Non-Fossil Fuels News Commentary: November – December 2016

India

The most fashionable non-fossil fuel source remains solar which kept up the momentum on generating positive news. India is reportedly generating 65.78 BU (or 5.60 percent of total generation of 1173.6 BU) from renewable energy sources in FY16. In November the media reported that India had crossed 10 GW solar capacity. India was expected to become the world’s third biggest solar market next year, after China and the US. An average annual capacity addition of 8-10 GW per annum is expected from next year. Utility-scale solar accounts for more than 85 per cent of the total installed capacity. Rooftop solar, so far about 10 percent of the sector, is reportedly grown at 98 per cent between 2011 and 2015. Among the states, Tamil Nadu has the highest installed capacity, followed by Rajasthan, Andhra Pradesh, Gujarat, Telangana, Madhya Pradesh and Punjab. These seven states collectively accounted for more than 80 per cent of total installed capacity.

A shadow was cast on the sunny story of solar energy in India by the statement by the concerned Minister that 84 per cent of solar cells and modules imports were from China alone in FY16. As much as $1.96 billion worth of solar cells and modules were imported from China against the total imports of these equipment of $2.34 billion in FY16. India imported solar cells and modules worth $820.95 million in FY15 including $603.34 million imports from China alone. Total wind power equipment imports were $727,741 which included $ 190,096 from China alone. It appears that Indian taxpayers and rate payers who ultimately underwrite India’s renewable energy push are also effectively subsidising solar jobs in China.

The saga of nuclear energy cooperation between India and Russia continues to move forward albeit at glacial pace. It was reported this month that in India and Russia are expected to sign the GFA on Kudankulam units 5 and 6 by December. The story began in the 1960s when Russia actually declined the request of Homi Bhabha, the founder of India’s nuclear power program, for a nuclear plant. Soon global geo-political alliances shifted and Russia offered India a 1000 MW LWR, a predecessor of the two 1000 MW LWRs at Kudankulam but this time India declined.

In the 1980s, Leonid Brezhnev repeated the offer but once again India declined as it would have meant altering the Indian programme for nuclear power development, which was focused on HWRs. The Russians repeated the offer in 1982 to Prime Minister Indira Gandhi. In 1983, India suggested starting negotiations over two 440 MW reactors instead of one 1000 MW unit.

After a pause following the accident at Chernobyl 1986, Russia offered a long-term low interest loan of 2 billion roubles, repayable in rupees. India declined saying that it would not import any item that would require it to sign the NPT. India eventually agreed in late 1988 to buy two 1000 MW LWRs with Rajiv Gandhi and Mikhail Gorbachev signing the deal. Construction began in Kukankulam in 1992 but stalled when the Soviet Union imploded. In 1993 Russian President Boris Yeltsin visited India to revive the Kudankulam project after which the 1988 agreement was amended for Russia to install two VVER-1000/392 reactors at Kudankulam. The project was to cost $2.6 billion.

The ground-breaking for Kudankulam was conducted in 2001 with the first unit scheduled for commissioning in December 2007 and the second in 2008. The deadlines were not met and Kudankulam was then slated for completion in 2012 at an estimated cost of 158.2 billion rupees (about $3.4 billion). Eventually the first unit started operations in 2013 and the second started in 2016. Unit 3 and 4 of the Kudankulam are expected to be commissioned by 2022-23.

Rest of the World

European renewable stocks reportedly fell sharply after Donald Trump won the US presidential election. The US wind market, the World’s second-largest with 2015 installed capacity of over 75 GW is said to be a major market for European turbine manufacturers. On the brighter side the Norwegian oil major Statoil was reported to have made its first investment in solar power technology by making an investment in Oxford PV, a solar technology company.

On the technology front solar received a boost in terms of efficiency gains. Researchers from Australia were reported to have achieved an efficiency record of 12.1 per cent for a 16 cm2 perovskite solar cell, the largest cell of its kind. The result set a new world efficiency record for the perovskite photovoltaic cell certified with the highest energy conversion efficiency. The team reportedly also achieved an 18 percent efficiency rating on a 1.2 cm2 single perovskite cell and an 11.5 per cent for a 16 cm2 four-cell perovskite mini-module. The cell is said to be 10 times larger than the current certified high-efficiency perovskite cells on record.

On the nuclear front, there was a call for a nuclear power plant to be built in western Victorian city of Portland to supply cheap electricity to Alcoa’s troubled aluminium smelter. It is believed that the city with a population of about 10,000, will become a ghost town if the smelter closes and cheap power generation is not created.

The British government received a warning from scientists that nuclear power stations were at risk from tsunamis caused by undersea landslides. Scientists said that Britain had been hit by more tsunamis than previously believed, including one wave which reached a height of 60 feet and they urged the government to take the threat of tsunamis seriously.

In one of the most significant boosts for nuclear energy in the developed world, citizens of Switzerland rejected the proposal to force older nuclear power plants to close in a referendum. The five reactors that provide over one-third of electricity can now continue to operate according to their economic lives. As per news reports, nuclear power is Switzerland’s second largest source of electricity, providing about 35 per cent of electricity in 2015 with hydropower providing 52 percent. Both are low carbon sources which gives Switzerland one of cleanest and most efficient power systems in Europe.

Now Swiss nuclear plants can operate according to their owners’ commercial plans, subject to approval from safety regulators. They are now likely to continue until the age of 60, closing in the 2030s-2040s. They are expected to generate some 320 TWh of electricity in the longer operating period, which would reportedly avoid at least 50 MT of CO2 compared to a typical replacement mix of natural gas and imports from France and Germany.

In the USA media reported that ‘big oil’ and ‘big corn’ were pitching for a major battle after the election of Trump. The Renewable Fuel Standard (RFS) program, signed into law by President George W. Bush requires energy firms to blend ethanol and biodiesel into gasoline and diesel. The policy was designed to cut greenhouse gas emissions, reduce US reliance on oil imports and boost rural economies that provide the crops for biofuels.

The farming sector has lobbied hard for the maximum biofuel volumes laid out in the law to be blended into gasoline motor fuels, while the oil industry argues that the program creates additional costs. Balancing oil and farm interests is said to be a challenge for Trump, who had apparently promised to boost both.

NATIONAL: OIL

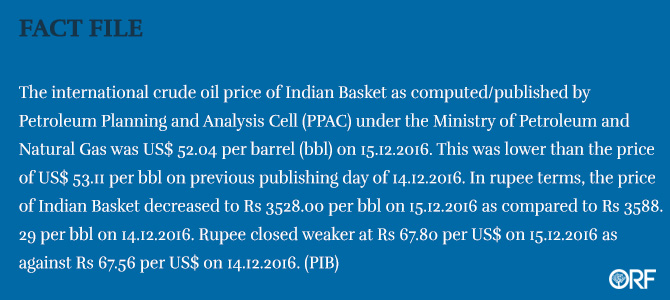

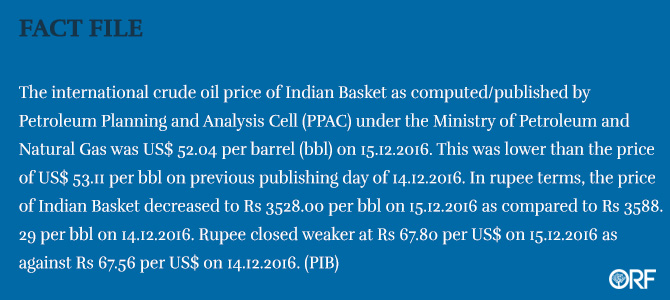

Indian basket of crude gains $3 after OPEC, non-OPEC output deal

December 13, 2016. The Indian basket of crude oils gained more than $3 a barrel even as global prices surged to an 18-month high after a landmark deal to reduce output was agreed on by the world’s largest producers, including Saudi Arabia and Russia. The Indian basket, comprising 73 percent sour-grade Dubai and Oman crudes, and the balance in sweet-grade Brent, rose to $54.42 per barrel from its closing rate of $51.03 on the previous. Oil producers outside the Organisation of the Petroleum Exporting Countries (OPEC), led by Russia, agreed to reduce output by 558,000 barrels per day. This came in the wake of the 13-nation OPEC cartel’s November 30 decision to cut output by 1.2 million bpd for six months effective January 1. As per latest OPEC data, its reference basket of 13 crude oils closed at $53.24 a barrel. It is the first time since 2001 that OPEC and some of its rivals reached a deal to jointly reduce output in order to tackle the global oil glut. Analysts said the market might see an under-supply of crude starting next year. The oil price will most likely stay in the $53-to-57 range. Oil prices have fallen by more than 50 percent in less than two years, from levels of well over $100 a barrel.

Source: Business Standard

India’s fuel demand in November soars 12 percent on demonetisation

December 13, 2016. India’s fuel demand surged 12.1 percent in November on the back of high petrol and diesel sales following demonetisation. After banning old Rs 500 and Rs 1,000 notes on November 8, the government allowed their use for paying for auto and cooking fuels for almost a month. Petroleum product consumption rose to 16.64 million tonnes in November, up from 14.84 million tonnes in the same month a year back, according to the data released by the oil ministry. Petrol consumption was up 14.4 percent to 2.01 million tonnes while diesel sales soared 10.45 percent to 6.75 million tonnes. But when compared to October, the sales were up only marginally. 16.55 million tonnes of petroleum products were sold in October 2016 with petrol sales at 2.1 million tonnes and diesel at 6.67 million tonnes. Cooking gas or LPG sales in November surged 16.5 percent to 1.88 million tonnes as the government gave free connections to poor households.

Source: Business Standard

ONGC, OIL hit fresh 52 week high on surge in oil prices

December 12, 2016. Shares of oil exploration & production (E&P) companies such as Oil Natural Gas Corp (ONGC) and Oil India Ltd (OIL) have hit their respective fresh 52-week highs on the BSE in early morning trade tracking surge in oil prices. Aban Offshore, Hindustan Oil Exploration, Selan Exploration Technology, Deep Industries, Cairn India and Jindal Drilling & Industries are other from the E&P sector, trading higher between 2% to 4% on the BSE in an otherwise weak market. Higher crude prices will result in higher realisation for oil exploration and related business companies and result in increased profitability for them. According to report, oil prices shot up by 4% to their highest level since 2015 after Organization of the Petroleum Exporting Countries (OPEC) and other producers over the weekend reached their first deal since 2001 to jointly reduce output in order to rein in oversupply and prop up the market.

Source: Business Standard

Crude oil price will not rise beyond $55 a barrel: OIL Chairman

December 12, 2016. Oil industry experts don’t expect the price of crude oil to breach the $55 a barrel threshold, according to Oil India Ltd (OIL) Chairman Utpal Bora. Bora assesses the upward movement of crude price as being positive for upstream oil companies. OIL is also evaluating a strategy for increasing production from its ageing fields in the North-East through tie ups with Schlumberger. Commenting on the roadmap, he said. The country’s largest crude oil producer, ONGC has recently signed a statement of understanding with Schlumberger for enhancing production at its Geleki field in Assam. OIL will be looking to forge a similar production enhancement contract with Schlumberger, according to Bora.

Source: The Hindu Business Line

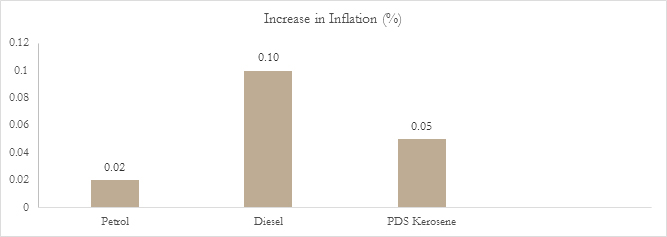

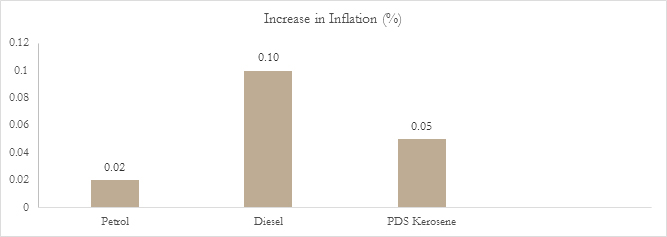

Petrol prices in India set to rise to Rs 75, diesel Rs 64 as oil surges

December 10, 2016. Petrol prices are expected to rise 5-8% and that of diesel by 6-8% over the next 3-4 months after the Organisation of Petroleum Exporting Countries (OPEC) agreed to cut crude oil production by 1.2 million barrels per day, according to CRISIL Research. In Mumbai, that means petrol prices could exceed Rs 75 per litre compared with Rs 72 now, and diesel can reach Rs 64, from Rs 60 at present. The price of Brent crude could increase to $50-55 per barrel by March 2017, following OPEC’s move, and if it surges to $60 as some believe, petrol can hit Rs 80 and diesel Rs 68 per litre. While a cut in production lifts prices, it depends on the OPEC members adhering to the cut. There have been many instances of members breaking away from the cartel because of domestic compulsions. Thanks to demonetisation, there could be a slowing down in oil usage, but this would rebound once currency in circulation reverts to normal. The government will have to keep the oil surge in mind while doing the budget calculations for next year.

Source: The Financial Express

IOC, BPCL, HPCL sign deal to set up India’s biggest oil refinery

December 7, 2016. Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) signed a pact to build India’s biggest oil refinery at a cost of $30 billion on the west coast. The three firms signed the pact for the 60 million tonnes (mt) a year refinery in Maharashtra with IOC as leader of the consortium. IOC will hold a 50 percent stake in the project while BPCL and HPCL will have 25 percent each. Oil Minister Dharmendra Pradhan said oil majors like Saudi Aramco of Saudi Arabia are interested in taking a stake in the project, but nothing has been finalised as yet.

Source: The Economic Times

NATIONAL: GAS

Swan Energy gets nod for Rs 56 bn floating LNG terminal

December 13, 2016. Nikhil Merchant-led Swan Energy said it has received approval from the Gujarat Maritime Board (GMB) for construction of a Rs 5,600 crore floating liquefied natural gas (LNG) terminal off the Gujarat coast. Oil and Natural Gas Corp (ONGC), Indian Oil Corp (IOC) and Bharat Petroleum Corp Ltd (BPCL) have agreed to take one million tonnes per annum capacity each on the 5 million tonnes a year floating LNG terminal. Swan Energy, which is building the project in joint venture with Exmar of Belgium, is targeting 2019 for commissioning of the one jetty-moored floating storage and re-gasification unit (FSRU) at Jafrabad. It plans to expand the capacity to 10 million tonnes through the deployment of a second FSRU. Merchant’s Swan Energy Ltd holds 51 percent stake in Swan LNG Pvt Ltd – the company building the Jafrabad terminal. Exmar Marine holds 38 percent and the remaining 11 percent is with Gujarat State Petroleum Corporation (GSPC). Exmar is known as a pioneer in floating regasification solutions for having introduced world’s first FSRU in 2005. The company had last year secured all necessary permits for the project and the state-owned firms agreed to hire 60 percent capacity of the terminal on tolling basis for importing their own gas will help Swan take the final investment decision and tie-up project financing. ONGC and IOC own 12.5 percent stake each in Petronet LNG Ltd, which owns and operates a 10 million tonnes a year LNG import terminal at Dahej in Gujarat. This terminal is being expanded to 15 million tonnes by next month. While Petronet expanded the Dahej terminal on premise of leasing out the capacity third parties, the company also has a 5 million tonnes a year LNG import facility at Kochi. GSPC is building its own LNG terminal in joint venture with Adani Group at Mundra in Gujarat by 2017. Also on the west coast is an under-utilised 5 million tonnes Dabhol LNG import terminal, operated by state gas utility GAIL (India) Ltd.

Source: Business Standard

GAIL gets second extension for Kochi-Mangalore natural gas pipeline

December 13, 2016. GAIL (India) Ltd has won a second extension for completing the Kochi- Bangalore-Mangalore natural gas pipeline as it faces unprecedented problems in getting land in Kerala and Tamil Nadu. Oil regulator Petroleum and Natural Gas Regulatory Board (PNGRB) gave GAIL four more years till February 2019 to complete the 1104 km Kochi-Koottanad-Bangalore-Mangalore natural gas pipeline. GAIL is to lay the pipeline in two phases – a 44 km Phase-1 connecting Kochi port to FACT plant in the city and a 1,060 km Phase-II taking the line from there to Thrissur- Kotanand and Pallakad in Kerala and onward to Coimbatore and Salem in Tamil Nadu before reaching Bangalore. From Kootannd a branch line is to go to Kozhikode and onward to Mangalore. Phase-I of the pipeline has been commissioned, which takes the gas imported at Kochi LNG terminal to the fertilizer plant in the city.

Source: The Economic Times

Haridwar to get gas supply pipeline by March 2017

December 13, 2016. Oil Minister Dharmendra Pradhan, heralding the arrival of environment friendly natural gas in the holy city, launched a natural gas awareness campaign in Haridwar. He promised the supply of compressed natural gas (CNG) and piped natural gas (PNG) in the city through gas pipeline by March next year. While there will be around twenty lakh beneficiaries of the PNG, over ten thousand vehicles will get the benefit of CNG, the minister claimed. Pradhan referred to Prime Minister Narendra Modi’s Ujjwala scheme under which free gas connections are being given to poor families. According Haridwar Natural Gas Private Ltd (HNGPL), the Haridwar city gas distribution (HCGD) project is a joint venture of Bharat Petroleum Corp Ltd and GAIL Gas Ltd. It is being executed by Haridwar Natural Gas Pvt Ltd (HNGPL). The company will supply gas in 2305 sq. km. area of Haridwar district including Haridwar, Roorkee and Laksar cities with a projected capital expenditure of Rs 148.91 crore in the first five years and Rs 200.02 crore over a period of 25 years. HNGPL was authorised for the work in July 2015.

Source: The Times of India

ONGC to roll out new ‘basin’ in Agartala by 2017

December 11, 2016. Oil and Natural Gas Corp (ONGC) will set up a new ‘basin’ in Agartala by the end of next year as it looks to focus more on exploration of oil and gas in the North-East region. Construction work is going on as earlier there was no proper building to start functioning of a ‘basin’ in Agartala, ONGC said. ONGC’s North East operations are divided into two areas — Assam Shelf from Jorhat to Duliajan and Assam Fold Belt from Silchar to Agartala. While exploration is being done only by Assam-Arakan ‘basin’ based at Jorhat, the production is divided by three ‘assets’ — Assam Asset at Nazira, Jorhat Asset at Jorhat and Tripura Asset at Agartala. Basin’s job is to discover or explore oil and gas, but it does not produce anything. On the other hand, an ‘asset’ exploits or produces and sends products to refineries. Assam Fold Belt has mainly gas, while there are both oil and gas in Assam Shelf, ONGC said. ONGC said the new ‘basin’ is being created to focus more on exploration of energy sources in the area. Before creating an ‘asset’ in Jorhat, it was only a ‘basin’ with a daily production of 350 tonnes. In last fiscal, ONGC production in Assam was 0.9 million tonnes and this year, it is targetted to reach the figure of one million tonnes.

Source: The Economic Times

ONGC awaits DGH nod for $5 bn KG-D5 gas development plan

December 11, 2016. Oil and Natural Gas Corp (ONGC) is awaiting nod of upstream regulator DGH to commence investing $5.07 billion in bringing to production oil and gas discoveries in its Bay of Bengal block KG-D5. About a year back ONGC submitted to the Directorate General of Hydrocarbons (DGH) a field development plan (FDP) for bringing to production 10 oil and gas discoveries in KG basin block KG-DWN-98/2 (KG-D5), which sits next to Reliance Industries flagging KG-D6 fields. A meeting of the block oversight panel, Management Committee (MC) headed by DGH, has been called next week to review the FDP. The board of ONGC had approved an investment of $5,076.37 million for developing Cluster-II discoveries to flow natural gas from June 2019 and oil by March 2020. In 2014, ONGC had announced plans to start gas production from 2018 and oil by 2019 but a final investment decision was made contingent upon government approving a remunerative price for the deepsea block as the current rate of $2.5 per million British thermal unit (mmBtu) was unviable. The government in March announced a new pricing formula for difficult areas that would at current prices give developers just about $6 per mmBtu price. KG-D5 gas fields are viable at that price, he said. The 7,294.6 sq km deepsea KG-D5 block has been broadly categorised into Northern Discovery Area (NDA – 3,800.6 sq km) and Southern Discovery Area (SDA – 3,494 sq km). The NDA has 11 oil and gas discoveries while SDA has the nation’s only ultra-deepsea gas find of UD-1. These finds have been clubbed in three groups – Cluster-1, Cluster-II and Cluster-III. Gas discovery in Cluster-I is to be tied up with finds in neighbouring G-4 block for production but this is not being taken up currently because of a dispute with RIL over migration of gas from ONGC blocks. From Cluster-II a peak oil output of 77,305 barrels per day is envisaged within two years of start of production. Gas output is slated to peak to 16.56 million standard cubic meters per day by end-2021.

Source: The Times of India

India in talks with Russia to swap natural gas with China and Myanmar

December 8, 2016. India is in early talks with Russia to swap natural gas with China and Myanmar as an alternative to building world’s most expensive pipeline costing close to $25 billion. The two nations had in October signed an initial pact for building a 4,500 km to 6,000 km long pipeline from Siberia to the world’s third biggest energy consuming nation. ONGC Videsh Ltd (OVL) said talks are on with Russian gas monopoly Gazprom for an alternative swap. The Russia-to-India pipeline that was being considered will see its route passing through Himalayas into Northern India, a route which poses several technical challenges. Alternately, the pipeline can come via Central Asian nations, Iran and Pakistan into Western India. However, the route will be expensive when compared to the long discussed but shorter and cheaper Iran-Pakistan-India pipeline. Tehran may suggest India take its gas through IPI rather than building such an expensive pipeline. The third and the longest alternative is to lay a pipeline through China and Myanmar into North East India bypassing Bangladesh. According to preliminary cost estimate prepared by Engineers India Ltd (EIL), which October signed an agreement with Gazprom for studying the Russia-India pipeline, the longest route of 6,000 km may cost close to $25 billion. The cost of transporting gas may be $12 per million British thermal unit, according to EIL.

Source: The Economic Times

Govt probes prior info of ONGC gas migrating to RIL block: Oil Minister

December 7, 2016. The government has initiated a probe into Reliance Industries Ltd (RIL) and Oil and Natural Gas Corp (ONGC) having knowledge as early as in 2003 of state-owned firm’s natural gas flowing into adjoining fields of RIL in KG Basin. ONGC had in late 2013 stated that it suspects extension of reservoirs from its blocks in the Bay of Bengal into RIL’s KG-D6. Oil Minister Dharmendra Pradhan said the government had constituted a Committee under Justice (Retd) AP Shah to look into the dispute of gas migration from ONGC’s Blocks KG-DWN-98/2 and Godavari PML to RIL’s Block KG- DWN-98/3 (KG-D6) in KG Basin. Committee has submitted its report, and its recommendations have been accepted by the Government. He said that ONGC, on its part, also had some form of prior knowledge about possible continuity in 2007, but did not act promptly or with due diligence, and took up the matter only six years after it first obtained relevant information.

Source: The Economic Times

NATIONAL: COAL

India does not need more coal-based capacity addition till 2022: CEA

December 13, 2016. Indicating a significant shift in the Indian power sector, the Central Electricity Authority (CEA) has, in its National Electricity Plan (2017-2022), said the country does not need any more coal-based capacity addition till 2022. CEA said India would add massive renewable-based capacity. CEA in its draft plan has also mentioned adequate coal is expected to be available for the coal-based power plants during 2021-22 and 2026-27. The draft is open for comments from all stakeholders till January 2017. CEA is the apex technical authority for the power sector. As most of the coal-based capacity is being built by the private sector, investments are likely to be hit. At the same time, the 4,000 MW Ultra Mega Power Plants would also be not needed if the CEA projections are adhered to by the government.

Source: Business Standard

Mahagenco gets mining lease for Chhattisgarh coal block

December 12, 2016. Maharashtra State Power Generation Company (Mahagenco) has got the mining lease for its Gare Pelma II coal block in Raigarh district of Chhattisgarh. Now, the company can begin the process of land acquisition. As per the deadline given by the Union ministry of coal, Mahagenco has to start production by December 2019. Mahagenco said that the extractable coal reserve was estimated at 656 million tonnes as against the total reserve of 1,059 million tonnes. The capacity of Gare Pelma II was 50 million metric tonnes per annum. The importance of the mine can be understood from the fact that the present requirement of the generation company is 46 million metric tonnes. The ministry of coal had allotted the block for Mahagenco’s new and upcoming six units — two of 500 MW power at Chandrapur Super Thermal Power Station, three of 660 MW at Koradi and one of 250 MW at Parli thermal power station. Mahagenco was earlier allotted the Machhakatta block in Odisha, but it was scrapped by the Supreme Court. Now, the future of the company completely depends on Gare Pelma II block.

Source: The Times of India

India’s coal demand to see biggest growth globally

December 12, 2016. India’s coal demand will see the biggest growth over next five years even as it slows down globally on lower consumption in China and the US while renewable energy sources gain ground, the International Energy Agency (IEA) said. India will see an annual average growth rate of 5 percent by 2021 even as demand peaks in the world’s top consumer, China, IEA said. India’s coal output rose 5.1 percent last year, it said. Global coal consumption declined for the first time this century in 2015, falling 2.7 percent, while global production decreased for the second year in a row.

Source: Business Standard

CIL likely to miss 2016-17 sales target unless power demand picks up

December 7, 2016. Coal India Ltd (CIL), which is already more than 40 million tonnes short of its sales goal in the first eight months of this financial year, is likely to miss the year’s target by a large margin unless power demand picks up drastically, analysts indicated. The mining company’s performance last year was lifted as demand for coal from the power sector increased by about 90 million tonnes. A similar boost has been missing this year. CIL’s sales in the eight months ending November were 340.3 million tonnes, trailing the target of 381.6 million tonnes. Production was 323.6 million tonnes compared with a target of 360.8 million tonnes, the company said. The company’s production increased to 539 million tonnes in the year ended March 2016 from 494 million tonnes a year earlier. The coal ministry hasn’t changed CIL’s annual output target of 1 billion tonnes by March 2020.

Source: The Economic Times

National: Power

Power ministry projects fund requirement of Rs 10 lakh cr over 5 yrs through 2022

December 12, 2016. The power ministry has projected a mammoth fund requirement of Rs 10.33 lakh crore over the next five years (2017-22) for completion of the targeted electricity generation capacity during the period. This is a 40 percent jump over the funding requirement of Rs 6.43 lakh crore estimated in 2012 for meeting the targets of power capacity addition in the current Plan period ending March 2017.

Source: The Economic Times

Every Bihar household to be lit up by end of next year: CM

December 11, 2016. Bihar Chief Minister (CM) Nitish Kumar said that every household in the state would get electricity by the end of next year and exhorted people to start practising rational use of power to avoid fat bills. Survey work has been carried on households still not having power connection and the government would provide free electricity connection to all such households across Bihar by the end of 2017, Kumar said. Power was an important election issue during the 2015 Bihar polls. Prime Minister Narendra Modi has repeatedly made references to dismal power situation in the state almost in every rally he had addressed in Bihar at that time. Kumar has refuted the charges by stating that power situation had been continuously improving in the state with urban areas enjoying electricity on an average for 20 hours daily while rural areas have 14-15 hours of power. Kumar also exhorted people to start practising rational use of electricity to avoid heavy power bills. Providing free electricity connection to every household forms a part of “seven resolves” which the grand alliance government has adopted as policy of “sushasan” (good governance) for rest of its term, he said. Kumar had launched ‘Har ghar bijli lagataar’ programme in Patna to achieve this target.

Source: The Economic Times

Report power theft in Haryana, get reward

December 9, 2016. The Dakshin Haryana Bijli Vitran Nigam (DHBVN) has authorized its officers to sanction cash rewards to people providing information on electricity theft, pilferage of material, and corruption. The superintending engineer (operation) can sanction and disburse rewards up to Rs 10,000, while the chief engineer up to Rs 25,000 in a case. Similarly, the director (technical) has the authority to sanction rewards up to Rs 50,000, and the managing director up to Rs 1 lakh in a case. Full-time directors have powers to sanction rewards of Rs 5 lakh. The competent authority will use its discretion and sanction cash rewards in the best interests of DHBVN to improve general efficiency, increase revenue, and reduce loss and illegal activities.

Source: The Times of India

Karnataka stares at power tariff hike next year

December 9, 2016. Come 2017 and electricity consumers in Karnataka could be in for a rude shock. For, they may have to shell out considerably more on their power bills. The five electricity supply companies (Escoms) have been pushing for a massive power tariff hike for domestic consumers, commercial and industries sectors. For domestic consumers, they have sought an average increase of Rs 1.40 paise per unit. If even half of what’s being proposed is accepted, it could create a record of sorts as there’s never been a hike of more than 50 paise per unit in this category. The Escoms have sought a hike ranging from Rs 3.50 to Rs 7.50 in other categories, including commercial and industries sector.

Source: The Economic Times

Power prices climb to a year’s high on heavy mist in North

December 9, 2016. Power prices climbed to a year’s high as heavy mist enveloped north India. Peak-hour electricity prices for the region rose above Rs 4 per unit on power exchanges and touched Rs 5 per unit in the South. Electricity bills of consumers may go up this winter in these areas, while they may drop in regions supplying electricity, such as the west and east.

Source: The Economic Times

India’s debt-laden power retailers seen scaring off global investors

December 8, 2016. India’s money-losing state power retailers may be scaring off power plant investors, according to Sembcorp Industries Ltd, compounding the industry’s woes that have left about 20 percent of the country without electricity. Delayed payments by the distributors and their reluctance to sign long-term purchase contracts are risks for investors, Sembcorp said. Sembcorp, controlled by Temasek Holdings, has 2,748 MW of installed generation capacity in India, including three coal-based units of 660 MW each. One of those units has yet to find long-term buyers for its power. A fourth, also without a contract, is yet to be commissioned, Sembcorp said.

Source: The Economic Times

Shillong prays for ‘power-packed’ Puja

December 8, 2016. With regular power cuts over the past one month, the Central Puja Committee (CPC) expressed hope that the authorities would spare the state from periodical bouts of darkness during Durga Puja. The CPC, a representative body of Hindus in Meghalaya and a co-ordinating body of all puja committees, has been working towards strengthening communal harmony in the state. Expressing concern over frequent power cuts, which could aggravate law and order problems during festivities when people take to the streets, the CPC president Naba Bhattacharjee said, not only during the pujas, uninterrupted power supply should be provided during all religious festivals. The Meghalaya Electricity Power Corp Ltd has resorted to regular power cuts as its reservoirs are short of water because of a weak monsoon.

Source: The Times of India

Over 40 percent households in Odisha go without power connection

December 7, 2016. While both the central and the state governments often claimed to ensure electricity for all by 2018, around 40% families in Odisha don’t have power connections. According to the Energy Minister Pranab Prakash Das in the assembly, of the 96.53 lakh households in the state, 58.29 lakh have power connections. This leaves out 38.24 lakh families, 40% of the total families in the state, without power connections. The number of below poverty line (BPL) families in the state is 44.93 lakh. In the mineral-rich Keonjhar district, the situation is worst. Around 67% houses don’t have power connections. Of the 5.8 lakh families, only 1.9 lakh have electricity. More than 50% houses in highly-industrialised Angul district, considered the power house of the state for housing power plants of NTPC, are not electrified. Of the 2.91 lakh houses, only 1.33 lakh are having electricity. Highly-urbanised Khurda district, of which state capital Bhubaneswar is a part, has more than 60% unelectrified houses, the minister said.

Source: The Economic Times

Govt issues cross border electricity trade guidelines

December 7, 2016. The Ministry of Power has issued guidelines for cross border trade of electricity, which will be put on final terms by the Central Electricity Regulatory Authority (CERC). As per the guidelines, an entity will be qualified for cross-border trading on Indian power exchanges, which includes Indian Energy Exchange and Power Exchange India. The trading could be done in term-ahead contracts, intra-day contracts and contingency contracts. The transmission interconnection between India and its neighbouring country would be planned jointly by transmission planning agencies of the two countries with approval of the respective governments. At present, cross-border trade of electricity takes place with Bangladesh, Bhutan and Nepal.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/CLIMATE CHANGE TRENDS

India’s largest rooftop solar tender to see record low tariffs: Bridge to India

December 12, 2016. Solar Energy Corp of India (SECI)’s tender for development of 1,000 MW rooftop solar capacity are likely to see record low project costs and tariff with capital subsidies of up to 35-90 percent, according to a report by solar energy research organisation Bridge to India. The report said most installations were most likely to be at educational and training institutes. Various departments and ministries under central government have collectively committed to deploying 5,938 MW of rooftop solar capacity for their internal power consumption. SECI is aggregating demand for a part of this requirement and helping in procuring rooftop solar systems. It has already identified suitable rooftops with the potential to install at least 1,000 MW solar capacity. SECI shall provide a capital subsidy of 35-90 percent of total capital cost ranging from Rs 18,750 ($ 277)/kWp for general category states and Rs 45,000 ($ 665)/kWp for special category states. In a departure from previous such tenders, the subsidy amount shall be substantially reduced in the event of delays in construction time-table. Bridge to India expects a very enthusiastic response to the tender both from rooftop solar specialists and utility solar players.

Source: The Economic Times

BPSL gets green nod for Rs 90.9 bn expansion project in Odisha

December 11, 2016. Kolkata-based Bhushan Power and Steel Ltd (BPSL) has received environment clearance for a Rs 9,090 crore crude steel expansion project in Odisha. The company has proposed to enhance production capacity of crude steel from 3 million tonnes per annum (mtpa) to 5.5 mtpa and captive power from 560 MW to 710 MW at its premises in Sambalpur district. The environment ministry said that the company has informed that it has already acquired 284 hectares required for the expansion.

Source: Business Standard

Another educational campus in Gurgaon starts using solar power systems

December 10, 2016. A 50 kilo Watt solar power plant was unveiled on the premises of Shiv Nadar School, Gurgaon. The power plant has been built as part of an initiative of the Haryana government that mandates certain categories of buildings, including those of private educational institutes, schools, colleges, hostels, and technical/vocational education institutes and universities with a sanctioned load of 30 kilo Watt and above, to set up solar power plants.

Source: The Economic Times

Riverfront development project being planned to generate solar energy in Uttarakhand

December 10, 2016. The Mussoorie Dehradun Development Authority (MDDA) is planning to generate solar energy as a part of the riverfront development project on rivulets Rispana and Bindal. The aim of the project is to generate 40 MW of energy and also to make sure that people do not litter the rivers. However, few NGOs in the city support the initiative and doubt the benefit of using rivers for generating solar energy.

Source: The Economic Times

Kendriya Vidyalayas to go green with solar power

December 10, 2016. The Kendriya Vidyalaya Sangathan (KVS) is going to generate electricity through the rooftop solar photovoltaic (PV) system. A pilot project will be launched at viable Kendriya Vidyalayas across NCR with more than 40 KWp capacity, and in such schools in the northeastern states. According to the KVS, a detailed survey of KVs located in NCR has already been conducted for installation of rooftop solar PV power system. Based on the survey report, approximately 1.18 MWp grid connected rooftop solar PV system can be installed in 24 KVs.

Source: The Times of India

Health cost of air pollution in India assessed at 3 percent of its GDP

December 10, 2016. The cost of serious health consequences from Particulate Matter pollution is estimated to be around 3 percent of India’s gross domestic product (GDP), according to the health ministry said. The ministry that the total damage because of environmental degradation amounts to Rs 3.75 trillion, which is equivalent to around 5.7 percent of the India’s GDP. Introduction of alternate fuels like gaseous fuel (CNG, LPG), implementation of Bharat Stage IV (BS-IV) norms in 63 select cities, promotion of public transport network of metro, buses, e-rickshaws and phasing out of 15 year old diesel vehicles in Delhi were some other steps taken by the Government to improve the air quality, the ministry said. Meanwhile, Greenpeace India too, in a report, has claimed that total deaths caused due to air pollution in the country are underestimated at least by six lakh people. According to the report, air pollution kills over 1.6 million people in India and China every year due to increasing use of fossil fuels, particularly coal.

Source: The Economic Times

Praj Industries inks MoU with IOC, BPCL for bio-ethanol plants

December 9, 2016. Praj Industries said it has signed agreements with Indian Oil Corp (IOC) and Bharat Petroleum Corp Ltd (BPCL) to set up three bio- ethanol plants in Gujarat, Haryana and Odisha. These second generation (2G) bio-ethanol plants would have capacity to produce 100 kilo litres of ethanol per day. This is a progress milestone as per Memorandum of Understanding (MoU) signed wherein IOC selected Praj as its technology partner for setting up multiple 2G bio-ethanol plants based on its indigenously developed technology, the company said.

Source: The Economic Times

India and Vietnam likely to sign civil nuclear pact

December 9, 2016. India is likely to seal a landmark civil nuclear pact with Vietnam during the visit of the President of Vietnam’s National Assembly, Ngyun Thi Kim Ngan, the first such partnership with a neighbour of China. The Indo-Vietnam Inter-Governmental Framework Agreement in the field of civil nuclear cooperation will entail capacity building and training of Vietnamese nuclear scientists by India besides assistance to improve safeguard measures of nuclear installations in the Southeast Asian country. Sri Lanka is the only other developing country with which India has signed a civil nuclear pact.

Source: The Times of India

India’s 87 percent solar cell imports from China in April-September: Goyal

December 8, 2016. India imported solar and photovoltaic cells worth about $826 million from China in the first six months of the current fiscal, which is over 87 percent of the country’s total such imports. India’s total imports of these cells were worth $948.88 million, including $825.98 million from China, constituting 87.05 percent, during the April-September period of 2016-17, New & Renewable Energy Minister Piyush Goyal said.

Source: The Economic Times

Govt plans projects to overcome land problems for solar power

December 8, 2016. To overcome the scarcity of land for expansion of solar energy in the country, government is planning a number of initiatives like development of solar parks, ultra mega solar power projects and solar zones. New & Renewable Energy Minister Piyush Goyal said solar parks are common development areas for solar power projects and offer the developers location/land with prior approvals that is well characterised with proper infrastructure and access to amenities and where the risk of the projects can be minimised.

Source: The Indian Express

International: Oil

Oman to tell customers of oil supply cuts in January after OPEC deal

December 13, 2016. Gulf oil producer Oman will inform its customers of a cut in their crude oil supplies for January, in line with a deal with the Organization of the Petroleum Exporting Countries (OPEC) to reduce production. The non-OPEC producer will tell its customers of a total reduction of 45,000 barrels per day under the global agreement, while the scale of the cut for each customer will be communicated later. OPEC and non-OPEC producers reached their first deal since 2001 to curtail oil output jointly and ease a global glut after more than two years of low prices.

Source: Reuters

China November refinery runs hit record high, crude output falls

December 12, 2016. China’s refinery throughput hit a daily record in November as plant maintenance wound down and independents ramped up productions, while crude oil production fell as producers held to output cuts at inefficient wells. Data from the National Bureau of Statistics (NBS) showed that refinery throughput rose 3.4 percent year-on-year to 45.77 million tonnes, or 11.14 million barrels per day (bpd), an all-time high on a daily basis. Daily crude oil output in November, however, fell 9 percent from a year ago to 3.915 million barrels, the data showed. It recovered from October’s 3.78 million bpd, though, the lowest in more than seven years. For the first 11 months, crude production in the world’s second-largest oil consumer was down 6.9 percent on the year at 182.91 million tonnes, just under 4 million bpd. Major upstream producer PetroChina reported in October that its crude output for the first nine months of 2016 fell 3.7 percent from a year earlier to 696.6 million barrels.

Source: Reuters

PetroChina wins US crude tender to sell to PDVSA

December 12, 2016. China’s trading firm PetroChina was awarded a tender to sell up to 1.65 million barrels of United States (US) light crude to Venezuela’s state-run PDVSA for delivery in the coming weeks at a terminal in Curacao, traders said. The Chinese company along with British BP were awarded a previous tender by PDVSA in March to import more than 8 million barrels of light crude this year. But deliveries have been affected by long payment delays to PDVSA’s suppliers. The last cargo sent by BP from a list of 13 agreed shipments discharged at Curacao after waiting for 90 days, according to vessel tracking data. The cargoes of 550,000 barrels each of US WTI or DSW crudes, must be delivered from mid-December through January at PDVSA’s Bullenbay terminal in Curacao. China and Venezuela exchange a large volume of crude and refined products according to several oil-for-loan agreements involving their state-run firms, but the US oil cargoes to be supplied this time will be prepaid. PDVSA has been using foreign oil to dilute with its own extra heavy crude output and to feed its Caribbean refineries since it started crude imports in 2014. So far this year it has bought some 12.1 million barrels of U.S. and Nigerian light crudes, versus 16.9 million barrels of African and Russian oil imported in 2015, according to traders and trade flows data.

Source: Reuters

Deepest oil cuts in world’s top market didn’t need OPEC deal

December 12, 2016. Malaysia and Brunei are doing their bit for the global pact to rebalance oil markets, but the biggest production cuts in Asia are coming from a country that didn’t sign up. China, the world’s fifth-biggest producer last year, has reduced output by about 300,000 barrels a day this year, more than the combined cuts announced by non-OPEC countries, excluding Russia, as part of a deal coordinated with the producer group. The decline is expected to continue next year, with Chinese production shrinking as much as 200,000 barrels a day, according to consultant Energy Aspects Ltd. China’s output slumped as state-owned firms shut wells at mature fields that are too expensive to operate amid last year’s price crash. Production during the first 10 months of the year averaged about 4 million barrels a day, down about 7 percent from the same period last year, according to National Bureau of Statistics data. Malaysia and Brunei were the only Asian nations in the group of producers outside the Organization of Petroleum Exporting Countries (OPEC) that agreed to cut output by a combined 558,000 barrels a day starting January 1. The region will use 32.88 million barrels a day of oil this year, accounting for more than a third of global consumption, according to data from the International Energy Agency. Daily demand is forecast to expand to 33.7 million barrels in 2017.

Source: Bloomberg

Quebec passes hydrocarbon bill that opens oil and gas reserves

December 10, 2016. Quebec passed hydrocarbon legislation that is likely to open up shale gas and oil reserves to energy companies operating in the province. Bill 106, introduced in June, passed by a margin of 62 to 38. It creates a new agency to promote Quebec’s transition to cleaner energy but also includes the Petroleum Resources Act, which may clear the way for more exploration. The company announced that its Galt No. 4 horizontal well has produced a total of 17,798 barrels of light, sweet crude oil in the province. Bill 106 106 establishes a system for licensing and authorizing the exploration and production of oil and gas, which had been governed by the province’s Mining Act. It also creates an energy transition fund for the payment of petroleum royalties.

Source: Bloomberg

OPEC cooperation key to stabilising oil: Iranian President

December 9, 2016. Iranian President Hassan Rouhani said that members of the Organization of the Petroleum Exporting Countries (OPEC) should work together to secure implementation of a deal reached last month aimed at stabilizing the oil market. Rouhani said Tehran backed measures aimed at stabilising the market that could led to an oil price increase. OPEC agreed in Vienna to reduce output by around 1.2 million bpd from January 2017, a move that bolstered crude prices. Iran was exempted from the cut, being allowed to boost production slightly from its October level – a victory for Tehran, which has long argued it needs to regain market share lost under Western sanctions. Oil producers in Vienna will see whether those outside OPEC will cut production to reduce a global supply glut that has pressured prices for more than two years.

Source: Reuters

Global O&G industry to see modest rebound in 2017: Moody’s

December 8, 2016. The global oil and gas (O&G) industry will continue to be plagued by the weight of high debt levels next year despite the Organization of the Petroleum Exporting Countries (OPEC) offer to lower production from January, which has helped the industry rebound modestly from its 2016 trough, Moddy’s said in a report. While free cash flow is expected to turn positive in 2017 if firms maintain scrip dividends, in the near-term, sustained dividends will create negative free cash flow which will need to be covered by debt and asset sales, it said. Maintaining a stable outlook for the exploration and production companies for next year, it said this segment should fare better going forward. It has a negative outlook for drilling and oilfield services companies as the players in the sector are facing continuing weak upstream spending limiting any meaningful recovery for drillers on one hand and on the other equipment excess continues to weigh on prices for offshore services. Despite having fastest growth in oil demand for the past many years and is likely to remain so, the report does not even name India.

Source: The Economic Times

China teapots to extend oil buying spree into 2017

December 8, 2016. China’s small, independent refiners are set to raise their crude oil imports again in 2017 on expectations that Beijing will keep their intake quotas steady, market participants said, a move that should help eat up some of the global supply glut. Called “teapots” due to the small capacities of their plants compared with the big state-run refineries, the independents made up nearly 90 percent of China’s crude oil import growth this year, helping to put the world’s No.2 economy on course to challenge the United States as the top importer. Next year, teapots will contribute 200,000-400,000 barrels per day (bpd) to China’s crude import growth, out of an overall import rise of 500,000-700,000 bpd, according to estimates from research consultancy Energy Aspects. In 2016, China has raised its imports by nearly 900,000 bpd on average, more than enough to supply the whole of the Netherlands, thanks largely to 17 new teapot buyers.

Source: Reuters

Saudi will continue to meet global oil demand: Energy Minister

December 7, 2016. Saudi Arabia’s Energy Minister Khalid al-Falih said the kingdom is committed to meeting global oil demand, including from the United States. Falih said that the kingdom is committed to the oil market’s stability and balance.

Source: Reuters

Shell, Iran agree on future O&G development

December 7, 2016. Royal Dutch Shell signed a provisional agreement to develop Iranian oil and gas (O&G) fields, the first deal by the world’s second biggest listed oil firm in Iran since sanctions were lifted. Analysts said the agreement underscored major oil companies’ willingness to keep doing business with Iran despite the risk that United States President-elect Donald Trump could scrap the nuclear deal that ended the sanctions earlier this year. Iranian oil ministry said Shell would sign three Memoranda of Understanding (MoUs) in Tehran to develop the South Azadegan, Yadavaran oil fields and the Kish gas field. The South Azadegan and Yadavaran fields both straddle Iran’s border with Iraq. Total, which signed the first deal by a Western energy firm since sanctions were lifted, will start talks about new oil and gas projects but will not be signing any deals. Iran, the third largest producer in the Organization of the Petroleum Exporting Countries, hopes its new Iran Petroleum Contracts (IPC) will attract foreign companies and boost production after years of underinvestment. Foreign firms keen to tap Iran’s vast O&G reserves have so far made little inroads into the country despite the lifting of many sanctions and the new contracts that aim to improve the terms Iran offers for oil development deals. Iran will launch its first new-style tender to develop oil and gas fields since the lifting of sanctions after January next year.

Source: Reuters

US gasoline consumption growth may slow in 2017

December 7, 2016. United States (US) gasoline consumption has been growing at the fastest rate for more than a decade as lower fuel prices and an expanding economy have combined to produce a big increase in demand. The Organization of the Petroleum Exporting Countries (OPEC) is relying on continued growth in US gasoline consumption, as well as other fuels, coupled with faster growth in demand from emerging markets, to help rebalance the oil market in 2017. Gasoline demand depends on continued gross domestic product (GDP) growth in the US, where the expansion is becoming increasingly mature, and the transition to a new administration has injected a source of uncertainty. But gasoline demand will also likely be influenced by the course of gasoline prices, which are now rising rather than falling. The impact of earlier sharp price falls between 2014 and early 2016 on gasoline consumption in the US may start to fade in 2017. In that case, OPEC may have to rely more heavily next year on growing demand for other fuels, such as distillate and jet fuel, and emerging markets.

Source: Reuters

OPEC wants oil price to be moderate, not too high: Venezuelan Oil Minister

December 7, 2016. The Organization of the Petroleum Exporting Countries (OPEC) is aiming for a moderate but not too high oil price, Venezuelan Oil Minister Eulogio Del Pino said. Del Pino said that he expected oil prices to stabilize at around $60-70 per barrel following a global oil pact reached. Del Pino said that he expected the market to rebalance in six to nine months following the deal. Del Pino said Venezuela is proposing to include Russia and Oman in a commission that would monitor the implementation of the agreement, in addition to OPEC members Kuwait, Algeria and Venezuela.

Source: Reuters

International: GAS

Leviathan partners approve natural gas production target for late 2019

December 12, 2016. The Israeli partners in the Leviathan gas field said they approved a development plan for the field with a target production date for the end of 2019. The plan includes a first stage development for production of about 12 billion cubic meters (bcm) a year at a cost of $3.5-4 billion. The Israeli partners in Leviathan, one of the world’s biggest offshore natural gas discoveries of the past decade, include Delek Drilling and Avner Oil, each with a 22.67 percent stake, and Ratio Oil with a 15 percent stake. With estimated reserves of 621 bcm, the Leviathan partners have signed an export deal in Jordan and are exploring the possibility of selling gas in Egypt, Turkey and Europe.

Source: Reuters

Independent Oil and Gas seeks approval to develop Blythe gas field in North Sea

December 12, 2016. Independent Oil and Gas is seeking approval from the UK Oil and Gas Authority (OGA) for the development of the Blythe field located in the Southern North Sea. Located close to existing infrastructure and other IOG-owned licenses, the IOG-owned Blythe gas field comprises independently verified 2P reserves of 34.3 billion cubic feet and requires no further appraisal, the company said. Subject to completion of the development funding, the field is expected to commence gas production in the second half of 2018. The planned gas hub around Blythe comprises the nearby Elgood discovery as a tie-back to the same infrastructure.

Source: Energy Business Review

Rosneft to pay up to $2.8 bn to join Egyptian gas block

December 12, 2016. Rosneft PJSC agreed to pay as much as $2.8 billion to buy up to 35 percent of a natural-gas project off Egypt, joining Eni SpA and BP Plc in the largest discovery in the Mediterranean Sea. Rosneft will pay $1.13 billion for an initial 30 percent stake in the Shorouk concession, which includes the Zohr find, plus $450 million for past expenditures, Eni said. The Russian state-controlled energy producer has an option until the end of 2017 to acquire an additional 5 percent, which would also require payments for past spending, Eni said. Rosneft, which pumps more than 40 percent of Russia’s crude and over 10 percent of its gas, has planned to expand its gas business for years. It has been seeking assets and contracts overseas, while at home challenging the piped-gas export monopoly of state-run giant Gazprom PJSC. In May, Rosneft supplied its first liquefied natural gas cargo to Egypt. Egypt has said it will keep all of Zohr’s reserves for domestic use, allowing the country to cut liquefied natural gas (LNG) imports. Eni discovered the field last year, estimating its resources at about 30 trillion cubic feet. It expects the first gas to flow in late 2017.

Source: Bloomberg

Eastern Australia could face gas crunch as of 2018 as LNG exports boom

December 12, 2016. According to the Australian Energy Market Operator (AEMO), eastern Australia could suffer from a gas supply crunch as early as 2018, due to soaring liquefied natural gas (LNG) exports, as the commissioning of several liquefaction plants should make Australia the second largest LNG exporter by 2018 and the largest LNG supplier for East Asian markets.

Source: Enerdata

Qatar to merge Qatargas and RasGas to create a bigger entity

December 12, 2016. Qatar will merge two of its state-owned liquefied natural gas (LNG) firms to facilitate streamlining of distribution along with the creation of necessary scale for higher operational efficiency. The peninsular Arab country will combine Qatargas, the world’s’ largest producer of (LNG), with smaller RasGas to create a bigger entity, according to a report in Saudi Gazette. The Gulf country is the world’s largest producer of LNG, which is produced by chilling natural gas to liquid form for shipment on tanker ships. The merger is expected to be completed within 12 months and save hundreds of millions of dollars. Notably, major global oil firms have a stake in these two LNG firms. While Total, ConocoPhillips, Exxon Mobil and Royal Dutch Shell have stakes in Qatargas production lines, RasGas is a joint venture between Qatar Petroleum and Exxon Mobil with the latter holding a minority stake in the company. According to analysts, the move is seen as Qatar’s effort to adapt to prevailing low energy pricing regime in the world.

Source: International Business Times

Tanzania, Nigeria’s Dangote reach natural gas supply deal

December 10, 2016. Tanzania and Nigeria’s Dangote Cement have reached a deal on the supply of natural gas to the firm’s manufacturing plant in the East African country after negotiations stalled over prices, Tanzanian President John Magufuli said. After meeting Aliko Dangote, the company’s chairman who is Africa’s richest man, Magufuli blamed unspecified middlemen of interfering with supply plans and said the issue has now been resolved with gas supplies to be sold at a “reasonable” tariff. The country announced that it had discovered an additional 2.17 trillion cubic feet (tcf) of possible natural gas deposits in an onshore field, raising its total estimated recoverable natural gas reserves to more than 57 tcf.

Source: Reuters

World Bank cancels $100 mn loan for Pakistan’s natural gas project

December 8, 2016. The World Bank has cancelled a $100 million loan to Pakistan for a natural gas efficiency project due to no progress in achieving the development objectives and a lack of interest on the part of the gas distribution company. The project, which was to be carried out by Sui Southern Gas Company (SSGC) in its distribution areas in Karachi, interior Sindh and Balochistan, was aimed at enhancing the supply of natural gas by reducing physical and commercial losses of gas in the pipeline system. A World Bank report said the failure of the project led to its closure and, as a result, the levels of unaccounted-for gas (UFG) remained high while continuing to drain the precious natural resource. The ministry of petroleum and natural gas was keen on the reduction of UFG, which was on the rise at the time of the project preparation and increased further during the project implementation phase. Oil and Gas Regulatory Authority had imposed a penalty on gas companies for UFG beyond the benchmark of 4.5 percent.

Source: The Hindu

TransCanada to move ahead with $655 mn Saddle West natural gas project

December 8, 2016. TransCanada’s wholly-owned subsidiary, NOVA Gas Transmission (NGTL) is all set to go ahead with its $655 mn Saddle West natural gas project. The expansion of the NGTL System will help in increasing the overall natural gas transportation capacity on the northwest section of the system by about 355 million cubic feet per day. Expected to be commissioned in 2019, the project is supported by incremental firm service contracts.

Source: Energy Business Review

Shell returns to Iran with deal to assess O&G fields

December 7, 2016. Royal Dutch Shell Plc signed an agreement to assess three of Iran’s largest oil and gas (O&G) fields as OPEC’s third-biggest producer looks to boost output with the help of international companies. Shell signed a Memorandum of Understanding to evaluate the Azadegan and Yadavaran oil fields near the Iraqi border, and the Kish gas deposit in the Persian Gulf, the National Iranian Oil Co. (NIOC) said. International oil companies have re-established contact with Iran since sanctions were lifted in January. However, no final contracts to develop oil fields have yet been signed. Total SA reached a non-binding $4.8 billion agreement to develop a natural gas field last month. The oil ministry said Shell and Total would sign deals to develop the three fields, in what would have been a major step forward for Iran’s oil industry.

Source: Bloomberg

International: Coal

Growth in global coal demand to slow over next 5 yrs: IEA

December 12, 2016. Growth in global coal demand will slow over the next five years due to lower consumption in China and the United States (US) and as renewable energy sources gain ground, the International Energy Agency (IEA) said. The IEA said last year that the world’s top coal consumer, China, could be facing peak coal demand for the first time due to measures to cap coal use to tackle air pollution and curb excess supply. Even though China’s consumption is likely to have peaked, the country will still be the largest coal user over the next five years. Its coal demand should decrease slightly to 2.816 billion tonnes of coal equivalent by 2021, compared to 2.896 billion tonnes of coal equivalent in 2014. Globally, the IEA expects coal demand to total 5.636 billion tonnes by 2021, compared to 5.400 billion tonnes last year, when coal demand dropped for the first time this century. This equates to 0.6 percent average annual growth from 2015 to 2021, below the 2.5 percent average yearly growth over the past decade. The biggest growth in coal demand will occur in India, which will have an annual average growth rate of 5 percent by 2021. After years of decline, coal prices have rebounded sharply in 2016, driven by a sharp cut in Chinese coal output coupled with strong demand across the Asia-Pacific region and in Europe. In its report, the IEA forecasts thermal coal prices to decline next year and then remain relatively flat to 2021. Coal demand in the US and Europe will continue to decline, falling to 475 million tonnes and 337 million tonnes respectively in 2021.

Source: Reuters

DEWA secures financing for 2.4 GW Hassyan clean coal power project

December 12, 2016. The Dubai Electricity and Water Authority (DEWA) has secured a financing package to fund the development of the first 2,400 MW phase of the proposed Hassyan clean coal power project in the country. The $3.4 bn first phase of Hassyan project involves construction of four units each with 600 MW generation capacity. The units are planned to be commissioned in March 2020, March 2021, March 2022, and March 2023 respectively. The Hassyan clean coal power project is expected to contribute to the country’s Dubai Clean Energy Strategy 2050, which aims to produce electricity from clean coal as part of Dubai’s energy mix.

Source: Energy Business Review

China halts North Korean coal imports

December 10, 2016. China announced that it was suspending coal imports from North Korea for three weeks, in line with the latest United Nations (UN) sanctions against the hermit state. It limits North Korea’s coal exports next year to 7.5 million tonnes or just over $400 million, down 62 percent on 2015. The cap represents a fraction of the North’s current annual exports to China, the isolated country’s sole ally and its main provider of trade and aid. Between March and October, 24.8 million tonnes of coal was imported, three times the annual limit now allowed by the UN.

Source: Hindustan Times

China’s top coal province to shut 49 mt a year in capacity by 2020

December 8, 2016. China’s biggest coal-producing province Shanxi pledged to eliminate 49 million tonnes (mt) a year in capacity by shutting 39 mines over the next five years. The plan aims to replace outdated capacity with more advanced mines without increasing output. Shanxi produced nearly 1 billion tonnes of coal in 2015, accounting for about a quarter of China’s total coal capacity. The local government has vowed to cut its annual coal capacity by a total of 110 million tonnes by 2020. In July, China’s National Development and Reform Commission (NDRC), together with the national energy administration and coal safety supervisor, said the country would stop approving new coal projects in the next three years and urged local governments to eliminate more excess capacities.

Source: The Economic Times

International: Power

Kenya Power plans $2.1 bn investment by 2021

December 13, 2016. Kenya’s power grid operator Kenya Power plans to invest KES219 bn (US$2.14 bn) in capital-intensive projects over the next five years. By 2021, the company aims to double the number of customers connected to the national grid, from 4.8 million in 2016 to 10.8 million in 2021. Kenya Power aims to build 52 new primary substations, 1,000 distribution substations and around 16,000 km of new power lines, while refurbishing 70 substations. In addition, 2.8 million smart meters will be installed by 2021.

Source: Enerdata

KEGOC builds high-voltage transmission line in eastern Kazakhstan

December 13, 2016. A new high-voltage Ekibastuz-Shulbinskaya-Ust-Kamenogorsk power line will cover the electricity needs of eastern Kazakhstan. Implementation of a large-scale project titled “Construction of 500 KW North-East-South Transmission Grid” began in 2014. The project seeks to create a modern infrastructure of power lines to provide uninterrupted power to a number of the country’s regions. Kazakhstan Electricity Grid Operating Company (KEGOC) is in charge of the implementation. The implementation is divided into two phases: construction of the 500 kW Ekibastuz-Shulbinskaya-Ust-Kamenogorsk transmission line and construction of 500 kW Shulbinskaya-Aktogai-Taldykorgan-Alma line. Initially, completion of the first phase was scheduled for 2017. However, construction was completed early. The new line is designed to transmit electricity to eastern Kazakhstan powered from the north.

Source: The Astana Times

UK awards 52 GW of power generation contracts

December 12, 2016. The United Kingdom (UK) government has signed agreements with energy storage, demand side response (DSR) and gas plant operators to deliver 52.4 GW of electricity capacity for the period October 2020 to September 2021. The deals were signed following 2020/2021 UK Capacity Market auction aimed at ensuring continuous and reliable energy supply during high demand, such as winters. Centrica, Drax, EDF Energy, E.ON, RWE, ScottishPower, SSE and Uniper are among the firms which signed the capacity agreements.

Source: Energy Business Review

China completes power plant in Tajikistan

December 9, 2016. A Chinese firm has completed a power plant worth $350 million in Tajikistan’s capital Dushanbe, the ex-Soviet country said, indicating Beijing’s growing economic dominance in the cash-strapped state. Tebian Electric Apparatus (TBEA) began building the coal-powered plant in 2013 and received the rights to a gold mine in the north of the Central Asian country to offset the cost of the investment. TBEA also built a 325 kilometre, $400 million electrical transmission line across Tajikistan in 2009.

Source: Daily Times

China’s Shanghai Electric to invest $9 bn in Pakistan upgrades

December 8, 2016. China’s Shanghai Electric plans to spend $9 billion overhauling electricity infrastructure in Karachi. Shanghai Electric said it would invest an average of $700 million a year until 2030 to increase capacity, improve cabling and target bill defaulters. The investment would also aim to tackle widespread electricity theft and other losses that cost about $269 million a month in the city, partly by replacing above-ground grid stations with underground ones. Shanghai Electric announced in August it would buy a majority stake in K-Electric, which is owned by Abraaj Group of Dubai, for $1.7 billion, which would be Pakistan’s biggest ever private-sector acquisition. K-Electric, formerly known as Karachi Electricity Supply Corp, supplies electricity to more than 2.2 million households and commercial and industrial consumers.

Source: The Economic Times

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Bulgaria and Rosatom settle deal on cancelled Belene nuclear project

December 13, 2016. Russian nuclear group Rosatom has received €620 mn from Bulgaria as compensation for having cancelled the Belene nuclear project in Bulgaria and has announced that it would not seek interests worth €24 mn, settling the deal. The construction of the Belene power plant started in 1987 but was stopped in 1991 under the pressure of ecological movements and neighbouring countries. Bulgaria is discussing reviving the project with the China National Nuclear Corp.

Source: Enerdata

Uganda starts up first solar power plant in bid to tap renewables

December 12, 2016. Uganda started up its first grid-connected, 10 MW solar power plant as the east African country moves to tap its renewable energy resources and expand its electricity generation capacity. Uganda generates about 850 MW of electricity, mostly from hydro power dams. The plant, a vast field of some 32,600 photovoltaic panels, is located in Soroti in northeastern Uganda and the electricity generated will help power at least 40,000 homes.

Source: VOA News

French nuclear plant availability back to normal mid-January: EDF

December 12, 2016. French state-controlled utility EDF confirmed that seven nuclear reactors shut down for safety checks would be up and running again by the end of December and there would be no problem with power supplies this winter. The company said its reactors were safe and also confirmed revised 2016 targets for nuclear production of 378-385 terawatt hours, as well as for its core earnings. Grid operator RTE said in a report that three of the seven reactors offline – Gravelines 2, Dampierre 3 and Tricastin 3 – would resume production from December 20 and that four more would restart before December 31. The seven reactors are among 12 that have been slated for inspections under orders from the nuclear regulator ASN following the discovery of high carbon concentrations, which could weaken their steel. EDF aimed to have available nuclear power output at more than 90 percent of total capacity then. From mid-January, EDF will only have four of its 58 reactors offline, for reasons not related to the ASN investigation. These plants are Bugey 5, Paluel 2, Fessenheim 2 and Gravelines 5. French power prices have fallen sharply in recent days as worries about the security of electricity supplies over winter eased.

Source: Reuters

Carney panel set to demand climate-risk scenarios from companies

December 10, 2016. Companies should tell investors how their profits may be hit by tighter pollution rules and extreme weather events coming from climate change, a panel advising the Group of 20 nations will conclude. The group, set up by Bank of England Governor Mark Carney in his role as head of the Financial Stability Board, is due to report on best practices for companies disclosing how they manage environmental risks. Two of the 31-member group said companies will be advised to investigate and publish an outlook for how they would be affected by targets to cut greenhouse gases. Carney’s ambition is to bring consistency to the hodgepodge of environmental and social governance reporting that companies currently do. The effort is among the first to set out best practices for issuing data on everything from carbon dioxide emissions to workplace deaths, which isn’t often comparable between companies or industries.

Source: Bloomberg

First Solar, NextEra Energy commission 250 MW solar energy center in US

December 9, 2016. First Solar and NextEra Energy Resources have commissioned the 250 MW Silver State South solar energy center in Nevada, United States (US). Constructed by First Solar, the plant features more than 3.4 million First Solar thin-film photovoltaic (PV) solar panels mounted on single-axis trackers. Under a 20-year power purchase agreement between SCE and NextEra Energy Resources, the plant will supply electricity to Southern California Edison consumers starting this year. NextEra Energy will own and operate the solar energy center. The solar energy center has a capacity to generate enough clean energy to power approximately 80,000 homes. The project, which stretches across 2,000 acres of federal lands managed by the US Bureau of Land Management, is expected to avoid approximately 150,000 metric tons per year of carbon dioxide emissions.

Source: Energy Business Review

Canadian PM strikes climate deal despite provincial holdouts

December 9, 2016. Canadian Prime Minister (PM) Justin Trudeau has reached an agreement for a carbon price and national climate plan, pledging to move ahead even as two Canadian provinces continue to hold out. Trudeau met premiers in Ottawa, emerging in the evening to announce a framework toward 2030 emissions reduction targets that includes a minimum carbon price. It will be up to provinces and territories to choose either a tax or cap-and-trade. Dubbed the Pan-Canadian Framework on Clean Growth and Climate Change, the plan comes with caveats. Environment Minister Catherine McKenna said the provinces’ disagreement in the final stages was specifically on carbon pricing, which was one part of the framework. Trudeau pledged a minimum price of C$10 ($8) a metric ton beginning in 2018, and rising to C$50 a ton in 2022. Canada will jointly develop a clean-fuel standard, build electrical transmission lines to support a coal phase-out and retrofit buildings as part of the effort.

Source: Bloomberg

German car emissions probe widens to Volkswagen’s Porsche

December 8, 2016. German regulators are investigating whether Porsche illegally manipulated fuel-economy data on its vehicles, potentially opening a new front in parent Volkswagen AG’s emissions-cheating scandal. Germany’s Transport Ministry and Federal Motor Transport Authority are examining whether Porsche installed devices allowing its cars to sense whether they were being tested for fuel consumption and carbon-dioxide emissions, representatives at both agencies said. That type of technology can be used to falsify results by making cars appear more energy efficient during tests.

Source: Bloomberg

Bangladesh’s ECNEC approves 2.4 GW Rooppur nuclear power project

December 8, 2016. The Executive Committee of the National Economic Council (ECNEC) of Bangladesh has approved the construction of the Tk1,131 bn (US$14.2 bn) Rooppur nuclear power project, which will be the first nuclear plant with a capacity of 2,400 MW and the most expensive power project in the country. As agreed in November 2011, Russia’s state-owned Rosatom will finance 80% of the total project cost – the remaining 20% will be financed by the government – and will build the project. Construction is expected to start in August 2017 (2018 for the second unit) with commissioning by 2025.

Source: Enerdata

Solar Impulse founder sees electric passenger plane in 10 yrs

December 8, 2016. The co-founder of a project that saw a solar-powered aircraft complete the first fuel-free flight around the world this year expects electric passenger planes to operate in just under 10 years. Bertrand Piccard, who along with fellow pilot Andre Borschberg founded Solar Impulse, also shrugged off concerns that United States President-elect Donald Trump’s appointment of a fossil fuel industry defender as his top environmental official could hamper global clean technology efforts. Since completing their historic fuel-free flight in July, Piccard and Borschberg have been working on projects to show how the technologies used in their plane can be used in other applications. Borschberg said they were especially interested in how the technology could be used to develop small electric planes with a flying time of about 1.5 hours. The two plan to announce their next project early next year, Borschberg said. Piccard said that it didn’t matter what people thought about climate change because clean technology was getting cheaper and would help to drive growth.

Source: Reuters

Japan Fukushima cost seen almost doubling to $188 bn