Prime Minister Narendra Modi’s recent announcement about the demonetisation of high value currency notes has shocked the citizens of this country. Also, the decision, taken to weed out black money and fake currency, has disrupted normal circulation of money. With higher denomination notes losing utility, smaller denomination notes are not available sufficiently. As a result, households have become cash-strapped.

The Reserve Bank of India’s (RBI) annual report for 2015-2016 said that nearly 90.3 billion bank notes worth Rs16.4 trillion were in circulation in the economy at the end of March this year. Out of the total value, higher denomination notes accounted for a significant share of 86.4 per cent, while remaining share of 13.6 per cent was held by smaller currency notes.

It observed that during the period 2014-2016, there was a substantial growth in the volume of higher denomination currency notes, wherein Rs500 and Rs1,000 notes experienced a growth rate of 17.4 per cent and 11.6 per cent respectively.

The growth of higher denomination notes can be attributed to their demand which remained high, despite the middle class resorting to online and electronic transactions. In contrast, the volume of smaller currency notes of denominations Rs100 and Rs50 together witnessed a sluggish growth of 9.4 per cent.

This corresponds to their low demand despite the cost of living in India increasing significantly. Prices of almost all commodities, including food, housing, and healthcare have skyrocketed, which necessitated greater use of higher denomination notes over smaller currency notes.

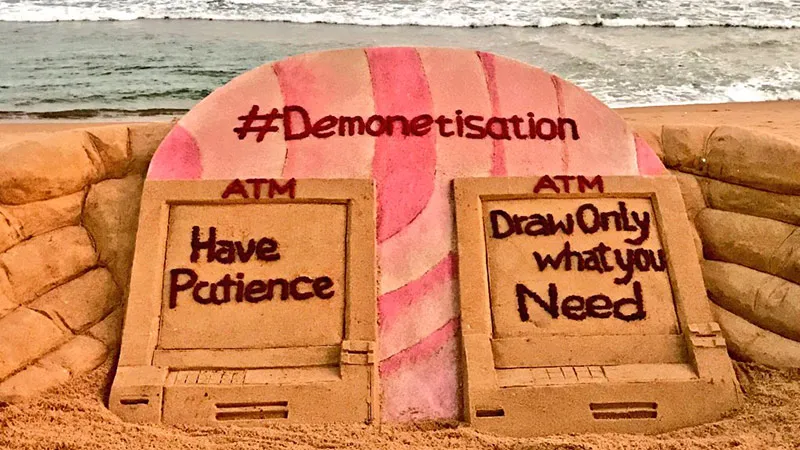

However, due to demonetisation, there is a sudden surge in the demand for smaller currency notes. Alas, there are not enough smaller denomination notes in the market. Against this background, it will be interesting to analyse the state of the economy post-demonetisation and understand the implications of this crucial decision.

Due to immediate withdrawal of currency from the market, circulation of money has been hampered. People are reluctant to undertake cash transactions, which has resulted in low sales and purchases.

Small businesses, retail traders and unorganised workers (roadside vendors, housemaids, rag pickers, and drivers), have been severely affected. As per estimates by the National Commission of Enterprises in the Unorganised Sector (NCEUS 2008), the unorganised sector in India contributes about 50 per cent to the gross domestic product.

Disruptions in sales and earnings of workers will likely affect national income in the near future. The prevailing liquidity crisis is also expected to cause a decline in consumption spending, which might reduce economic growth.

The repercussions of this policy decision have been strongly felt in the real estate and construction sectors too which are dependent on cash transactions. Real estate investments are expected to decline due to non-availability of informal funding sources as stricter tax laws are put in place.

As per estimates of Ambit Capital, nearly two-third of household savings in India are invested in physical assets ie real estate and gold. Real estate sellers generally demand half the payment in cash as it is considered to be the safest alternative to invest black money. Now, individuals will not have realty as an option to park their unaccounted-for cash. This move will promote a more transparent, lawful and electronic mode of financing.

On the other hand, the banking sector will definitely benefit from increased deposits in the short-term, which may lead to a fall in interest rate, therefore, augmenting domestic lending in India. The deflationary effect of demonetisation will also be witnessed in the Indian economy in medium to long-term. This will be favourable for consumers and investors who are keen on purchasing land, especially agricultural, which was expensive earlier. With demonetisation, illicit activities and money laundering too will be checked.

Although the Government has injected money supply through new currency notes of value Rs2,000 and Rs500, but these notes are either not sufficiently available or are not useful. A person who tries to shop using Rs2,000 is told by the shopkeeper to spend the entire note as he doesn’t have enough change. Therefore, the RBI must print adequate volume of smaller denomination currency, alongwith new currency, to ensure smooth conduct of economic activities.

This commentary originally appeared in The Pioneer.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV