in the project while the promoters holding was reduced to 45 percent. The project still has a debt ofRs2,366 crore. The power plant project was completed in 2012, but the commissioning of the project was delayed due to unavailability of gas supply on account of unprecedented fall in gas production in KG-D6 basin which led to cost over-runs.

Source: The Hindu Business Line

Nepal to increase power import from India to plug demand-supply gap

January 30, 2017. Hydropower rich, Himalayan country Nepal is going to increase its power import from India to plug up own winter time demand-supply gap. In addition to its existing 350 MW import, Nepal will take additional 25 MW from India as per a power purchase agreement signed between Nepal Electricity Authority (NEA) and NTPC Vidyut Vyapar Nigam Ltd of India. The additional intake will take place through a cross country transmission line between Dhalkebar in Nepal and –Muzaffarpur in Indian state Bihar. Nepal’s imports total 350 MW from India through four cross country lines.

Source: The Economic Times

Peak power shortage in UP down to 9.8 percent in April-December: Govt

January 29, 2017. Peak power shortage in Uttar Pradesh (UP) has reduced to 9.8 percent during the period April-December, 2016 from 17.0 percent during the period April-December, 2014, according to data given by power ministry. Peak shortage during October 2016 was 1.8 percent and during December 16 it further reduced to 0.5 percent. The ministry said peak power met in UP has increased from 11,821 MW in May 2014 to 15,501 during the current year 2016-17 up to December. As reported by the state, the ministry said energy shortage has reduced to 2 percent during the period April-December, 2016 from 16.4 percent during the period April-December 2014. Energy shortage during October 16 was 1.2 percent and during December 2016 was 1.3 percent. The government said central allocation of power increased by 6.3 percent (390 MW) from 6,165 MW as on May 2014 to 6,555 MW as on October 2016. As on December 2016, central allocation to UP remains 6,555 MW. It said that the supply of power from central generating stations to UP has increased by 19.7 percent to 6,545 million units. During current year 2016-17, up to October 2016, supply of power from central generating stations to Uttar Pradesh stood at 23,123 million units.

Source: The Economic Times

Jharkhand electricity board continues to lose despite distribution reform scheme UDAY

January 29, 2017. The Jharkhand Bijli Vitran Nigam Ltd (JBVNL), despite joining the centre’s ambitious UDAY scheme aimed at bringing power distribution companies (discoms) out of losses, is again saddled with huge arrears to be paid to DVC and Coal India Ltd (CIL). Jharkhand was the first state to join the scheme in September 2015. Under the scheme, in January 2016,Rs5,553 crore was taken as loan from the central government, of whichRs4,770 crore was paid to the DVC andRs783 crore to CIL. However, within an year, it again suffered heavy losses and according to JBVNL sources, the company owes DVCRs1,500, while Coal India is owedRs83 crore. At the time of joining the scheme, the power ministry had categorically asked the power utilities to improve their performance. The state government, every month on an average, provides a resource gap ofRs200 crore in lieu for supplying power in the rural areas at subsidised rates, aimed at reducing the JBVNL’s losses. Jharkhand requires 2,100 MW every day, of which JBVNL purchases 700 MW from DVC atRs4.50 per unit. The remaining power is purchased from the central pool and other state-owned entities, incurring a loss of more thanRs250 crore. Jharkhand has 68 lakh houses, of which only 38 lakh have been provided power connections.

Source: The Economic Times

Govt taking initiatives to ensure round-the-clock power supply: J&K Deputy CM

January 29, 2017. Jammy and Kashmir (J&K) Deputy Chief Minister (CM) Nirmal Singh has said the government has introduced several initiatives for upgrading the power sector which would have a long-time impact on power generation and distribution so that the consumers get 24×7 power supply and 100 percent electrification. Singh said in order to reduce AT&C losses, strengthen the sub-transmission distribution network and electrification of un-electrified household schemes like RAPDRP, IPDS, DDUGJY & RGGVY Phase-II and Prime Minister’s Development Package (PMDP) have been undertaken. Under PMDP, thrust is on electricity generation through small hydroelectric projects andRs4,153 crore has been received for Pakal Dul-state equity and other projects, he said. Similarly, an amount ofRs1,263.9 crore has been earmarked to ensure the transmission system of the state gets augmented and Kashmir-Ladakh Transmission Line work is also in progress, he said. Singh said in order to clear liabilities in the power sector, the government has with active collaboration of Centre implemented UDAY scheme under whichRs3,537.55 crore loan andRs3,500 crore bonds are in pipeline, which would ensure that liabilities would be cleared by 2017-18.

Source: The Economic Times

Chandigarh administration to distribute cheap LED bulbs as part of save energy campaign

January 28, 2017. In an attempt to save energy, Chandigarh administration has decided to distribute a total of 8.64 lakh light emitting diode (LED) bulbs, 4.32 lakh LED tube lights and 2.16 lakh fans among consumers at concessional rates. As per official records, there are as many as 2.16 lakh electricity consumers, of which, 1.75 lakh fall in the domestic category. A total of 4 LED bulbs (9watt), 2 LED tubes (10watt) and 1 fan (50watt) will be given to each consumer under the Unnat Jyoti Affordable LEDs for All (UJALA) scheme of the central government.

Source: The Economic Times

NLC to increase power generation by 2.6 GW

January 28, 2017. Neyveli Lignite Corp (NLC) India Ltd has proposed to enhance power generation at its Neyveli complex by 2,640 MW. The company’s project to increase lignite-based power generation by 1,320 MW (two units of 660 MW) has reached the advanced stages of completion. He said the company has also proposed to add another 1,320 MW (two units of 660 MW) in the second phase at Neyveli. The company has awarded contracts for enhancing coal-based power generation by another 1,980 MW through its joint venture Neyveli Uttar Pradesh Power Ltd at Kanpur in Uttar Pradesh and for enhancing lignite-based power generation by another 500 MW through Barsingsar expansion and Bithnok green field project in Rajasthan.

Source: The Economic Times

Power ministry releases medium-term power procurement guidelines

January 27, 2017. The power ministry has released the guidelines for procurement of electricity for medium term from power stations set up on finance, own and operate (FOO) basis through the e-bidding portal DEEP. Medium term power is purchased through a power procurement agreement for a period between one and five years. The government issued standard bidding documents to be adopted by distribution licensees for procurement of electricity from power producers, traders, distribution companies through competitive bidding through DEEP e-Bidding portal based on offer of lowest tariff from power generating stations constructed on FOO basis. The ministry in the guidelines said any deviation from the model bidding documents shall be made by the distribution licensees only with the prior approval of the appropriate commission. The ministry said any agreements signed or actions taken prior to the date will not be affected by such repeal of the sail guidelines and shall continue to be governed by the pervious guidelines.

Source: The Economic Times

Tata Power Delhi Distribution launches microgrid project in Bihar village

January 25, 2017. Power distribution company Tata Power Delhi Distribution Ltd said it has implemented a microgrid project in Bihar’s Tayabpur village, which has an estimated 190 hutments with a population of around 1000. The project is in line with the Govt of India’s Electrification program which aims to provide “electricity to all” by establishing a standalone off-grid village electrification system where grid supply has not reached or is not feasible.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Training of ‘Solar Mamas’ successful in enhancing ties between India-Nauru: President

January 31, 2017. Extending warm greeting to the Government and people of the Republic of Nauru on the eve of their National Day, President Pranab Mukherjee said that the training of ‘Solar Mamas’, have been successful in enhancing the relationship between both the countries. ‘Solar Mamas’ are a group of nearly 30 rural women solar engineers from six African countries who have been trained under India’s developmental support for harnessing solar energy. He said that the traditional relationship of friendship and cooperation between both the countries is growing stronger and has diversified to the shared satisfaction.

Source: Business Standard

Solar players expect tax incentives in budget, uncertainty over GST remains

January 30, 2017. Amid uncertainties over the impact of Goods and Services Tax (GST) and Make in India programme being affected by falling prices of Chinese modules, solar manufacturers and developers are expecting tax incentives and policy drive to make unused money of clean energy fund available to the sector in the forthcoming union budget. Solar players said continuation of the appreciated depreciation, a financial incentive, along with concessional interest rates and proper use of theRs54,000 crore National Clean Energy Fund could be crucial to achieve country’s ambitious target. After the Narendra Modi government came to power in 2014, it announced a major policy shift in India’s solar energy sector by multiplying the 2022 target five-fold to 100,000 MW. The solar sector, which crossed 10 GW of total installed capacity including rooftop and off-grid segments in 2016, has been facing challenges from different fronts. The big concern for the sector this year is GST because with implementation of the new indirect tax regime, the present tax benefits availed by the sector will be done away with and this would raise generation costs.

Source: Hindustan Times

Renewable energy sector looking for clarity on policy this Budget: CLP India

January 30, 2017. The renewable energy sector, in the upcoming Union Budget 2017-18, is looking for clarity on policy direction and incentives that will help continue growth across the sector, Mahesh Makhija, Director, Business Development and Commercial (Renewables), CLP India, said. Makhija said this way, per unit cost of power generation can be reduced and benefits can be passed to the consumers. He said a key point in the power sector wish list is the extension of generation based investment (GBI) Scheme for wind energy, which will be crucial to smoothen its transition from an investment-based incentive to an outcome-based incentive, thereby broadening the investment base further. Makhija said that in addition to the UDAY scheme, an incentive mechanism for power distribution companies on timely payments and new renewable energy procured for fulfilling the renewable purchase obligation targets can be introduced as well. Finally, the National Clean Energy Fund should be utilised more effectively by allotting certain funds to various state discoms to make payments only to Renewable energy developers, he said.

Source: The Economic Times

Athirappilly hydel power project would not be abandoned: Kerala Electricity Minister

January 30, 2017. Kerala Electricity Minister M M Mani said the state government had not abandoned the controversial Athirappilly hydro-electric project and it would be implemented after reaching a consensus on the matter. The recent moves by the state to revive the 163 MW project had drawn protests from environmental organisations and political parties citing the irreparable loss of biodiversity in case of likely implementation of the hydel project. Mani said the Kerala State Electricity Board (KSEB) was forced to purchase 70 percent of electricity needed for consumption, from outside the state.

Source: The Economic Times

Govt mulls introducing fixed-cost component in renewable energy tariff

January 30, 2017. The government is exploring a change in the tariff structure for electricity from clean energy sources to boost India’s efforts to promote a green economy. The ministry of new and renewable energy is contemplating a fixed-cost component to the tariff for electricity generated from renewable energy sources such as solar or wind. The idea is to prevent distribution companies (discoms) shying away from procuring electricity generated by such projects, as they will have to pay the fixed tariff component even if they don’t buy the electricity contracted for. Such a tariff mechanism already exists for electricity from conventional sources such as coal and gas which has two parts—a fixed cost, which is the investment incurred towards power generation equipment, and a variable cost or the cost of fuel. India’s demand for renewable energy is expected to grow by seven times in 2035, according to the latest BP Energy Outlook, which means the share of renewable energy in the country’s fuel mix will increase from 2% to 8% in 2035. India, the third-largest energy consumer after the US and China, plans to achieve 175 GW of renewable energy capacity by 2022 as part of its global climate change commitments. India is the biggest greenhouse gas emitter after the US and China but renewable energy accounts for 15% of the total installed capacity. The government said India has a renewable energy potential of around 900 GW.

Source: Livemint

Indian nuclear sector does not expect Budget bounty, unlike last year

January 29, 2017. After getting a firm commitment ofRs3,000 crore allocation over the next two decades for atomic power projects in the last Union Budget, the nuclear power sector is not expecting anything new in the upcoming 2017-18 budget, the Atomic Energy Commission (AEC) said. The government has said it has accorded in-principle approval to set up 14 units of 700 MW in Haryana, Madhya Pradesh, Rajasthan and Karnataka. AEC said after six 1,000 MW units from Russia, India will source VVER 1,200 MW reactors from that country.

Source: The Economic Times

Solar parks with capacity of 7.5 GW to come up in Ladakh

January 28, 2017. The Jammu and Kashmir (J&K) government has signed an MoU with the Centre for the development of two mega solar parks in the rocky mountainous region of Ladakh with a total capacity of 7500 MW. Minister for Science & Technology, Sajjad Gani Lone said the government has proposed development of one each Mega Solar Park in the districts of Leh and Kargil. He said the work on these projects has not been started as yet in view of non-availability of land and lack of proper infrastructure in Ladakh for transmission of power generated from the proposed parks.

Source: The Hindu Business Line

Increase subsidy on rooftop solar installations: Vikram Solar

January 27, 2017. Vikram Solar suggested that the government should increase subsidy on solar rooftop installations to 50%, remove service tax on renewable project installations, extend tax holiday on solar projects by 10 years, and lift excise duty on solar equipment and raw material in the budget. According to Vikram Solar, the current 10 years tax holiday should be extended for another 10 years.

Source: The Economic Times

Construction work for KNPP 3&4 units to begin soon

January 27, 2017. Work on constructing Units III and IV of the Indo-Russian Joint Venture Kudankulam Nuclear Power Project (KNPP) would begin soon, KNPP Site Director R S Sundar said. Stating that some tests were being conducted at Unit 2 prior to declaring it for commercial operation, he said. On the third and fourth units, he said significant progress has been made in the site excavation works.

Source: The Economic Times

MNRE asks states to prepare conducive policies for renewable energy

January 25, 2017. Ministry of New and Renewable Energy (MNRE) Secretary Rajeev Kapoor called upon state governments to prepare a conducive policy regime for the sector. Speaking at the concluding session of National Review Meeting with state government officials, he emphasised on the need to comply with Renewable Purchase Obligations (RPOs). He also urged upon states to view renewable power in the backdrop of India’s commitment of raising 40 percent of electric installed capacity from non-fossil fuel sources by 2030. The Secretary urged upon the states to formulate and modify their policies and prepare a conducive policy regime for renewable energy. A mobile app for solar rooftop systems ‘ARUN’ – Atal Rooftop Solar User Navigator and Information Guide on Rooftop Systems was also launched on the occasion.

Source: The Economic Times

20 firms submit bid for Rewa solar power plant

January 25, 2017. A total of 20 national and international players in renewable energy sector have submitted their bids for developing the world’s largest solar power plant in Rewa district of Madhya Pradesh. Rewa Ultra Mega Solar Ltd, a joint venture of Solar Energy Corp of India and Madhya Pradesh Urja Vikas Nigam, invited bids for developing the project that closed. The 750 MW park being developed in three segments of 250 MW each, is spread over 1,500 hectares of land in Gurh tehsil of Rewa district and is to cover five villages of Barseta in the district. Once completed, it will generate clean energy, overtaking 648 MW solar power plant at Kamathi in Tamil Nadu, the largest plant in the country so far.

Source: The Times of India

INTERNATIONAL: OIL

Brazil’s oil regulator to list subsalt areas for auction

January 31, 2017. Brazilian regulator ANP plans to present a list of subsalt offshore exploration areas by early February for the government to consider auctioning at the end of the year as part of what the agency’s new head called a historic opening of the nation’s oil sector. A second subsalt auction was planned for this year, in November, and that the government expected it to generate the most revenue of any in 2017. The first auction, expected in the first half of this year, will offer areas next to existing discoveries already in development. The November auction will be for new exploration areas.

Source: Reuters

Nigeria crude oil exports to climb in March after loading delays pushed cargoes

January 31, 2017. Nigeria’s crude oil exports are on track for a month-on-month rise in March after a string of loading delays pushed back some cargoes, according to loading programmes. Exports are slated to reach 1.62 million barrels per day (bpd) in March on 55 cargoes, up from a revised February loading schedule of 1.48 million bpd on 46 cargoes. Shipments of Erha and Qua Iboe that were originally planned to load in February were deferred, adding to the March exports and taking away from the original February plan of 1.62 million bpd. The March increase comes despite only two cargoes of Bonga crude oil. Traders said the field has planned maintenance from mid-February until the end of the month that had cut into exports. Field operator Shell has declined to comment on maintenance plans. Planned exports also include four cargoes of Akpo condensate for a total of 129,000 bpd, compared with February’s exports of four cargoes for a total of 136,000 bpd.

Source: The Economic Times

Industry group boosts Canadian oil well drilling forecast

January 30, 2017. The Petroleum Services Association of Canada upped its 2017 oil and gas well drilling forecast by 23 percent as global oil prices recover from a two-year rout. The industry body now estimates 5,150 wells will be drilled across Canada this year, up from its previous 2017 forecast, made in November, of 4,175 wells. Canada’s oilfield service sector was hard hit by the collapse in global oil prices since mid-2014 as producers canceled exploration and drilling plans and slashed capital investment. But with United States crude CLc1 holding above $50 a barrel, roughly double the 13-year low it hit in February last year, the sector is seeing an increase in demand. The new forecast puts Alberta as the top drilling province for 2017 with 2,706 new wells, followed by Saskatchewan with 1,985 and 367 in British Columbia.

Source: Reuters

OPEC January oil output shows high compliance with supply cut deal: Petro-Logistics

January 30, 2017. The Organization of the Petroleum Exporting Countries (OPEC) oil output is set to fall by 900,000 barrels per day (bpd) this month, a company that tracks OPEC supply said, pointing to a strong start by the exporter group in implementing a supply cut deal. OPEC is cutting its output by 1.2 million bpd from Jan. 1 — its first such deal since 2008 — to prop up oil prices. OPEC supply is on track to decrease by 900,000 bpd in January, suggesting a high level of compliance thus far into the production curtailment agreement, Daniel Gerber, chief executive of Petro-Logistics, said.

Source: Reuters

Russia’s Lukoil hopes for Iran oilfield development decision this year

January 30, 2017. Lukoil, Russia’s No.2 oil producer, hopes to reach a decision on developing two new oilfields in Iran and wants to expand its operations further in the Middle East this year, Gati al-Jebouri, vice president and head of upstream operations in the Middle East, said. Lukoil is talking with the National Iranian Oil Company (NIOC) on taking part in development of the Abe Timur and Mansuri fields in central-western Iran, Jebouri said. Iran hopes its new Iran Petroleum Contract (IPC), part of an effort to sweeten the terms it offers on oil development deals, will attract foreign investors and boost production after years of sanctions. The first tender, which is likely to be for the South Azadegan oil field in south-western Iran, will take place after January 2017. Earlier this month, Iran named 29 companies – including Lukoil – from more than a dozen countries as being allowed to bid for oil and gas projects using the IPC model. The new IPC has more flexible terms that take into account oil price fluctuations and investment risks.

Source: Reuters

IEA does not foresee oil demand peaking soon: Birol

January 30, 2017. The International Energy Agency (IEA) does not expects oil demand to peak any time soon due to rising consumption in developing economies, Director Fatih Birol said. Birol warned that oil markets could enter a period of high volatility unless companies develop new projects after two years of sharp drops in investments sparked by low oil prices.

Source: Reuters

Hedge funds prepare for possible border tax adjustment on US oil imports

January 30, 2017. Hedge funds seem to be quietly positioning for the possible imposition of a border tax adjustment on imports of crude oil into the United States (US). The principal impact of a border tax adjustment would be to raise the price of domestic crude compared with international grades such as Brent. Hedge funds have been progressively adding to their net long position in both of the major crude benchmark grades since the middle of November. A border-adjusted tax would eliminate corporate income taxes on crude exported from the US while preventing US refiners from deducting the cost of imported crude from their taxable net income. The plan aims to create a level playing field with other countries which impose value-added tax on imported items while zero-rating exports. Since the US imports more goods and services than it exports, imposing extra taxes on imports while cutting them on exports would also raise net tax revenues for the Treasury. Researchers at Goldman Sachs put the probability of a border tax adjustment with no oil exemption being introduced at just 20 percent. Border tax advocates claim the impact of higher import costs and perceived subsidy for exports would be a rise in the real exchange rate of the US dollar. A stronger dollar would in turn tend to depress the price of crude worldwide but the main impact would probably be felt on international grades linked to Brent.

Source: Reuters

South Sudan aims to more than double oil output in 2017/18

January 27, 2017. South Sudan plans to more than double oil production to 290,000 barrels per day (bpd) in fiscal 2017/2018, indicating a target higher than the level recorded shortly before conflict erupted in late 2013. The nation, which seceded from Sudan in 2011 but plunged into civil war just over two years later, aimed to add 160,000 bpd to existing output of 130,000 bpd in the financial year starting in July. The main oil firms involved in South Sudan, which produced about 245,000 bpd until fighting flared at the end of 2013, are China National Petroleum Company (CNPC), Malaysia’s oil and gas firm Petronas and India’s ONGC Videsh.

Source: Reuters

Iran’s oil exports to rise slightly in February

January 27, 2017. Iran’s monthly oil exports are set to climb slightly in February, as Indonesia takes its first shipment since sanctions on Tehran were lifted last year. Volumes remain below last September’s high, however, suggesting that Iran has had difficulty finding more buyers for its oil, even after being exempt from production cuts agreed by the Organization of the Petroleum Exporting Countries and other exporters last November. Traders had expected it to raise output slightly and boost exports to reclaim market share. Crude and condensate exports for February will be just over 2.20 million barrels per day (bpd), up from 2.16 million bpd this month, which is the lowest rate since July. Exports rose to as high as nearly 2.6 million bpd in September.

Source: Reuters

Millions of barrels of Venezuelan oil stuck at sea in dirty tankers

January 26, 2017. More than 4 million barrels of Venezuelan crude and fuels are sitting in tankers anchored in the Caribbean Sea, unable to reach their final destination because state-run PDVSA cannot pay for hull cleaning, inspections, and other port services. About a dozen tankers are being held back because the hulls have been soiled by crude, stemming from several oil leaks in the last year at key ports of Bajo Grande and Jose, which has resulted in delayed operations for loading and discharging. Oil production and exports are currently at lows not seen in more than two decades. PDVSA’s difficulty with paying creditors and service providers makes pulling itself out of that hole more onerous. That has contributed to a deep, years-long recession in the OPEC country. The list includes the Aframax Hero, loaded in September with 520,000 barrels of fuel oil bound for China. The cargo is moored in Curacao, delayed by more than 100 days, until a payment to inspection firm Saybolt is made. PDVSA’s crude exports fell to 1.59 million barrels per day (bpd) in the last quarter of 2016 from 1.82 million bpd in the first quarter, a 13 percent decline, according to trade flows data.

Source: Reuters

As crude prices rise, China’s oil majors set to lift capex for first time in years

January 26, 2017. China’s oil majors are expected to pump up spending in 2017 for the first time in years, scrambling to squeeze more barrels of crude out of ageing domestic wells in the hope that higher prices are here to stay. State-run explorer CNOOC Ltd set the tone this month. After an international output cut agreed late last year lifted benchmark Brent crude futures to a peak of nearly $58 a barrel, not seen for 18 months, CNOOC said it would spend as much as $10 billion, up to 40 percent more than 2016. Industry experts expect energy giants PetroChina Co and Sinopec Corp will likely follow suit in investments centered on arresting declines at lower-risk, mature oilfields rather than ramping up any new oil production. With the global oil market still vastly oversupplied, developing natural gas fields will take priority for the time being, they said. PetroChina and Sinopec are expected to announce capital spending in late March. In CNOOC’s case, despite the higher spending plan it has cut its 2017 oil and gas output estimate by 3.3-5.5 percent from 2016 to 450-460 million barrels, a level it expects to maintain through 2019. Last year, China’s crude output hit its lowest since 2009 and analysts have forecast it to fall by as much as another 12 percent by 2020. Still, any Chinese success in getting more out of its older fields could be bad news for top exporters like Saudi Arabia and Russia. Both have boosted oil sales to the world’s No.2 consumer in recent times, with Russia leading the growth by supplying a quarter more last year.

Source: Reuters

Iraq to double oil export capacity at terminal to 1.2 million bpd

January 26, 2017. Iraq has started work to double the crude oil loading capacity at one of its two southern offshore oil export terminals to 1.2 million barrels per day (bpd), South Oil Company (SOC) said. Dredging operations have started to deepen the sea bed at the Khor al-Amaya terminal, to enable the loading by Suezmax vessels, tankers that can carry up to 1 million barrels of crude, SOC said. The expansion work should be finished by June, SOC said. Khor al-Amaya’s current loading capacity is around 600,000 bpd. OPEC’s second-largest producer, after Saudi Arabia, Iraq contributed to the biggest crude production increase from the 13-member oil exporters’ group in 2015, as it ramped up output from the giant oilfields in its southern region, in cooperation with foreign oil companies. The country reluctantly agreed in November to an OPEC deal to cut production in a collective effort to try and boost oil prices. Khor al-Amaya is located in the Gulf near the much larger Basra offshore terminal which has several berths and mooring points. Iraq’s southern exports reached a record 3.51 million bpd in December, according to the oil ministry.

Source: Reuters

Continental to spend more in 2017 amid oil price rise

January 25, 2017. Oil producer Continental Resources Inc set a capital budget of $1.95 billion for the year, compared with the $1.1 billion it had earmarked for 2016, joining a list of producers raising spending amid a recovery in oil prices. The company said it expects full-year production to average about 220,000-230,000 barrels of oil equivalent per day (boepd), higher than the 2016 output of 217,000 boepd. The company plans to operate 20 drilling rigs in 2017, an increase of one rig from 2016.

Source: Reuters

Magellan pipeline spills diesel in Hanlontown, Iowa

January 25, 2017. About 138,600 gallons of diesel was spilled in Hanlontown, Iowa, following a pipeline break, according to a report on globegazette.com. The source of the spill was a 12-inch pipeline owned by Magellan Midstream Partners, the report said adding, much of the fuel pooled in a farm field. Magellan has reported the spill to federal regulators, the report said.

Source: Reuters

INTERNATIONAL: GAS

US natural gas pipeline companies seek FERC decisions before Bay leaves

January 27, 2017. Three United States (US) natural gas pipeline companies asked the US Federal Energy Regulatory Commission (FERC) for permission to move forward on their projects by February 3, which is when one of the FERC commissioners will step down. Only one of the three companies, Nexus Gas Transmission, specifically said it was making the request for a certificate to build its pipeline because Norman Bay, the former FERC Chairman, said he would step down at the end of next week. Bay said he would leave his post after President Donald Trump appointed Commissioner Cheryl LaFleur as acting chairman. FERC Chairman LaFleur said that the commission is working to get as many orders out as it can in the time it has left with a quorum. Nexus is designed to move up to 1.5 billion cubic feet of gas per day from the Marcellus and Utica shale basins to the US Midwest and Ontario. It will be built in Ohio, Michigan and Ontario.

Source: Reuters

Australia’s LNG projects face major delays, benefiting US producers

January 26, 2017. Australia’s plans for a huge increase in its production of liquefied natural gas (LNG) are being dealt a big blow by a series of production delays, as energy companies struggle with technical problems and cost overruns. The country is still likely to become the world’s biggest LNG exporter, dispatching about 85 million tonnes a year by the end of the decade, up from 30.7 million tonnes in 2015 and 45.1 million tonnes last year. But the pace of growth is much slower than expected because of snafus and higher-than-expected costs that have delayed plans to start or increase LNG exports from four megaprojects, Gorgon, Ichthys, Prelude and Wheatstone, all along or off the coast of northwest Australia. Now at least three of them, Shell’s Prelude floating LNG production vessel, Inpex’s Ichtys project, and the expansion of Chevron’s Gorgon operation, won’t begin exporting until 2018 or even later, rather than 2017 as previously planned, according to several sources with knowledge of the matter. It should all be a boon for other suppliers of LNG to Asian buyers, such as utilities in the region. These suppliers can also benefit from higher prices. Traders said that the beneficiaries include United States (US)-based Cheniere Energy with its facility at Sabine Pass in the Gulf of Mexico, and global energy giant Exxon Mobil with its production in Papua New Guinea. Making matters even worse, the producers in Australia are having to go to their rivals to fulfill contracts. Once completed the four projects will have a combined annual LNG capacity of 36.5 million tonnes. The development costs will total $130 billion. Ichthys, which includes a stationary rig and a floating production vessel, was due to start operations between July and September this year, but the power station problem will almost certainly cause more delays and costs.

Source: Reuters

Ready for more talks with Iran in gas dispute: Turkmenistan

January 26, 2017. Turkmenistan is ready to continue talks with Iran after cutting gas supplies to Tehran this month but also has the right to take the dispute over payments to arbitration, the Central Asian nation’s foreign ministry said. The ministry said that Iran’s debt stemmed from the National Iranian Gas Company’s failure to abide by the “take or pay” provision of the gas supply contract. Tehran said that Turkmenistan had threatened to stop gas exports because of arrears in payments, which amounted to about $1.8 billion and dated back more than a decade. Iran wanted to refer the issue to arbitration. Iran has its own major gas fields in the south of the country but has imported gas from Turkmenistan since 1997 for distribution in its northern provinces, especially during the winter. Turkmenistan in turn faces a foreign currency shortage after Russia, once a major buyer of its gas, halted purchases last year, leaving China as its biggest customer.

Source: Reuters

Lebanon re-launches first O&G licensing round

January 26, 2017. Lebanon re-launched its first oil and gas licensing round after a three-year delay, Energy Minister Cesar Abou Khalil said, kick-starting the development of a hydrocarbon industry stalled by national political paralysis. Lebanon has opened five offshore blocks (1,4,8,9 and 10) for bidding in a first licensing round, Abou Khalil said. In 2013, 46 companies qualified to take part in bidding for oil and gas tenders, 12 of them as operators, including Chevron, Total and Exxon Mobil. But political paralysis, which left Lebanon without a president for more than two years, meant the licensing process was put on hold.Abou Khalil said a second pre-qualification round for companies interested in exploration and production contracts would be launched soon. Lebanon, along with Cyprus, Israel and Egypt, sits on the eastern Mediterranean gas field discovered in 2009.

Source: Reuters

AltaGas to buy WGL in $6.4 bn deal in gas distribution push

January 25, 2017. Canadian energy infrastructure company AltaGas Ltd said it would buy US-based WGL Holdings Inc (WGL) in a deal valued at C$8.4 billion ($6.42 billion), the latest company pushing deeper into natural gas distribution. WGL Holdings, the parent of natural-gas utility Washington Gas, provides natural gas services in Maryland, Virginia and the District of Columbia. The company has a retail energy-marketing business and operates natural-gas distribution facilities. AltaGas’s deal for WGL follows Dominion Resources Inc’s $4.4 billion buyout of Questar Corp last year. Energy firms are betting on natural gas distribution, given rising demand from homes and businesses, and to help offset shrinking profits at utility businesses due to waning power demand. Calgary-based AltaGas, which operates in the United States and Canada, has three businesses – natural gas gathering and processing, power generation and utilities that deliver natural gas to homes and businesses.

Source: Reuters

INTERNATIONAL: COAL

Congressional Republicans move to undo Obama coal rules protecting streams

January 31, 2017. Congressional Republicans are moving swiftly to repeal Obama administration regulations aimed at better protecting streams from coal mining debris. Coal country lawmakers unveiled legislation to block the rules, which they say would kill jobs in the coal industry, which is reeling from competition from cleaner-burning natural gas. The regulations would have tightened exceptions to a rule that requires a 100-foot buffer between coal mining and streams.

Source: The Economic Times

China strong-arms ‘all-weather friend’ Pakistan on coal power project

January 27, 2017. China has strong-armed ‘all-weather friend’ Pakistan to scale back up a coal-fired power project in Balochistan. Pakistan had scaled down its Hub power project – that was to be run on imported coal -from 1,320 MW plant to 660 MW. This was as part of an overall decision to restrict power plants based on imported fuels. The project is being developed by a consortium of Hub Power Company and China Power International Holding Company at an estimated cost of $2.5 billion. Work on the project has already begun and it is expected to be completed in August 2019.

Source: The Economic Times

Bangladesh police fire tear gas at anti-coal protest

January 26, 2017. Clashes erupted in Bangladesh’s capital as police fired tear gas at hundreds of campaigners protesting against a massive coal-fired power plant they say will destroy the world’s largest mangrove forest. Witnesses said Shahbagh Square, Dhaka’s main protest venue, turned into a battleground as police used water cannon and fired tear gas and rubber bullets at hundreds of left-wing and environmental protesters. Campaigners have been protesting for the last three years against the under-construction plant which is 14 kilometres north of Sundarbans forest, part of which is a UNESCO world heritage site. Experts from both Bangladesh and India — part of the forest also lies in eastern India — say the project could critically damage the unique forest, which is home to endangered Bengal tigers and Irrawaddy dolphins. In November, more than 20,000 people joined a similar protest against the 1,320 MW plant after UNESCO urged Bangladesh to halt construction of the plant. Bangladeshi Prime Minister Sheikh Hasina has defended the project and rejected concerns about it as politically motivated. She said the plant was needed to provide power to the impoverished south.

Source: The Economic Times

INTERNATIONAL: POWER

Ataqa power plant production falls by 200 MW after development

January 30, 2017. The electricity production of Ataqa power plant dropped by roughly 200 MW, despite the renovation and development operations conducted on production units. The electricity ministry said that the total capacity added to the national grid from the plant is estimated at 700 MW, including 120 MW from the first unit, 120 MW from the second unit, 220 MW from the third unit, and 240 MW from the fourth unit. The total capacity of the plant amounts to 900 MW. The first two units secure 240 MW out of the actual capacity of 300 MW. The production of the third and fourth units dropped by 140 MW from the actual total capacity of 600 MW.

Source: Daily News Egypt

Engie wins EPC contract for $1.2 bn Fadhili power project in Saudi Arabia

January 30, 2017. French electric utility Engie, in partnership with Doosan Heavy Industries & Construction, has received engineering, procurement and construction (EPC) contract for the $1.2 bn Fadhili independent power project in Saudi Arabia. The 1,507 MW Fadhili combined cycled gas power plant will be one of the most efficient cogeneration plant in the country.

Source: Energy Business Review

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Brazil solar energy drive stalled by high costs, strict rules

January 31, 2017. A government plan to spur the construction of solar energy farms in Brazil is faltering because of high costs, strict rules requiring local components and low-priced competition from Chinese suppliers. Developers had been excited about solar power’s potential in a continent-sized country with 200 million consumers and plentiful sunlight. But many have grown discouraged, and the government’s three-year-old program is moving so slowly that the national development bank is taking another look at rules that require a minimum amount of locally made components in projects. Even if the current program were successful, more than doubling the current supply of solar-generated power, it would still amount to only about 2 percent of Brazil’s total electricity matrix.

Source: Reuters

ADB to provide $109 mn for geothermal plant in Indonesia

January 28, 2017. The Asian Development Bank (ADB) signed a new $109 million financing package for the Muara Laboh geothermal power generation project in western Indonesia. The financing, which was approved in December 2016, is part of ADB’s efforts to scale up private sector-led infrastructure development in Asia and the Pacific and boost support for clean energy. On completion, the Muara Laboh geothermal facilities, located in West Sumatra, will generate 80 MW of electricity.

Source: Daily Times

EU countries oppose duty extension on Chinese solar panels

January 26, 2017. A majority of European Union (EU) countries opposed a European Commission plan to extend anti-dumping duties on Chinese solar panels for two years. However, the duties will not necessarily end because the 18 countries that voted against them do not represent a majority of the EU’s population, falling short of the blocking “qualified majority”. The case will now go to an appeal committee, also including representatives from the EU’s 28 member states. The majority view could also pressure the European Commission to review its proposal. The EU governments did back a two-year extension of tariffs designed to counter trade subsidies.

Source: Reuters

Plans to remove nuclear fuel at Fukushima delayed again

January 25, 2017. A plan to remove spent nuclear fuel from Tokyo Electric Power Co Holdings Inc’s Fukushima Daiichi nuclear plant hit by the March 2011 tsunami has been postponed again due to delays in preparation. Work is now set to begin in fiscal 2018 at the earliest. Removal of the spent fuel from the No. 3 reactor was originally scheduled in the first half of fiscal 2015, and later revised to fiscal 2017 due to high levels of radioactivity around the facilities.

Source: Reuters

US biofuels credits drop as EPA delay uncertainty grips market

January 25, 2017. Prices of paper credits used to meet United States (US) biofuels standards dropped to over one-year lows, extending the previous day’s slide on news of a government freeze that heightened uncertainty over the program. The US Environmental Protection Agency (EPA) said that the federal agency is delaying implementation of 30 regulations finalized recently by the Obama administration. That included implementation of 2017 biofuels requirements, which sent prices of Renewable Identification Numbers (RINs) into a tailspin as traders bet on the possibility President Donald Trump’s administration may relax requirements.

Source: Reuters

DATA INSIGHT

Natural Gas Consumption & Price Scenario

| Particulars |

2015-16 (P)

(Apr to Dec 2016)

|

2016-17 (P)

(Apr to Dec 2016)

|

Percentage change

w.r.to previous year

|

| Domestic Production (BCM) |

24.7 |

23.9 |

-3.29% |

| Domestic Availability (BCM) |

19.4 |

18.7 |

-3.76% |

| Imports (BCM) |

15.6 |

18.8 |

19.94% |

| Total Consumption (BCM) |

35.1 |

37.4 |

6.81% |

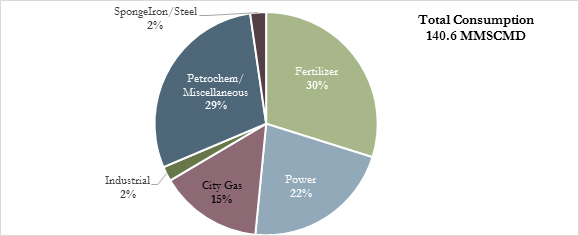

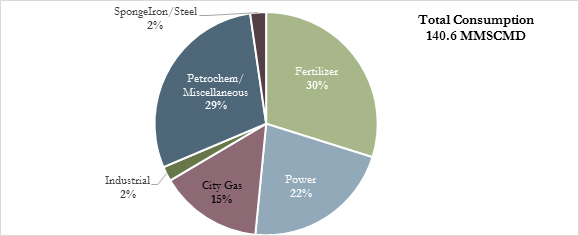

Sectoral Consumption of Natural Gas for December 2016

Domestic Natural Gas (Notified) Prices

(P): Provisional, MMSCMD: million metric standard cubic meter per day, BCM: billion cubic meters, mmBtu: million metric British thermal units

Source: Petroleum Planning & Analysis Cell

Publisher: Baljit Kapoor

Editorial advisor: Lydia Powell

Editor: Akhilesh Sati

Content development: Vinod Kumar Tomar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV