[December 2015: Post Paris Blues]

“This is good for India as higher energy consumption can potentially contribute to higher levels of economic activity. Demand for oil products grew by 6 percent in November but demand growth was not uniform along all products. Petrol consumption continued to show double digit growth while consumption of most other petroleum products including diesel has slowed down substantially. The growth in petrol consumption signals growth in use of personal vehicles…”

Energy News

[GOOD]

End to state monopoly on coal trade may pave the way for a vibrant coal sector!

[BAD]

Ground-breaking of TAPI pipeline is not necessarily a ground-breaking development for the India gas sector!

[UGLY]

Extension of the bidding deadline for hiring LNG carriers signals a weak market!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· December 2015: Post Paris Blues

DATA INSIGHT………………

· Village Electrification 2015-16

[NATIONAL: OIL & GAS]

Upstream…………………………

· CAG raps Govt over delay in signing Ratna R-Series contract

· Will protect ONGC's interest in Bay of Bengal gas row: Oil Minister

Downstream……………………………

· IOC’s Guwahati refinery facing water shortage

Transportation / Trade………………

· GAIL extends bidding deadline for hiring LNG carriers

· Indian state oil firms in talks to buy stake in Siberia oil project

Policy / Performance…………………

· India approves conversion of ONGC loan to unit into equity

· India re-negotiating terms of gas contract with Qatar: Oil Minister

· Cairn writes to PM Modi on retrospective tax case

· India’s fuel demand up 6.4 percent in November

· CNG sales volume to be boosted on SC directive on diesel vehicle ban: ICRA

· Cabinet approves OVL's $1.2 bn stake buy in Russia's field

· Moody's affirms Baa2 ratings on Oil India

· US welcomes ground-breaking of TAPI pipeline

[NATIONAL: POWER]

Generation………………

· NHPC's Teesta Low DamIV project running behind schedule

· BHEL to get Anpara D plant operational by January end

· APERC to decide on Hinduja power plant

· States surrendering share of costly power from generating companies

Transmission / Distribution / Trade……

· Five discoms failed to clear dues worth ` 41 bn: CAG

· MSTC to build national e-auction portal for PPAs

· Power discoms gear up to meet peak winter season demand

Policy / Performance…………………

· Govt electrified 13 Assam villages under DDUGJY

· Coal price rationalisation likely early next year

· India, Russia likely to sign pact on Kudankulam during PM Modi’s visit

· Kerala to set up first Petcoke power plant at Irumpanam

· UP joins Centre's 'UDAY' scheme

· Chhattisgarh not keen to set up 4 GW Suruja UMPP

· India should pay attention on 'gasification' of coal: Kakodkar

· Govt working on coal allotment procedure for commercial mining

· Centre's LED scheme pares Delhi's peak demand by 145 MW

· States receive ` 5.8 bn from coal block auction so far

· India's cabinet backs plan to end state monopoly on coal trade

· NTPC urges Delhi govt not to shut down Badarpur plant

· Teesta hydro project which was stalled for 7 yrs back on track: Goyal

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Shell cuts 2016 spending by $2 bn as it prepares for BG

· Russian oil output may fall in 2017 due to tax regime: Energy Minister

· Statoil submits rare $940 mn plan amid oil-price rout

· Mexico sees $44 bn in investment for deep water oil fields

· Carrizo Oil & Gas said to seek buyers for Colorado shale assets

Downstream……………………

· Indonesia says it will let private investors build oil refineries

Transportation / Trade…………

· Investors wary as Russian pipeline project splits EU

· PetroChina to build temporary gas pipe in 10 days after blast

· China's November Iran crude oil imports down

· Iran woos Indian refiners to drive oil sales in cut-throat market

· Saudi Arabia's oil exports rise to 7.364 mn bpd in October

· Angola signs oil deal with Sinochem in bid for Chinese buyers

· Shell, Gunvor to supply 120 LNG cargoes to Pakistan

· US on verge of lifting 40 year oil export ban

Policy / Performance………………

· Finland and Estonia to start gas pipeline planning

· Oil collapse spurs budget shortfalls in US oil states: Moody's

· US gas prices fall to lowest in more than 6 yrs

· BG Group receives Lake Charles LNG project approval from FERC

· Canada's Trudeau leaves room for oil pipelines to gain local approval

· Britain awards more shale gas licenses

· Nigeria to pump 2.4 mn barrels of oil daily in 2016

· Russia's Novatek says China's Silk Road Fund provided $761 mn to Yamal LNG

· Qatar expects to start Barzan gas project in 2016

· Egypt plans to cut oil product subsidies to 30 percent of July 2014 level

[INTERNATIONAL: POWER]

Generation…………………

· Russia set to build 2 nuclear power plants in Iran

· Acciona-led consortium signs $1.2 bn contract for Site C hydro project in Canada

· RWE shuts down new 800 MW Hamm coal-fired unit

Transmission / Distribution / Trade……

· Kenya Power will invest $59 mn in power distribution grid expansion

· New York backs new transmission lines to ease power prices

Policy / Performance………………

· NEPC panels to probe power plant programme

· Jordan to sign $400 mn plant deal with Saudi Arabia's ACWA

· China approves loan for Thar coal mining, power plant

· Polish utilities rise as regulator boosts coal plant support

· China supplying 2 more nuclear reactors to Pakistan

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· DMRC plans off-site solar power project

· Low solar tariffs in India could put off potential investors

· Nearly 60 percent greenhouse gas emissions from energy sector: Govt

· KREDL striving to meet solar power target

· Bio-fuel policy in for revision; Centre calls meet with industry

· Environment group opposes coal-fired power plant near Mumbai

· Delhi Power Secretary bats for investments in renewable energy

· India has 4.8 GW solar power generation capacity: Goyal

· J&K CM felicitates duo for representing India at UN climate meet

· Tata Power, Gamesa India sign pact for 100 MW wind project in AP

· India spurs ethanol for vehicles to combat pollution in Delhi

· New diesel-gulping SUVs banned in Delhi to fight toxic air

GLOBAL………………

· Non-fossil fuels make up 12 percent of China's primary energy mix at end-2015

· Japan to consider emissions trading in climate change plan

· Europe's warmest year heralds free German power for Christmas

· Half of world's coal may go unmined to meet Paris climate target

· UK reduces solar subsidies less than proposed after appeal

· 2016 set to be hottest year on record globally

· Ireland seeking renewables to provide 16 percent of energy by 2020

[WEEK IN REVIEW]

India monthly energy briefing

December 2015: Post Paris Blues

Lydia Powell, Akhilesh Sati and Ashish Gupta, Observer Research Foundation

Climate Change

ecember was dominated by news on negotiations in Paris and post Paris analysis. India’s call for a just and equitable agreement that takes aim at lifestyle emissions rather than livelihood emissions failed but few in the media thought that this was important enough to be reported. The Paris Agreement was more about the power and tastes of western civil society organisations than about democratic responsibilities and choices of nation states. The influence of civil society organisations such as 350.org that see fossil fuels as the biggest enemy of mankind was much stronger than democratic preferences of large nation states such as India. The media which the civil society trusts as the final arbiter of policy hailed the agreement as historic. Thanks to the simplifying powers of the media the world is now convinced that the complex phenomena of climate change has been conquered by man.

Conventional Fuels

Oil & Gas

Oil prices continued to fall in December. This was both good and bad for India. One of the many reasons why oil prices are low is that global economy has not revived as anticipated. Obviously this has not been good for India as export markets are shrinking.

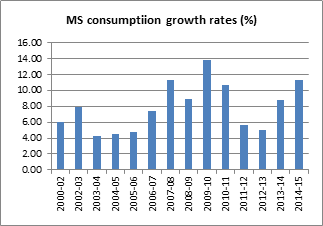

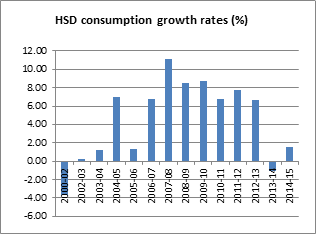

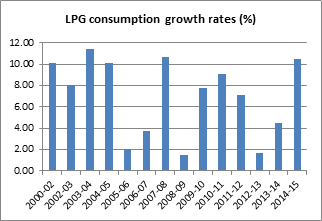

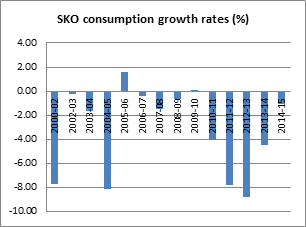

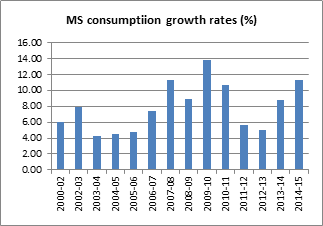

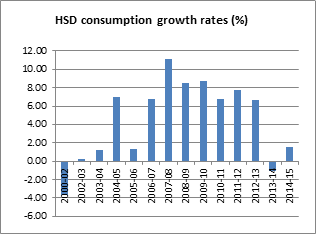

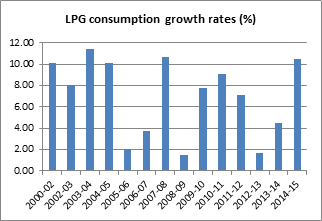

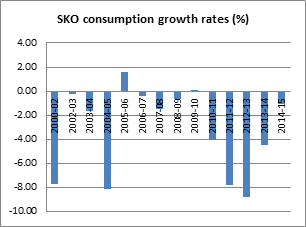

Source: PPAC

This is taking a toll on employment in the manufacturing sector as well as the service sector. Tax take from the petroleum sector is falling and this has led to calls for an increase in ad valorem levy on oil cess. On the other hand low oil prices have enabled higher consumption. This is good for India as higher energy consumption can potentially contribute to higher levels of economic activity. Demand for oil products grew by 6 percent in November but demand growth was not uniform along all products. Petrol consumption continued to show double digit growth while consumption of most other petroleum products including diesel has slowed down substantially. The growth in petrol consumption signals growth in use of personal vehicles. On the other hand the decline in consumption of diesel signals a decline in economic activity. It will not be a good sign if the latter catches up with the former.

The other big headline in December was the ground breaking ceremony for the TAPI pipeline in which the Hon’ble Vice President of India participated. The speed with which announcements of progress are being made on TAPI defiles logic. The world is awash with cheap natural gas and yet this has had little or no impact on consumption levels in India. In this light, it is not clear why India would rush to consume gas delivered through a cross border pipeline.

Source: PPAC

There were reports of an alternative undersea gas pipeline from Iran as well. Only one of the many pipeline options can succeed, even in theory. GAIL was reported to be promoting gas as an alternative to coal based power generation in and around cities. The idea has not worked in Delhi and it is unlikely that it will work in any other city.

The nuclear sector got back on the news in December with the visit of the India Prime Minister to Japan and Russia. India and Japan signed an MoU on peaceful use of nuclear energy. There were announcements of many more nuclear plants from Russia. There was also talk of a policy to fast track nuclear plants. Whether it is promoting natural gas or nuclear energy as fuel for power generation the real problem has been the absence of a clear economic case. The economic case will strengthen only when demand takes off.

Coal

The lime light was on coal as the climate deal was being negotiated in Paris. Notwithstanding the article in the Paris agreement that seeks to limit funding for non-green energy sources, India stressed on efficient utilisation of coal resources with minimum damage to the environment. To take the commitment forward, the government announced a plan to bring in a new regime for sampling and testing of dry coal from 1 January 2016 to ensure supplying quality coal to consumers. The decision was the outcome of controversies between NTPC and CIL on the quality of coal. Coal India Ltd (CIL) has roped in additional thirdparty agencies such as Allied (India), Shree Coal Research LLP, Mitra SK Pvt Ltd, R V Briggs & Company Pvt Ltd. As per the new rules, the authorized representatives of NTPC and CIL shall jointly witness the process of sample collection as per Bureau of Indian Standard regulation. It has also been decided that coal will be crushed before supplying to the consumers from 1 January 2016 onwards. This decision can be seen as an endeavour towards efficiency wherein the customers pays for the quality that is determined independently.

In another major development, the Cabinet Committee on Economic Affairs (CCEA) approved the allotment of coal blocks to PSUs for sale of coal mainly to medium, small and cottage industries under the provisions of the Coal Mines (Special Provisions) Act, 2015 keeping in mind the interest of small and medium enterprises. This is a step towards commercial mining as state utilities will be allowed to sell coal to private companies. This could put an end to the Centre's monopoly over mining and sale of coal. This will also enhance domestic production of coal and eventually reduce imports.

Apart from this, the Union Cabinet also has approved a policy framework for development of Underground Coal Gasification (UCG) in coal and lignite bearing areas in the country. Central Mine Planning and Design Institute Limited (CMPDIL) has been selected as the nodal agency for development of bid documents, work programme, conducting the bidding process, evaluation of bids, monitoring and process protocols etc. An Inter-Ministerial Committee under the Ministry of Coal with members from concerned Ministries has been entrusted with the task of identification of the areas, deciding blocks to be put to bidding or awarding them to Public Sector Units (PSUs) on nomination basis. Given the limited coal reserves, UGC is a way forward towards securing energy security as the method allows extracting of energy from coal/lignite resources which are otherwise regarded as uneconomical to work through conventional mining methods.

Views are those of the authors

Authors can be contacted at [email protected], [email protected], [email protected]

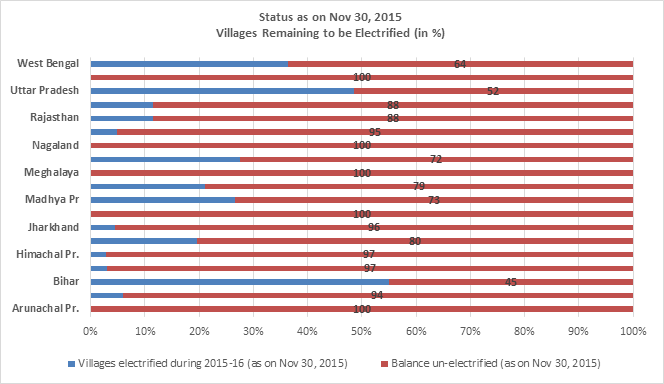

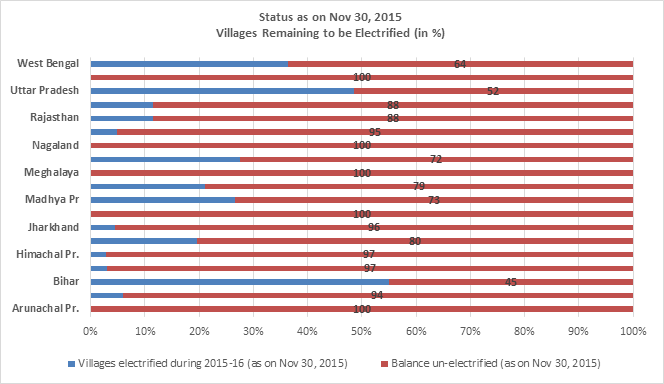

Village Electrification 2015-16

Akhilesh Sati, Observer Research Foundation

|

Total inhabited villages (as per Census 2011)

|

597464

|

|

Total inhabited un-electrified villages (as on 01.04. 15) Census 2011)

|

18452

|

|

State details un-electrified villages(as on 01.04.15)

|

|

Arunachal Pradesh

|

1578

|

|

Assam

|

2890

|

|

Bihar

|

2719

|

|

Chhattisgarh

|

1080

|

|

Himachal Pradesh

|

36

|

|

J & K

|

132

|

|

Jharkhand

|

2581

|

|

Karnataka

|

39

|

|

Madhya Pradesh

|

472

|

|

Manipur

|

276

|

|

Meghalaya

|

912

|

|

Mizoram

|

58

|

|

Nagaland

|

82

|

|

Odisha

|

3450

|

|

Rajasthan

|

495

|

|

Tripura

|

26

|

|

Uttar Pradesh

|

1528

|

|

Uttarakhand

|

76

|

|

West Bengal

|

22

|

|

Total

|

18452

|

|

|

|

Source: Ministry of Power & Press Information Bureau

NEWS BRIEF

[NATIONAL: OIL & GAS]

CAG raps Govt over delay in signing Ratna R-Series contract

December 18, 2015. Comptroller and Auditor General (CAG) of India rapped the government for 16-year delay in giving the Ratna and R-Series oil and gas fields, saying over ` 26,000 crore of hydrocarbons production was deferred besides ` 1,086 crore damage to un-used facilities in the Arabian sea. The medium-sized Ratna and R-Series (R&RS) fields off the Mumbai coast have been languishing since 1993 when the PV Narasimha Rao-led Congress government decided to invite bids. The fields were awarded to a consortium led by Essar Oil in 1996. The Cabinet Committee on Economic Affairs (CCEA) in 1999 approved finalising and concluding PSC within six months after negotiations are held by Negotiating Team of Secretaries (NTS) but the same has not been signed till date over what royalty and cess is to be charged from Essar Oil and partners. CAG said considering four years and eight months as the time that would have been taken to start production, R&RS fields should have been up by October 2005. Government's take of ` 1,050 crore as royalty and cess on crude oil and ` 55 crore as royalty on natural gas for the period also remained deferred and unrealised, CAG said. It said Oil and Natural Gas Corp (ONGC) had created facilities in Ratna R-12 field, which is part of R&RS, at a cost of ` 472.55 crore. These facilities were used by the company for production since 1983 before production was stopped in September 1994 after the field was up on auction. (www.business-standard.com)

Will protect ONGC's interest in Bay of Bengal gas row: Oil Minister

December 17, 2015. Oil Minister Dharmendra Pradhan vowed to protect government and ONGC's interest on the issue of state-owned firm's natural gas from Bay of Bengal block flowing to adjoining fields of Reliance Industries. Pradhan said a committee under Law Commission Chairman A P Shah has been constituted to look into acts of omission and commission and recommend compensation to ONGC. US-based consultant DeGolyer and MacNaughton (D&M), in its final report, stated that as much as 11.122 billion cubic meters (bcm) of natural gas, worth over ` 11,000 crore, had migrated from idling Krishna Godavari fields of Oil and Natural Gas Corp (ONGC) to adjoining KG-D6 block of Reliance Industries Ltd (RIL). The Shah panel has been constituted "to understand the financial implications and to protect the interest of the government and government companies." The one-man committee will submit its report in three months on "how to compensate the losses keeping in mind the legal and business aspects." The panel has been asked to report any "acts of omission and commission" on part of all the stakeholders including RIL, ONGC, the Directorate General of Hydrocarbons and the government, he said. D&M in its report established that reservoirs in ONGC's Krishna Godavari basin KG-DWN-98/2 (KG-D5) and the Godavari-PML are connected with Dhirubhai-1 and 3 (D1 & D3) field located in the KG-DWN-98/3 (KG-D6) Block of RIL. It states that as much as 11.122 billion cubic meters of ONGC gas has migrated from Godavari-PML and KG-DWN-98/2 to KG-D6. Of the 58.68 bcm of gas produced from KG-D6 block since April 1, 2009, 49.69 bcm belongs to RIL and 8.981 bcm could have come from ONGC's side, D&M said. At gas price of $4.2 per million British thermal unit, the volume of gas belonging to ONGC which RIL has produced comes to $1.7 billion (` 11,055 crore). (www.dnaindia.com)

IOC’s Guwahati refinery facing water shortage

December 17, 2015. Falling water level in the Brahmaputra could affect the functioning of Indian Oil Corporation's Guwahati refinery, according to a top executive at the company. The refinery is located in the vicinity of the river and draws its surface water for its operations and processes. A further drop in the water level could affect the refinery's operations, as sandbars have come up in the areas from where the refinery draws water. According to the refinery, the water level in the river has come down by two feet in comparison with last year. The refinery requires at least 1,300 cubic metres of water every hour, but it is now getting just only 1,000 cubic metres. The refinery supplies water from the river to military engineering services, Oil India Limited and township residents. (economictimes.indiatimes.com)

Transportation / Trade…………

GAIL extends bidding deadline for hiring LNG carriers

December 22, 2015. State gas utility GAIL (India) Ltd has extended last date of bidding for its $7 billion (` 46,417 crore) tender for hiring nine newly built ships for ferrying LNG from the US by over two months to allow Indian shipyards to tie up technology for building the specialised vessels. Bids for charter hiring of nine ships quoted in three lots of three ships each were due but have now been extended till February 29, 2016. One ship in each lot is to be built at an Indian shipyard. The extension in the bid date has been done to accommodate request of Indian shipyards for allowing them time to tie up technology for building the specialised cryogenic carriers. After postponing the deadline thrice, GAIL had in February scrapped the tender to hire nine LNG carriers to ferry gas from the US, with a caveat that three of them be made in India. At that time no foreign shipyard was willing to share LNG shipbuilding technology. Negotiations that followed saw Korean shipbuilders Samsung Heavy Industries, Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering agreeing to cooperate with Cochin Shipyard, L&T Shipbuilding and Pipapav Shipyard respectively. GAIL had re-floated the tender for charter hiring of nine ships. The tender document provides for Indian shipyard taking 5% to 13% in the liquefied natural gas (LNG) carrier that it will build. This condition was not there in the original tender floated last year. Also, GAIL has a right to take up to 10% equity stake in any or all of the nine ships. Shipping Corporation of India (SCI), which is to operate the carriers, will have a right to 26% interest, according to the document. GAIL and SCI had last year signed an agreement wherein the state-owned shipping company has the step-in right to take at least a 26% stake in each of the nine LNG carriers hired by GAIL. GAIL plans to time charter, or hire, the carriers for 18 years from fleet owners. Overseas shipyards have been given time till May 31, 2019 to deliver their ships while those built at Indian shipyards are to be delivered between July 1, 2022 and June 30, 2023, the tender document said. GAIL has tied up 5.8 million tons per annum of LNG from the US which the newly built ships will ferry. (www.dnaindia.com)

Indian state oil firms in talks to buy stake in Siberia oil project

December 18, 2015. Indian Oil Corp (IOC) and Oil India Ltd (OIL) are in talks with Russia's Rosneft to buy up to a 29 percent stake in a Siberian oil project, as New Delhi accelerates a push to secure overseas energy assets. India, the world's fourth-biggest oil consumer, has to ship in three quarters of its oil needs and with oil prices close to their lowest since the global financial crisis has added incentive to seal purchases to limit import reliance. The deal, which could be worth around $1 billion based on the valuation of a recent stake purchase, is expected to take final shape during Prime Minister Narendra Modi's visit to Moscow for summit talks with President Vladimir Putin. If the deal goes through, it would mark India's second acquisition in Russia since Modi took office in May last year and a third under the ruling Bhartiya Janata Party. In 2002, Oil and Natural Gas Corp (ONGC) bought a 20 percent stake in the Sakhalin I field. India has frequently lost out to China in the race to acquire resources overseas in the last decade, but its oil diplomacy has gained momentum under Modi, who has made frequent foreign trips. In September, ONGC Videsh Ltd acquired a 15 percent stake in Russia's Vankor field, a deal that was sealed in July when Modi met Putin at a BRICS summit. (in.reuters.com)

India approves conversion of ONGC loan to unit into equity

December 22, 2015. A Union cabinet panel approved the conversion to equity of a ` 50 billion ($755.16 million) loan extended by Oil and Natural Gas Corp (ONGC) to its overseas investment arm ONGC Videsh Ltd (OVL). Oil Ministry said the investment will strengthen the capital base of ONGC Videsh Ltd (OVL), which is exploring for oil and gas assets in regions including Africa to feed India's rising energy demand. (in.reuters.com)

India re-negotiating terms of gas contract with Qatar: Oil Minister

December 21, 2015. India is re-negotiating the terms of long-term gas contract with Qatar to reflect the slump in global energy rates but no binding agreement has been signed so far, Oil Minister Dharmendra Pradhan said. Petronet LNG Ltd (PLL), India’s biggest gas importer, is in talks with RasGas to rework pricing formula after liquefied natural gas (LNG) under the existing 25-year contract coming for double the rate available in spot or current market. Pradhan said PLL has a contract to buy 7.5 million tonnes a year of LNG from RasGas on a long-term contract that ends in April 2028. The revised price has been in-principle agreed between the two and will help cut the rate by about half to USD 6-7 per million British thermal unit. The revised formula will base the price on a three-month average price of Brent crude oil, replacing a five-year average of a basket of crudes imported by Japan, on condition that PLL buys an additional 1 million tonnes of LNG annually. The trailing three month average Brent price is about USD 48 a barrel, while the average of Japan Crude Cocktail for the five-year period ended September 30 was USD 100. Credit Suisse said PLL is under-lifting LNG from RasGas by 32 percent and is seeking to re-open the price formula, outside of a contractual price review. The value of the underlifted cargoes in 2015 is USD 1.5 billion and if the change to price formula was implemented it would suggest a USD 2.5 billion buyer saving over three years. Credit Suisse said PLLs contract is a 100 percent take or pay agreement where the price formula is not subject to a price review. PLL is also seeking waiver of USD 1.5 billion penalty for under-lifting the contracted volume. PLL is taking only 68 percent of the volumes it agreed to in 25-year contracts with RasGas after a slump in global energy prices led to gas being available in spot or current market at roughly half that rate. As per the new deal being negotiated, PLL will take the quantities it did not take this year during the remainder of the contract period. State-owned GAIL (India) Ltd, Indian Oil Corp (IOC) and Bharat Petroleum Corp Ltd (BPCL) have committed to buy all of the 7.5 million tonne a year of LNG that Petronet is to import from Qatar. But with slump in global prices, they have opted to buy gas from spot market rather than use the long-term LNG. (indiatoday.intoday.in)

Cairn writes to PM Modi on retrospective tax case

December 21, 2015. British oil firm Cairn Energy Plc has written to Prime Minister (PM) Narendra Modi, seeking clarity on its ` 10,247 crore retrospective tax dispute in the light of his statement that the government will not resort to retrospective taxation. Stating that Cairn’s retrospective tax issue was yet to be resolved, he said it had been dragging on for almost two years that had resulted in $1-billion loss in value, forcing it to sell assets, postpone investment and cut workforce by 40 percent. Cairn Energy CEO Simon Thomson wrote the tax issue had been dragging on for almost two years that has resulted in $1-billion loss in value. He said it forced the firm to sell assets, postpone investment and cut workforce by 40% The income tax department says Cairn Energy allegedly made a capital gain of ` 24,503.50 crore in 2006 while transferring all its India assets to a new company, Cairn India, and getting it listed on the stock exchanges. Cairn Energy, which had in 2011 sold majority stake in its Indian unit to mining group Vedanta for $8.67 billion, still holds 9.8 percent stake in Cairn India. But it has been barred by the income tax department from selling this stake. (www.business-standard.com)

India’s fuel demand up 6.4 percent in November

December 21, 2015. India’s fuel consumption rose 6.4 percent in November on back of continued surge in petrol demand even as diesel sales showed signs of tapering. Fuel consumption in November at 14.8 million tonnes was 6.4 percent higher than 13.9 million tonnes consumed in the same month a year ago, according to latest data from the petroleum ministry. Diesel, the most consumed fuel in the country, however, saw a tapering in demand growth to 1.5 percent - rising from just over 6 million tonnes in November 2014 to 6.1 million tonnes this year. Petrol sales surged 17 percent to 1.77 million tonnes while naphtha consumption was up 39 percent at 1.05 million tonnes. LPG consumption was up 2.8 percent at 1.61 million tonnes but kerosene sales was down 13 percent at 518,000 tonnes, the data showed. Consumption of all petroleum products had surged1 17.5 percent in October to 15.25 million tonnes. From a 3.3 percent contraction or decline in year-on-year demand in March, diesel saw consumption rise by 9.3 percent in April (6.48 million tonnes) before again showing negative growth rate of 0.6 percent each in May and July. It soared by 6 percent in August (5.4 million tonnes) before touching the peak 20.2 percent expansion in September (5.88 million tonnes). It in following month tapered to 16.3 percent expansion to 6.34 million tonnes. Petrol sales has risen in two digits every month this year except in May and June when it was 9 percent and 9.7 percent respectively. In September they had risen by a record 25.4 percent. (indiatoday.intoday.in)

CNG sales volume to be boosted on SC directive on diesel vehicle ban: ICRA

December 18, 2015. CNG sales volume are likely to be boosted while diesel sales may decline on the recent Supreme Court directive on diesel vehicle ban, rating agency ICRA said. The Supreme Court (SC) banned the registration of new diesel cars over 2000 cc capacity till March 31, 2016 in 13 cities including Delhi and banned the entry of trucks, which are more than 10 years old, in Delhi. The apex court also directed all taxis in Delhi to be converted to CNG and has doubled the green cess levied on commercial vehicles entering Delhi. ICRA said the proposal is likely to dampen the sales of luxury and SUV carmakers as many of their popular brands are dieseldriven. But the rating agency added that the impact on Oil Marketing Companies (OMCs) because of lower diesel sales will be partly offset by CNG margin, as some part of CNG gets retailed through their outlet. (economictimes.indiatimes.com)

Cabinet approves OVL's $1.2 bn stake buy in Russia's field

December 16, 2015. The Cabinet approved ONGC Videsh Ltd (OVL) buying 15 percent stake in Russia's Vankor oilfield for $1.26 billion, the first oil deal since the Narendra Modi-led government came to power. OVL, the overseas arm of state-owned Oil and Natural Gas Corp (ONGC), will get 4 million tonnes of oil and oil equivalent gas for the stake in Vankorneft, the developer of the Vankor oil and gas condensate field in Turukhansky district of Krasnoyak Territory in Russia. The field has recoverable reserves of 2.5 billion barrels. Rosneft, Russia's national oil company, holds 100 percent stake in Vankorneft. The acquisition is subject to relevant board, government and regulatory approvals and is expected to be completed by 2016-mid. This will be the fourth biggest acquisition by OVL. (energy.economictimes.indiatimes.com)

Moody's affirms Baa2 ratings on Oil India

December 16, 2015. Moody's Investors Service has affirmed Oil India's Baa2 issuer and bond ratings. The outlook for the ratings is stable. The rating actions follows Moody's revision of its assumptions for oil prices. Moody's expects the crude oil price will stay at current low level for longer period. Moody's current price assumption for Brent is US$ 43 per barrel and US$ 48 per barrel in 2016 and 2017 respectively. Oil India's Baa2 rating is equivalent to its baa2 baseline credit assessment (BCA). The rating outlook is stable reflecting Moody's expectation a) that the fuel subsidy burden on Oil India Ltd (OIL) will remain low, b) the company will lower shareholder payments in line with reduction in its net profits and c) that the company's growth plan will continue to be executed within the tolerance level of its current ratings. Negative pressure on the ratings will develop if 1) the sovereign rating for India is downgraded; or 2) any major adverse changes are made to the fuel subsidy mechanism; or 3) OIL increases its pace of acquisition, such that it results in higher business risk and a deterioration of its credit metrics. Moody's would consider adjusted debt-to-proved developed reserves above $5 per barrel, adjusted debt to average daily production above $15,000 per barrel, and retained cash flow (RCF) to adjusted debt below 60%, on a sustained basis, as indicative of negative pressure on the ratings. Upward pressure on the rating in the next 12-18 months is unlikely, given the current scale of OIL's production and reserves. (www.business-standard.com)

US welcomes ground-breaking of TAPI pipeline

December 16, 2015. The US congratulated India, Turkmenistan, Afghanistan and Pakistan on the recent ground-breaking for the construction of USD 7.6 billion TAPI pipeline crisscrossing the four countries across South and Central Asia. The US continues to support the TAPI pipeline project, which would further diversify Turkmenistan s energy market options, provide revenue and jobs for Afghanistan at a critical time in its economic development, and bring clean fuel to the growing economies of Pakistan and India. (indiatoday.intoday.in)

[NATIONAL: POWER]

NHPC's Teesta Low DamIV project running behind schedule

December 21, 2015. NHPC's 160MW Teesta Low DamIV hydroelectric project in West Bengal that is scheduled to be commissioned during the next fiscal is running behind schedule, Parliament was informed. Other reasons for the project running behind the schedule are agitation by local organisations and flash floods in 2007, 2009 and 2010, the Power and Coal Minister Piyush Goyal said. The minister said Central Electricity Authority (CEA) in consultation with the concerned utilities has broadly identified thermal power projects with a total installed capacity of 4,800 MW which could be considered for taking up for renovation and modernisation (R&M) based on viability. (economictimes.indiatimes.com)

BHEL to get Anpara D plant operational by January end

December 19, 2015. The Bharat Heavy Electrical Limited (BHEL) claimed that the 500 MW unit in Anpara D power plant may finally get operational by January 22. The unit has been non-operational for the past eight months, despite being inaugurated by Uttar Pradesh (UP) Chief Minister Akhilesh Yadav in April earlier this year. The BHEL gave an expected date for revival of the unit after its top brass was called in by the UP energy department to know the fate of the project. The PSU also indicated that the second 500 MW unit would start anytime around March 8. The Akhilesh government, as a matter of fact, has been promising 16 hours power supply to the rural and 24 hours to the urban areas in the state by the end of 2016. UP energy department estimates that it can happen only when the power availability increases sufficiently, presumably up to 18,000 MW, as against the existing 12,000 to 14,000 MW. (timesofindia.indiatimes.com)

APERC to decide on Hinduja power plant

December 16, 2015. Andhra Pradesh power utilities and Hinduja Power Corporation are at loggerheads over the cost of the 1,040 MW power project that was commissioned recently in Visakhapatnam. Trouble broke out after state-owned power generation company, APGenco, raised serious objection over the cost estimates submitted by Hindujas. The promotors of the project, Hinduja group, had come out with a fixed cost of over ` 8,000 crore for which APGenco refused to give its assent. To resolve the issue, the matter was submitted to AP Electricity Regulatory Commission (APERC), which is now examining estimates of both the parties. Hinduja National Power Corp Ltd had signed an agreement with the state government in 1998 to set up a 1,040 MW coal-based thermal power plant. (timesofindia.indiatimes.com)

States surrendering share of costly power from generating companies

December 16, 2015. At a time when the country is aggressively adding power generation capacity to provide power for all, states are surrendering their quota of power which they are receiving from generating companies. Six states have already surrendered around 3,100 MW of power they were receiving from various companies. Earlier, states used to unofficially request power generators to reduce supply of power, but of late state power distribution companies are officially asking them to reduce the quota of power. Some states have even asked for reduction in the total volume of power purchase agreement that was initially signed. Delhi alone wants to surrender close to 2,300 MW of power. This would affect seven plants of NTPC. These are the ones at Badarpur, Auriya, Dadri-Gas, Anta, Dadri-Stage II, Jhajjar and Koldam thermal power plants. Total power being surrendered from NTPC is close to 2000 MW. (energy.economictimes.indiatimes.com)

Transmission / Distribution / Trade…

Five discoms failed to clear dues worth ` 41 bn: CAG

December 21, 2015. Five power utilities, including national capitals BRPL and BYPL, "consistently failed" to clear dues worth over ` 4,112 crore to three hydro power producers at the end of March 2015, CAG said. The audit report of the Comptroller and Auditor General (CAG) on NHPC Ltd, SJVN Ltd, THDC India Ltd and NHDC Ltd was tabled in Parliament. One of the main objectives of hydro central public sector enterprises (CPSEs) was to operate and maintain power station with maximum efficiency. Design Energy of Chamera-I power station of NHPC has not been reviewed though it has consistently been generating substantial secondary energy since its commissioning in 1994-95. CAG said that audit examination revealed that during 20 years since commissioning in 1994-95, actual generation of Chamera-I had exceeded the design energy by 13 to 60 percent. Despite significant and consistent variations in the actual generation vis-a-vis design energy consistently over the last 20 years, the design energy of Chamera-I power station was not reviewed by NHPC in terms of various guidelines. (indiatoday.intoday.in)

MSTC to build national e-auction portal for PPAs

December 19, 2015. Long-term power purchases contracts will now be decided through reverse e-auctions and the successful bidder will sign power purchase agreements (PPAs) with the utility that wants to buy power. The power ministry has issued a standard bidding document for distribution companies and licensees intending to enter into power purchase agreements with power generators and traders on long, medium and short-term basis. Power Finance Corp Ltd, another state-run company under the power ministry will team up with MSTC for developing and operating the national e-bidding portal. Following a meeting chaired by the power secretary, it was decided that the portal shall be made operational by the end of January 2016 and the first phase will be implemented for short-term power purchase agreements. This means power purchase contracts for more than 15 days and up to one year will be handled through this portal. Thereafter, power purchase contracts for medium term, for more than one year and up to five years, will be introduced. Finally, long term PPAs will be settled through the portal. The bidding process will involve multi-stage bidding including online request for quotation, request for proposal and reverse e-auction. MSTC has also been engaged by the mines ministry to provide the e-auction platform for allotment of mineral mines across all states pursuant to the amendment of the MMDR Act. The process began in November and the mineral seeking industries can now directly get the licence for mineral mines and secure their raw material needs on a long-term basis through open and transparent competitive bidding. (energy.economictimes.indiatimes.com)

Power discoms gear up to meet peak winter season demand

December 17, 2015. Delhi’s peak power demand this winter is expected to be around 4,500 MW-4,600 MW and power discoms are gearing up to ensure adequate electricity availability during this period. Tata Power Delhi Distribution Ltd (TPDDL) has also made arrangements for meeting a peak demand of approximately 1,300 MW this winter season. (indiatoday.intoday.in)

Policy / Performance………….

Govt electrified 13 Assam villages under DDUGJY

December 22, 2015. Government said 13 villages were electrified in Assam under Deendayal Upadhyaya Gram Jyoti Yojana. Out of these electrified villages, three belong to Baksa district, one in Darrang and other nine villages falls in Nagaon district of the state, Power and Coal Minister Piyush Goyal said. Under Deendayal Upadhyay Gram Jyoti Yojana (DDUGJY) there is a provision for providing electricity access to unelectrified villages/habitations through microgrid and offgrid distribution network where grid connectivity is either not feasible or not cost effective. Goyal had said that electrification works in 3,286 villages out of 18,452 unelectrified villages in the nation have been completed so far. He had said that in Uttar Pradesh, 1,529 villages were still to be electrified as on April 1, 2015. (economictimes.indiatimes.com)

Coal price rationalisation likely early next year

December 20, 2015. State-run miner Coal India Ltd (CIL) may take a decision on price rationalisation of various grades of the fossil fuel early next year. The coal miner is looking at rationalising prices of coal in grades ranging from G1-G5. Coal Secretary Anil Swarup said that the price rationalisation proposal was on the cards as some issues have been raised with regard to pricing of the fossil fuel. Coal and Power Minister Piyush Goyal had earlier said that the Centre needs to rationalise prices of certain grades of coal as per gross calorific value (GCV) but there is no need to align them to international rates. At present, average international (free on board) coal price was quoted at $52 per tonne. On the other hand, average domestic prices of coal were in the range of ` 1,100 to ` 1,200 per tonne. (profit.ndtv.com)

India, Russia likely to sign pact on Kudankulam during PM Modi’s visit

December 20, 2015. India and Russia are likely to sign an agreement on Kudankulam units 5 and 6 during Prime Minister (PM) Narendra Modi’s visit to the Eurasian country. The government is also planning to make optimum use of the available nuclear sites in various states to accommodate more atomic reactors to meet energy-starved country’s growing needs. Unit 5 and 6 of VVER technology are expected to be of the same MW like units 1-4, but the cost details of the project is yet to be finalised. In what could be a major policy decision, the government will now insist that the states should have more reactors at one site. The reason behind coming up with a policy is taken in view of the limited number in terms of space available for building a nuclear site. The government is constructing six reactors in new projects like Jaitapur (EPR 1000×6) in Maharashtra built with French technology, Kovadda in Andhra Pradesh (1000MW x 6) and Mithi Virdhi in Gujarat. (indianexpress.com)

Kerala to set up first Petcoke power plant at Irumpanam

December 19, 2015. The Kerala Government will set up state’s first Petcoke (Petroleum coke)-based power plant using the fuel produced from Kochi Refinery’s Integrated Refinery Expansion Project (IREP) at 150 acres of FACT at Irumpanam. The FACT (Fertilizers and Chemicals Travancore Limited) land at Irumpanam is adjacent to the BPCL expansion project. It will be acquired by Kerala State Industrial Development Corporation (KSIDC) and used only for the implementation of the petcoke based power plant, under Government directions. IREP, which is expected to be completed by May 2016, will yield approximately 1.4 million metric tonnes per annum of petcoke. This can be used to produce around 500-600 MW (mega watts) of power. (www.newindianexpress.com)

UP joins Centre's 'UDAY' scheme

December 18, 2015. Government said Uttar Pradesh (UP) has formally joined the Centre's 'UDAY' scheme for reviving debt-laden discoms. UDAY can help states reduce interest cost, improve operational efficiency and lower cost of power, to ensure power for all, Power Minister Piyush Goyal had said. States that have communicated their in-principle approval to the Power Ministry for joining the UDAY scheme includes Chhattisgarh, Andhra Pradesh, Jharkhand, Rajasthan, Punjab and Jammu & Kashmir. The scheme is optional and gets operationalised by signing a pact between states, state discoms and the Centre. UDAY aims at reviving ailing state electricity boards and operational efficiencies of power distribution companies. It envisages on reducing interest burden, cost of power and AT&C losses. Consequently, the discoms will become sustainable to provide adequate and reliable power enabling 24x7 power supply. The scheme provides that states would take over 75 percent debt of discoms, as on September 30 in two years. (economictimes.indiatimes.com)

Chhattisgarh not keen to set up 4 GW Suruja UMPP

December 18, 2015. The Chhattisgarh government is not keen on setting up a 4,000 MW ultra mega power project (UMPP) at Surguja at present citing surplus power in the state. The Power Ministry has tentatively identified five UMPPs, to bid out in the ongoing fiscal. The five UMPPs includes Cheyyur UMPP in Tamil Nadu, Bhedabahal UMPP in Odisha and Surguja UMPP in Chhattisgah. (www.business-standard.com)

India should pay attention on 'gasification' of coal: Kakodkar

December 17, 2015. Former Atomic Energy Commission chairman Anil Kakodkar said India should pay greater attention on "gasification" of coal for maximum exploitation of the untapped coal resources in the country. Stating that only 40-45 percent of coal reserves could be mined in the country, he wondered why gasification of coal was not being considered. (www.business-standard.com)

Govt working on coal allotment procedure for commercial mining

December 17, 2015. The procedure for allocating coal blocks for commercial mining is under the government's consideration, Parliament was informed. The statement comes a day after the government allowed the states to commercially mine coal and permitted state utilities to sell the fuel to private companies. The Cabinet Committee on Economic Affairs (CCEA) chaired by Prime Minister Narendra Modi had approved the allotment of coal blocks to PSUs for sale of the fossil fuel mainly to medium, small and cottage industries, thus putting an end to the Centre's monopoly over mining and sale of coal. The move is seen as a big-ticket reform in the coal sector. Coal India Ltd (CIL) is the largest domestic provider of the dry fuel and accounts for 80 % of domestic production. (www.business-standard.com)

Centre's LED scheme pares Delhi's peak demand by 145 MW

December 17, 2015. The Narendra Modi government's programme to get consumers to replace less efficient CFL or incandescent lights with LED bulbs at a discount has reduced Delhi's peak load by 145 MW and creating savings of over ` 61 lakh daily in power bill. The Prime Minister Narendra Modi had announced the campaign, called Domestic Efficient Lighting Programme (DELP), on January 5. The programme was rolled out on June 1 in Delhi and will close on December 31. Since its launch, 43 lakh bulbs have been distributed among nearly 11 lakh households in Delhi, resulting in an estimated daily energy saving of 1.5 million units. The scheme is also yielding environmental dividend. Energy Efficiency Services Ltd (EESL), the nodal agency implementing the scheme in the participating states, reckons a reduction in daily greenhouse emissions equivalent to 1,259 tonne of CO2 in Delhi. Power Minister Piyush Goyal has projected a target of distributing six crore LED bulbs through the DELP scheme. The government has already distributed about 3.88 crore LED bulbs. This has reduced the countrywide peak demand by 1,292 MW and saving ` 5,000 crore in costs. The scheme is also estimated to save more than 11 million units of power and brought down the daily greenhouse emissions by 11,288 tonne of CO2. In a related development, the renewable energy ministry has stopped subsidy on CFL-based solar lighting system to encourage the use of the LED version. Under the DELP scheme, consumers in Delhi can avail of up to 10 LED bulbs per domestic household on upfront payment. These technically superior LEDs are available at a discounted price of ` 93 each, against a market price of around ` 350. Each LED bulb helps a consumer save anywhere between ` 160 to ` 400 every year and has a life expectancy of 25,000 hours, thus making the cost recovery lesser than a year. The bulbs are available at distribution kiosks across Delhi and the list of the same is available on www.delp.in. For availing the scheme, the customer needs to provide a copy of the latest electricity bill, along with a copy of ID proof. (timesofindia.indiatimes.com)

States receive ` 5.8 bn from coal block auction so far

December 17, 2015. Six state governments have received a total of ` 582 crore from 31 coal blocks that have been auctioned so far with West Bengal's Sarisatolli block attracting the highest bid, according to data compiled by the coal ministry. Jharkhand and West Bengal have collected around ` 165 crore each, followed by Madhya Pradesh at ` 158 crore. West Bengal received around ` 151 crore from the Sarisatolli block won by CESC. The second biggest sale so far is the Amelia North in Madhya Pradesh that fetched ` 131 crore from Jaiprakash Power Ventures. Nevertheless, it has been estimated that the recently concluded auction of coal mines in two phases will lead to total earnings of ` 1.93 lakh crore, surpassing CAG's estimate of ` 1.86 lakh crore losses on account of allocation of 206 captive coal blocks without auction since 1993. It is also estimated that an additional tariff benefit of around ` 69,300 crore will accrue to the power consumers through the reverse auction of coal blocks. Moreover, greater revenue flows to states from the auctions dovetails with the government's plans to develop the coalrich eastern region. It is estimated that coal mines eauctions and allotments will bring ` 3.35 lakh crore of likely revenue to states. Jharkhand and Chhattisgarh are likely to receive a total of nearly ` 1.10 lakh crore each, including royalty over 30 years from just the second phase of auction. (economictimes.indiatimes.com)

India's cabinet backs plan to end state monopoly on coal trade

December 16, 2015. India’s cabinet approved a plan to end the state’s monopoly on the production and sale of coal after more than four decades in control of the industry. The step may foreshadow a broader opening of the industry which would see private investors gain access. In March, Parliament approved changes to the mining law that would enable such a reform when needed. Once mines have been allocated, companies will need to pay 10 percent of the value of the coal held, according to the statement. They’ll make payments in three tranches to the host province within a year of allocation. India plans to more than double coal production to 1.5 billion metric tons by 2020 to feed power plants and supply industries. To achieve that goal, it needs to access deep deposits that remain untapped because of high costs and insufficient technology at Coal India, which controls more than 80 percent of the nation’s output and is the biggest seller. India produced about 612 million tons of coal in the year through March compared with demand of about 826 million tons, the statement shows. The shortfall is met with imports. Lifting government control altogether on coal mining and sales may allow global companies such as Rio Tinto Group and BHP Billiton Ltd. to enter the country’s coal business. At present, the only other company allowed to sell coal in India is Singareni Collieries Co., a joint venture of the federal government and the southern state of Telangana. Others can mine coal for their own use. (www.bloomberg.com)

NTPC urges Delhi govt not to shut down Badarpur plant

December 16, 2015. The National Thermal Power Corporation (NTPC) has urged the Delhi government not to shut down its coal-based Badarpur thermal power plant, a week after being served a closure notice for being a contributor to air pollution. AAP Govt says Rajghat was inefficient; NTPC can convert Badarpur to gas. The NTPC has said that the functioning of the said plant, that "meets pollution norms", was essential to meet the capital's power needs, and that even the State Load Dispatch Centre (SLDC) places demands for power to it, a senior Delhi government official said. NTPC has also said that while it was earlier asked to switch to cleaner fuel like gas, it could not do so due to "unavailability" of the same. The Delhi Pollution Control Committee had served a notice to the NTPC to shut its Badarpur Plant by mid March in view of it exceeding the prescribed emission standards. It had also issued a notice to the city government managed Rajghat plant and had given them time till December 15 to reply. While NTPC replied to the notice, the power department, which runs the Rajghat plant filed its reply. The government is yet to issue its final order on the matter. The decision to shut the two power plants were part of a series of measures proposed by the government to combat the menace of rising air pollution in the city. (energy.economictimes.indiatimes.com)

Teesta hydro project which was stalled for 7 yrs back on track: Goyal

December 16, 2015. Teesta hydro power project, which was stalled for seven years, is back on track as the work on the power plant in Sikkim started on October 1, Power Minister Piyush Goyal said. Earlier in September this year, he had said that the government will very soon resolve the issues related to Teesta power project in Sikkim which was holding back an investment of around ` 9,000 crore. The project commonly know as Teesta III is being implemented by Teesta Urja Ltd. The company is developing the 6x200 MW Teesta Stage-III Hydro Electric Power Project on Teesta River situated in North District of Sikkim. This project is a part of overall development of Teesta basin being undertaken by Sikkim Government. The project is run of the river designed to generate 5,214 Million kWh (units) annually in 90 percent dependable year, as per the information provided. The first unit (200 MW) of the project is expected to be commissioned in March 2017. Thereafter, other units will start generating power at an interval of one to two months one by one. All the statutory clearances for the Project were received by November 2007 and the civil works for the project were started in January 2008. The first unit of the project was to be commissioned in 2013 but the project got delayed due to earthquake in 2011 and issues among promoters. (www.dnaindia.com)

[INTERNATIONAL: OIL & GAS]

Shell cuts 2016 spending by $2 bn as it prepares for BG

December 22, 2015. Royal Dutch Shell Plc, Europe’s largest oil company, further reduced spending plans for this year and 2016 as it prepares to take over BG Group Plc amid slumping prices for crude. The combined company plans to spend $33 billion next year, lower than Shell’s previous guidance of $35 billion, the company said. Shell also cut its spending forecast for this year by $1 billion to $29 billion. Oil’s collapse to less than $37 a barrel from about $55 on the day the deal was announced in April has prompted some investors to question whether Shell is paying too much. The oil producer has justified the deal by saying that it boosts its ability to maintain dividends, makes it the world’s biggest liquefied natural gas company and gives it oil and gas assets from Australia to Brazil. (www.bloomberg.com)

Russian oil output may fall in 2017 due to tax regime: Energy Minister

December 22, 2015. Russia's oil production may start declining in 2017 if a tough taxation policy continues, Energy Minister Alexander Novak said. The government has decided to freeze its oil export duty instead of cutting it to 36 percent from 42 percent next year, as had been previously planned, due to state budget constraints. The oil industry has been worrying that the freeze will continue beyond 2016. Russia's oil output, buoyed by investments made in the past two to three years, is forecast to rise to 533 million tonnes this year from 526.7 million tonnes in 2014, Novak said. (www.reuters.com)

Statoil submits rare $940 mn plan amid oil-price rout

December 18, 2015. Statoil ASA is forging ahead with an 8.2 billion-krone ($940 million) project designed to squeeze more oil and gas out of the Oseberg area of the North Sea, a rare investment decision amid a collapse of crude prices. The Oseberg Vestflanken 2 project is designed to extract 110 million barrels of oil equivalent thanks to Norway’s first unmanned wellhead platform, the Stavanger-based company said. Cost cuts have reduced total investments by 1 billion kroner since the concept decision in February, it said. Statoil is moving ahead with the project even as it cuts spending to cope with lower oil prices and following a decade of rising costs. Vestflanken 2, which will start production in the second quarter of 2018, is the first of three planned phases for the development of remaining reserves in the Oseberg area. It will play an important part in Statoil’s goal to maintain its production in Norway at current levels to 2030 and beyond, it said. (www.bloomberg.com)

Mexico sees $44 bn in investment for deep water oil fields

December 18, 2015. Mexico will auction 10 offshore fields for exploration and development next year in the deep waters of the Gulf of Mexico, estimating that each field will require an investment of $4.4 billion during the life of the contract, Deputy Energy Minister Lourdes Melgar said. Participants in the auction, which will be held in the second half of next year, must have previous experience operating in deep water fields and will be contracted to operate for 35 to 50 years, Melgar said. The announcement of the deep water bidding guidelines follows Mexico’s successful sale of 100 percent of its 25 onshore fields to private companies. Mexico has awarded 69 percent of the fields auctioned in the country’s first-ever three bid rounds this year, accounting for around $7 billion in estimated investment, Energy Minister Pedro Joaquin Coldwell said. Mexico ended Petroleos Mexicanos’s long-standing crude production monopoly last year to welcome private participants to develop oil. Of the 10 deep water fields to be auctioned, four are in the Perdido area near the maritime border with the U.S. and six are in the southern gulf’s Cuenca Salina. Seventy-six percent of the country’s prospective resources are located in the deep waters of the Gulf of Mexico, according to Coldwell. (www.bloomberg.com)

Carrizo Oil & Gas said to seek buyers for Colorado shale assets

December 16, 2015. Carrizo Oil & Gas Inc. is seeking buyers for its land in Colorado’s Niobrara shale formation, which could fetch as much as $200 million. The Houston-based company is working with Royal Bank of Canada to seek buyers for the assets. U.S. explorers are selling off land to preserve cash and raise money for drilling in their best areas as they deal with a prolonged slump in commodity prices. Analysts and investors consider Carrizo to be among the healthier U.S. shale explorers because it has a fairly liquid balance sheet and controls lots of valuable land in Texas, Colorado, Pennsylvania and elsewhere. The company has significant hedges to sell much of its oil at above-market prices through 2016, and was among more than a dozen U.S. explorers that made it through a recent evaluation of its bank loans with its credit line intact, according to company. Carrizo drills in the Permian basin of west Texas and New Mexico, and in the Utica and Marcellus Shale basins in the eastern U.S. (www.bloomberg.com)

Indonesia says it will let private investors build oil refineries

December 21, 2015. Indonesia will let private investors build oil refineries in a regulation to be issued "in days", Darmin Nasution, coordinating minister for economics said. The move will be the latest in a series to seek to restore investment confidence and revive growth in Southeast Asia's largest economy. Nasution said as part of the measures to take effect in January, Indonesia will bundle a refinery project with a petrochemical plant to make it more commercially viable. Investors interested to build oil refineries may ask for tax or non-tax incentives and the government will consider the requests, he said. Pertamina currently operates seven refineries and is working to upgrade four of them, including the one in Cilacap, Central Java, partnering with Saudi Aramco. Saudi Aramco is also looking for further investment opportunities in downstream refining and petrochemical industry. The government aims to speed up the development of refineries in Tuban, East Java, and Bontang in East Kalimantan province. Pertamina announced that it was looking for a partner for a greenfield refinery project in Tuban and it will make a selection by January or February. Getting a refinery in Bontang under way this year was a goal of President Joko Widodo, but it hasn't happened. The government has previous said it will offer such a refinery, with an expected investment value of 140 trillion rupiah ($10.17 billion), under a public-private partnership scheme. (www.reuters.com)

Transportation / Trade……….

Investors wary as Russian pipeline project splits EU

December 22, 2015. Investors are wary of pouring money into a planned doubling of Gazprom's Nord Stream gas link to Germany, analysts said, amid doubts about regulatory approvals and deep political divisions. Since taps opened five years ago on the first pipeline from Russia's Baltic coast to Germany, bypassing Ukraine, the gulf has widened between EU countries angered by Russia's military actions there and those worried about security of gas supply. (in.reuters.com)

PetroChina to build temporary gas pipe in 10 days after blast

December 21, 2015. PetroChina plans to lay a temporary natural gas pipeline in the southern Chinese city of Shenzhen to replace a line that exploded near the site of a deadly mudslide, the company said. The new line will be laid over the next seven to 10 days after a 400-metre-long section of the pipe exploded, according to the PetroChina. The ruptured line is part of the massive PetroChina-operated west-to-east pipeline project that supplies Shenzhen with about 770 million cubic meters a year of natural gas and Hong Kong with about 400 million cubic meters a year, consultancy SIA Energy said. The west-to-east pipeline supplies about 3 billion cubic meters a year to Guangdong province, according to SIA and the Guangdong Oil & Gas Association. Since Shenzhen and Hong Kong have access to other natural gas supplies either through liquefied natural gas or piped gas from offshore fields, analysts said the impact should be minimal for the two cities. (www.reuters.com)

China's November Iran crude oil imports down

December 21, 2015. China's November crude oil imports from Iran fell 5.1 percent from a year earlier to 2.02 million tonnes, or 491,100 barrels per day (bpd), customs data showed. On a daily basis, November imports from Iran rose 45.2 percent from 338,300 bpd in October. Russia again became China's top provider of crude oil in November, supplying the country with 3.90 million tonnes, or 949,900 bpd, during the month. (af.reuters.com)

Iran woos Indian refiners to drive oil sales in cut-throat market

December 21, 2015. Iran has agreed to consider Indian demands for steep oil price discounts and other buying incentives, as it works to rebuild market share in a world awash with crude. Tehran's return to the market will deepen a global supply glut that has cut benchmark Brent crude prices by two-thirds since 2014, below the lows hit during the 2008 financial crisis and to levels last seen in 2004, leaving producers to battle for market share. The National Iranian Oil Company's international affairs director, S.M. Ghamsari, met Indian refiners, including firms that halted imports from Tehran because of the sanctions. Ghamsari was willing to consider better pricing and sales terms, as well as offering new grades of crude, to boost market share. Currently, Iran offers 90-day credit, free shipping and some discounts on crude prices to buyers in India. India is Iran's second-biggest customer for oil, and at around 4 million barrels per day (bpd) is the world's fourth-biggest oil consumer. The country imports some 80 percent of its needs and demand is set to rise fast as the economy grows at over 7 percent a year. (www.reuters.com)

Saudi Arabia's oil exports rise to 7.364 mn bpd in October

December 20, 2015. Saudi Arabia's crude oil exports in October rose by 253,000 barrels per day from September to 7.364 million bpd, the Joint Organizations Data Initiative (JODI) data showed. The oil exporting heavyweight maintained high output and pumped 10.276 million bpd in October, slightly higher than September's 10.226 million. Domestic refineries processed 2.028 million bpd of crude, lower than the September level of 2.501 million bpd, the JODI data showed. Exports of refined oil products dropped to 1.093 million bpd from 1.190 million bpd in September. Rabigh refinery and petrochemical complex was shut down for maintenance for 50 days from October to December. In October, crude oil directly burnt to generate power fell from the month before to 667,000 bpd, the JODI data showed, reflecting a decline in electricity consumption from the hot summer months when air conditioning use is high. (www.reuters.com)

Angola signs oil deal with Sinochem in bid for Chinese buyers

December 16, 2015. Angola is expanding its long-term oil sales deals to China, signing a 10-year agreement with Sinochem Group that would make the Chinese firm one of the largest contract buyers of Angolan oil. The deal, with state energy company Sonangol, will help the west African oil producing nation raise funds to withstand the low oil price storm. The agreement will help Angola secure an even bigger share of the Asian market as West African oil grapples with the long-term displacement from the U.S. market by the shale oil revolution. Sonangol already has a contract with China's Unipec, but the total number of cargoes given to all term buyers in any month rarely surpasses 15. The new contract is the first between Sonangol and Sinochem. Already, Angola sells as much as half of its 1.7 million barrels per day (bpd) of crude oil exports to China, but competes for buyers worldwide with OPEC rivals such as Saudi Arabia and Iraq. The deal directly related to loans that the Chinese government has given to Angola as its commodity-reliant economy struggles with the slump in crude oil prices over the past year. The government earlier this year granted almost 700,000 bpd of new crude import quotas to domestic refiners as part of efforts to reform the industry, and also authorized more of these refineries to export oil products. (www.reuters.com)

Shell, Gunvor to supply 120 LNG cargoes to Pakistan

December 16, 2015. Oil major Shell (RDSa.L) and trading house Gunvor will supply Pakistan with 120 liquefied natural gas (LNG) cargoes between 2016 and 2020 after both companies submitted the lowest offers in two highly sought after tenders, traders said. Pakistan State Oil company launched two tenders seeking 60 cargoes each for delivery during the period. The likely winner of Pakistan's parallel 60-cargo supply tender is trading house Gunvor, which offered a delivered price of 13.37 percent of a barrel of crude oil, traders said. A global glut in gas supplies has caused spot LNG prices to plunge, prompting some countries to take advantage of the cheap supplies to become importers for the first time. (uk.reuters.com)

US on verge of lifting 40 year oil export ban

December 16, 2015. The United States appears on the brink of ending a four-decade ban on most exports of crude oil, which would end a years-long fight brought about by a boom in domestic shale output that contributed to a supply glut and depressed prices. The measure is part of a sprawling deal wrapped up by congressional leaders to keep the United States government open through September. The $1.15 trillion spending bill, negotiated in secret talks over the last two weeks, would be difficult for President Barack Obama to veto despite his opposition to ending the oil export ban. Allowing oil exports would be a win for the U.S. oil industry and Republicans, who had argued the ban was a relic of the 1970s Arab oil embargo. (www.reuters.com)

Finland and Estonia to start gas pipeline planning

December 22, 2015. The European Commission, Finland and Estonia signed a deal to start planning for a gas pipeline between the two countries, the Finnish government said. The pipeline, called Balticconnector, will improve energy security in Finland, which now totally depends on pipeline gas imports from Russia. (af.reuters.com)

Oil collapse spurs budget shortfalls in US oil states: Moody's

December 21, 2015. Lower tax revenues because of job losses in energy and related sectors due to the collapse in oil prices will hit the budgets of oil-producing states through the remainder of this fiscal year and next, Moody's Investors Service said. Moody's comments came after Oklahoma revised down its revenue projections for the remainder of the current fiscal year by $444 million, or 8 percent, and by 13 percent for the next fiscal year, which starts July 1. The price of U.S. crude has fallen to its lowest level in seven years at just over $34 per barrel. The price has fallen nearly 70 percent over the last 18 months. Moody's analysts expect to see a similar dynamic to Oklahoma in Alaska, Louisiana, New Mexico, North Dakota and Texas, with those states having to dip into budget reserves to meet shortfalls. (www.reuters.com)

US gas prices fall to lowest in more than 6 yrs

December 20, 2015. U.S. gasoline prices dropped by 4 cents to $2.06 a gallon on average in the past two weeks to the lowest in more than six years, according to a Lundberg survey. The price, for regular grade, was the lowest since $2.05 in April 2009 as oil prices continued to slide, survey said. U.S. crude prices have dropped 17 percent in December. Gas prices have averaged $2.48 this year, down from $3.37 last year, according to the survey of about 2,500 U.S. filling stations. Of the cities polled, Tulsa had the lowest average retail price at $1.72, and Los Angeles had the highest at $2.71. (www.reuters.com)

BG Group receives Lake Charles LNG project approval from FERC

December 18, 2015. BG Group announced that it has received approval from the US Federal Energy Regulatory Commission (FERC) to construct and operate a natural gas liquefaction and export facility at the Lake Charles LNG export project, situated in Louisiana. FERC approval is the key remaining regulatory consent for the Lake Charles LNG project, which BG Group is developing with Energy Transfer Equity LP and Energy Transfer Partners, LP. Energy Transfer owns an existing LNG regasification facility in Lake Charles, which will be converted to a liquefaction facility. The project has conditional authorization from the US Department of Energy for the export of up to 2 billion cubic feet of natural gas per day or approximately 15 million metric tons of LNG per annum. Final investment decisions from both BG Group and Energy Transfer are expected to be made in 2016, with construction to start immediately following a positive decision. First LNG exports are expected around four years later. (www.rigzone.com)

Canada's Trudeau leaves room for oil pipelines to gain local approval

December 17, 2015. Canada's government sounded another note of opposition to a proposed oil pipeline in the country's west coast, though he appeared to leave the door open to allowing proponents to acquire the needed local approval for projects to go ahead. The newly elected Liberal government campaigned on a promise to toughen up the environmental review process for oil pipelines and has voiced its opposition to Enbridge Inc's Northern Gateway pipeline. Canada's energy ministry said that Canada will give aboriginal groups more say in discussions over natural resource projects located on their territory, which should help pave the way for major pipelines and mines. (in.reuters.com)

Britain awards more shale gas licenses

December 17, 2015. Britain awarded another 132 new onshore oil and gas exploration licenses, giving developers access to more land for shale gas fracking for the first time in seven years. Britain is estimated to have substantial amounts of gas trapped in underground shale rocks and Prime Minister David Cameron has pledged to go "all out" to extract these reserves, to help offset declining North Sea oil and gas output, despite opposition from environmental campaigners. Many other European countries, including France and Germany, have banned the use of shale gas hydraulic fracturing, or fracking, due to environmental concerns. The latest awards conclude Britain's first onshore oil and gas licensing round in seven years. Overall, it awarded 159 licenses and 75 percent of the blocks covered were related to shale gas or oil, the government said. Companies which obtained new licenses include established shale gas companies IGas, Egdon Resources, Cuadrilla Resources and INEOS. The latter won 21 new licenses which it said now made it Britain's biggest shale gas by acreage. (www.reuters.com)

Nigeria to pump 2.4 mn barrels of oil daily in 2016

December 17, 2015. Nigeria plans to pump 2.4 million barrels of oil per day in 2016 as it pursues low-cost production to offset revenue losses from falling crude prices, Emmanuel Kachikwu, petroleum minister of state, said. Africa’s biggest oil producer depends on exports of the commodity for more than 90 percent of its foreign earnings and two-thirds of government revenue. A 68 percent drop in the price of Brent crude from its 2014 peak, has seen government revenue plummet, piling pressure on the country’s currency, the naira. Kachikwu sees average prices of crude per barrel at $45 next year, higher than the budget estimate of $38. With the government unable to fund new oil and gas investments in the face of limited income, new financing models are being considered for capital investments, Kachikwu said. A long-delayed reform bill for the oil and gas industry will be split into two parts, separating its fiscal and non-fiscal aspects for easier passage by lawmakers, he said. Nigeria, which holds Africa’s largest gas reserves of more than 180 trillion cubic feet, will give low-tax incentives for investments to help boost gas revenue in the face of falling crude prices, Kachikwu said. Nigeria is determined to revamp its refineries and make them work efficiently before deciding if they should be sold, Kachikwu said. The refineries with a combined capacity for 445,000 barrels per day only managed to operate at an average of 5 percent of their capacity in the first 10 months of this year, leaving a loss of 67.4 billion naira ($338.6 million), according to Nigerian National Petroleum Corp. For an average daily consumption of 40 million liters of gasoline, Nigeria has paid subsidies of more than 1 trillion naira this year to maintain a fixed price, according to the petroleum minister. (www.bloomberg.com)

Russia's Novatek says China's Silk Road Fund provided $761 mn to Yamal LNG

December 17, 2015. China's Silk Road Fund has provided € 700 million ($761 million) to Yamal LNG, Leonid Mikhelson, the head of Russia's Novatek, said. Novatek controls Yamal LNG, which is due to start producing liquefied natural gas in 2017. The $27 billion project has been struggling to raise funds due to international sanctions against Russia over Ukrainian crisis. (af.reuters.com)

Qatar expects to start Barzan gas project in 2016

December 16, 2015. Qatar expects to start operations at its Barzan gas project in 2016 with full output the following year, the Ministry of Development Planning and Statistics said. The $10 billion project was originally expected to come online in 2014 and will serve Qatar's own growing energy needs. The ministry said the Ras Laffan 2 condensate refinery is expected to come on stream in the fourth quarter of 2016. Qatar Petroleum signed an agreement with a consortium led by France's Total in 2013 to build the $1.5 billion refinery. It will have a production capacity of 146,000 barrels per day (bpd) including 60,000 bpd of naphtha, 53,000 bpd of jet fuel, 24,000 bpd of gasoil and 9,000 bpd of liquefied petroleum gas. The ministry said it expects crude oil production in 2015 to fall by about 6 percent and condensates output to fall by about 8 percent. (af.reuters.com)

Egypt plans to cut oil product subsidies to 30 percent of July 2014 level

December 16, 2015. The Egyptian government plans to reduce subsidies on gasoline, diesel and natural gas to 30% of their July 2014 level, thanks to lower global oil prices and to the discovery of the giant Zohr gas field (estimated reserves of 30 trillion cubic feet, i.e. nearly 850 billion cubic meters of gas). In July 2014, the previous government announced a dramatic cut in subsidies by EGP40 bn (US$5.6 bn) to EGP100 bn over the 2014-2015 period, aiming to curb the expected budget deficit from 12% in the 2013-14 fiscal year to 10%. The subsidy reduction led to an increase in oil prices by up to 78%. The government then expected to gradually remove subsidies over a five-year period starting in July 2014. (www.enerdata.net)

[INTERNATIONAL: POWER]

Russia set to build 2 nuclear power plants in Iran

December 22, 2015. Russia has announced that it will build two nuclear power plants in Iran. The Atomic Energy Organization of Iran seems to be referring to extending the Russian-built Bushehr nuclear power plant in southern Iran. This move come a year after Iran signed a contract with Moscow to build up to eight reactors at the Bushehr power plant, where one nuclear reactor is already running. (www.algemeiner.com)

Acciona-led consortium signs $1.2 bn contract for Site C hydro project in Canada

December 22, 2015. British Columbia Hydro and Power Authority (BC Hydro) has awarded a contract to Peace River Hydro Partners for the main civil works construction of the 1.1GW Site C dam and hydroelectric power generation project on the Peace River in north-eastern British Columbia. The Peace River Hydro Partners consortium includes Acciona Infrastructure Canada with 37.5% interest, Petrowest 25% and Samsung C&T Canada 37.5%. Under the contract, valued approximately CAD$1.75 bn ($1.2 bn), the Acciona-led consortium will be responsible for the construction of an earth fill dam, two diversion tunnels and a roller-compacted-concrete foundation for the generating station and spillways. Canadian electric utility BC Hydro will own and operate the project upon completion, which is scheduled by 2020. (hydro.energy-business-review.com)

RWE shuts down new 800 MW Hamm coal-fired unit